SOYBEANS & SOYOIL COLLAPSE

MARKET UPDATE

Prefer to listen instead? Listen to an audio version below

Futures Prices 12:00pm CT

Overview

Grains open lower following a nice gain yesterday in the soybean and wheat markets. The biggest story coming from the massive losses in soybeans and soy oil.

Export sales this morning came in pretty disappointing across the board. As the numbers were sharply down from last. Corn and beans coming in at the low end of estimates, and wheat coming in below.

Yesterday we saw the House of Representatives pass a bill to avert the rail strike. The bill adds 7 sick days for the union members. The Senate must now approve for it to be sent over to the White House, so the outlook is that they get it done sometime. It likely won't happen super fast but will eventually be signed from the looks of it. This news is friendly for futures prices.

Today's Main Takeaways

Corn

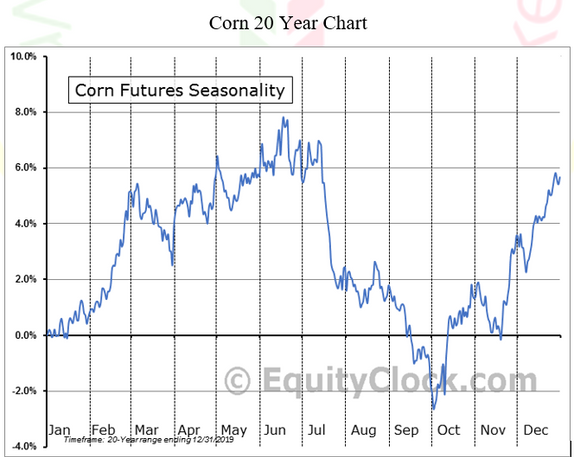

Yesterday we saw corn close slightly lower despite the bounce in crude oil. The corn market continues to trade sideways in a tight range. Trading lower here today, but overall hasn’t done much of anything. Headlines haven’t had much of an effect on the corn market thus far. We will have to see if that changes.

This morning we saw a reported sale of 114,300 metric tons of corn for delivery to Mexico for 2022/23.

Export sales this morning came in on the lower end of trade estimates for corn. Coming in at 603,000 metric tons. Corn sales now nearly -50% lower than a year ago.

U.S. ethanol production was down slightly last week, as we saw a decline in producer margins. The current production is about on par with the pace for the USDA forecast.

For corn, we still have questions surrounding demand. China just bought corn from Brazil as well as Ukraine. Export sales continue to be pretty disappointing. So overall demand is one of the larger factors holding back the corn market.

Some supporting factors; Argentina is still facing crop concerns, we managed to avoid the rail strike for now, as well as war headlines still having the possibility to make some headlines and shift prices. Overall I think we have more beneficial cards in the deck rather than negative ones. But for corn to go higher and break that $7 barrier we would like to see demand increase and perhaps a South American weather scare.

Technical Analysis Chart Credit: Jeff Peterson @jeffpeterson1 on Twitter

Seasonal Corn Chart Credit: Wright on the Markets

March-22 (6 Month)

Soybeans

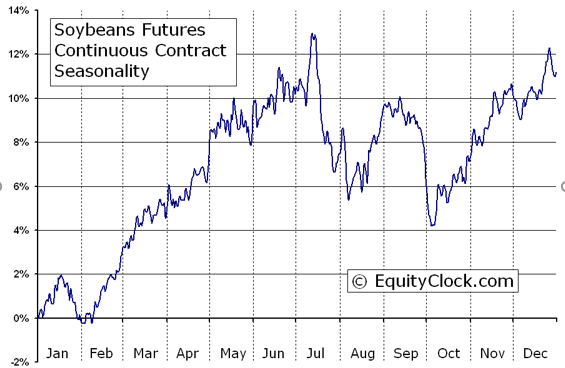

Soybeans and soy oil absolutely fall apart today, after beans saw a 2-month high yesterday. Soybeans down over 40 cents (-2.9%). With soyoil down 4.50 (-6.25%). Overnight soy oil took out the last month of gains.

Sharp losses in soy oil were largely due to RVO's being just slightly raised to 20.82 million gallons from 20.63 million. This wasn’t as big of a jump as most were expecting. Some thought perhaps this move was already priced into the markets, but it doesn’t appear that way with soybeans and soy oil trading sharply lower today.

Yesterday we saw the USDA announce a sale of 136,000 mts of soybeans sold to China. We also saw a bunch of sales out of Argentina with their new peso deal. A reported 868,000 metric tons the first two days of the week.

Soybean export sales also on the low end of trade estimates. Coming in at 694,000 metric tons. Soybean sales are even with last year. China is said to have bought 6 cargoes of beans from Argentina instead of the U.S. Which is a bit of a trouble for U.S. exports and demand.

Argentina saw some meaningful rain but the forecasts are still calling for hot and dry weather. But Brazil on the other hand isn't currently facing any issues weather wise and their crop reportedly looks pretty good along side their expected record bean crop.

We have been talking about the concerns with the soybean market for some time. With the expected large crop out of Brazil amongst other factors. To go along with the Argentina peso deal. There just isn’t the demand we need to support prices. But then again, we do have Argentina still facing drought and other problems which could ultimately be beneficial for the soybean market but I'm not counting on South America weather woes. Even with today’s sharp losses, prices are still relatively high. If prices were lower it would make one feel more comfortable placing a bet on South America problems. So it’s not too entirely unlikely that if beans can't find support here, we have the potential to see another leg lower. But then again perhaps we see a bounce here, nobody really knows at this point.

