CORN LARGEST DAILY LOSS SINCE AUGUST

MARKET UPDATE

Prefer to listen instead? Listen to an audio version

Futures Prices Close

Overview

Corn and wheat trade sharply lower today, with corn notching its largest single day loss since August and wheat seeing its largest in a month. Soybeans rebound following yesterday’s blood bath in the soybean and soy oil markets following the EPA guidance not being as high as most had anticipated.

Today's Main Takeaways

Corn

Corn down around -14 cents today hitting new lows we haven't seen since mid August. Also notching its single biggest decline of 2.2% in a day since August 16th. Falling below most of its moving averages. December-23 closed below $6 for the first time since August as well. With pressure coming from continued poor export sales and the EPA numbers not looking too friendly.

The EPA proposal yesterday added some pressure to the corn market, but the ethanol numbers were far more in line with expectations than the biofuels were, so it wasn’t as bad for corn as it was beans.

Year to date U.S. export sales for corn are 48% below where we were last year. As exports sit at 0.722 billion bushels compared to last years 1.395 billion. So demand is still a pretty large concern surrounding the corn market. But one would think we start to see demand pick up sometime in the future.

We could see export demand increase in the future as well as ethanol requirements get stronger, but currently there isn’t enough demand to justify corn trading above $7.

Taking a look at South America, there isn’t much to chew on here for the corn market as of now. Sure one could argue that we see production slip over in Argentina with all the problems they have been facing, but we just don't know enough at this point. Here in the U.S. the crop is essentially out of the ground so there isn’t much there either.

From a technical standpoint, we have seen prices break below most of their moving averages. We also saw corn break below a support level of $6.53 1/2 cents. We will have to wait and see if we have some support here at these levels we haven’t seen in 4 months. I'm slightly optimistic looking long term but waiting on the sidelines for now for some more clarity.

March-22 Corn (6 Month)

Soybeans

Soybeans and soy oil stole the show yesterday as they both saw massive selling following the EPA guidance. As the numbers came in very disappointing for the biofuel industry. They proposed an increase from 2.76 billion gallons in 2022 to 2.82 billion in 2023, 2.89 billion in 2024, and 2.95 billion by 2025. That is just a 7% increase of 190 million gallons over the next few years. Traders were expecting a much larger increase upwards of over 1 billion gallons.

This news led to soy oil sharply falling 6% yesterday trading limit down, followed by some more bleeding overnight, hitting new lows we haven’t since the middle of October. Soybeans followed suite and traded sharply lower as well (-40 cents lower). However, soybeans are seeing somewhat of a rebound today following that drastic sell off. Soybeans up around +7 cents at $14.36 1/2. If soybeans continue to fall in the coming days, one would look at the $14 level for some major psychological support. The funds are still long soybeans, bean oil, and meal so we will have to see what they decide to do.

