WEATHER REMAINS BULLISH BUT CROP CONDITIONS DISAPPOINT

MARKET UPDATE

Futures Prices Close

Overview

Soybeans continue their rally, back over $14 after trading below $12.85 less than 3 weeks ago. Corn follows beans higher, up nearly 9 cents as both gap open higher. While the wheat market continues to disappoint, trading lower across the board as we look to test our recent lows.

The trades main focus has been on the weather, which we will get to in a moment.

We saw a few sales of both corn and beans this morning which was supportive. Today marked the 6th straight Monday in a row that we saw a sale of beans.

Crop conditions came out after and close. They were highly disappointing for the bulls. As soybean rating dropped ONLY 1% from last week to 58% rated good to excellent, while corn dropped 2% from last week to 56%. Both of these were 1% to 2% better than the trade was expecting.

Everyone, even the bears of the industry were expecting a larger decline, especially to the bean crop.

Will be interesting to see how the trade reacts and if they discount the damage from the last week or trade the dry & hot forecasts.

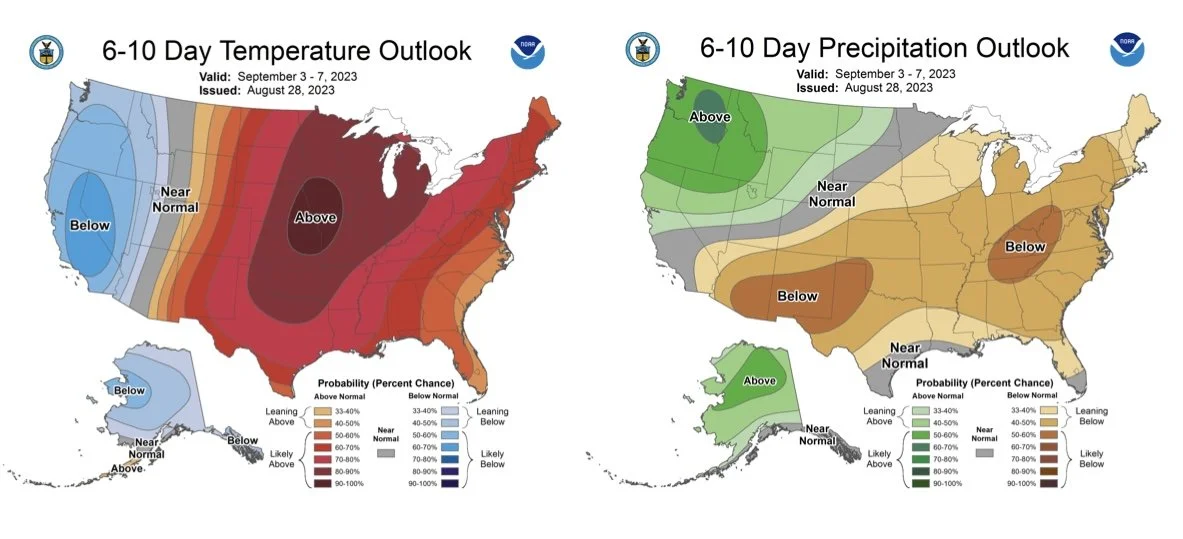

The weather is slightly cooler to start this week, but heats right back up this weekend into next week. As majority of the corn belt is expecting anywhere from 8 to 11 days a row in the 90's, with many areas especially in the western belt seeing temps above 100.

