CONTINUED WEAKNESS IN GRAINS

Overview

Grains continue weakness again today following solid gains the last two weeks, with all grains trading lower. Corn breaks lower from its tight trading range, wheat sees sharp losses, while soybeans continue lower from their sell off yesterday.

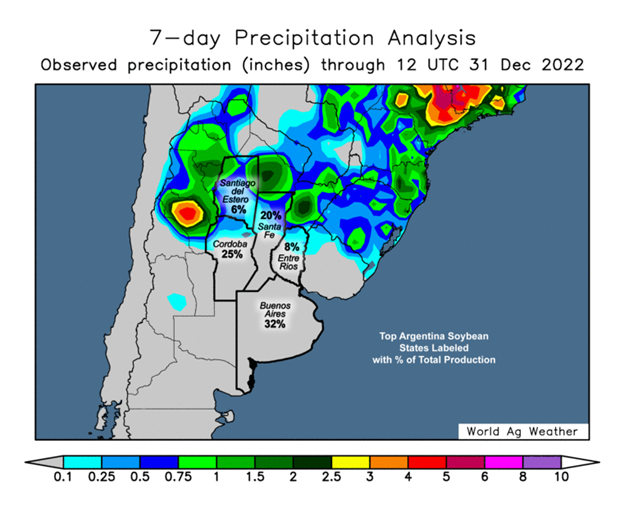

Traders continue to decide if the rain in Argentina over the weekend will outweigh the next 2 weeks of expected dryness. The middle of January does however look a bit more wet.

Brazil’s President decided to exempt fossil fuels from federal tax yesterday. Which has corn and beans under some pressure.

Fund liquidation continue to pressure grains and commodities following yesterday’s poor performance in the grain and energy markets.

Today's Main Takeaways

Corn

Corn sees some pressure today, breaking through some support and moving averages closing the day down nearly -17 cents down to $6.54. Just a week ago there was talks about $7 corn.

Despite the recent weakness, one thing that should look to add support in the short term is the extremely poor crop over in Argentina. As they are currently rating their crop at 15%. But Argentinas yields are made in the months of January through April.

We also saw StoneX Brazil lowered their corn production estimates by 1.6 million metric tons down to 128.7 million even with the great weather and rain over in Brazil.

Another factor adding pressure to the corn and ethanol markets was the decision Brazil's President Lula made. As he issued a decree to keep gasoline and ethanol exempt from federal taxes. This was a negative for ethanol since gasoline typically gets taxed more than ethanol. With no tax in gasoline, it hurts the edge that biofuel has.

Looking at the charts, corn did break below a key level of $6.65 in today's sharp losses. Our next major support is the $6.35 level. We will have to see if we can get a bounce before then, as until this week corn had formed a pretty nice uptrend. Upside target for bulls is still $7.

Bullish Factors

Poor Argentina crop

Carry outs are less than they were a year ago.

Basis and spreads are stronger than they were a year ago.

StoneX lowered Brazil corn crop.

Bearish Factors

Yesterday's sell off included a 5 cent drop in national basis, an indicator of farmer selling

Broke through some support and moving averages, which could lead to more fund selling.

