USDA REPORT SHORT RECAP

Overall, the numbers came in a tad bearish for corn. Bean numbers were the most bullish of the grains. Lastly, wheat numbers were pretty neutral across the board, which hasn’t helped the bleeding.

Currently we have corn and wheat both trading in the red, down 6-8 cents. While soybeans still managing to trade in the green, up around 3 cents, but beans are currently 16 cents off their highs.

Corn 🌽

Like we mentioned yesterday, we did see U.S. corn exports were cut by 75 million bushels from February which was the premature reduction we were expecting. Which resulted in a bigger than expected increase to ending stocks. I think this was a little too aggressive. April crop report we could see an increase in feed usage which could offset exporting less corn.

We did however see the USDA cut their Argentina production estimates from 47 million last month down to 40 million today. Which was also below the average trade estimate of 43.40. Brazil estimates were left unchanged as expected.

Beans 🌱

With the bullish numbers from beans, we saw futures rally initially following the report but we have came back down off those highs, still trading in the green.

We saw a 10 million bushel reduction to U.S. crush, but this was more than offset the 25 million bushel increase in exports. Which led to ending stocks falling 15 million bushels (Estimates were just a 5 million reduction).

Similar to corn, we also saw a pretty big cut to the Argentina estimates. With the USDA going from 41 million tons down to 33 million. Which was also below the average estimate of 36.55 million. That 8 MMT reduction is more than the entire U.S. carryout.

Its also looking like Mato Grosso's expected large crop might not be enough to offset the losses in the southern states such as Rio Grand Do Sul. So perhaps we already saw the high print for Brazil's crop.

Wheat 🌾

Was overall a quiet report for wheat as many expected. With the U.S. balance sheet being left unchanged. Wheat continues to struggle with cheap world values and enough supplies.

We did see world wheat supplies slightly smaller, but most of this was due to the changes made in China's feed and residual use.

On the bearish side of things we saw the world crop upped by roughly 5 MMT.

In conclusion, we didn’t see any huge major changes or surprises. Even though the Argentina numbers came in below estimates, everything else was pretty much what the market expected which has us trading lower. Outside markets also pressuring the grains with the dollar trading at 3-month highs.

The next major report that could shake things up is the Prospective Plantings & Quarterly Stocks Report on the last day of March.

We will have a more detailed update surrounding the report and action today sent out later this afternoon.

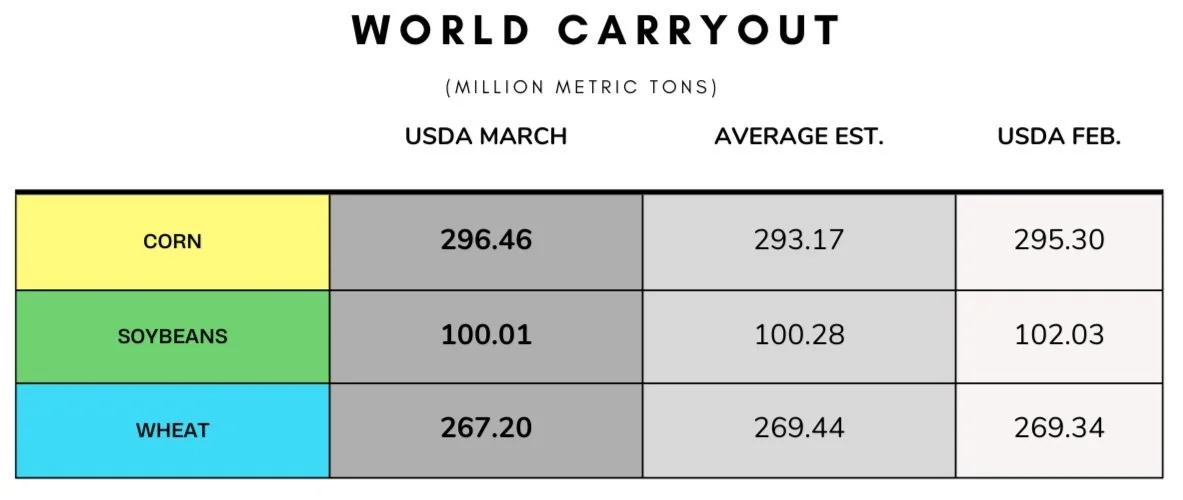

The Numbers