WEEKLY NEWSLETTER

This is Jeremey Frost with some market minute not so fearless comments and tidbits.

Pro Farmer Numbers...

If realized likely lead to new all-time corn highs. But I don’t see a straight shot up as many simply don’t put enough confidence into Pro Farmer as they do for the USDA. If the USDA would drop our corn production by as much as Pro Farmer has projected it would be a market mover. The only way it wouldn’t be is if it was already priced into the market.

The real question now is how much of the Pro Farmer number reported after the close on Friday was already priced into the market via the daily reports? How much smaller did Pro Farmer peg the crop at versus other analysts? I guess Sunday night's action will tell us.

I don’t look for a runaway, but I do look for higher prices over the next coming days and weeks.

As many of you know I follow Roger Wright’s service (among many) and I will reference his Tech Guy report that I wouldn’t argue with. You can read to his comments here.

One other thing in the back of my mind is what was the market and individuals saying in the past year. What fears was everyone talking about pre-growing season into the growing season?

One fear that was talked about in the past year was the shortage of fertilizer and chemicals. As this crop develops and we see estimates like Pro Farmer had for corn. I ask, did some of the top end of yield come off because of the issues in the supply chain? When we see areas not hit with dryness that came underestimates it has to make one wonder.

Basis Recommendation Alert for Old Crop Corn.

Many areas have a 50-75 cent inverse. So if you have corn now is a time to move it on a basis contract. Then see what the board can do. Do not pay 25 cents plus a month to store it. Sell the inverse. If you have questions or need help on this give me at call 605-295-3100 or Wade at 605-870-0091.

The bottom line is when you come to the end of a time period when supply is tight and you go into a period where supply outweighs demand. You go from a seller's market to a buyer's market. An inverted basis is like that. Don’t pay off the charts stupid high storage costs via letting basis slip 50 cents or more a bushel.

How do you know if you are getting taken advantage of on basis? Likely your elevator is offering an exorbitant time of free delayed price. When I was a merchandiser the bigger the inverse the longer I would offer free delayed price. The difference between me and some merchandisers is I would tell farmers exactly what I was doing and why and I recommended them to lock in the basis versus taking the free delayed price storage.

Birdseed Markets Consolidate.

What does this mean for you as a farmer? We mentioned this in some audio comments last week. You can listen to the audio here.

More discussion to follow later in the week as we attempt to execute more trades. One thing that I think it should lead to is more opportunities for arbitrage. One way to get this to work for you is via working with Banghart Properties and myself or Wade Hardes. 605-870-0091 or myself at 605-295-3100

Weevils in Sunflowers.

Are buyers aware?

Talking to farmers over the past several weeks it has become obvious that we are seeing more issues with Weevils in sunflowers. So I got some info from a respected agronomist Bryan Lutter and he gave me Adam Vernhorst contact info from SDSU.

Here is some of what they told me..

From Adam V

“Nice to meet you Jeremey. At this point, it’s hard to say what impact the red sunflower seed weevils will have on yield. There were large populations present but a lot of effort was put forth to reduce those populations. I know that some treatments didn’t work well during the 2022 season but in some cases they did work. The very large populations and insecticide issues seem to be spreading out from where we first observed them in 2017 and 2018.”

“We are continuing to increase our efforts at SDSU to test more products that are currently not labeled in sunflower to hopefully find something for next year that will knock the population down. Right now we are dealing with a vicious cycle of large populations that are not dying and then resulting in larger populations for the following season. “

Bullet points from Bryan L.

Lost Lorsban; which was the best tool for fighting weevils

If nothing is fixed could see a major shift in years ahead away from Sunflowers

Some claim adjuvants help, but his research indicates they don’t

Yield loss is a given on later planted sunflowers

Bottom line I think that the sunflower buyers might have a wide awaking once we get into sunflower harvest. Our yields are probably not going to be what they want.

Keep in mind that if you are selling your sunflowers to ADM, Cargill, Penn Pak, or even Global Harvest. The buyer that you are dealing with at any one of those jobs is to buy as cheap as possible.

There is nothing wrong at all doing business with any of those companies and I have had great relationships for years with most of the buyers at all of those companies. But at the end of the day the bias that they tell me, tell farmers, tell elevators, and tell anyone that they are buying from is one of a bearish bias as it’s in their DNA to attempt to buy as cheap as possible.

