MORNING MARKET UPDATE

Futures Prices 10:00am CT

Overview

Grains mostly higher following the slightly lower prices we saw yesterday afternoon. Some support coming from the outside market markets with the weakness in the dollar and strength in crude oil. Weekly export sales this morning were mixed, with soybeans being strong but corn and wheat coming in on the weak side.

Today's Main Takeaways

Corn

Corn is higher here this morning following the rest of the markets, despite the pretty poor export sales numbers, which came in right around the middle of the trade estimates.

Harvest begins to pressure both corn and soybeans, as we the U.S. harvest will be over half way complete, and it doesn't appear there will be many road blocks stopping the progress from moving along smoothly. Obviously the big question remains, where will we see the final yield come in at? Its looking like most think its going to be around the 170-172 bpa area. Anything below 170 would be considered pretty bullish. But there is still a chance the yield actually comes in higher, perhaps slightly above the 172 mark, which would put a lot of pressure on prices.

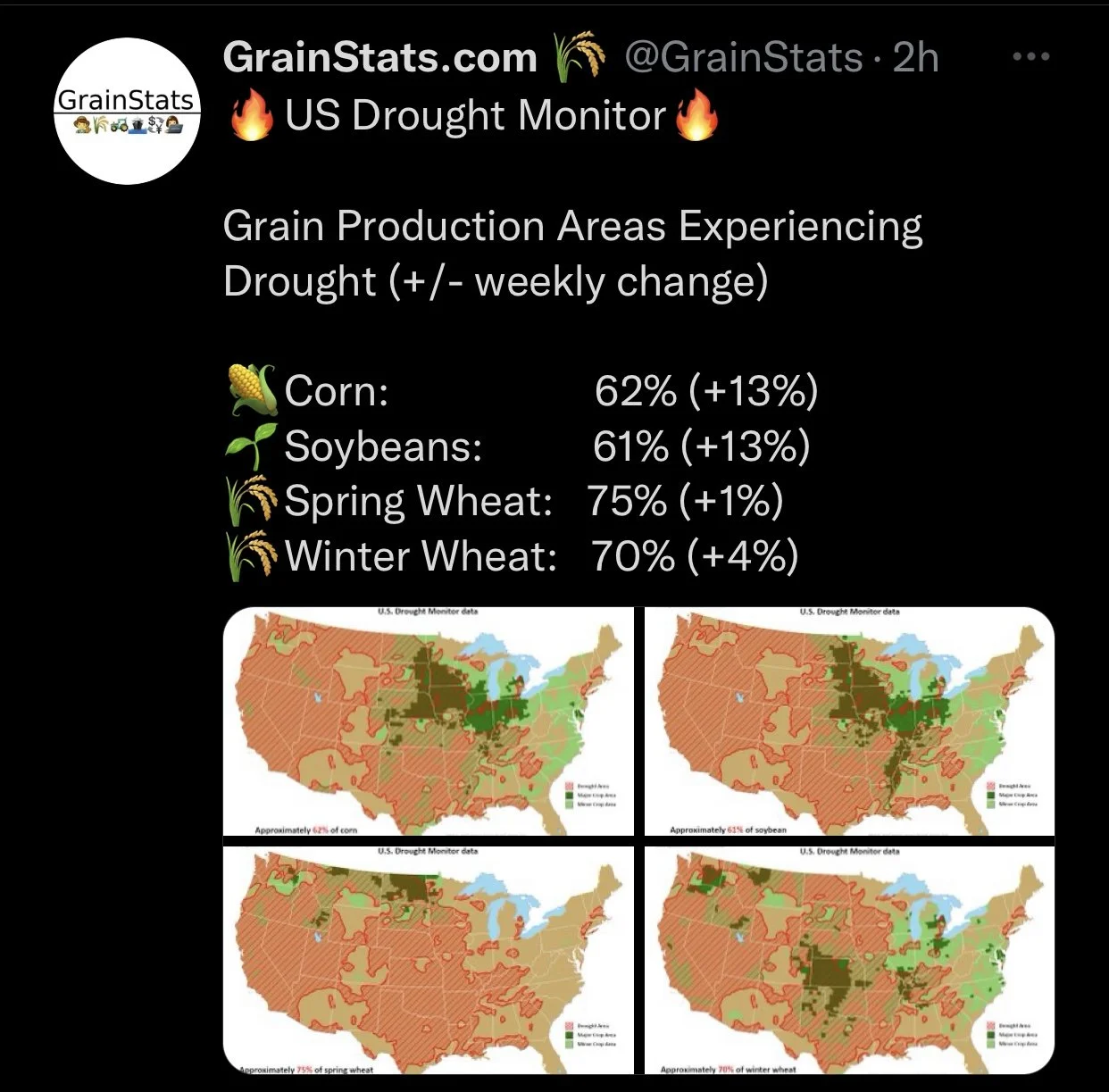

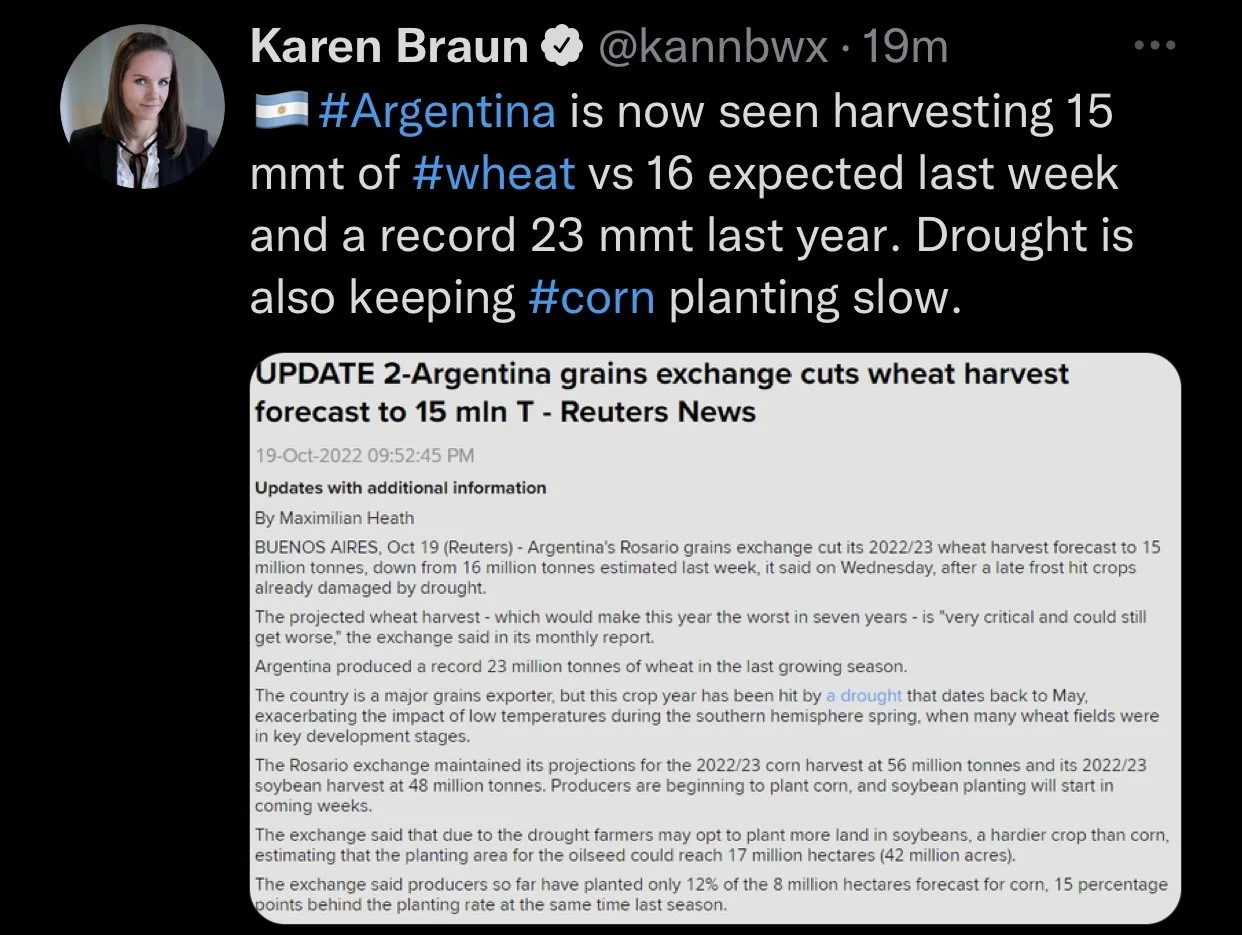

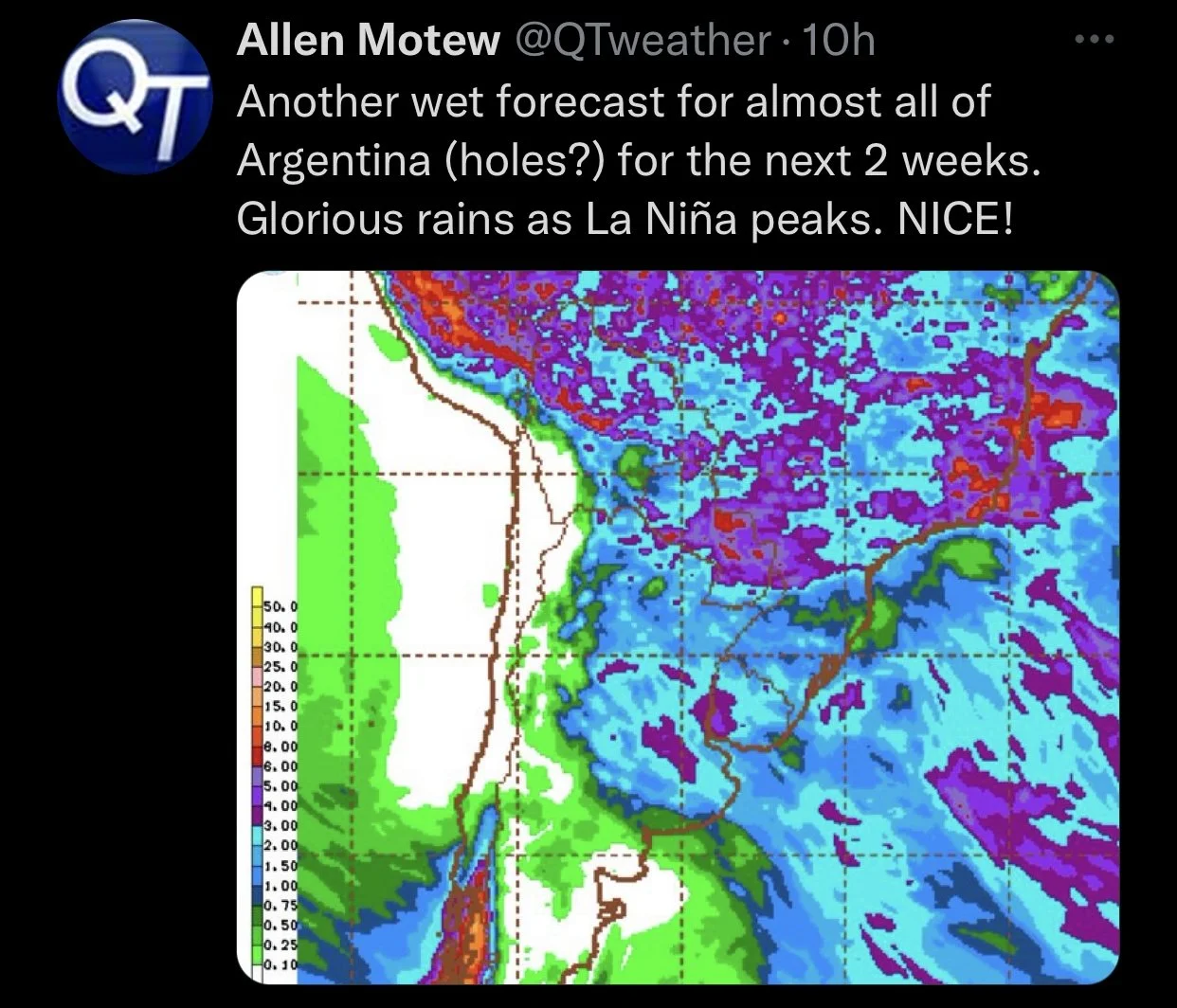

Globally, there is still some weather concerns that have the potential to further support prices. With Brazil getting too much rain, adding to the possibility of delayed planting or harming crop quality. Argentina has been the one that's been in a massive drought for a while which has already delayed planting, but its looking like they might finally get some beneficial rain.