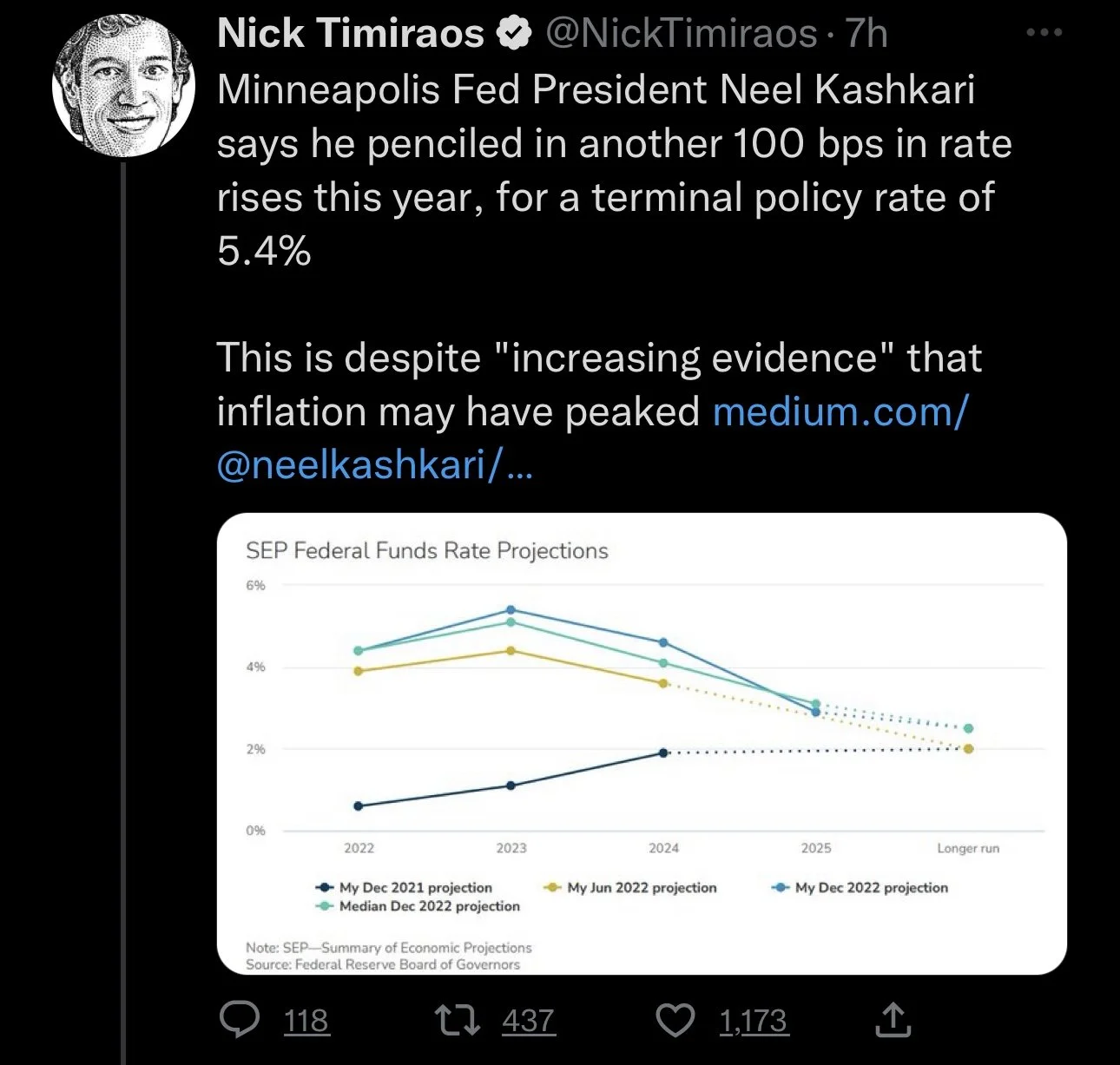

Interest rates lead to more farmer selling after 1st of year.

Wild Cards

USDA Report

Demand & China

What will trigger the funds to buy or sell commodities?

March-23 (6 Month)

Soybeans

Soybeans see a continuation of weakness from yesterday’s sharp sell off. Trading in a very wide range here today, as early on we did see beans push back up past $15 hitting a high of $15.06 but prices ultimately followed corn and wheat lower, closing down nearly -9 cents cents to $14.83 and a half. Beans now over 50 cents off our highs from December 30th.

Similarly to corn, one thing that should add support is the awful bean crop in Argentina. As their crop is rated just 10% good to excellent. The make and break months for Argentinas bean crop is January through April. As this time window typically determines their yield.

On the flip side if we take a look at Brazil, their bean yield is typically determined by the weather in December and January. So the window for that weather scare on this expected record crop is getting smaller. Which is ultimately a rather large concern surrounding the soybean market.

StoneX Brazil did lower their production estimate for their bean crop. As they lowered it by 1.3 million metric tons from last month bringing the total forecast to 153.79 million. However, this is still far higher than last years production of 127.23 million.

Soybeans will continue to trade in a weather market until we see a change in Argentina weather or until enough time has passed that the yield damage is essentially irreversible. Current thoughts around the markets are that Brazil's large crop has a good chance to offset the losses in Argentina, which has added uncertainty to the future of beans.

We also can’t forget to mention China. As over the weekend they kind of sent some mixed signals. We are seeing a massive surge in covid cases. But they also released a stimulus to help ease their sagging economy. The uncertainties in their economy has added pressure here to start the year, as many are talking about China going into a recession which would likely hurt demand.

Short term, Argentina weather will continue to decide the fate of the soybean market. The two week forecast remains dry so that should be supportive of beans on any break out. The USDA report next Thursday, January 12th, will also be a market mover to watch out for.

I wouldn’t be surprised to see a relief bounce tomorrow, but the charts don’t too great. Nonetheless, South American weather, China, and the USDA report will decide where we go from here.

