ARGY FROST PULLS BEANS HIGHER

Overview

The biggest thing everyone was watching over the long weekend was the possible frost situation in Argentina as Argentina weather continues to steal the show in the markets. Over the weekend, it does look like parts of Argentina experienced some light to perhaps moderate unseasonal frost. Which has beans rallying here today. The extent of the damage probably won't be fully assessed for a few more days. To put this freeze into perspective, its like seeing a freeze around July or early August here in the midwest.

Outside of South American weather, all eyes will be on Thursday & Friday's USDA Ag Forum where 2023 acerage estimates will be released.

Another main headline is whether or not we see China aid Russia in war. As China is set to meet with Russia this week. The U.S. warned China not to help Russia. Ukraine said if China allies Russia in the war there could be serious problems ahead.

Later in Today's Update:

Photos and temps from Argy freeze

Education from Wright on the Markets

Read Yesterday's Weekly Grain Newsletter Here

Today's Main Takeaways

Corn

Corn closing 3 cents higher here today near the top of our daily range while closing a nickle off our lows.

The Argentina freeze situation didn’t have much of an impact on their corn like it did beans. Hence the little bit of weakness here today while beans rally.

Likely the biggest thing surrounding the corn market continues to be the delays to Brazil's second crop corn. Planting in Brazil currently sits around 40%, which is behind the 53% pace last year. While Mato Grosso sits at 50% complete vs lat year's 68%. Lastly, Parana is just a mere 12% complete. So ultimately I think this will continue to be a supportive factor for corn, but it's still a little early.

Aside from South America, traders will likely have a lot to digest this week, as we have the USDA Ag Forum on Thursday, which will provide first look at average estimates. But we won't get the more detailed numbers from the USDA until the end of March. One possible negative thing is that they are talking about more corn acres. We also have the Ukraine and Russia agreement set to expire on March 19th.

Outside markets haven’t been very supportive as of late, as crude oil continues to chop lower and the U.S. dollar continues to push to 5-week highs. Bulls would like to see these two roles reverse, as it would give the funds more incentive to push us higher.

Biggest things going forward to watch this week will be the USDA acre numbers, weather, war headlines, and the outside markets.

Looking at the charts, we remain in a sideways trend as we sit directly under our trendline. With stiff resistance still at the $6.85 level. Hopefully we can get some sort of news to push us out of this choppy trade, and the next week or two might just provide us with enough news to do so. Bulls are still optimistic that we get that break higher to test $7.

