GRAINS FALL SHARPLY, WHEAT HITS NEW LOWS

Overview

Grains fall sharply across the board. Corn and beans lower as expected with the Argentina rain over the weekend. Wheat makes new lows with improved weather in the US. The good news for the grains was that we were able to close nicely off our lows.

Will have to see if we get a turnaround Tuesday tomorrow or continue lower.

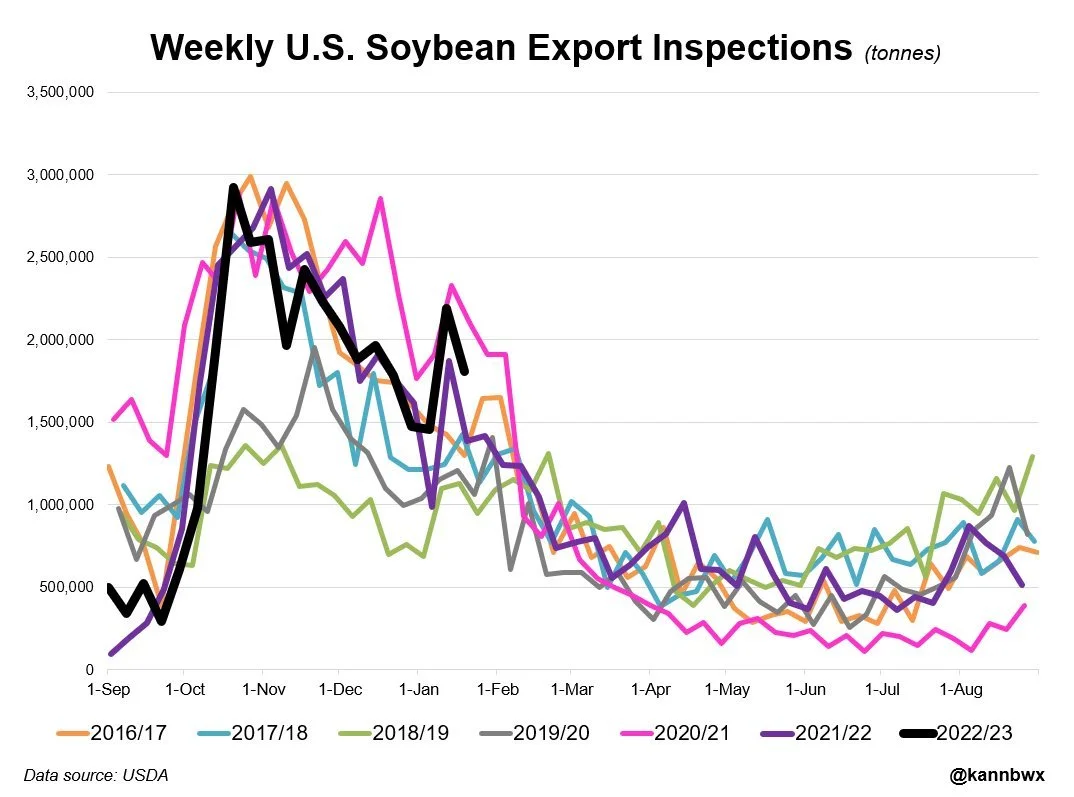

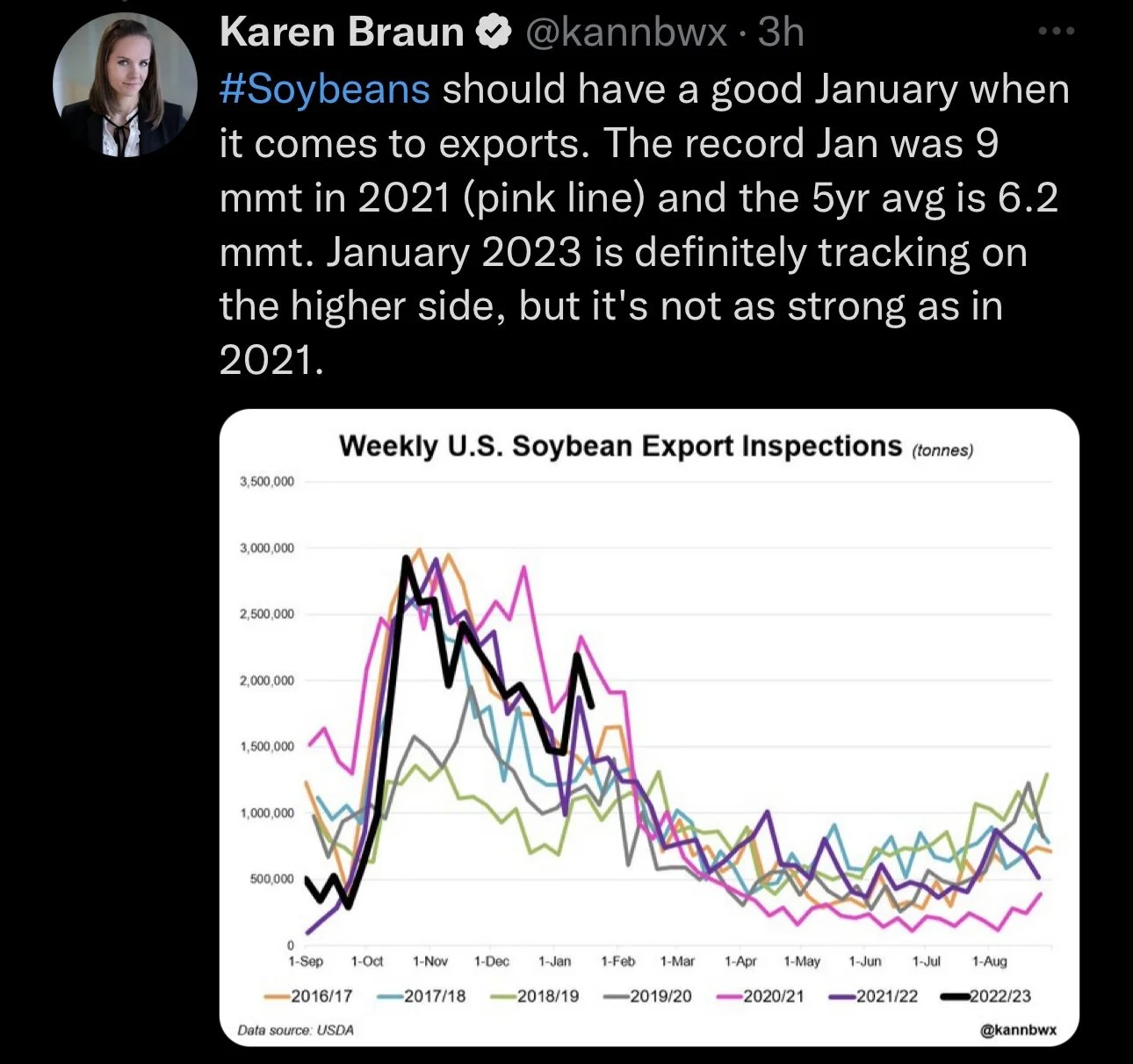

Export inspections this morning were average, with all falling in between the estimates. Soybeans were on the high end of the range.

In case you missed it, read yesterday's Weekly Grain Newsletter.

Should Grains Be Higher or Lower Than Last Year? - Read Here

Today's Main Takeaways

Corn

Corn lower to start the week but held up the best among the three grains. Trading 10 cents lower, but managed to close 5 cents off our lows, which was closer to its highs rather than its lows.

Pressure coming from rain in Argentina over the weekend.

The corn market also continues to be pressured by Ukraine and other countries export prices continue to be lower. Which has created further competition in the export market.

On the positive side of things, we did see increases in export sales and ethanol production which were both beneficial to corn.