Crush Report

U.S. November soybean crush was 189.48 million bushels

This was within the trade range but roughly 10 million bushels more than last year.

U.S. November soybean oil stocks were 2.108 billion pounds

This was up from 2.094 billion in October, but far less than a year ago where the total was 2.406 billion.

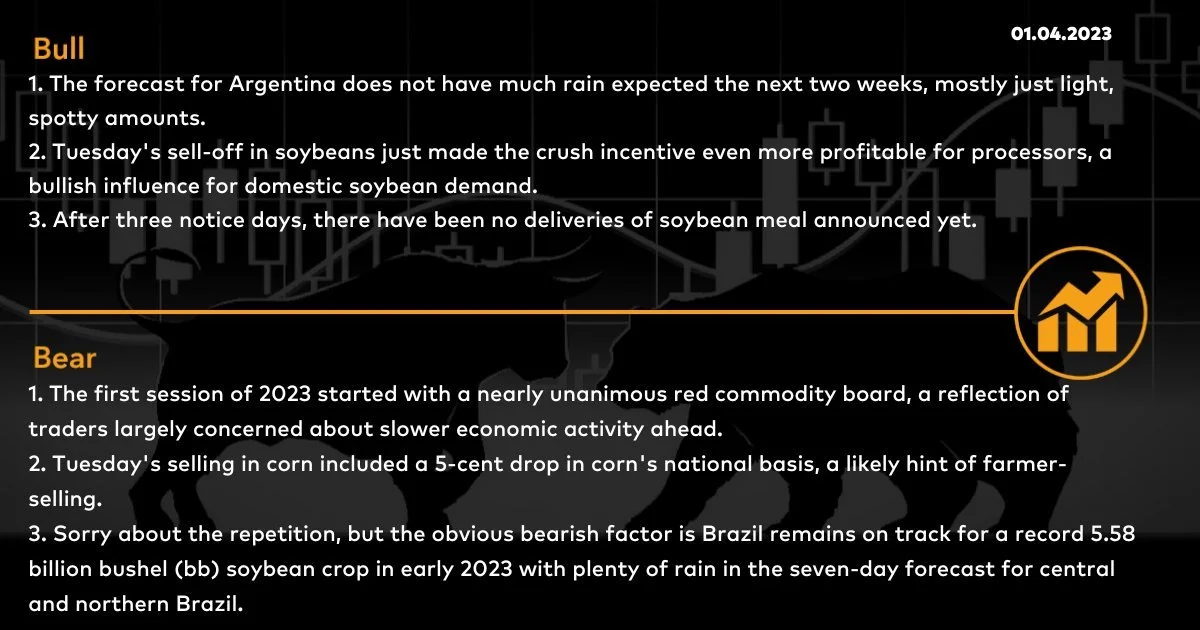

Bullish Factors

Very poor Argentina crop

Outlook for next two weeks is dry in Argentina.

StoneX lowered Brazil crop estimate.

Carry outs are less than they were a year ago.

Recent sell off made crush incentive more profitable for processors, which is bullish for domestic demand.

Bearish Factors

Expected record Brazil crop

Broke through some support and moving averages, which could lead to more fund selling.

Interest rates lead to more farmer selling after 1st of year.

Wild Cards

USDA Report

China headlines

What will trigger the funds to buy or sell commodities?

Soybeans March-23 (6 Month)

