GRAINS RALLY BEHIND BLACK SEA NEWS

MARKET UPDATE

By Sebastian Frost

Futures Prices Close

Overview

Grains all sharply higher following the news released over this weekend that Russia was suspending its UN-brokered grain export deal with Ukraine. This came as somewhat of a surprise to the markets as they decided to back out immediately rather than at the deal expiration date. This move broke the grains out of their recent choppy trade action. Russian Foreign Ministry said this suspension is "indefinite". There is a reported 170 ships carrying over 2 million tons of grain stuck in the Black Sea now. Despite this, there was some news reports saying Ukraine confirmed 12 ships had set sail.

Today's Main Takeaways

Corn

Corn futures piggy backing off the Black Sea news following wheat higher. We gapped up higher double digits and opened the morning at $6.96 1/2. Corn touched $7.00 before coming back down. We closed at $6.91 1/2.

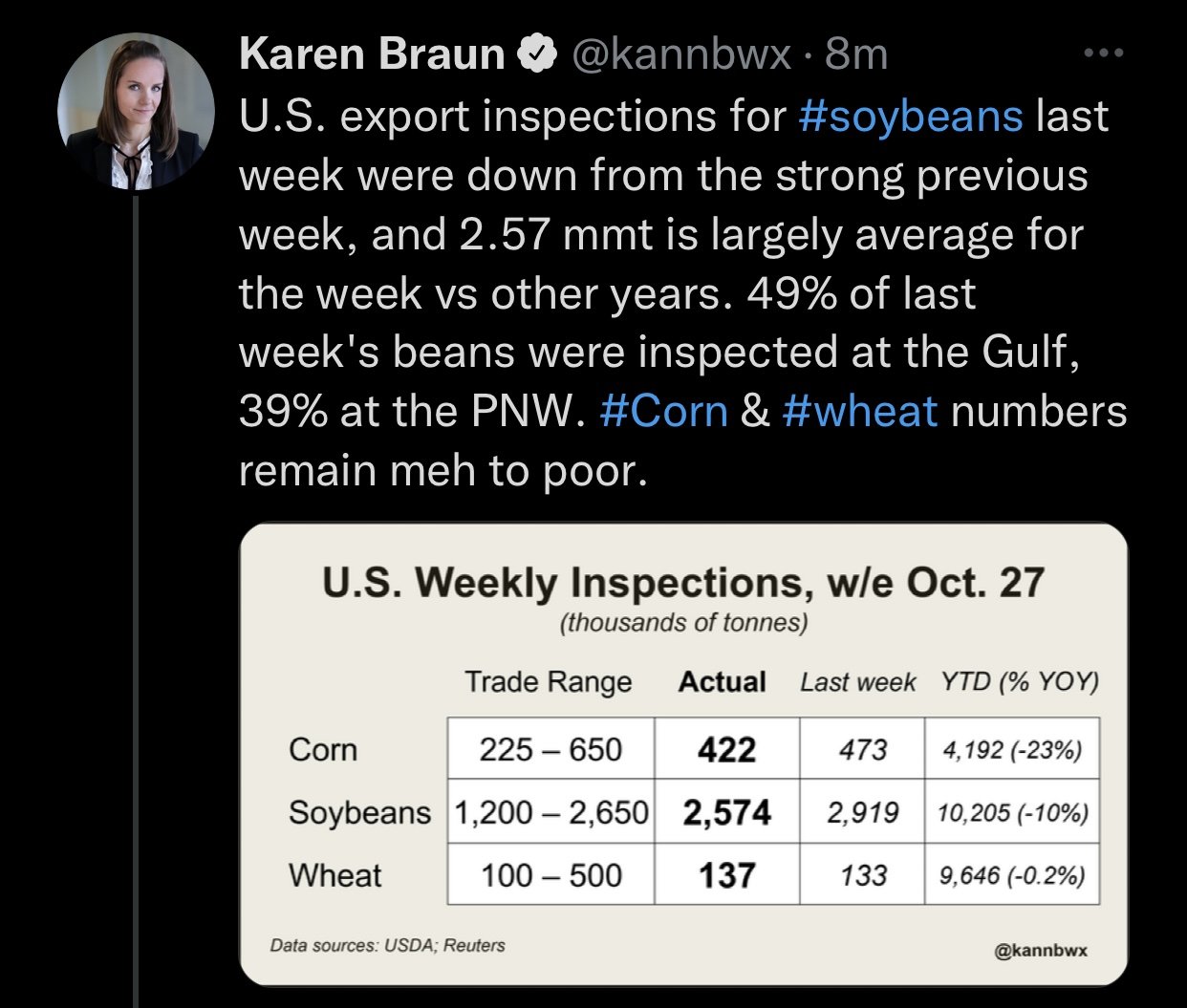

Outside of the Russia and Ukraine deal suspension there isn't a ton of other new currently in the markets. Everyone is anticipating the next USDA report, which is the Supply & Demand report scheduled for November 9th.

After the initial shock of the Black Sea news dies down, there is some other factors we will need to keep our eye on. Demand for starters has been fairly poor. As last week we saw awful exports. Globally we still have the possibility to start seeing less corn acres being planted due to how expensive everything is. Forcing growers to switch to less expensive crops which would impact global corn supply.

Addiionally, we of course have the U.S. economy and strength of the dollar which will continue to be a playing factor. To go along with U.S. exports and Chinese demand.

Lastly we have weather. In the U.S. its looking like harvest might be up as high as 75% complete, as last week we came in at 61%. Focus will also start to shift more towards South American weather rather than U.S. weather.

Dec-22 (6 Month)

Soybeans

Soybeans higher along with the rest of the grains today following the Russia & Ukraine news. It appeared that soybeans were effected the least among the grains, trading lower for the majority of the day before seeing a big rally to finish +19 1/4 cents higher. However, the real story might be with soy and veg oils. As some sunflower oil products are being reported as stuck in the vessels after the suspension of the deal.

Soybeans gapped up overnight along with corn and wheat. With Nov-22 seeing a high of $14.11 1/4, finally seeing prices over $14. We closed the afternoon at $14.07 (+19 1/4 cents) on the Nov-22 contract.