We are now close to the time of year when we should start to see a major increase in US corn exports. We have had a very poor marketing year thus far for corn exports. But, we should now expect to see bigger corn inspections and sales the next few weeks.

The Argenitna problems and the war in Ukraine are the two things giving bulls hope in the corn market. As its tough to be full blown bearish given those two bullish factors. Traders will also be keeping a close eye on Brazil's second crop corn as there is an entire growing season left there.

Bulls continue to struggle to see prices creep back up to $7. One of the largest things holding back corn from trading higher is the demand concerns, which struggles to justify prices trading $7 or higher. If we want to see corn futures higher, its looking like we will need a more demand driven story to elevate prices. To see this demand story we might need some greater fund interest or a major production worry.

Corn continues to chop around, working its way towards the bottom of the triangle. We will have to wait and see if we get a break to either side.

Corn March-23

Soybeans

Soybeans run into more weakness following the lack luster week last week. Losing -16 cents today, now almost 60 cents off our high of $15.48 made just 3 sessions ago last Wednesday. Beans did manage to close over +10 cents off their lows of $14.79 3/4, closing at $14.90 1/4.

Soybeans are being pressured from two things. The first being the sharp losses in soy meal pulling beans lower, which isn’t really surprising given meal's recent bull run. We of course also had Argentina rain over the weekend which we all knew would likely add some pressure to start the week. Forecasts in Argentina are also looking more wet.

When we combine the rain and wet forecasts for Argentina with early harvest under way in Brazil, who is expecting a record large crop, as well as the lower US soybean crush totals in December, we get to see the bears take over and push prices lower.

Early harvest in Brazil is running behind but isn't really a major concern for anyone right now.

We also need to keep in mind that the Chinese New Year started yesterday, so this might lead to some slower sales this week.

The funds are already pretty long beans, Brazil is expecting a massive crop, and it looks like the problems in Argentina may be getting pushed to the side with the recent rain. So there isn’t a whole lot there benefiting the bean market right now. Chinese demand remains an uncertainty, and there just isn't any new fresh bullish headlines to carry the market higher for the time being.

However looking long term, we will need to keep an eye on the tight US balance sheet as well as the possible weather worries and an increase in China's appetite, which could all benefit the markets in seeing higher prices.

Soybeans broke their upward trend line briefly but managed to close just at the support line, remaining in their uptrend from October. We will have to see if we bounce here, as a break below wouldn’t look great on the charts.