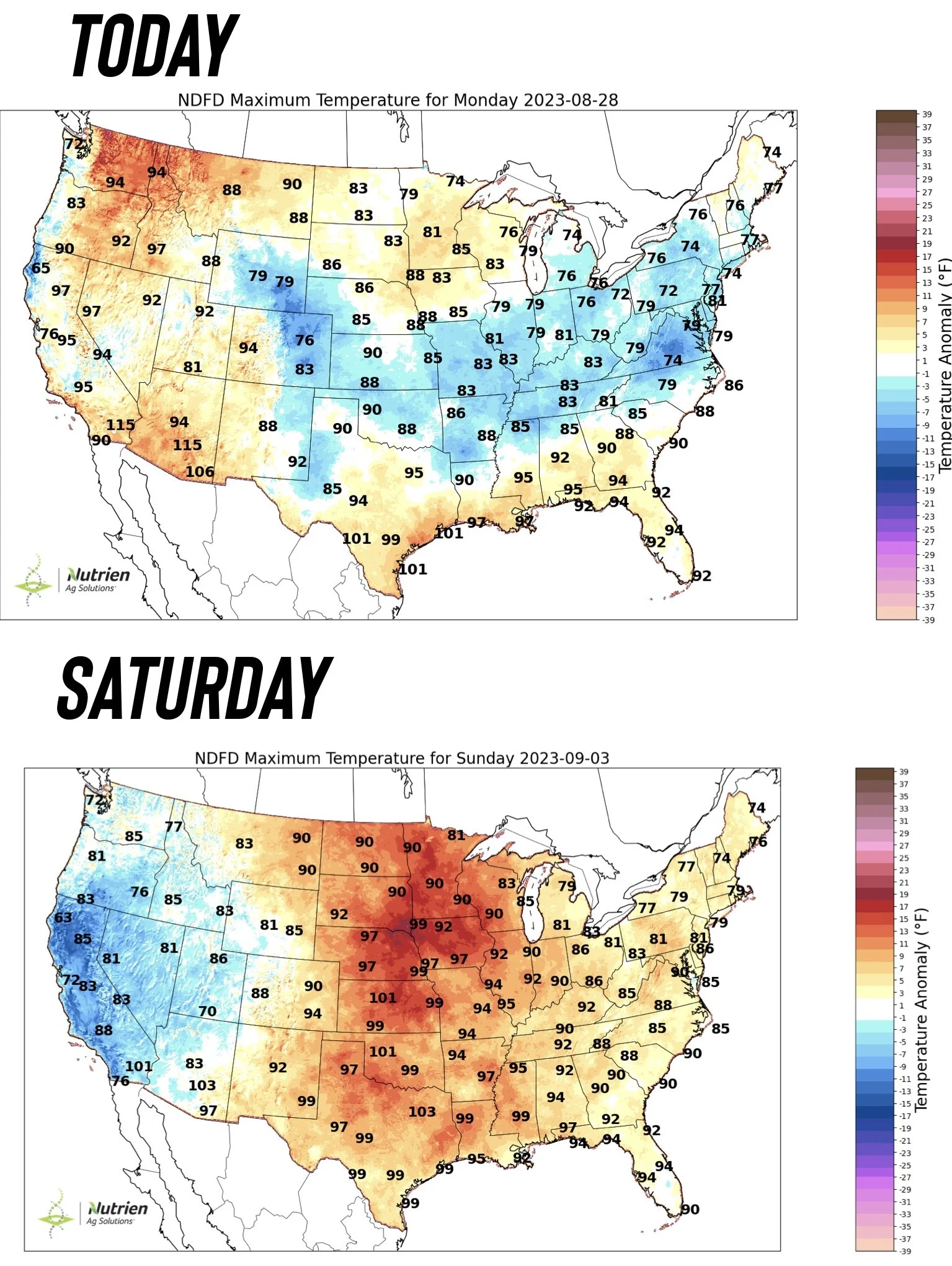

Here is the maximum temps from today and next Saturday.

Here is the 6 to 10 and the 8 to 14 day outlooks.

