GRAINS RALLY, YIELD ESTIMATES, CHINA STARTS TO BUY

Overview

Great day for the grains as corn reclaims $4.00 and all grains close higher.

As for news, we saw yet another flash sale of soybeans to China of 202k MT. This is the 2nd day in a row of sales, as we had 132k MT yesterday.

These sales are virtually nothing, but are hopefully a good sign that perhaps China is interested in buying. But these were likely just routine purchases.

When they are start buying a lot and we start seeing sales of +500k MT at a time, then that would indicate China is actually in a buying mood. If we saw that, it would probably give soybeans enough of a reason to see some short covering. But these last 2 small purchases won’t do that.

Weather still looks pretty ideal for most. It is too late in the year to get a big weather scare rally, but if it gets hot it could provide soybeans some support.

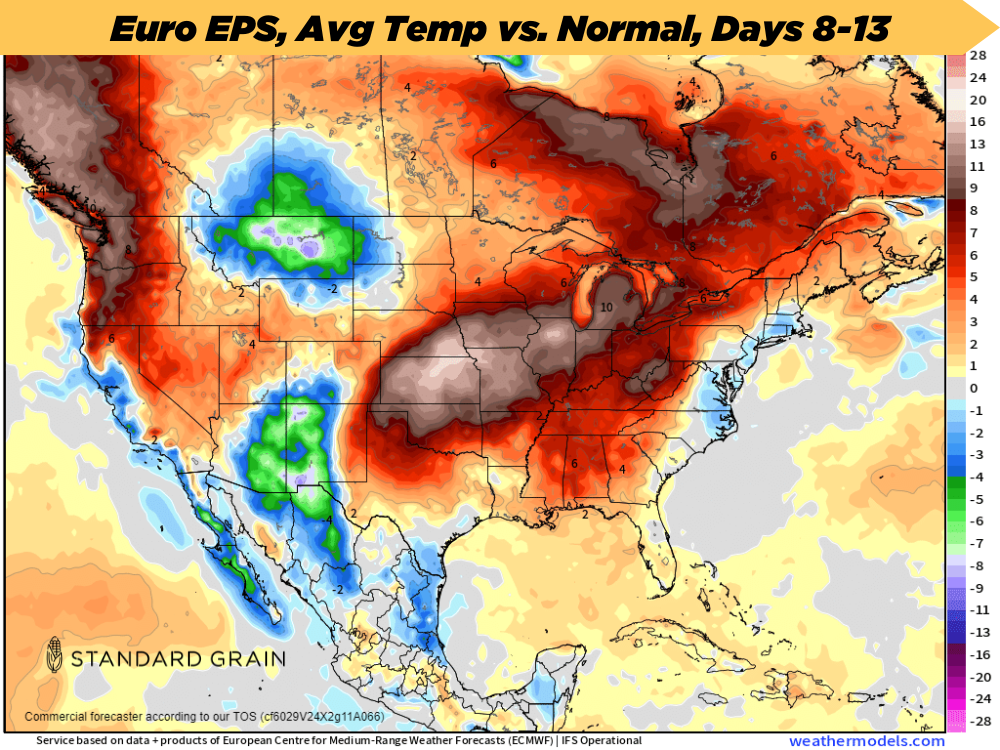

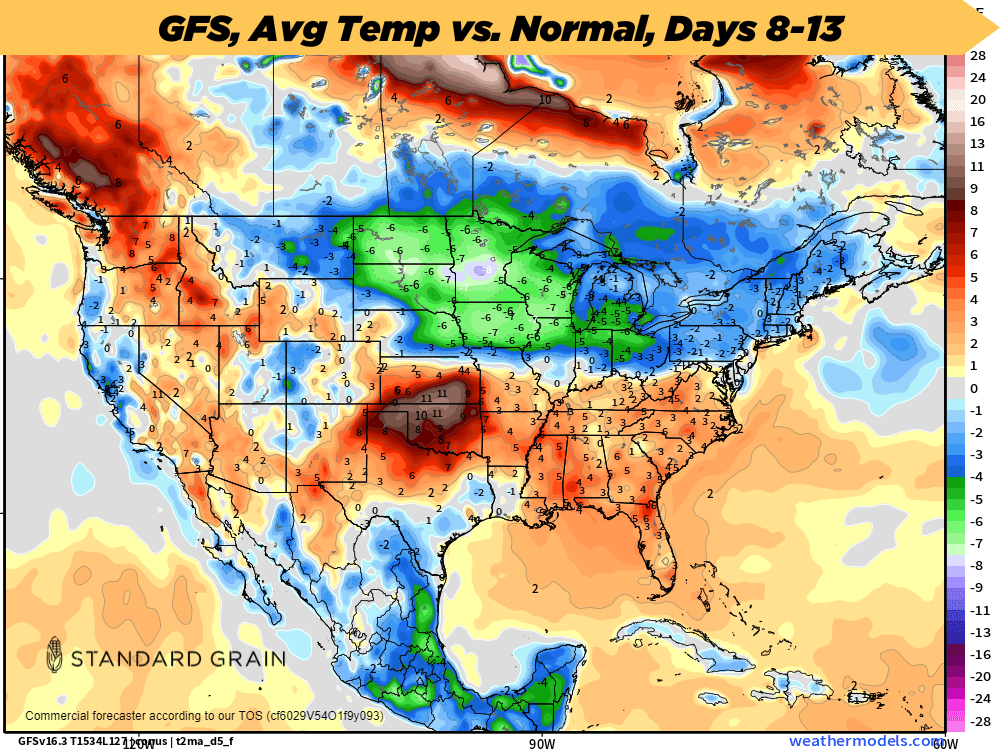

Right now most forecasts call for it to cool off the next 2 weeks, so I don’t see a major concern. However, there are a few Euro models that have some pretty serious heat. If these come to fruition, soybeans will be supported. But overall I am not expecting heat, as nearly every forecast is calling for cooler temps.

