ARE YOU COMFORTABLE HEADING INTO USDA REPORT

AUDIO COMMENTARY

Will we follow the trend?

What we might see in tomorrow’s report

What should you do for marketing

What to do if you aren’t comfortable

Seasonal rallies & what to expect going forward

Listen to today's audio below

MARKET UPDATE

Futures Price Close

Overview

Tomorrow is the big day of the USDA report. Ahead of the report, we are seeing a little bit of weakness across the board with Chicago wheat seeing the most pressure.

In today’s write up we will go over the estimates, a little history, and some thoughts from two other advisors who are bullish going into the report. Scroll to the end to read their thoughts and insights. One thinks we have the chance for a limit up, the other says if there is a noteworthy surprise tomorrow, it will be a bullish stock number in corn.

USDA Estimates

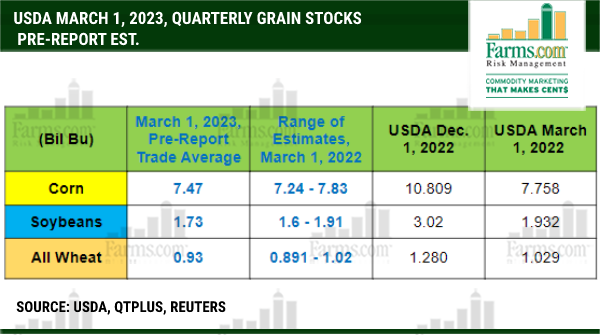

The quarterly stocks are estimated to come in a lot smaller than recent years, with corn the smallest in 9 years, wheat the smallest in 15 years, and beans the smallest in 2 years. So the stock numbers are predicted to be fairly bullish, and it is bullish because of how small they are compared to history and even just a year ago. But the real story will be where the USDA actually has these numbers come in at. With the numbers being estimated a lot lower, it makes it harder for estimates to come in below. But if they do come in even lower like they did in January, our supplies might be less than everyone realizes.

The acre numbers on the other hand, everyone thinks these numbers will come in bearish, which they very well could. But the high estimates again make it easier for numbers to surprise to the downside. If we take a look at beans acres estimates, our trade range estimate is the tightest its been in 16 years or so. Which opens the door for surprises.

So overall, we could see this thing going either way. We wouldn’t be surprised to see a fairly bearish report because of the high estimated acres. So there is some risk tomorrow that the USDA prints some high numbers. We need to be prepared for the possibility of a bearish report. After the report the markets will again shift back to fundamental headlines.

Other Advisors Making Sales

Because of the risk in tomorrow's report, we have had some other respected advisors we follow recommend making some sales in old-crop corn and 2023 & 2024 wheat. There is absolutely nothing wrong with taking some risk off the table ahead of tomorrow’s report, because there is a lot of uncertainty.

We recommend to do whatever makes you comfortable in your operation. If you have any questions or want personal help with your specific operation you can always give us a call free of charge at (605)295-3100.

