GRAINS LOWER FOLLOWING NEUTRAL REPORT

Overview

Despite the overall neutral report yesterday, we saw all grains finish higher. Today grains give back a lot of those gains as all closed lower with a risk off day. Beans held up the best despite having the worst report out of the three grains, as meal soared to near contract highs as Argentina concerns grow.

Today's update won’t go over a ton about the report. If you want more details regarding the report, listen & read yesterday's full post USDA report analysis: Click Here

We are offering 50% off both monthly & yearly subscriptions

Today's Main Takeaways

Corn

Corn lower along with the rest of the grains following the higher price action yesterday. Prices breaking below both the 10, 20, 100, and 200 day moving averages, looking to test our trend line as corn continues to trade sideways.

No real reason for lower prices here, perhaps the funds wanted to liquidate some of those longs. Argentina and U.S. weather also likely added some pressure as both are looking for slight improvements.

One thing bulls have their eye on is still Russia and Ukraine. As there is some rumors surrounding the possibility that we see them not renew the grain corridor deal when it expires in a little over a month. From what people are talking about, Russia just isn’t really happy with the agreement. So if Russia remains stubborn, we could see limited exports out of Ukraine in the future. But the entire situation is hard to predict, as nobody ever knows what Putin will pull out his bag of tricks next.

Chinese demand is another big thing traders will be watching. Following the balloon drama, everyone is wondering where the relationship between China & the U.S. stands, whether we see further implications, and how this effects demand from China.

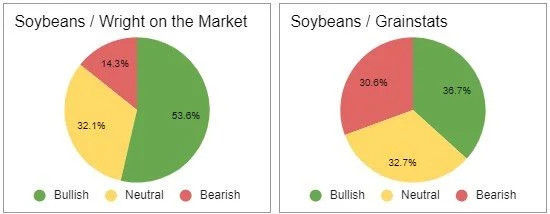

Lastly, we can’t leave out South America. As their forecasts and crop conditions will continue to play a massive role in both corn and beans. Main headline to be watching for is the continuation of Brazil rain leading to possible planting and harvest delays in their crops. The prime window for Brazil to plant is at the end of this month. So we will have to see if they continue to see problems, as the next two weeks will be huge.

The USDA left their Brazil estimates unchanged. But CONAB actually did decrease their second crop corn. Seeing a reduction from 125.1 to 123.7 MMT. So there is some optimism for bulls there as they hope to see the USDA follow suite and reduce Brazil's crop.

