BEANS TRY TO BOUNCE FOLLOWING BEARISH USDA

Overview

First trading day following the data dump and bearish USDA report on Friday.

As everyone knows in that report they increased final US yields, but both were slightly offset by the decrease in acres. However there was still a net increase in carryout in both. South America production was also higher than bulls would’ve liked, but not unexpected.

After the report Friday, soybeans rallied over +20 cents off their lows. Overnight it looked like soybeans would continue that strength, as they were up double digits.

However, they failed the hold those gains despite the new record crush number this morning for beans. As the NOPA crush came in at 195.328 which was well above the estimates of 193.1, the previous month's 189 and last year's 177.5

Wheat was also higher overnight but sold off pretty hard, dragging the corn market down with it. As corn was holding up well until wheat fell apart.

We didn’t get a ton of fresh bullish news over the holiday weekend which allowed the funds to continue to add to their short positions. The funds now hold the shortest position of corn, beans, and wheat combined since May of 2019.

The funds and lack of fresh news was the biggest reason for the lower action in wheat and corn today.

As for what's going on today, we got a flash sale of corn to Mexico this morning.

The US dollar is rallying, which isn’t helping the grains.

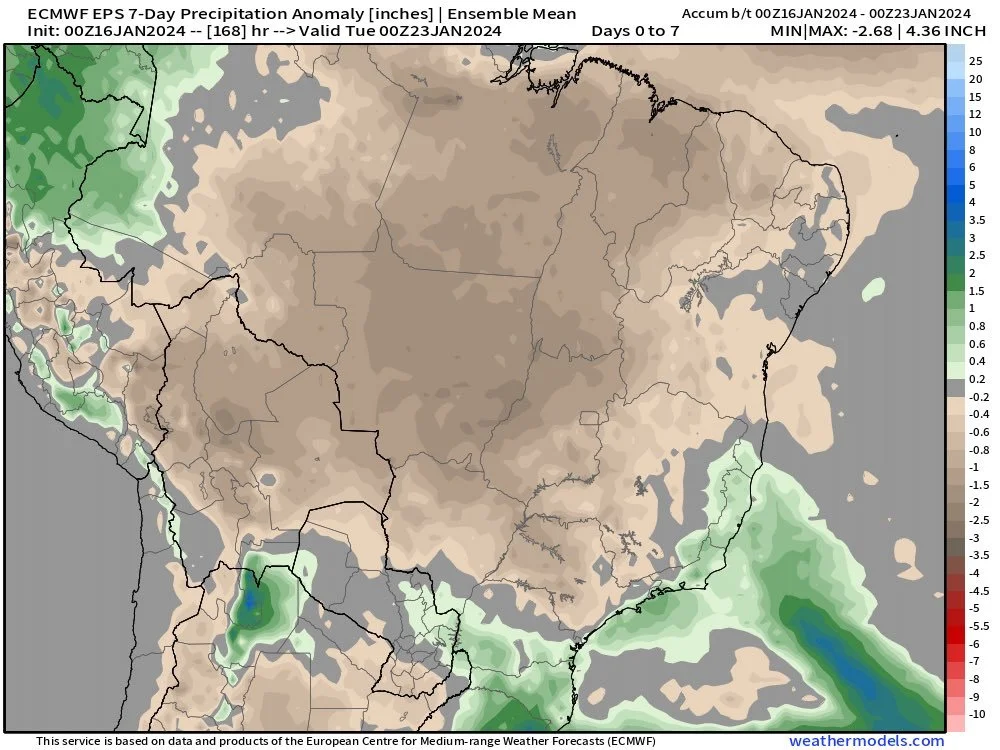

The forecasts in Brazil are looking hot and dry for the next 7 to 10 days, but rains are expected to bring some relief towards the end of January.

We continue to see downgrades to the Brazil crop estimates.

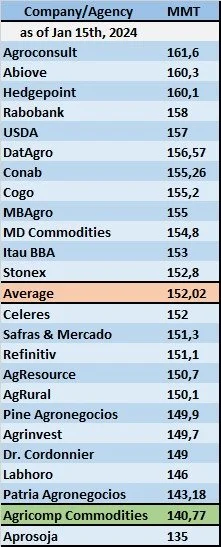

The big one today was a farmer lobby Aprosoja in Brazil. They are saying that the Brazil soybean estimates are too high by as much as 20 million metric tons.

The association which is represented by thousands of farmers in Brazil projects production at 135 million. This is a very low number and far below the USDA's current 157 and CONAB's 155 numbers from last week.

How much creditability does this report have? Hard to say. On one hand, they are the ones in the fields, so they know better than any of us what their crop looks like. On the other hand, they are typically the most bullish when it comes to their crop. The producers there obviously have a bias, but this is a massive swing in numbers from theirs to the USDA's.

