WEEKLY GRAIN NEWSLETTER

By Jeremey Frost

This is Jeremey Frost with some not so fearless grain market thoughts for www.dailymarketminute.com

The Magical Pencil

A rather uneventful choppy trading week. With no big highlights on the surface but sometimes it is what a market did not do that is important.

So a couple of “despite of” highlights this week. First “despite of” the Mississippi River plugged and out of water, we had rather good soybean export sales on Thursday coming in at the highest level of the year so far.

“Despite of” the impending recession, and the whole wide world about to fall apart, the DOW is up around 2700 points from the low on October 13th. As we called that day in our audio comments, we continue to believe that the equity markets will go higher despite everyone thinking that we will melt down. We believe that too many had jumped on the world's ending side of the ship, causing that ship to flip over and catch the bear’s underneath it. A few more strong weeks and the headlines will change to did you miss the buying opportunity in the stock market.

“Despite of” harvest we have very little harvest pressure in corn or beans. What does 7.00 corn futures and 14.00 bean futures at harvest tell us? Perhaps we have yet to realize how small the supply for our commodities are. Or perhaps it is the fact that we haven’t used our magic pencil to curb demand like the USDA decided to do when they printed the latest USDA supply and demand report. Or maybe farmers have slowly got more powerful, smarter, with more bins, more cash, and thus more holding power.

“Despite of” no demand talk, we have corn basis on fire in many areas of the US. The only ethanol plants with what I would call a weak basis are also offering a rather big carry, because they have good crops right around them (that they can buy cheap) but also can’t afford to let corn leave the trade area without getting slapped in the face later in the marketing year.

Why? Because we didn’t use our magic pencil to erase demand like the USDA implies will happen. Obviously, demand will go lower, but only because it is not there.

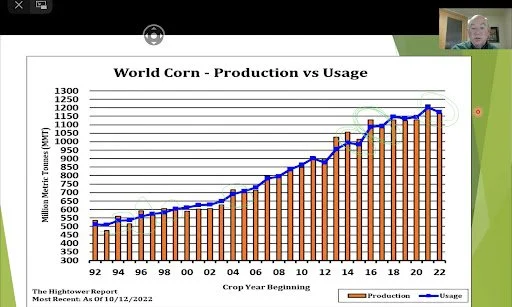

Here is a screenshot showing what I mean. This is from a webinar from the Northern Crops Institute. Mike Krueger is presenting the webinar.

This is a graph showing world corn production versus use. The blue line is world #corn usage with the orange being world corn production. Do you notice many years where we actually see usage of the blue line dip at all? How about many years where the orange is down year over year, what is the impact to the blue line?

The far right is the projected 2022-2023. You will notice that our blue line or usage is going down a fair amount. Next look at other times that the orange line or production drops. I circled many of these in light green. Just looking at the chart one might come to the conclusion that the present projected drop in demand has NEVER been done before. One might further look at the chart and realize that even in similar years when production slipped even then demand didn’t drop very much if at all.

Folks if you have ever been in business you will know that it can take awhile to build demand for various products. But once demand is built it does not shut off like a light switch or via using a magic USDA pencil.

Don’t get me wrong, this graph won’t change a lot, but the price action from what gets this graph to be accurate is what one will be watching. Meaning if we are going to curb demand like the graph says we will, how are we going to go about that?

As farmers are you going to be a price taker? Or a price maker?

Demand has got to slip over a billion bushels in the USA alone or we run out of corn.

We can’t run out of corn so that is going to cause some demand to go away naturally or look for replacements. But how fast can we make that demand go away?

I challenge farmers to have a New Year resolution of becoming a price maker instead of a price taker. We are just a few days from going to the spot when our corn supply in the US will go down every day until sometime in harvest 2023. Next week we will show over 75% beans harvested and over ⅔ of the corn harvested. Our supply for the grains will start going down shortly after that. Because of our solid demand. We use nearly 40 million bushels a day, the marketing year started nearly 2 months ago. So by Halloween I expect us to be 80-85% harvested, meaning we will have roughly 2 billion bushels left to harvest. Our supply will be shrinking.