Some Main Takeaway's from Report

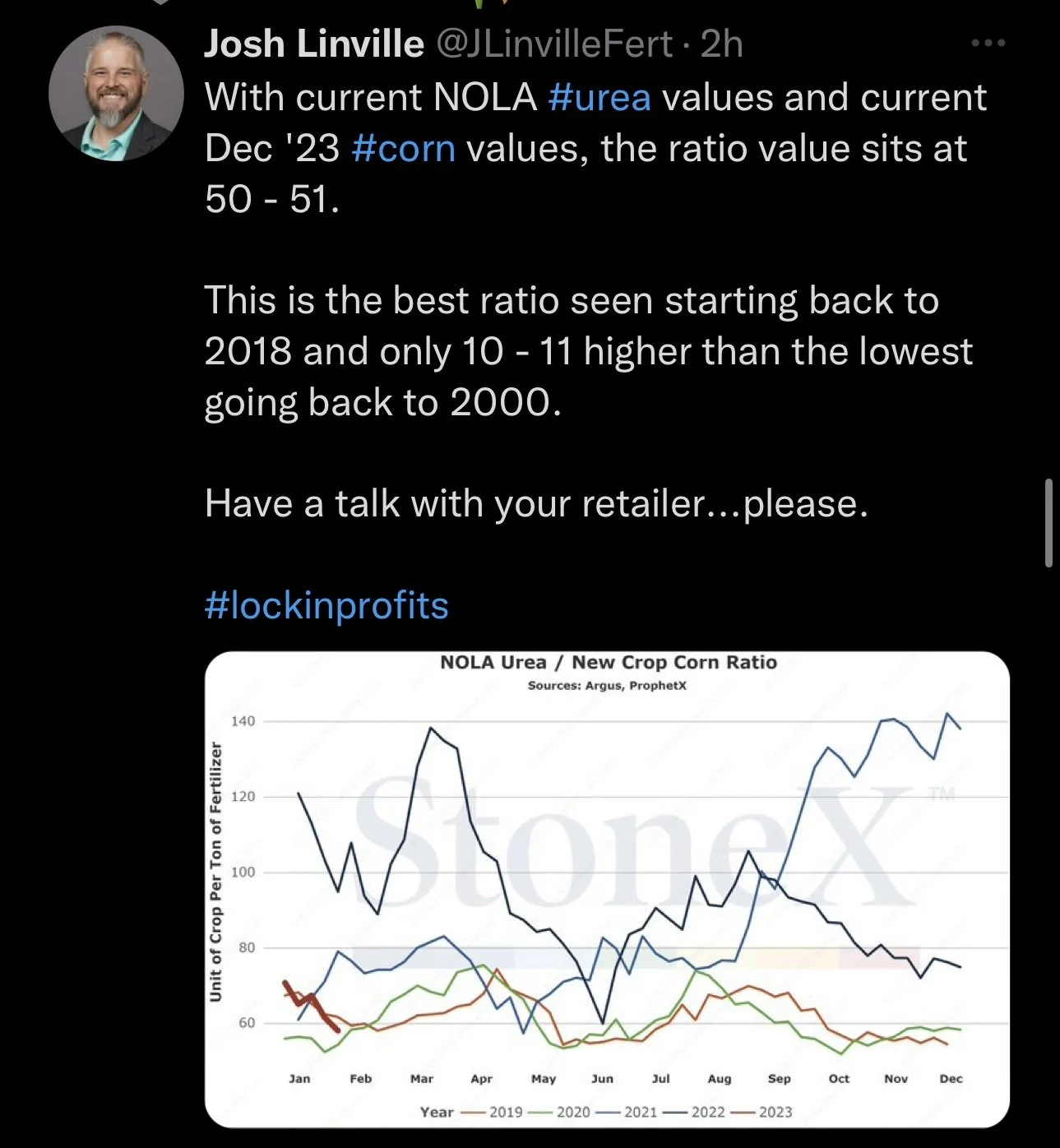

USDA lowered corn used for ethanol by -25 million bushels. There is some debate whether we see this lowered even further. Some throwing out numbers of -100 million.

Brazil left unchanged

Argentina reductions were larger than expected

From a technical standpoint, charts not looking as good as they have with today’s sell off. Will have to see if we find support here or work our way towards the trendline. If we did happen to continue lower, the charts would look for some big support around the $6.65 level.

Corn March-23

Soybeans

Soybeans close the afternoon down just half a cent at $15.19 after trading as high as nearly $15.34. Despite beans having arguably the worst report yesterday, the main thing here today was meal soaring to near contract highs. So that really kept beans head above water

Argentina looks to continue to support the bean and meal market. Yesterday we saw Argentina estimates come in below expectations. If Argentina continues to face problems I don’t see why we wouldn’t continue to see these numbers lowered even further. Argentina's problems have also sparked a conversation surrounding meal shortage.

A negative takeaway from the report was the -15 million bushel cut to domestic crush as ending stocks rose from 215 to 225 million. On the bright side, we did see global production lowered slightly by -5 million tons with the problems surrounding Ukraine and Argentina.

The two main things that will continue to influence the bean market are again South America & China. As Chinese appetite and demand remains a rather large question mark as reports say China has seen negative crush margins.

Going forward these two will decide if we go higher or lower from here, but I still hold a nervous stance on beans as there are a ton of uncertainties. But if we continue to see South American problems I don’t see why we couldn’t push higher.

Other Main Takeaway's from Report

Argentina saw bigger than expected production cuts. Bringing the new estimate to 41 million. There is definitely discussion in this number eventually being lowered to possibly below 35.

Bump in U.S. ending stocks as the USDA lowered domestic crush by -15 million bushels.

From a technical standpoint, we remain in a solid uptrend from October. Yesterday we bounced exactly where we needed to. A massive break below the uptrend wouldn’t look good. But if we can continue to push higher we still have a wide gap to keep running much higher.

Soybeans March-23

Soymeal

Soymeal rallies to near contract highs as the concern surrounding Argentina meal and shortage continues to grow.

Soymeal March-23

Wheat

Wheat lower today following the strong price action yesterday. Lower prices likely a result of not much new fundamental news following yesterday's relatively boring report.

