USDA RAISES YIELD BUT REPORT WASN’T ALL THAT BEARISH

AUDIO COMMENTARY & USDA BREAKDOWN

USDA raises corn yield

Bean yield unchanged

Report wasn’t actually super negative

Corn carryout still dropped with demand increase

Carryout is what matters, but yield was the headline

Top 5/6 states with record corn yields

Actual corn balance sheet wasn’t negative

Soybeans kind of a snooze

Who is left to sell after today?

Wheat basically left unchanged

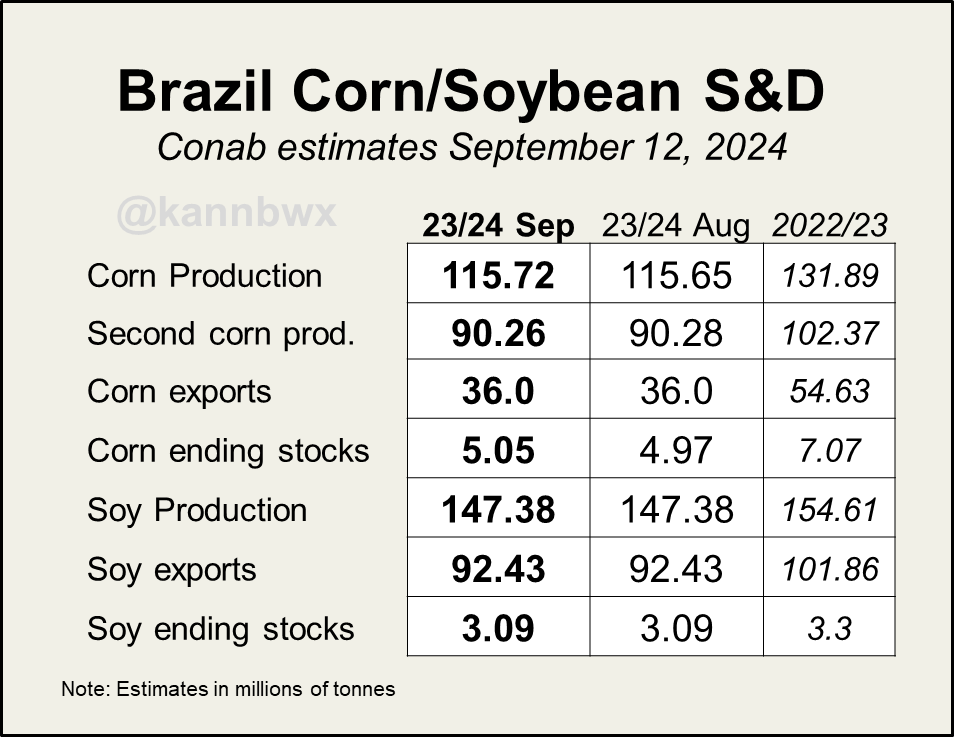

CONAB still massive difference vs USDA

War news had grains higher overnight

The report was not bullish, but doesn’t scream we have to go make new lows

All USDA numbers & breakdown below*

State by state yield below*

Drought change below*

Bull flag in corn? All technical charts below*

USDA NUMBERS

The corn market essentially got caught looking the wrong way.

As they thought corn yield would decrease, yet we saw a slight increase.

However, if you look at the balance sheet (next image) the change wasn’t all that bearish as carryout still decreased, just not by as much as expected.

From Karen Braun: “As long as corn can find demand, supplies may be kept in check”

Soybeans were essentially a snooze. No changes expected, and we got no changes.

23/24 corn carryout smaller than last month and smaller than expected.

24/25 corn carryout came in higher than expected due to the bump in yield, but carryout still managed to see a slight decrease from last month as they added some demand to the balance sheet.

Soybeans came in slightly below last month and the trade estimates.

Wheat left unchanged.

Global corn stocks down slightly from last month.

Wheat was higher than estimates and compared to last month due to an increase in the Canada crop.

Soybeans were higher than estimates and compared to last month, but we did see a small cut to the Argy crop.