We also have to keep in mind, even after losing 40 cents today, Jan-23 beans are only down a few cents on the week. I am currently on the sidelines waiting for more developments and outlook on South America and other factors.

Another factor to keep your eyes on would the China and COVID situation following their protests. As its looking like we may see them start to ease of their lockdowns and strict policies. So this could add some support to Chinese demand and soybean prices.

Soymeal & Soyoil

Soymeal up +0.8 to 418.6

Soyoil down -4.50 to 67.38 (-6.26%)

Soybeans Jan-23 (6 Month)

Soybean Seasonal Chart Credit: Wright on the Markets

Wheat

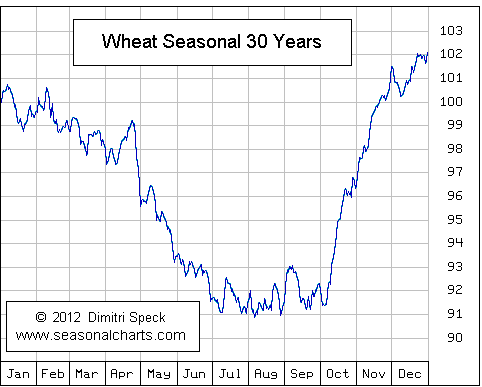

Wheat futures had a nice day yesterday, getting close to that $8 level for March Chicago. However, prices slipped overnight and are giving back some of those gains today.

Export sales this morning were pretty bad for wheat. Coming in at 156,000 tons, which was far below trade estimates. So not a great news for the wheat market.

The dollar continues to trade lower off its highs which has been beneficial, but that alone can't justify pushing prices higher but can certainly help.

We saw Russian wheat prices rise for the first time in a while, which is bullish news as Russia dominates the global wheat market.

We have improved condition in the U.S. winter wheat crop, but its still one of the worst crops on record, so I look for this to add support in the future. To add onto the problems here in the U.S. we still have global concerns with the wheat crop. With the potential for Ukraines final harvest to be half of what it was a year ago.

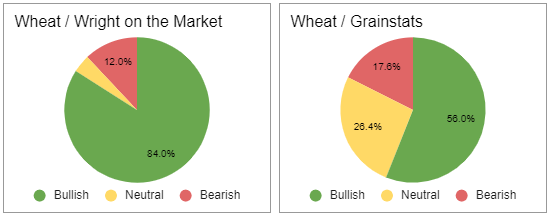

Prices remain far below their moving averages, as we have been making lower highs as well as lower lows. But perhaps wheat is beginning to become oversold here, with funds holding on of their largest short positions on record. With all of the factors at play, I'm still optimistic that we start to see some strength in the markets some time in the near future. We are still close to testing support, but if we can get a push back over $8 our next target would be $8.20 which is about where wheat fell off two weeks ago. Either way, I don't think anyone is shorting wheat here.

March-23 Chicago Wheat

Seasonal Wheat Chart Credit: Wright on the Markets

Wright on the Market & Grainstats outlook, via Wright on the Market

Chicago March-22 (6 month)

KC March-22 (6 month)

MPLS March-22 (6 month)

Other Markets

Crude oil up +1.79 to 82.39 adding a little bit of support to the grains.

Dow Jones down -200 points

Dollar Index hits lowest levels since August, down -1.13 today to 104.77

Cotton down -0.75 to 83.96

News

The U.S. exported a record amount of crude oil and refined oil products last week. The most ever in fact.

Next USDA Supply & Demand report is next Friday, December 9th.

Employers cut most jobs since 2021. Cutting 76,835 jobs in November. Highest single number since January 2021.

Gold hit highest levels since August

Yesterday we saw Fed Chairman Powell say his final interest rate target is higher than where interest rates currently stand today. But the pace will be slower than it has been.

Livestock

Live Cattle down -0.525 to 155.150

Feeder Cattle up +0.05 to 180.525

Live Cattle (6 Month)

Feeder Cattle (6 month)

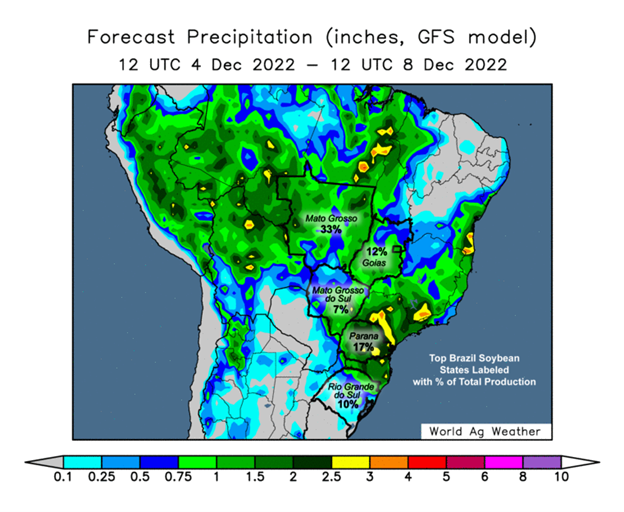

South America Weather

Argentina saw some meaningful rain, the forecasts remain dry and hot for the near future. Brazil on the other hand isn't looking too bad this far, as their crop remains in pretty good shape with the expected record soybean crop.

Brazil is expected to see some more rain above normal levels, while Argentina is expected to see some spotty showers but ultimately remains dry. So ultimately weather for Brazil is currently bearish while weather in Argentina is bullish.

Chart Source: Roach Ag

Social Media

All credit to respectful owners

Precipitation Forecast 2-Day

U.S. Weather

Source: National Weather Service