HOW THE USDA REPORT WAS A GAME CHANGER

WEEKLY GRAIN NEWSLETTER

Some not so fearless comments for www.dailymarketminute.com

On Friday we got the big USDA Acre and Stocks report.

Here are the numbers:

As you can see we had a few surprises as we saw corn and bean stocks come in below estimates. While corn acres came in above estimates, and spring wheat and beans came in below the estimates.

My big takeaway from the report is that we tightened up our old crop balance sheets even more, so not only do we have a lot less grain then the past couple years, we continue to see our usage pace via quarterly stocks report be higher than the market estimated. Which opens the doors to carryover numbers tightening even further.

Corn came at 70 million less than estimated while beans came in at. 57 million below estimates. Those numbers themselves don’t sound that big, but for beans it was around 20-25% of our carryout. While for corn the number is supportive, but things can be really interesting if we can continue to follow up with strong Chinese demand and exports in the second part of the marketing year.

As basically with our stocks coming in below estimates it likely means we have an adjustment to feed usage in the future.

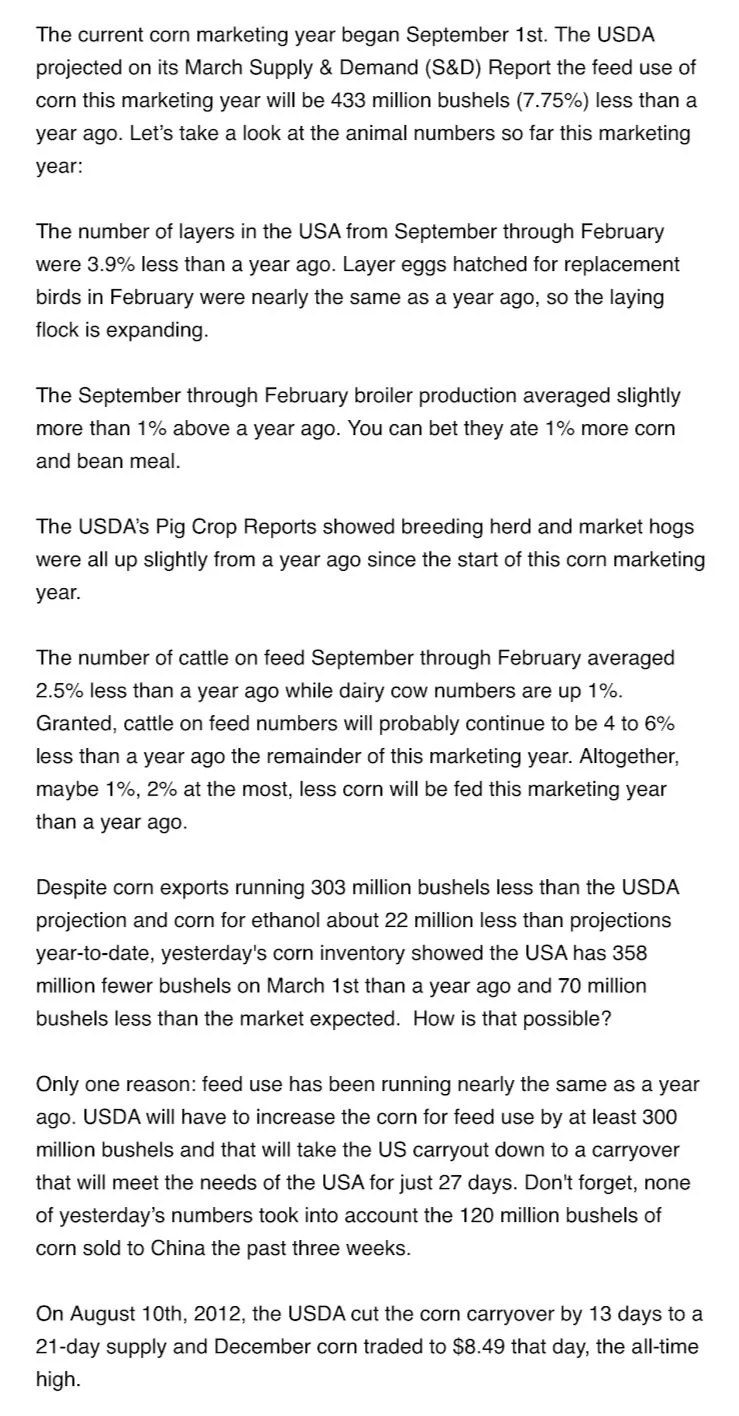

Here is what Wright on the Market wrote about it a couple days ago.

Here is what he wrote about beans.

