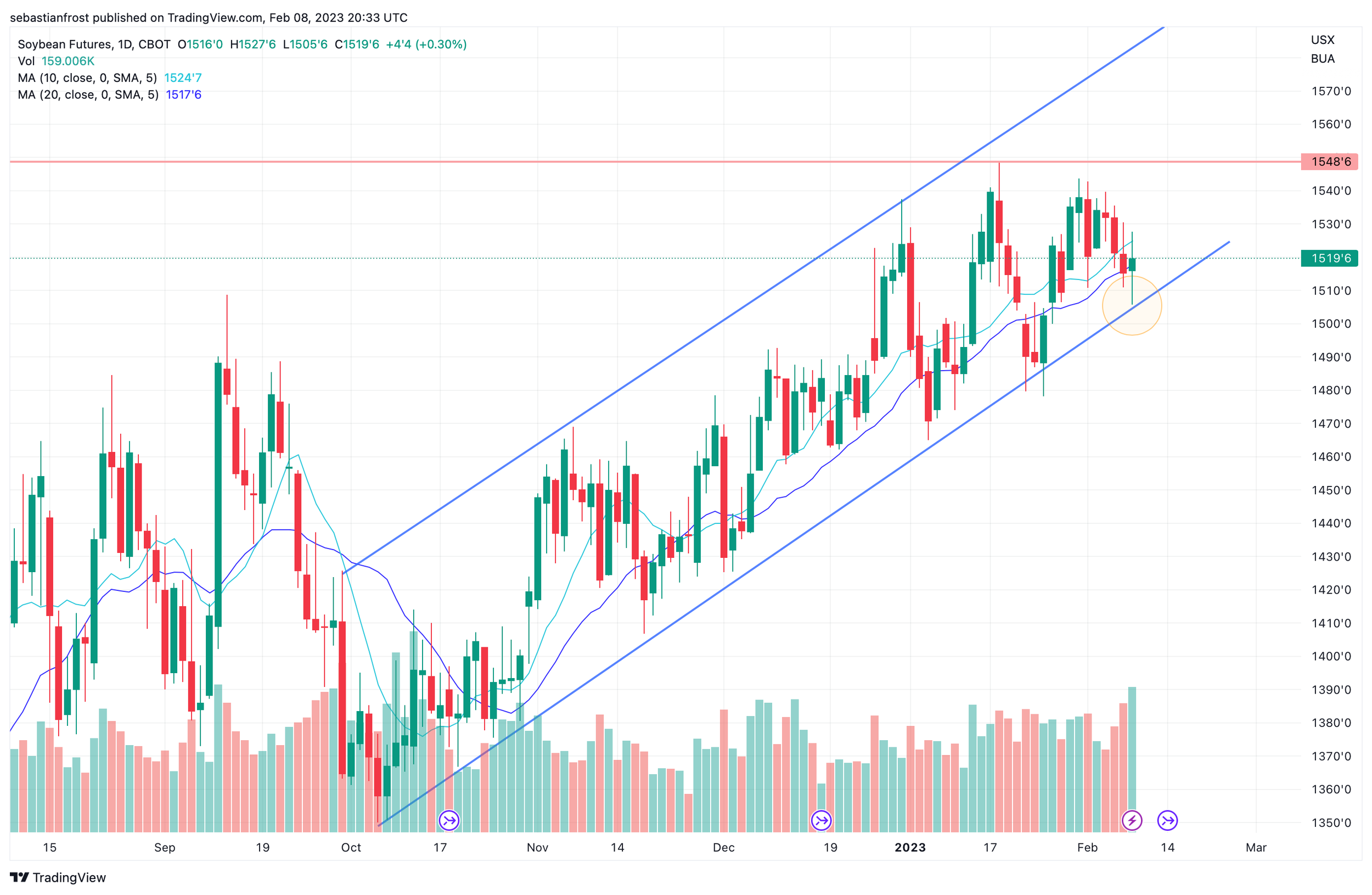

HIGHER PRICES TO COME?

USDA RECAP - AUDIO COMMENTARY

Listen to today’s audio below

Like Our Stuff?

We are currently offering 30 day trials for just $1

Futures Prices Close

Report Recap

Grains finished the day higher across the board despite really just an overall neutral report. Beans even managing to close higher despite what some would call a slightly negative report.

Corn 🌽

One thing bulls were happy to see was the rather large cuts to Argentina production, but this was somewhat offset by increases in Vietnam and the Philippines. Nonetheless was a small bullish surprise as the USDA does realize just how bad the problems in Argentina are, and we think the USDA continues to lower these numbers in the future.

As expected, they left Brazil estimates unchanged. But with the rain delays, there is a chance we see some more problems down the road. Ukraine production was also left unchanged.

The USDA lowered corn used for ethanol by -25 million bushels. Export, feed, and residual were left unchanged.

U.S. ending stocks were bumped +25 million bushels to 1.267 billion.

World ending stocks down -1.1 million to 295.3 million tons. Trade was looking for a slightly bigger reduction.

Soybeans 🌱

Despite the slightly negative report, beans managed to bounce +15 cents off their lows and end the day green along with the rest of the grains. Beans found support right on our upward trend line from Oct.

Soybeans had the worst report amongst the grains, as bears got that bump in U.S. ending stocks as the USDA lowered domestic crush by -15 million bushels.

Outside of that it was a pretty quiet report, with most estimates left unchanged.

Global production was reduced by -5 million tons to 383 million, mostly due to the smaller crops in Argentina & Ukraine. Similar to corn, the cuts on Argentina estimates were larger than expected, as Argentina and South America continue to be the focal point in beans.

Argentina was decreased -4.5 million tons to 41. Definitely a chance we see this number at 40 or lower if Argentina continues to stuggle.

Brazil & Paraguay production estimates were both left unchanged.

Ukraine production down -0.4 million with lower harvested areas.

Global exports essentially unchanged. The lower Argentina exports basically offset by the increases in in Brazil and Paraguay.

Global oilseed crush was cut -3.4 million tons. Due mostly to lower crush for Argentina and China. As China's crush was lowered due to slow pace.

Global ending stocks down -1.5 million to 102 million. Which was in line with expectations.

Wheat 🌾

Fairly neutral report, nonetheless we saw wheat rally today. I think we continue to see strength in the wheat market with the poor crop conditions in the U.S., future war headlines, and a shift in funds.

As for the report, we saw small changes to domestic use and ending stocks. Food use was cut -2 million bushels to 975 million (Still a record).

Seed use was bumped +1 million bushels to 70 million.

Wheat exports were left unchanged at 775 million.

2022/23 ending stocks saw a +1 million increase to 568 million bushels.

Global ending stocks also raised +0.9 million tons to 269.3 million. Which was higher than estimates of 268.5 million.

Production in Australia saw an increase of +1.4 million tons to 38. Which would be a record crop.

Russia also saw increases to their production, getting a +1 million ton increase to 92 million. This was due to the larger SW harvested area.

South America

Argentina numbers came in below trade estimates.

Brazil numbers were left unchanged as expected.

Personally we think the Argentina numbers will continue to be lowered going into the future.

U.S. Carryout

U.S. corn carryout saw an increase as expected on a cut to corn used for ethanol exports remain unchanged.

Soybeans a tad bigger than expected as crush was reduced and exports left unchanged.

Wheat came in as expected.

World Carryout

Corn stocks come in below expectations with the shrinking Argentina crop.

Ukraine corn exports saw a bump of 2 MMT to 22.5 MMT.

China imports for corn & beans went unchanged, but saw a slight increase to wheat

Russia & Australia wheat crops saw increases

The Numbers