WILL SVB DRIVE GRAINS TO NEW HIGHS

WEEKLY GRAIN NEWSLETTER

We have had a very wild week for our markets and the macro markets. The big stories out include FED statements about more interest rate hikes to be expected, a USDA report that cut corn exports again, while coming in below estimates for the Argentina crops, and possibly the biggest news was the collapse of Silicon Valley Bank.

Corn and wheat continued to get beat up, before stabilizing and as mentioned as a possibility in Thursday’s audio comments left some reversal signs on the charts on Friday. Can we follow up the reversal with some buying?

Short term I think our market direction is going to be very dependent on what news comes out for SVB. How the mess gets handled.

Here are some technical comments on the corn, beans, wheat, and US Dollar. These are from the Tech Guy at Wright on the Market.

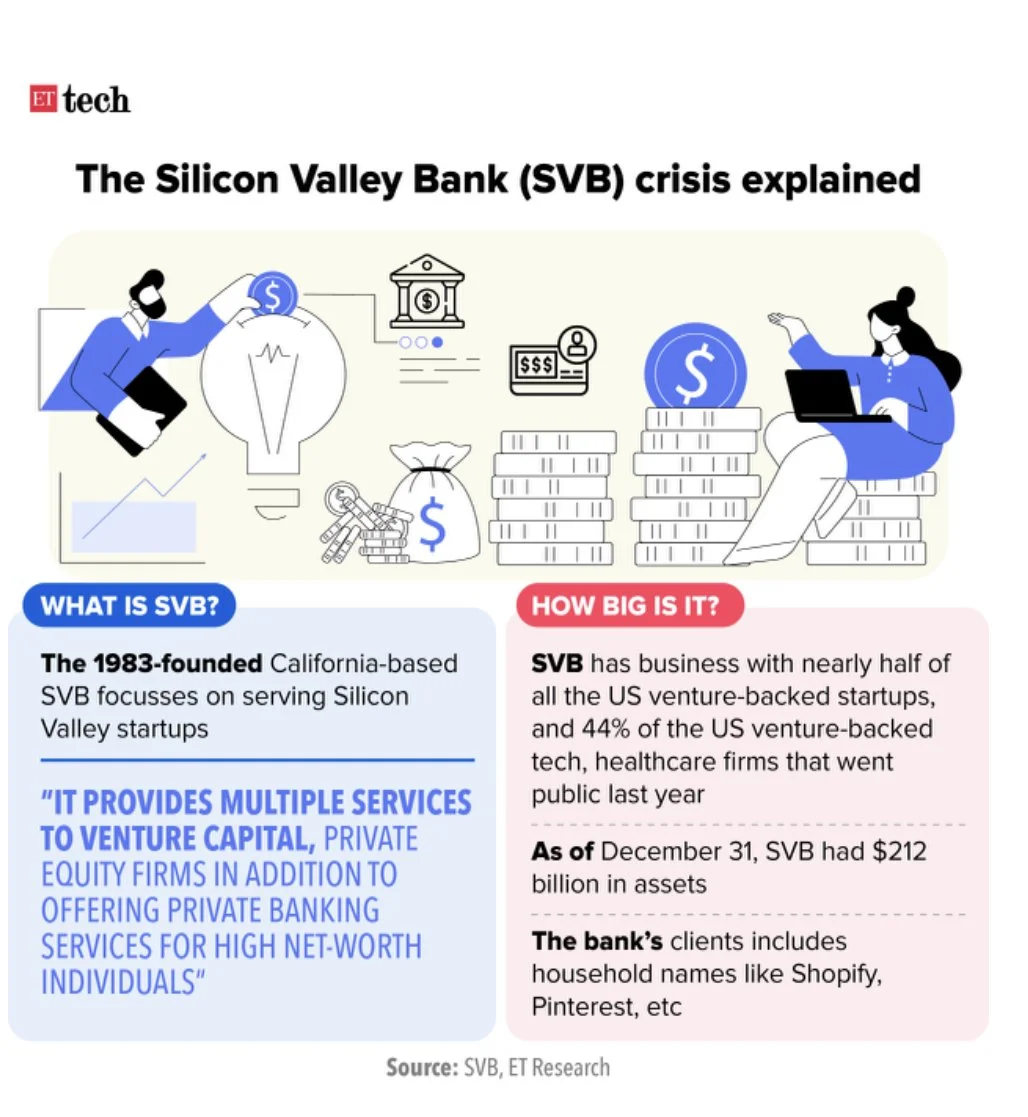

So what happened at the SVB?

Basically fear leads to panic, and once fear hits and everyone runs for the door at once, you end up with panic and a big mess.

It doesn’t matter what business one is involved in, if every customer comes into a restaurant all at once, people will get unhappy and leave. If everyone tries to pick up all of the prepaid fertilizer at once, very few will end up getting any.