Corn May-23

Soybeans

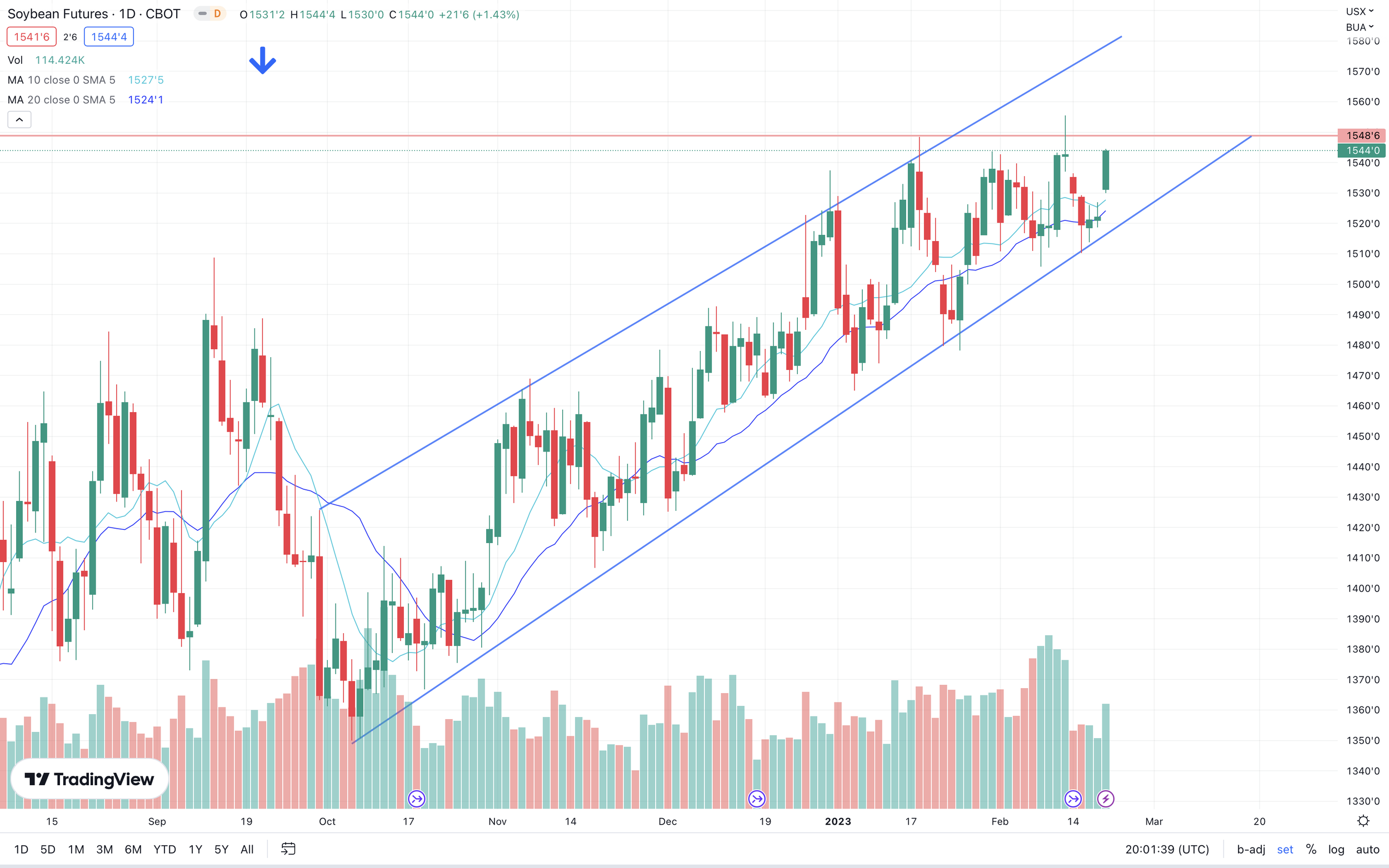

Soybeans rallying off the back of Argentina weather headlines once again. Last week we saw beans lose -15 cents, but we have quickly regained those losses with the freeze concerns. As May beans notch their highest close since June, as we go back to retest our recent highs.

Just when it felt like the drought headlines in Argentina were behind us, we get this bullish surprise. Reports are saying some areas experienced light to moderate freeze, but there isn't any actual numbers just quiet yet as to how much damage they actually had. But over the next week I'm sure we will get plenty of information. Some say that the drought is still the biggest issue for Argentina, which I would have to agree with.

Areas where the freeze hit were the driest areas. Frost creates more damage when the soil is dry rather than when it is wet, and it looks like temperatures will bounce back fast to nearly 100 degrees. So we have a crop that was under severe heat, put into freezing temps, and thrown back into the heat again. Crops don’t typically handle that very well.

Even though we don’t know the extent of damage, even just the thought of them receiving damage from this freeze is enough to push us higher. So know we need to watch out for the reports from the fields this week. Just how bad was it? If reports come out and say it was worse than they thought we could see us push past our recent highs. But there is also that chance that the damage was minimal. Bears also are making the argument that they think Brazil and Paraguay will offset the losses in Argentina.

Going forward, nearly everyone’s biggest concern with us seeing beans higher is Brazil's massive crop. But there is still plenty of logistic problems going on in Brazil with the heavy rains and dirt roads.

Dr. Cordonnier cut another 2 million metric tons from his Argentina bean estimate. Bringing it to 34.5 million. We also saw Rosario Grain Exhange drop theirs to 34.5 million. Both of which trail the USDA by quiet a ways, as the USDA's estimate is at 41 million. So the USDA likely still has some work to do in bringing these lower.