What do you need to do to be a price maker instead of a price taker? First off you must learn what basis is, why it can change, and what the local market does to affect it.

You need to work on having more staying power each and every year. You have to grow your business, add bins will surely help.

The most important thing as farmers, is the realization that you are already the price makers, you are no longer the price takers. The wealth and success farmers in general have had, has turned many into price makers. Remember this when you are deciding how to market your grain and even where to market your grain to.

I was traveling in SD Friday and today; I drove by several open elevators like Agtegra, ADM, Cargill, CHS, and Oahe Grain. All of which were open and serving the farmers like they should be. I talked to Sunbird in Huron last week and I know they had plans on being open to service sunflower growers. I noticed the extended hours that the crush plants in ND have for sunflower growers.

Do you know what else I noticed was Global Harvest closed Friday afternoon at a location, and obviously closed today.

If a buyer was working for a farmer would they not try to accommodate the farmer during harvest?

So farmers, especially those of you that grow specialty crops. Please realize you are price makers, not takers. Take a look at the sunflower crop and bean oil. We have been oil breaking out over 70 cents, up over 6 cents this week alone. Once you put those sunflowers away you will make these buyers pay up, like they should.

Keep in mind they will continue to do everything they can to wipe out competition, but they are not your friend. They try to buy product as cheap as possible, some of them do great and are win win approach, while others that I shall not name again are simply ruthless businessmen that will bend you over and rape your wife or kids when you are not watching.

Bottom line is the lesson for the week, the affirmation for the week is to tell your buyers what price you will sell at. Next time they give you a bid, give them an offer.

Don’t let buyers convince you that the “Magical Pencil” is actually out there.

Be patient in your marketing grain as much higher prices are in store for months to come. Realize the risks that are out there from things like a recession, or Mother Nature acting perfectly everywhere.

Realize how strong Chinese demand has been since COVID hit. I have read and listened to much about the fact that once Chinese stop the lock downs demand could really accelerate. Are the lockdowns simply because China is running out of food and it is an attempt to help curb demand?

Free Grain Marketing Plans

A couple other updates, please check out our Grain Marketing Plan page. Fill out the questionnaire and I will send you a recommendation for a marketing plan based on your answers. Free.

Check out our all-new Ag Directory

To add value and efficiency the Ag Directory provides a way for users to have a “one-stop” shop in the palm of their hands and not have to search for contacts when they need a trucker, seed, fertilizer, parts, financing, etc.

To get your business listed in our Ag Directory simply contact me at 605-295-3100.

Next week we will talk about emotional, technical, or fundamental factors triggering the price moves and what they mean.

AntiTrust - Class Action Lawsuit

With recent headlines “Regulators Accuse Pesticide Makers of Inflating Prices for Farmers” in the Wall Street Journal I have had a few farmers ask me about some specialty grains with some of the recent acquisitions and mergers that have happened. I have been in contact with an AntiTrust and Class Action Firm that has had a large amount of success in the ag industry. Please send me your contact info if you would like more information or be included in a possible class action lawsuit for AntiTrust and price fixing for some of the speciality grains. (Email me at jfrost@banghartproperties.com)

Not so Fearless Predictions

2023 will bring new all time highs for corn, wheat, and soybeans. Crush margins for soybeans continue to improve lead by bean oil which will also make a new all time high.

Conspiracy Corner

Ukraine and Russia. Provide much of the fertilizer and nitrogen for the farmers across America who provide food for the world, are we headed for a famine

Commodities Overview by Sebastian Frost

Overview

We saw a pretty volatile day Friday to end the week, which resulted in the grains closing slightly in the green. Going into the last trading week of October, we won't be seeing any major reports. So direction of the markets will likely be impacted by factors such as South America, Chinese demand, as well as any Russia & Ukraine updates.

