3RD DAY OF GRAINS FALL OUT

MARKET UPDATE

Video Version is Subscriber Only*

Full Access: CLICK HERE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Grains continue to get absolutely hammered for the 3rd day in a row.

Why have we been hit so hard this week?

The first reason is simply a lack of bullish news. Especially in soybeans & wheat.

We have the US dollar continuing to surge. As it rallies to +1 year highs. Trading at it's highest level since October 2023.

This is bad for exports and makes us less competitive. Strength in the dollar effects all of the grains, but usually impacts the wheat market the most. Hence the recent heavy sell off.

We also have uncertainties surrounding what a Trump Presidency will mean.

How will it effect our relationship with China? Will they support bio fuel? Will we get a trade war and tariffs?

Altough bean demand has stagnated here, corn demand remains very solid. As we continue to see daily flash sales.

The market seems more concerned about "future demand". Meaning they are wondering how much of this demand was front ran in anticipation of a Trump presidency and how much of this demand will stay.

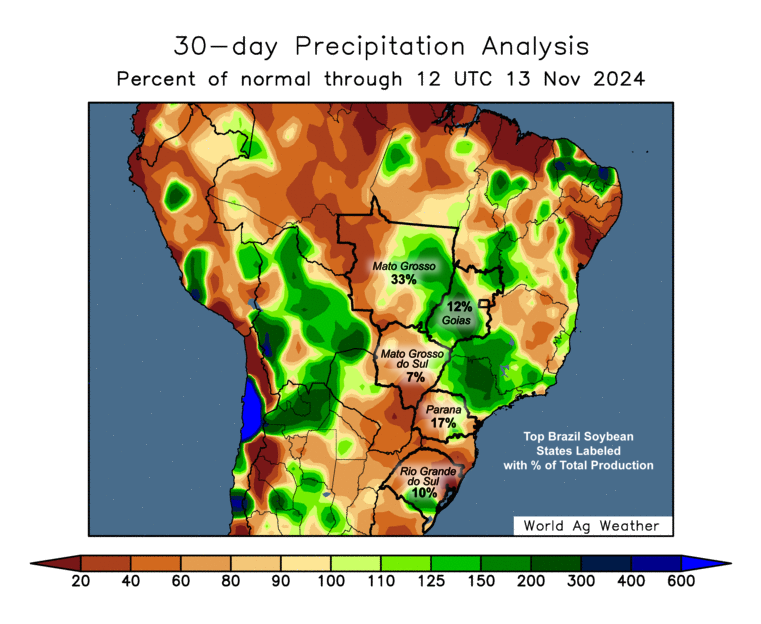

We also have South America weather still looking ideal. With all signs pointing to record bean production if weather remains normal.