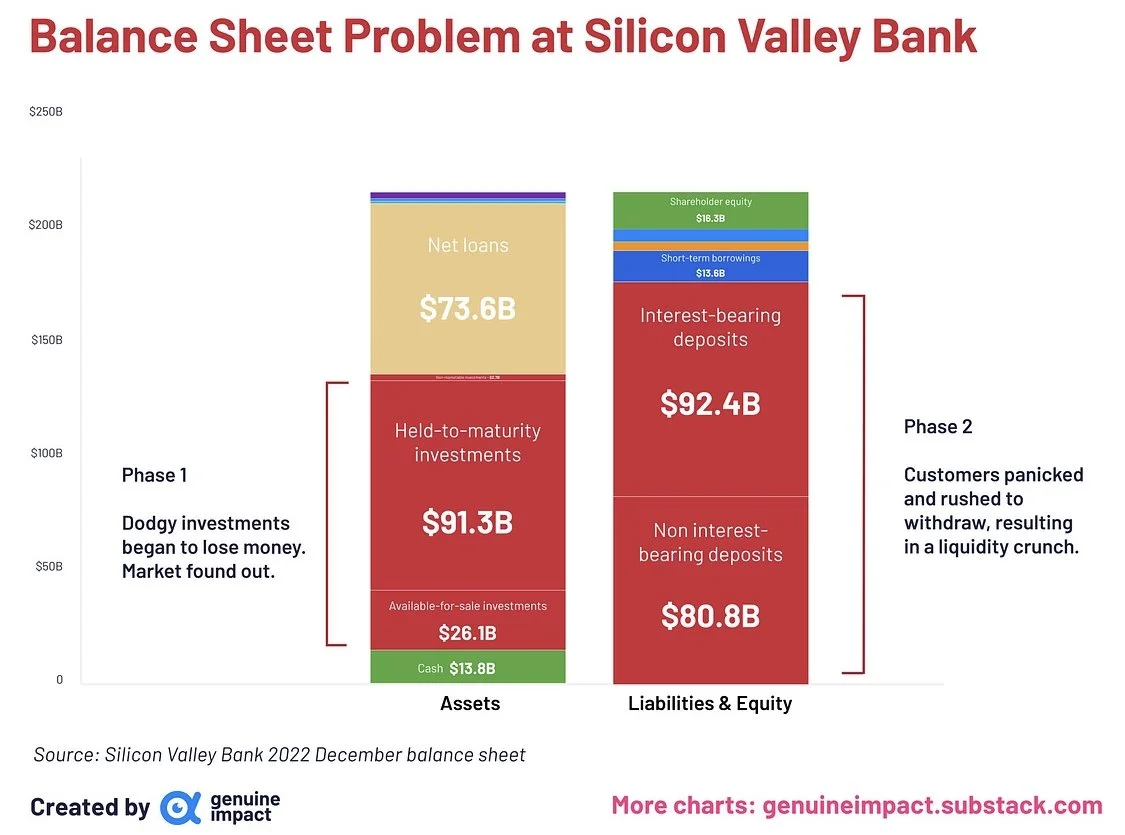

In any bank case if everyone goes to pull money out all at once, it won’t all be there as cash. In SVB case they had mismatched investment time frames versus lending time frames and the big interest rate hike caused them to be underwater.