Today's Main Takeaways

Corn

Corn has continued to trade in a tight sideways range, for the most part, this week. We managed to end the week on Friday slightly green. And we were a nickel and a half lower on the week.

Corn has seen a lot of pressure from the quick progress we are seeing in harvest, which is expected to keep moving nicely. We are looking at some rain in some growing areas but its not expected to cause any set backs. We also have some pressure coming from the low water levels in the Mississippi River. Lastly, one of the biggest issues looming is still our demand.

Last week we saw the International Grains Council trim their global corn production estimate by 2 million metric tons. Bringing their new total to 1.166 billion metric tons. The lowered estimates were due to the lower production estimates we've seen in the U.S. and EU. This estimate is 51 million tons below last years global corn production of 1.217 billion.

The entire Russia & Ukraine situation remains an unknown as it has been for quiet some time now. If we see news of them nearing an agreement we will see prices come under pressure, and vice versa. If we see more conflicts arise or if the deal gets thrown out, prices will likely rally.

Obviously, the big question remains, where will we see the final yield come in at. It's looking like most think we will see somewhere in the 170-172 bpa area. Anything below 170 would be considered pretty bullish. On the other hand, there is still that possibility we see yield actually comes in higher, perhaps slightly above the 172 mark, which would put a lot of pressure on prices.

So we know here at home things seem to be going well for harvest. But globally, there is still some weather concerns that have the potential to further support prices. With Brazil getting too much rain, adding to the possibility of delayed planting or harming crop quality. Argentina has been the one that's been in a massive drought for a while which has already delayed planting, but its looking like they are starting to get some rain. So with this rain, the current outlook for South American weather is looking to the slightly bearish side.

5-Day Change

Dec-22 Corn: -5 1/2 cents

Dec-22 Corn (6 Month)

Soybeans

Soybeans had an okay week, following their rally Thursday where we saw weekly exports far exceed expectations. Soybeans continued higher Friday about +4 cents. Leading to us seeing over a dime higher prices on the week (+11 3/4 cents).

The weekly exports came in over three times that of the previous week and was the highest we've seen for the marketing year. This makes some wonder whether we will continue to see strength in demand, as the lack in demand has been holding back prices for quiet some time now.

However, we are looking at a record crop size expected in Brazil. With the USDA estimating Brazil's production at 152 million metric tons compared to last year's 127 million metric tons. We touched on this in the corn section, but South America weather is looking fairly cooperative as well. So the South American weather story will be one that many will be keeping their eyes on going forward. We will have to see just how much of an impact Argentina's early drought made on their crop.

Along with South American headlines, Chinese demand will play a large role in the direction we see soybeans. We also have soy oil which has been performing tremendously, recently hitting a new high last week.

5-Day Change

Nov-22 Beans: +11 3/4 cents

Nov-22 Soybeans (6 Month)