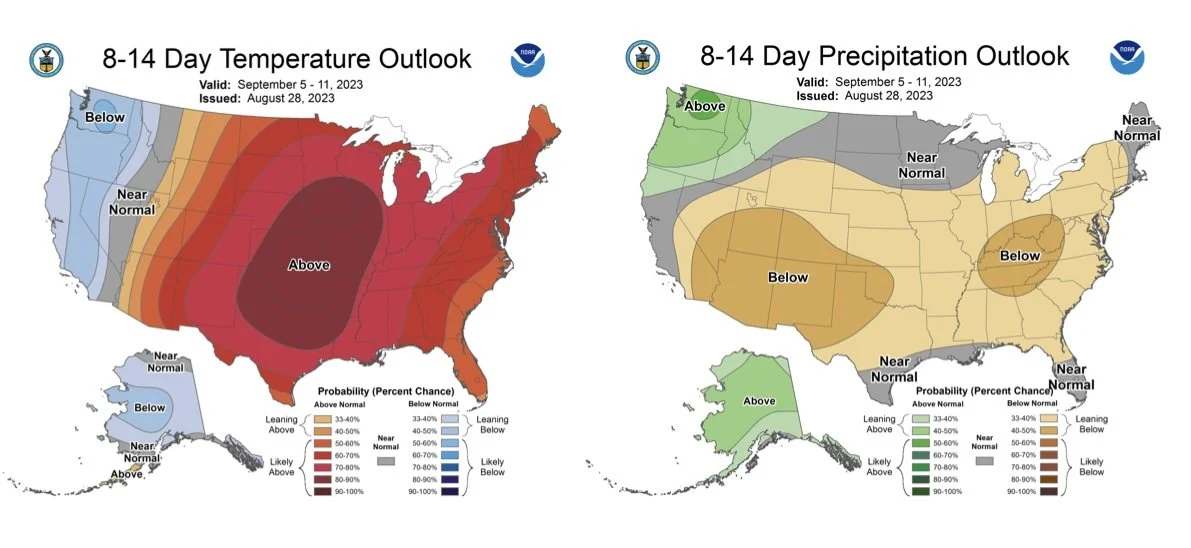

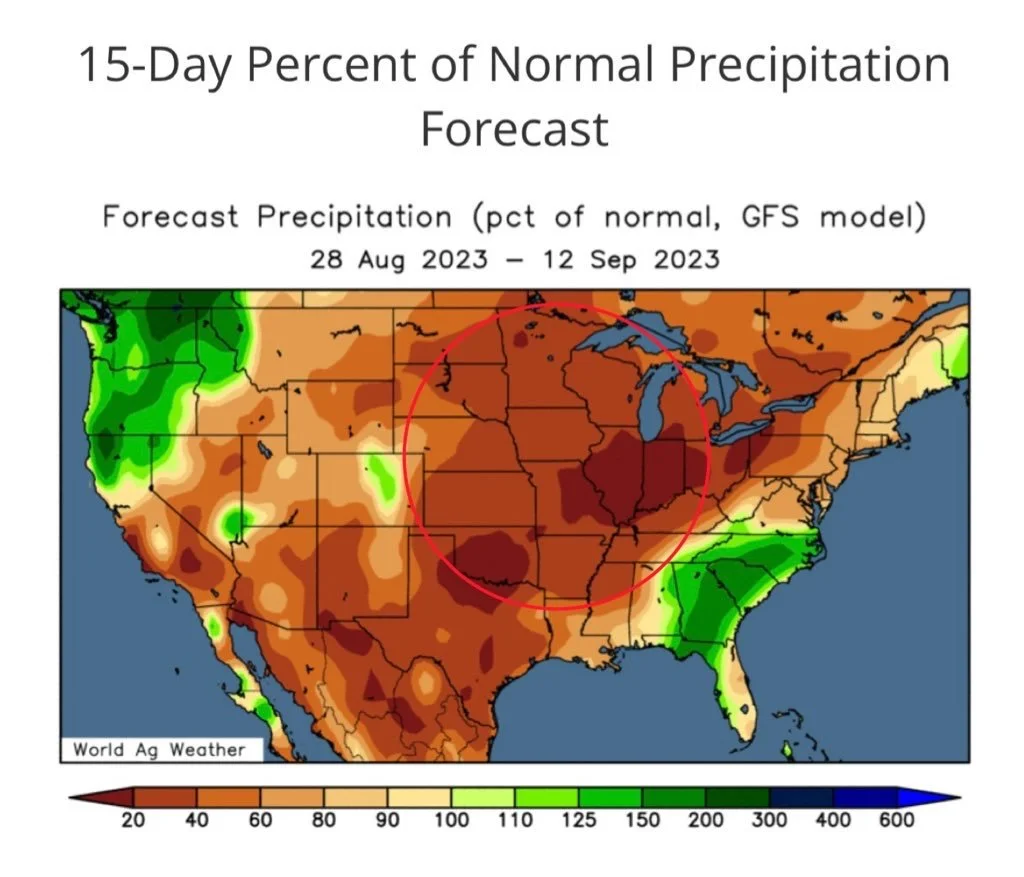

Not only does the heat continue, but look at the lack of moisture.

