AFTERNOON MARKET UPDATE

Futures Prices 12:45pm CT

I want to start off today's newsletter by paying respect to Mark Senftner. As today was a tough day for my home town of Onida, South Dakota. Our prayers go out to the Senftner family and all the lives he touched. Mark was an amazing coach and an even better person. Personally, he was my football coach and led us to three state title games, but his impact on the lives he touched went beyond the field. As he inspired everyone around him and in our community.

Overview

Grains mixed following yesterday's modest rally where we saw all the grains close in the green. Yesterday's gains came despite the overall mixed weekly export sales. Where we saw soybeans come in very strong, well above expectations leading to a good day in the soybean market. However, both corn and wheat saw relatively weak and disappointing export numbers but both still managed to trade higher.

Today's Main Takeaways

Corn

Corn has continued to trade in a tight sideways range, for the most part, this week. Corn is slightly green, trading roughly 6 cents off its highs. Corn has mainly been pressured from a speedy harvest as well as the historically low water levels we have seen from the Mississippi River. The poor exports and demand haven’t helped either.

Yesterday we saw the International Grains Council trim their global corn production estimate by 2 million metric tons. Bringing their new total to 1.166 billion metric tons. The lowered estimates were due to the lower production estimates we've seen in the U.S. and EU. This estimate is 51 million tons below last years global corn production of 1.217 billion.

There is still a lot of uncertainty regarding the Black Sea situation as many are wondering if they will come to an agreement. The entire situation is really a wild card as has been recently. Any news could send the markets either which way depending on if the agreement nears a close or if tensions escalate.

As for harvest, its still expected to move along fairly quickly which has added some pressure to the markets. We do have forecasts showing widespread in the Midwest and other areas the next few days so this could somewhat slow progress but its not expected to heavily slow harvest.

Unlike soybeans, the weekly exports in corn were disappointing, adding some additional pressure to the corn market and helping the argument that demand remains on the lack luster side. Despite the exports being on the weaker side of expectations, they were still twice the size of the week prior.

As mentioned yesterday, the bulls would love to see a break over the $7 psychological level as we haven't seen a close above $7 since June. On the flip side, support remains around the $6.50 level or so.

Dec-22 (6 Month)

Soybeans

Soybeans higher again today following yesterday’s rally, where we saw a sharp increase in the weekly export sales where they came in above estimates, showing the possibility of an increase in strength for U.S. soybeans. The weekly exports came in over three times that of the previous week and was the highest we've seen for the marketing year.

We have to mention the record crop size expected in Brazil, as this will likely put the markets under a lot of pressure in the near future. The USDA has Brazil's production set at 152 million metric tons compared to last years 127 million metric tons.

Despite yesterday’s rally and good export numbers, soybeans haven’t been able to capitalize, trading lower overnight trading below their 20-day moving average. However, we have seen a really strong rebound this morning currently trading around 5 cents higher and over 20 cents off our lows. From a technical standpoint, the bulls would love to see us be able to break and close above $14, support is around the $13.60 range or so.

Along with the soybean exports, we also saw weekly meal exports pretty strong as well. Helping push meal higher. Soy oil also hit a new high yesterday with the rally surrounding the bean market.

So we have the demand story, which recently the headlines have said demand is really weak and is what’s keeping a lid on the markets. But perhaps this is the demand increase we've been looking for. Im not too entirely optimistic on this idea however. As there are still plenty of other factors that can play into where we demand head. Especially given the expected recorded crops in South America, it is difficult to foresee demand continuing to surge.