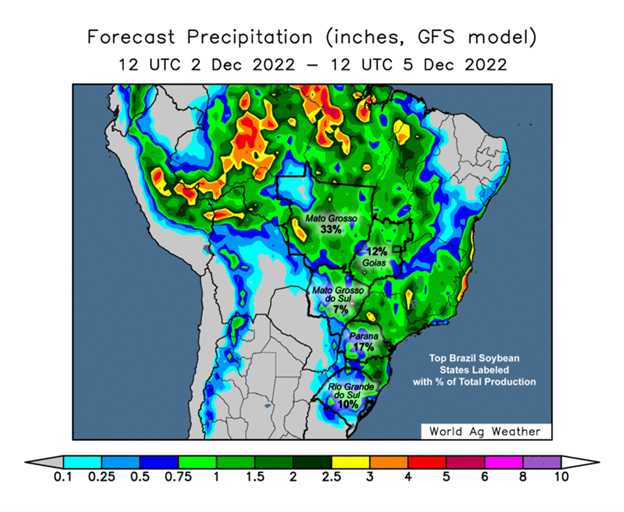

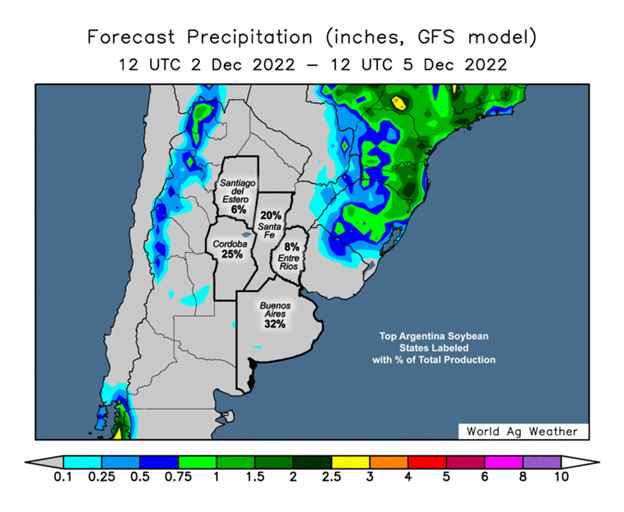

Taking at Brazil. They are still projected to see a massive record crop, with production estimates still sitting at record levels. With their weather forecasts not giving any optimism of a weather scare as they look pretty favorable for the crop. Argentina on the other hand has seen a lot of struggles, but are expecting to see some rain. But this doesn’t change the fact that 1/3 of the early planted beans in Argentina are already in regular to poor condition due to their dry weather.

We also have Russia and Ukraine adding to the soy oil pressure, as they are unloading sunflower oil on the market right now, and this is much cheaper than bean oil. With the price difference between the two being the largest in over 9 months.

On the bright side, we saw U.S. October soybeans crush total 196.7 million bushels which was just under the record crush we saw in October at 196.9 million bushels. This was also above the average trade estimates of 195.9 million.