The Numbers

History

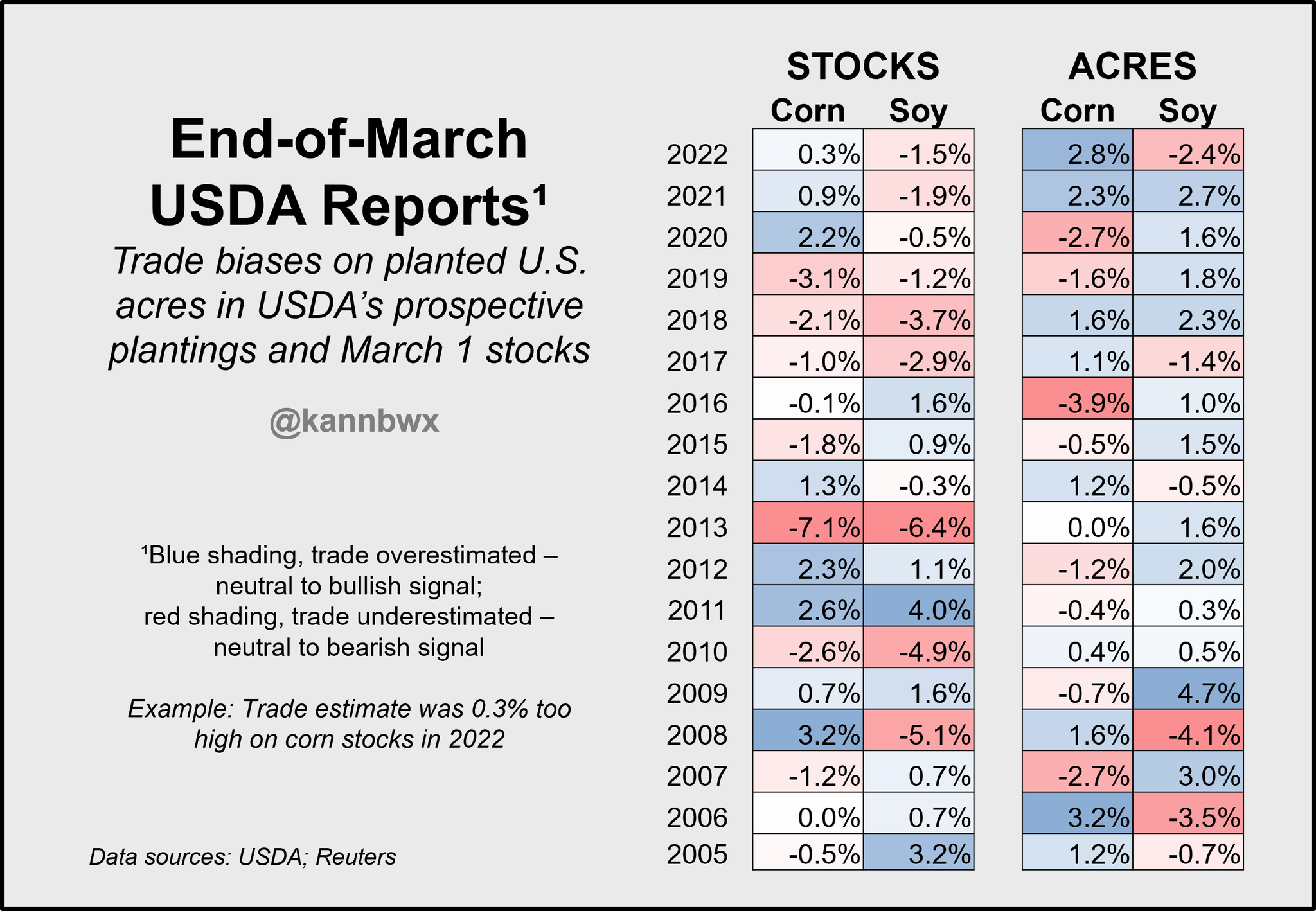

Here is the March 31st USDA report outcome for the U.S. corn and soybeans the last 18 years.

The shading identies bullish & bearish numbers.

🔵 Blue = Bullish

🔴 Red = Bearish

The Stats

(Years Bullish to Neutral)

Corn 🌽

Stocks: 9/18 (50%)

Been bullish the past 3 years, but the 5 years before that were all bearish.

Acres: 10/18 (56%)

Last 2 years have been bullish.

Beans 🌱

Stocks: 8/18 (44%)

Have came in bearish the past 6 years. Last bullish one was 2016.

Acres: 12/18 (67%)

4 out of the last 5 years have been bullish. Last year was bearish, and the most bearish since 2008.

Chart Credit Karen Braun

Today's Main Takeaways

Corn

Corn slightly lower in a tight trading range today as trader prepare for the report tomorrow.

