WHY THE BULL RUN IN BEANS ISN’T OVER

AUDIO & MARKET UPDATE

Crop conditions didn’t drop as much as expected

These numbers are often delayed. So watch out for next week.

Exactly why beans bull run isn’t over

What is the market not expecting in yield?

Time for courage calls?

The market is not pricing in the upside risk

Hedging, not chasing. What to do in each market

Make sure you scroll to read today's market update*

Listen to today's audio below

WANT TO KEEP LISTENING? TRY FREE TRIAL

You only got to listen to half of today’s audio. Keep listening and get every one of our daily updates sent via text & email, or get 50% monthly or yearly HERE

Become a Price Maker. Not a Price Taker.

MARKET UPDATE

Futures Prices Close

Overview

Grains lower across the board, as corn and beans see pressure from yesterday's crop conditions dropping but coming in quiet a bit better than most expected. As soybeans only dropped 1% and corn dropped 2%. The majority expected at least a 4% to 5% drop.

Wheat continues to fall, making new lows for the year. Seeing some pressure from news that Russian wheat is in a downtrend after 12 weeks of gains. Demand for wheat is declining, and exporters are also purchasing less figuring they will have plenty to go around and sell for the time being. This weakness in the Russian market is spilling over into the US market.

Overall, it wasn’t a great close on the charts, as we saw a big drop across the board in the last 15 minutes of trade. As corn fails to close above $5, failing for the 8th time this month. As corn has an outside down day, taking out yesterday's high but closing below yesterday's low. This is often a negative technical indicator and opens the door to lower prices.

Soybeans also fail to stay above that $14 level, but didn’t fill that gap to the downside so that was a positive.

Today’s weakness wasn't a surprise in corn and beans, as yesterday I mentioned the crop conditions report would likely cause some selling today. But I can imagine the next few weeks will paint a different story when it comes to crop conditions.

I have heard some individuals say that this weather isn’t going to affect our corn crop. Here is what some people on Twitter had to say, I agree, this weather certainly still cause some problems.

From Tim Gregerson,

"65-75% of the bushels of corn in the US are at a stage where they could lose 10-20% yield from dropped ears. Realistically if you have a field drop 50% ears prematurely you could lose 8-10% of yield. Nebraska & Iowa are dropping ears since last Wednesday."

From 247 AG,

"Corn yield is worse than most have anticipated in those areas running short on moisture. Many more surprises ahead." Which brings me to another argument regarding how dry or not dry this year has been and what the soil moisture situation looks like.