Here is a comparison of a euro model that has heat vs a GFS that does not.

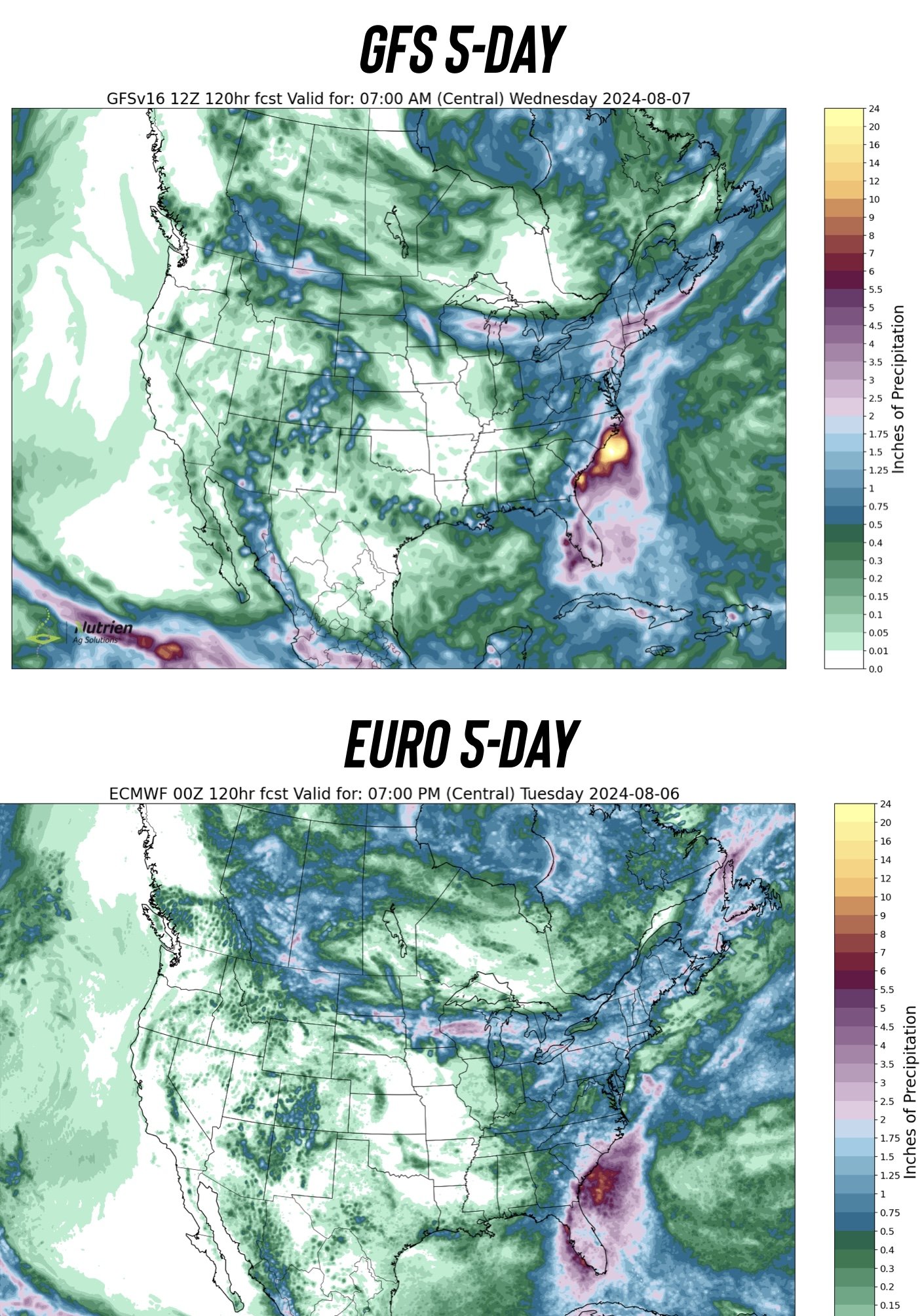

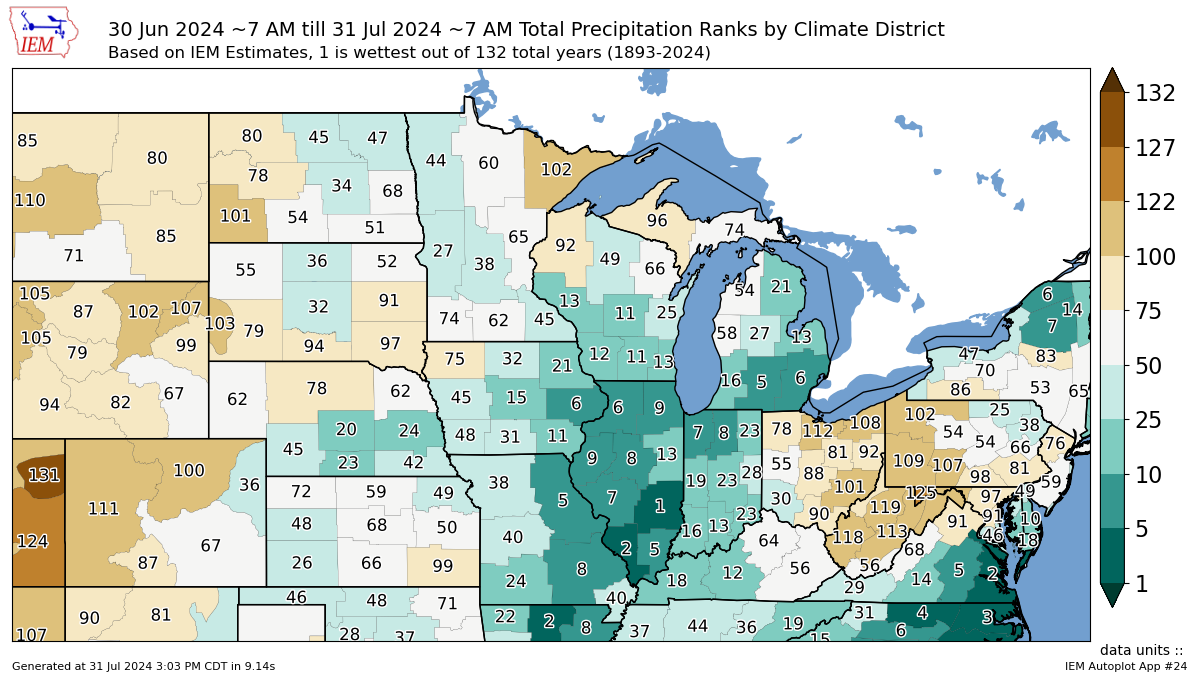

The I-states are trending drier while Minnesota is expected to get even more unwanted rains.

Overall no real concern with weather to the markets unless something changes and they throw some heavy heat in.

