WEEKLY NEWSLETTER

By Jeremey Frost

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

USDA Report was it a bust or a boom

What did Friday’s USDA September Stocks report and small grains production do to the grain markets. Was it a bullish boom or a bearish bust.

That depends on what perspective one puts on it.

Here are the highlights

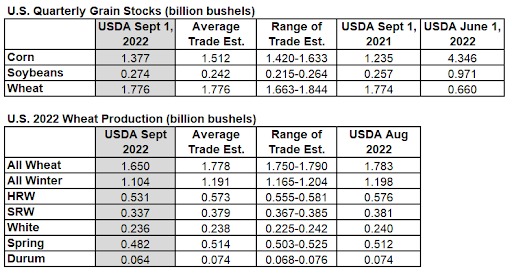

Source USDA

Price action had beans down 45 cents, wheat was firmer 15-25, and corn up 8. At one point wheat was up another 24 or so, and corn was up nearly another 20. Outside markets weighted on the grains with the DOW off nearly 500.

So let’s look deeper and combine the Sept 12th report along with this quarterly stocks report and small grains production. On the surface I was always taught that you need to combine these two reports and that will get you a good estimate for the October WASDA report or at least what the market may be trading.

So our September 12th report had corn 21/22 carryout at 1.525 billion bushels with a 1.219 billion bushel projected carryout for the 22/23 crop. If you take the 145 million bushels below the estimates for the Sept 1 stocks. You get a 22/23 ending stocks number under 1.1 billion bushels. I have been around long enough to know that sometimes it doesn’t shake out that way. That the USDA has various reasons for stock numbers.

Now if we consider that perhaps the USDA will drop the yield in October towards 170 or maybe even 165. Then we need to continue to destroy demand. Meaning prices have to get higher to curb some demand. Before this report, we already had to scale demand back by over a billion bushels. This simply added to that.

Beans were at 240 million bushels with 200 million projected for 22/23. For soybeans, the opposite happened. We found more soybeans. Was it because of the drought areas harvesting a little early? I think it might be to help the USDA pad the numbers a bit before the October report. I think that yield could come in well below estimates.

Why do I think we will come in below estimates? A few reasons; first off is wheat production. The wheat production number was well below estimates; I will get to that in a bit. But the fact that it was lowered and by a large amount shows how bad the drought hit the western corn belt. When are beans made? During the same time period. There was simply little moisture if any to fill beans in many areas.

Here is a drought monitor comparison from August 2nd to September 27th.

Here is the August 2nd monitor

Here is the September 27th monitor. Notice the massive increase in areas in the Western Corn belt.

Wheat production should give us a key on how corn and soybean production will slip.

The next reason is yield reports I see on places such as Twitter, AgTalk, and Facebook. Now it is hard to quantify these but I am not impressed by what I do see.

Next is the conspiracy corner type of reasons. First off the supply chain issues we had this year. Next is from Roger Wright and the tech guy https://www.wrightonthemarket.com/post/tech-guy-weekend-comments-for-10-1-22 If you read the article you will see him mention that he thinks the same is possible and refers to it as a conspiracy.

Wheat was at 660 million bushel carryout for 2021/20 22 with 610 million bushels projected carryout for 2022/2023. Wheat has to make people scratch their heads. Wheat production came in at 122 million less than the estimate. The estimate was 5 million bushels less than the September production number. But stocks came in at the exact number expected.

I think the doors are open to the USDA lowering wheat carry out more than the market may be expecting. Where will wheat prices go if we see them print a wheat carryout of less than 500 million bushels? It is possible that they do just with the 127 million decrease in production. With the stocks number one wouldn’t think that it happens that way. But the USDA has had various ways over the years to give odd explanations for the stock numbers. Usually well after the fact.

With what barge freight has done all grain stocks should have been higher. It has gone from 200-400% of tariff to 2000% of tariff. So if you are an elevator manager are you shipping more or less with the higher freight costs?

Same thing with the railroad service. For example, do you know any local elevators that can’t take corn yet because they have been waiting on trains to clean out a wheat bin? I know of one earlier this week.

As for the barge freight there has been good documentation out there whereas it is taking 1.5 to 2.0 barges to ship the same amount of grain as when river water was much higher. So how could we expect our stocks not to be higher. We have created a bottle neck so to speak and we created it where the USDA is going to count those bushels.