Other changes to estimates we saw include:

Dr. Cordonnier once again lowered his estimates. Dropping his beans by 2 million to 149 and his corn by 2 million to 115.

He did however also raise his Argentina estimates, raising beans by 2 million to 52 and raising corn by 3 million to 56 million.

AgRural dropped their bean number from 159 to 150.

Here is a chart with all of the bean estimates from analysts:

So why does the market continue to trade lower despite the downgrades across the board?

The reason the market isn’t taking into account of these reductions is because of Argentina.

Argentina's bean crop is expected to be double what it was last year at 50 million vs 25 last year.

Their corn crop is expected to be 55 vs last years 34.

So for combined Brazil & Argentina production for each corn and beans to be lower than last year, what would Brazil numbers need to come in at?

Last year combined Brazil & Argentina production for corn was 171. If Argentina's corn crop is 55, that means Brazil's corn crop would need to fall to 116 or lower for total corn production to be lower. The USDA has 127 but there are quiet a few estimates calling for lower.

If we take a look at the beans, combined bean production for Brazil & Argentina last year was 185. If Argentina has a bean crop of 50, that means Brazil needs to have a bean crop of 135 or lower for combined production to be less than last year. This is what bears continue to argue when looking at South America.

Now let's get into today's update..

Today's Main Takeaways

Corn

Corn slightly lower today following Friday's bearish USDA report.

There was no particular reason for the lower action today. Most of the weakness simply came from following wheat lower, as corn was holding up well until the funds hammered wheat.

In Friday's report the bulls got a brutally bearish surprise. As the USDA raised our yield here at home. Which not many were expecting, although last week we did say it was a possibility given the USDA tends to do what everyone thinks can't happen.

They raised yield to 177.3 which is a new record yield, up from the 174.9.

At the same time, they lowered harvested acres from 87.1 million to 86.5. So net net, production jumped by +90 million bushels to a record 15.342 billion bushels.

When you are looking at a total production of over +15 billion, a +90 million increase really isn’t all that much more.

The other surprise came from world ending stocks, as we saw a massive jumpe mainly from China claiming to have a record crop. Some question the legitimacy of this, but who really knows.

The funds are now short a massive amount of corn. Somewhere around -250k contracts. On the surface one would think this is bearish. But in reality, we are nearing a point where this could turn out to be one of the only bullish things corn has going for it here. The fact that at some point they will probably have to cover. And when they do, that is a lot of shorts to unwind. When will they decide to cover is the main question.

Right now, the path of least resistance is lower. Although I believe we should see higher prices come spring and summer, doesn’t mean that has to happen.

For corn to go higher we NEED a catalyst the funds can jump on and cover. But right now we are in a time period where US weather doesn’t really matter, it appears that Brazil weather is getting better, and China just hasn’t had much of an appetite.

So the risk moving forward is that Brazil weather continues to improve and they somehow manage to make an okay crop. I think the Brazil corn situation is still flying under the radar and that the acres simply won't be there when it is all said and done. But there is still a risk.

The other risk and probably the biggest risk our corn market faces is this upcoming year for US growing. What if we raise above trend line yield? We just produced a record yield with some questionable growing conditions and a drought. Credit to you the farmer for being able to innovate and produce a great crop under not so great circumstances, but that is the risk our market faces.

Bottom line, we seasonally go higher. But we need the funds to cover. For that to happen it could come from Brazil weather scares or an increase in Chinese demand.

Seasonally this isn’t the time to be making sales. Nor are our markets overbought. Most are oversold indicating a buy signal for what it's worth.

If you are worried about the downside or have unpriced, consider grabbing cheap puts. Make sure they cheap.

If you have made sales, we like reowning in some way. One option would be cheap calls.

Every operation needs different approaches. Some of you should be getting puts, some calls, some should be doing nothing. If you have questions please give us a call and we would be glad to help you free of charge (605)295-3100.

From Chris Robinson:

"It's not hard to be bearish and disappointed after Friday. But not much has changed in how to hedge these prices.

1) Keep a floor under unpriced bushels

2) Do not overspend on protection

3) Keep the upside completely open. At this point, the funds are short and bearish. The producers are still long in the bun and in the field. The most surprising move and the one that would catch the funds out of position? Some sort of unexpected or unseen bullish weather issue."

Taking a look at the chart, it doesn’t look the best. We did hold Friday's lows which is a good sign, but we really need to break out of this downtrend.

The first target bulls need to break is still $4.69 if we want to break out of this slump. Then to get really excited our 100-day moving average sits at $4.90.

Corn March-23

Soybeans

Soybeans find a little bit of life following the sell off on Friday's report.

