GRAINS SUCCUMB TO OUTSIDE PRESSURE

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Grains down hard today, as both beans & wheat fall double digits.

Why were we hit so hard today?

First was the war news (or lack there of).

The market was expecting news that Israel had attacked Iran's oil factories over the weekend.

Instead, Iran announced that Israel did not attack any oil facilities or nuclear plants.

So we received news that makes the market optimistic about de-escalation from that middle east war.

Initially, this news sent crude oil sky rocketing not too long ago. But this news can send crude lower just as easily as it rallied it.

The lack of war news led to crude oil dropping a whopping -5% today.

The sell off in crude oil also resulted in a brutal sell off in soybean oil.

As bean oil plunged over -3% today.

The grain markets were just unable to fight off the weakness in crude & bean oil. So they also got hit hard and followed the outside markets lower.

This middle east war does not "directly" impact the grain markets. Such as the Russia & Ukraine war affected wheat.

However, it does directly impact crude oil and other outside markets.

So this weakness (or strength) can spill over to the grains.

Take a look at this corn chart overlayed with a crude oil chart.

You can see just how closely correlated they are sometimes.

(Purple line crude - bars corn)

4 Hour Corn vs Crude

We also have first notice day this week on Thursday.

Historically, this adds a lot of pressure going into it.

So that might’ve added some additional weakness today.

Anyone that has a November basis contract will have to price or roll them by the end of Wednesday at the latest.

Brazil

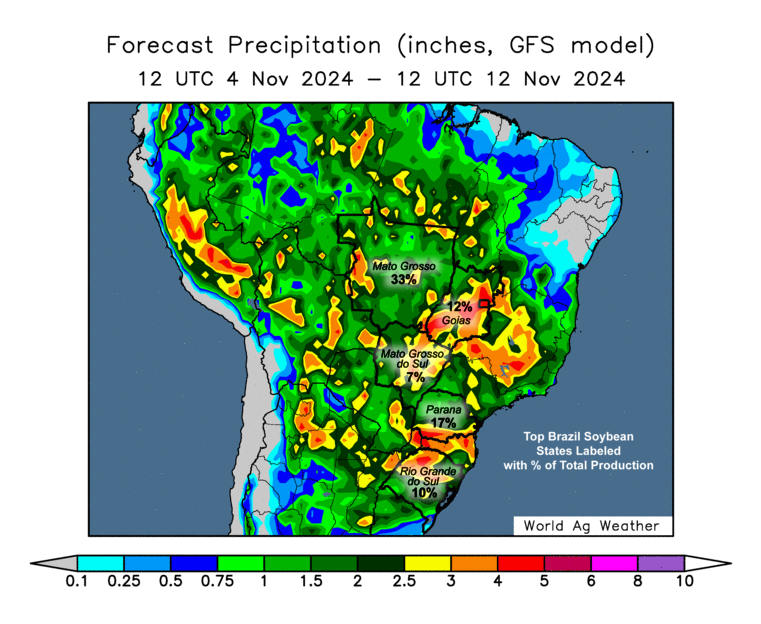

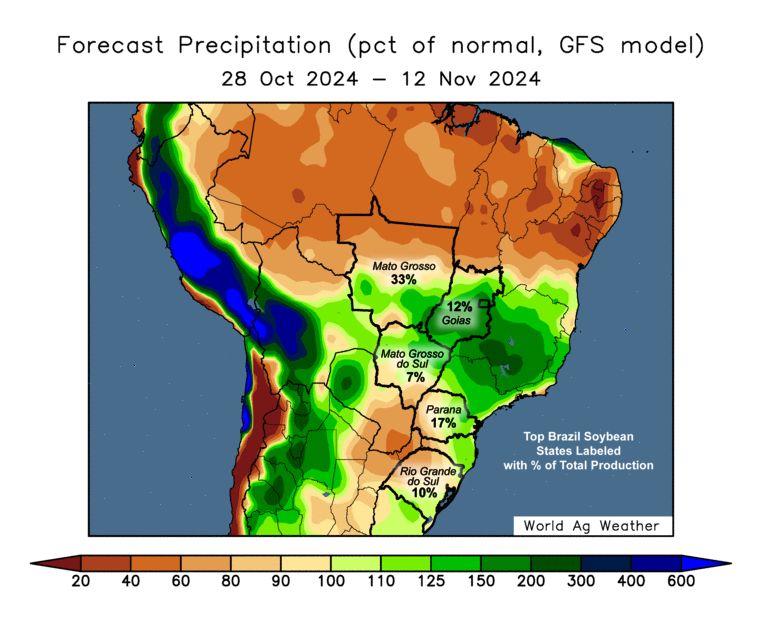

Brazil rain wasn’t a key reason for the weakness, but didn’t help.