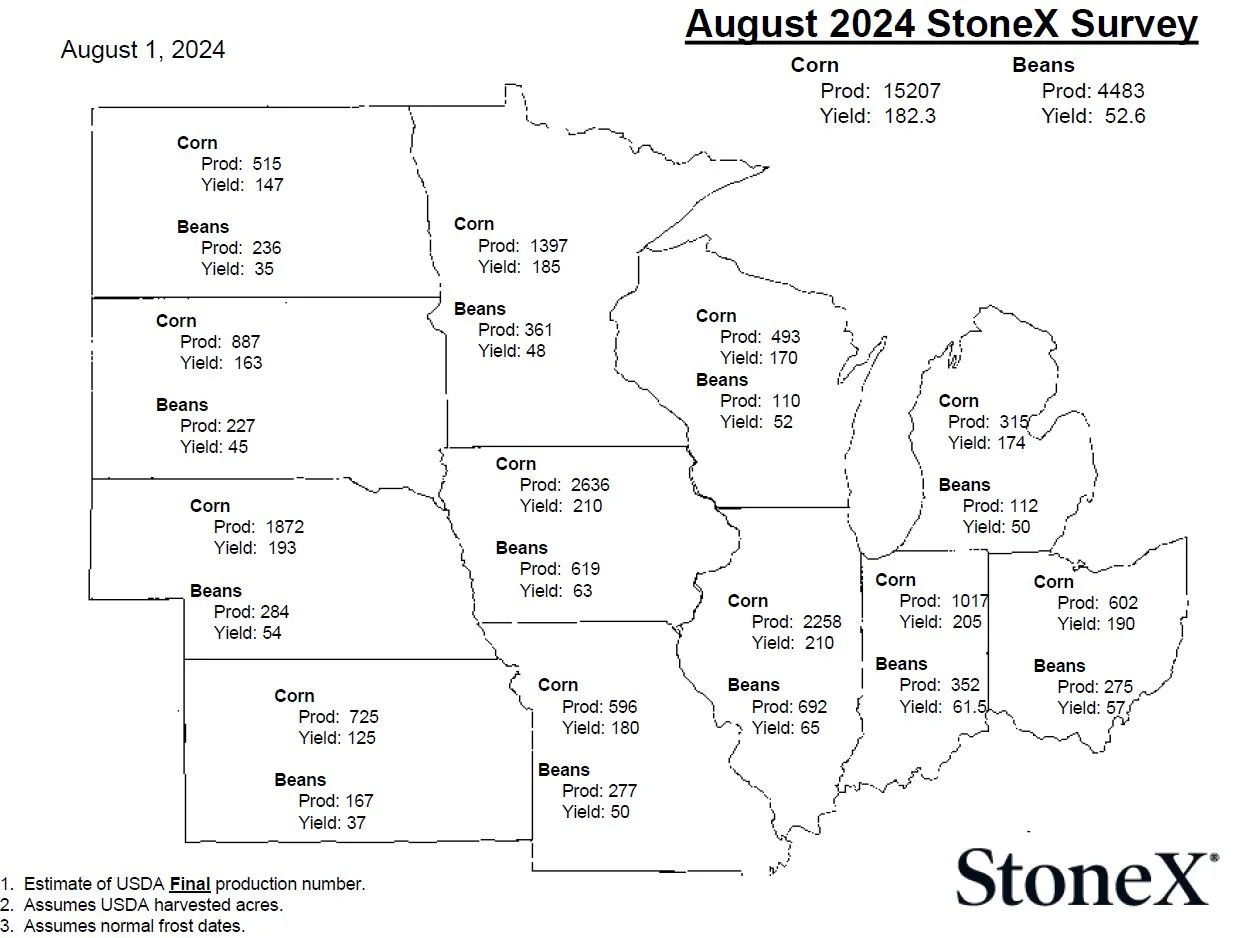

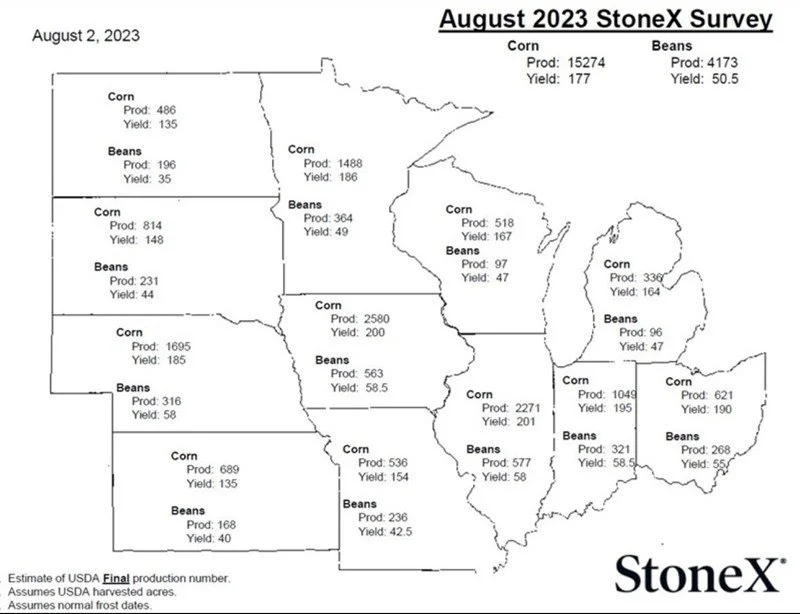

The other big news yesterday was StoneX.

They released their yield estimates for corn & beans.

Here is some comparisons.

StoneX:

Corn: 182.3

Bean: 52.6

USDA July:

Corn: 181

Bean: 52

USDA Final 2023

Corn: 177.3

Bean: 50.6

Current Record Yields:

Corn: 177.3 (2023)

Bean: 51.9 (2016)

How accurate has StoneX been in past years?

Their survey last August for corn had 177 vs USDA's 177.3. For soybeans they had 50.5 vs the USDA's 50.6.

So their estimate last August was spot on.

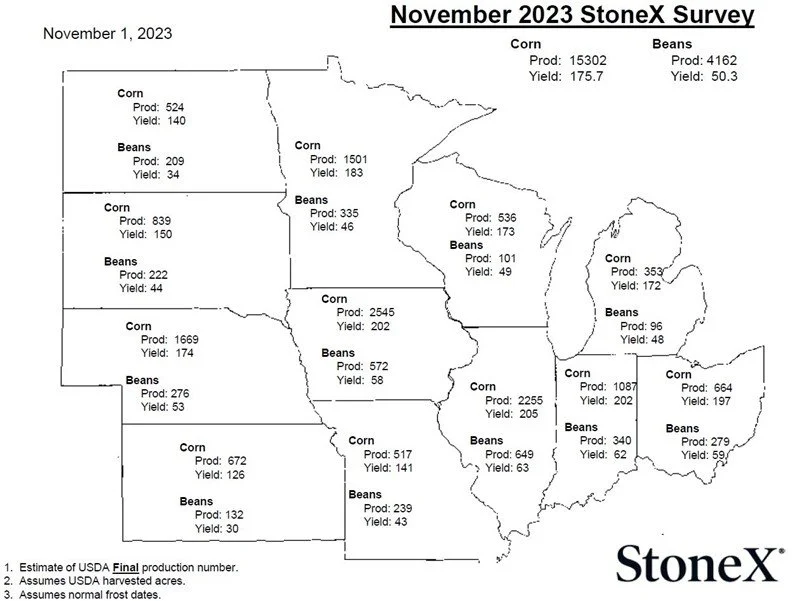

However, by November they lowered their corn yield to 175.7 and beans to 50.3.

So their August estimate was closer than their November estimate to final yield.

Could they be spot on again this year? Absolutely.

But the difference is last year was a dry year. This year was a wet year, with wet planting etc. So it is not quiet as easy to determine yields until we get into the crop because those problems usually show up later.

A week from Monday on August 12th we will get the USDA WASDE report.

This report will actually include acres. In the past the USDA usually doesn’t incorporate acres until September or October. Acres are one of the hardest things to predict going into a report. Because you can’t.

Unlike things such as production and demand where you usually have an idea, acres can be total curveballs. Something to keep in mind.

