GRAINS STRONG WHILE WORLD PANICS

Overview

Wild day across the world with one of the biggest equity sell-offs in history. Equities got smoked. Stock market fell hard. Cattle sold off. Japan's stock market collapsed. Yet, grains showed resilience.

Grains panicked early with the rest of the markets, but rallied off the early pressure with corn +11 cents off it's lows, beans +25, wheat +20.

Here is a look. Grains were the strongest market today while the world was panicking.

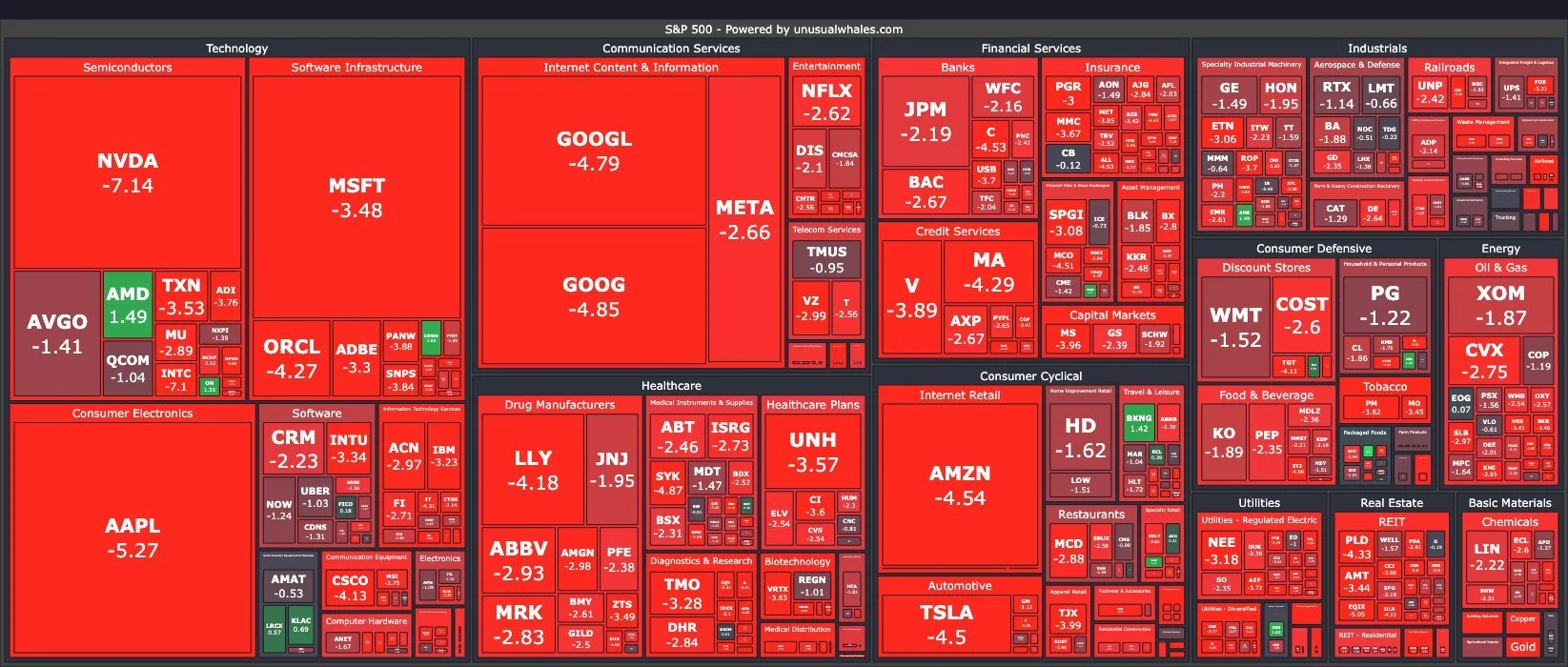

S&P 500 Heat Map Today

So what happened in the outside markets?

It was basically a Black Swan event. The first since COVID in 2020. Friday the jobs report sparked fear of recession. As July non farmpayroll showed less jobs and the unemployment rate jumped from 4.1% to 4.3%.

Japan raised their interest rates by 1/4 a point. This caused their stock market to crash -13% last night. The greatest drop since 1987.

It took Japans stock market 35 years to reach all time highs. It has dropped nearly -30% the past month.

