WHEAT FINALLY SEES STRENGTH

Overview

Wheat futures finally gain some momentum as both corn and wheat rebound following selling most of the week. While beans finished the day slightly in the red after having a stronger week comparatively to that of corn and wheat.

Yesterday's Audio

Bullish Bean Fundamentals Continue - Listen Here

If you enjoy our stuff, get 50% off monthly and yearly, or you can try 30 days for just $1. All updates & audio are sent via text message and email.

Today's Main Takeaways

Corn

Corn traded sharply lower yesterday despite actually having a fantastic week of export sales, trading at our lowest levels since August 3rd. The total exported was 57% above our 4-week average.

Today we saw a nice little bounce. On the week May corn was down 22 1/2 cents, but we did manage to close 11 cents off ours lows, as at one point we were down 33 cents.

The main reason for our recent decline is the liquidation of the large net holdings by the funds. Overall weak demand is also pressuring the corn market. We will have to see if funds continue to look to sell.

We again saw Argentina production estimates lowered, this time by Rosario Grain Exchange. They lowered their estimates all the way down to 35 million metric tons. Which is another 5 million lower than what we just saw the USDA. The last 5 years, their number has been an average of -1.9 lower than that of the final USDA number. Just how far the USDA has to lower their number is up for debate, but we will definitely see it lowered in the future.

Weather in Argentina is still a factor at play. Argentinas crop is all the way up to 59% rated poor to very poor, which is 3% higher than last week and far higher than the 22% we saw last year.

Bulls would like to see more strength in our export sales going forward following a pretty strong sales week this week.

Taking a look at the charts, we are well below all major moving averages. We have some resistance into the $6.50 range with heavy resistance at $6.80. We have a pretty major phycological support level at $6. We definitely could fill the gap down to $6 or perhaps slightly below that but we still have a bullish outlook going forward. Now the rally we are expecting might not happen until the we get into April and after the March 31st report.