A headline we are watching is the China lockdown situation. There were reports of additional lockdowns over the weekend. Looks like China will continue to double down on their recent zero covid policy. We will have to watch for how this effects Chinas appetite for U.S. soybeans.

Unlike corn and wheat, the focus for soybeans lies elsewhere. As most are watching Brazil headlines as they are the worlds largest soybean exporter. Currently Brazil is going through a presidential election. Where Brazil's Bolsonaro loses bid for second term in a tight race to Lula. Lula vows to help Brazil drive economic growth. Some think this presidential election may actually turn out being bullish for soybeans. As he plans on turning around the destruction of the Amazon rainforest, which could potentially lead to less room for acres to be planted.

All eyes will be on the upcoming USDA Supply & Demand Report scheduled for Nov. 9th, which is next Wednesday. Will be keeping an eye on the adjustments we see made to endings stocks as some could make the argument we don't have room for anymore production cuts with the already tight numbers.

Soymeal & Soyoil

Soymeal down -2.6 to 422.8

Soyoil up +1.48 to 73.27

Soybeans Nov-22 (6 Month)

Wheat

Wheat is off its highs, but is sharply higher to start the week as expected. With wheat receiving the biggest reaction to the news which was also expected. Wheat gapped up roughly 50 cents after the Black Sea news. This rally making up for last weeks losses across the board in the wheat market.

Chicago wheat opened at $8.84 1/2 this morning, peaking at $8.93 1/4 before closing at $8.82 1/4 for a gain of an astonishing +53 cents on the day.

We touched on what happened with the Black Sea situation in our weekly newsletter yesterday. But essentially, it was announced Russia will suspend its participation in the UN grain deal with Ukraine. This came after the drone attacks on Sevastopol. The Russian foreign ministry said the country has suspended its participation for an "indefinite period of time". The announcement came as somewhat of a surprise given it was made immediately rather than at the deal experation date.

To add on to the Black Sea headlines, the drought in Argentina is looking like its going to lead to a reduction in wheat production estimates. We also have parts of the U.S. wheat growing regions still suffering from drought. As a recent report showed nearly 75% of the U.S. growing areas in a drought.