Soymeal & Soyoil

Soymeal up +4.3 to 417.6

Soyoil up +1.06 to 71.48

Soybeans Nov-22 (6 Month)

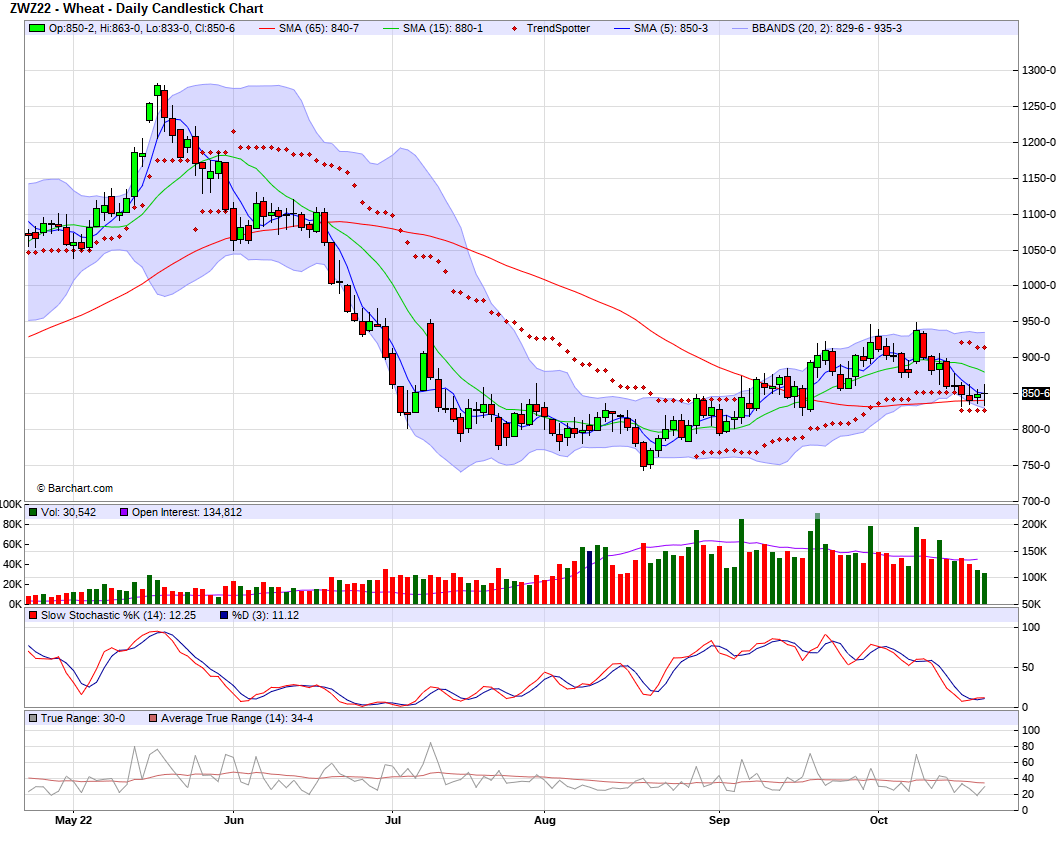

Wheat

Wheat continues to trade sideways and started off the morning lower then rebounded nicely, but is again trading lower here this afternoon. Currently trading mixed and in a very wide range. 16 cents off the lows and 13 cents off the highs. Once again finding support in the Russia and Ukraine headlines.

The Russia and Ukraine situation is still an unknown. The UN said the conversations with Russia regarding the Black Sea and export agreement were positive for the most part which added some pressure to the wheat markets. However, yesterday we saw some rumors that Russia is looking to block the Odesa port, so who knows where this will situation will go. If things continue to escalate, prices will more than likely go higher. If agreements are made we will likely see prices take a dip. There was also rumors that Ukraines biggest port, Odesa, will be blocked starting early November. If this happens we can expect grain prices to rally.

