SOYBEANS CONTINUE TO FALL

Overview

Grains lower again today posting their straight day of losses as the new year gets under way. Grains have now given up a vast majority of their gains made in the month of December.

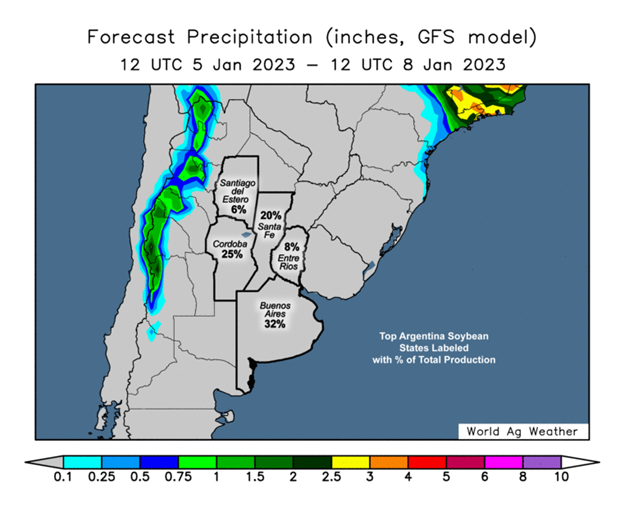

Wet forecasts in Argentina next week pressuring the grains. Of course any sign of meaningful rain will be negative to futures. But if this rain disappears we could see the narrative shift and see some strength, but this all depends on the weather. Overall outlook for Argentina is still dry.

Soybeans also seeing some pressure from belief that the covid situation in China is getting worse following their recent ease of restrictions.

Funds are exiting some of their long corn and soybean positions on this downturn.

There actually wasn’t any real major bearish news to cause this sell-off across the grains outside of possible Argy rain and fund selling. Ultimately, this sell-off may have actually just created some good buying opportunities. We will have to wait and see if we can find strength here or continue lower.

Today's Main Takeaways

Corn

Corn sees modest losses of just a penny in a 9 cent trading range today. Corn is down nearly -30 cents the past 5 trading days.

One thing that has kept corn under wraps is the very poor U.S. exports which can't be denied. But on the bright side, someone is buying corn, they are just looking to get the cheapest deal possible which is what anyone would do. Here is a small snippet from Wright on the Markets regarding U.S. exports and Brazil.

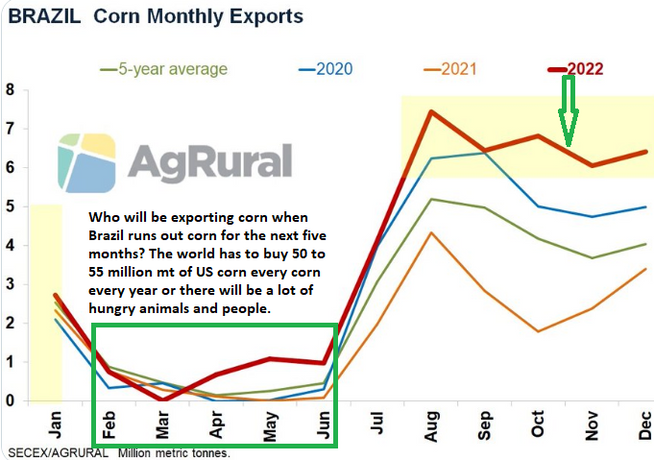

He said, "Even if U.S. corn was cheaper, ships could not be loaded economically at the Gulf where 80% of U.S. grain exports get loaded. The fact that Brazil is selling corn more than ever before is great news. How much corn would the U.S. sell in the coming five months if Brazil sold half as much as they did in the past five months? By the way, Brazil exported almost double the amount of corn to China to China in 2022 than it did in 2021..."

Below is a chart showing Brazil's exports the past 3 years. As you can see they have far exceeded 2021. Which ultimately gives a better outlook for U.S. exports in the future.

You can visit Wright on the Markets Here

The recent weakness in crude oil has of course not helped in supporting corn. As crude oil also fell through some support and moving averages on its recent decline. As yesterday we saw a -$3 drop in February crude due to global economic concerns and China's covid situation.

While we saw corn prices slip here in the U.S., March corn in China just posted its 8th straight day of consecutive gains. As their U.S. equivalent price would be $10.62 a bushel which is good for U.S. futures.