As for our thoughts, we feel the doors are open to the possibility that Chinese corn demand remains strong and continues at present pace and the USDA is forced to adjust our export sales higher in the future. So if Mr. Wright is right on the feed usage being understated by 300 million all of the sudden we slide under a billion bushels carryout which with our build up usage/demand simply is not enough supply.

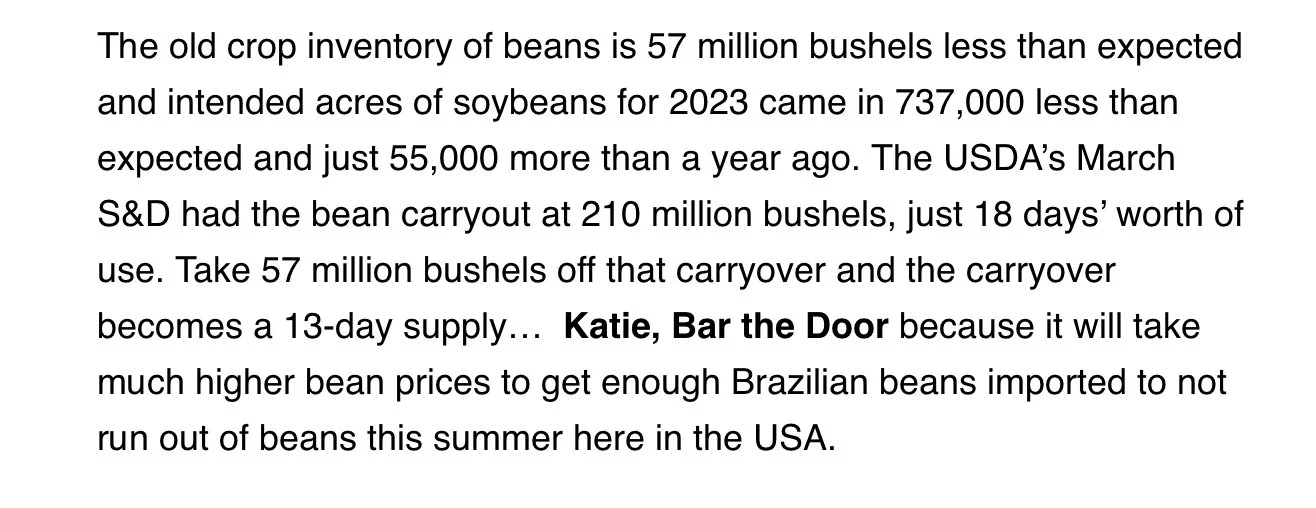

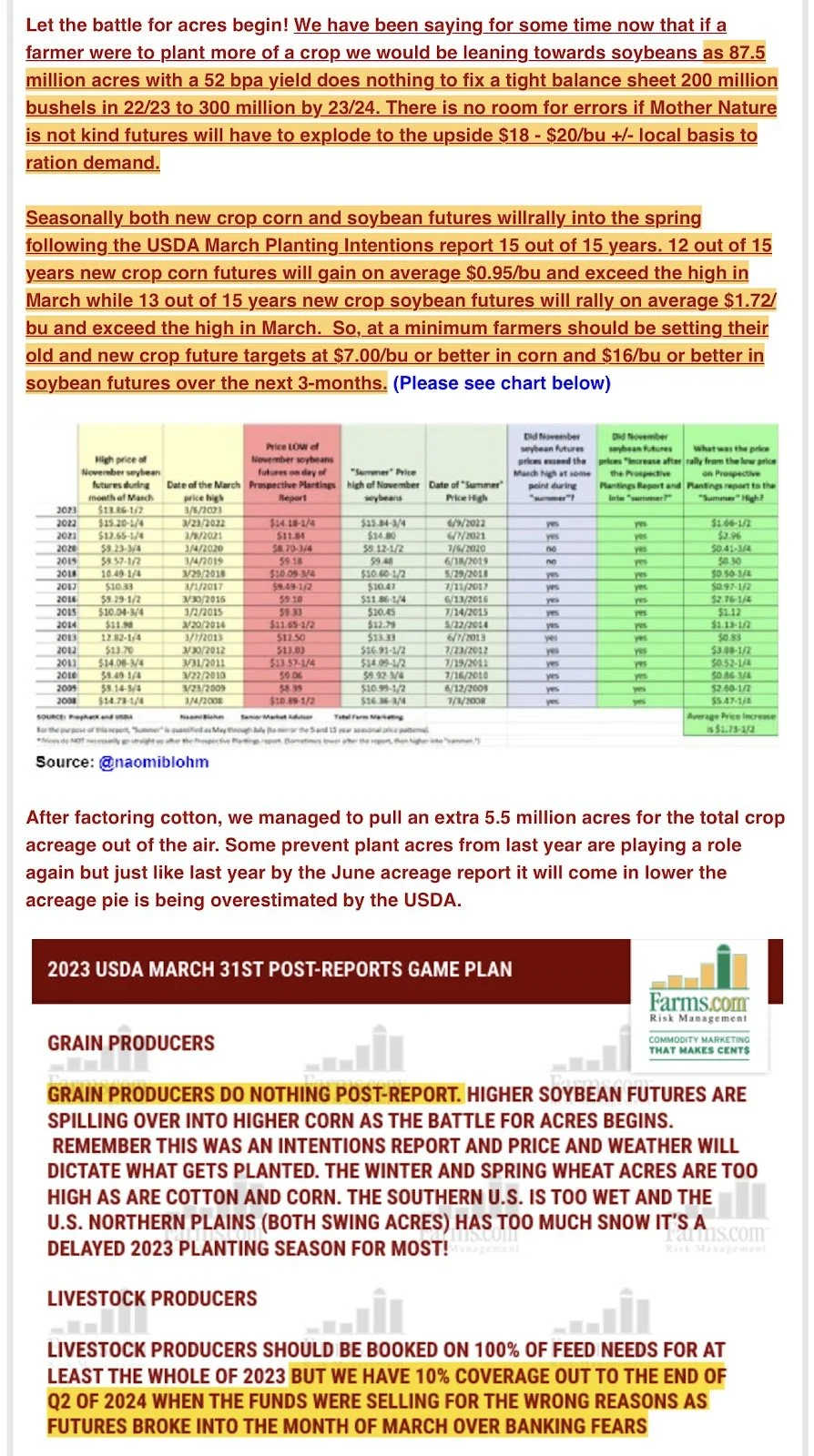

Here is what Farms.com Risk Management had to say.

The bottom line is that we just had a USDA report that confirmed what we have thought for some time and that is that our grain stocks are very tight. Much tighter than a year ago.

The question is we will see our markets rally on our carryout tightness if the acres come in as big as they are estimated at.

My thoughts on acres are that we really still have at least a 5 million range of what actual planted acres will be for corn and beans each. And if we see Mother Nature continue to be volatile we could still see acres much higher or lower than estimated.

I think by the time the end of June rolls around there is a good chance that acres are lower in corn, beans, and spring wheat just to prevent planting. My present prediction for acres is 89 million corn, 87 million beans and spring wheat 1-3 million less than what the estimates were.

I think the USDA printed numbers last week that helped keep panic from becoming side spread for food shortages. Because the reality is if we only get 90 million acres and we get some hiccups in production and yield like I think we could we open the price possibilities so high that we could break several elevators via margin calls and interest.

The probability of trading back over 7.00 corn is 80% in my opinion. With 8.00 corn having a ⅔ chance of happening, while about a ¼ chance of seeing prices explode to well over 10 per bushel.