Soybeans March-23

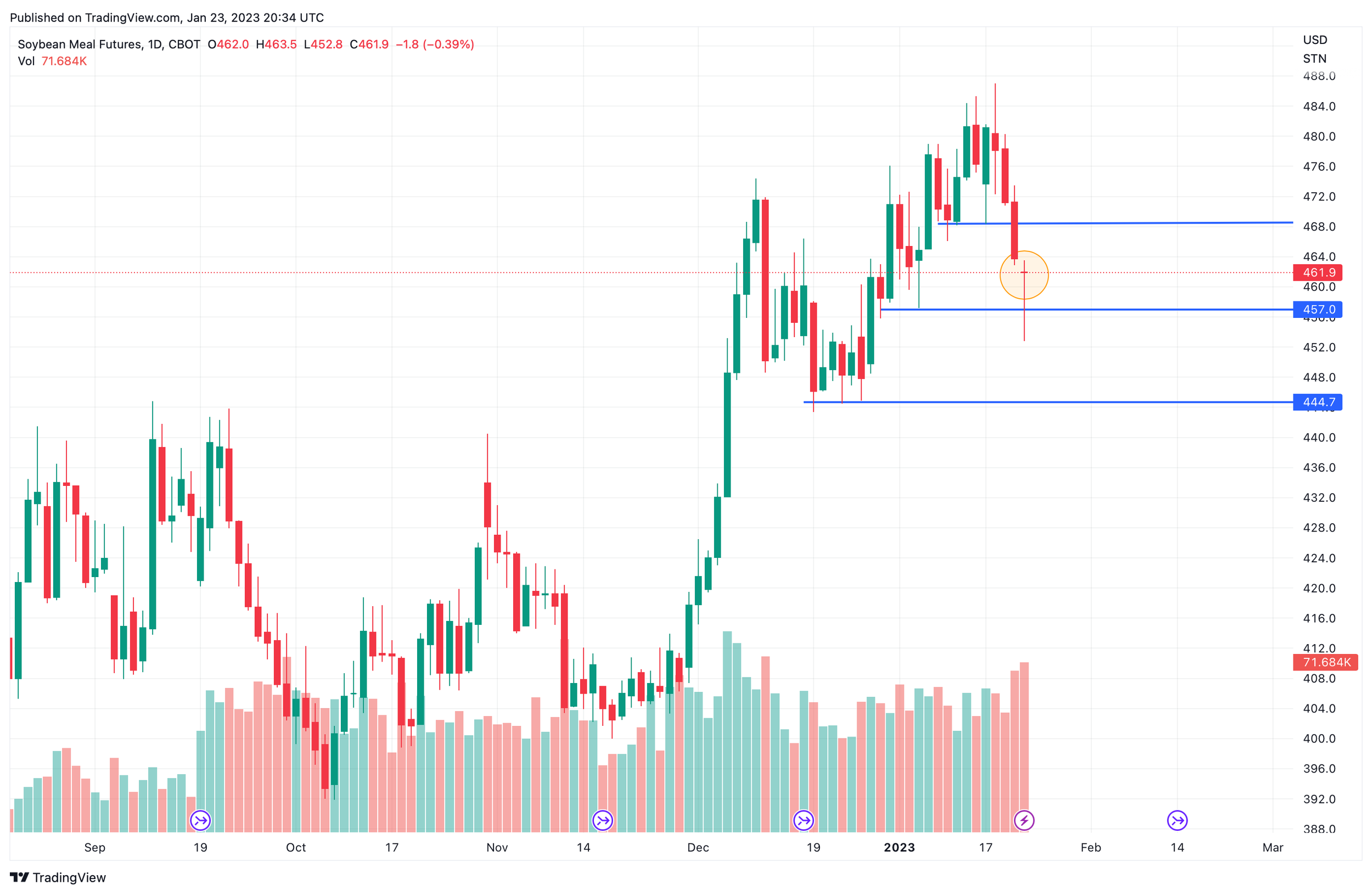

Soymeal

Soymeal broke multiple levels of support following its recent bull run. I think we all knew the meal rally would end in sharp losses when it ended given that the funds were holding a record long position.

However, we saw an incredible rebound from our lows, as you can see from the chart we formed a bullish doji candle. So we will have to see if that strength we saw on the rebound continues or if the recent correction comes for more blood.

Everyone has been preparing for a crash in soymeal, but we are now back to Sunday nights opening with the recovery.

Export Inspections Soybeans

Chart Credit Karen Braun @kannbwx on Twitter

Wheat

Wheat sharply lower here today. As March Chicago yet again falls to new lows, leaving bulls shaking their head in disappointment. Chicago traded as low as $7.12 1/2 before ultimately closing at $7.20.

Wheat's continuation of disappointment largely stems from the world simply being cheaper than that of the US. As the US continues to lose out to the rest of the world who have abundant supplies and cheap product.

We are also seeing some pressure from drought relief in many areas here in the US. This improvement in drought will likely continue to add pressure to the wheat markets short term. Taking a look at western Kansas who is currently still in one of the most drought stricken areas in the states, they are expected to see some above average snow as well. But even with this relief, a ton of areas crops are still in fairly poor condition due to the widespread drought we had, so there is still some concerns there.

The war also isn’t helping the wheat market as much as bulls would like. As the impacts from war headlines have been minimal as of recent. Putin did hint at restricting wheat exports last week, but most think he's just blowing smoke and that won’t actually happen.