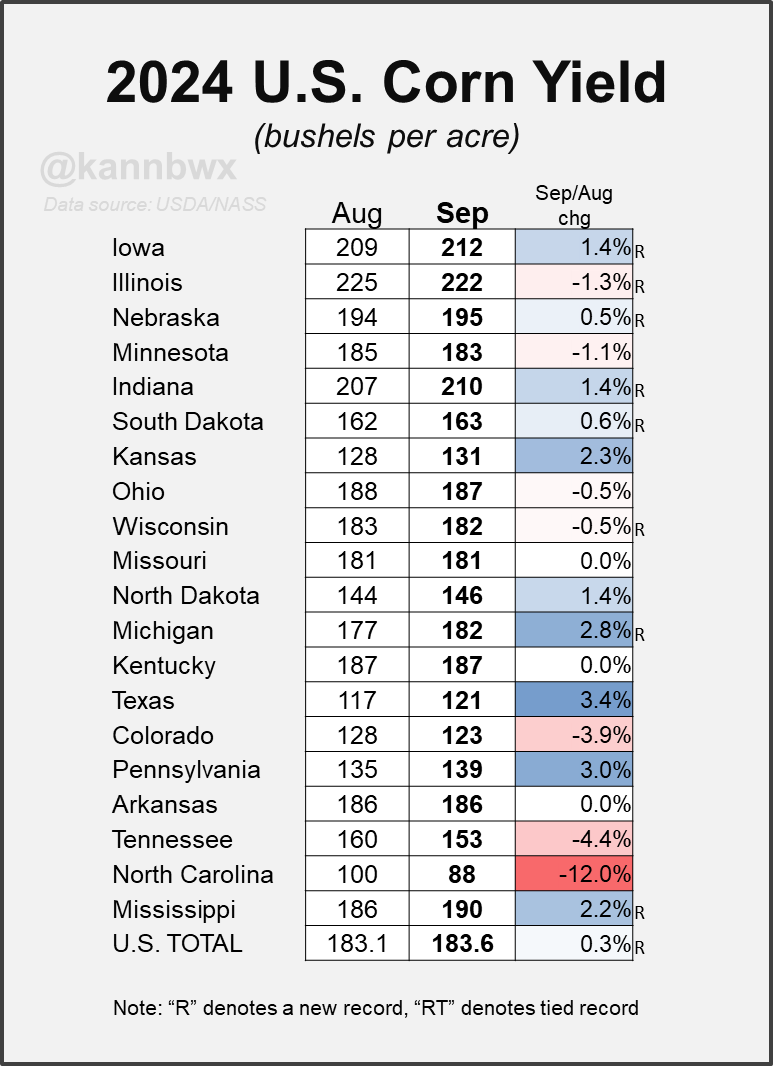

STATE BY STATE YIELD

Charts from Karen Braun

We saw some reductions in Illinois & Minnesota, but it was offset by increases in other smaller states.

Many think Minnesota is still too high, as the southern area where most of the production comes from looked in pretty bad shape during the crop tours just a month ago.

5/6 top states now projected to have record yields.

We saw a huge cut to Ohio beans (-7%), but areas like Iowa saw a large increase (+3.3%).

Iowa is now projected to match their 2021 record bean yield.