The focus will be on weather, first off will Mother Nature let us put anything in? Then shortly after it will become about how hot and dry areas are. If we see ridge building and get similarity to 2012 or even 1976 we will be off to the races. Whether the acre number ends up 95 or 85 million is very important but it will be a wide moving average with most thinking 90-92 is the present number. A 4-5 million acre shift is nearly the whole US carryout.

So the acre number estimate is in and now it will get adjusted based on weather, price fluctuations, and other considerations that farmers think about before making the final decision.

If our old crop stocks would have got comfortable or bigger that would have taken away a little of the importance of growing and planting conditions instead it just added more bang for your buck. Plus these weather issues are still out there for other areas in the world, such as the Brazil second corn crop and the India wheat crop. Not to mention that the forecasts are already for Australia to be down nearly ⅓ from the present record crop.

We mentioned last week that we thought this report was a game changer, it didn’t change my views, but I could see this report leading to those that made previous sales now potentially getting worried about selling early. So what do you do if you made previous sales?

So what do you do if you made previous sales?

You can just leave your sales or hedges as you have them, as there was a reason you made them in the first place. Or you can lift them, which we recommend ahead of this report. Or you can use options to help quantify your risk, should we get all of the stars to continue to align and get runaway new all time high prices in the future.

But the bottom line is you have to be comfortable with the strategy you use and ideally you already have considered possible follow up adjustments ahead of making a new crop sale, so that you already know what you are going to do. Every operation is different and grain marketing isn't one size fits all.

Just as important as if you adjust your present sales/hedges is what your follow up will be to that adjustment.