Corn May-23

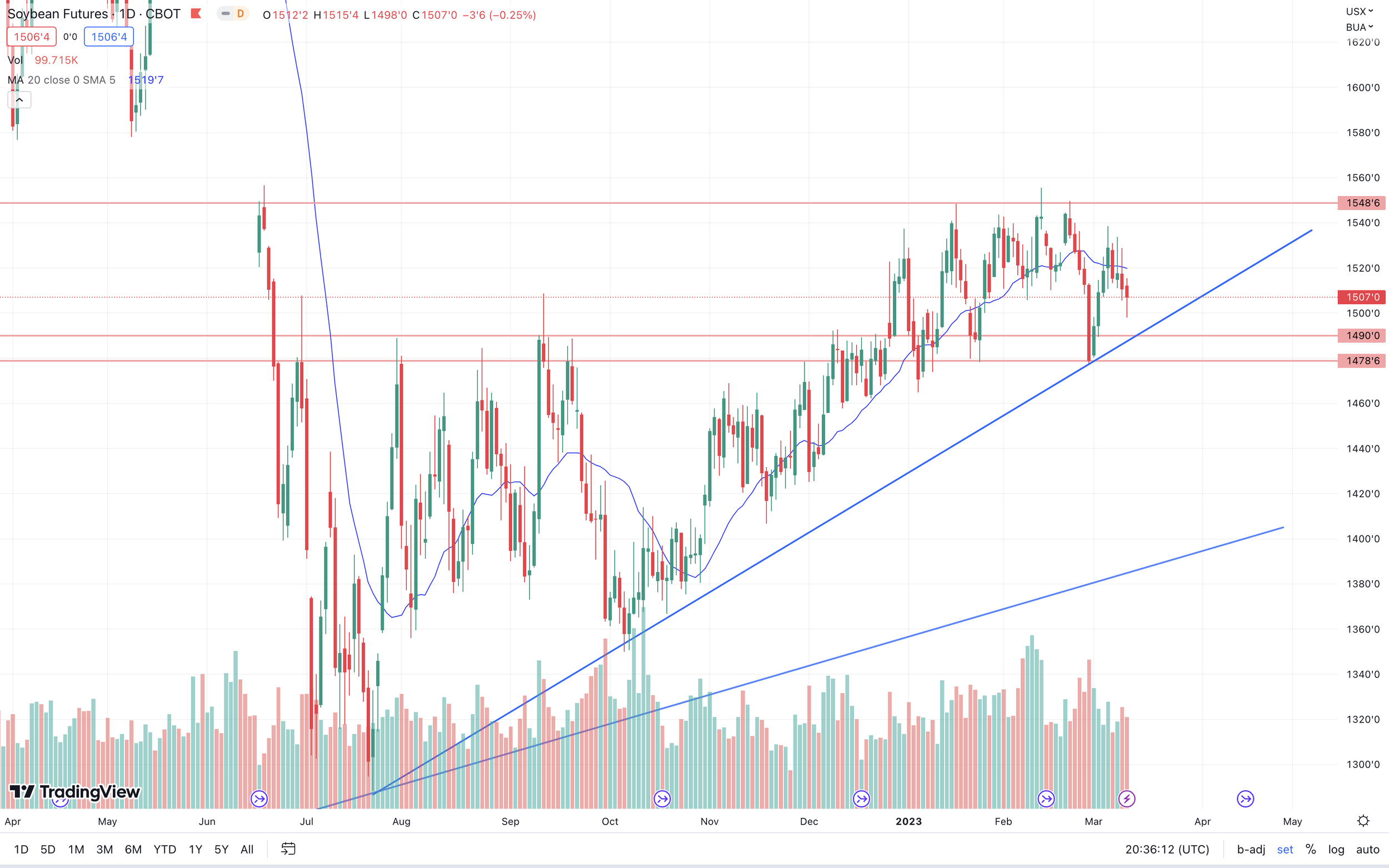

Soybeans

The markets decided to pick on beans today, as they get hit the hardest amongst the grains. Funds probably selling some beans along with the rest of the grains.

For the week, May beans were down 11 3/4 which isn’t terrible considering the weakness in corn and wheat. Beans closed 9 cents off its weekly low which was made earlier today.

We saw the USDA tighten its bean carryout to 210 million bushels. Which has added support in helping beans not see as much pressure as corn has this week.

We got the CONAB numbers yesterday, where we saw them reduce Brazil's bean crop from 152.89 million metric tons down to 151.42 million.

The biggest headline yesterday was Rosario Grain Exchange lowering Argentina's bean crop by 22% down to 27 million metric tons. This would be the smallest crop in 15 years. With Argentina continuing to see reductions, we will have to see how much of this is offset by the large crop in Brazil.

We also saw Argentina bean ratings get worse once again. Coming in at 71% rated poor to very poor, up from last week's 67% and again well above the 20% we saw last week.

Factors everyone will continue to pay attention to are Argentina weather, Brazil logistics and if they can get their crop out of the country, and the upcoming U.S. acreage and weather.

Fundamentals are still bullish. But I wouldn’t be too surprised to see funds look to sell some more here short term. Perhaps we look to test the trendline before going higher. We have some support at the $14.90 range if we were to continue lower here.

Soybeans May-23

Soymeal

Soymeal May-23

Wheat

Wheat futures finally see some strength today following virtually a month long sell off. As today was the best day we've seen from May Chicago since our rally on February 10th. This was our 4th green day in the past 18 trading days since this sell off started, the other 3 were dismal gains, which gives me more confidence that perhaps we found a bottom here.

On the week, May Chicago was down 29 1/2 on cents, and 18 cents off our lows which were made today.

KC was up 21 cents today, at one point in the week we were down 44 cents, but today’s rally helped us close just 18 cents lower on the week. We did also see KC briefly test the $8 mark again before closing a hair under at $7.98 1/4.

Wheat continues to be pressured by cheap global prices and a continuation of fund selling. The Black Sea agreement also continues to be the focal point for wheat. As optimism that the deal will get done continues to pressure wheat. Russian officials gave some supportive comments, but there is some rumors that Russia is doing this with some underlying motives. The deal expires in 8 days and we haven’t seen any real news of progress. But the majority does think it gets renewed.

Article From Andrey Sizov of SovEcon

"We feel that the global wheat market is substantially underestimating Black Sea war risks. The global wheat Supply & Demand is tight and still relies a lot on the Blac Sea supplies. There is a war going on in the region which doesn’t seem to end anytime soon. At the same time, we see record-high funds's wheat shorts position. Just imagine what would happen to that big short and the global prices if something bad happens in the region. It feels like we are sitting on a powder keg during the biggest war of the 21st century."

In this article he talks about last year's war rally, and how before last years rally the funds were also incredibly short wheat, and when the war headlines broke out they had to scatter to cover these shorts. Resulting in the nearest contract to jump 70% in just 3 weeks. He went on to say "If in the first half of 2022 the market was overestimating Black Sea supply risks, now it is underestimating them". It's a great read. You can read the full article here.