I have never heard of any end user in any industry being told; hey great job you paid more than everyone else for product. You deserve a raise.

I feel some buyers and brokers such as Banghart Properties, who includes myself and Wade Hardes have a focus on trying to help the farmer get the best price possible. There is a reason buyers over the years sometimes don’t like me.

Fall Harvest Shifts

Locally I am seeing more elevators leaving more room for soybeans. This means less bin room to handle wheat and or sunflowers. Which means wider margins or a wider basis on both. As a good rule ask your merchandiser if they have any different bins allocated this harvest versus prior. If they say I am handling beans instead of as much wheat or sunflowers. Then basis for beans is likely better than historically (or their margin for beans is more than the other grains). And the grain that they are not handling is going to have a wider basis. Econ 101

Congrats

Sept 1 fiscal end of the year for some grain companies. Which means retirement. Congratulations Ed Mallet with CHS. I worked with Ed for nearly 20 years and he was a great inspiration in my career. So Congrats Ed on your new ventures.

HOT MARKETS THAT WE ARE LOOKING FOR OFFERS ON

As mentioned I also work with Wade at Banghart Properties and some of the products that we have buyers presently looking for are:

Black Oil Sunflowers - Buyers are in control but we are looking for a shift back to a seller's market come October or November

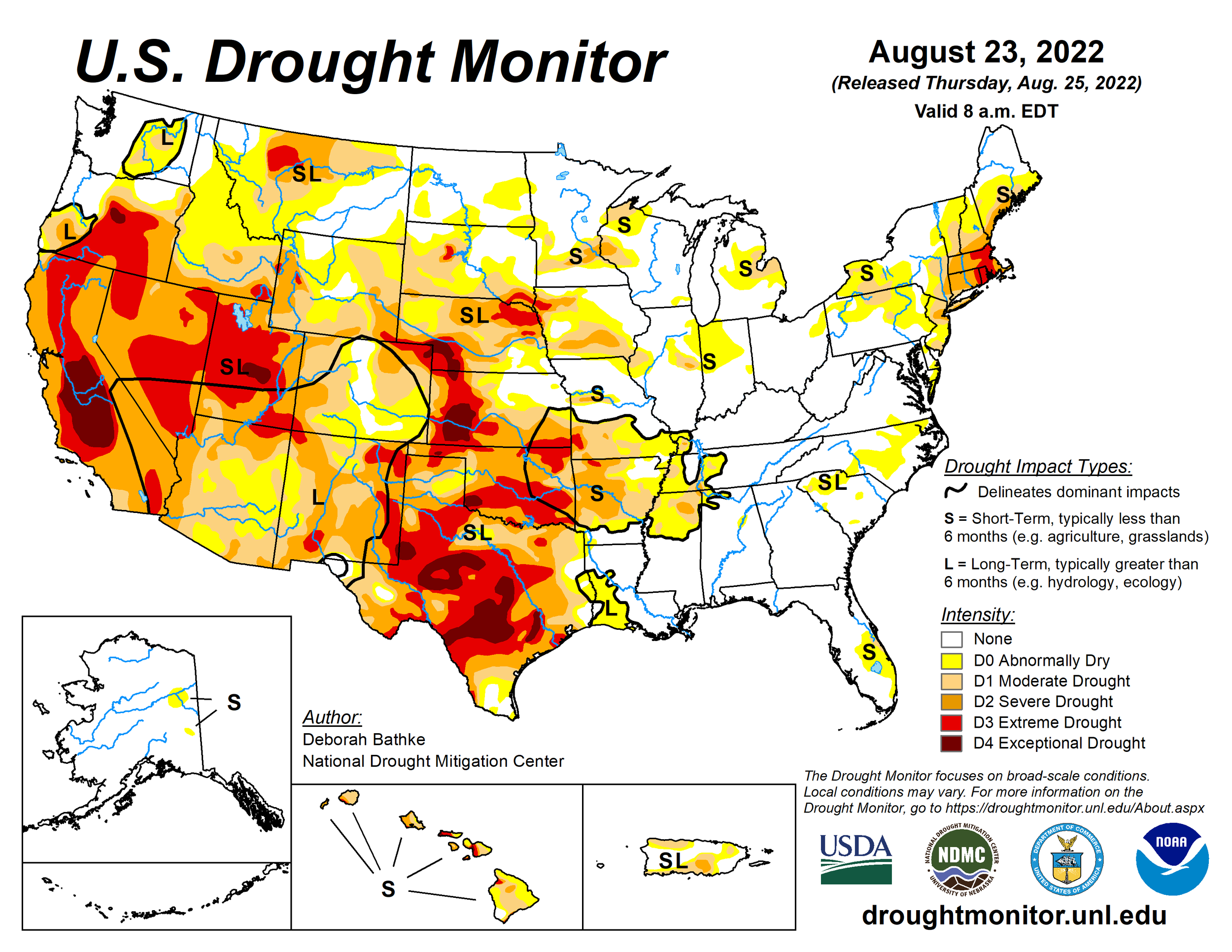

White Proso Millet - Dryness in CO has buyers starting to show some life

Ergot Spring Wheat - How big of a discount are you taking? We have homes that might save you some money

Old Crop Corn - Don’t give away the basis

Plus keep in mind we are always looking to help guys market corn, wheat, beans, milo, and any grain or feed ingredient that you may have.

You can reach me at 605-295-3100 or Wade at 605-870-0091.

Banghart Properties is bonded and licensed in SD, ND, and CO.

www.banghartproperties.com

Commodities Overview by Sebastian Frost

Overview

We ended the week Friday with a rally, as the trade was assuming the Pro Farmer Tours final results would be on the bullish side. They were correct, as the results were released shortly after the close. The crop tours dominated the markets for the majority of the week. With many regions reporting lower yields. These findings were far more beneficial to the corn market prices rather than the soybean prices. As soybeans still have some potential if we see some good weather.

Today's Main Takeaways

Corn

Corn capped off its week long rally with higher prices Friday. As everyone continues to look at the results from the Pro Farmer Crop Tours. The crop tours estimated that corn yield was lower in every state than the USDA had estimated, and their yield estimates came in a whopping 7.3 bushels per acre lower than the last USDA estimate.