Next 2 Weeks

Past 30 Days

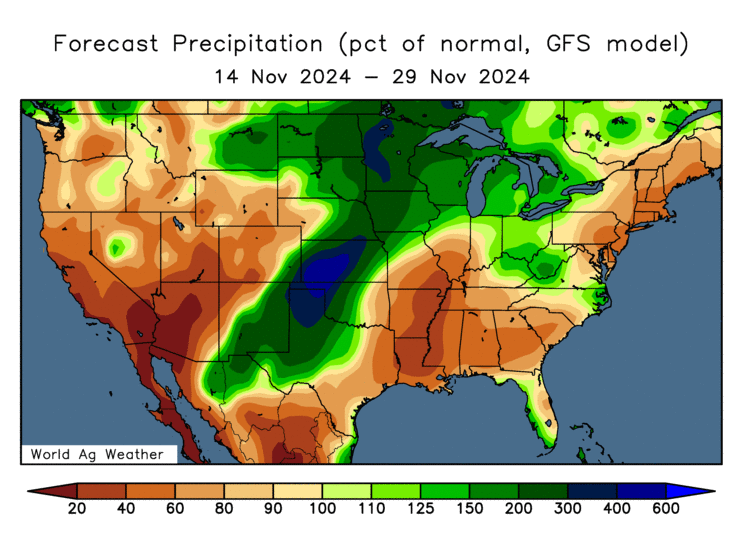

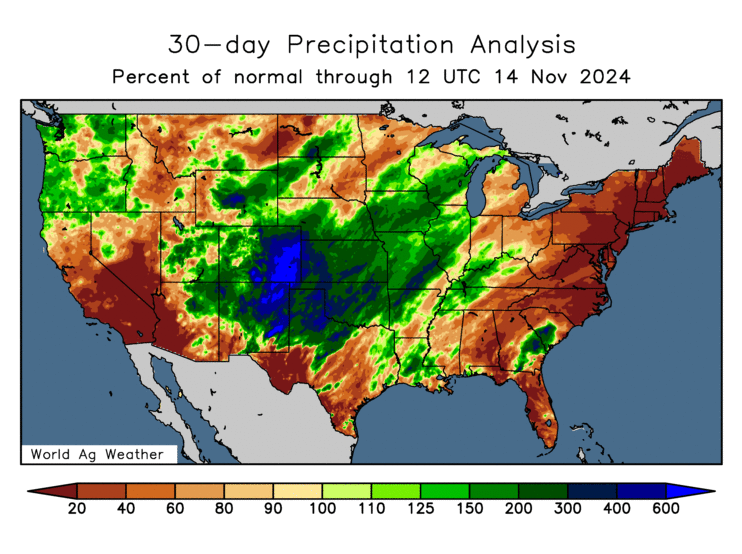

Then the wheat market is also seeing pressure due to the rain in the US plains.

We have received great rain with more on the way. So those drought concerns are going away as winter wheat crop ratings have been seeing a big improvement.

Next 2 Weeks

Past 30 Days

In my opinion, the biggest reason for the wheat sell off besides the dollar rally & rain in the plains was simply technical selling.

We broke that key $5.65 support level I had mentioning for a very long time. Once that broke, it opened the flood gates lower and the selling accelerated. As I had been saying there is very little support beneath that level if it broke.

Soybean meal prices have dropped to some historically low levels as the entire soy complex falls apart.

So as a livestock producer it makes sense to be an aggressive buyer here.

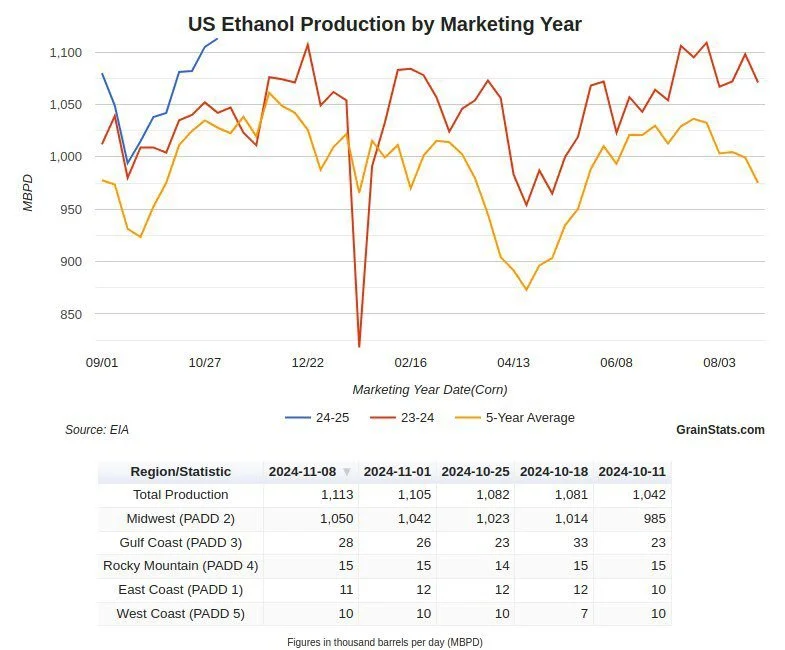

On a positive note.. corn ethanol production came in at a RECORD.

As ethanol production reached 1,113 thousand barrels per day.

This is such a friendly potential factor given that currently the USDA projects ethanol production to be worse than last year.. but we are well ahead.

This alone could very well be enough to add anywhere around +100 million bushels of corn demand on the balance sheet if pace stays this way.

Chart from GrainStats

Today's Main Takeaways

Corn

Corn sees it's largest daily loss in a month. Following the rest of the markets lower.

Unlike soybeans & wheat who really do not have much of a bull story here at least short term, corn does.

It has a very real…………………

The rest of this is subscriber-only..

Subscribe to keep reading & get every update along with our signals. Comes with 1 on 1 market plans.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24