In the article he didn’t flat out say it, but with just how short the funds are, when wheat decides to flip it could result in a rather quick rally to the upside. Perhaps not quiet to the extend of last year, but the similarities are definitely there.

I was bullish when we were just below $8 and was wrong, but with prices now $1 lower it definitely doesn’t change my long term outlook for wheat. I still don’t think anyone is getting short here. I think we are extremely undervalued here and still believe we see prices rally into spring and summer.

Most news outside of the Black Sea agreement and a higher dollar remain bullish. Such as India getting hit by a heat wave. Most of these headlines are smaller macro headlines but nonetheless will continue to provide support. I think we are close to making a major bottom and this downward move was a little over done. So when wheat does decide to flip I could see us going a lot higher in a hurry.

Chicago March-23

KC March-23

MPLS March-23

Reasons to Be Bullish

Below is an amazing write up this morning from Wright on the Markets, going over why he is bullish despite what has all transpired the last few weeks.

___

We received more good economic news for the US economy at 7:30 Central this morning. The US economy added 311,000 jobs in February and the market expected only 205,000 jobs.

The market knows a better economy means the Federal Reserve thinks that means more inflation, so the Fed will increase interest rates faster and higher than expected before the report was released.

In order to choke the economy to slow inflation; higher interest rates and a good economy means a stronger dollar, which makes US products more expensive to foreign buyers.

Higher interest rates reduce profitability and makes it more expensive to store everything, including grain.

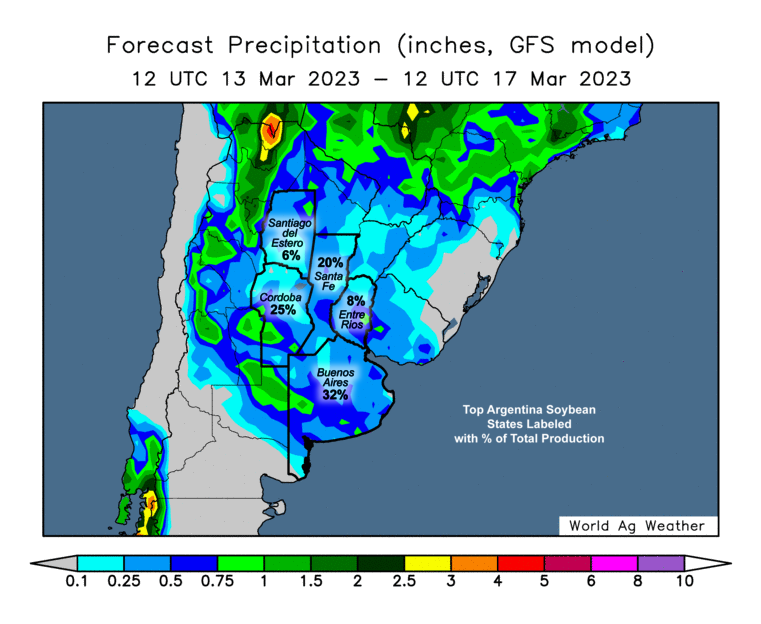

Let us set the record straight. The following is a list is the price change from the settlement on February 24th to the prices for the contracts 12 minutes after the employment report was released this morning:

Yep, that is ugly. And it hurts us as much as does you because we have to earn your business every year. Like you, there are no commission for us. Our entire income for one year is "in the bin" so to speak and the value is crashing.

We have been doing this grain marketing stuff long enough to have experienced many ugly situations just like this funk we are in the past month. Yes, we were and still are bullish, yet, prices went down. Before you conclude we don’t know what we are talking about, read what has changed since the 24th of February and if you still think we should have told you to sell corn, beans and wheat, please let us know, really, tell us. Everything below was in an email sometime since February 24th:

USDA’s Outlook Forum said it expects great yields and mediocre demand for grains and oilseeds with trend yield for corn is 181.5 (177.6 is the record), wheat, 49.2; soybeans, 52.

Jason Britt is President of Central States Commodities of KC reminded us the same day:

*Chinese soybean prices at an 8 month high of US$17.92 a bushel showing solid demand.

*The U.S. final corn carryover was lower than the USDA's February estimates 5 of the last 7 years.

*The U.S. final soybean carryover was lower than the USDA's February estimates in 12 of the last 16 years.

*The U.S. final wheat carryover was higher than the USDA’s February estimates 7 of the last 9 years.

Agrinvest considers the 2022 global corn crop the biggest failure since 1996.