The crop tours suggested that the extreme temps we saw back earlier this summer especially in July put a lot of damage on the corn crops, especially in the central part of the corn belt.

The crop tours estimated that 2022 U.S. corn yields would drop to 168.1 bushels per acre. With total 2022 U.S. corn production falling to 13.759 billion bushels. On August 1st, the USDA made these projections. They has yield at 175.4 bushels per acre, with production at 14.359 billion bushels.

If the crop tours estimates turn out to be true it wouldn't be unreasonable at all to think we could possibly see some new highs in corn. However, there is almost no chance the USDA lowers its yield by that much in one month.

(Dec-22) 5-Day Change: +45 cents

$6.20 - $6.65 (Now up to $6.70 Sunday Night)

Soybeans

As I'm writing this, soybeans are lower here Sunday night. With a pullback from Friday's impressive rally. We saw a contract high in Sep-22 soybeans Friday. Similar to corn, the crop tours dominated the soybean market for the majority of the week as well. The crop tours showed their estimates 0.2 bushels per acre lower than the USDA estimate. Which is really nothing compared to the crazy corn estimates we saw.

Even with the crop tours coming in slightly lower than the USDA estimate. There is still the potential for the soybean crop to see a turnaround if we see some good weather. We also still have concerns regarding Chinese demand. We did see another flash sale that hopefully indicates some strength in demand, as everyone is waiting to see if China will step back in and begin looking for more U.S. product. But I think for soybeans to keep pushing higher we will definitely have to see demand increase.

We also have to be aware that Brazil is looking to plant 20% more soybeans next season. However, the LaNina weather could definitely continue into winter and provide some support for a few months. We are still up well over $1.50 from our lows we saw back in July.

(Nov-22) 5-Day Change: +54 cents

$14.07 - $14.61 (Now down to roughly -15 cents $14.46 Sunday night)

We also saw amazing strength out of the soymeal market which has been one of the driving factors as of lately. The Sep contract making new contract highs with double-digit gains.

Wheat

Wheat finished the wheat with higher prices Friday, and overall higher prices on the week as well. Even though we are struggling to find any real momentum in the wheat market. Wheat continues to find support by our high prices globally. But at the same time, we are still seeing pretty weak U.S. exports which is putting pressure on prices.

We have improved forecasts here in the U.S. which is also putting pressure on prices, as well as the global recession concerns and strong U.S. dollar. To go along with those factors, we also have pretty weak exports and Russia is expecting to have a crop that is much larger than we all originally had thought it was.