So as an example say you have some new crop corn sold, and you decide to lift the hedge, locking in a loss. What will you do if all of the sudden the market starts going back down? What if it goes below your organical sales level, that now also has a loss attached to it?

What if you take hedges off, and the market runs up like you think. How will you make sure to not just watch it go up and then simply go back down, thus leaving you missing the price rally?

Typically we want to use triggers, such as seasonal dates tied to technical factors that are easily quantifiable. But sometimes we like to get a little complicated and add fundamental factor changes such as balance sheet trends.

Historically we see plenty of reversals in prices when we get a few reports in a row going one direction, leaving everything priced in.

The bottom line is if you have a marketing plan, and you give yourself flexibility to change it in the future make sure you also have a follow up plan of action.

I also mentioned last week that we would give you the simple strategy that typically out produces the market highs.

What that typically includes is selling puts and buying calls in the spring or before the spring seasonal rally hits our markets. Then taking profits and reversing buying puts and selling calls after we have the seasonal rally and our crop size becomes known.

Over the years whether in simulations like Winning the Game programs, or doing actual marketing plans the use of those couple strategies helps one outperform prices in more years then not.

The other tool that adds icing to the cake but even more risk is the use of spreads and or where one places his short hedge at.

So that means that one will place a short hedge in an upfront month at some point instead of making a new crop sale. So what typically happens in our markets is we start off with small inverses crop year to crop year.. Then when things get scary in terms of production buyers typically start to panic and farmers stop selling. That will take the old crop higher than the new crop, and the 2nd. year crop higher than the third year crop. At some point those spreads then collapse and many times we go from an inverse to a carry market.

When I worked at CHS we allowed rolling HTA from various months. I had one farmer that 4 years in a row just via where he placed his HTA, getting 30-70 cents higher than the crop year high just with that strategy.

Know that this strategy as well as the option strategy has plenty of risk in it, so I am not going to even put out how or where I would consider placing hedges today. But in the near future when we will the time is right for a possible reversal or market capulation we will communicate it to our subscribers, we do just have to caution that it needs to have good follow up because just because it has worked great in the past doesn’t mean it will in the future and the risk can be huge if not managed properly.

Please don’t go and blindly follow these generic strategies that historically have been very successful, make sure you consider the risk and understand the potential. Also consider part of them before utilizing all of them at once. The strategy that Wright on the Market utilizes to help achieve prices higher than the highs is simply buying puts on the way down. After he has already made sales and believe it or not this simple strategy also historically works.

Technically most of our charts look fairly decent, but most are simply sideways, so we will need to see momentum and bust out in the coming months if our predictions for new all-time highs are going to come to fruition.

Sunflower Acres

Sunflower acres are projected to be down 20% from a year ago. Hopefully this will help stabilize that market a little bit, because it has been struggling with more supply then present demand.

One thing to keep an eye on will be the storms that are forecasted in parts of the upper plains such as SD and ND. With the snow pack and cool temps we are falling further behind daily. Will it be materially impacting our acres?

Only time will tell, but it is something to watch. The big sleeper is MPLS wheat, which could be very interesting if we don’t get many acres in.

On Monday we will get some crop conditions and planting progress reports.

Here is a link to a good article from www.GrainStats.com it gives more information on planting intentions.

Check it out here:

https://www.blog.grainstats.com/p/occupy-agriculture

Here are a few more interesting articles you can check out:

- Why Is China so Focused on Food Security?

- India's Extreme Heat Waves Impact on Agriculture.

Charts

Corn 🌽

We finally reached that $6.60 level I had been talking about for the past week or so. Next upside target would be that upper trendline. Past that bulls would like to go and retest our previous highs from earlier in the year.

Beans 🌱

With Friday's rally, beans ripped through all resistance levels. Breaking out of the short term downtrend we had created. Now $1 off our lows just a week ago.

Wheat 🌾

Wheat didn’t follow corn and beans higher after the report. Bulls are still trying to break out of this long term downtrend. I would like to see us break that bottom trendline and break past the $7.13 range.

Past Updates

3/30/23 - Audio & Market Update

Are You Comfortable Heading into USDA Report?

Read More

3/29/23 - Market Update

Beans Extend 4-Day Rally

Read More

3/28/23 - Audio Commentary

Is Momentum Changing in the Markets?

3/27/23 - Market Update

Grains Continue Their Rebound

3/26/23 - Weekly Grain Newsletter

What Have Funds Already Factored In?

3/24/23 - Audio & Market Update

Russia Halting Wheat & Sunflower Exports?

3/23/23 - Audio Commentary

Chinese vs The Funds

3/19/23 - Weekly Grain Newsletter