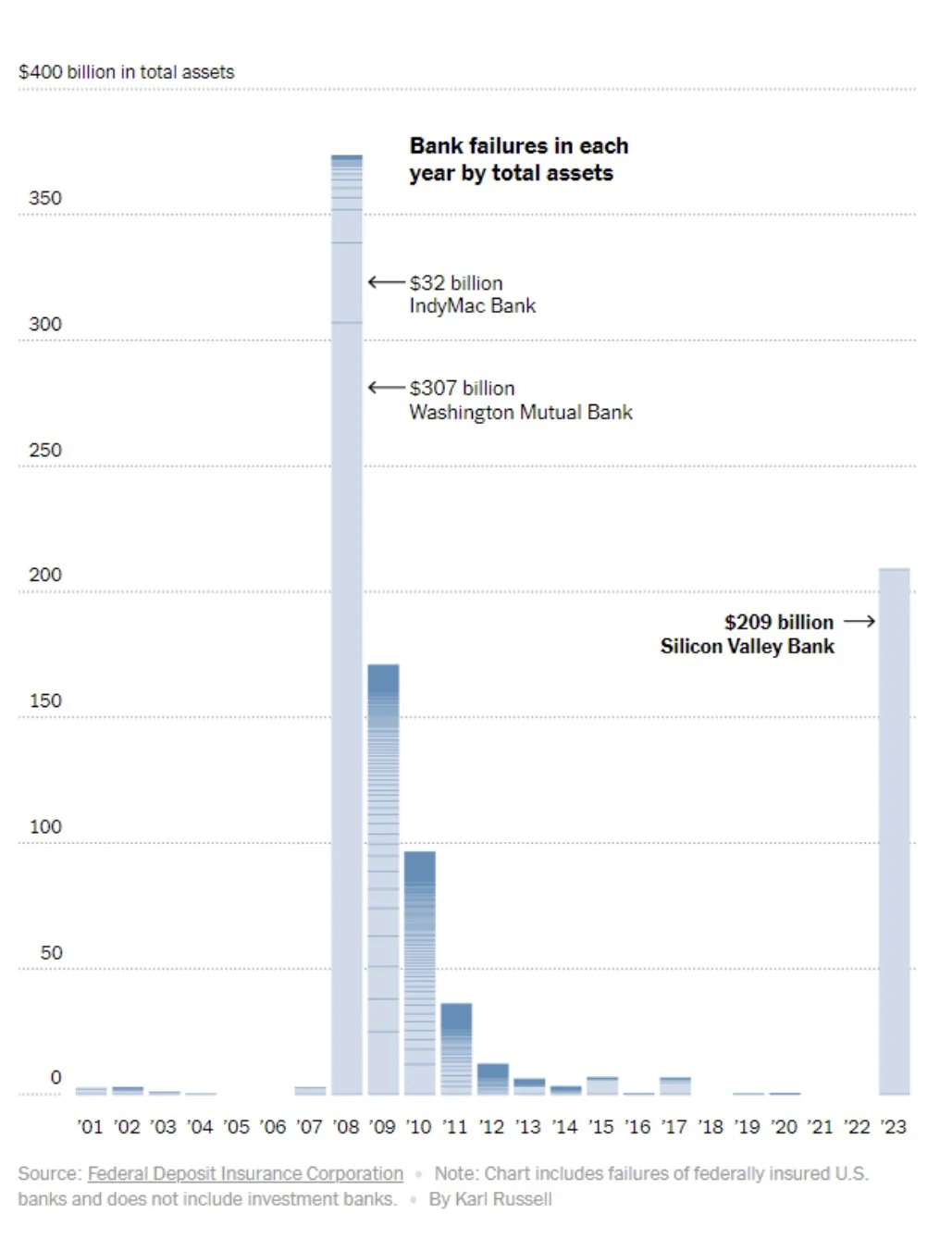

In 2008 the crisis was caused by banks giving loans to some that they shouldn’t have given loans to. This collapse was due to mad panic with everyone hitting the door at once.

Instead of explaining more and more, here are some snippets that give a good explanation.

Enjoy Our Stuff?

Get 50% OFF yearly & monthly or try 30-days for $1. All updates and audio sent via text message & email

So what does SVB mean to the Agriculture World?

This really remains to be seen, but the two big things are going to be

A) will this be the start of a major global recession and a complete meltdown similar to 2008. If you remember in 2008 corn went from about 8.00 to slightly under 3.00.

B) Will this cause the FED to pause the rate hikes or cut interest rates?

First off I dont think this is a 2008 repeat, everything that I read and research shows many differences. Having said that this is one of those Black Swans that we really don’t know how it will shake out. The one thing that is good for wheat producers is the fact that the funds are short a massive amount of wheat. So pulling money out of the wheat market means that funds would be buying a lot of contracts.