Going into this report, I am sure everyone is going to be bearish. So I could see grains seeing little bounce going into early next week, then seeing pressure as we head into the report. Just a guess.

Today's Main Takeaways

Corn

Corn reclaims $4.00 and $4.03. A great sign but still early.

Corn had some unimpressive export sales yesterday.

Weather has been favorable (weather from here on out will not impact the market much).

Supply will be there more than likely. We might not have a "record" crop, but we will have a good crop nonetheless.

July rain has the biggest impact on yields. July was very wet across most key growing regions.

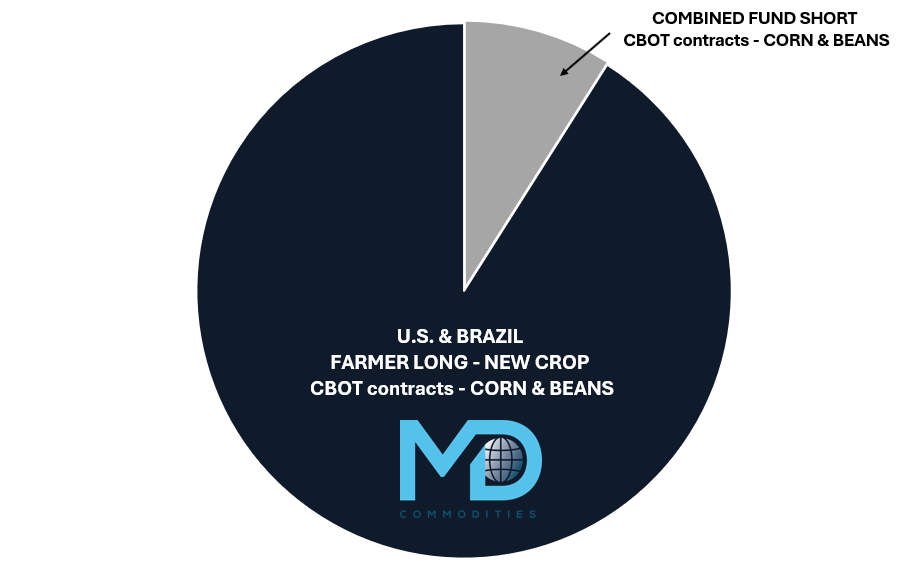

Outside of a possible monster crop. One of the biggest thing corn faces is still the old crop sitting in the hands of commercials on basis contracts & DP.

Take a look at this chart that compares the funds position to corn on hand for both US & Brazil combined.

First notice day is August 30th. So anyone with those type of contracts will have to decide to price it or roll in the days leading up.

This means that the next few weeks there is going to be a lot of supply hitting the market. Then to go along with that we also have early harvest just a few weeks later.

This will make it harder to rally. Unless we get something that changes fundamentally.

One thing that could change fundamentally is demand. It might not happen right away, but looking months from now demand could very well lead us higher. As these low prices are creating demand. The US is also some of the cheapest in the world, making us very competitive on the export market.

Bottom line, today was a very positive day as we clawed back above key support at $4.03, perhaps leaving a bear trap. But we will need some follow through Monday. A close above $4.05 would look nice.

Now yes, there is still the chance we go down and test $3.80. That would not surprise me at all if we cannot hold this $4.03 level. I still need to see us over the $4.23 to $4.26 level to call a bottom.

Until then, if your risk is to the downside protect it. If you have unpriced grain or need to move something off the combine please grab some puts.

Dec Corn

Soybeans

Great day for beans up double digits.

Looking at weather, it doesn’t look like it is going to create anything crazy for the markets. Yes, if we get some random heat thrown in then it could support this market. But heat in August for the soybean market does not react like corn does in June and July. So I am not expecting a weather driven rally, but it's possible.

For the most part, it looks like August will be pretty ideal. But these forecasts do change pretty often. Just a few weeks ago the outlook for August was hot and dry, now it looks cool and wet.