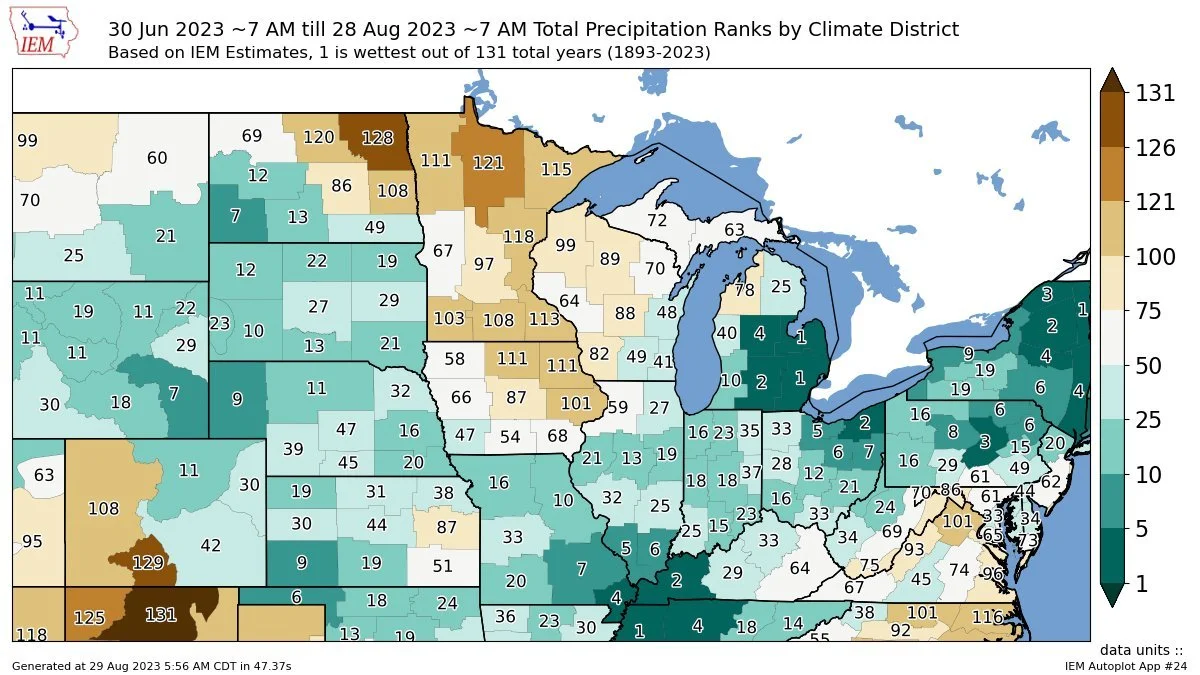

Here is how the month of August ranks precipitation wise out of the past 131 years. Some great moisture in parts of the corn belt, with the exception of north east Iowa, and Minnesota amongst a few others.

However.. this doesn’t tell the whole story.

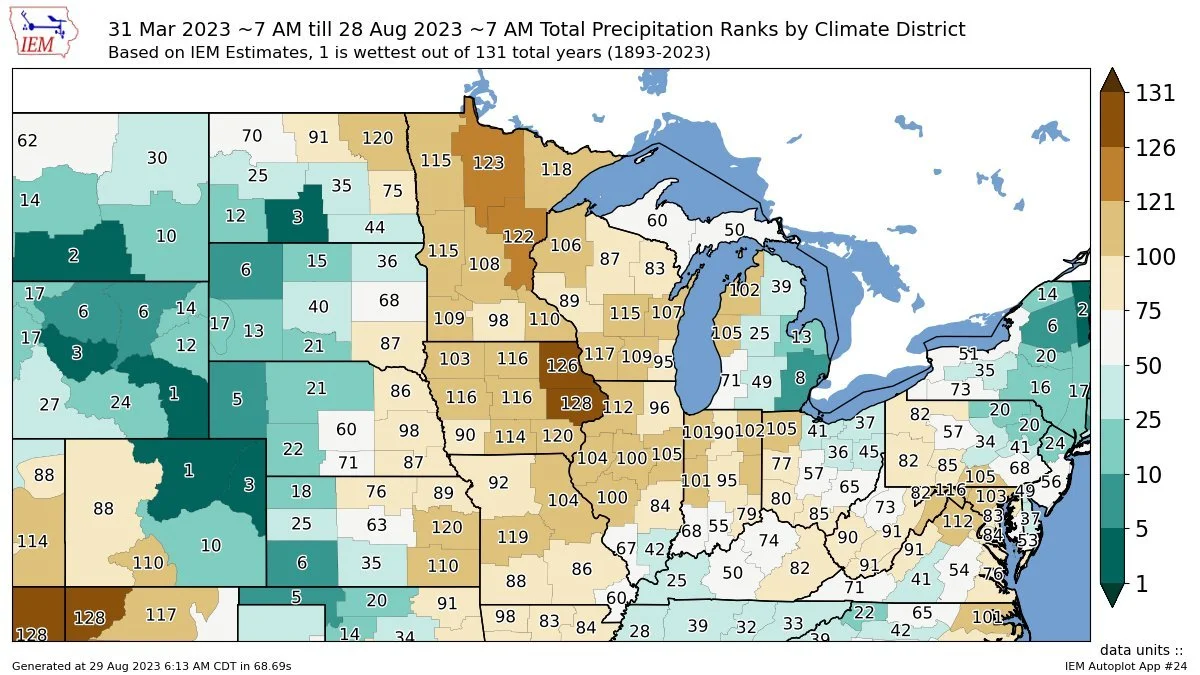

Let's figure around April 1st as the start of growing season.

Here is how March 31st until today shapes up to the past 131 year's in terms of precipitation. Still one of the driest growing seasons in history. Add on to this that it's been dry since 2020.