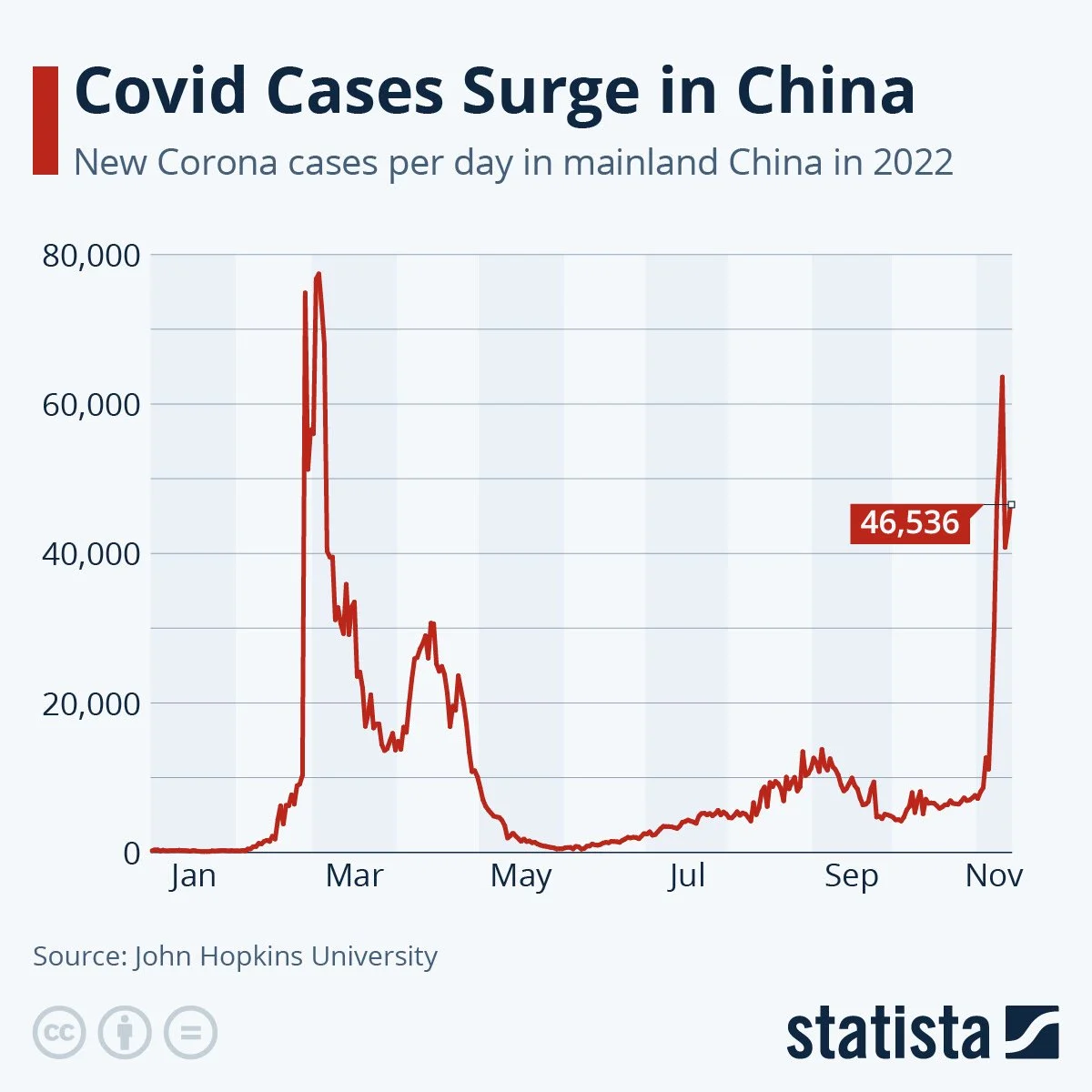

There are some rumors that China is looking to ease off their zero covid policy which has added some support to the bean market. We will have to wait and see how this pans out as this could have a large effect on Chinese demand.