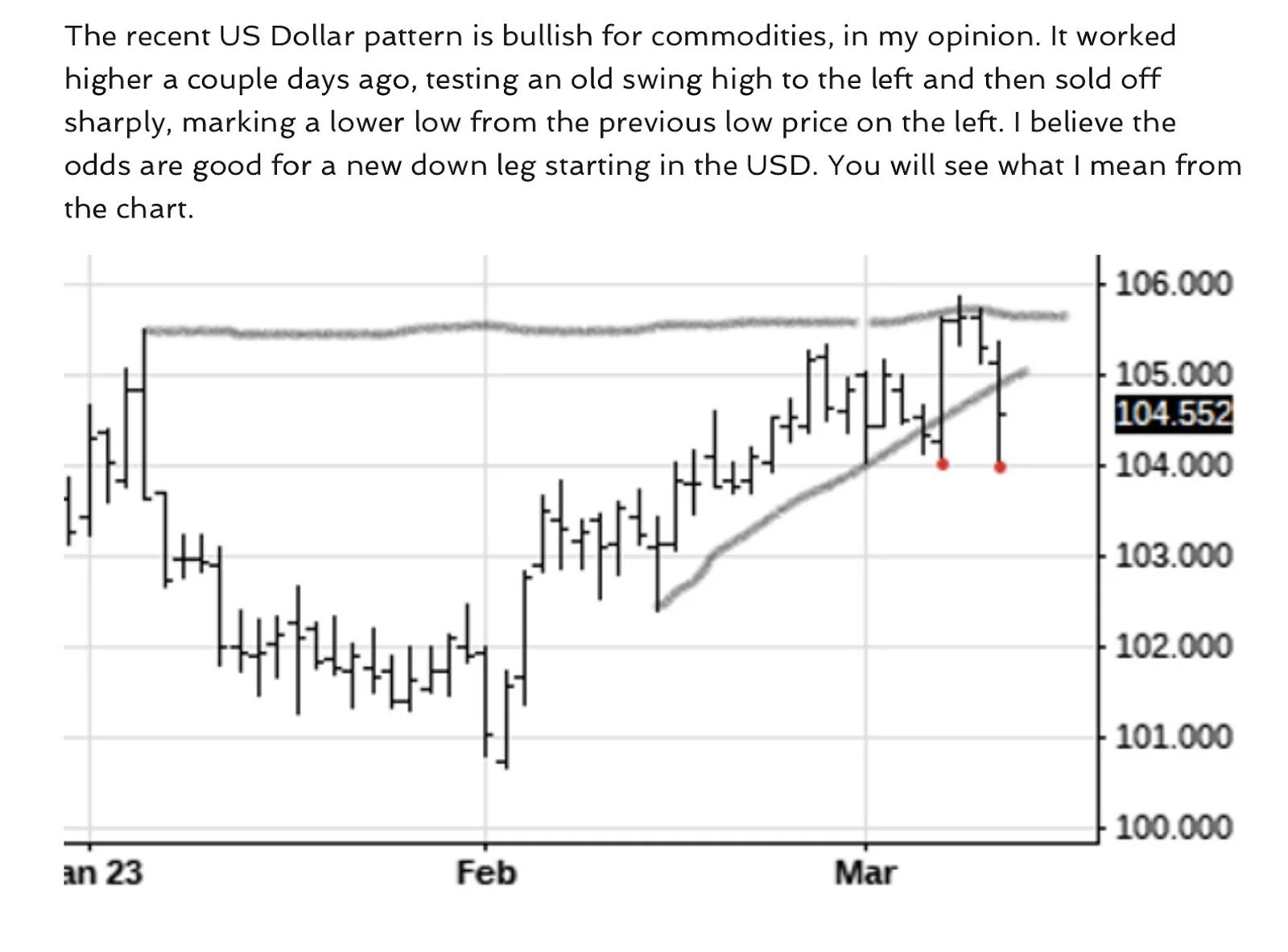

As for will the FED pause or actually cut rates? Larry McDonald was on CNBC on Friday saying he expects 100 basis points of easing by December. Now if that’s how this shakes out, I think you have money running into the commodities faster than you can believe.

Basically this SVB failure could cause the FED to reconsider its moves and it opens the door to a headline that might cause money to want to own commodities. As an inflationary hedge. Will the FED inject liquidity?

The other thing that SVB means to those in Agribusiness will depend on how much money investors had in SVB and how much of that money they get back. I have seen a little rumbling of a couple Ag companies that banked with SVB, but I don’t have a good enough source to confirm it. I do know that their clients are mainly start up tech companies. Those venture capitalist funded companies, bottom line is just be careful.

Broken Record

We have been longer term bullish for some time. After we get beat up like we have the past several weeks it is time for us to take a self inventory. Or in this case an inventory of the factors that are helping determine grain prices.

The number one factor that is always going to be the toughest to outguess yet has the biggest impact is Big Money or fund money flow. Will there be a headline to cause them to want to own commodities or will there be a headline to cause them to sell commodities. It goes without saying that despite the Black Sea war we haven’t had a headline to get the funds to buy wheat. So does that mean we should puke out wheat now? I don’t think so because I see other headlines that are supportive and give a reason for the funds to at any moment have to do exactly what happened to SVB. That is to hit the exit door at once.

If the short funds all hit the exit door at once, we will go lock limit up. Similar to last year. Here are a few points that with any luck could end up being the start of a catalyst to push grains much higher.