With the war, we have to question the legitimacy of both Russia and Ukraine’s production estimates. Russia is expecting a record crop. But there is some talk it might not actually be as big as they are saying, so that is definitely something to keep an eye on going forward. As the estimates might be a little overly optimistic.

Bulls such as myself have taken a beating, as wheat hit another low today. The main factors in the wheat market are the 3 W's. Wealth (Funds), Weather, and War. I'm still optimistic we see higher wheat prices over the next few months as there are a variety of factors that could push us higher. I also think it's just a matter of time before the funds step back in here as they might start to look to exit some of their corn, bean, and meal positions.

From a technical standpoint, the charts don't look great. We broke our early low from December, which puts us at a new 52-week low. So we will have to see where we find support and if we can break out this downtrend.

Chicago March-23

What's next - $6.80 or $7.60?

Here is a 3 year Chicago wheat chart from Andrey Sizov (SovEcon). As you can see from the chart, wheat is entering a apex that could from a technical perspective dictate the direction we go.

Chart Credit @sizov_andre on Twitter

KC March-23

MPLS March-23

Drought in the Corn Belt - Podcast

Below is a great listen of a podcast from 'Real Vision' that talks about the drought in the corn belt.

What a Drought Would Mean for Inflation - Listen Here

Write Up from John Scheve at Wright on the Market

It has been over a week since the latest USDA report.

The biggest surprise was harvested acres being down significantly due to dry weather in Nebraska and Kansas. With those acres removed from production, the national yield average rebounded slightly. Still, overall production is lower than previously estimated.

The USDA also decreased corn export demand to an attainable level as the US prime corn export season begins. Currently it is uncertain if world buyers will fill their storage facilities or wait to see how big the next crop in Brazil will be in May. There were some additional surprises in the January report that will take time for the market to digest.

Sorghum

While many market participants have discussed the drop in harvested corn acres and the slight increase in yield, they have overlooked sorghum. Sorghum had a 58% production decrease from last year, which means 200 million fewer bushels of a crop that competes directly with corn in the southern plains feed channel. Moving into spring and summer, there will need to be a lot more new crop wheat available to help fill this void, or it will put a bigger squeeze on an already tight corn supply in that area. Therefore, the spring weather in the southern plains will be watched closely, because it will have a big effect on hard red winter wheat production and corn basis in that area.

Hay

US Hay production being down 6.2% also caught my attention. To compare, year over year corn production was down 8.9% and soybeans were down 4.3%. Right now, hay stocks are the lowest since 2011. Nebraska, Oklahoma, and Texas are down nearly 33% from last year while Kansas is down 18%. This means spring weather will need to have normal to above average precipitation in the southern plains to ensure adequate fiber is available for feed needs in 2nd quarter 2023.

A tight fiber market could increase the value of other feed ingredients, many of which are also competitors for corn in feed rations.

Limited Grain Being Stored in Bins

The massive corn stocks decrease in Nebraska and Kansas will take time for the trade to fully understand. Currently, the USDA is reporting 30% less on farm and commercial stored corn in Nebraska compared to last year and Kansas is down 25% year over year. Looking to the northern part of the corn belt we find that North and South Dakota have between 5%-13% less corn on hand than they did last year when they were under extreme drought conditions. Even Iowa is down almost 2% from last year with most of those lost stocks being in the western third of the state. When looking across the entire US we find that overall corn stocks are 7% lower than the average of the last 8 years, and it is the lowest stocks on hand for this time of year since 2014. This could mean western corn belt end users, without coverage past March, may have issues sourcing corn to feed their animals or run the ethanol plants. This could suggest a rally in the basis later this summer. Plus, rail logistics get expensive trying to move grain from the east where there is plenty of supply to the west where stocks are limited.

Bottomline

There has been a lot of bearish news in the market recently it seems. However, limited stored corn west of the Missouri River Valley could offset a lot of negative export and ethanol news. Plus, spring weather could still have a big impact on hard red wheat production which could in turn sway both futures and basis prices on corn later this year.