Yesterday the funds were net sellers of 25,000 contracts of corn. With corn falling through some support and moving averages we will have to see if this pressures funds to further liquidate some of their long positions.

Corn has fallen through some key support of the $6.65 level. The next major support is around $6.35. But bulls would like to see a reversal before that. One would think with the recent sell-off that at the minimum we see a relief bounce tomorrow or early next week.

All eyes are on the WASDE report next week. There is some expectations that we see the USDA reduce demand estimates.

Below is a chart from Andrey Sizov (SovEcon). In his tweet he said "Is the sell-off in corn done? The chart says it could be the case."

Bullish Factors 🟢

Poor Argentina crop

Carry outs are less than they were a year ago.

Basis and spreads are stronger than they were a year ago.

StoneX lowered Brazil corn crop.

Brazil is selling more corn than ever.

Bearish Factors 🔴

Yesterday's sell off included a 5 cent drop in national basis, an indicator of farmer selling

Broke through some support and moving averages, which could lead to more fund selling.

Interest rates lead to more farmer selling after 1st of year.

Continued poor exports.

Wild Cards 🃏

USDA Report

Demand & China

What will trigger the funds to buy or sell commodities?

March-23 (6 Month)

Soybeans

Soybeans continue their downfall, getting hit the hardest amongst the grains here again today. Trading in a very wide range. With a high of $14.90 and a low of $14.65, ultimately finishing the day at $14.71, losing a dime.

Soybeans are now well over -60 cents off our highs made just before the new year last week.

A lot of pressure in the beans today is coming from China and their covid situation. As it appears that its getting worse. Which isn't much of a surprise given the absolute surge in cases. There is also some worries regarding the China economy.

The Chinese announced they are increasing export corridors on crude oil. Which is an indicator that their economy may be in trouble. So this news is likely bleeding over into the soybean market today causing some pressure.

Now for Argentina, which has been the talk of the town surrounding the bean market. It does look like they have added some rains to their forecast next week. Possible rains are scheduled from Tuesday through Thursday. So this might add some more pressure to the beans.

Fun Fact: Soybeans have trended higher from November 16th to January 9th the last 14 of 15 years. This past November 16th we opened at $14.58.

Despite the sell-offs across the grains, March soymeal still sits near its contract highs which could be looked at as a good sign.

The deciding factors still remain Argentina weather and China headlines. If Argentina remains dry and these rains next week miss, perhaps we see beans try to recapture some of these losses. If they do get plenty of rain we have the chance to see more downside.

Soybeans are still in an uptrend but are flirting with chart support. Below is a technical analysis from Jeff Peterson @jeffpeterson1 on Twitter.

Bullish Factors 🟢

Very poor Argentina crop

Argeninta facing possibly worst drought on record.

StoneX lowered Brazil crop estimate.

Carry outs are less than they were a year ago.

Recent sell off made crush incentive more profitable for processors, which is bullish for domestic demand.

Bearish Factors 🔴

Expected record Brazil crop

Broke through some support and moving averages, which could lead to more fund selling.

Interest rates lead to more farmer selling after 1st of year.

Wild Cards 🃏

USDA Report

China & Covid

What will trigger the funds to buy or sell commodities?

South American weather. Which is the ultimate factor.

Soybeans March-23 (6 Month)

Wheat

Wheat continues to struggle, leaving bulls scratching their heads. As wheat has broken below its 20 day moving average with the losses yesterday. Wheat market today was mixed, as Chicago wheat finished 10 cents off our lows giving us a good close going into the last day of the week.

Demand is an obvious concern surrounding the wheat market and just isn't there right now. As we saw in this weeks extremely poor export inspections report which showed all-time low volume.

Another thing weighing on the wheat market is overall global competition with the stiff competition and cheap product in Russia.

We also have the funds, who are still short wheat. With wheat near its recent lows, there is less pressure for them to cover their short positions.