Japan Stock Market

To add on to this, there was news of Iran vowing to missle Israel.

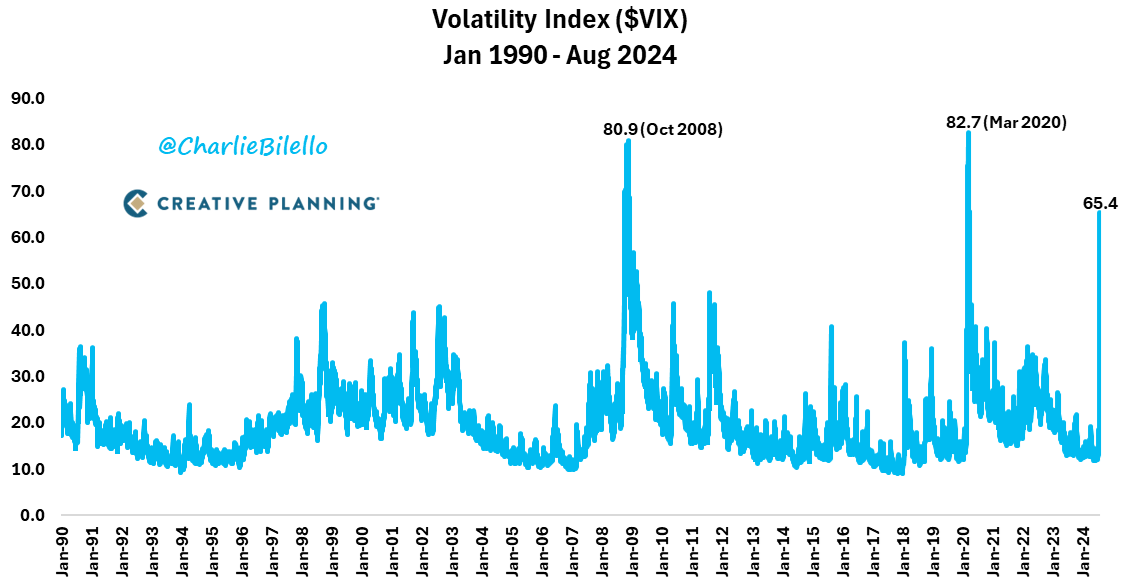

All of this caused the VIX (A stock market fear index) to soar to it's 3rd highest level ever. Only behind the 2008 crash and 2020 COVID crash.

Why didn’t this hurt grains?

A recession would 100% hurt grain prices. Soley because recessions kill demand. Less spending, less consuming of grain.

However, we are not in a recession. This was simply a Black Swan event. Grain prices are also heavily depressed compared to other markets. The real risk is in markets such as the stock market and cattle. Markets that have outperformed the grains.

This was a risk off day where hedge funds were liquidating their long positions.

Hedge funds are RECORD SHORT grains. So this equity sell off was somewhat friendly for grains. Long term a real recession would not be friendly. If the funds would have been long grains, this would’ve probably pressured them to. But the funds don’t have any risk to the downside in grains being short.

I do not believe we are headed to a recession. Goldman Sachs said they believe there will be a 25% of a recession the next 12 months. Back in 2022 they also said there was a 96% chance for one.. we didn’t get one.