Brazil has received a good amount of rain and the forecasts suggest more is on the way.

Mato Grosso's (#1 growing region in Brazil) bean planting is at 56% now and is just slightly behind average pace as the rain has allowed them to catch up fast.

So overall, no planting delay worries or growing season worries for now.

But that can always change the next 2 months.

Next 2 Weeks

Harvest

In other news, harvest is wrapping up. Well ahead of usual pace.

Harvest Complete:

Corn: 81% (Average: 64%)

Beans: 89% (Average: 78%)

This should result in less hedge pressure.

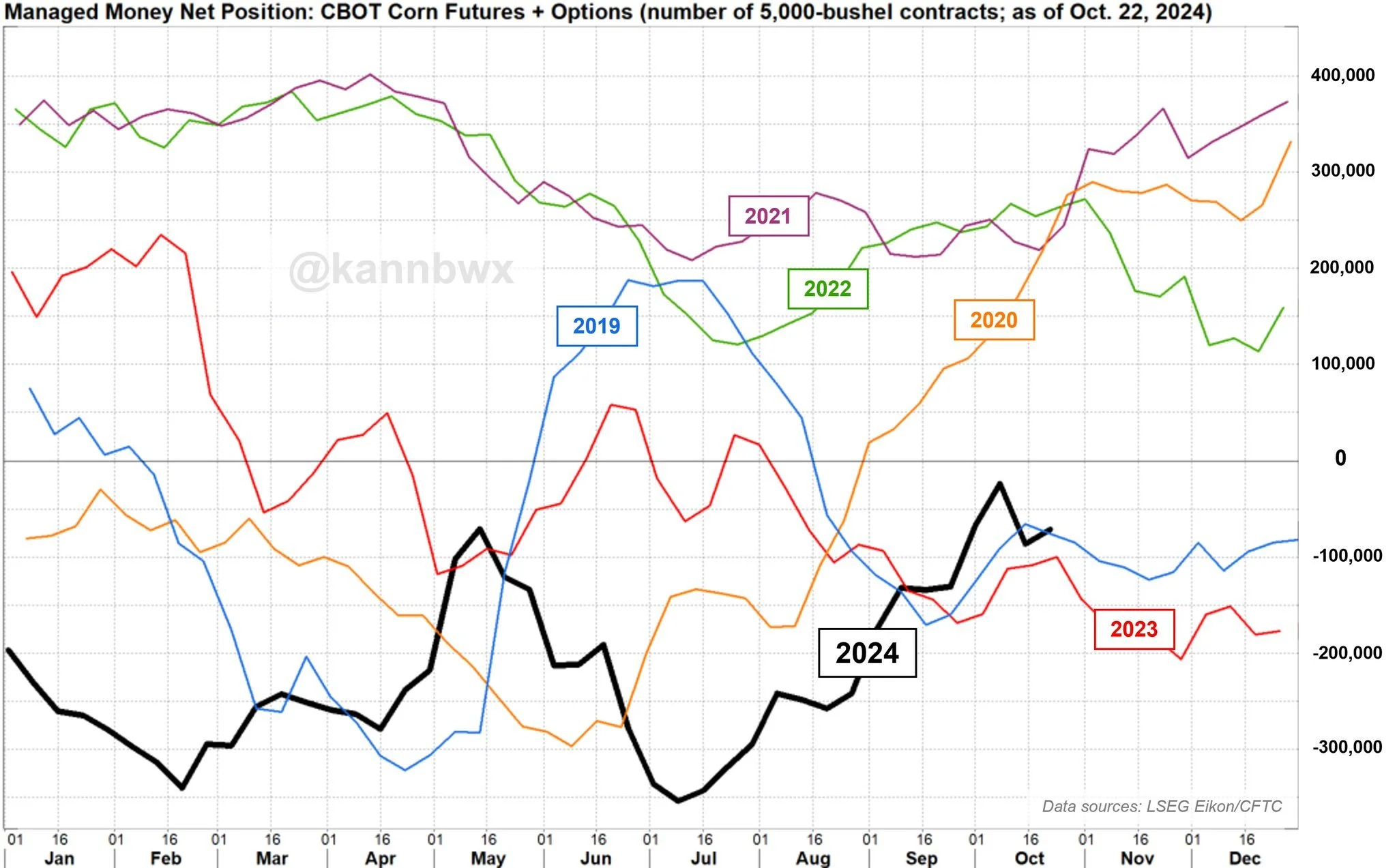

The Funds

The funds are short:

Corn: -71.5k

Beans: -59.5k

Wheat: -28.9k

So we no longer have the possibility for a big "short covering event".

As they are taking a more balanced approach here.

I could see them perhaps add to some of those shorts ahead of the election, especially in soybeans just given the uncertainty and what happened last time Trump was elected.

But I don’t expect them to hammer the market, as they won’t want to lean too heavily to one side with the uncertainty of the results of the election.

Chart from GrainStats.com

Chart from Karen Braun

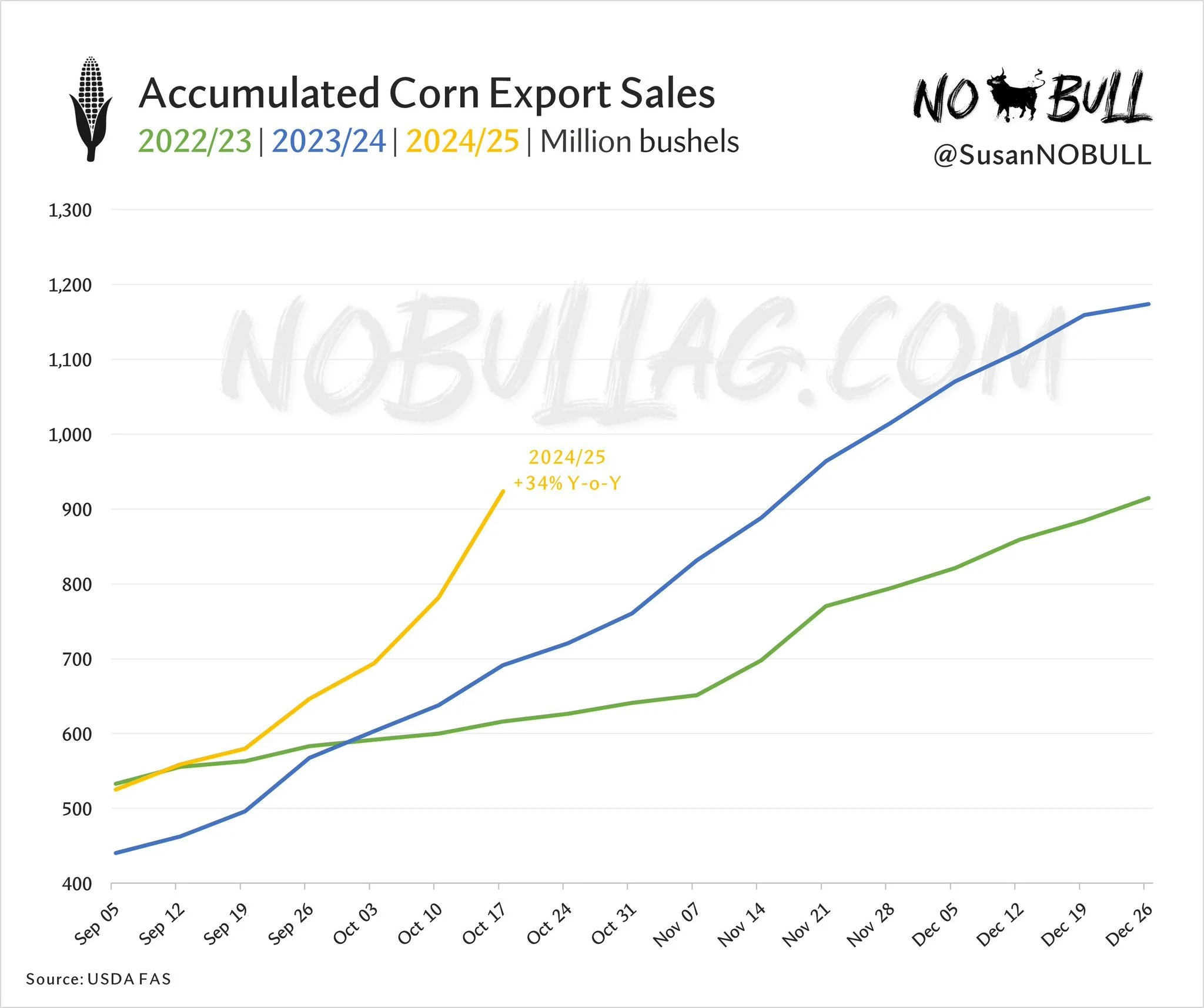

Corn Export Sales

The impacts of the recent sales & strong demand have worn off the past few days.

We saw our 9th straight day of corn sales in a row this morning.

Corn sales are the 3rd best of the past decade. Only behind 2020 & 2021.

Interestingly, in 2020 & 2021 it was China who spurred that buying.

We have seen pretty much zero buying from China this year.

It has all come from Mexico & unknown (also unlikely China).

There is some thoughts floating around that maybe Mexico is buying a ton of corn right now because they are worried about potential tariffs if Trump is elected. So they are basically front-running their purchases ahead of time.

That is definitely a possibility, but they also are likely just simply taking advantage of these low prices.

Soybean export sales have been "okay" but nothing special. Currently we sit in the middle of the pack for the last decade. Ranked 6th of the past 10 years.

Chart from NoBull Ag

Today's Main Takeaways

Corn

Corn mainly drug lower from weakness in crude oil.

Short term, we do have some tailwinds to face that could lead to slightly weaker or simply sideways price action.

We have harvest wrapping up and the yields are fantastic.

There are also some who believe that perhaps these recent export sales slow down if Mexico was really "just front running" their purchases. Possible.

Either way, corn is creating demand. Whether the effects of this demand show up soon or several months from now is an unknown.

Long term I still believe demand will lead us higher. If Brazil doesn’t get a weather scare.. demand will HAVE to lead us higher if we want higher prices.

I've went over several reasons in the past why demand should lead us higher long term.

To name a few:

Our current ethanol production is ahead of last year, while the USDA expects it to be lower.

The USDA could very possibly also be underestimating export demand