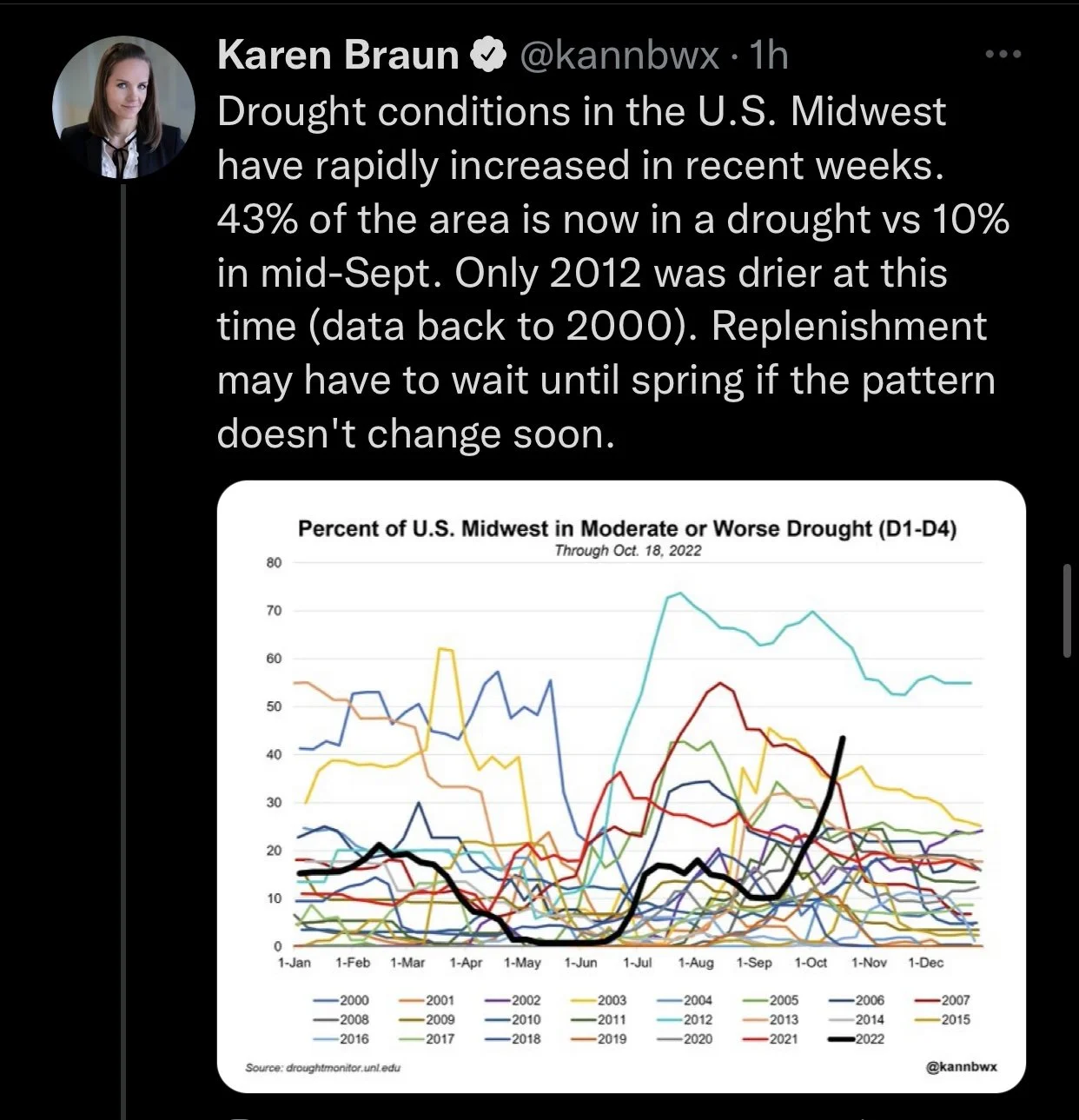

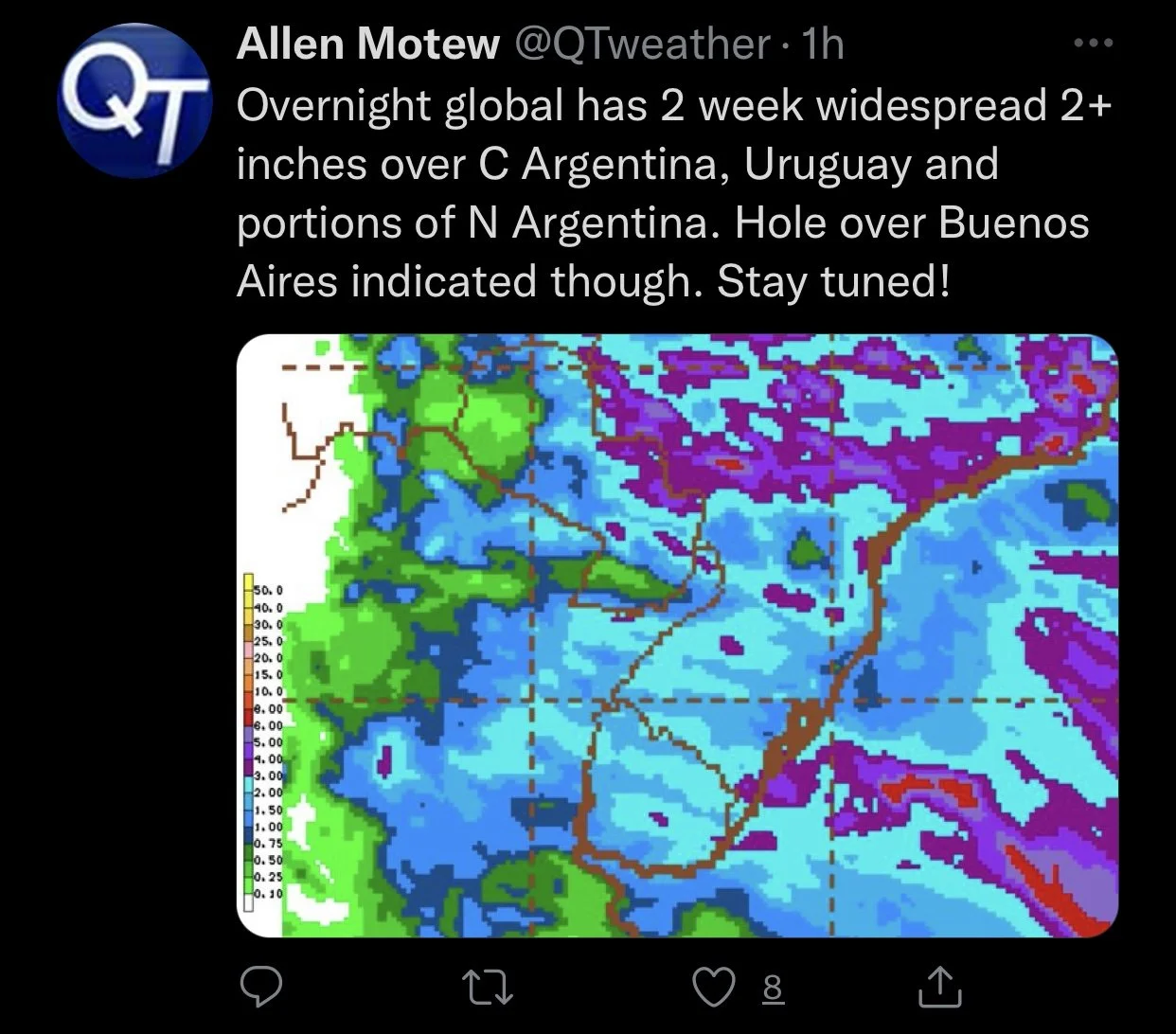

Taking a look globally, Argentina has faced some weather issues. With their extreme drought as well as a recent frost scare adding some additional damage to their crops. There is the likelihood who see a cut to Argentina wheat production estimates. They are expected to see some rain, but the overall outlook is still looking very dry, expecting to further worsen the drought. We are also seeing the crop in Australia reduced as well due to their flood situation.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil up +0.54 to 85.05

Dow Jones up +565

Dollar Index down -0.718

Cotton down up +1.17 to 78.57

News

As mentioned, IGC trim

China is set to auction off more wheat from reserves

College enrollment falls for third straight year

Yesterday the USDA announced 201,000 mt of soybeans to China, and 132,000 mt to unknown

There is rumors the Odesa port in Ukraine will be blocked starting early November

Livestock

Live Cattle up +0.275 to 151.950

Feeder Cattle up +1.100 to 180.350

Live Cattle (6 Month)

Feeder Cattle (6 month)

Previous Newsletters

Wednesday's Market Audio - Sunflowers

Sunday's Weekly Newsletter

Social Media

Credit: All credit to users of posts

Precipitation Forecast 2-Day

Weather

Source: National Weather Service