Similar to corn, another big headline surrounding both is the harvest delays to Brazilian beans, which is leading to delays in corn planting. The soybean harvest in Brazil did see good progression from last week. 8% to 25%. But is still lagging behind last year's 33%.

Lastly, we have to keep an eye on the relationship between the U.S. and China. As China is set to possibly meet with Putin this week, and the U.S. warned China to not get involved in helping Russia with the war. As China looks like they might be preparing to send weapons to Russia. This could create some conflict as the U.S. has been helping in sending aid and support to Ukraine in their war efforts.

Looking at the charts, we just notched another high close, as we look to test that recent resistance once again. Again, if we do get that massive break to the upside we have a huge gap.

Soybeans May-23

Soymeal

Soymeal May-23

Wheat

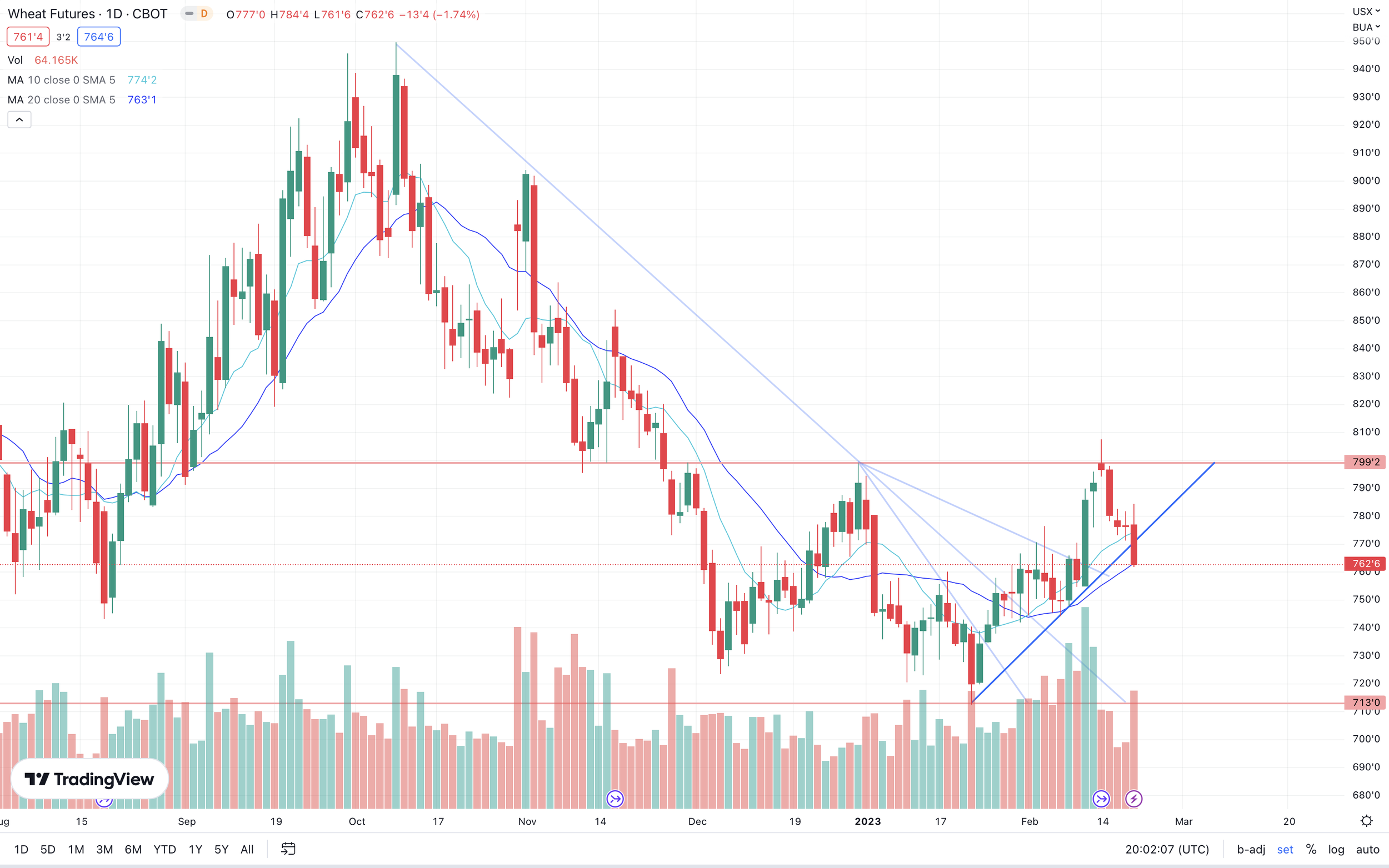

Wheat futures all trading lower here today with Chicago getting hit the hardest, down over 13 cents. KC and Minneapolis saw minimal losses of 2 to 5 cents.

As we are now 2 days away from the war anniversary, the biggest headline even a year later for wheat is of course war. As well as the ongoing discussion as to whether or not Russia will opt to renew the Black Sea agreement. The deal is now just a few weeks from expiring. Russia has said they are unhappy with the deal, and have made threats not to renew it. But we will just have to wait and see what they actually decide to do.

Today we will also see Putin reveal his military operation plans. If he’s not ending the war, we will likely see this support prices. Many including myself still think we might see some fireworks soon that will ultimately shake things up. There has been a ton of rumors swirling around that Russia is moving around a large number of troops to perhaps escalate things.

Something to also note, I mentioned the China and Russia rumors earlier. But Zelensky of Ukraine said; "If China allies itself with Russia, there will be World War 3."

To add on to that, we have Chinese officials set to meet with Russia leaders this week. So the next few weeks could definitely be an interesting one.

Adding pressure, we have increased precipitation in the southern plains as many areas are still suffering from drought. One of the biggest reasons for us being lower today was demand and news that Australia and Chinese trade relations have shown signs of improvement.

Bears also keep pointing at Russia and Australia looking at potential record crops and India considering reinstating wheat exports.