Exports to date are 924 million bu vs last year's 690 at this time.

High prices eventually cure high prices. Low prices also eventually cure low prices. These lower levels have been creating demand.

If Mexico is not front running their purchases, it means they find immense value here.

We just had the biggest weekly sales in years a week ago.

Our carryout could shrink vs last year despite yield being +7 bpa higher.

From Jody Lawrance:

"US corn cash prices are uncompetitive above $4.15 Dec futures, making a sustainable run toward the fall highs tough without a SA weather problem"

From John Scheve:

"The corn market is stuck between buyers who are looking for $4 corn & farmers wanting $4.20 corn."

I would mostly agree with John. Corn has traded in a 30 cent range between $3.95 and $4.25 for nearly 3 entire months now.

Despite me seeing higher prices long term (months from now) there is a good chance we are simply range bound for the time being.

Meaning we will go up and test the highs, and come back and test the lows. Simply stuck in a range.

Looking at the chart, our next support is the bottom of this triangle & $4.00

$4.00 is still a must hold. If we break below, there is very little support stopping us from those lows.

Looking to the upside, that green box is the area to break if we want to see higher prices.

If you have something to move off the combine, I like keeping a floor with puts. If you are done harvesting, you can still consider puts. But ideally we don’t want to spend a ton of money at what could possibly be the bottom of the range.

If you have questions, shoot us a call or text (605)295-3100

Soybeans

Beans hammered, giving back -20 cents since Friday. Nearing those recent lows.

I don’t have much for beans. Very little news.

Brazil is getting rain. No issues there.

Export sales have been decent but nothing like corn.

We have had zero news of China announcing any additional stimulus money into their economy.

Our global balance sheet is still extremely bearish unless Brazil has a crop scare.

There is just simply a ton of uncertainty & different factors that can influence beans.

For starters we have the election in a week.

Right now the betting markets say Trump is a 65% favorite to win.

If he does win, does he add tariffs? Does he make China required to meet a certain number of purchases? It is all unknown. But for now.. the trade views a Trump win as bearish soybeans. Rightfully so.