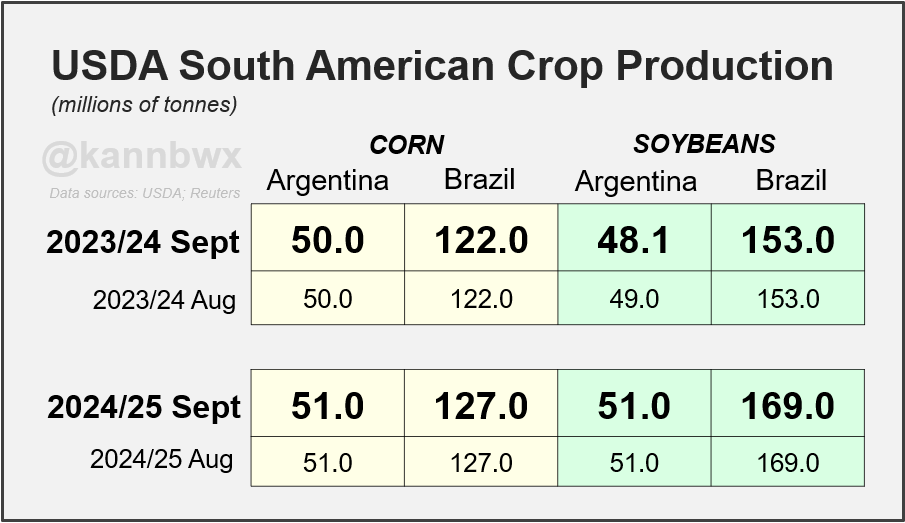

CONAB vs USDA

Charts from Karen Braun

No changes were made to the Brazil crops for either CONAB or USDA, but we do still have a pretty large difference between the two. USDA sees the Brazil crops much larger.