Report is a little bit of a mixed bag with a lot of things in the air. Most peoples main concern tomorrow is the acre numbers. Since the numbers are survey based, some think we see acres come in a tad high. However, what the survey collected and what producers thought they could produce vs what is actually planted will probably be very different.

Another thing that some are concerned with is the demand numbers, as the numbers are from last quarter, not this most recent one. So demand might not come in as strong as some would like.

Wright on the Markets had a different opinion than most for the corn numbers tomorrow, scroll the end to see his thoughts.

Pre-Report

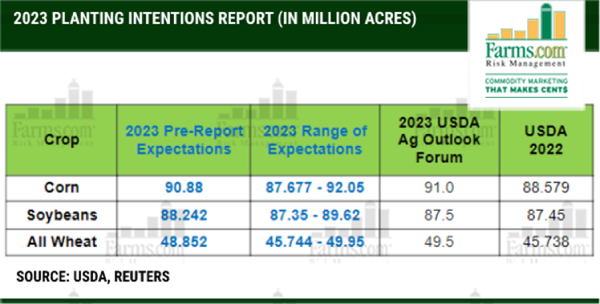

The report Friday is looking for quarterly stocks to come in at 7.47 billion bushels, which is 4% lower than last year and the smallest for the March 1st report in 9 years.

As for acres, the current estimate is 90.9 million new crop acres. Which is higher than last years 88.6 but lower than 2021's 93.3 million.

Outside of the report, one thing bulls are looking at is weather. We might get some pretty extreme weather conditions here in the U.S. corn growing regions. With rain and snowstorms in parts of the upper midwest. If we continue to get overly wet fields, we might start seeing discussion of fewer acres down the road.

Bulls are also looking at demand, as we have continued to see increased buying from China. Not too long ago, demand was a pretty big concern surrounding corn, so the recent sales have taken some of that worry off. As we again saw another purchase to China this morning. We have now seen purchases the last 11 of 13 business days. The volume isn't anything crazy or record breaking, the steady purchase streak is the longest in 3 years. China doesn’t currently have any U.S. new crop corn booked yet, but the last few years they started buying in April and May. So we will have to see if that trend continues or if the new trade relationship with Brazil makes them hold off.

Corn May-23

Soybeans

Beans also slightly lower, posting their first day of red since last Friday. May beans still up over 70 cents from our lows last Friday.

Taking a look at the report, some argue we see acres come in high. Some think we come in lower. I wouldn’t be surprised to see them come in a tad lower, given that the numbers are from earlier surveys, when producers may have been considering better corn insurance guarantees and prices. But we will have to wait and see.

Some think stocks also could come in somewhat bullish, with the strong quarterly demand from last quarter.

Pre-Report

Taking a look at the report, we have estimates showing acres up about 1% from last year at 88.24 million acres. But we also have the narrowest trade range we've seen in the past 16 years. Which opens the door for possible surprises come Friday. So there is some talk about acres coming in a tad lower than expected, which makes some sense given the report is using early data from producers who were looking at better corn insurance guarantees.

The quarterly stocks are predicted to come in at 1.742 billion bushels. Which is a 10% decrease year over year and the smallest in 2 years.

After the report, we will see the markets quickly go back to trading the usual. With Argentina and Brazil weather headlines, Chinese demand, among other factors.

Early observations in the Argentina bean crop are showing early yields are coming in below expectations. Argentina complications will look to support the bean and meal market.

Soybeans May-23

Wheat

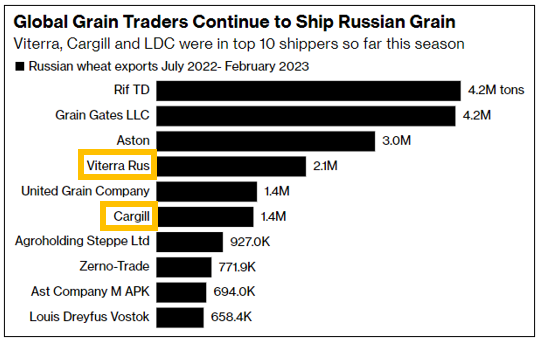

Wheat futures mixed here before the report. We had Chicago down double digits, while KC and Minneapolis both closed slightly higher. Yesterday morning the Cargill and Russia news provided an initial boost but we have since come well of those highs from yesterday morning.