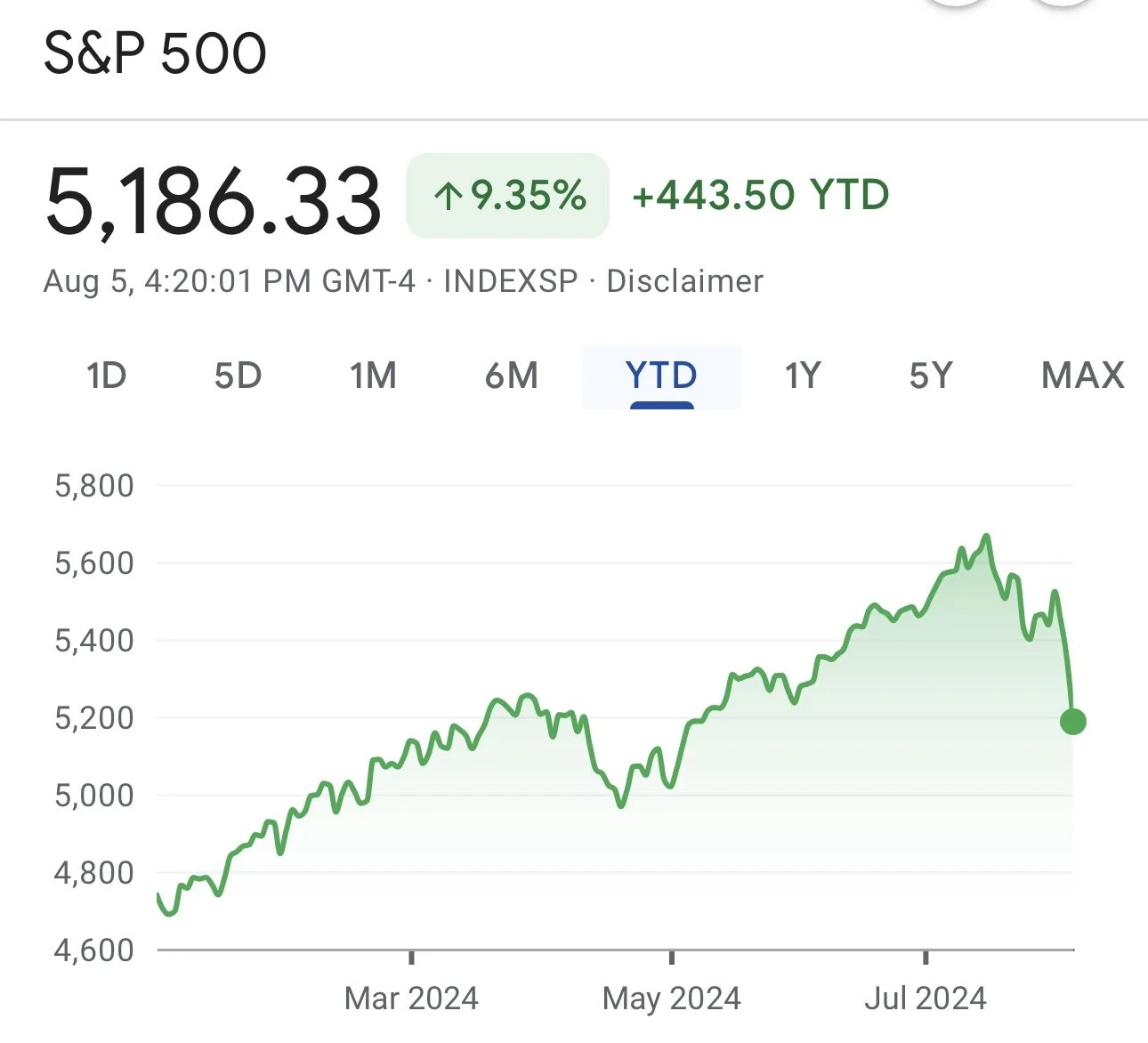

This correction across outside markets was not that crazy. The S&P 500 is still up +10% YTD.

Feds WILL cut interest rates. Likely 2 to 4 times this year. The data says there is a 90% chance they cut rates 50 bps by September. This would be friendly for grains. As it will pressure the US dollar which will help US exports and create more demand.

Bloomberg also says that there is a 60% chance we see an emergency rate cut from the Feds this week.

Overall, today was a phenomenal day for the grains, as we rallied off this morning's panic collapse. During this collapse, neither corn or beans took out last week's contract lows either and all grains rallied off their lows.

Let's dive into the rest of today's update...

Today's Main Takeaways

Corn

Corn gets follow strength we needed after closing above that key $4.03 level on Friday. We actually closed above Friday's high of $4.05 (Closing at $4.07) so very positive and optimistic price action. As we have found great support everytime they try to push corn under $4.00.

The funds are currently holding their 4th largest short in corn. However, they were buyers last week.

Corn crop conditions decreased by -1% from last week to 67% G/E, but this was the trade expectations.

Weather from here isn’t a major market mover for corn. So I will go over weather in the soybean section.

Overall not much news for corn today.

I wanted to include this takeaway from analyst John Scheve. He said:

"Everyone is asking if the lows are in yet. With what we know, it is unlikely because:

The low for the year rarely happens in early August

Too many farmers have unpriced old crop corn still in storage

Every rally seems to be met by farmer selling"

Do I agree with John? Hard to say. The low could definitely be in. On the other hand, I wouldn’t be shocked to see another -30 cents of downside.

