WAS BEAN FREEZE THE BULLISH WILD CARD WE’VE BEEN WAITING FOR

WEEKLY GRAIN NEWSLETTER

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

Another week of not much happening for the grain markets. But was that the real story? Or did the market leave us with some hints of the future?

#AgTwitter

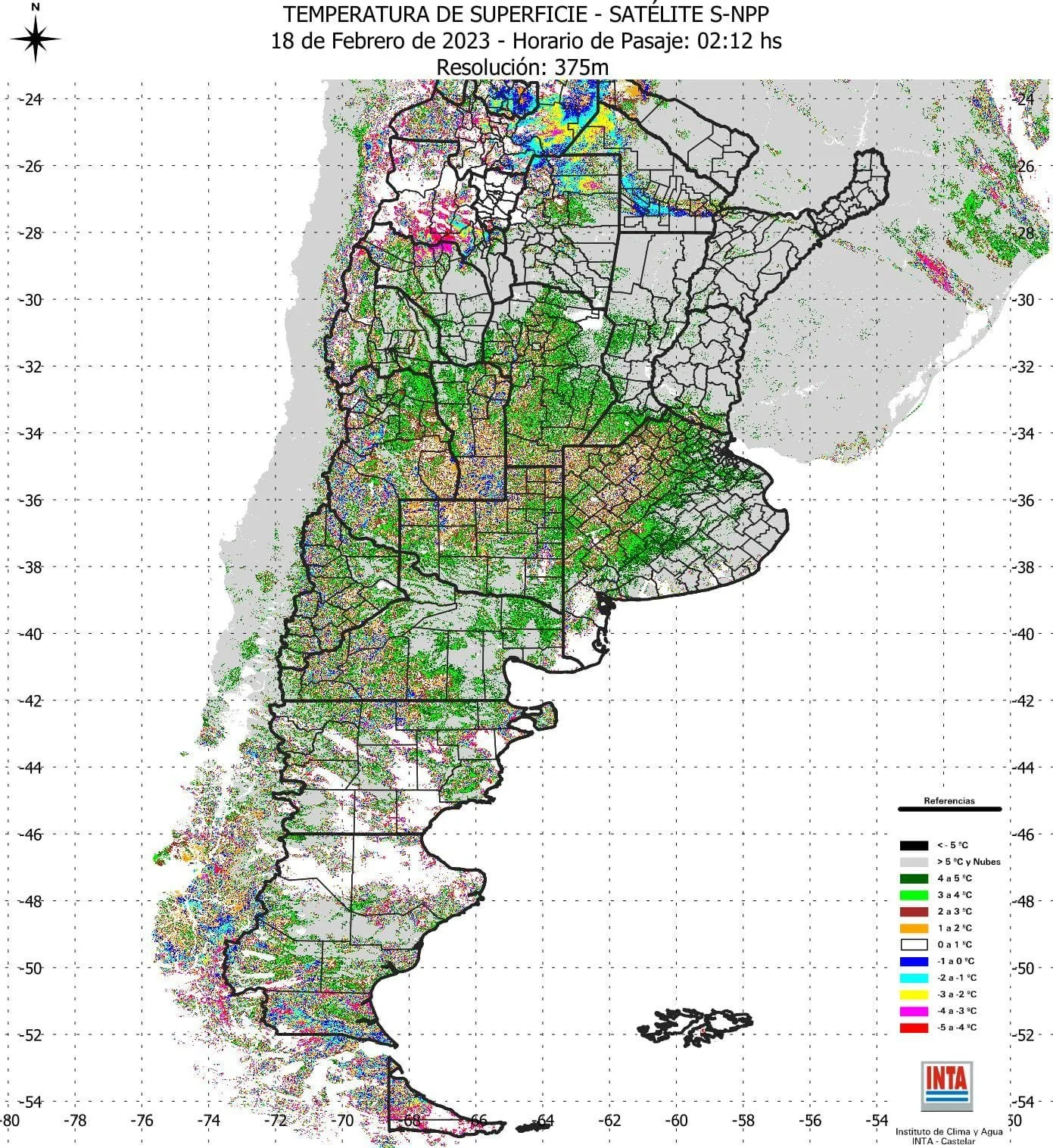

has seen numerous posts regarding the freeze in Argentina that recently happened. Most map reports don’t show that it got cold enough to do much damage. But there are also reports that as many as 5-10 million acres got hit with major damage.

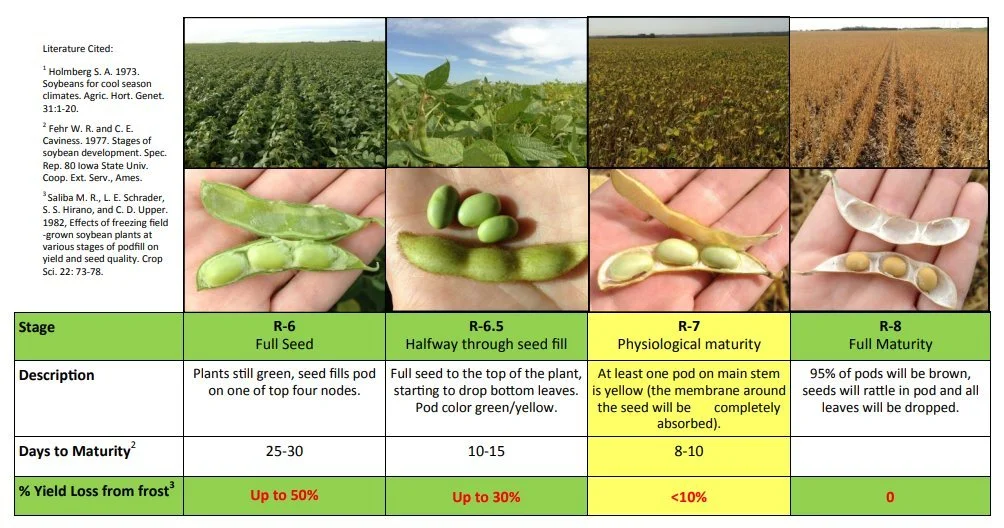

Here is a chart from Twitter showing the possible damage based on maturity.