Pre-Report

Now taking a look at the report. On one hand we have acres projected to come in 8% higher on the year, the biggest yearly increase since 1996. As all wheat acres are forecasted at 48.85 million, which is down from the Ag Forum Outlook's original guess of 49.5 million. But still a lot higher than last years 45.7.

On the other hand we have wheat stocks predicted to be the smallest in 15 years. As quarterly stocks are estimated at 930 million bushels, which is -100 million lower than last year.

Yesterday we got the big headline of Cargill and Viterra reducing their exports from Russia due to insurance costs. This may wind up being friendly for U.S. exports down the line. They are not expected to stop these exports until July 1st. Keep in mind, both Cargill and Viterra are in the top 6 of Russian grain exporters.

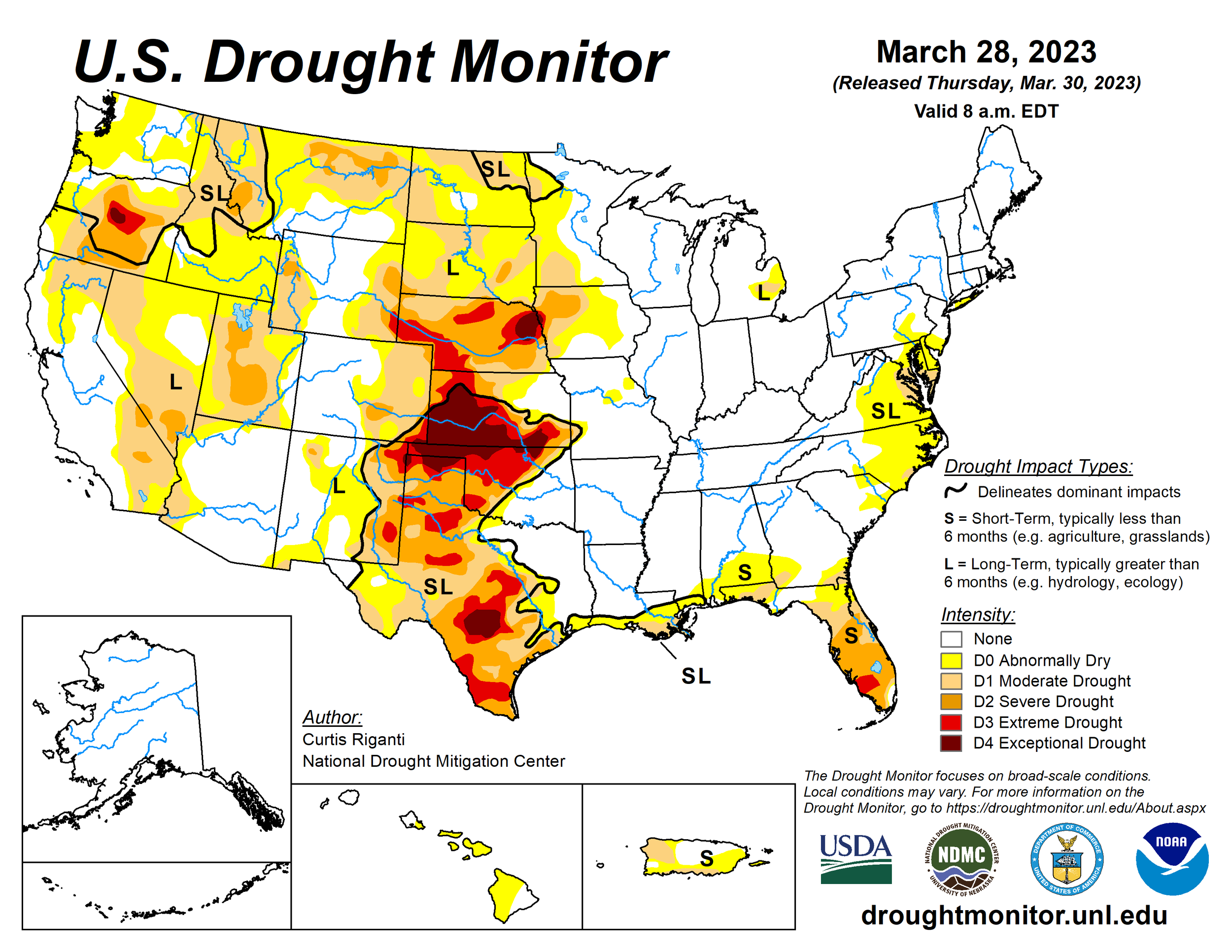

Other headlines traders are watching outside of the report and war headlines is weather, mainly here in the U.S. as well as in Canada. As we might be looking at some storms and freeze, while Canada remains in drought conditions. We have seen improvements as of late here in the U.S., but there is still a ton of concern with the quality of our crop.

Taking a look past the report, bulls still think we have a good chance for some wild cards including war and weather to spark a short covering rally down the road.

Chicago March-23

KC March-23

MPLS March-23

Corn Going Higher?

Marketing Recommendation

From Wright on the Market

Today or tomorrow morning is the day to lift corn hedges and HTAs or roll from old crop months to new crop December. If old crop corn futures are lower today, do not wait until tomorrow. If there is a noteworthy surprise tomorrow, it will be a bullish stocks number. Acres intended to be planted do not matter so much, because whatever they are, the acres will change substantially by June. Weather is still #1 and demand is #2.

Corn prices are going higher. We just made the winter low with panic selling over the banking crisis and lack of exports, the seasonal trend is up, China is buying corn every day but one since the low was made March 10th, there will be several feet of snow on the fields across the Upper Midwest for another 14 days at the least, and then flooding and wet fields for how many days after that? And... the Corn Belt will have a wetter than normal early spring, at the least.