Check out Wright on the Market Here

Highlights & News

Cattle on feed down -3%.

Farm groups are urging the FTC to investigate the high egg prices.

Despite some of the largest lay offs in decades, the stock market and tech sector sees a massive rally today.

CONAB noted that the carryovers of both beans and corn need to be increased substantially in 2024 as a matter of food security.

Last week the U.S. government hit its $31.4 trillion debt limit.

Other Markets

Crude oil essentially unchanged at 81.60

Dow Jones down up +180

Dollar Index up +0.109 to 101.89

Cotton up nicely, +0.69 to 87.39

Stock Market Approaches Magic Line

The S&P 500 approaches its downward trend line resistance on the charts. Which has held true so far during this entire decline since late 2021.

Will we break lower again or shift out of the downtrend?

Livestock

Live Cattle up +0.625 to 160.550

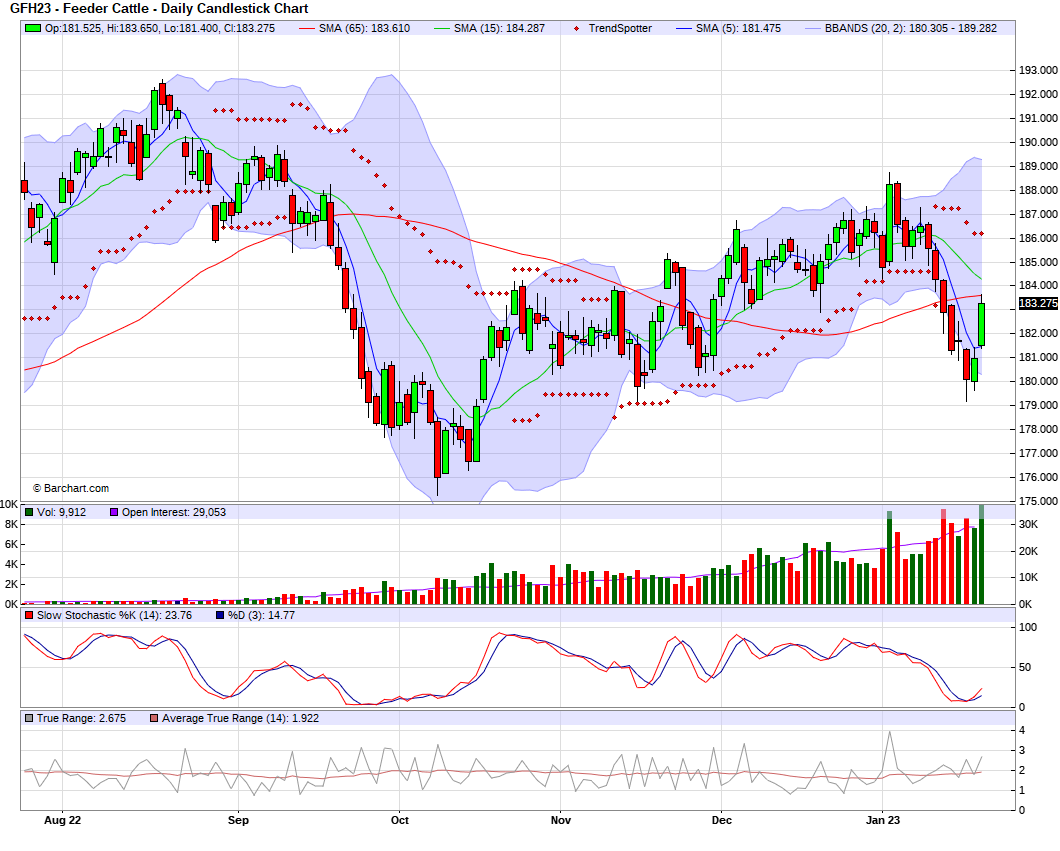

Feeder Cattle up +2.300 to 183.275

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 8-15 Max Temp

Brazil 8-15 Precipitation

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service