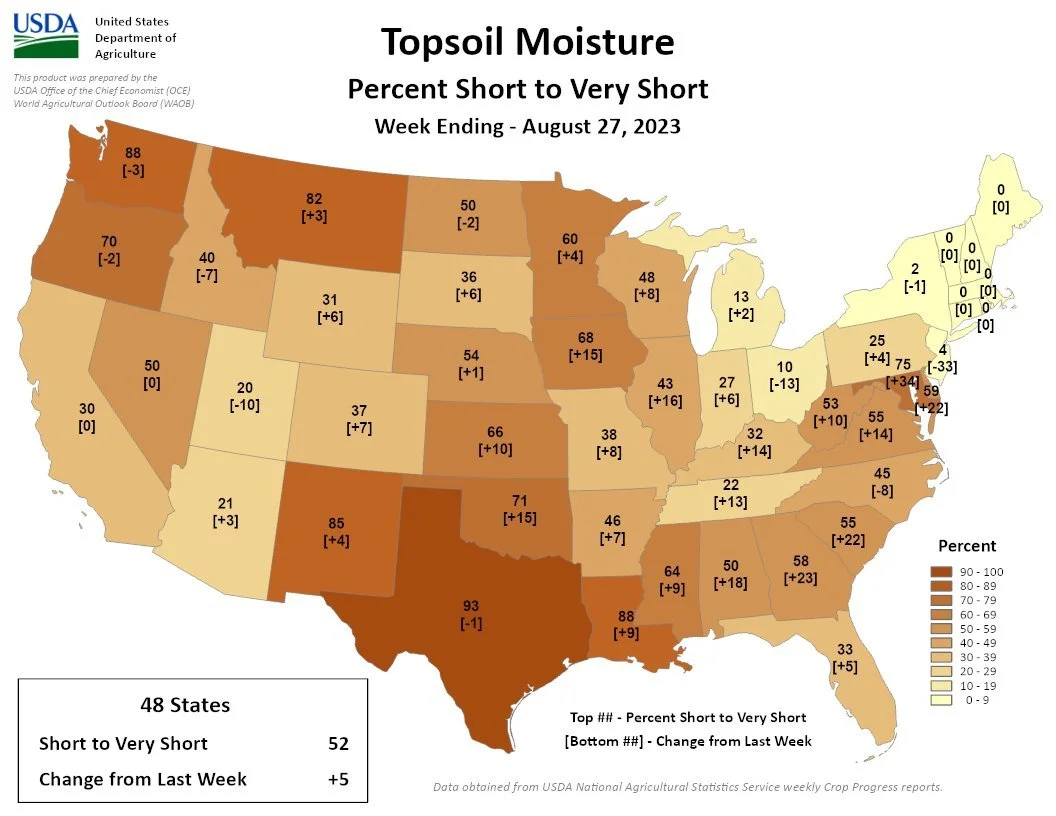

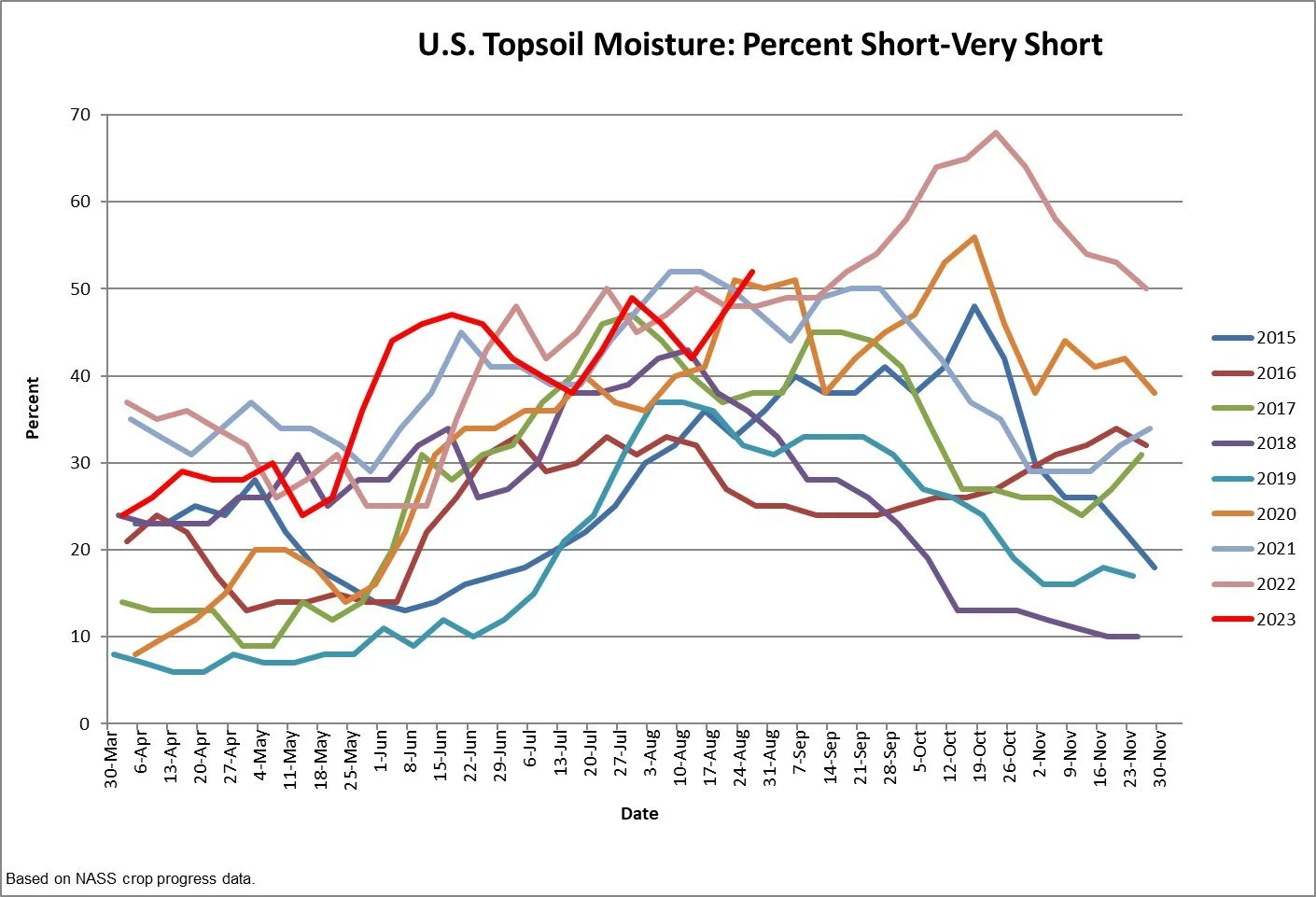

Now here is the results of such a dry growing season. This is how our topsoil moisture situation looks like.

52% of the US is very short to short topsoil currently. A 5% increase from last week. This is the highest number for the end of August since the USDA began tracking this data back in 2015.

