SHOULD GRAIN BE HIGHER OR LOWER THAN LAST YEAR?

WEEKLY GRAIN NEWSLETTER

By Jeremey Frost

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

Here we are coming up on the end of January, so I think it is time to take some personal grain marketing inventory.

Some of the things I want to think about are what is the market telling me, what is the fundamental story, what is the technical story, what is the story the funds are telling or want to see, am I where I am supposed to be in terms of grain sold or grain marketing? What is my plan should the markets decide to go straight up or straight down?

But the number one and really most important question that summarizes all of the above is am I comfortable in my grain marketing position with all of the known information and unknown future path for grain prices.

On Friday I had an audio out that called out some advisors for having pocket books lined from those that make money buying grain cheaply. I mentioned how I thought fear selling didn’t make much sense and how it was stupid to be giving grain away making new crop sales.

As many of you know I subscribe to nearly every advisor out there. With my 20 plus years at CHS I have had several great advisors put on marketing seminars that I helped host and I have seen several other advisors in person who I think do a great job. There are also several such as Mark Gold who I have listened to his audio comments nearly every day for 20 plus years. I don’t agree with his philosophy 100%, but I respect and understand his methodology and it is rather simple.

One of the advisor’s that I have started following just the past couple of years has been Roger Wright and Wright on the Market. Last night Roger Had a great write up and it fits well with my thinking that guys should not be fear selling new crop 2023 grain. You can listen to that audio here

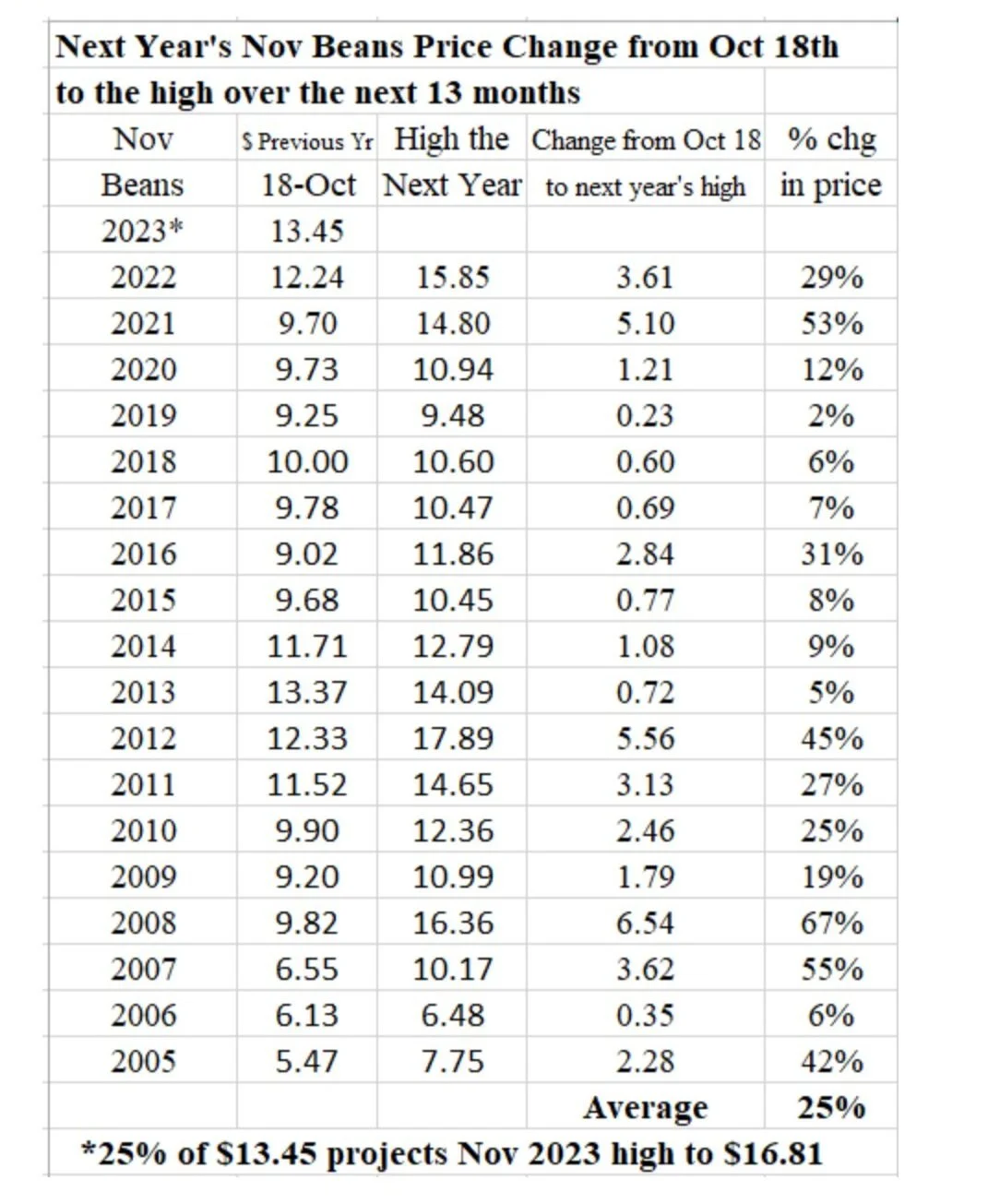

Here is what Roger wrote. “Note that if Nov beans and Dec corn gain the same percentage this crop year as they have gained on average since 2005, November beans will trade to $16.81 this year and December corn will trade to $8.08.”

Followed by these two tables.

When I look at all of the different advisors that I follow, some of whom I respect. Others I think are simply there to promote farmers to sell cheap. Most of them have been rather aggressive lately in making 2023 new crop grain sales.

When I look at the tables above 2013 scares me a little bit I must admit. But for an industry that is so much about averages and locking in profits. How can so many not look at what has happened the past few years. Look at the averages over the past 15-20 years, look at seasonals. Then look at our balance sheet and come up with a conclusion that farmers should be aggressively selling new crop 2023 grain?

I just don’t get it, but maybe I will be wrong. I know very well that there is a chance that some black swan will hit and Mother Nature will be so perfect everywhere. But I can also look at the above and realize that there is 1 year in corn and zero in soybeans where our high hasn’t been above our Oct 18th price. That doesn’t mean it can’t happen this year. But the numbers above don’t get me wanting to sell anything anytime soon.

Why is everyone selling 2023 new crop grain?

The conspiracy theorist in me would say it is a simple play to help the large ABC commercials buy grain cheaper. Anyone remember the Cargill Pro Pricing contracts last year?….

To continue reading please subscribe.

The rest of this post is subscriber-only content. To continue reading and receive every update please subscribe. Use can code “GRAIN” for 50% off.

Included in this Week’s Edition

Why is everyone selling 2023 new crop grain

Why you shouldn’t be making 2023 sales

Are you comfortable in your operation

What do the charts say

For those of you that made 2023 new crop sales. Do you feel you locked in a good basis if you made a cash sale? How much less of a basis versus nearby did you lock in or sell your cash 2023 grain for?

What does the technical picture for grain look like?

+$9 Wheat?

What’s the fundamental story

Brazil & Argy

Millet & Sunflowers

Will corn ever have a 2012 type yield repeat?

Commodity overview