Taking a look at ethanol, it has added some support to the corn market. Ethanol production increased for the second week in a row, moving back over 1 million barrels a day for the first time since August. As we saw the third biggest weekly increase ever at 84k barrels per day. Which is an improvement but still lower comparatively looking back to last year, as its 7% behind last year. The overall ethanol stocks were just lower on the week but well above last year's. But given the circumstances of the economy, its hard to think that ethanol demand will keep increasing here. With the recession fears and increasing dollar.

Most people would love to see corn crack the $7 level, but we just haven't been able to break through and hold those price levels. As we haven’t seen Dec-22 close above the $7 mark since June. So that area still remains a strong resistance level. On the flip side, we will be looking around the $6.50 area for support.

Dec-22 (6 Month)

Soybeans

Soybeans very strong this morning, as yesterday they finished slightly in the green and watched corn and wheat close lower. Today they are leading the grains. Main support coming from the better than expected weekly export sales. Where we saw weekly exports for soybeans come in very strong which is adding quiet a bit of support this morning, coming in near the high end of the estimate range.

Soyoil has also been on a great rally, hitting a new high yesterday, continuing its higher prices overnight and into this morning. We have seen a rally in global veg prices due to Ukraine's uncertainty regarding their sunflower production and exports.

Going forward, demand will likely be the biggest hurdle for the soybean market. With both Brazil and Argentina expected to produce much larger crops than that of last years. The USDA is forecasting Brazil to have a record soybean crop at 152 million metric tons. So with the U.S. dollar being so high and seeing larger crops elsewhere, we could definitely see this take a toll on the U.S. exports side of things. Argentina's soybean exports are also expected to be twice as more than they were last year.

I'm not totally bullish on soybeans, but with the strong export numbers we saw today maybe there is a possibility we go back and test the $14 range if we see demand pickup.

Soymeal & Soyoil

Soymeal up +7.5 to 409.2

Soyoil up +0.46 to 71.10

Soybeans Nov-22 (6 Month)

Wheat

Wheat continues to trade sideways, and is following the rest of the markets higher this morning despite the pretty weak export sales coming in below the estimates.

Russia is set for a record crop. U.S. exports have remained fairly weak. So it's hard to think we see a massive demand story to help prices. We do have some global weather issues with Argentinas drought, as well as the floods in Australia which have the potential to partially offset Russia's expected record production. But then again we have to mention the strength U.S. dollar as well as recession concerns, which could both weigh on demand.

Yesterday we saw some news later in the afternoon that Russia was close to agreeing to the deal extension with Ukraine. This sent prices falling into the close. The Russia and Ukraine war headlines continue to be one of the main factors in the wheat market, as it has been for months. But right now the entire situation is really just a wild card. On one hand, any signs of agreements put pressure on prices. While on the other, any escalations send prices higher. Nobody knows how any of it will play out. But it appears there will be some sort of conflict for a while, so one might look at the situation as slightly bullish looking longer term until a resolution is made. But, the war headlines can only carry the wheat market for so long.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil up +1.56 to 86.08

Dow Jones up +282

Dollar Index down -0.649 to 112.230

Cotton down up +0.16 to 78.45

News

New $1.3 billion program giving debt relief to U.S. farmers who qualify

Two of India's biggest refiners announced they would no longer be accepting Russian crude oil after Dec. 5th

Egg prices are more than $1 per done higher than last year

Crude oil inventories in the U.S. were down -1.7 million barrels last week

China set to release its sixth batch of frozen pork from reserves

Germany's corn crop is expected to fall -20% on the year

Livestock

Live Cattle down -0.025 to 151.325

Feeder Cattle down -1.550 to 178.525

Live Cattle (6 Month)

Feeder Cattle (6 month)

Previous Newsletters

Yesterday's Market Audio - Sunflowers

Sunday's Weekly Newsletter

Social Media

Credit: All credit to users of posts

Precipitation Forecast 2-Day

Weather

Source: National Weather Service