The biggest headline right now has to be Russia, Ukraine, and War. As Russia recently said they were reportedly unsatisfied with the deal as the EU. So if this does happen, it would be very beneficial in seeing higher prices.

We also have the news that Russia is preparing for a potential attack on Ukraine in the coming weeks, and as we all know. War escalation makes for higher prices.

Additionally looking to add support to the wheat market is the extreme drought conditions in the Southern Plains. Last week 96% of Kansas and 95% of Oklahoma were experiencing drought. Crop conditions came in 47% poor for Kansas and 34% poor for Oklahoma. Forecasts still remain dry as well.

Overall, the USDA was mostly a snoozer for wheat. We saw small changes to ending stocks and domestic use with slight increases in both Russia and Australia production. Food use was reduced -2 million bushels to 975 million. Exports were left unchanged.

Going forward I still think we have a ton of upside from here. I'd like to see funds rebuild a long position. I think its just a matter of time before they do so and we see a few of these other bullish catalysts push us higher.

From a technical standpoint, we were this close to getting that break to the upside we've been waiting for. If we can get some upward movement and break out of the downtrend, there is a ton of upside.

Chicago March-23

KC March-23

MPLS March-23

Managing March Basis Contracts

From Wright on the Market

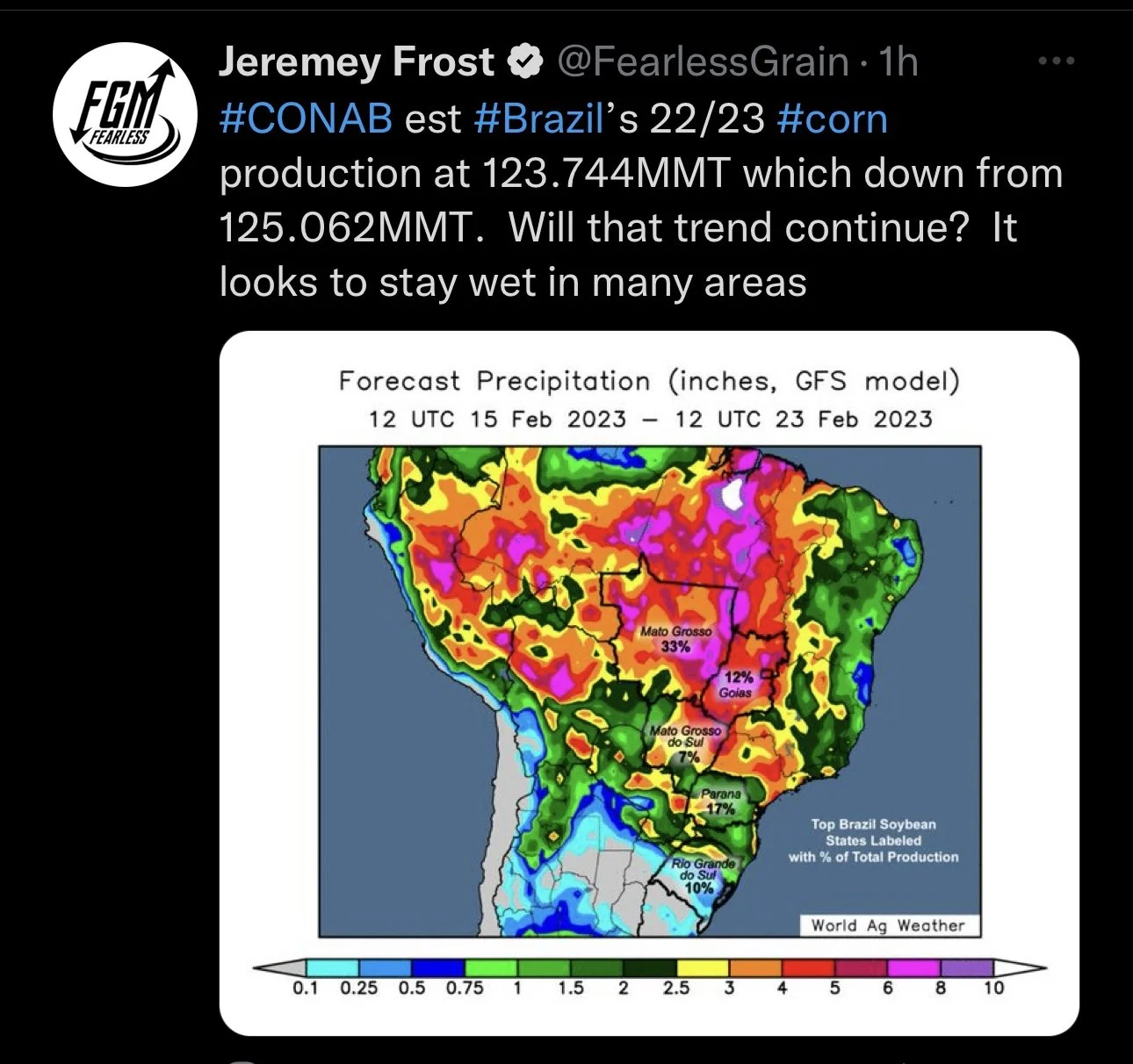

Many of you have delivered corn and beans, received a cash advance of 70% by establishing a March basis contract, which must be cashed out (priced) or rolled to a deferred futures month no later than the close of business Monday February 27th.

Since we expect the high on corn to be the first half of May and the high for beans during the first half of June, we recommend you roll these March basis contracts to May or July.

Both corn and bean markets are inverted, meaning the nearby months are trading at a higher price than the deferred months, which is good for those who need to roll a basis contract. Why?

A March basis contract means your merchandiser bought March futures for you to enable you to benefit with the expected gain in futures. To roll from March to a deferred month, the March long (buy) position must be offset with a sell and the long position that was in the March will be re-established in a deferred month. Since the deferred contract is a lower price, the March futures will be sold at a price higher than the purchase price in the deferred futures. On yesterday's close, March corn was $6.74, May corn was $6.73, and July corn was $6.62. If the roll was done at those prices, the merchandiser would sell March corn at $6.74 and buy the May corn at $6.73. Sold at $6.74, bought at $6.73.