Lastly, we have the Ukraine situation. Which has been in the headlines for months. Ukraine continues to send out shipments. But one could argue that the numbers aren’t really as big as everyone is saying they are. We did also just see Russia launch another attack.

On the other side of things, we have the concerns in the EU, India, and China. As they deal with energy complications. This alone would could cause a spark in buying and higher prices.

News

Putin agreed to increase Russian military personnel by 137k people. Bringing their total to 1.15 million.

India restricts wheat flour exports to counter record prices.

Russia is set to lower its sunflower oil exports tax in September.

Mortgage rates raise to a two month high at 5.55%

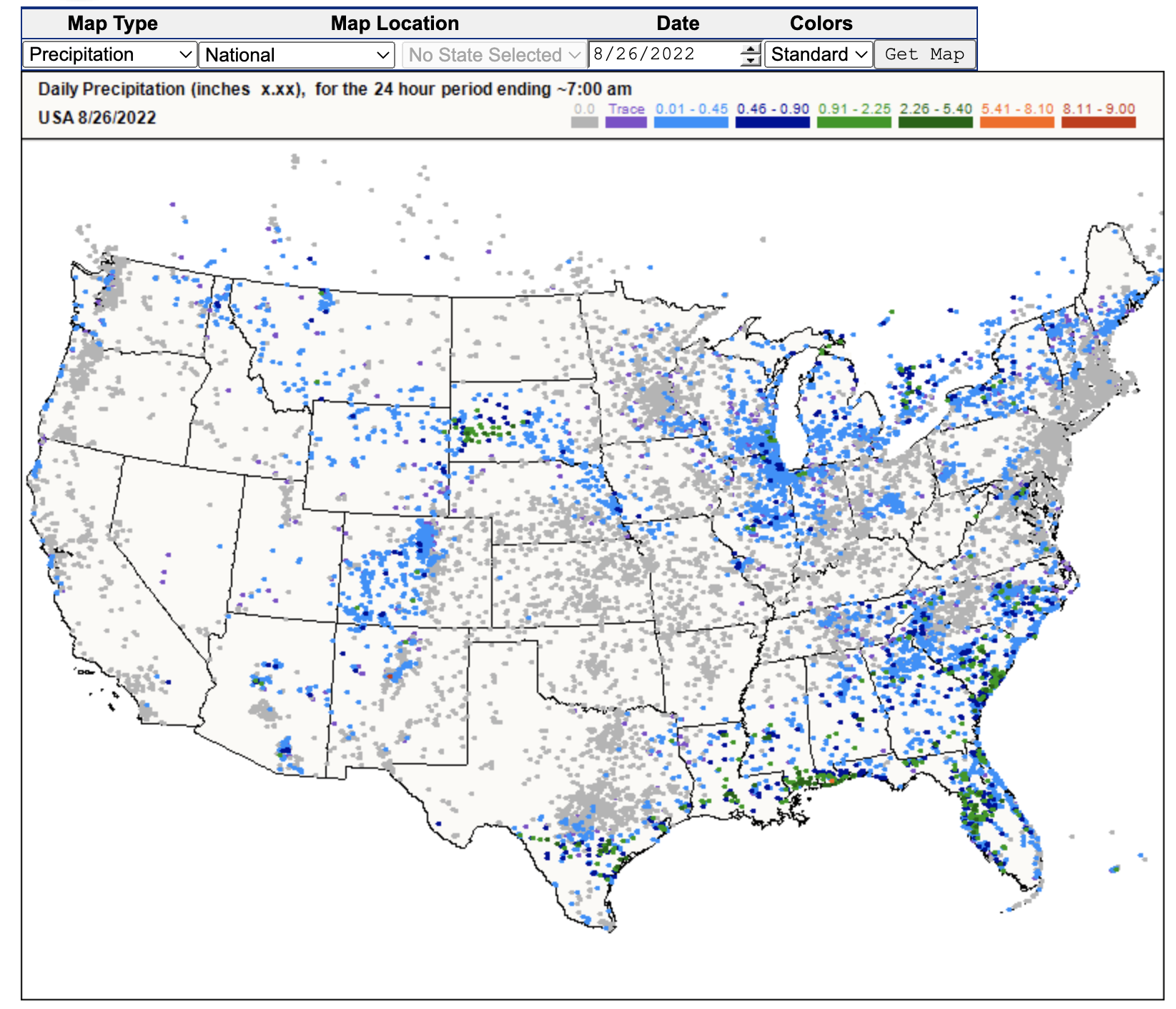

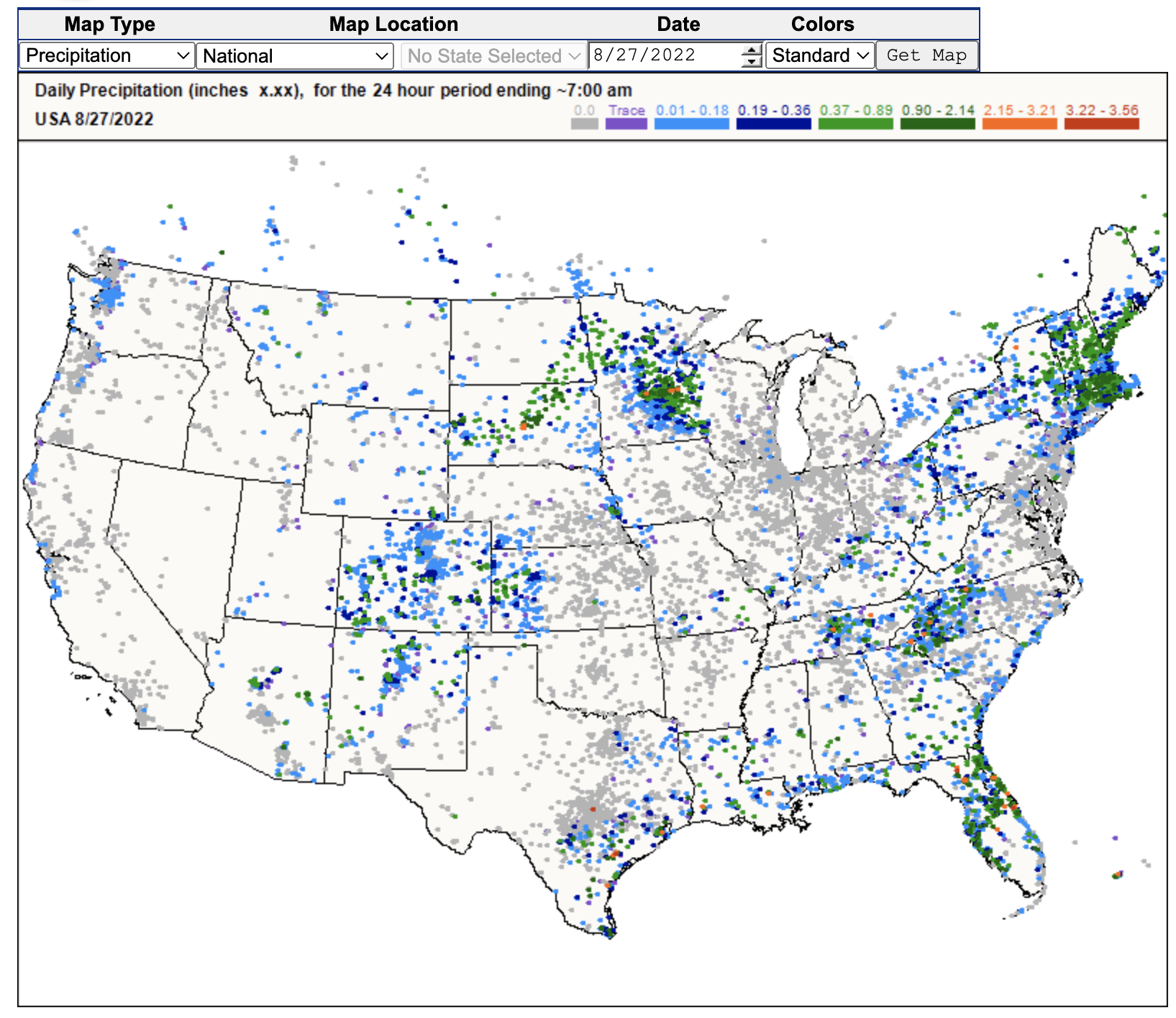

Precipitation Reported

Aug. 26

Aug. 27

Precipitation Forecasts

Aug. 29

Aug. 30

Weather

Source: National Weather Service