The thing that we don’t know is what stages and how cold it actually got to. I did see some that think this will add dollars to beans. I think soybeans can go a few dollars higher but I think it will take some time and I don’t know if the market will react that strongly to the freeze, at least not until you see confirmation of damages which according to my sources will take a few days.

I do know that when I googled “Argentina soybean frost damage” what came up was articles from various years. But the date on the articles is what I was interested in. In 2019 one article was from March 12th, but the vast majority of the articles other than ones the past few days were from late March to early May, with the majority being early April.

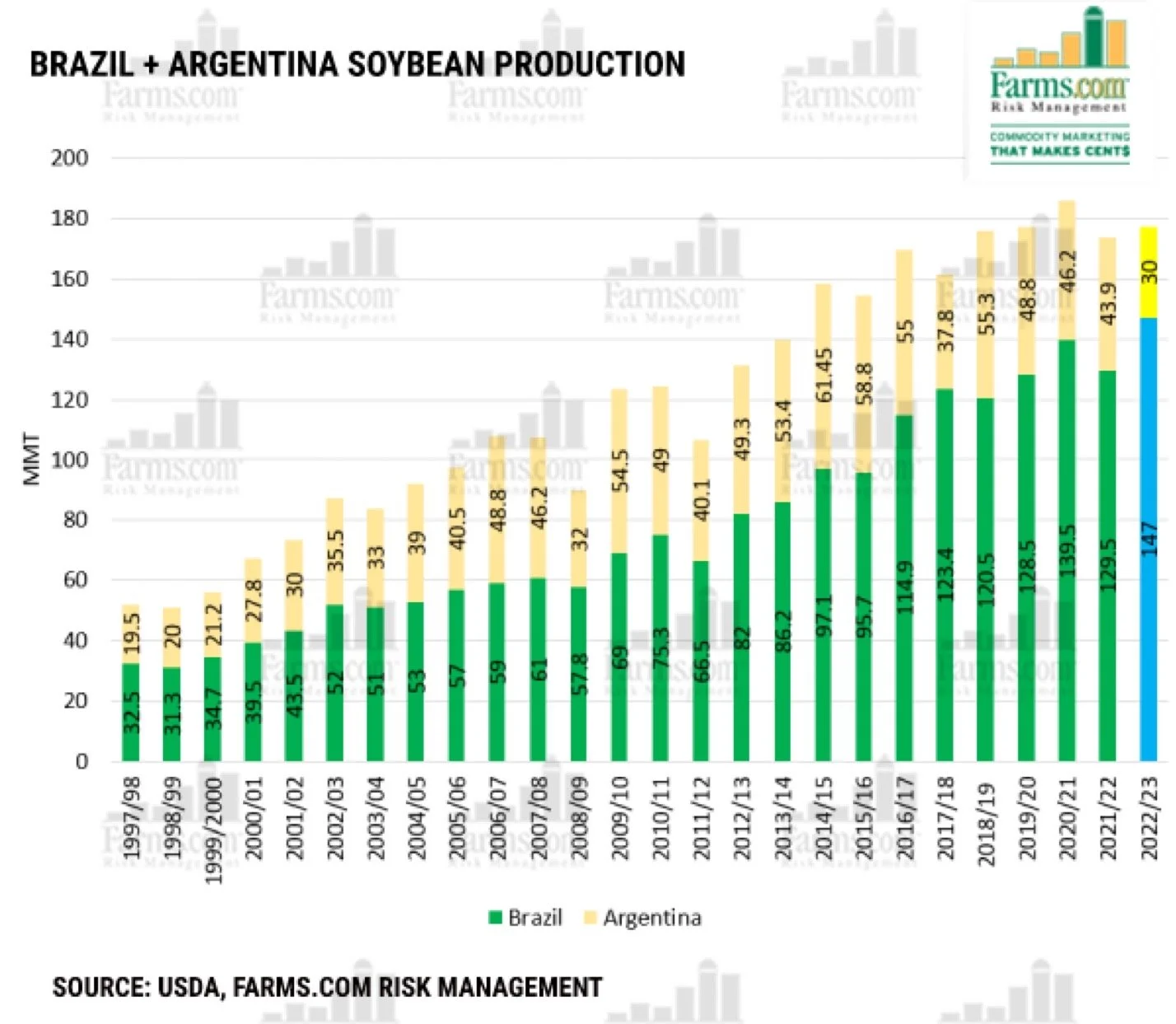

So I do think that the Argentina soybean crop just went under 30 MMT. If you combine that with Brazil, we will be down year over year, even if Brazil comes in slightly higher then it is presently estimated at. But with all of the acres for us not to have a year over year record really says something.

It tells me we once again won’t have enough supply at the right places.

Can you have your cake and eat it too?

I hear this saying all the time, but the reality is that I think in grain marketing we can have our cake and eat it too. I think we can have good yields with good prices. As a matter of a fact I think we can have record yields with all time high prices. That sounds like a stretch when one writes it down on paper, but the reality is that is happening presently in India for wheat, where they have all time high prices despite a record crop.

I think the key to being able to have cake and eat it too comes back to demand. If demand is strong we can have both, without demand along with an increase of supply we don’t get both.

In my opinion demand has yet to be curbed nearly as much as it is needed to slow demand down. Plus I think longer term we will be seeing a boomerang in Chinese demand in the second half of 2023.

50% OFF PRESIDENT’S DAY SALE ENDS TONIGHT

For those of you on a trial, this is just a reminder that our sale ends tonight. Get half off monthly or yearly.