Pre-Report Game Plan

From Farms.com Risk Management

U.S. grain stocks are expected to come in lower than last year while 2023 acres are leaning too high. With the sentiment turning bullish after a U.S. western banking crisis, will the USDA provide a bullish surprise and a limit up move?

This Friday we get the all-important USDA planting intentions and quarterly grain stocks report which we rank as the 3rd most important reports of the year and can be market moving. The average trade guesses on acreage are larger than the Outlook Forum numbers and leaning too high for both corn and soybeans while the stocks estimates show U.S. corn, wheat, and soybean inventories are tighter than a year ago.

The range of estimates for acres is tight while the range of estimates for grain stocks is wide which suggest someone will get surprised!

Trade sees 2023 U.S. corn plantings up 2.6% Y/Y, soybeans up 0.9% and all wheat up 6.8% ahead of USDA's March 31 report. The soybean range - it's the narrowest in at least 16 years and much smaller than in recent years. Range of trade guesses for soybeans is 2.3 mil acres - smallest since at least 2007. Corn range is much better at 4.4 mil acres - the largest since 2009. March corn acres have landed outside the range of analyst estimates in 6 of the last 7 years and the USDA farmer survey tends to underestimate acres.

The last time March corn and soy acres both landed within the pre-report ranges of trade estimates was in 2015. The last time March corn and soy acres both landed within 1% of the average trade estimates was in 2011.

This report’s accuracy has been challenged in the past by weather & prices. For example, in 2019, in the Planting Intentions report, USDA overestimated corn acres by 3.1 million and soybean acres by 8.5 million because the planting season turned out to be too wet. The COVID-19 anomaly year of 2020 had anxiety over fall corn prices which caused eventual (planted) corn acreage to shrink to 90.7 mil from 97 mil acres in the Planting Intentions survey.