Some new not so fearless predictions

Soybeans make their lows this week if they didn’t make them on Friday.

All three wheat classes trade above 11.00 futures before the end of the year. (CBOT, KCBT, MGEX)

Corn trades above 7.50 before the end of the year.

Soybeans trade above 15.00 before the end of the year.

Millet trades above 32 before the end of the year.

Sunflowers trade below 22 locally during harvest as elevators take advantage of farmers without bin storage. Sunflowers trade back above 30 by the end of the year and back above 40 in 2023.

Sunflower acres in the US are down over 20% in 2023 unless the National Sunflower Association does something to help with the seed weevils.

Basis Basis Basis

Basis remains very volatile. Some areas have got hit in the face with the huge surge in barge freight. Whereas other areas have seen basis appreciate a bunch because of the bad crops. The bottom line is basis will be volatile. But it is somewhat predictable. It should get better the later marketing year we get. For all of the grains. Obviously, things like a railroad strike could curtail that, but it will take major black swans for basis not to get better. Futures going parabolic would be one risk to the above basis statement.

Build Bins

I have always been a proponent of having enough on farm storage to hold one’s crop. If you are in an area that is getting hit with a wide basis or is seeing a massive carry in the market and you are selling off the combine because you don’t have bins. Do yourself a favor and build additional storage on your farm. If you are always supplying the market with your product at the time the supply is the highest, how can one thing that is a good move?

You not having enough storage is a great move for your neighbors as it helps demand spark at wider basis levels which in turn helps basis improve for them to sell at better levels. It helps the elevators make more money at gut slot harvest. Those are good and needed to keep things flowing. But other than the comfort level and operational needs that it could benefit to a farmer there are not many benefits from a lack of bin storage.

Please balance what I say above about building bins with becoming complacent in marketing. That is one of the biggest risks in building additional grain storage. I have heard many times of farmers not wanting to move grain because they have storage.

There are reasons to sweep out bins.

Some of those reasons include an inverse in futures or basis. The bigger the inverse the higher the cost of storing in one's own bins becomes.

Hitting a target price however and selling without a reason other than it hit your target price is usually a way to leave a lot on the table. Be able to distinguish selling because you should, you have to, and you want to. The more you sell when you should the better off you will be.

Millet Market Remains on Fire

This will likely be a broken record for a while, but the market remains very strong. I have seen slight signs of demand slowing down a little and coverage being extended enough for some buyers but overall it still feels like it has legs. I may through up a caution flag in the next few weeks and want to take a little risk off the table. But right now my mentality is that this is still a sellers market. Make the buyers pay up; and when one considers the consolidation that has happened in the birdseed market one knows that bids will eventually evaporate.

The same thing that will happen in the millet market has happened in the black oil sunflower birdseed market. The difference is that we are close to having the few buyers left all come in at once. So as fast as the sunflower buyers have driven that market down I look for them to drive it back up. It’s probably a month plus away but they will all be back in and all back in at once.

They magically go to no bids at once and never talk to each other or nothing. But when it comes to buying I think that’s when they unfriend the others.

This would be a good spot to go to the Conspiracy Corner

Conspiracy Corner

Article talking about cell phones in Europe going dark.

China painting mountains to fool enviromists?

Should Nestle be able to sell water that they steal?

Commodities Overview by Sebastian Frost

Overview

After Fridays USDA report, we saw the grains finish mixed. The USDA report came in pretty bullish for corn, was friendly wheat, and bearish for soybeans. Looks like most are planning for some big progress made in harvest as weather is looking cooperative.

Today's Main Takeaways

Corn

The USDA report Friday was pretty friendly to corn. Where we saw the USDA stock numbers come in lower than expected. September 1st grain stocks came in at 1.377 billion bushels, which was far lower than the trade was expecting, and was a bullish surprise to end the week.

The USDA revised the 2021 production at 15.073 billion bushels, which is down almost -42 million bushels, and well below expectations.