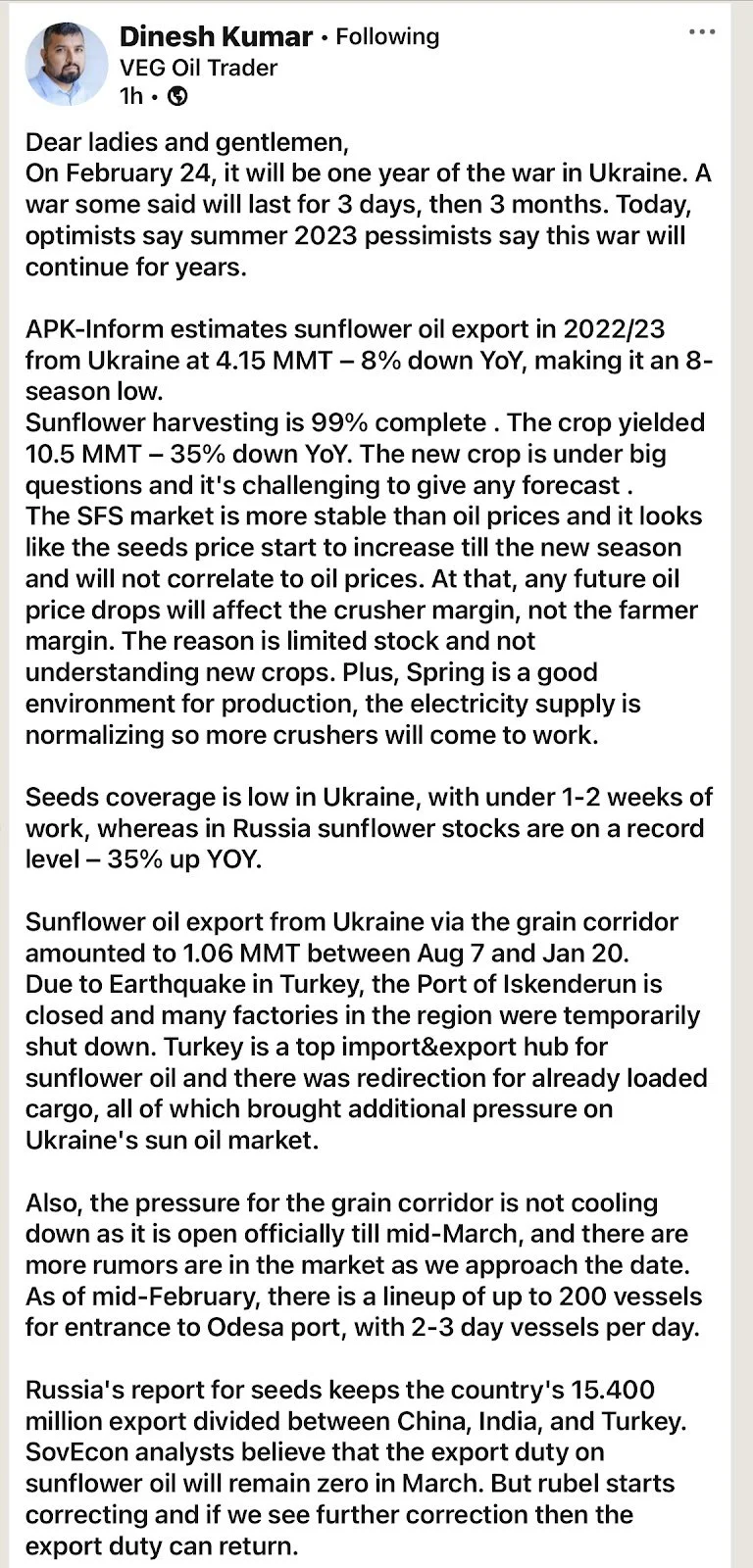

From LinkedIn. Notice the sunflower crop in Ukraine is down 35% year over year. That would be like losing 3 of our whole US crops. That doesn’t mean we have to rally sunflowers, but I think eventually we do once we get into the field and slow down the supply that is presently allowing buyers to simply drop bids almost daily.

This is also from Linked In. Where it mentions that the processing industry in Ukraine has lost about a third of it’s seeds.

Next is from Farms.com Risk Management, notice they have Brazil and Argentina production not at a record. If our biggest competitor doesn’t have a record crop and it is down from a couple of years ago why wouldn’t we see prices do what they have the past couple of years? Especially if world demand is up, which it is. Especially considering our crush margins and the climate scam focus that has us using more renewable fuels like soybean oil for diesel.

Here is a map showing low temps. It doesn’t appear like the damage was widespread.

Here is a field showing some of the possible damage.