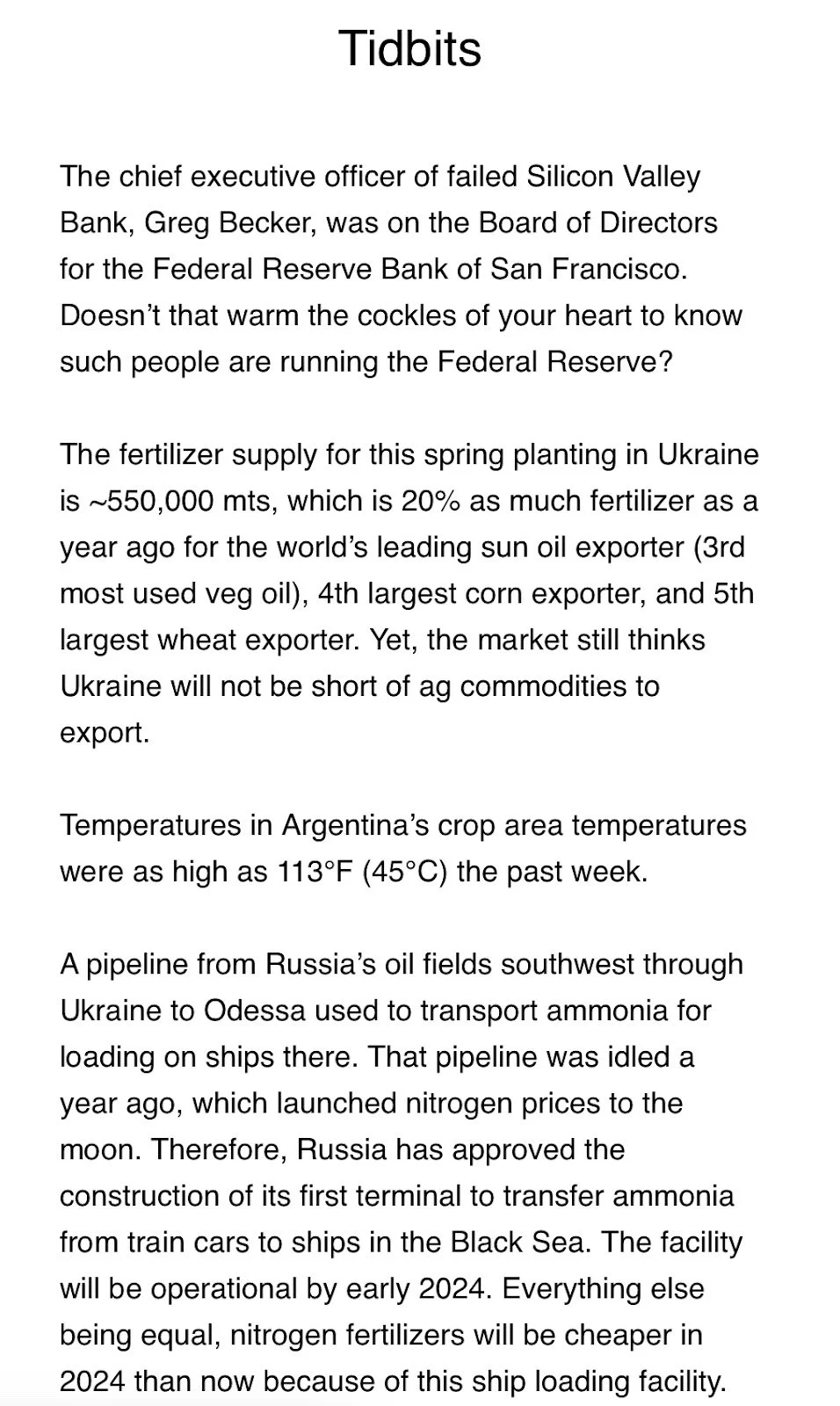

Ukraine will only have 20% of the fertilizer supply it did a year ago.

Grain Corridor

India record heat hitting crop

Drought in Africa, worst in 70 years

Argentina crop continues to get smaller and smaller, China canceling purchases from them

20% plus of Brazil safariha corn crop planted outside ideal window

SVB possible solution could be decreasing interest rates, which will add more interest into investments such as commodities

Spring wheat area has heavy snow pack, acres could be record low

Kansas wheat crop worst rated ever

Unknown weather and growing season ahead for US

The list goes on and on, and could include info such as margins for soybean crush plants and the planned expansion.

I think that the biggest factor is going to be how the FED handles the SVB, and maybe not so much how they handle it, as what the market thinks they might do. The most logical solution to prevent more banks from going under is going to be to slow down the interest rate hike, most likely lowering it in the future. That folks is such a big catalyst when added to bullish fundamentals that it really makes me feel comfortable, despite looking like a fool with what the markets have done.

Bottom line is let’s continue to be patient in making grain sales, the upside just became much higher than it was a week ago. Don’t be afraid of owning puts to establish a floor price to keep one comfortable. Look for volatility to pick up as we go into growing season and we have the stock market casino ready to go bust or hit a jackpot.

Here are some other Tidbits, from Wright on the Market and Farms.com Risk Managment