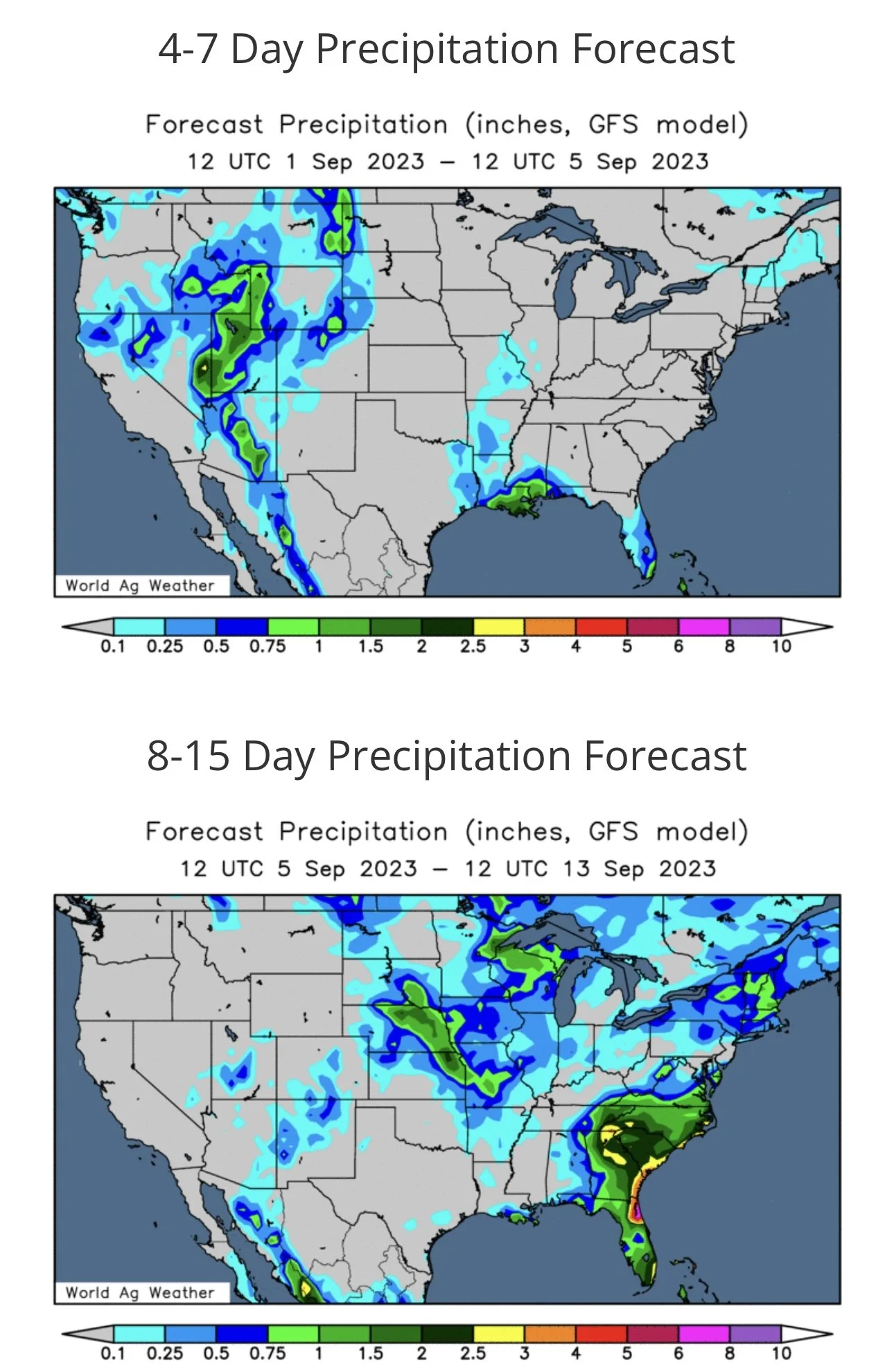

The forecasts are still bullish.

The rest of this week is relatively cooler. But that heat we just had is making a quick come back this weekend and into next week.