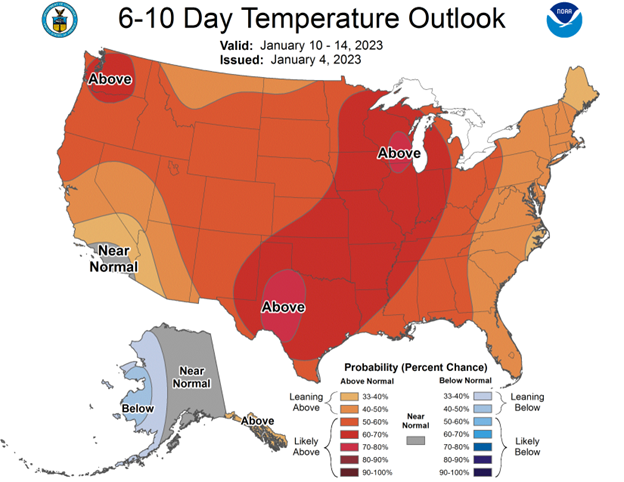

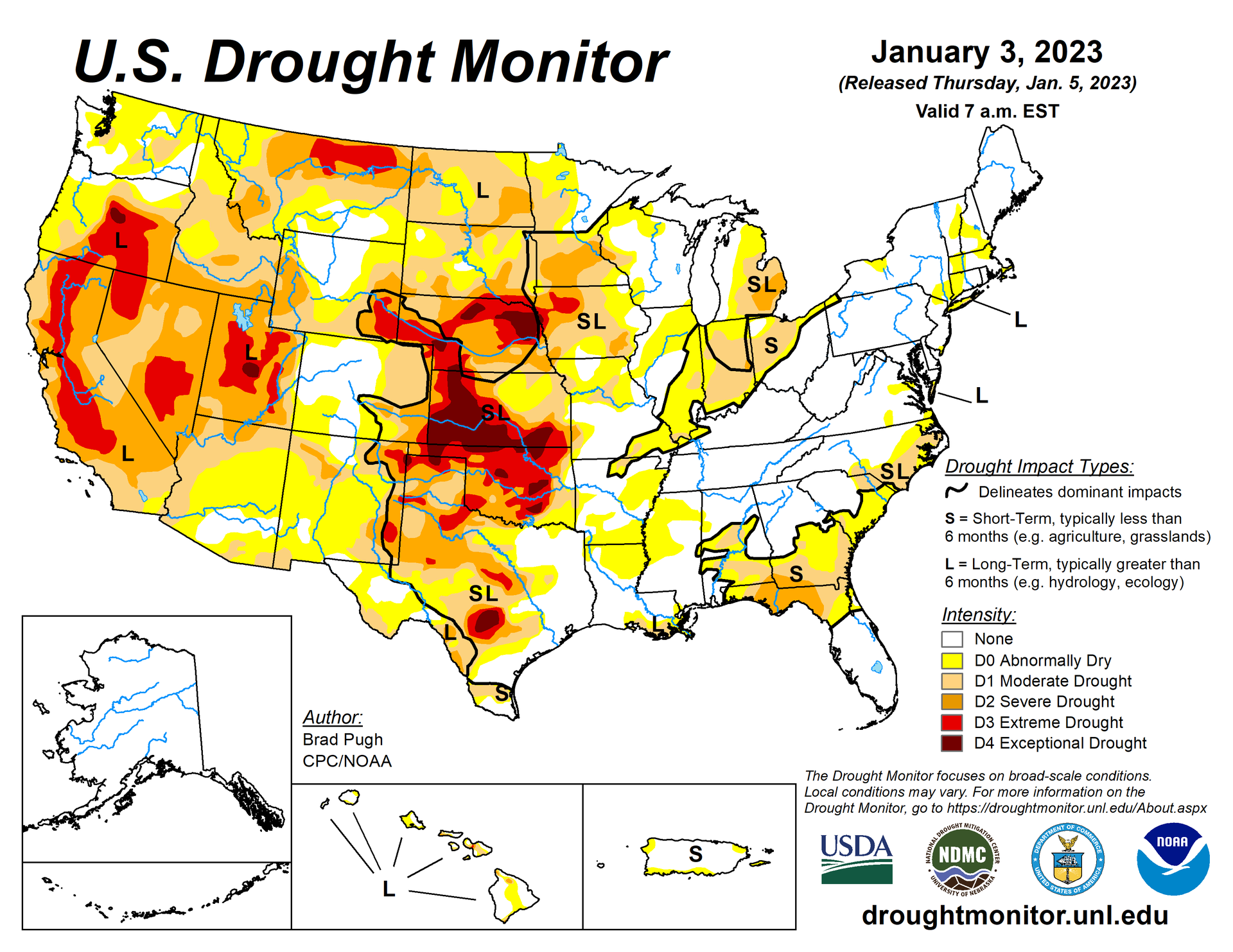

Winter kill here in the U.S. isn’t a major concern at the moment, with the warmer temps and snow cover in most areas that need it. The only area that may still be dry in western Kansas. We also saw the drought indicator see a pretty good drop. Going from 49.65% to 46.26% in the last week. There wasn’t any area in the country last week that saw an increase in their drought index. So we may see some soil moisture replenished.