Here is a good read regarding SVB

Charts

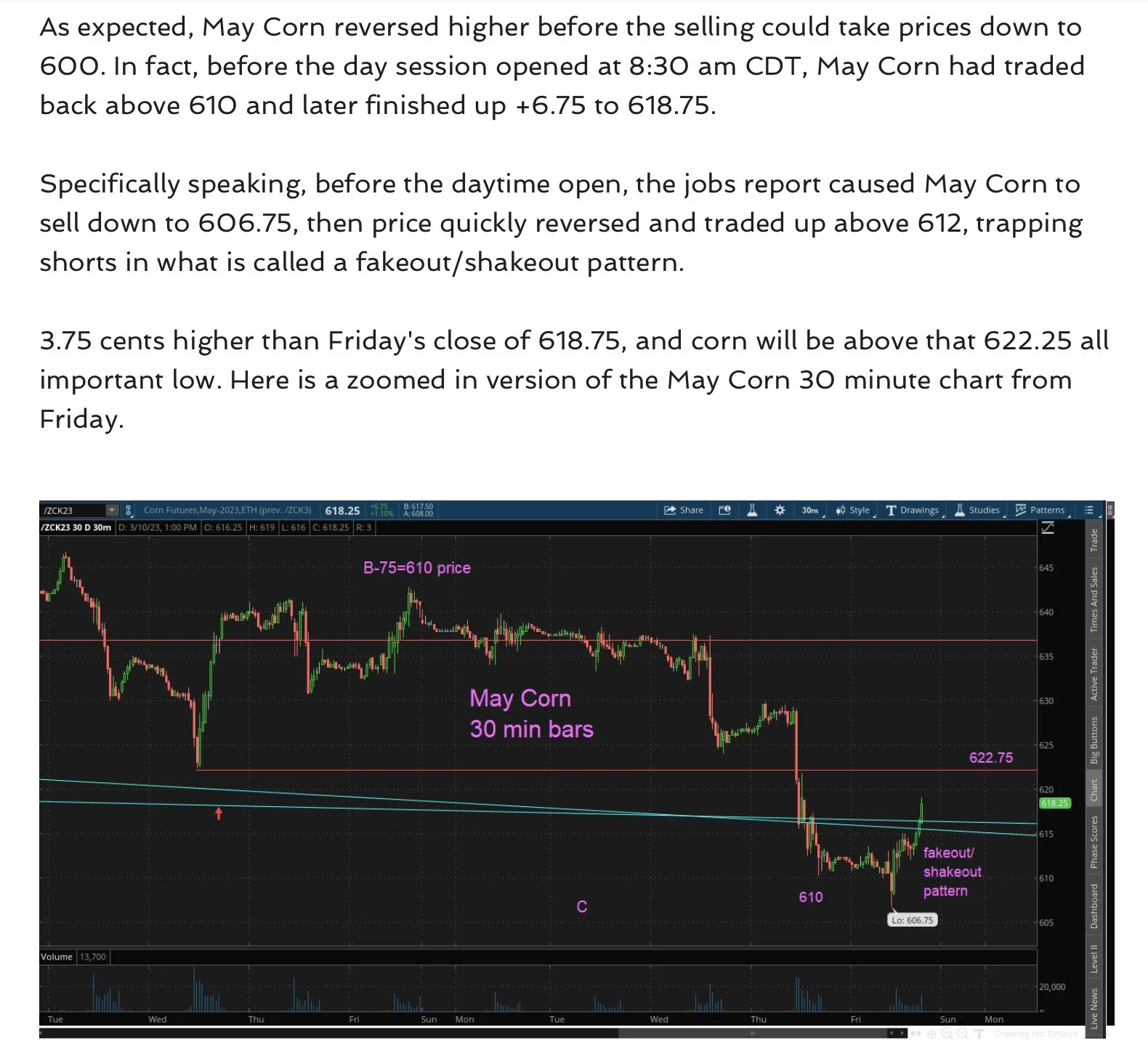

Corn 🌽

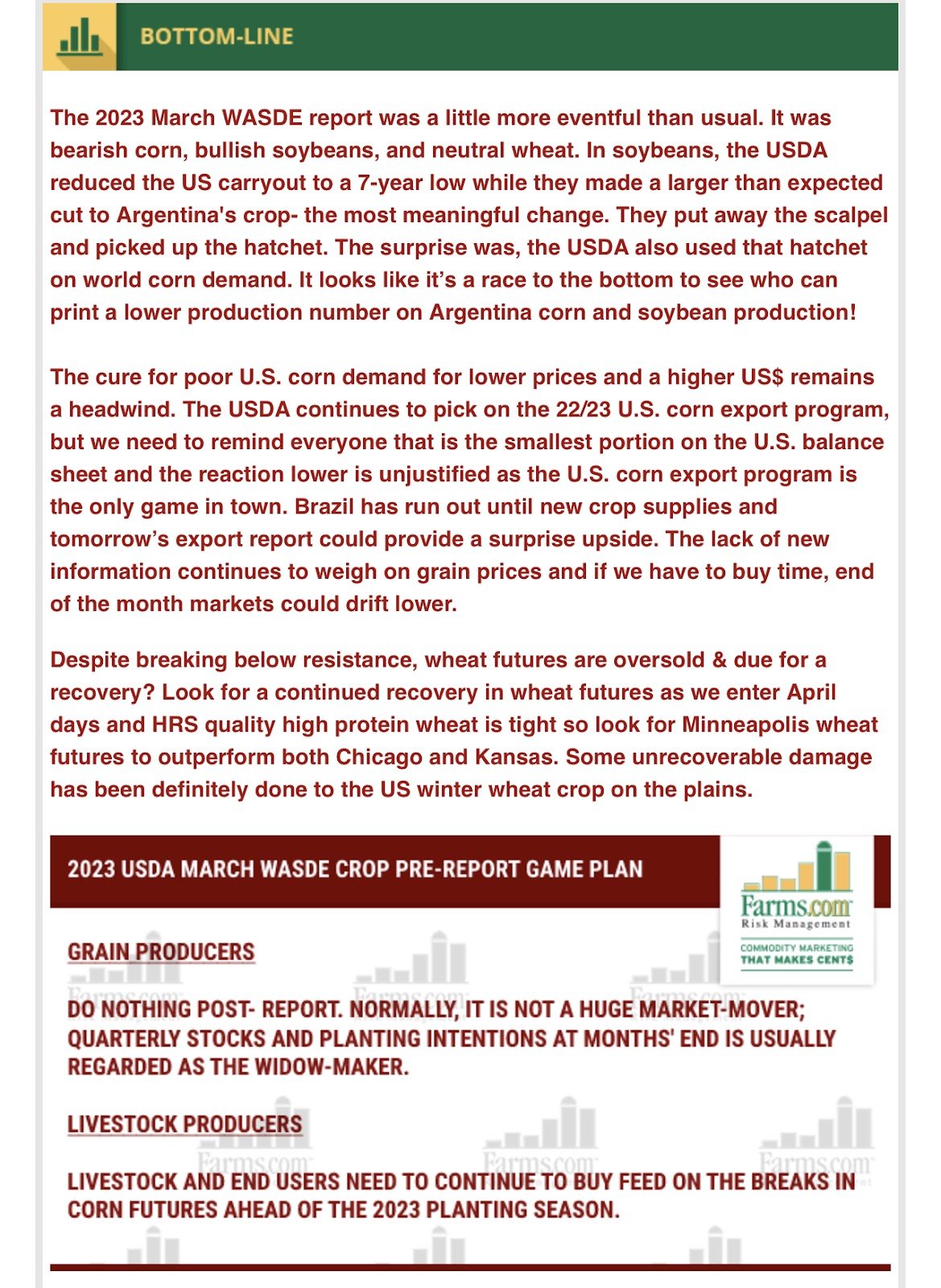

Taking a look at the charts, we are well below all major moving averages. We have some resistance into the $6.50 range with heavy resistance at $6.80. We have a pretty major phycological support level at $6. We definitely could fill the gap down to $6 or perhaps slightly below that but we still have a