With the sentiment turning bullish after a U.S. western banking crisis, we maybe setting up for a bullish upside surprise and the potential for a limit up move.

Did the 2-week farmer survey at the start of March from The USDA buy any acres as prices were falling? For the most part many are sticking to a rotation but with falling fertilizer prices, better productivity and profitability and a better crop insurance price in corn farmers are favoring more corn acres? But our source is saying the corn acres are not there and more SRW wheat acres in the ECB says at the end of the day soybeans will be left with less acres!

These were just a few snippets of their full write up, click here for their full write up and check out their website for some of their other stuff

History of Seasonal Rallies

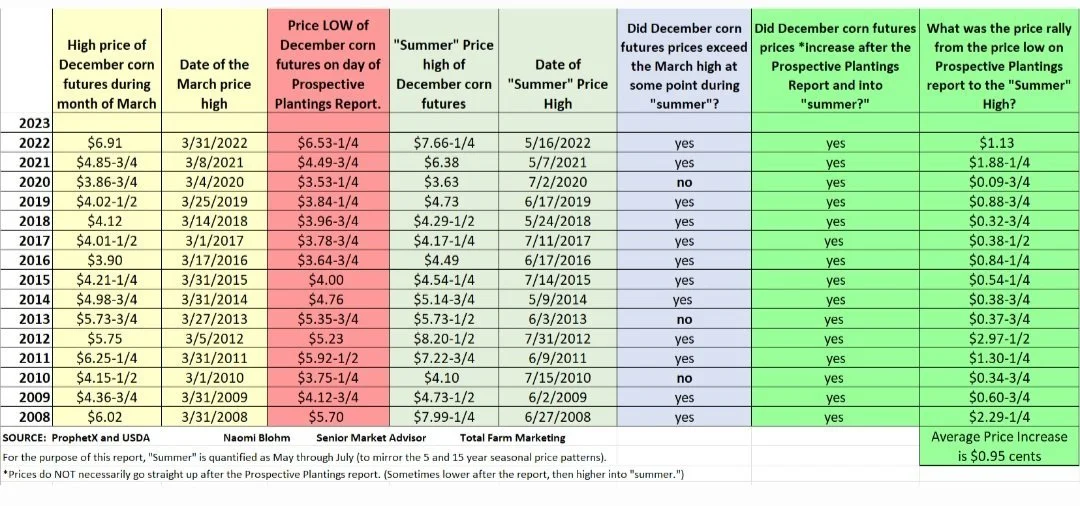

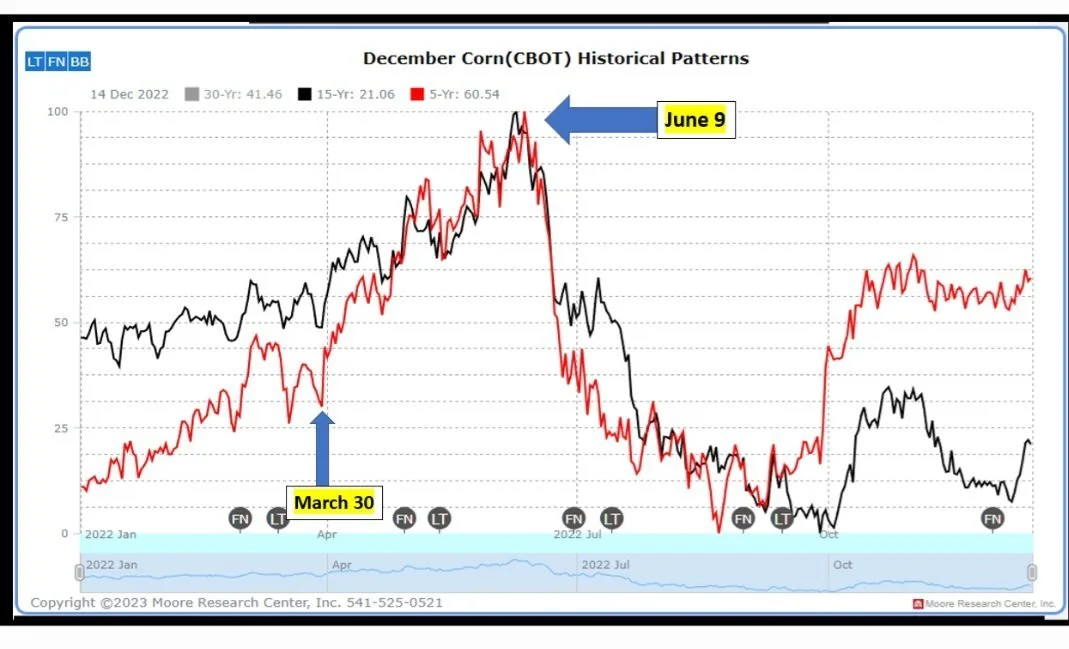

Corn 🌽

10 of the past 15 years the corn rally has started after the Prospective Planting report.