Kansas wheat crop’s first spring crop rating was 19% gd/ex, worst ever for spring; and 17% a week later.

Rosario Exchange reduced the Argentine bean crop 7.5 million mt to 27 million (USDA 33) and their corn production estimate was also down 7.5 million mts to 35 million (USDA 40).

AgResource revised their Argentine corn crop lower to 38.4 million mt (USDA 40).

S&P Platts reduced their Argentine forecast for corn by 2 mil. mts to 43 (USDA 47), and reduced their bean forecast 3 mil mts to 33 mil. mts. They left Brazil's corn production unchanged at 127.5 mil mt (USDA 124) and beans at 153 (USDA 153).

The Buenos Aires Grains Exchange (BAGE) lowered their Argentine corn condition rating 3 pts to just 6% in the good-to-excellent category.

UN officials reported if the rainfall continues below normal in the Horn of Africa (Ethiopia, Kenya, Somalia) area for the next three months, this will be the worst drought in the region in at least 70 years.

Ukraine’s grain production in 2022 was 54 million mt, down 32 million from 2021.

Ukraine’s 2023 corn acres will be down as much as 50% from last year’s reduced acreage.

Dr. Cordonnier, the guru of South American crop production:

*Left his Brazilian bean estimate unchanged at 151 million mt (USDA at 153)

*Lowered Brazil’s corn production to 121 million mts (USDA 125). Late planting of safrinha corn already trimming yields.

*Lowered Argentine bean estimate another 2 million mts to 32 mil mts (USDA 41) with 60% of the crop rated poor to very poor and 3% good to excellent.

*Argentine corn was also lowered 2 million to 41.0 million mts (USDA 47) as 51% of the corn crop is rated poor to very poor and 9% good to excellent.

*Nationwide, approximately 37% of the safrinha corn will be planted after their ideal planting window has closed according to Patria AgroNegocios consultancy firm.

Safras & Mercado lowered their Brazilian soybean crop estimate by 940,000 mt to 152.43 million.

Private analysts are seeing Argentina’s corn crop as low as 36 to 39 million mts (USDA 41).

China’s soybean imports for Jan/Feb were 16.17 million mts, highest since 2008.

Teucrium Investment Firm:

Over the past several years, combined corn, wheat, and soybean consumption was greater than world production. The world carryovers of all three commodities are in a consistent decline, especially wheat.

The EPA reaffirmed it is leaning toward allowing year around sales of E15.

Datagro raised their Brazilian corn production estimate by 700,000 mt to 128.6 million mt.

Brazil’s export soybean sales are down 31% from last year at just 6 mil. mts due to rain delayed harvest. It is also why US bean exports the past two months have been unusually strong.

China had to cancel the purchase of one million mts of Argentine beans because Argentina does not have that many soybeans.

Local analysts in Mato Grosso see 20% of Brazil’s safrinha corn crop will be planted outside of “ideal conditions.”

The US corn ethanol crush improved 41¢.

The US bean crush improved 17¢.

Two consecutive weeks US corn exports sales were above the high end of the range of expectations.

National average basis change:

*Corn lost 3¢

*Beans gained 10¢

*New crop CBOT wheat lost 4¢

*New crop KC wheat unchanged

Russia said they will not sign the grain corridor deal unless Russian agricultural and fertilizer producers are “taken into account.”

CONAB reduced Brazil's soybean crop by 1.45 million mt to 151.42 (USDA 153).

USDA increased US corn carryover 75 million bushels to a 35 day supply, up 2 days

USDA decreased:

*US soybean carryover by 15 million bu

*Argentina’s corn crop by 276 million bu (20% of the US carryover)

*Argentina’s bean crop by 294 mil. bu. (84 mil bu more than the US carryout)

On the March S&D the USDA carryovers were:

*US corn more than expected

*US soybeans less than expected

*US wheat less than expected

*World corn more than expected

*World soybeans less than expected

*World wheat less than expected

If you knew all of the above was going to happen two weeks ago, would you have sold your corn, beans and wheat?

Crude Oil

For a few days it looked like crude may have broken its 9-month long downtrend. But it worked its way back down once again. Is the downtrend over or is there more downside? Has stiff resistance at the $80 level.

April-23 Crude Oil WTI

Livestock

Live Cattle down -0.525 to 164.275

Feeder Cattle down -1.500 to 197.650

Feeder Cattle

Live Cattle

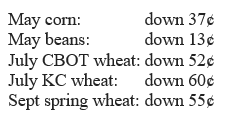

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service