bullish outlook going forward. Now the rally we are expecting might not happen until the we get into April and after the March 31st report.

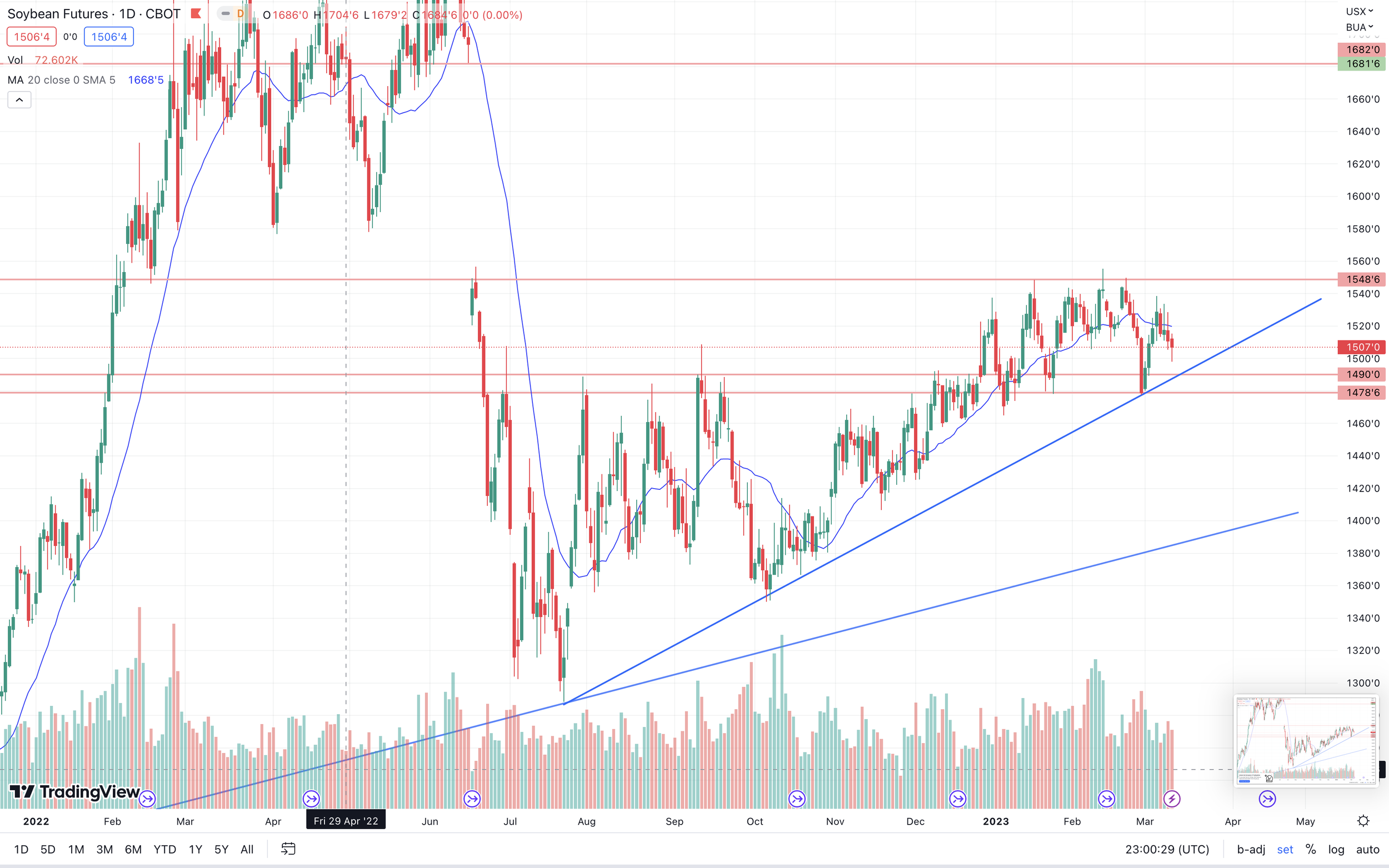

Beans 🌱

Fundamentals are still bullish. But I wouldn’t be too surprised to see funds look to sell some more here short term. Perhaps we look to test the trendline before going higher. We have some support at the $14.90 range if we were to continue lower here.