The 15-year average price rally from the low of the Prospective Plantings report to the summer high is $0.95 cents.

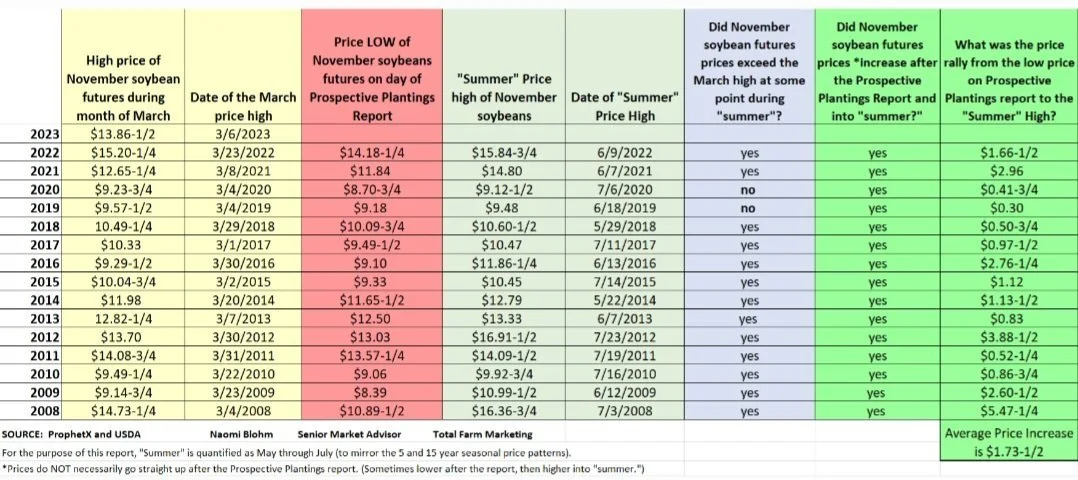

Beans 🌱

The past 10 of 15 years the rally has also started after the Prospective Plantings report.

The 15-year average price rally from the low on the Prospective Plantings report day to the summer high is $1.73

Will this year follow suite?

Check Out Past Updates

3/29/23 - Market Update

Beans Extend 4-Day Rally

Read More

3/28/23 - Audio Commentary

Is Momentum Changing in the Markets?

3/27/23 - Market Update

Grains Continue Their Rebound

3/26/23 - Weekly Grain Newsletter

What Have Funds Already Factored In?

3/24/23 - Audio & Market Update

Russia Halting Wheat & Sunflower Exports?

3/23/23 - Audio Commentary

Chinese vs The Funds

3/19/23 - Weekly Grain Newsletter

Mother Nature & Black Swans

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

U.S. Weather

Source: National Weather Service