Russia is expected to export a record 21.3 million metric tons of wheat during the first half of the calender year. But, much of Russia's winter wheat crop is expected to face brutally cold temps of -10 degrees with no snow cover. Roughly 70% of Russia's wheat is winter wheat and Russia is far and away the worlds leading exporter in the wheat market. Most are saying damage will be minimal. But if they do see some damage with this possible winter kill, this could lead to some support for the wheat market.

Here is an interesting fact that Wright on the Markets mentioned about the recent sell-off in the wheat market. He said, "At 1:55 AM Wednesday, the number of contracts traded in all three March wheat contracts combined was 2,099 contracts. At 6:30 AM, all three march wheat contracts had traded a total of 6,315 contracts. That is nothing! Every commodity trading volume was about 6% of normal volume. That makes the sell-off the past two days almost meaningless, except for those long grain on the bin or futures."

From a technical standpoint we have nearby support at $7.39 with further support from our early December lows at $7.23 3/4 cents. Bulls still have their eyes set on $8, as if we can get prices above that level, it would be a good indication for higher prices as we try to break out of this downtrend. Short term it really doesn’t look great for wheat futures, but there is definitely the chance for more upside come spring.

Bullish Factors 🟢

U.S. winter wheat is still in pretty poor condition

Possible winter kill in U.S.

Russia facing brutally cold temps and no snow

This is the 4th year the world consumes more wheat than we produce

War escalation

Carry outs are less than they were a year ago.

Bearish Factors 🔴

Record Russian and Australian crops

Warmer temps across the U.S.

Demand just isn’t there yet

Indian government is considering selling 2.1 mt of wheat in open market to control inflation.

Global competition and International currency

Broke through some support and moving averages, which could lead to more fund selling.

Interest rates lead to more farmer selling after 1st of year.

Wild Cards 🃏

USDA Report

Funds are short wheat. What will trigger the funds to buy or sell commodities?

Chicago March-23 (6 month)

KC March-23 (6 month)

MPLS March-23 (6 month)