Overall with the war, I still can't help but have a bullish tilt, with the possibility of escalation at any moment causing a short covering rally. Taking a look at the chart, we did break our recent uptrend, but still sit well above our earlier downtrend from October. KC on the other hand still sits in a clear uptrend.

Chicago March-23

KC March-23

MPLS March-23

Education From Wright on the Market

Here are two great right ups from Roger over at Wright on the Market. I highly recommend giving them a visit at wrightonthemarket.com

Here is what his write up said;

Question from a client:

"Don't take my critical view as an offense. I'm trying to understand.

The Weekly Basis email states (paraphrase) the 4 locations are offering a firmer basis (widened) for fall delivery. 2023 being more firm than 2022 insinuates a lower demand correct?"

Good afternoon, Levi,

Let’s define the terms describing changes in basis to make sure we are talking the same language. The first thing is to never refer to the basis as widening, more wide, less wide, etc.

Why?

If a merchandiser moves his basis from 20 under to 25 under, that would be “wider” (greater distance from a zero basis) and bad for the farmer.

If a merchandiser moves his basis from 20 over to 25 over, that would also be “wider”, but good for the farmer.

We want to know if a basis change is good or bad for the farmer and wider, widened, more wide, etc just does not do the job.

Therefore, we use firm, firmer, firmed, and weak, weaker, weakened.

If a merchandiser moves his basis from 20 under to 25 under, that would be a weaker basis and everyone would know that was bad for the farmer. Yea, it is wider, but so was the +20 to +25, which is good for farmers. That would be a 5¢ firmer basis.

Why are predictions in May for a corn futures of 7.00-7.60 for corn and beans for Nov futures $16 in June.

There are many, many factors which contribute to our conclusions of market outlook. All the market highlights and tidbits we send you are intended to keep you abreast of the dozens of some major, but mostly minor facts, any one of which, by itself, is not important. However, if the majority of those tidbits are bullish or bearish, they, together, will move the market. We send those tidbits to you so you can make an informed marketing decision. Yes, we will tell you what we think you should do, but the most important thing is for you have the market facts to combine with the particulars of your operation to make an informed marketing decision of what is best for your operation.