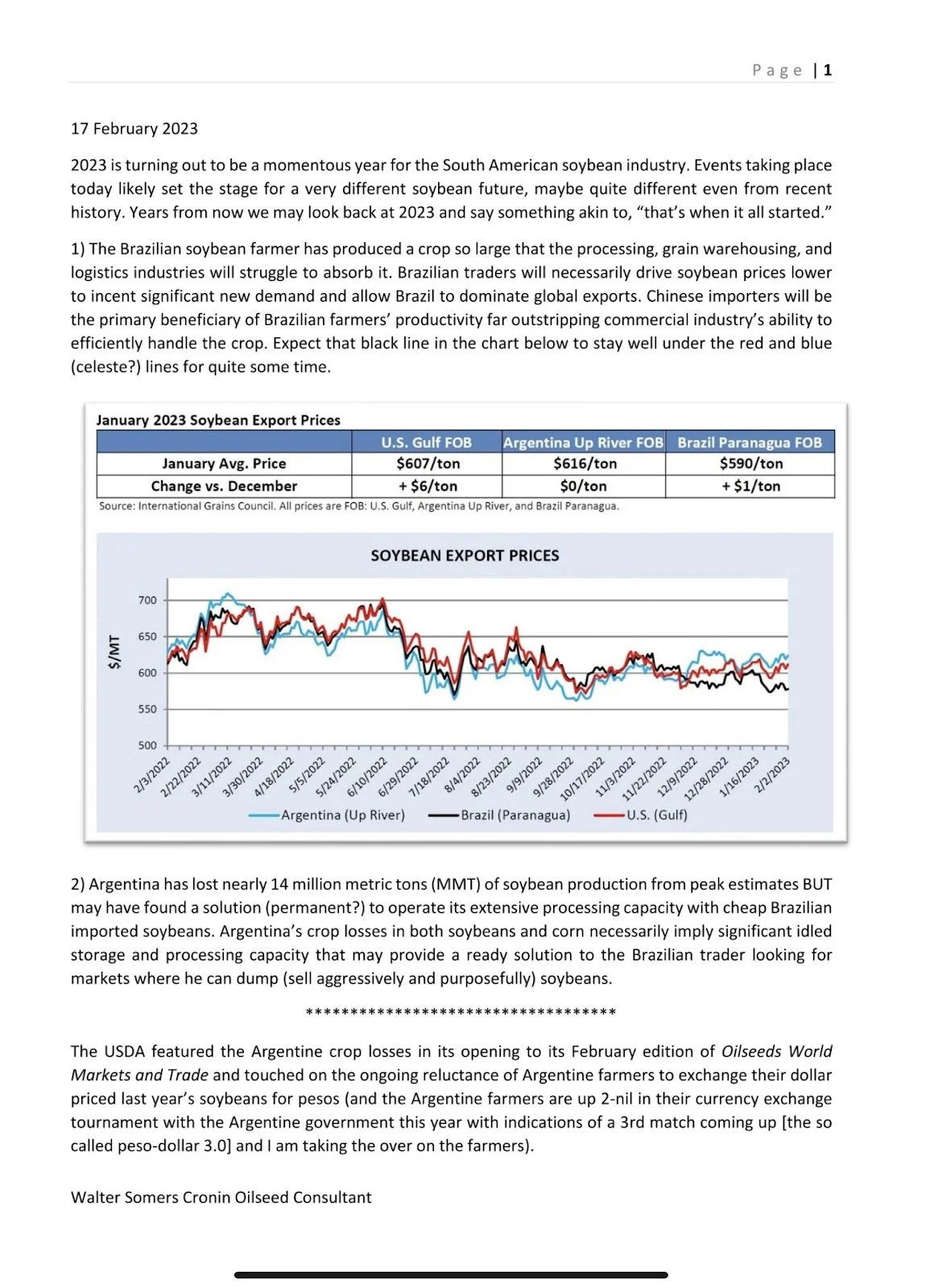

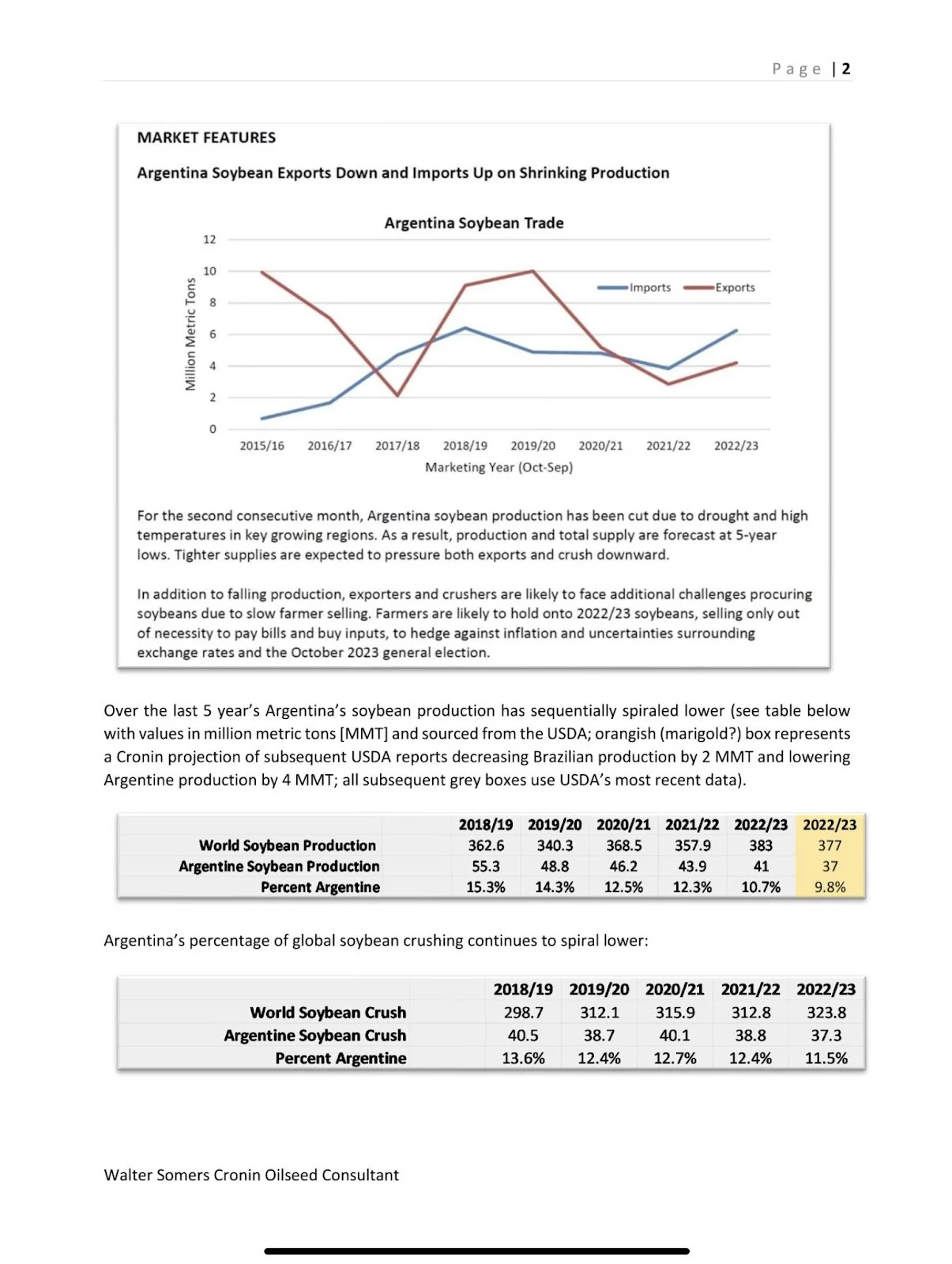

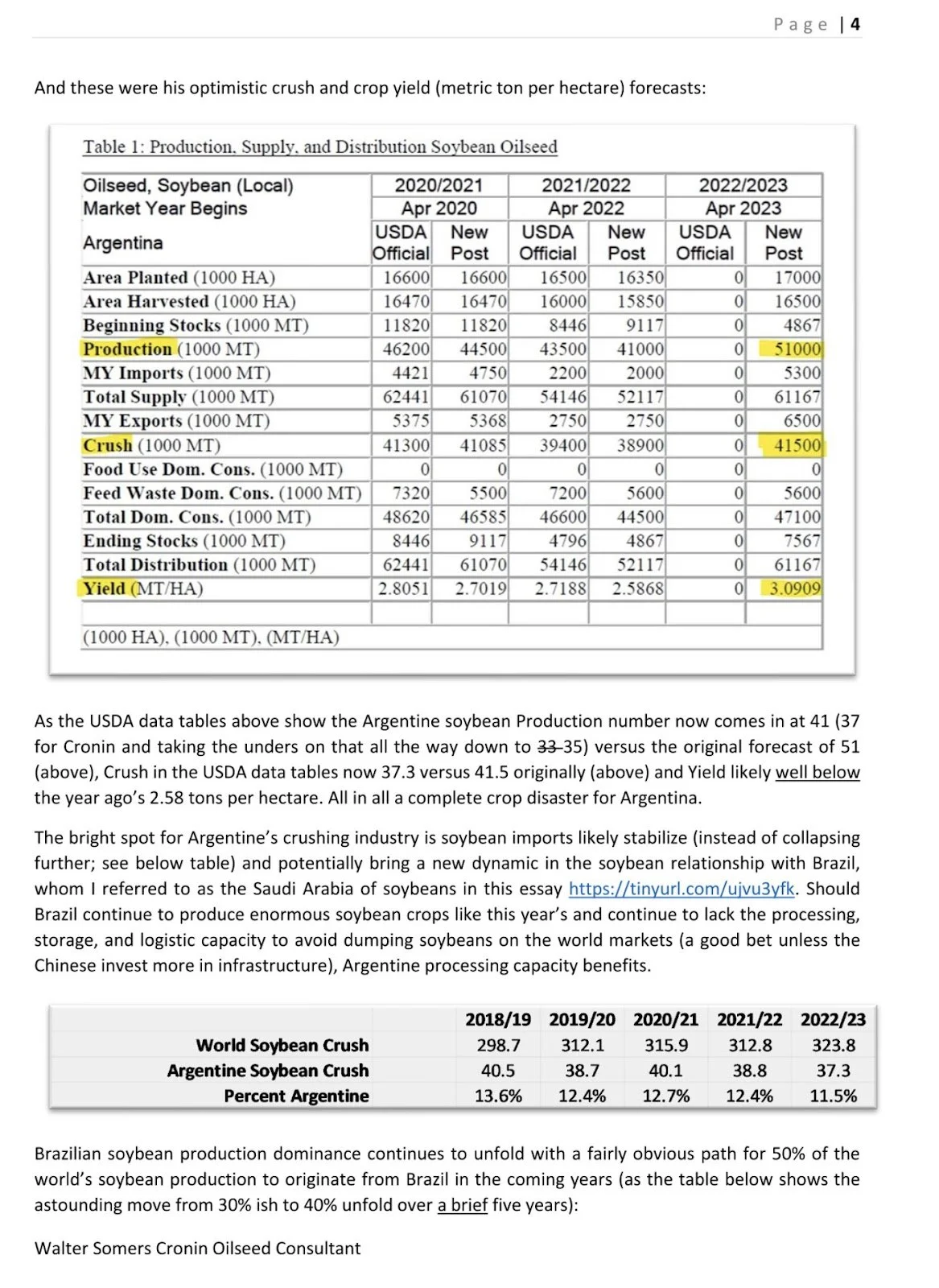

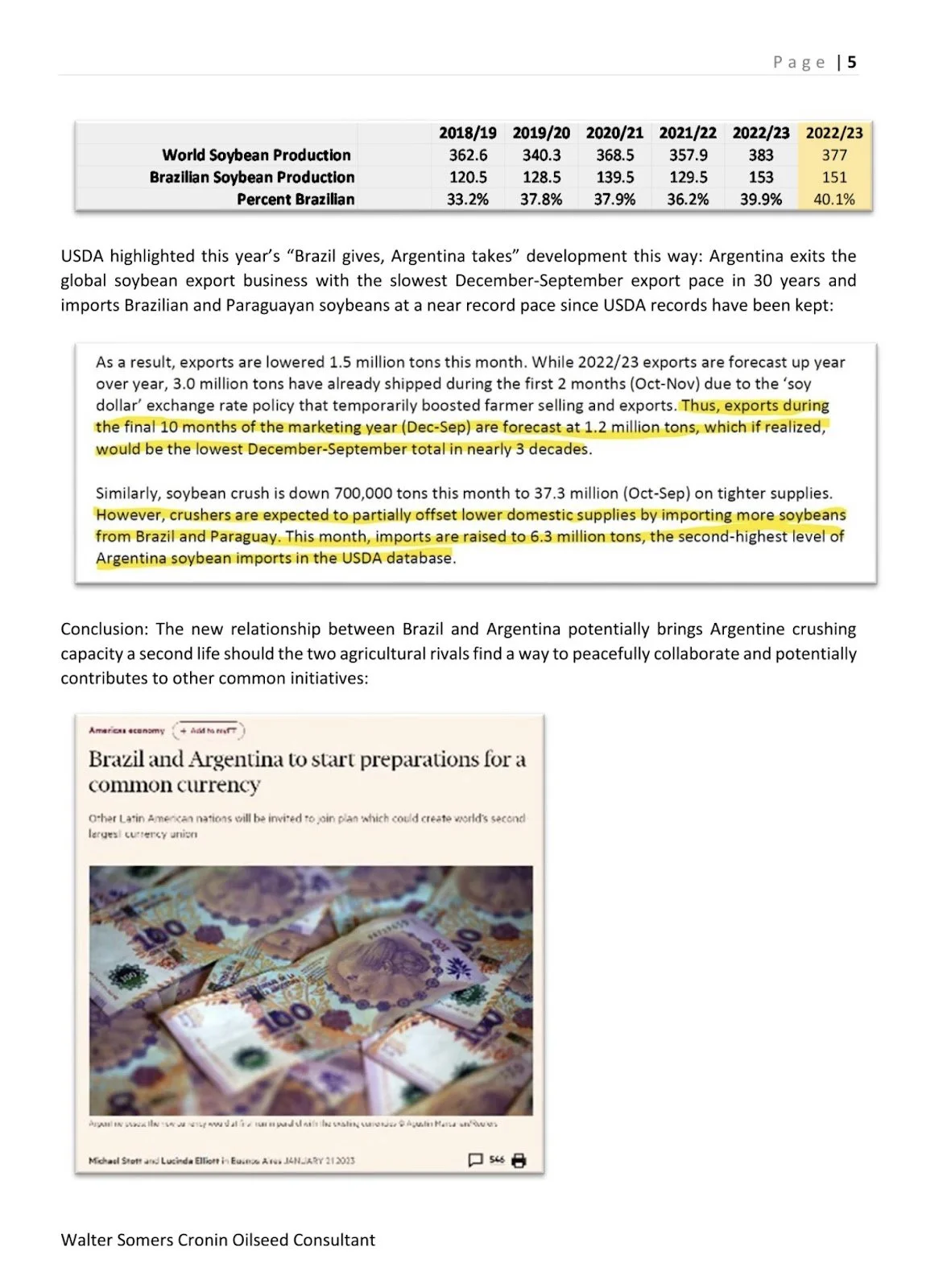

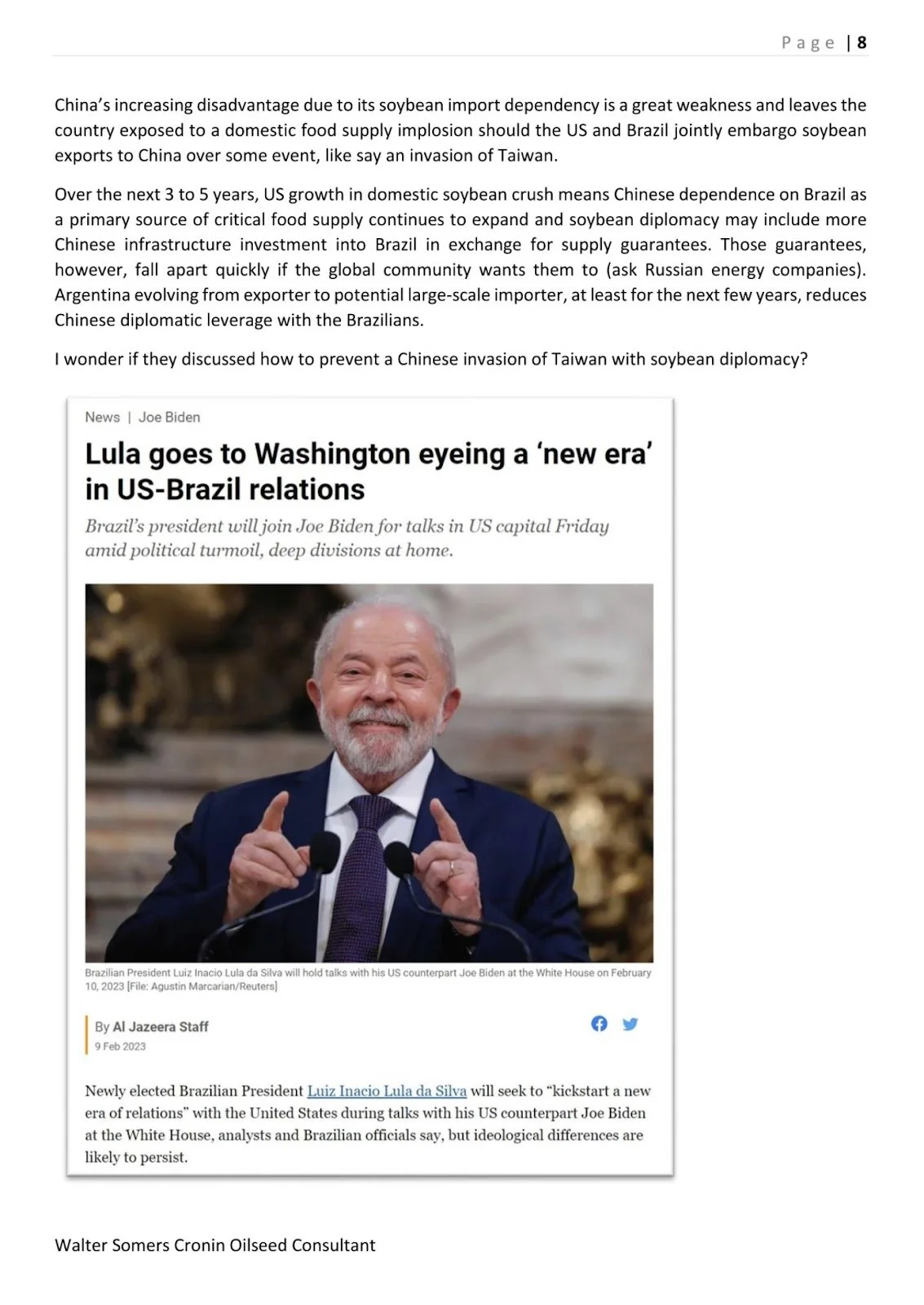

Here is a great write up from Walter Cronin. Thank you Walter for the insights.

The moral of the above that I get is that China needs beans, as soybeans might be the only thing that keeps China out of Taiwan.

Bottom line is let’s be patient and wait for the markets to tell us what to do. Let’s get prepared because we are closer to making sales than we have been. Our time is coming in the next few months.

Bullish & Bearish Factors

Bullish 📈

Argentina frost?

Argentina has one of the worst crops on record.

How much of this is already priced in? We will undoubtedly see the USDA continue to lower Argentina production estimates.

Harvest & planting delays in Brazil.

Will they keep getting rain. How big of a delay will this cause, and ultimately what will be the impact on the crop.

War headlines.

This thing still looks far from over.

2/3 of U.S. winter wheat growing regions are suffering from drought. With some of the worst conditions in recent memory.

Bearish 🐻

Brazil is still expecting a massive bean crop

Possible recession

High acres are possible

Wild Cards 🃏

Chinese relations and demand.

We keep seeing "balloon" headlines. Will this impact the relationship between the US and China?

Will Russia renew the grain deal?

The Charts

Corn 🌽

We continue to chop around as we work our way to the end of our pendant. Which way will we see a break towards? The $6.85 level remains very stiff resistance, as we bounced lower off that range the last three times we went to test it. A break above and we could see $7.