So obviously we all knew this headline would be all anyone would talk about in the wheat markets today, rightfully so. But outside of the headlines, weather in both the U.S. and South America will be the other dominating factor in determining the direction of wheat. We will have too see how long the Russia & Ukraine headlines can hold the markets higher.

Last week we sent out a wheat buy signal expecting headlines to send prices higher. If you want to re-listen to what we had to say last Monday and Wednesday you can do so below.

Last Monday’s audio - Wheat Buy Signal

Last Wednesday’s Audio - Is wheat set up for a rally?

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil down -1.79 to 86.13

Dow Jones down -100

Dollar Index up +0.864 to 111.470

Cotton down -0.11 to 72.00

News

The US Federal Reserve meets this week, expecting a interest rate raise of 0.75%.

Euro zone inflation hit a record high of 10.7% last month.

Ukrainian supply looks to be replaced. But the Mississippi River problems limit the U.S. export market.

Rumors of another potential railroad strike

Livestock

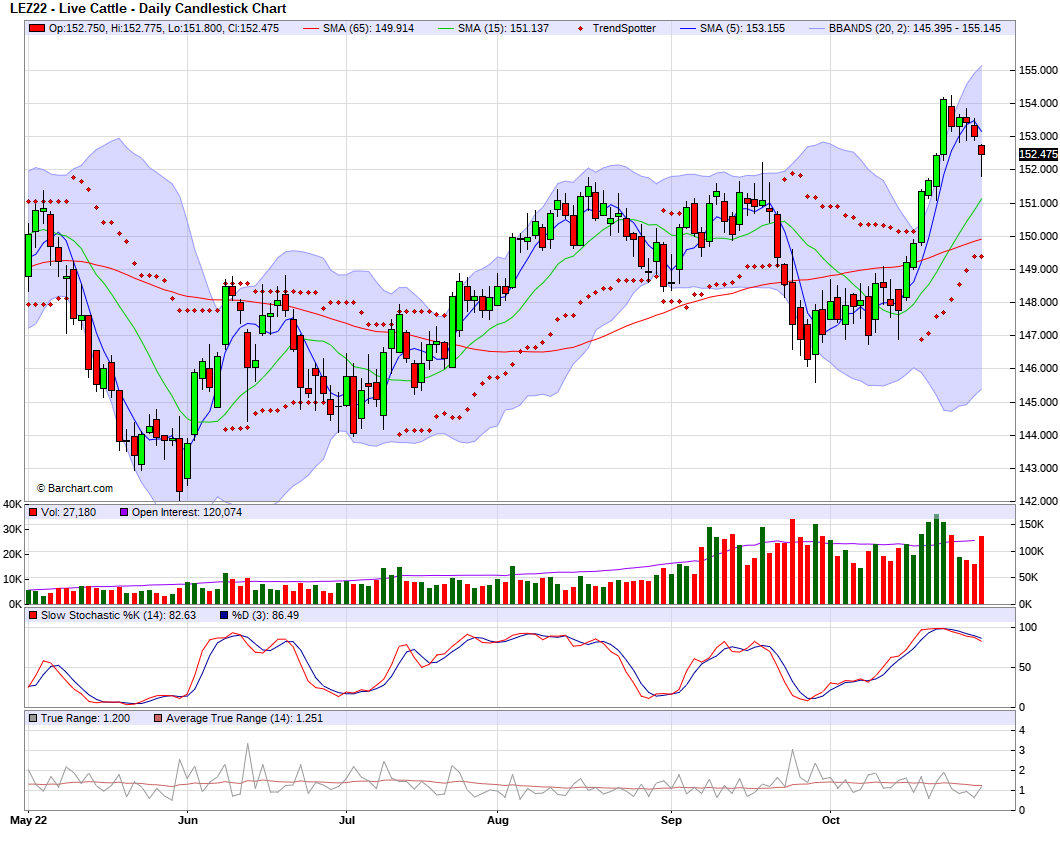

Live Cattle down -0.625 to 152.375

Feeder Cattle down -0.750 to 179.625

Live Cattle (6 Month)

Feeder Cattle (6 month)

Yesterday’s Weekly Newsletter

In case you missed it. Read yesterday’s weekly newsletter here

Social Media

All credit to respectful owners

Precipitation Forecast 2-Day

Weather

Source: National Weather Service