U.S. Ethanol

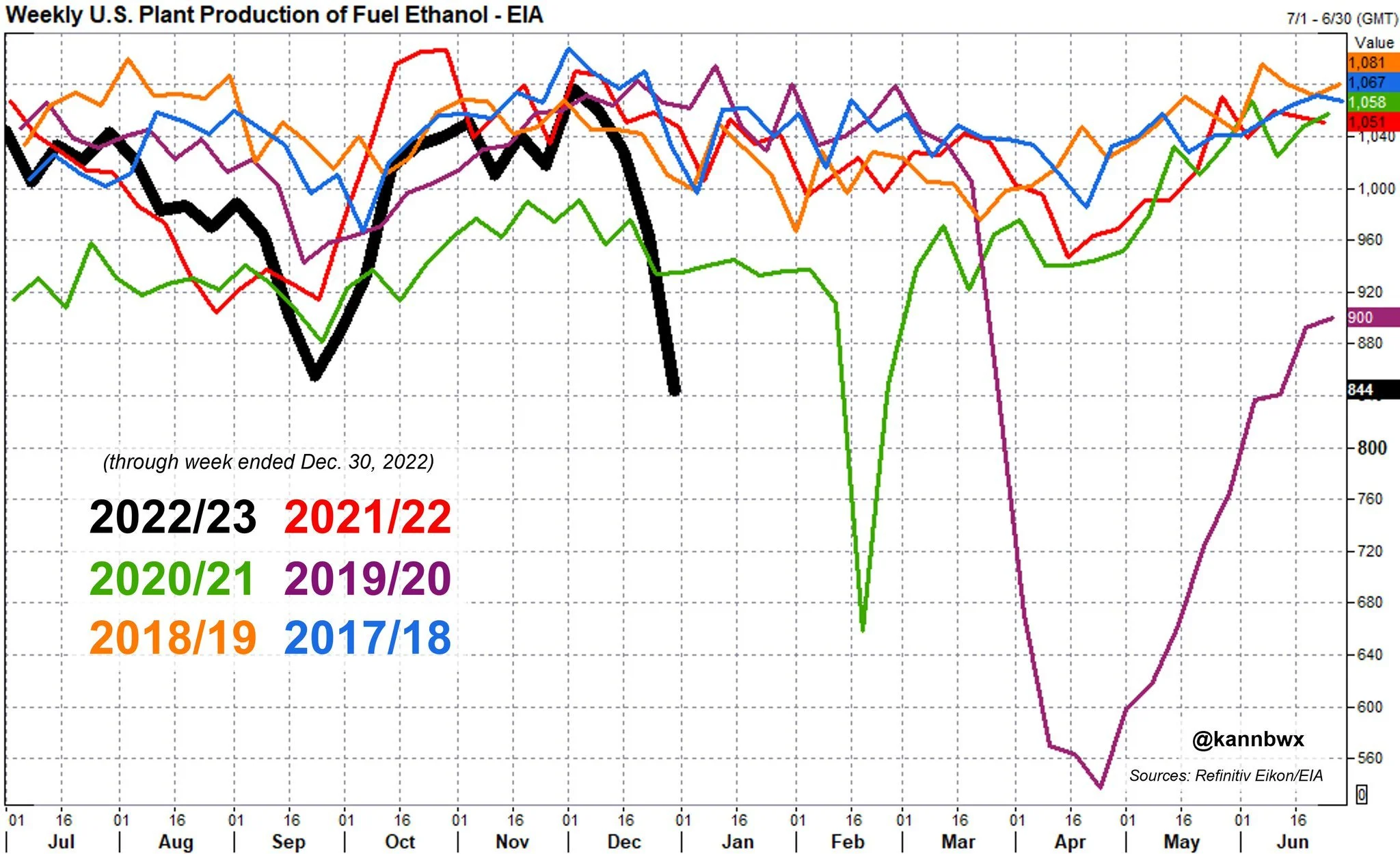

Ethanol production dropped a massive 18% in the last two weeks of the year. That was the 5th largest 2 week drop on record. This was likely in part to the brutally cold temps and snow storms that shut down plants and halted transport.

February of 2021 was worse which was also due to weather implications, but saw a quick bounce back.