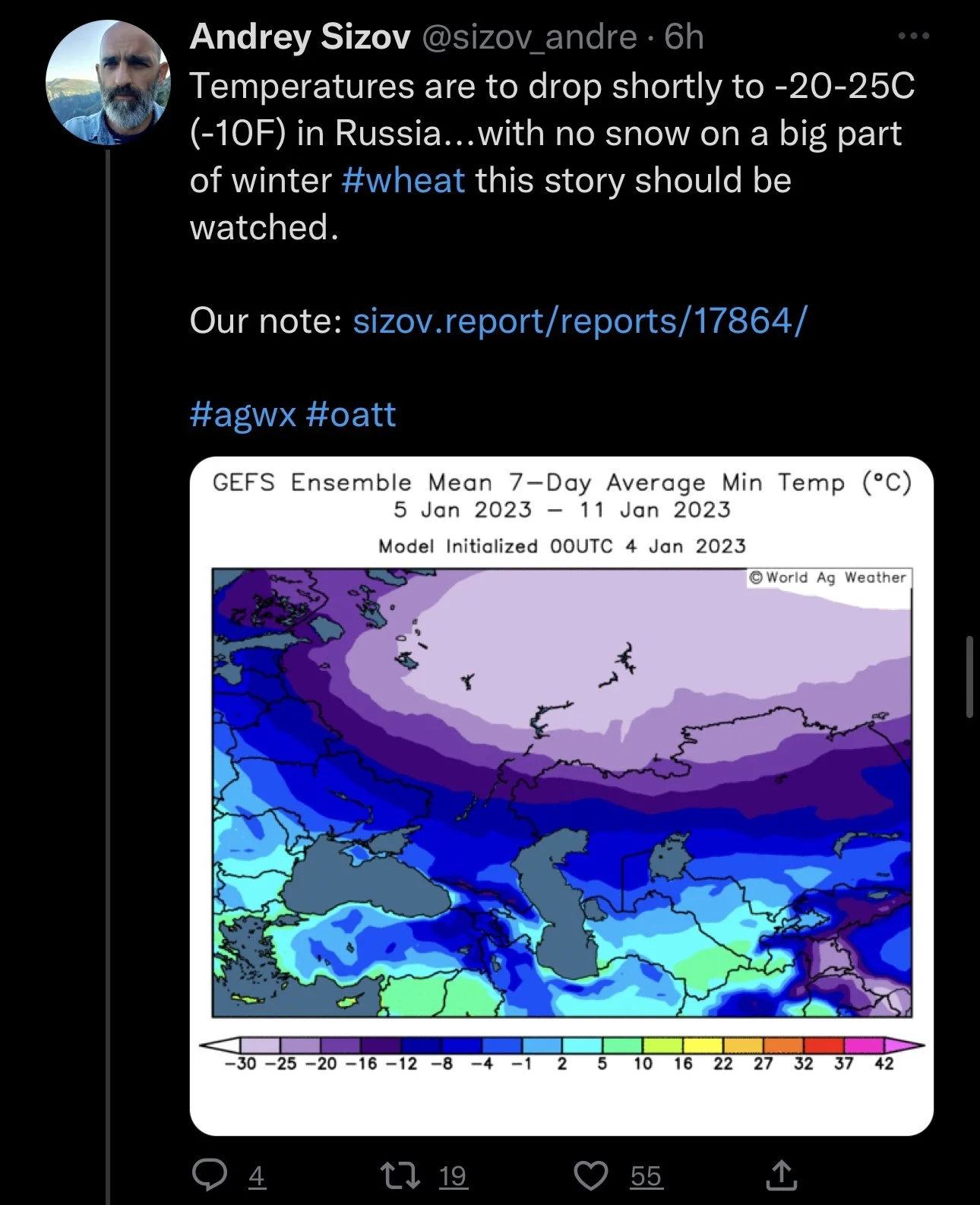

Wheat

A terrible day in the wheat market, seeing sharp losses today following their month long rally in December. The last two days of losses took out nearly half of our gains made in December from the bottom. Bulls are disappointed we couldn’t get that $8 we were so close to getting before the new year. Prices now 50 cents or so off their highs but still a little over 20 cents off their lows we saw a month ago.

Demand in wheat is just awful right now. As we saw in the U.S. wheat export inspections yesterday, as they came in at some all-time low volume. But we also have to remember it was Christmas and pretty bad weather. So one week isn't a tell-all tale and doesn’t make it a trend. Wheat inspections are only 3% behind the USDA pace.

The question now is what do the funds want to do. Do they want to bail out more here and rebalance these positions. One would think they liquidate some of these shorts as they still hold a large short position but nobody really knows how they will play this.

Global competition is another concern for the wheat market, with the recent collapse in the Russian Ruble and a relatively high U.S. dollar, further creating more competition for U.S. wheat.

Additionally adding pressure to prices here, Russian exports for December are estimated to be record large around 4 to 4.5 million metric tons. With Australia also having a record December. On the other hand, Argentina may only have half of their usual exports due to drought and Ukraine exports are nearly 50% behind that of last year.

Another thing to mention is that this will mark the fourth year in a row where the world as a whole consumes more wheat than we produce, and too add on to that. We have a war in Russia and Ukraine, whom are both top 5 wheat exporters typically, with Russia being number 1.

I said this yesterday and have been for a while, but none of these major factors with the ability to push prices higher are necessarily things that are going to happen or affect the markets today, or tomorrow, or even weeks from now. But more so in the coming months as we near spring. Short term, perhaps we go lower, or maybe we bounce from these levels. Either way, long term I still remain with a bullish tilt as there is plenty of upside.

From a technical standpoint we have nearby support at $7.39 with further support from our early December lows at $7.23 3/4 cents.