Zero rain forecasted for the corn belt over the course of the next week.

Not a good look for the bean crops. As mentioned last week, at this point in the maturation cycle, moisture is so crucial. If we don’t get moisture, it could very well result in some pretty heavy losses to yield.

If the forecasts stay true, I can only imagine we are in for some much larger declines to crop conditions the next few weeks than we saw today.

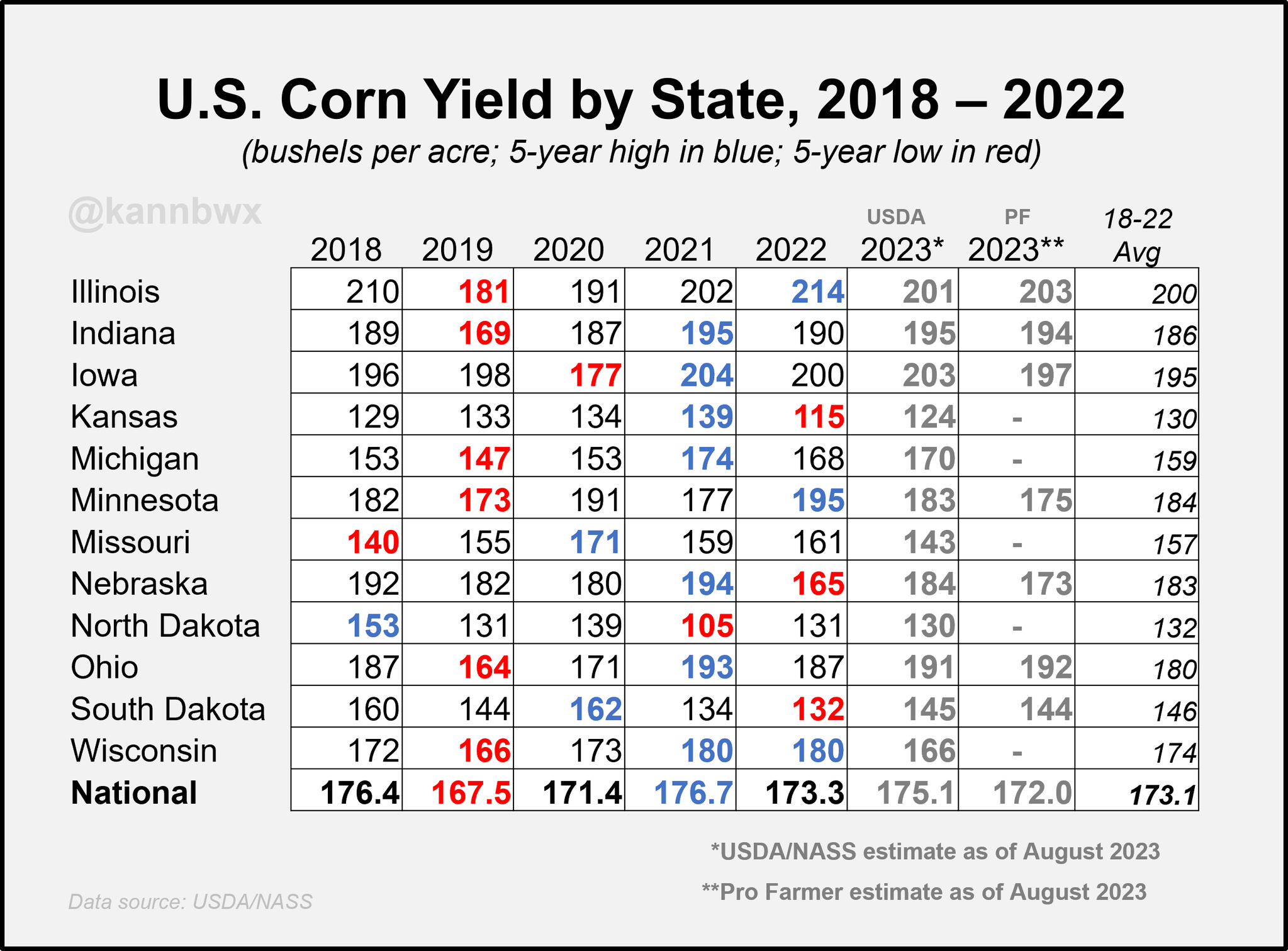

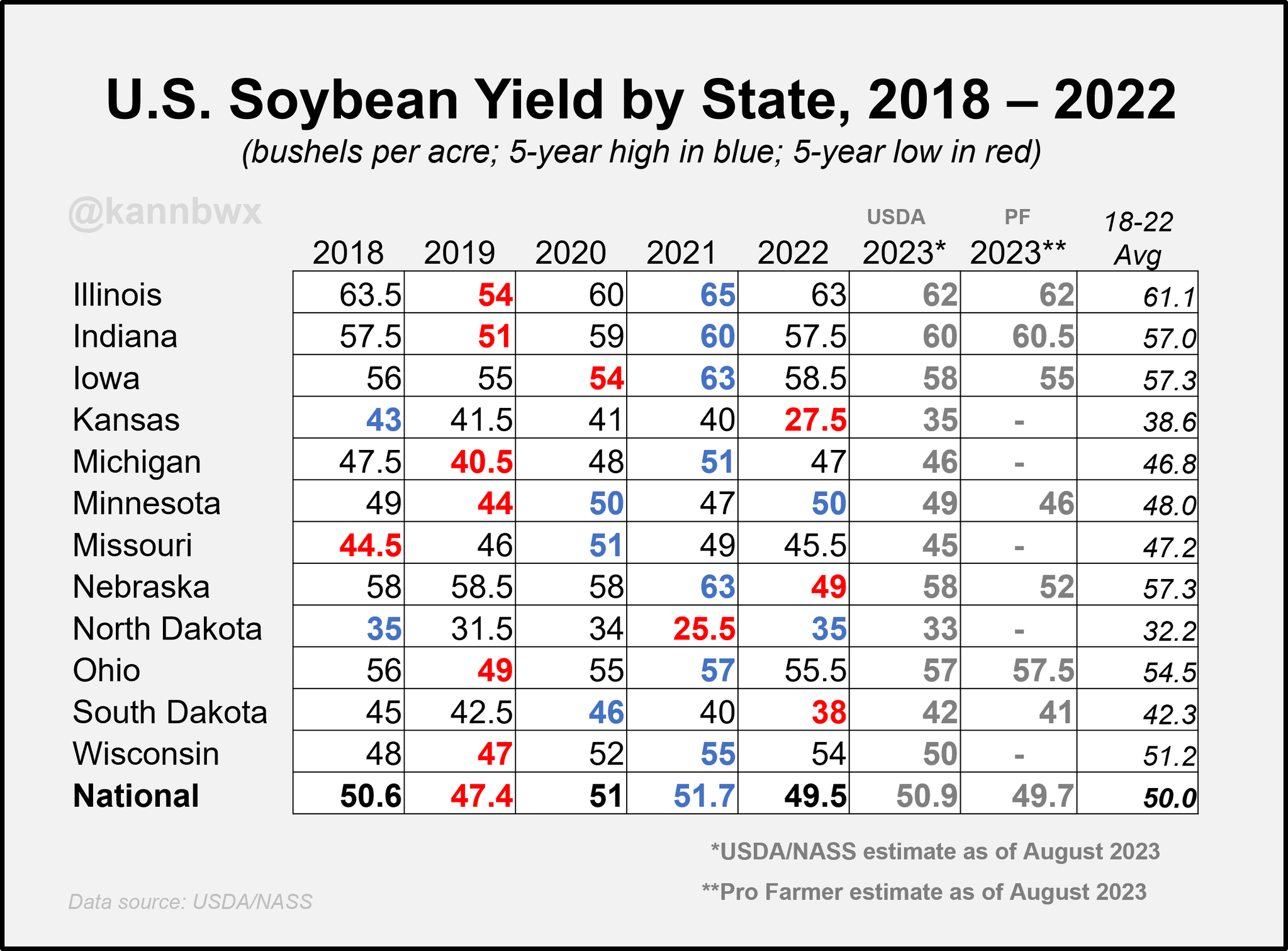

Here is the Pro Farmer vs USDA yield estimates from Friday in case you missed them. Both charts are from Karen Braun.