All you can do is play the cards dealt and get comfortable with early scenario. If you are sold, look at calls. If you are undersold please grab puts for protection.

Looking at the chart, super friendly looking chart. We took out Friday's highs. The first time taking out the previous days high in 2 weeks. Sitting above key support. The chart looks like we are going higher, but we still have work to do. Longer term I see demand leading us higher, but we could definitely go lower first.

I still need to see us close above $4.23 to $4.26 to say for certain that I believe the bottom is in. Until then, if your risk is lower, protect it. If $4.03 breaks, we could still see $3.80.

I mentioned this Friday:

“Going into this report, I am sure everyone is going to be bearish. So I could see grains seeing little bounce going into early next week, then seeing pressure as we head into the report. Just a guess.”

I could still see us pressured going into the report, because everyone will be talking about record yields etc. even though record yields are already priced in.

Dec Corn

Soybeans

Soybeans rally double digits back to back days.

Soybean ratings came in +1% from last week, at 68% rated G/E. However the trade was expecting a -1% cut to 66%. So this could definitely cause some pressure short term. It shows that this recent heat did not do the damage some thought it would.

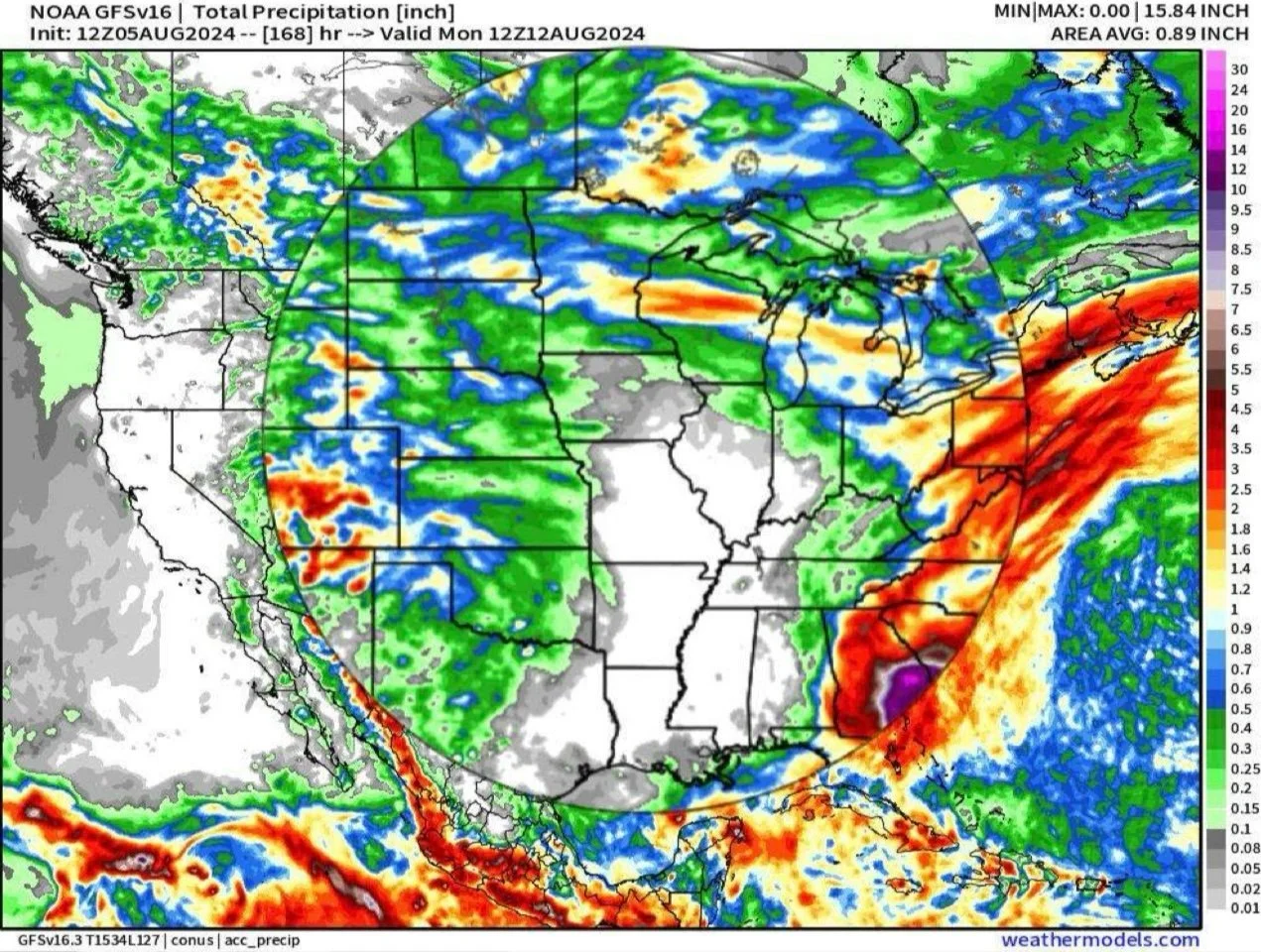

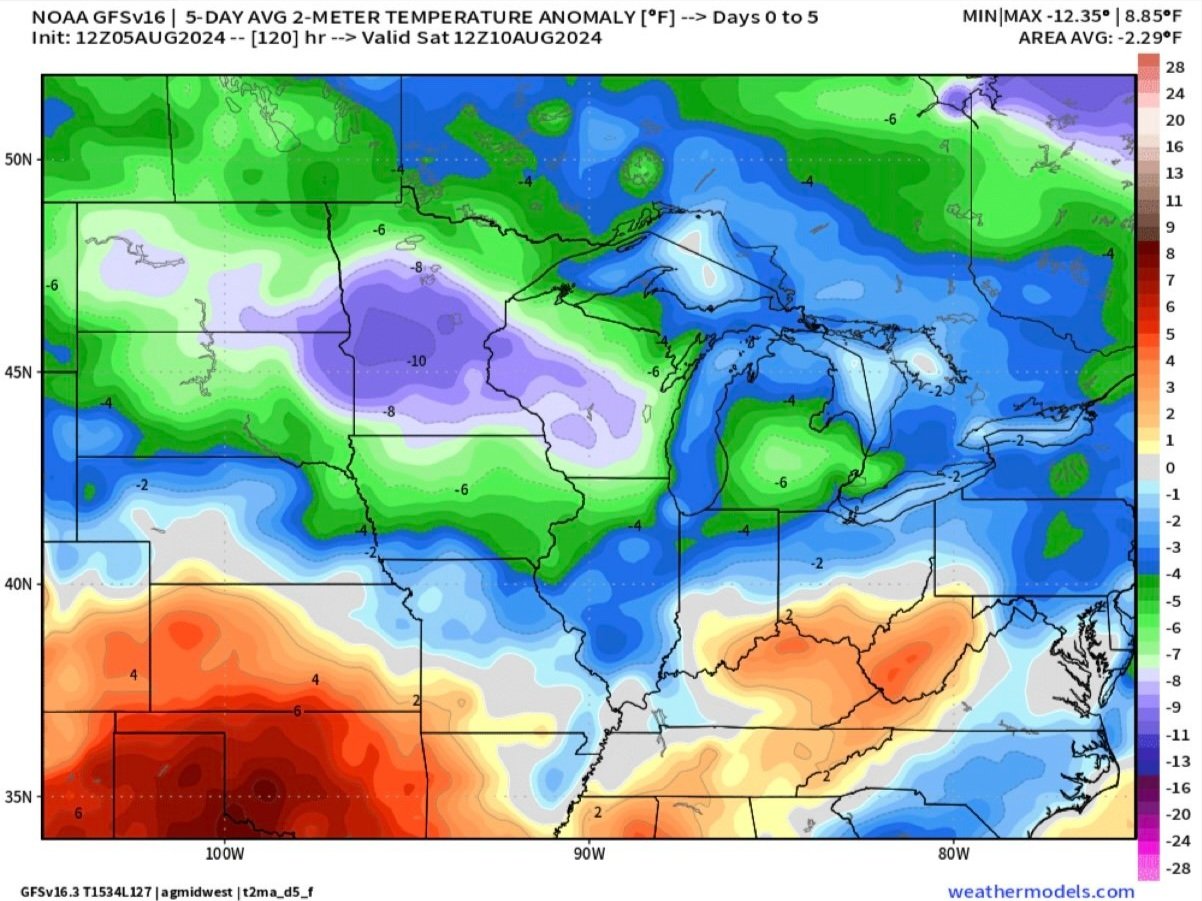

Weather from here does not look threatening. We do lack rain in Iowa and Illinois which could provide some support, but we really lack heat. So I do not see this as a big threat.