There is still tremendous downside risk in the bean market as I have been stating for a long time.

Only things that can save the bean market are:

Brazil scare

More China stimulus

China buys a lot more beans

If none of those happen, I would be lying if I said $9.00 beans was impossible.

But hope isn't a marketing plan. if you still have something to move then grab some puts for protection.

If you have a basis contract or any other questions please give us a call or text (605)295-3100.

Big Picture Chart

Here is a monthly continous bean chart.

As you can see, on the recent lows we found support right at that $9.61 level. That was the trade war resistance. Often times, old resistance turns to new support.

But this chart also gives you the realization that there is plenty of potential downside in beans if the cards don’t fall right.

If $9.61 fails, it opens the door to $8.50 (bear market support)

To escape this "bear market box" we would need to close above $10.75 for 2 months in a row.

Looking at the chart, I still can’t even contemplate the idea of us being done going down until we close above $10.00

This recent $9.68 bottom should offer support. As we had bounced there 3 times before the mini rally last week.

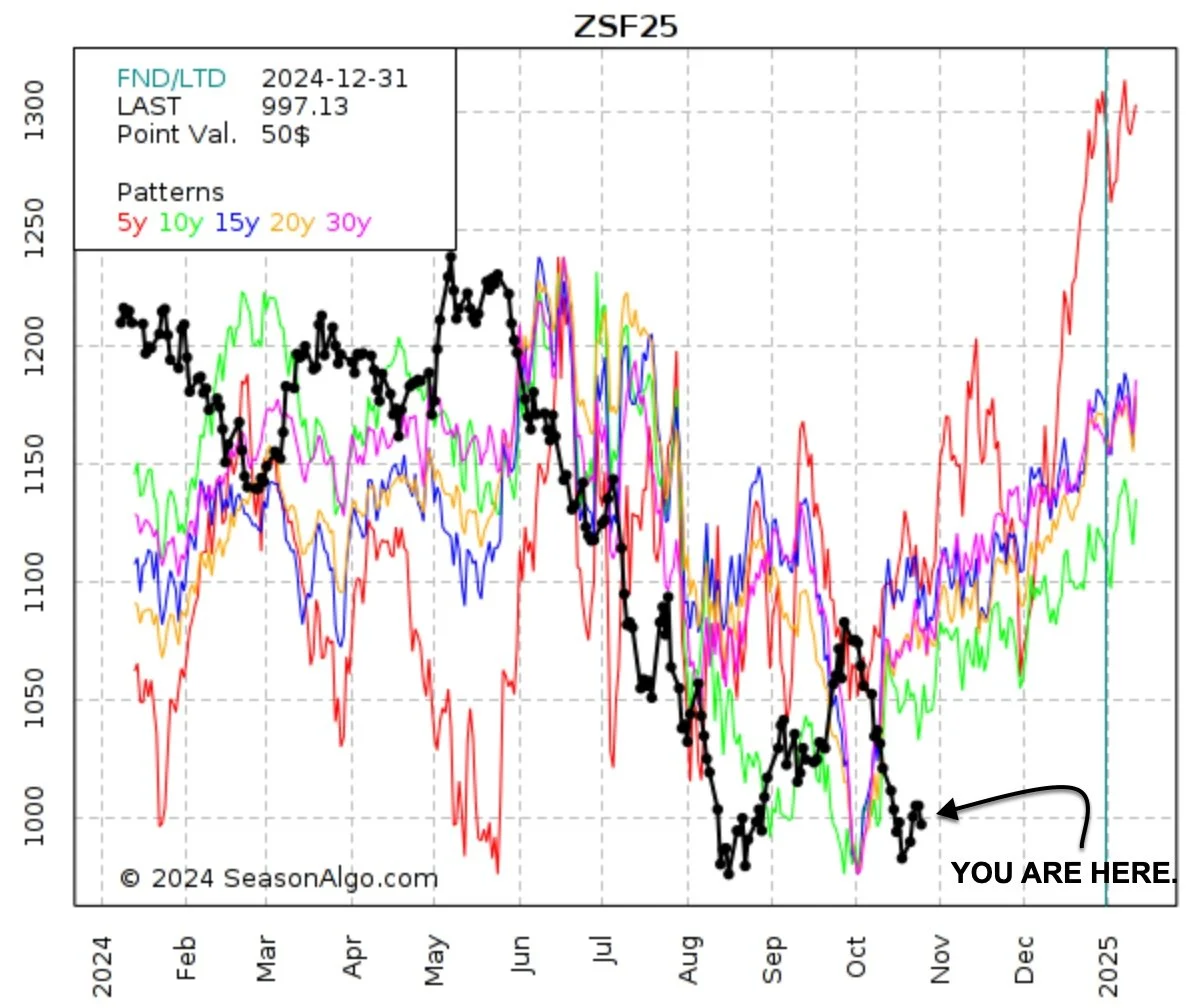

Seasonal Chart

I wouldn’t get too excited, as there are plenty of factors that pose a risk in beans... but this seasonal pattern does point to higher beans.

Wheat

Wheat down hard, sitting at it's lowest levels since September 3rd.

Unlike corn & beans, the middle east war was a small factor in the recent wheat rally. As any war news adds uncertainty globally.

Today was a lack of news day aside from the war de-escalation. So not much new to add.

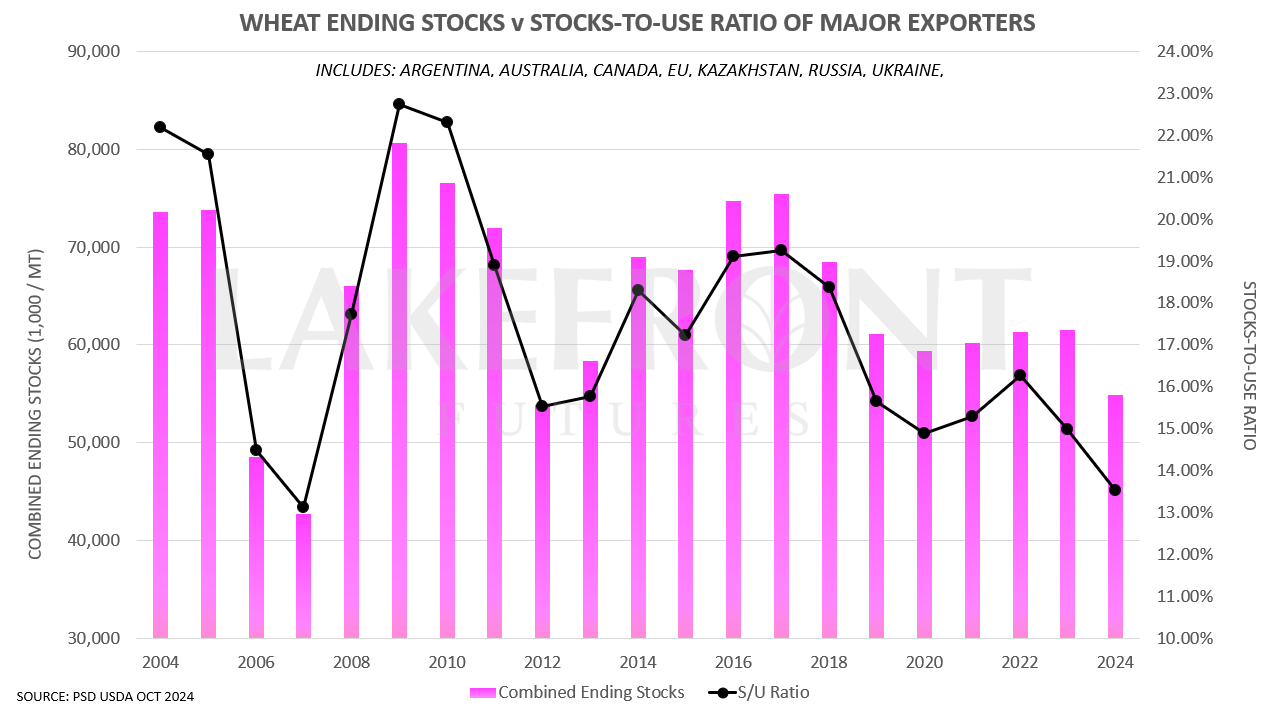

Globally, we still have a bullish balance sheet. With an all-time low stocks to use ratio on par with 2008 & the lowest global carryout globally in 10 years.

This alone makes me believe wheat has plenty of potential.

However, this "potential" does not have to happen tomorrow. Or next week. Or next even next month.