Bullish Factors

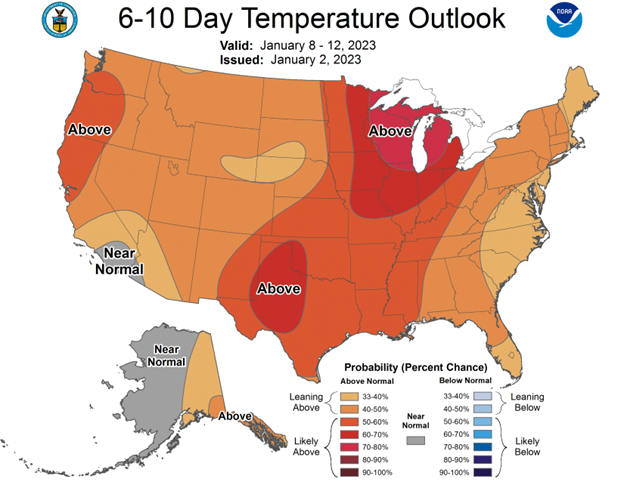

U.S. winter wheat is still in pretty poor condition

Possible winter kill

This is the 4th year the world consumes more wheat than we produce

War escalation

Carry outs are less than they were a year ago.

Bearish Factors

Record Russian and Australian crops

Warmer temps across the U.S.

Demand just isn’t there yet

Indian government is considering selling 2.1 mt of wheat in open market to control inflation.

Global competition and International currency

Broke through some support and moving averages, which could lead to more fund selling.

Interest rates lead to more farmer selling after 1st of year.

Wild Cards

USDA Report

Funds are short wheat. What will trigger the funds to buy or sell commodities?

Chicago March-23 (6 month)

KC March-23 (6 month)

MPLS March-23 (6 month)

Fertilizer Price Update

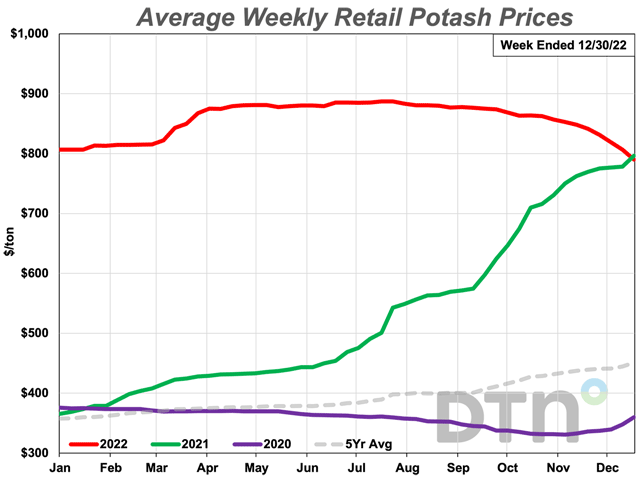

For the second week in a row, retail fertilizer prices have moved significantly lower. This info comes from DTN. You can read the full article here

All 8 major fertilizers are once again less expensive compared to last month.

Half of them were significantly lower compared to last month. A significant move is considered 5% or more.

Significant Changes vs Last Month

Potash was 8% lower vs last month

Average price of $765 a ton

MAP was 7% lower vs last month

Average price of $891 a ton

Urea was 6% lower vs last month

Average price of $751 a ton

Anhydrous was 6% lower vs last month

Average price of $1,325 a ton

Slight Changes vs Last Month

DAP was slightly less expensive at $885 a ton

10-34-0 was slightly less expensive at $751 a ton

UAN28 was slightly less expensive at $573 a ton

UAN32 was slightly less expensive at $679 a ton

Compared to a year ago, prices are now mixed with 6 being less expensive and 2 being higher.

More Expensive vs Last Year

UAN32 is 1% more expensive

DAP is 3% more expensive

Less Expensive vs Last Year

UAN28 is 2% less expensive

MAP is 4% less expensive

10-34-0 is 6% less expensive

Potash is 6% less expensive

Anhydrous is 7% less expensive

Urea is 18% less expensive

These are some fertilizer takeaways from Roach Ag

Urea has fell to the lowest prices since October of 2021. With most expecting prices to continue downwards in the short term. Roach Ag said this about Urea "Our genera recommendation remains at 50% of spring needs, if prices in your area have fallen below $700 a ton, feel free to book any remaining needs".

Unlikes Urea, UAN has remained somewhat stubborn as prices remain relatively high. Some think there should be an opportunity to buy pre-plant. As there isn't much reason for the prices to remain this high. Roach Ag suggested to hold 50% of spring needs.