Many people do not vote in elections because they think their vote is not important, but, together, those votes determine who will lead our local, state, and federal government and those are the people who will set the rules and laws that determine the quality of our lives. Hundreds of non-important facts do move the grain markets.

Our price and timing expectations are the sum of all the technical (math calculations, cycles) tidbits, fundamental (supply and demand) tidbits, and seasonal price considerations.

One of those tidbits is the more firm fall delivery basis this year versus last year.

All four locations already are offering a firmer basis for fall delivery this year than last year for both corn and beans. Basis is the throttle by which merchandisers control the flow of grain into their facility. If they want more grain coming in than they are receiving, they will firm the basis. If they want less grain arriving, they will weaken the basis.

Since all four locations have a firmer basis, it means all four of them think they will have to pay more for corn and beans this fall than last fall to get the amount of bushels they will need.

Does that mean they think 2023 crop production will be less? With La Niña fading away, a reasonable person has to expect better weather and better yields. We think the firmer fall delivery basis means they expect to have a need for more bushels this fall than last fall. For that stronger demand indication to be shown three months before the crops are planted… Wow, I don’t care what anybody says, that firmer than a year ago fall basis bid is a mighty bullish tidbits.

"Hi Roger

I do have a question from an email last week that compared fall delivery bean basis into Sidney, Ohio to a year ago. That is the location where we deliver all our soybeans. We typically set fall delivery basis in July or August. Do you think this fall basis will improve or should we consider setting basis on some of the fall delivered beans at this very early time?

I'm sure you know, Sidney Cargill has been undergoing expansion to double their crush and should be open to full capacity by fall.

Thanks in advance!"

Good afternoon, Sadie,

No matter what basis is bid now for new crop fall delivery, those merchandisers expect the basis to be firmer for that delivery period.

If you were a merchandiser for Sidney Cargill, your job would be to buy beans on as weak a basis as possible and still keep the crushers running. Would your basis bid be on the firm side of your range of basis expectations or on the weak side? Given you (as a merchandiser) do not need the beans now and cannot get the beans until fall, of course, you would low-ball the basis bid. That is the job of a merchandiser and Cargill's merchandisers do their job well.

No merchandiser is going to make his top basis bid eight months before he needs the beans. Given what we know now, continue to set fall delivery basis late July and early August because seasonally, that is when the basis for fall delivery is as firm it will get. If SAF gets warmed-up by late 2023 or the crop is just a little bit short in your area, you will see a much firmer basis for fall delivery than currently offered.

Photos From Argy Frost

Here is some freezing temps experienced in Argentina

(0 Degrees C = 32 Degrees F)

Berrotaran: - 1.0°C

AZR La Dormida: -1.5°C

Paso Cabral: -1.2°0

La Cruz: -2.1°C

AZR Elena: -2.8°C

Tancacha: -0.1°0

Rio de los Sauces: 0°C

Gigena: 0.3°C

B Las Gamas: 1.0°C

Hernando: 1.0°C

Almafuerte: 1.8°C

Rio: 1.9°C

48 Hours After

South America Update

Argentina

Corn

45% rated poor to very poor.

11% rated good to excellent

Beans

56% rated poor too very poor.

Just 9% rated good to excellent.

Brazil

Corn

40% planted vs 53% last year.

Beans

25% harvested vs 33% last year.

Highlights & News

Biden visited Ukraine this weekend and promised more financial support to help with war.

The U.S. warned China not to help provide lethal support to Russia.

64% of Americans are living pay check to pay check according to CNBC.

Argentina inflation rises to nearly 99%, the highest since 1991.

Argentina reports new cases of Bird Flu.

China plans to buy 20,000 metric tons of pork for reserves.

U.S. weekly export inspections today were all in line with trade expectations, so nothing surprising there.

Livestock

Live Cattle dup +0.450 to 165.100

Feeder Cattle up +0.350 to 186.875

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service