Meal 🐮

Meal still remains in a clear uptrend, currently sitting around its recent highs right below resistance.

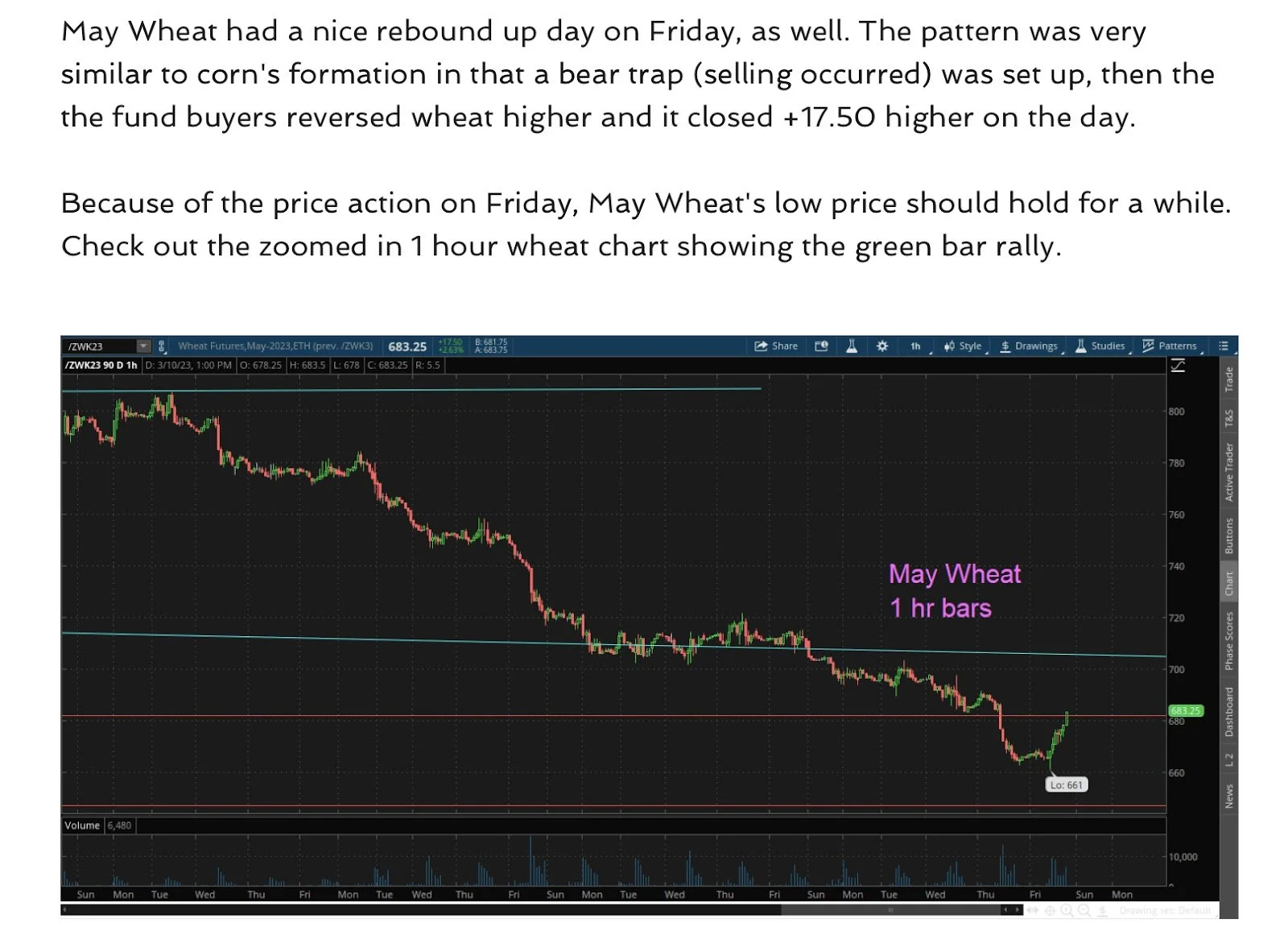

Chicago Wheat 🌾

Charts look awful, but Friday finally provided us with some support. I think we are definitely undervalued here. With funds being as short as they are, I think when wheat does decide to flip, we could see us going higher in a hurry.

Crude Oil 🛢

For a few days it looked like crude may have broken its 9-month long downtrend. But it worked its way back down once again. Is the downtrend over or is there more downside? Has stiff resistance at the $80 level.

Check Out Last Week's Updates

3/10/23 - Market Update

Wheat Finally Sees Strength

3/9/23 - Audio Commentary

Soybean Fundamentals Continue to Get Bullish

3/8/23 - Market Update / USDA Recap

Post USDA Report

3/6/23 - Market Update

Beans Continue Their Rally

3/5/23 - Weekly Grain Newsletter