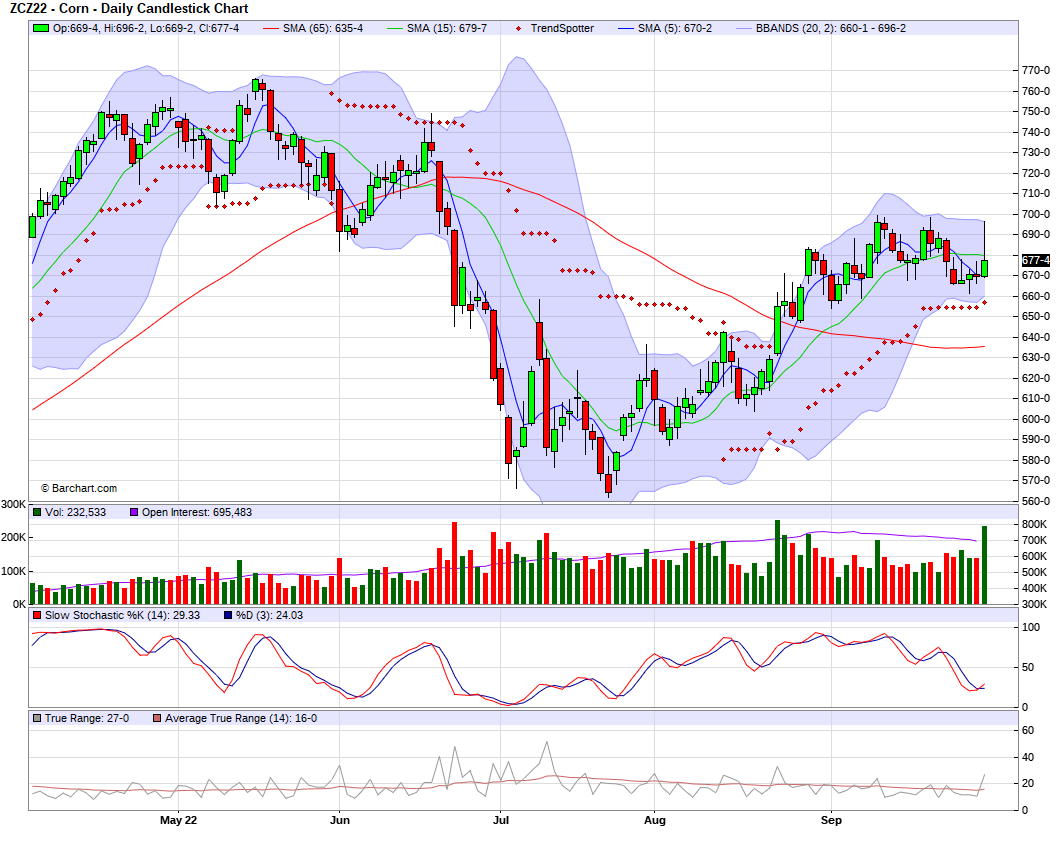

We saw Dec-22 corn close up +8 cents at close on Friday. But we closed nearly 20 cents off our highs on the day. As we saw a high of $6.96 1/4, and finished the afternoon session at $6.77 1/2.

Taking a look outside of the USDA report. Weather is looking cooperative for the most part, so harvest is expected to start moving along at a much quicker pace. We also have the demand side of things, which hasn’t been beneficial to prices as of lately. As demand has been very lackluster for the most part. Last week we saw export sales come in at about half of last years pace.

We just haven’t been able to break above that $7 resistance range, as they continues to be a tough resistance level. Nearby support is looking to be right around that $6.60 level.

5-Day Change

Dec-22 Corn: +3/4 cent

Dec-22 Corn (6 Month)

Soybeans

Unlike corn and wheat, the USDA report came in very bearish for soybeans. As September 1st grain stocks came in larger as well as a much bigger 2021 crop than the trade was estimating.

The USDA had the 2021 soybean crop at 4.465 billion bushels, an increase of 30 million bushels. They also had September 1st stocks at at 274 million bushels, which was far larger than trade expectations.

We saw Nov-22 contracts close down -46 cents Friday after the report, closing near the bottom of their trading range.

We also have harvest moving along nicely. Looks like we are seeing a mixed bag, some showing worse yields, and some showing slightly better than expected.

With Friday's report, as well as a multitude of different things. There isn’t a whole lot to get excited about in the soybean market right now. Demand from China is still poor, as they are still looking to get their soybeans from anywhere except the US. South America planting is also apparently moving along fairly well also, but looking long term there are some potential problems we could see, but those aren’t anything to be concerned about right now.

Friday we broke well below all nearby support, now current nearby support looks to be around the $13.55 range, which is still nearly 10 cents away.