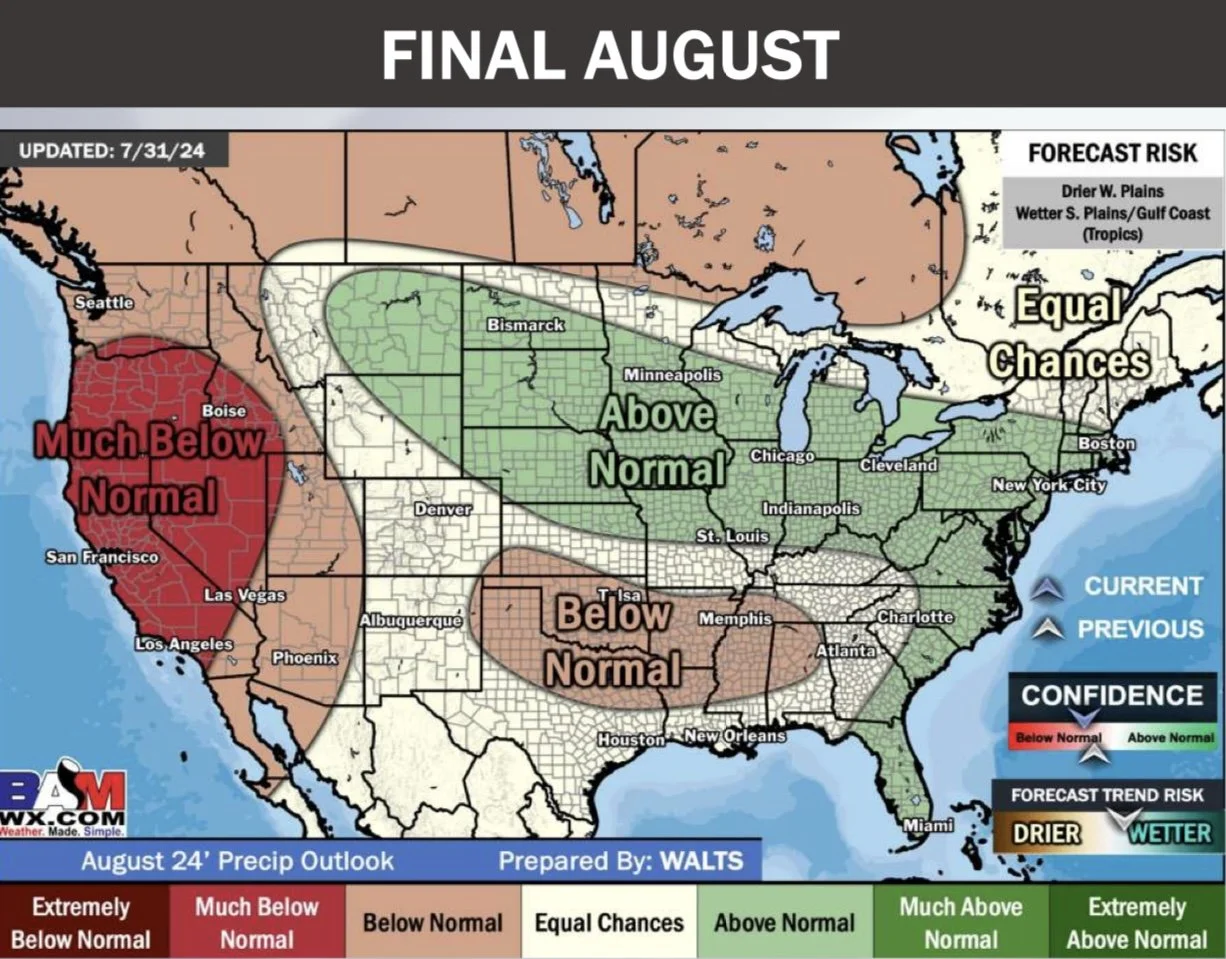

August Precip

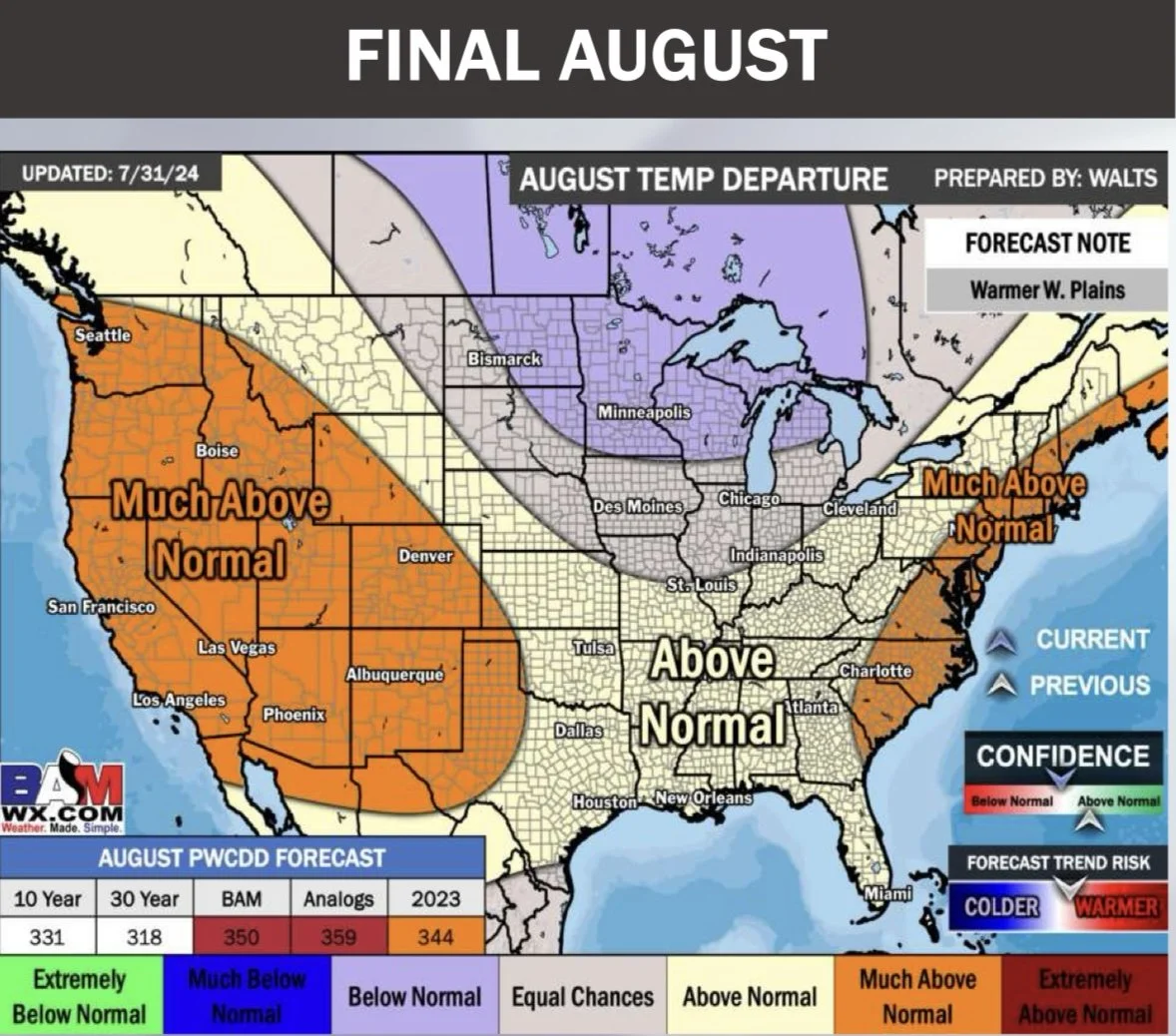

August Temps

The biggest news was the purchases from China I mentioned.

They bought back to back days. This could have just been routine purchases, but was a nice sign. These were not enough to move the needle at all. We will need more.

US soybean sales are now finally ahead of where we were during the 2019 trade war, but still down a whopping -97% from our 3 year average.

That would be a bottom indicator for soybeans. If China comes in and starts to buy heavily. Why would China start buying now if they think they can get it for cheaper? They won’t. So if they start buying it would be a very positive sign and would be enough to spark some short covering.

The funds are also still record short soybeans.

Demand is probably a bigger problem than a bumper crop here in the US. However, that is something that can change. They could start buying any day now, or not. Nobody knows.

So bottom line, China needs to buy. Until China does start coming to buy, there is no saying we can’t go lower from here.

So if you need to move something off the combine or cannot afford if beans go lower, please protect your downside with some puts.

Looking at the chart, a close above our first resistance of $10.31 1/2 would look friendly. But we have a ways to go before I start calling a bottom.

Nov Beans

I am still keeping an eye on this chart. The $9.60 level is a very real risk. I hope we do not get there, but if China does not start buying that is our downside risk. As that was where we found resistance during the trade war.

Continuous Beans

Wheat

Wheat higher for the 3rd day in a row. The first time we have seen that since the Russian crop scare rally.

Overall there just isn't much news surrounding the wheat market.

Our crop here in the US looks great.

The Black Sea are is dry but it's getting a little late for concerns over there anyways.

People are talking about the freezes in Argentina as well as the fact they had their driest July in 60 years. But this is not a real factor as Argentina makes up for 2% of global wheat production while Argentinas corn and beans are in the bin.

Wheat today did see some support from hot and dry weather, along with some unneeded rain in France, as well as the dollar collapsing over -1% today.