Pro Farmer sees big downside in Minnesota and Nebraska corn, and a sub-200 bpa crop in Iowa. However, Pro Farmer saw some small upside in Illinois.

Pro Farmer has their bean numbers similar to last year's. However, they have Nebraska, Iowa, and Minnesota far below the USDA's number.

Oats were up another 1% today. Now up nearly 9% the past 5 trading days alone. Historically, the oat market is often an indicator for grain prices prices.

So the question remains, do oats know?

Looking forward this week, I wouldn’t be surprised to see the disappointing crop conditions pressure corn and beans tomorrow. But after the trade soaks it in, I think they again begin to look at the bullish weather headlines we have coming next week.

For you sunflower guys, here was some news over the weekend.

Today's Main Takeaways

Corn

Corn follows beans higher, as we again near the $9 mark, closing today at $4.98. As we haven't had a close above $5 since August 2nd.

Crop conditions came in 2% lower than last week, coming in at 56%, which was less than expected. However, Iowa on the other hand looks to be declining extremely fast, falling 6% from last week. This also happens to be the bullseye of this upcoming heat wave and dryness. So something to definitely watch out for.

Pro Farmers final yield estimate came in at 172 bpa. With a range of 170.3 to 173.7 bpa. This number is well below the USDA's 177 bpa. Which had the bulls excited.

Bulls are also looking at the recent brutal heat possibly leading to further stress on the crops. But bears then point out that our planted acres could offset any reduction in yield. Even if we get a reduction to yield, they argue US ending stocks will still likely be large. As demand is still one of the biggest things keeping a lid on corn.

In yesterday's newsletter, we pointed out that the spread between US and China corn is over $5 a bushel. The largest it has been since the fall of 2021. The exact reason why we think China will be buying our corn very soon.

Corn production in the EU is expected to be 10% below their average.

Last year we made our lows on July 22nd. In 2021 we made them on September 10th. In 2020 it was August 4th.

Seasonally, we are nearing lows. Are this year's lows in?……..

The rest of this post is subscriber content only. Subscribe to continue reading and get every exclusive update sent via text & email.

Want to Keep Reading? Try Free Trial

Get every single exclusive update sent via text & email. Scroll to check out past updates you missed. Try a 30 day free trial or get 50% OFF yearly or monthly HERE

Scroll to check out updates you would’ve received.

Become a Price Maker. Not a Price Taker.

Updates You Might’ve Missed..

8/27/23 - Weekly Grain Newsletter

ECON 101 APPLIED TO GRAIN SALES

Read More

8/25/23 - Market Update

BEANS CONTINUE BULL RUN

Read More

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio

DON’T PANIC. TODAY REINFORCED HIGHER PRICE OUTLOOK

8/21/23 - Audio & Market Update

MARKETS PLAYING LEAP FROG

8/20/23 - Weekly Grain Newsletter

WHY THIS IS MORE THAN A DEAD CAT BOUNCE..

Read More

8/18/23 - Market Update

GRAINS BOUNCE. WEATHER REMAINS BULLISH

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio

CAN DEMAND & WEATHER LEAD TO A BOUNCE?

8/15/23 - Audio

GRAINS LOWER WITH IMPROVEMENT TO CROPS

8/14/23 - Audio

BEANS RALLY BUT CONDITIONS IMPROVE & WHEAT DISAPPOINTS

8/13/23 - Weekly Grain Newsletter

WHAT’S NEXT FOLLOWING DISAPPOINTING USDA REPORT?

8/11/23 - Audio & Report Recap

USDA REPORT BREAKDOWN

Read More

8/10/23 - Audio