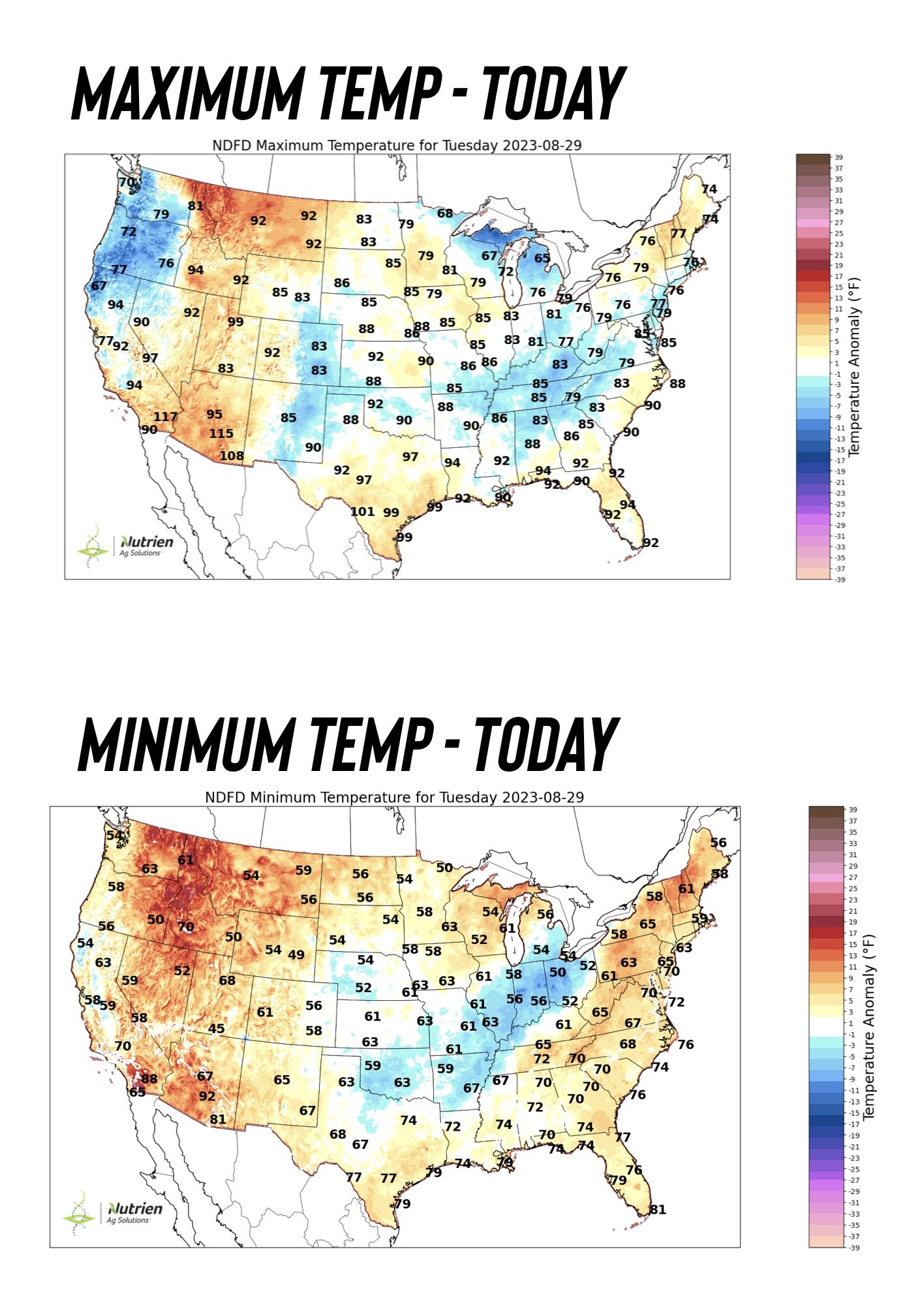

Here is the minimum and maximum temps compared from today to next Monday.

Still practically zero moisture for the next week.

Couple that with the heat, and we could definitely see these crops take more damage than some realize.

Overall, today's lower price action was no surprise. Could there be more downside? Of course. But I think the forecasts will continue to provide support in pushing us higher as we head into September, as the weather outlook is still bullish throughout at least mid-September.

I also am fully expecting to see crop conditions take a bigger hit over the course of the next few weeks rather than what we saw yesterday, which should ultimately provide support and help the trade realize these crops aren’t made and that this weather could indeed cause damage.

I included an oats chart yesterday, but oats were up another 2% today, as they continue to trade at their highest levels all year long.

An indication of higher prices for the grains?

Today's Main Takeaways

Corn

Corn loses nearly a dime in today’s lower price action. On the charts, today was not a great look for corn.

We had an outside down day. Meaning we took out yesterday's highs, but then closed below yesterday's lows. This was the 4th outside down day this month. Often times this is an indication of lower prices. So we will have to wait and see if bulls can hold or if we do indeed see some further downside.

This was the 8th time this month that corn has tried to close over $5 and failed, as today we had a high of $4.99 1/2, and we still haven't got a close above $5 since August 2nd. More on the charts a little later. First let's go over yesterday's crop conditions.