5-Day Change

Nov-22 Beans: -61 cents

Nov-22 Soybeans (6 Month)

Wheat

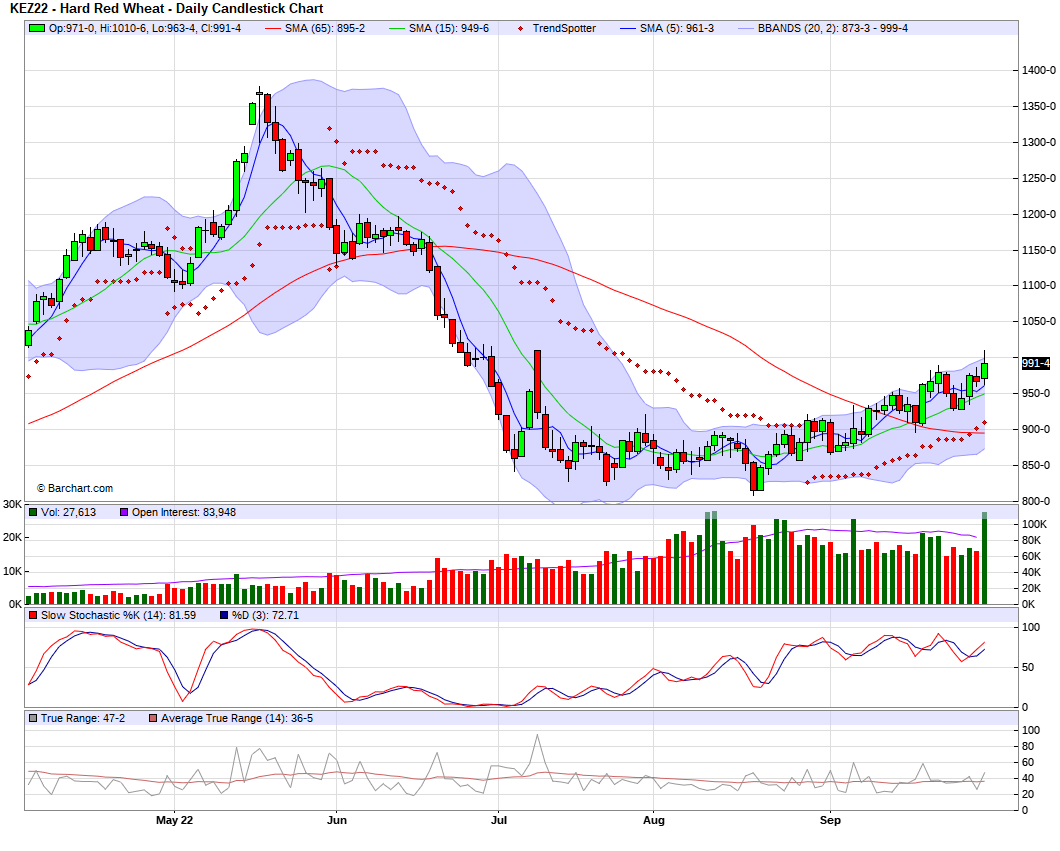

The USDA report came in somewhat neutral but was overall pretty friendly for wheat. Where was saw all production much lower than trade expectations. USDA had all wheat production at 1.650 billion bushels, which was well below estimates. This tight number came mostly from the reductions in winter wheat.

The USDA had September 1st stocks at 1.776 billion bushels which was right about where estimates were.

To go along with the friendly report, we also have the escalating Russia and Ukraine tensions supporting prices. As there is definitely a possibility of these problems slowing Ukraine exports.

The wheat market will likely continue to see its up and downs as the Russia/Ukraine headlines come and go, and will probably be the main driving factor in the markets either which way.

The supportive report helped us add on to the gains we saw through out the week, as on Friday we saw the classes of wheat close anywhere from +16 to 25 cents, while closing in the middle of their respective trade ranges all closing 20 cents plus off their highs.