7-Day Rain

7-Day Precip % of Normal

1-5 Day Temp

6-10 Day Temp

The biggest concern with soybeans is demand. We might have a record crop here in the US, but demand has been awful. Outside of the 2019 trade war, China is buying their least beans in 20 years.

The bright side is, since our export sales to China are virtually zero, they can’t get any worse. We are already at trade war levels when it comes to exports.

This is already known to the trade. This is also a factor that change instantly.

Thursday & Friday China bought small amounts of beans, but nothing crazy. When China starts to buy big amounts that is how you will know the bottom is in. China is smart, they won’t buy if they think it is going lower.

There was rumors today that China was going to come in an buy 6-7 cargoes of beans. This was another reason we rallied hard off the lows. If China does start to come in and buy, it will spark this market and give the funds a reason to cover.

Longer term there are plenty of reasons soybeans can go higher. Short term our risk is still lower until China starts to buy. So if you have unpriced grain please keep protection. This bounce has made puts and protection cheaper.

Today's price action was very friendly. We rallied +30 cents off our lows taking out the last 3 sessions highs. A break above $10.45 would look friendly.

If the market shrugs off crop conditions, the chart looks like we could higher. However, to be certain a bottom is in we will still need at the very least to close above out July highs of $10.86 which is still a long ways away. This little rally is a good start, but far from enough to say we have bottomed. We are still in a clear downtrend, and that trend needs to be broken. Until then the risk is lower.

Our downside risk is still all the way down to $9.60, which is our support from the trade war resistance. We do NOT have to get there. That is simply the risk.

Nov Beans

Continuous Beans

Wheat

Wheat higher (barely) for the 4th day in a row. The longest streak since the Russia crop scare in May. However, bounced +20 cents off the lows ending the day just green.

The dollar was down -0.50% today, continuing to fall. Personally I think the dollar continues to fall. This is a supportive factor to wheat as it helps our exports.

US Dollar

Short story short, I think we are finally carving out a bottom here.

For those of you that missed the Russia rally, I think you will get another chance to price wheat. No it will not likely even be close to the $7 we signaled in May. But a realistically we could still get at least $6.25 wheat.

We have plenty of issues globally that may not be market movers short term, but long term do change the landscape of the wheat market.

There is talk that Russia wheat is having quality issues. There is talk that France's crop is being decreased by 28% due to too much rain.

Rumor is that India might start importing wheat which would friendly, as they are typically an exporter.

There are a lot of reasons wheat could go higher long term. Historically we are at low prices that aren’t going to incentive wheat planting.

Great action on the charts today, +20 cents off the lows.

Overall, I am looking for a pop in the wheat the next few months. BUT for me to be confident we found a bottom I at the very minimum need to see us close above $5.56, preferably $5.67.

After that, some targets would be $6.00 and then $6.25 which is our 50% retracement to the May highs.

If you have unpriced grain, keep puts for protection until you make a sale.

Sep Chicago

Sep KC

Cattle

Since last week I had been saying that the cattle market would likely see more downside as we broke support.

That is exactly what we got with today's Black Swan event. As with a risk off day, cattle is seen as a risk. Because it has outperformed and funds were long. So they started to exit when panic hit.

The chart does not look great, but I could see a relief bounce along with the stock market.