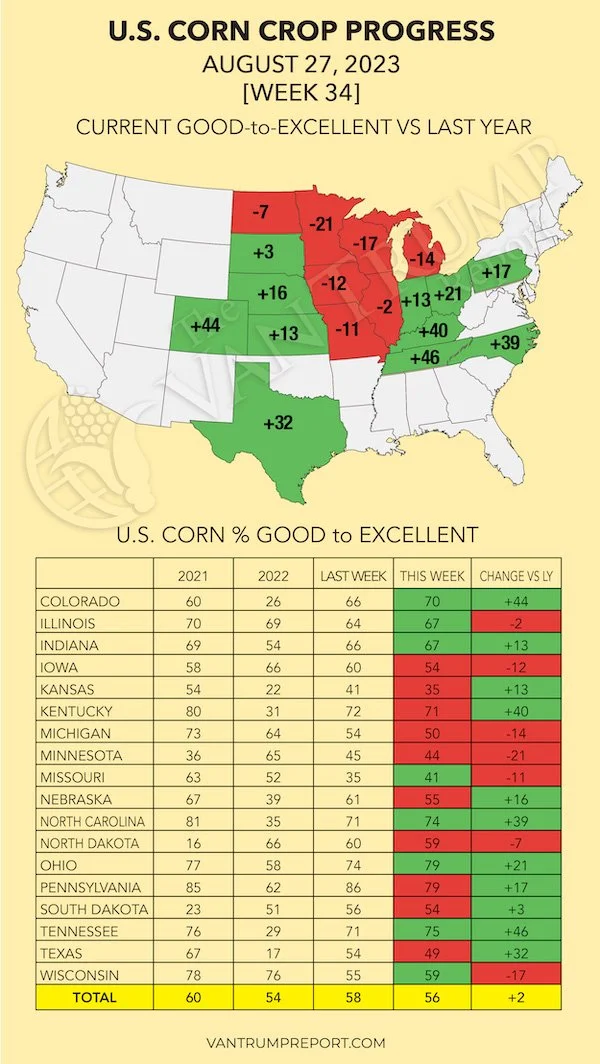

Corn's conditions report wasn’t quiet as big of a disappointment as beans were. Corn conditions fell 2% while the trade was expecting a 3% drop.

We saw Nebraska, Iowa, and Kansas all fall 6% this week. Missouri actually improved by 6%, but this improvement only brings them to a sub par 41% rated G/E.

Here are the top 5 producing states and changes they saw:

Iowa: 54% (-6%)

Illinois: 67% (+3%)

Nebraska: 55% (-6%)

Minnesota: 44% (-1%)

Indiana: 67% (+1%)

Here is the conditions compared to last year from the Van Trump Report.

One thing that's not priced in? What’s not priced in is………

The rest of this post is subscriber content only. Subscribe to continue reading and get every exclusive update sent via text & email. In the rest of this update we go over the corn market, why the bean bull run isn’t over, and much more.

Want to Keep Reading? Try Free Trial

Try all of our daily exclusive updates completely free for 30 days. Scroll to check out past updates you would’ve received.

Become a Price Maker. Not a Price Taker.

Check Out Past Updates

8/28/23 - Market Update

WEATHER REMAINS BULLISH BUT CROP CONDITIONS DISAPPOINT

Read More

8/27/23 - Weekly Grain Newsletter

ECON 101 APPLIED TO GRAIN SALES

Read More

8/25/23 - Market Update

BEANS CONTINUE BULL RUN

Read More

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio

DON’T PANIC. TODAY REINFORCED HIGHER PRICE OUTLOOK

8/21/23 - Audio & Market Update

MARKETS PLAYING LEAP FROG

8/20/23 - Weekly Grain Newsletter

WHY THIS IS MORE THAN A DEAD CAT BOUNCE..

Read More

8/18/23 - Market Update

GRAINS BOUNCE. WEATHER REMAINS BULLISH

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio

CAN DEMAND & WEATHER LEAD TO A BOUNCE?

8/15/23 - Audio

GRAINS LOWER WITH IMPROVEMENT TO CROPS

8/14/23 - Audio

BEANS RALLY BUT CONDITIONS IMPROVE & WHEAT DISAPPOINTS

8/13/23 - Weekly Grain Newsletter

WHAT’S NEXT FOLLOWING DISAPPOINTING USDA REPORT?

8/11/23 - Audio & Report Recap

USDA REPORT BREAKDOWN

Read More

8/10/23 - Audio