DAP/MAP has seen some downtrend. There isn't much upside unless we see more war escalation. Roach Ag does not recommend any spring purchases at this time.

Potash is at its lowest levels since last November. Most seem to think there is further downside ahead, and many areas have been coming down. Roach Ag recommended to cover 25% of spring needs.

You can visit Roach Ag Here

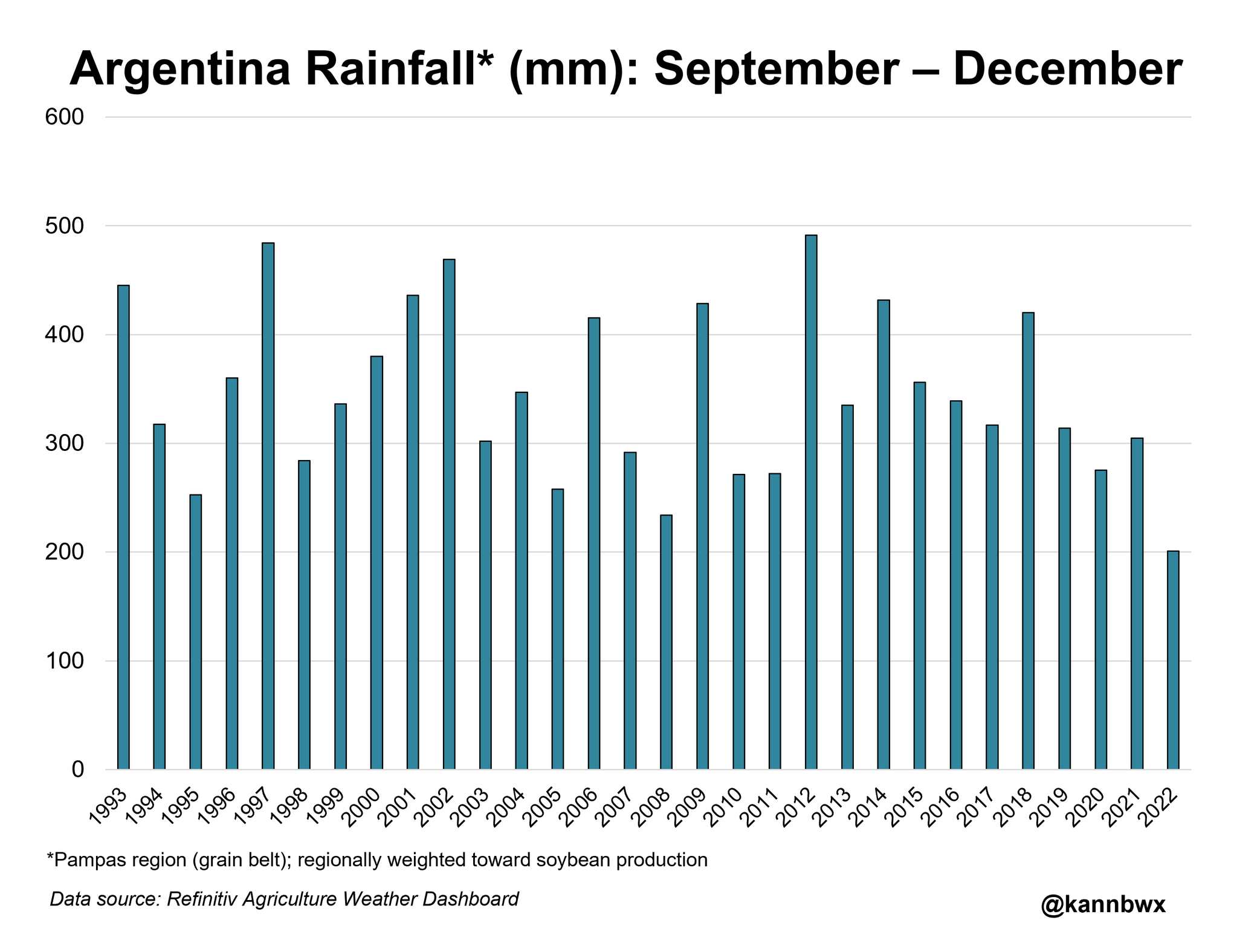

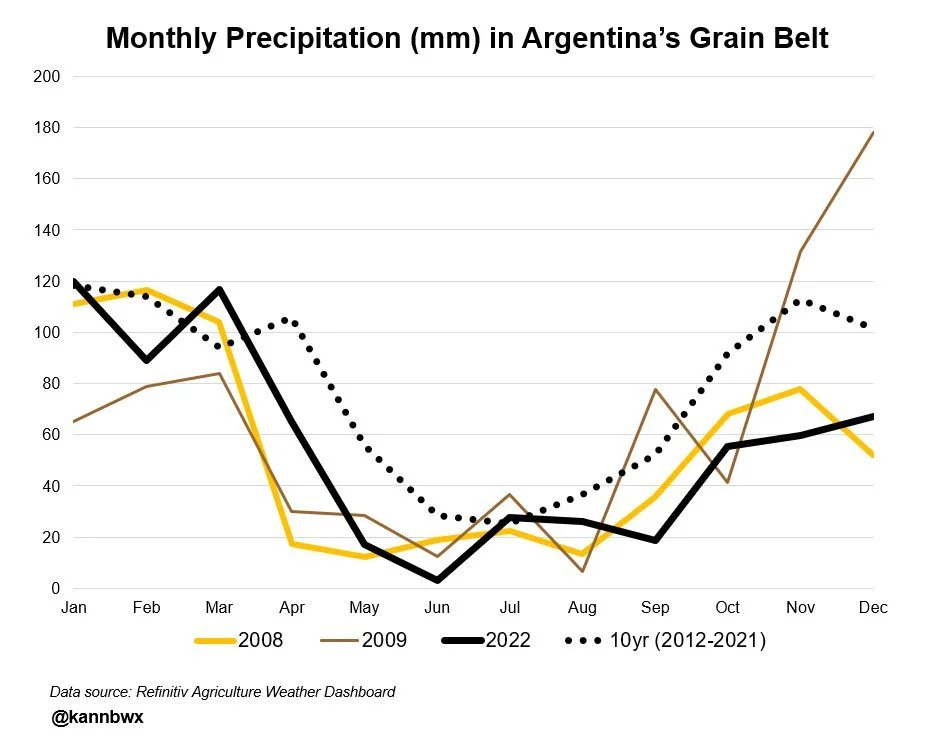

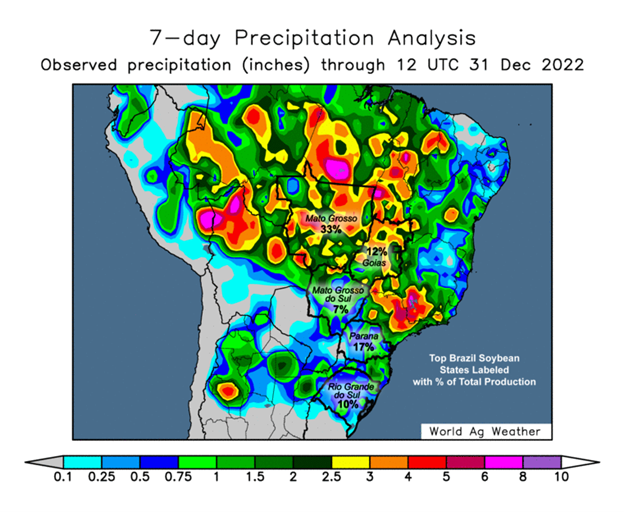

Argentina Drought & Yields

Despite the clear problems in Argentina, the trade mostly ignored the dry forecasts. The last quarter of 2022 was the driest 3-month period in over 35 years. With moisture sitting at roughly 44% below normal levels.