On Friday, beans were down over -30 cents but rallied well off those lows. Today we saw a little continuation strength. One point we were actually higher than we were before the bearish USDA report.

We felll way off today's highs but managed to close green.

Today the market was supported by the record NOPA as mentioned.

We also are seeing the forecasts shift back to hot and dry for Brazil.

However rains do look to pop back up near the end of the month.

Here is what BAM Weather had to say about Brazil weather:

"Central brazil now entering the hotter/drier period as advertised.

Data is wetter beyond 10 days, but I’m very cautious with that, as almost the same identical atmospheric pattern drivers that lead to a very dry December are in place ahead.. So the data is trending hotter/drier longer into late January is the risk here."

As for Friday's report, the numbers weren’t quiet as bearish as they were for corn, but certainly weren’t friendly.

Of course the USDA decided to not make a major cut to Brazil numbers as expected.

And that is what the future of beans is going to come down to here. Brazil.

Can they raise a decent crop and will the estimates stop falling? Or will some of these private estimates in the 130 to 140 range be right?

The truth is nobody really knows. All we do know is that the USDA's number is far higher than almost anyone else's at 157.

I believe the estimates will continue to drop, but how much will they have to drop to offset the increases in Argentina and how much will they have to drop to give us a reason to ration demand and go higher? Those are the questions that none of us have the answer to.

If Brazil's crop flops, there is still a chance we see beans go much higher.

If the weather continues to cooperate, we will likely see sub $12 beans.

So you need to manage your risk accordingly.

I believe prices will be higher come spring and summer. I also believe that long term (months and years from now) that the sustainable aviation fuel story will continue to grow and only push soybeans higher. But all of that does not have to happen. And it certainly does not have to happen on mine or your time table and when we want it to.

As for risk management, the same goes for soybeans as corn.

Seasonally we go higher, but that doesn’t mean we have to. If you have unpriced bushels or are worried about the downside, look at cheap puts to establish a floor. Don’t overspend on protection though. If you made sales, we still like reowning and keeping the upside open.

As always please give us a call, a text, or email if you ever have questions as to what you should be doing. (605)295-3100.

Taking a look at the chart, Friday's bullish doji left us some hope with that rally into the market close.

Today the action wasn’t all that great. We need to hold Friday's lows and that $12 mark or we could very well look to test $11.50 or $11.60 before a bounce.

Fist upside target is $12.53 but we really need to get back into the $12.80 range if we want to stop this terrible downward trend.

I did want to point one thing out that I mentioned Friday. Often times when you get candles with long tails such as the one Friday, it is an indicator of a reversal. We will need a follow through for a confirmation however.

Soybeans March-23

Wheat

The wheat market has the most friendly report on Friday, coming in pretty neutral. Yet, the wheat market is the only one that takes it on the chin today.

A little recap from the report was that bulls were happy to see US ending stocks lowered by -11 million bushels. They also saw all winter wheat acres surprise with numbers well below what the trade was expecting.

On the other hand bears had the world stock numbers which saw both Russia and Urkaine production and exports higher.

What bulls are now looking at is a tighter wheat balance sheet as well as some talk about winter kill here at home. As we are seeing some brutally cold temps which could impact crops without snow cover.

I'm not sure how big of an impact this will have, but most don’t seem too concerned thus far.

So why was wheat lower despite not having an awful report?

Simply the funds and the outside markets. There just wasn't a reason for the funds to want to buy.

When there is a lack of reasons to buy, oftentimes they look to sell.

Today's action was pretty ugly on the charts, as we broke some support. I still view wheat as a sleeper and think we will be higher, but that doesn’t mean we can’t t go lower and look to test some previous support.

If you look at the chart, if we don’t bounce here our next support is $5.67 and the one after that is our lows from November at $5.56. My first upside target is $6.16 and bulls still need to see $6.39 to confirm the downtrend is over. But for now, we are stuck in the middle of this recent range.

KC wheat on the other hand is treading it's old lows of $5.95. Bulls need to hold or it could trigger a leg lower.

Just like corn and beans, seasonally we go higher. Worried about the downside or have unpriced bushels? Look at cheap puts. Made sales? Consider reowning. Give us a call with questions (605)295-3100.

Chicago March-23

KC March-23

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/12/24

FULL USDA REPORT BREAKDOWN

1/11/24

USDA REPORT TOMORROW. ARE YOU PREPARED?

1/10/24

PREPARING FOR THE USDA

1/9/24

TURNAROUND TUESDAY & USDA PREVIEW

1/8/24

HOW TO GET COMFORTABLE AHEAD OF USDA REPORT

1/5/24

FIRST WEEK OF NEW YEAR FLOPS

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23