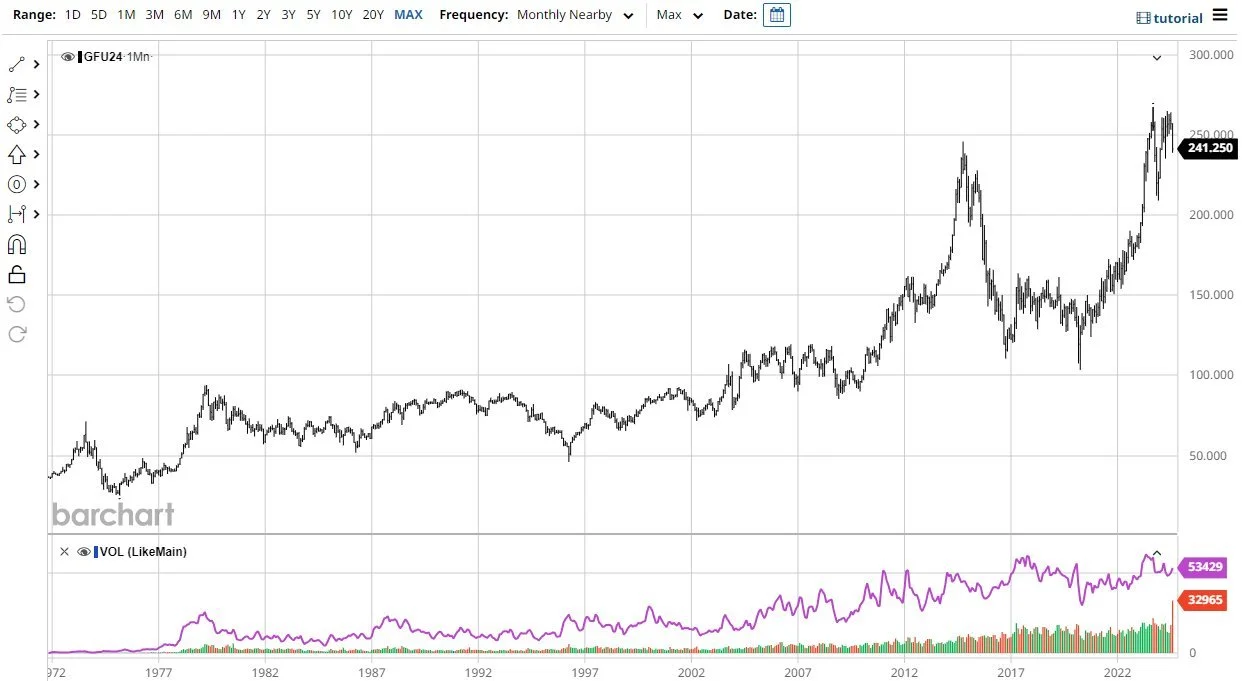

If you look at this first chart, it does put into perspective how far cattle could potentially fall. So just be careful as we realistically aren’t that far off the highs when you look at the big picture.

Big Picture Cattle

Continuous Live Cattle

Sep Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

8/2/24

GRAINS RALLY, YIELD ESTIMATES, CHINA STARTS TO BUY

8/1/24

MARKET EXPECTS A PERFECT CROP?

7/31/24

CORN BREAKS $4.00, FAVORABLE WEATHER & CHARTS

7/30/24

GRAINS FAIL REVERSAL BACK NEAR LOWS

7/29/24

GRAINS SHOW SIGNS OF REVERSALS

7/26/24

BLOOD BATH IN GRAINS: EPA REVERSAL & WEATHER

7/25/24

CHINA, DROUGHT, FUNDS & RISK

7/24/24

BEANS LOWER DESPITE DROUGHT TALK

7/23/24

BACK TO BACK GREEN DAYS FOR CORN & BEANS: MARKETING DECISIONS

7/22/24

BEST DAY FOR GRAINS IN A LONG TIME

7/19/24

DULL MARKETS: STRATEGIES TO USE IN GRAIN MARKETING

7/18/24

DEMAND, CHINA, POLITICAL PRESSURE, & TECHNICALS

7/17/24

DIFFERENT GRAIN MARKETING SCENARIOS YOU MIGHT BE IN

7/16/24

RELIEF BOUNCE FOR GRAINS

7/15/24

GRAINS HAMMERED. TRADE WAR FEAR

7/12/24

USDA REPORT: LOW PRICES CREATING DEMAND

7/11/24

USDA TOMORROW

7/10/24

GRAINS CONTINUE TO GET HAMMERED

7/9/24

RAINS, RECORD FUND SELLING & 2014 COMPS

7/8/24

PUKE SELLING, RAIN MAKES GRAIN & FUNDS RECORD SHORT

7/3/24

THIN HOLIDAY TRADE FOR GRAINS

7/2/24

BEARISH WEATHER, RECORD SHORTS, & CHINA

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL-OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24