There is no doubt that Argentina is facing a historic drought.

Make or Break Yield Window

Argentina

The weather window for yields is January through April for both corn and soybeans.

Brazil

The soybean weather window for yields is decided from December through January.

Corn yield is the same window as Argentina, January through April.

The 2 charts below showcase just how significant of a drought this has been.

Chart Credit to Karen Braun @kannbwx on Twitter

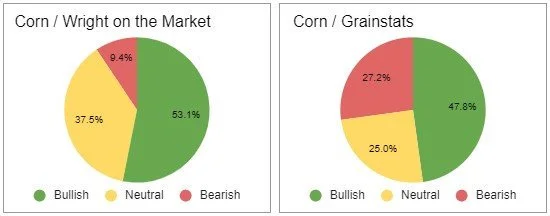

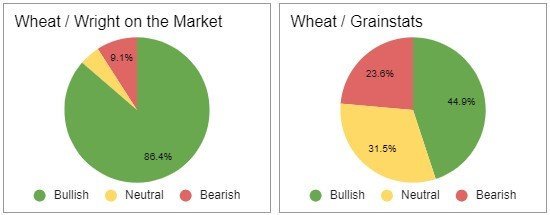

Bullish & Bearish Consensus

These results are voted on by the audiences of Wright on the Markets and GrainStats.