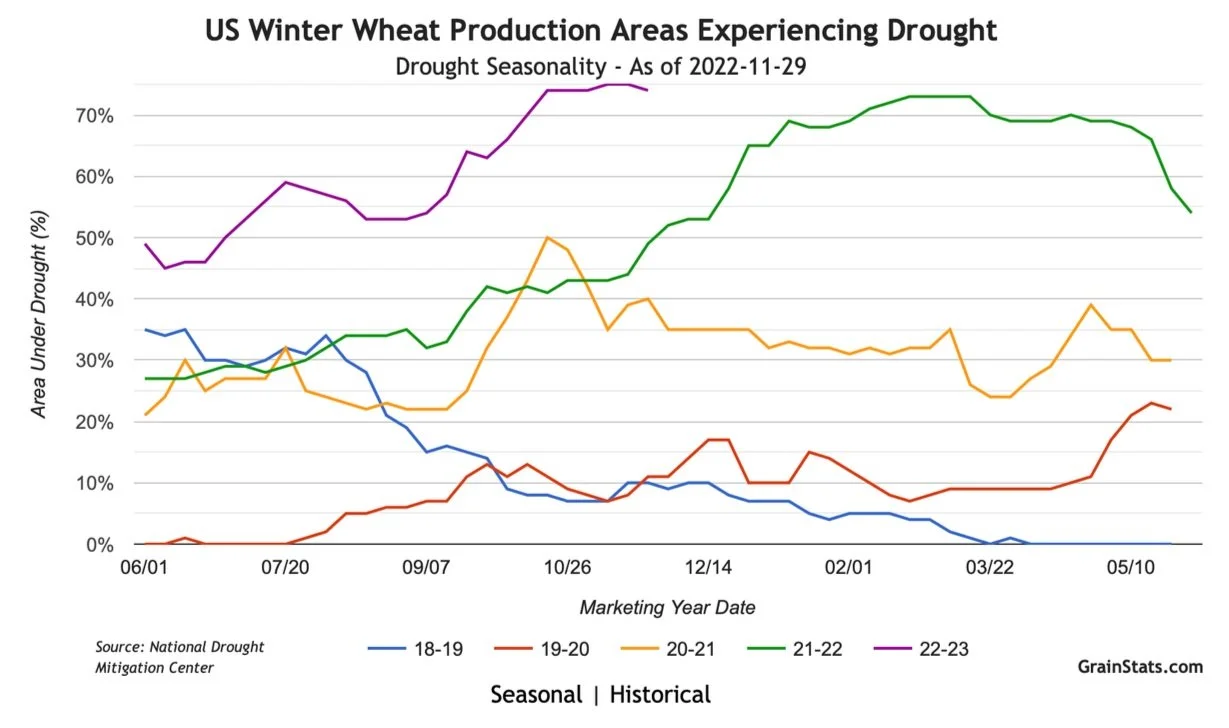

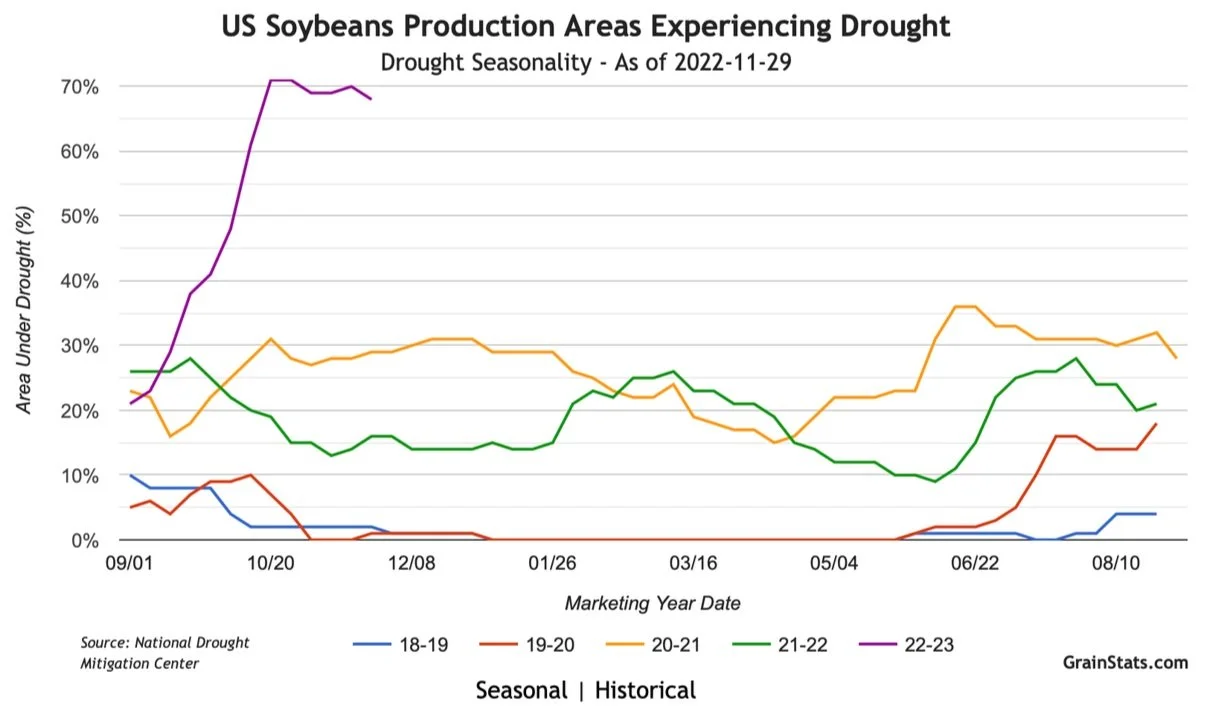

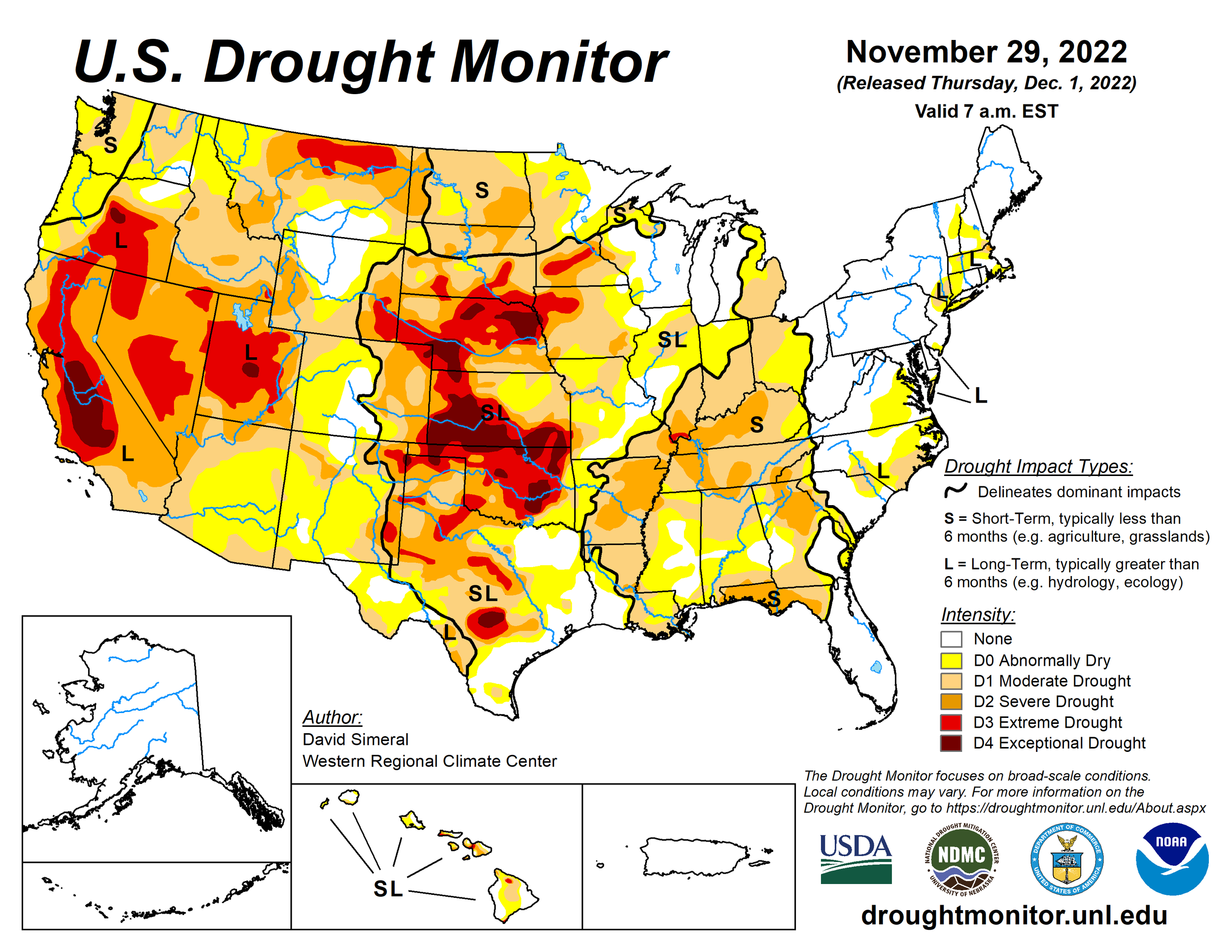

Although planting is still a long ways to go for U.S crops, people still have their eyes on the drought soybean planting areas are experiencing. As 68% of U.S. soybean acres are being impacted drought. Which is way higher than last year's numbers and one of the more historical numbers we have seen.