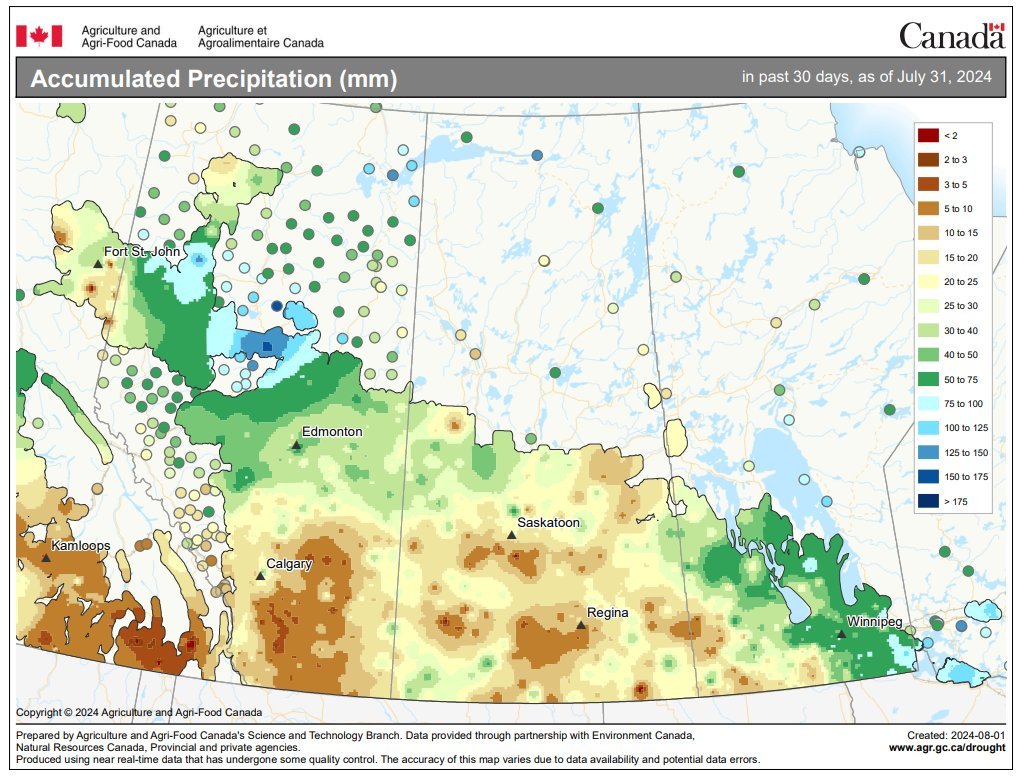

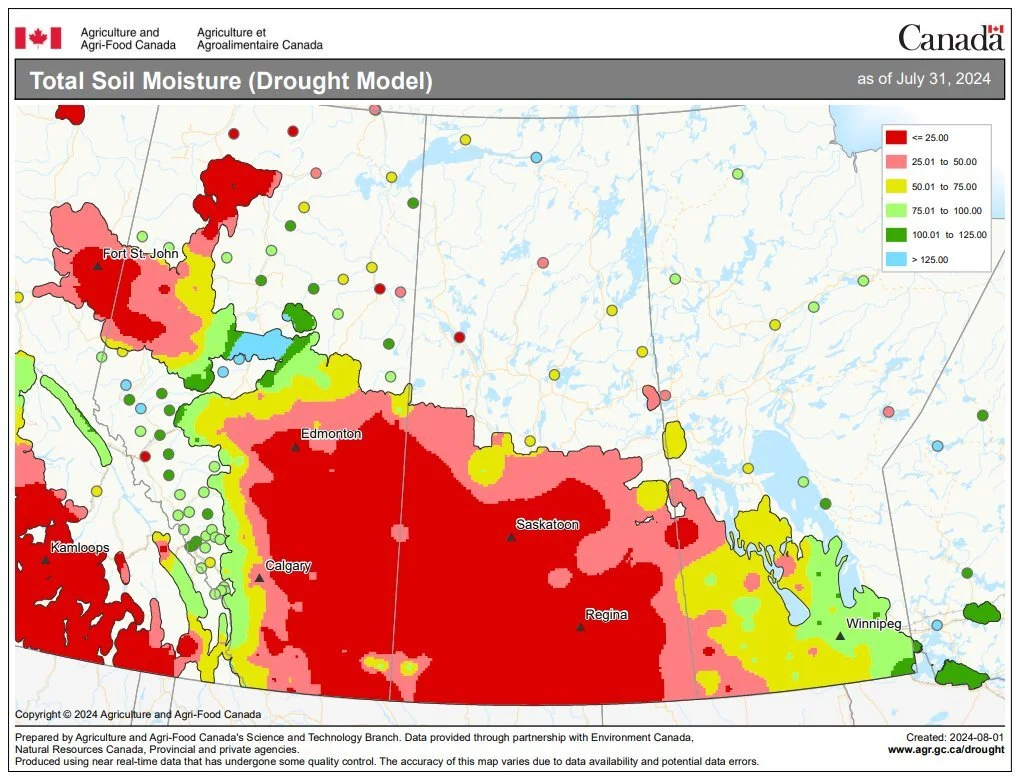

If we take a look at Canada. They had a very dry month of July. So this could add some support to Minneapolis wheat.

Not much else for wheat today.

We are getting a nice bounce off the lows but still stuck in the recent 30 cent range.

If we can break above $5.53 it would look friendly. A break above $5.67 would look great and make me feel somewhat comfortable calling a bottom.

We alerted our sell signal in May. If you have yet to make sales or are undersold, I like keeping puts under your unpriced grain and wait for a better pricing opportunity.

(Make sure to scroll as I added cattle charts)*

Sep Chicago

Sep KC

Cattle

Cattle falls apart.

Both feeder & live cattle took out our uptrend support.

So from a technical standpoint it does not look good and would indicate more downside.

Continuous Live Cattle

Sep Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

8/1/24

MARKET EXPECTS A PERFECT CROP?

7/31/24

CORN BREAKS $4.00, FAVORABLE WEATHER & CHARTS

7/30/24

GRAINS FAIL REVERSAL BACK NEAR LOWS

7/29/24

GRAINS SHOW SIGNS OF REVERSALS

7/26/24

BLOOD BATH IN GRAINS: EPA REVERSAL & WEATHER

7/25/24

CHINA, DROUGHT, FUNDS & RISK

7/24/24

BEANS LOWER DESPITE DROUGHT TALK

7/23/24

BACK TO BACK GREEN DAYS FOR CORN & BEANS: MARKETING DECISIONS

7/22/24

BEST DAY FOR GRAINS IN A LONG TIME

7/19/24

DULL MARKETS: STRATEGIES TO USE IN GRAIN MARKETING

7/18/24

DEMAND, CHINA, POLITICAL PRESSURE, & TECHNICALS

7/17/24

DIFFERENT GRAIN MARKETING SCENARIOS YOU MIGHT BE IN

7/16/24

RELIEF BOUNCE FOR GRAINS

7/15/24

GRAINS HAMMERED. TRADE WAR FEAR

7/12/24

USDA REPORT: LOW PRICES CREATING DEMAND

7/11/24

USDA TOMORROW

7/10/24

GRAINS CONTINUE TO GET HAMMERED

7/9/24

RAINS, RECORD FUND SELLING & 2014 COMPS

7/8/24

PUKE SELLING, RAIN MAKES GRAIN & FUNDS RECORD SHORT

7/3/24

THIN HOLIDAY TRADE FOR GRAINS

7/2/24

BEARISH WEATHER, RECORD SHORTS, & CHINA

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL-OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24