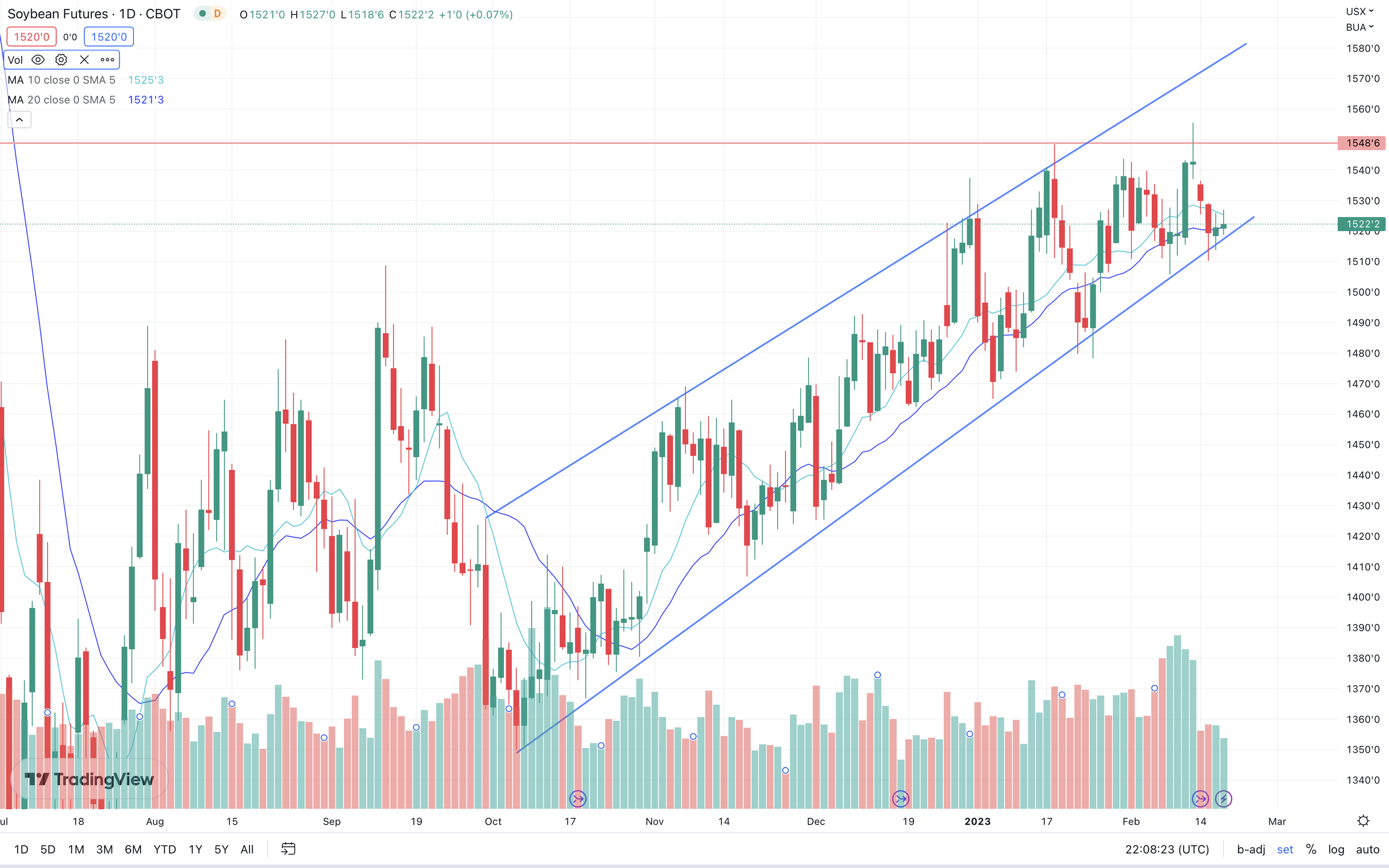

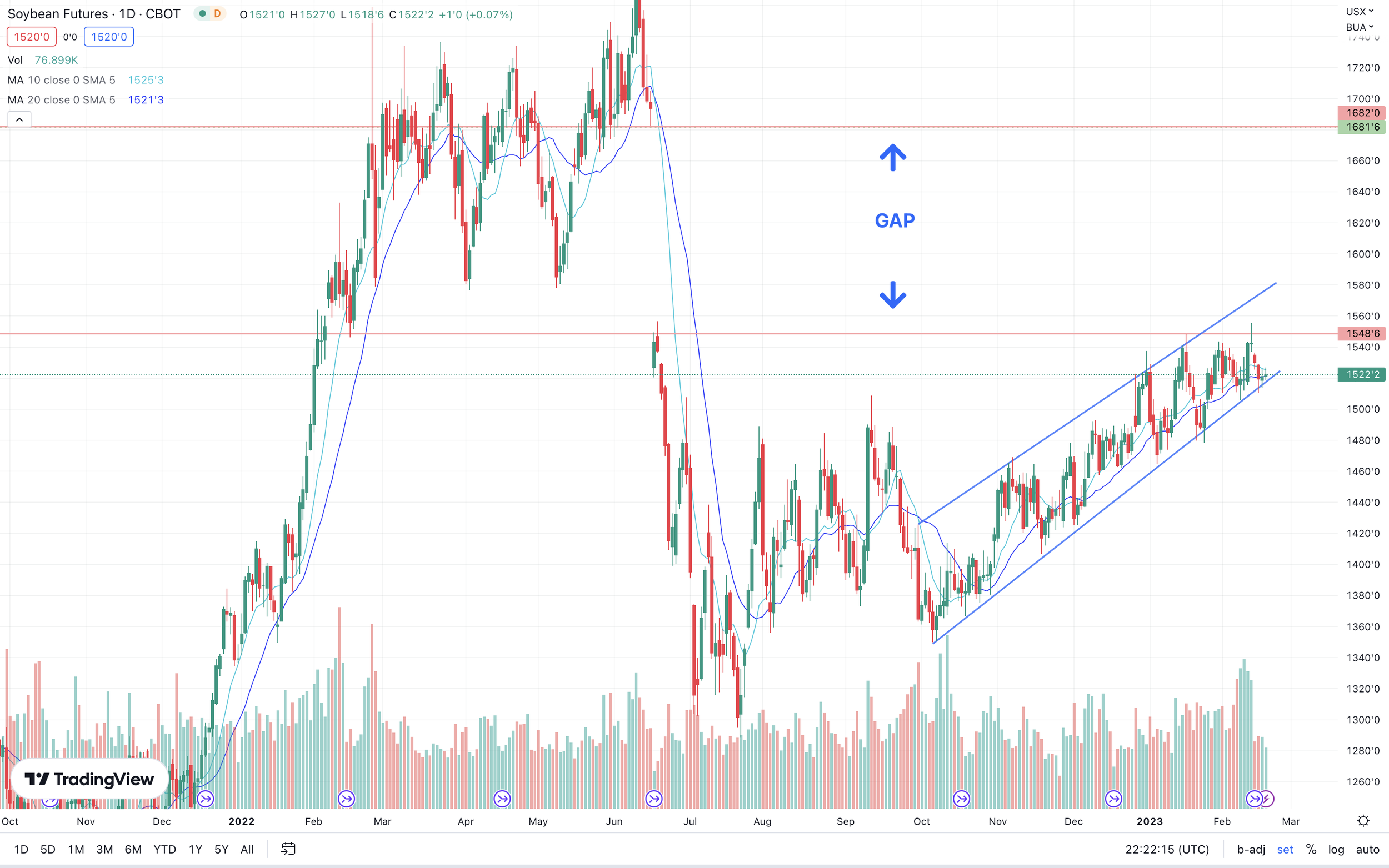

Beans 🌱

Soybeans still remain in a clear uptrend from October but are lately have lacked steam to keep up with the channel it sits in. Currently sitting near the bottom of their recent range. Do we hold here and go to test our recent highs or do we see a leg lower? Ultimately South American weather will probably be the deciding factor. If we do manage to break our recent highs, there is a huge gap to the upside.