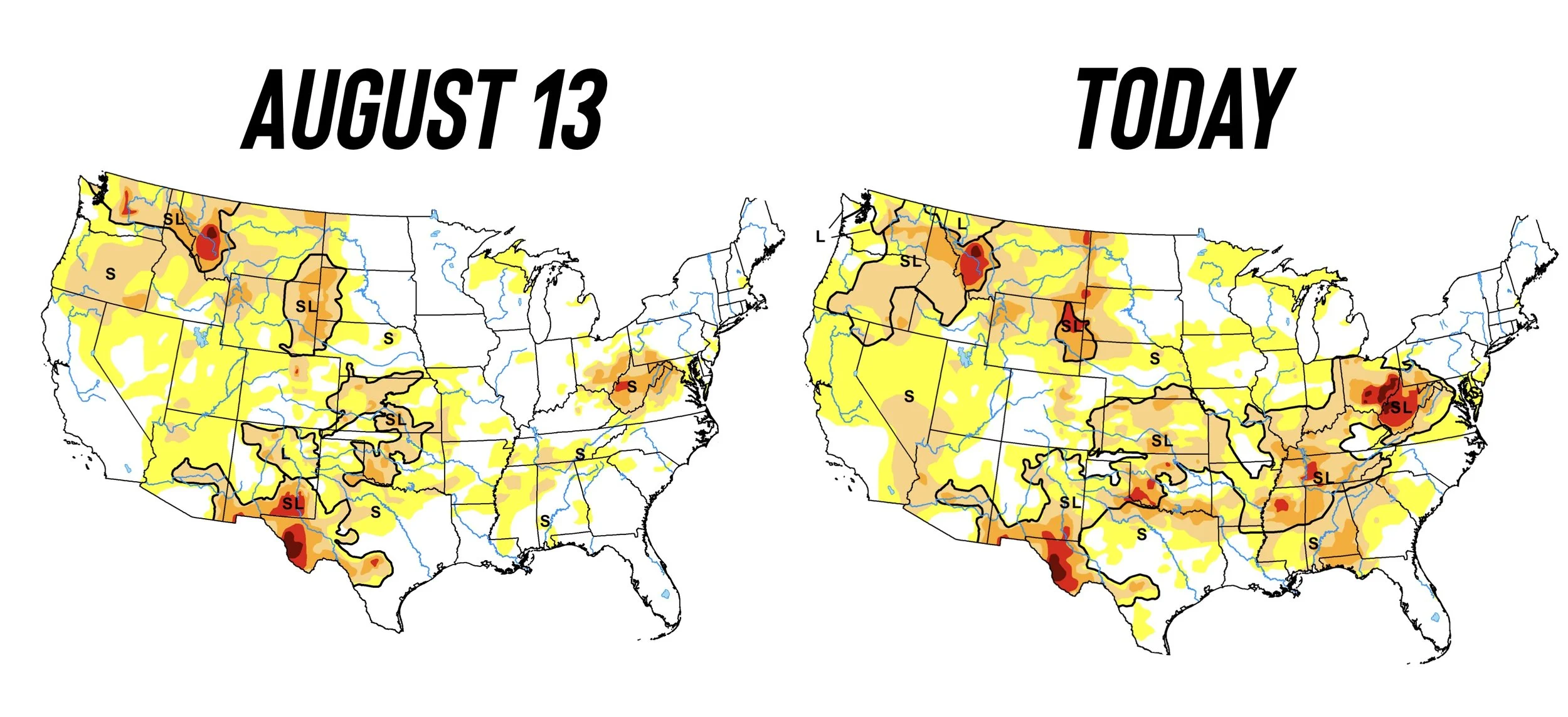

DROUGHT CHANGE

Areas experiencing drought (+/- weekly change)

🌽 Corn: 18% (+5%)

🌱 Beans: 26% (+7%)

🌾 Spring Wheat: 22% (+0%)

🌾 Winter Wheat: 57% (+5%)

A lot of dryness has emerged since July. A quarter of bean producing areas now experiencing drought.

August wasn’t exactly ideal.

CHARTS

Corn 🌽

Holding $4.03 would be nice, could possibly be a bear trap as well. Price action tomorrow will be key.

We are potentially forming a bull flag (drawn in pink). The implied move for this flag brings us right to that $4.26 area.

This is still the biggest thing I’m watching.

If we can close above this trendline and turn it into support, I would feel really confident about our chances are keeping this as the bottom.

Beans 🌱

As long as we hold $10.00 the chart looks decent for now.

My next support if we fail here is $9.85. If we were to break $9.85 the chart would not look good, but as long as we are above it, the recent small uptrend remains in tact.

A close above the 50-day MA would be a great sign. We have not done that since May.

Still looking for our first higher high at $10.42 to say making a new low isn’t possible.

Wheat 🌾

This $5.80 level remains the key as I’ve been mentioning for weeks. If we fail to break it today, it is the 5th time we have rejected off of it.

Just shows you how important of a level it is. A break above should bring higher prices.

Targets are still $6.12 and then $6.40

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

9/11/24

USDA TOMORROW. MAKE OR BREAK SPOT ON CHARTS

9/10/24

USDA THURSDAY

9/9/24

LOWS ARE IN UNLESS SOMETHING FUNDAMENTALLY CHANGES?

9/6/24

GRAINS WEAK. OUTSIDE DOWN DAY ON CHARTS

9/5/24

GRAINS GET HEALTHY CORRECTION. GETTING READY TO PROTECT DOWNSIDE

9/4/24

GRAINS CONTINUE RUN. WAYS TO PLAY THE MARKET. WHAT’S YOUR SITUATION?

9/3/24

GRAINS CONTINUE BREAK OUT FROM LOWS

8/30/24

ANOTHER STRONG DAY. GETTING MORE CONFIDENT BUT NO CONFIRMATION

8/29/24

CHANCE FOR A BOTTOM, BUT STILL CAUTIOUS. DIFFERENT MARKETING APPROACHES

8/28/24

WHEAT FOLLOW THROUGH WHILE CORN & BEANS GIVE BACK

8/27/24

DECENT PRICE ACTION. BASIS CONTRACTS. ROLLING VS FUTURES. NOT FALLING FOR BIG AG TRAP

8/26/24

FIRST NOTICE DAY PRESSURE & CROP TOUR RECAP

8/23/24

CROP TOUR SHOWS MASSIVE BEAN YIELD

8/22/24

UGLY DAY FOR WHEAT & BEANS, STILL RISK, CROP TOURS, CAPTURING CARRY

8/21/24

CROP TOUR DAY 3. NOT HUGE MOVEMENT

8/20/24

CROP TOUR SO FAR & COMPARISON TO USDA

8/19/24

CROP TOUR BOUNCE

8/16/24

RISK REMAINS LOWER. MANAGE YOUR RISK

8/15/24

DEMAND, BIG US CROPS & BRAZIL DROUGHT

8/14/24

DEAD CAT BOUNCE

8/13/24