5-Day Changes

Dec-22 Chicago: +41 cents

Dec-22 KC: +41 cents

Dec-22 MPLS: +32 3/4 cents

Dec-22 Chicago Wheat (6 month)

Dec-22 KC Wheat (6 month)

Dec-22 MPLS Wheat (6 month)

News

Putin claims annexation of four Ukrainian territories in Kremlin ceremony

US gas prices fell for 99 straight days

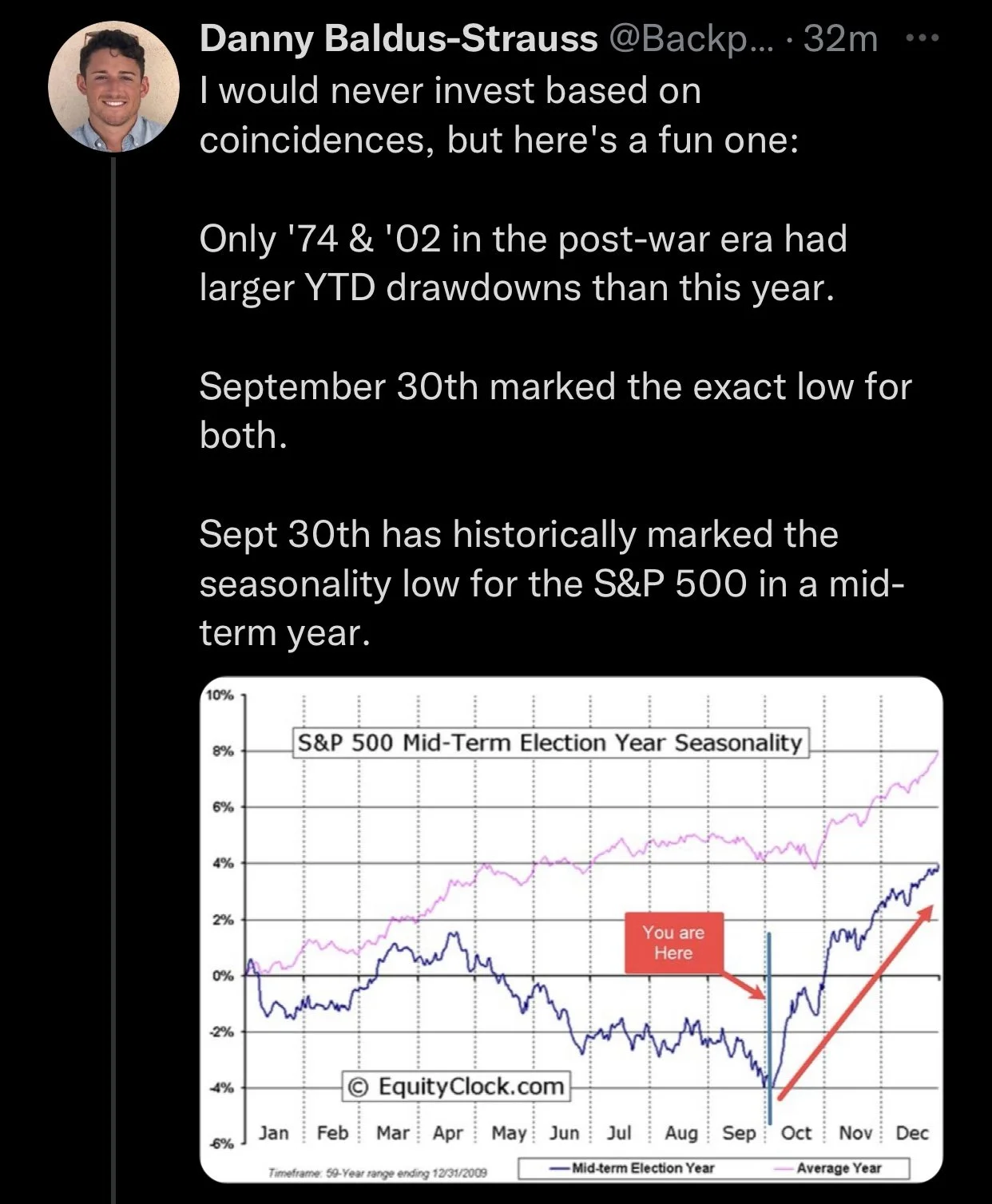

Somewhat old news. But treasury yields spiked with the Feds raising interest rates, sending mortgage rates to highest levels since 2007

Ag Week: "Chinese lockdowns, global recession concerns are the biggest issues facing U.S. ag

Major ports and rail facilities across the south east had to close due to hurricane Ian

Here is a few of our recent newsletters in case you missed them..

What if we don't go into a recession?

Can grains separate themselves from stock market?

Social Media

Precipitation Forecasts

2-Day

Weather

Source: National Weather Service