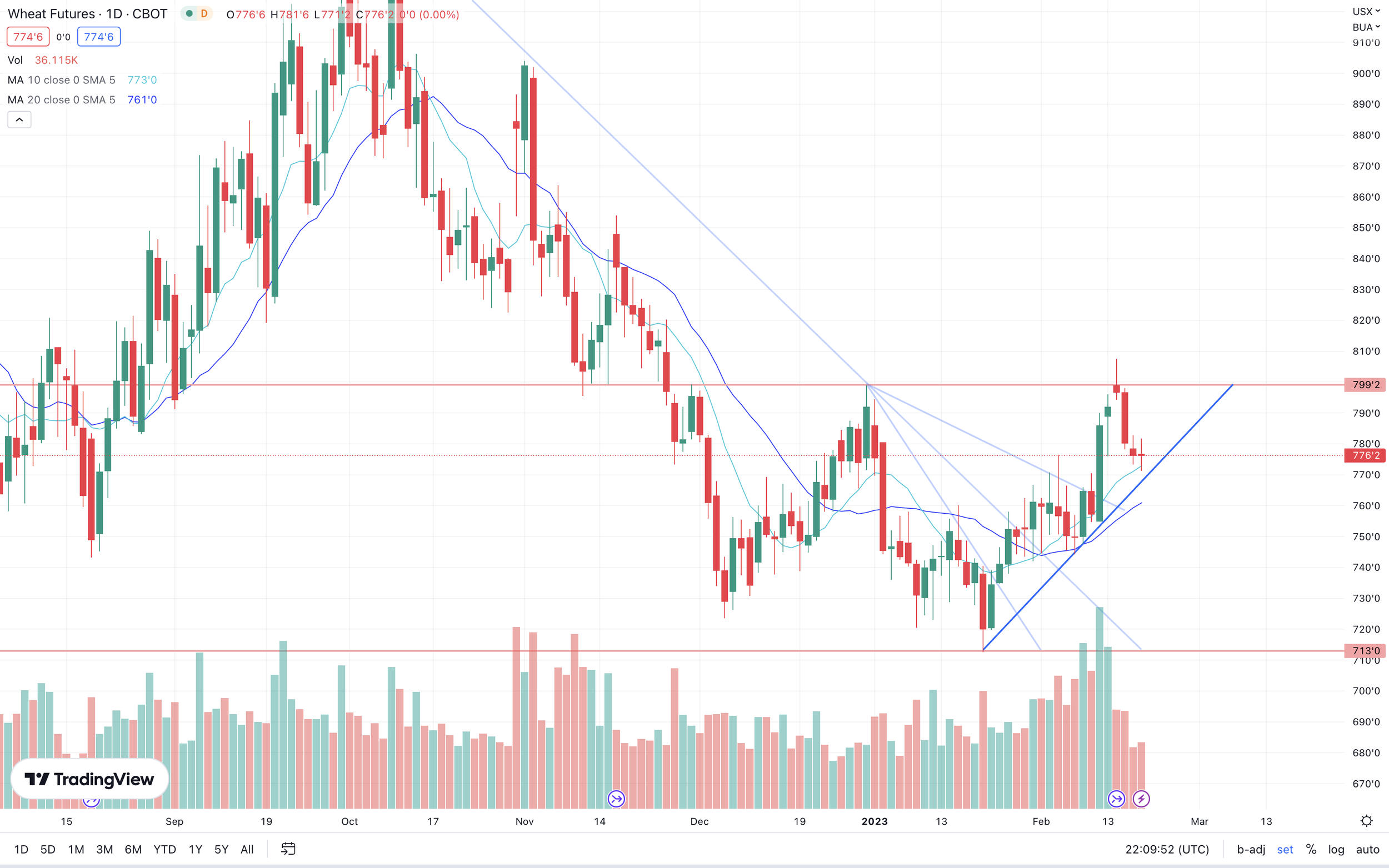

Chicago Wheat 🌾

Chicago sits in a gradual uptrend from the end of January. We are getting close to testing that upward trend line. Ultimately I still think we go and test $8 again. If we do get that break above, there is plenty room to the upside.

Mark You Calenders - Important Dates

February 23-24th

USDA Agricultural Outlook Forum