We could possibly see prices try to regain some of the losses occurred yesterday, but overall with prices still relatively high, it’s kind of tough to be bullish here unless we see some weather scares in South America or increased demand.

Soymeal & Soyoil

Soymeal up +2.5 to 424.1

Soyoil down -2.16 to 65.22

via GrainStats

Soybeans Jan-23 (6 Month)

Wheat

Wheat continues to trickle lower from our small rally we saw Wednesday, where it looked like we might see some support come in for the wheat market but that hasn’t been the case thus far. March Chicago trading over -20 cents lower here today in a pretty wide nearly 30 cent range. Chicago wheat hit its lowest level since August 19th and had its largest single day decline in a month. As wheat is now well below all of its moving averages. Being pressured by Black Sea competition.

We are now sitting very close to some support at the $7.60 1/4 level which was our low we saw back on August 18th. So bulls would like to see prices hold above that range otherwise we have to look for additional support from our lows all the way back on January 14th of $7.48 3/4. Looking to the upside, one would like to think we see buyers step back in here. But I think we need prices to break the $8 mark to see the charts look more enticing and see more upside. We got close on the rally this week seeing a high of $7.96 3/4 but since we have seen wheat continue to make new lows.

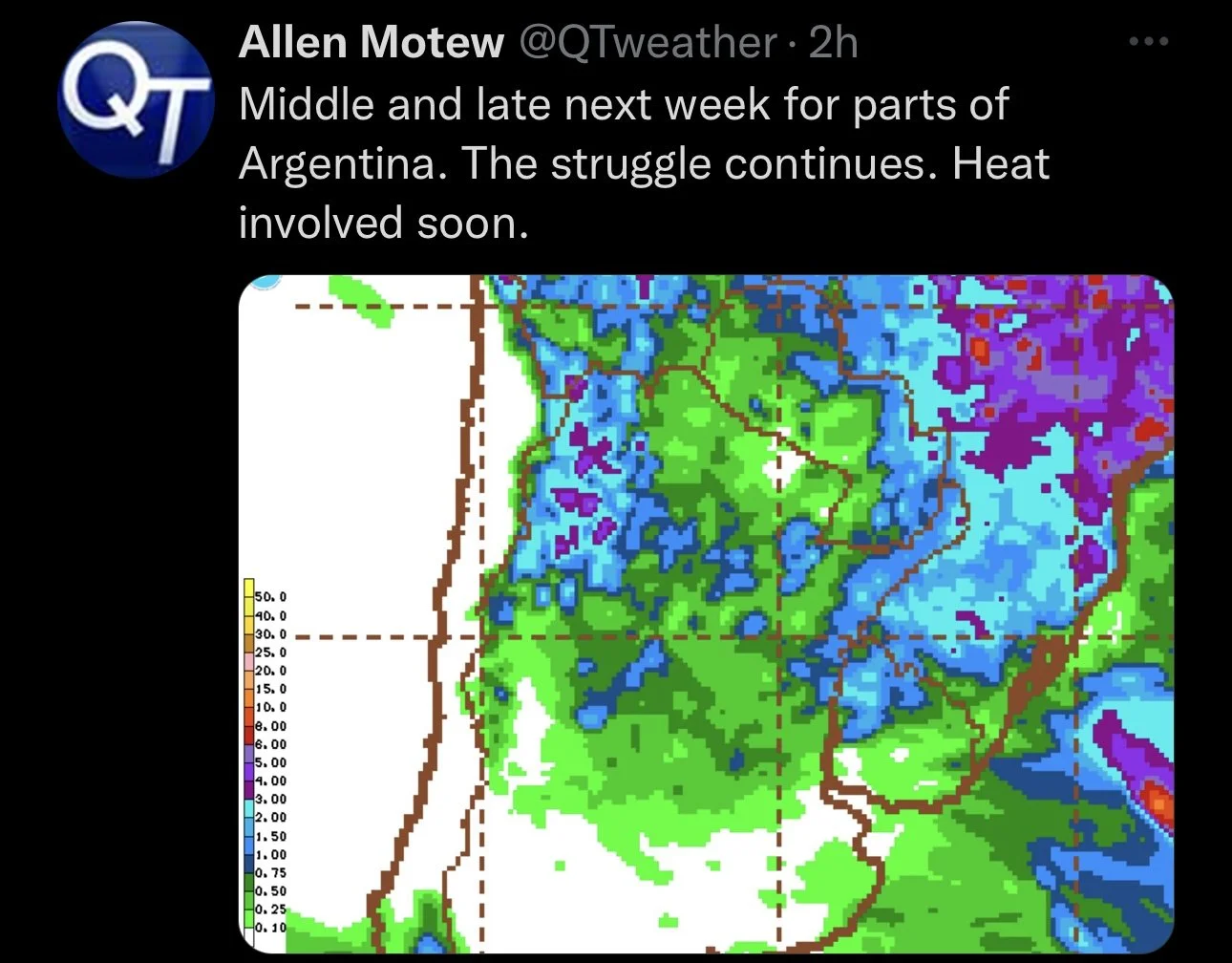

Argentina is actually starting to see some more rain which has the chance to be beneficial to their crops they have just planted, which could add some pressure to prices. But overall outlook for Argentina still remains pretty dry and hot for the most part until the start of next year where we could potentially see conditions become better. U.S. winter wheat crop conditions have also slightly increased but remain some of the worst on record which can't be ignored.

BAGE had Argentina wheat crop pegged at 23% harvested while their conditions remained unchanged at 9% good/excellent which is still far below last years 65%. With their production estimate being a lot lower than the USDA's, coming in at 12.4 million metric tons compared to the USDA's 15.5 million metric tons. So thoughts are that the USDA will still need to make some pretty big changes to their estimates which should ultimately give a boost to wheat futures when they decide to do so.