Thus, your merchandiser will be selling high and buying low for you; that is always a winner.

When to roll?

The markets are inverted because both markets want corn and beans now and refuse to pay for storage. We can talk all day why the market is not paying for storage, but all the reasons are the same reasons why the market is expected to rally (go up) into the late spring.

Last year the inverse of corn peaked the second week in March. This year, the national basis is firmer and the carryover is tighter than it was this date a year ago. Therefore, we recommend you stay in the March until at least Thursday, February 23rd. If no deliveries are expected on March corn futures, it may pay to wait another day or two.

What month to roll to?

When futures prices are in an uptrend, the nearby months will gain on the deferred months. Since we expect corn and beans to make their highs in the mid to late spring, it is reasonable to expect March will be stronger than May this month and then the May contract will be stronger than the July contract. Therefore, roll March corn and soybean basis contracts to the May contract with plans to roll to the July at the end of April.

Before you do a roll, ask your merchandiser how much he will charge to roll and ask if you will be allowed to roll to the July from the May. There is no legal or regulatory reason why you cannot roll as many times as you want, but some “house rules” are different from regulatory rules. The standard roll fee is one or two cents per bushel.

If you can only roll your basis contract one time, roll from the March to the July.

Visit Wright on the Market Here

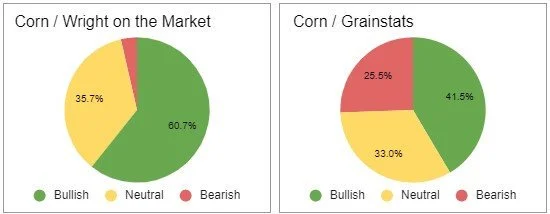

Bullish vs Bearish

The following charts are voted on by GrainStats and Wright on the Markets respective audiences showcasing their opinions

Highlights & News

CONAB cut Brazil's second corn crop estimate.

China was Brazil's biggest buyer in January.

Argentina's soybean harvest might be the lowest in 14 years according to Reuters.

India's ban on wheat exports is scheduled to end in April.

China will auction off 140k metric tons of governors wheat to damped domestic wheat prices.

Market has priced in a 25 basis point hike in March and May.

In Case You Missed It..

Here are a few of our past updates in case you missed them

Livestock

Live Cattle down -0.075 to 163.625

Feeder Cattle up +0.375 to 186.825

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service