Other Markets

Crude oil down -3.76 to 73.17

Dow Jones up +90

Dollar Index down -0.300

Cotton down -2.70 to 80.44

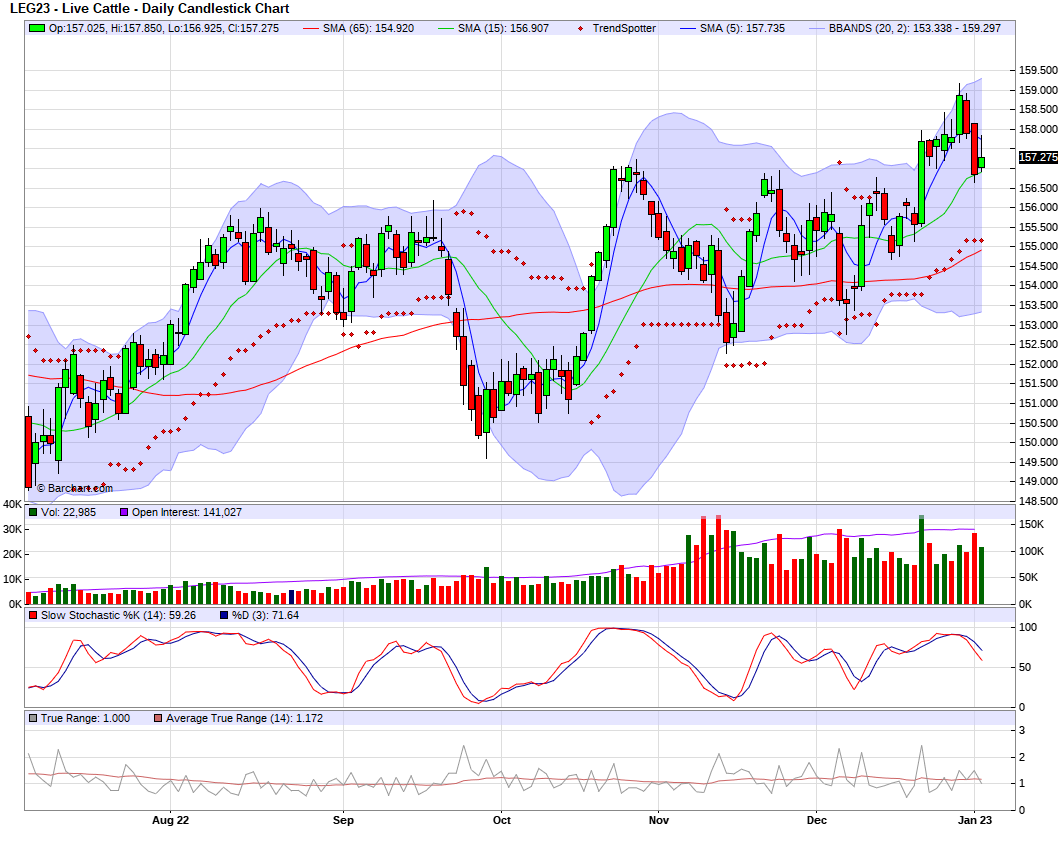

Livestock

Live Cattle up +0.425 to 157.275

Feeder Cattle up 3.450 to 188.225

Live Cattle (6 Month)

Feeder Cattle (6 month)

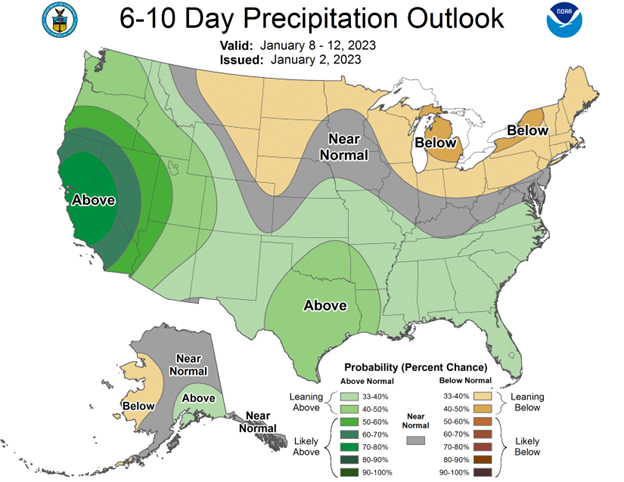

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service