USDA ESTIMATES & MARKET UPDATE

Futures Prices 8:30 am CT

Overview

Grains higher to start of the morning as all eyes are on the USDA report at 11 am CT. Grains seeing strength as at one point the dollar was down 60 points in the overnight session, however the dollar has picked up steam trading higher this morning. Grains will likely trade the report instead of the outside markets after the release, but ultimately no matter where the report comes in at, the outside markets will likely continue to dictate the direction of grain. With all the hype surrounding the report, we have to keep in mind that there is a chance the report comes in as a dud, and with the small changes we’ve seen in prices the past few days it's hard to say.

USDA Estimates

September 1 U.S. Grain Ending Stocks (Million Bushels)

Corn

Average Estimate - 1,512

USDA June 1, 2022 - 4,346

USDA Sep. 1, 2021 - 1,235

Soybeans

Average Estimate - 242

USDA June 1, 2022 - 971

USDA Sep. 1, 2021 - 257

Wheat

Average Estimate - 1,776

USDA June 1, 2022 - 660

USDA Sep. 1, 2021 - 1,774

2021/22 Revised U.S. Production (Million Bushels)

Corn Production

Average Estimate - 15,091

USDA Previous - 15,115

Soybean Production

Average Estimate - 4,437

USDA Previous - 4,435

2022/23 U.S. Wheat Production (Million Bushels)

All Wheat

Average Estimate - 1,778

USDA Previous - 1,783

All Winter

Average Estimate - 1,191

USDA Previous - 1,198

Hard Red Winter

Average Estimate - 573

USDA Previous - 576

Soft Red Winter

Average Estimate - 379

USDA Previous - 381

White Winter

Average Estimate - 238

USDA Previous - 240

Other Spring

Average Estimate - 514

USDA Previous - 512

Durum

Average Estimate - 74

USDA Previous - 74

Today's Main Takeaways

Corn

Everyone is looking forward to the Quarterly Stocks Report this morning. One of the biggest things people are keeping an eye on will be where we see last year's production come in at. There is a lot of rumors that we see this old crop number come in below expectations, which would be a bullish surprise. However, one could argue that demand is still too poor even if last year's numbers come in lower.

Demand as has been the story for the past few weeks, remains fairly weak. Last weeks export sales were better than the previous week, but still very poor, at about half of last years pace.

Nonetheless, wherever numbers come in at, we can expect some volatile trade after the report as usual. The USDA report will likely set the tone for the rest of the week.

U.S. weather is looking pretty good for the next few weeks. Most are expecting harvest to start moving along at a faster pace given this window of cooperative weather. South America has also begun planting, and we won't likely see any major weather headlines out of there until later in the year when it matters a lot more.

Dec-22 (6 Month)

Soybeans

Soybeans 6 1/2 cents higher this morning. Similar to corn, all eyes are on the USDA report this morning. However there are some other headlines in the soybean market that may get as much attention as the USDA report. That being the political tensions in Brazil. This will likely be a bigger story going into next week.

We are looking for a 242 million ending stocks, down 15 million from last year. Which is the number everyone will be watching.

Of course the outside markets have continued to keep a lid on grain prices, with the dollar continuously surging to new highs. But other than outside markets, demand just isn't there yet. We did see weekly exports come in a little better than previously. But Chinese demand for U.S. exports remains lackluster, to go along with the recent tensions and their lockdown situation. Ultimately if we want higher prices we will almost certainly need to see an increase in demand.

Soymeal & Soyoil

Soymeal up +2.9

Soyoil down -0.08

Soybeans Nov-22 (6 Month)

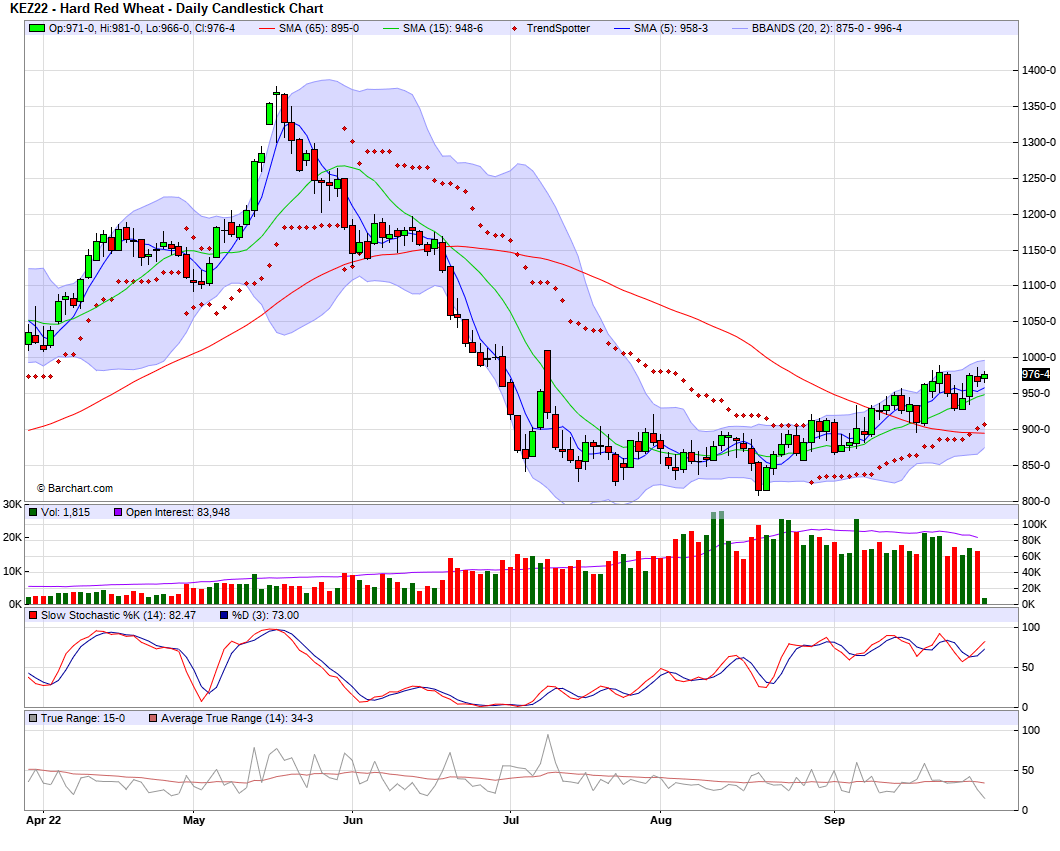

Wheat

Wheat higher this morning, making up for most of yesterdays losses. As for the report we are looking at for the Sep. 1 stocks to come in right about where they were last year.

Weekly exports came in disappointing again. The strength of the U.S. dollar has also been continuing to put pressure on the markets.

The Russia and Ukraine war headlines have been bullish for the wheat markets, and one could argue that they will continue to do so. But ultimately, the entire situation remains a wild card as nobody knows what Putin will do next.

There is a rumor that former President Trump is looking to land a peace deal between Ukraine and Russia.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil down -0.38 to 80.85

Dow Jones down -20 (-0.05)

Dollar Index up +0.485 (+0.43%)

Cotton up +0.19 to 85.35

News

Trump is looking to carve out a peace deal between Ukraine and Russia

The second quarter GDP came in at -0.6% which further confirms we are technically in a recession according to historical data.

Inflation rate in Europe hit 10%

Hurricane Ian is looking to make landfall again, this time in South Carolina.

This Week's Weekly Newsletter - Read Here

Social Media

Credit: All credit to users of posts

Weather

Source: National Weather Service