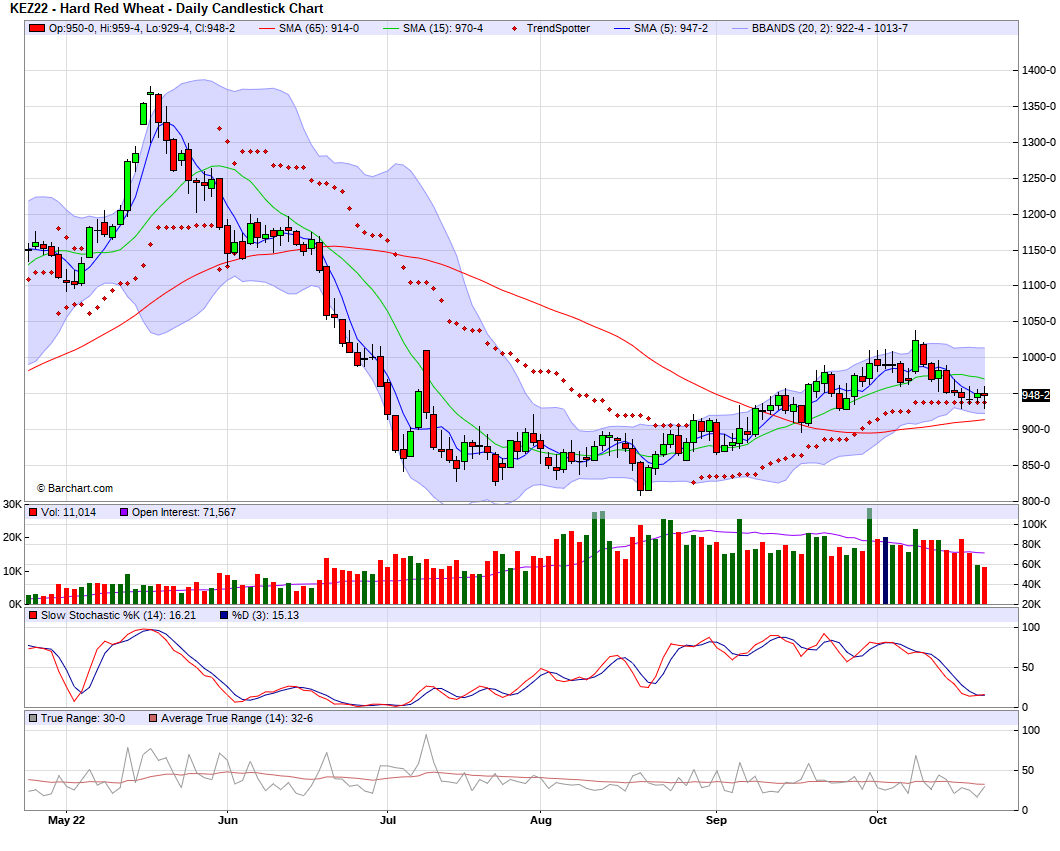

Wheat

Wheat ended the week of Friday mostly lower, as we have traded in a very wide trade range the past week. As on Friday alone we saw a 30 cent swing from the highs and lows. Chicago and KC closed lower on the week, while MPLS outperformed the rest and closed higher on the week.

The UN said the conversations with Russia regarding the Black Sea and export agreement were positive for the most part which added some pressure to the wheat markets. However, after this we saw some rumors that Russia is looking to block the Odesa port, so who knows where this will situation will go. If things continue to escalate, prices will more than likely go higher. If agreements are made we will likely see prices take a dip. There was also rumors that Ukraines biggest port, Odesa, will be blocked starting early November. If this happens we can expect grain prices to rally.

It looks like Argentina is now finally getting some meaningful rain after their historic drought. So we might not be getting as much weather premium if South Americas weather continues to go smoothly. But there is still definitely that possibility we see some more weather scares as we near the end of the year.

5-Day Changes

Dec-22 Chicago: -9 cents

Dec-22 KC: -4 cents

Dec-22 MPLS: +7 1/4 cents

Dec-22 Chicago Wheat (6 month)

Dec-22 KC Wheat (6 month)

Dec-22 MPLS Wheat (6 month)

Cattle

Dec live cattle futures ended Friday up +$0.750, up to $152.425 continuing its rally hitting a new contract high Friday, finishing +$4.650 higher for the week.

Jan feeder cattle ended the week higher +$1.125 to $180.375 and was up +$5.275 on the week.

Dec Live Cattle (6 month)

Nov Feeder Cattle (6 month)

News

There is rumors the Odesa port in Ukraine will be blocked starting early November

China is set to auction off more wheat from reserves

New $1.3 billion program giving debt relief to U.S. farmers who qualify

Two of India's biggest refiners announced they would no longer be accepting Russian crude oil after Dec. 5th

Germany's corn crop is expected to fall -20% on the year

In case you missed it..

Oct. 19 Audio - Sunflowers

Social Media

Precipitation Forecasts

2-Day

Weather

Source: National Weather Service