Chart Credit to Karen Braun @kannbwx on Twitter

Argentina Drought

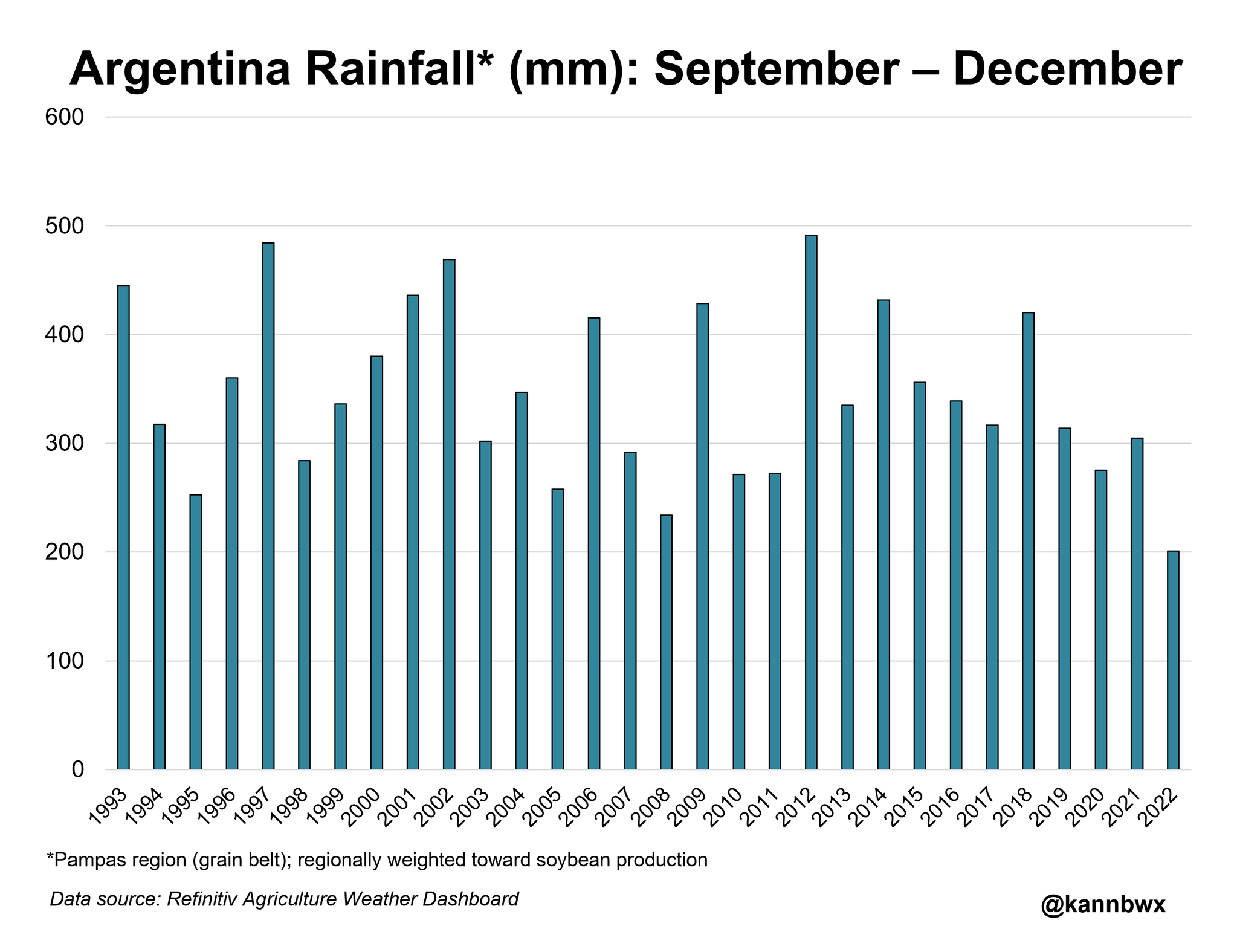

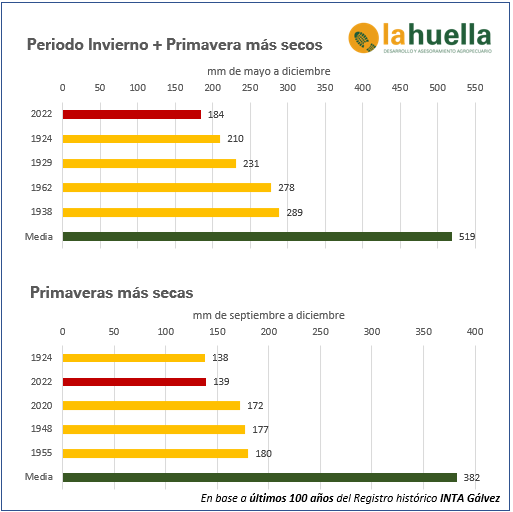

I showcased two of these charts yesterday. But I just again want to emphasize just how bad the drought in Argentina has been.

The last quarter of 2022 was the driest 3-month period in over 35 years. With moisture sitting at roughly 44% below normal levels.

This is one of their worst droughts on record. Either they receive rain soon, or eventually, we just get to the point where the damage is irreversible.

Last month Argentina had its worst drought since 1931. So we know there is plenty of concerns. But what if the drought gets worst? Which it can.

Keep in mind, Argentina is the world's leading exporter of soy oil and soymeal.

Chart Credit to Karen Braun @kannbwx on Twitter

In Case You Missed It..

Yesterday's Update

Fertilizer Price Update & Recommendations

Wheat loses 30 cents

Bullish & Bearish Consensus

Highlights & News

Putin talked to Turkey’s president, and Turkey wants to cease fire. But Putin basically said that isn't going to happen unless they get some Ukrainian territories.

USDA WASDE Report out next Thursday.

Argentina soybean conditions dropped to just 8% rated good to excellent.

Farmers in Argentina have sold 80% of last years harvest of soybeans, which is half a percent behind last year.

Other Markets

Crude oil up +90 to 73.75

Dow Jones down almost -300

Dollar Index up +0.859 to 104.88

Cotton up +2.14 to 82.58

Livestock

Live Cattle up +0.075 to 157.350

Feeder Cattle down -1.675 to 186.550

Live Cattle (6 Month)

Feeder Cattle (6 month)

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service