We are also seeing some pressure from the large supplies out of the Black Sea region as well as some recession concerns still adding a little bit of pressure.

The French have been pretty active in selling wheat over to China, as they sold roughly 400,000 to 700,000 metric tons of wheat to them. This has added some pressure to prices as well.

Overall the improving weather conditions haven’t helped wheat break out of this slump. One would love to see demand increase to help push prices higher. On one hand we still have the possibility of Russia and Ukraine completely end their war or sign a peace treaty etc. which wouldn’t be beneficial to prices. But then again this could also flip the other way and we see more conflict. But with all the problems the wheat crop has been facing here in the U.S. and globally one would like to think its only a matter of time we find support or see some bullish headline to push prices higher.

via GrainStats

Chicago March-22 (6 month)

KC March-22 (6 month)

MPLS March-22 (6 month)

Other Markets

Crude oil down -1.10 to 80.12

Dow Jones down -100 points

Dollar Index unchanged

Cotton down -1.65 to 83.20

News

U.S. farm income soars to new records. With 2022 net U.S. farm income at $160.5 billion. A 14% increase from last year.

The discount from sunflower oil to soy bean oil hits a 9 month high

Planting pace for Argentina soybeans and corn is still behind but they aren’t getting further behind

Livestock

Live Cattle up +0.450 to 155.875

Feeder Cattle up +1.375 to 182.450

Live Cattle (6 Month)

Feeder Cattle (6 month)

South America Weather

It is looking increasingly more likely that we see a heat wave develop in crop regions in Argentina over the weekend and perhaps into next week as well. So overall Argentina remains dry which is a bullish factor, while Brazil, on the other hand, isn’t currently facing any issues so their forecasts are on the bearish side of things.

Chart Source: Roach Ag

Social Media

All credit to respectful owners

Precipitation Forecast 2-Day

U.S. Weather

Source: National Weather Service