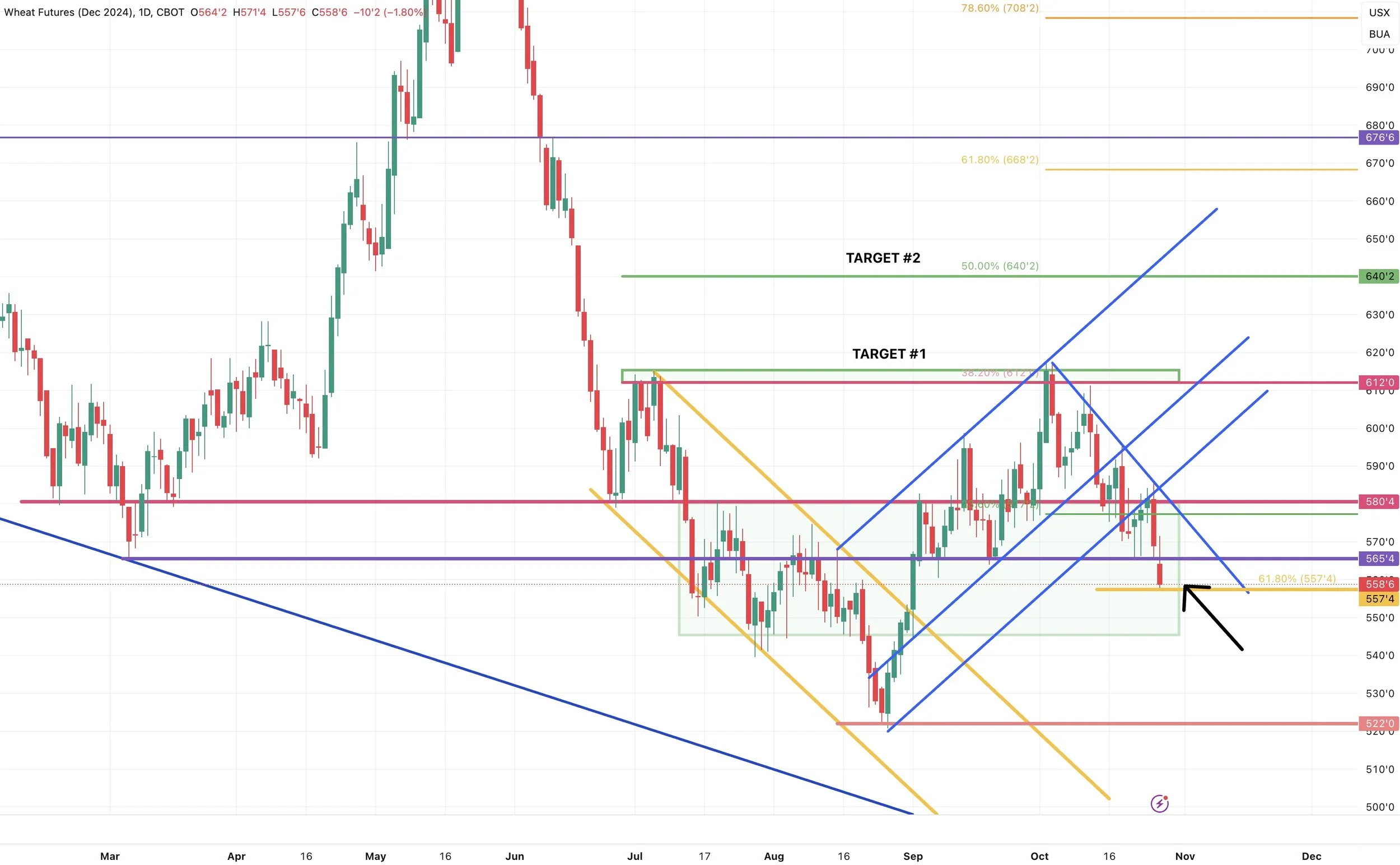

Looking at the chart, wheat went from looking bullish from a technical standpoint, to pretty bearish real quick.

We broke below that $5.65 support. (purple line)

Next big support might be $5.45 (the bottom of that green box)

However, one hope bulls do have is that today we bounced right at the 61.8% retracement to those recent highs (meaning we have given back 61.8% of the rally) (yellow line)

This level is often referred to as the golden retracement. So would be a good spot to bounce. We will know soon.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24