BEANS & WHEAT CONTINUE TO DISAPPOINT

Overview

Grains opened the morning higher, but sold off through the day as wheat continues to disappoint and beans run into selling. Corn held up well comparatively as we had another sale of corn to China, this time we had a sale of 136k metric tons. Bringing the new total since last week to nearly 2.25 million metric tons.

Dr. Cordonnier made additional production cuts to his Argentina estimates. Lowering his bean number by 2 million metric tons down to 26. While also lowering corn by 1 million down to 36 million.

The markets attention will shift to the acre and stock numbers next Friday. Most of the market is looking for more acres across the board. The extent of the increase over last year might be the key to how prices react come March 31st.

Tomorrow is the FOMC meeting.

Read Sunday's Weekly Newsletter

Mother Nature & Black Swans - Read Here

Today's Main Takeaways

Corn

Corn futures close just lower with May down -3 cents on the day and -8 cents off our highs. Perhaps the funds were looking to get rid of the last of their long position.

As mentioned earlier, corn is finding support with another sale to China. U.S. export inspection have increased for the 6th consecutive week, as we pushed to a marketing year high yesterday. We still remain 4% behind the USDA forecast pace (80 million bushels). Bears are pointing to the fact that we are -35% behind last years pace. Despite the increase we saw last week demand is still an uncertainty surrounding corn. However, I think we could see export demand continue to improve as we roll into spring.

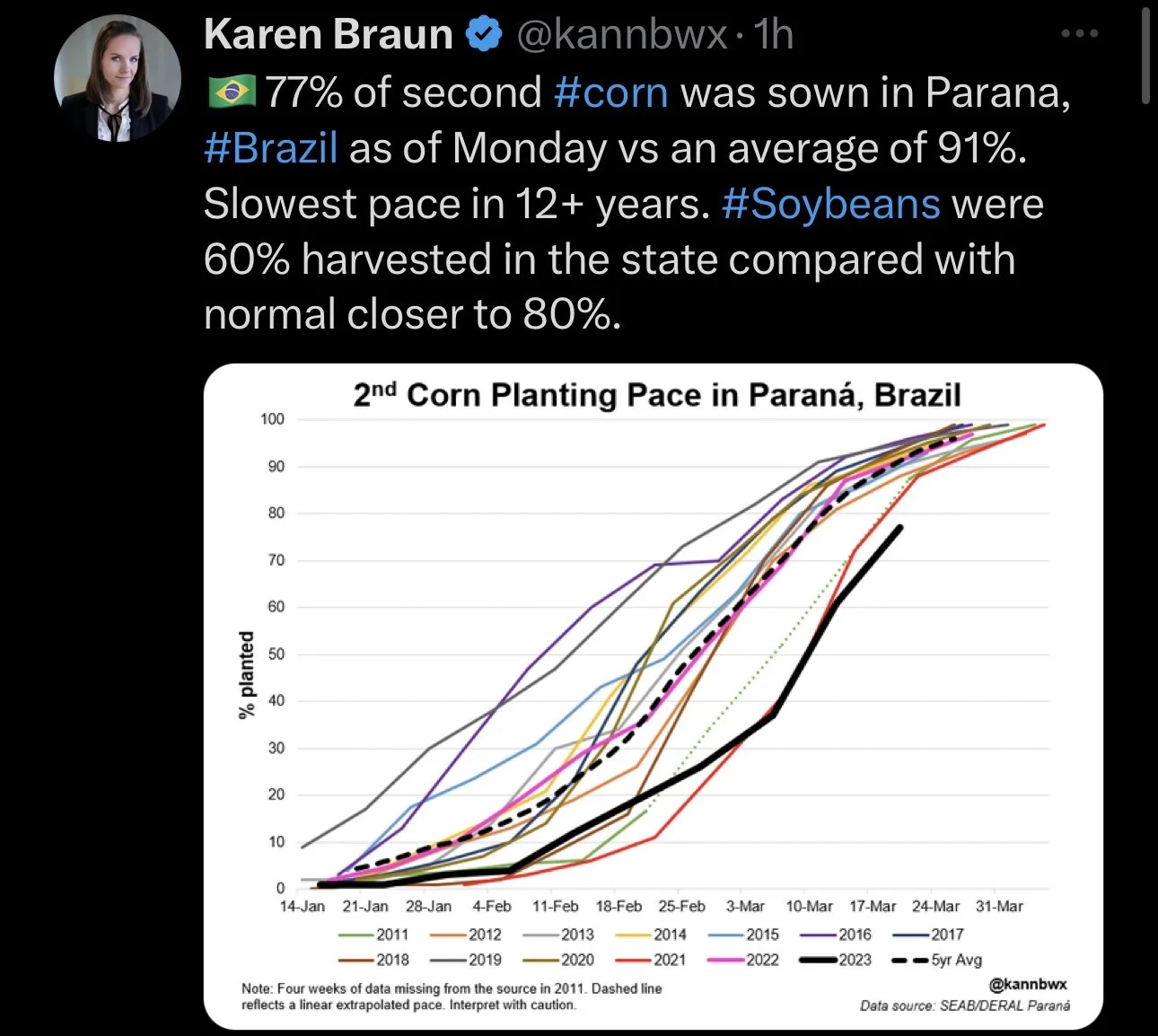

Brazil second crop corn planting is starting to move along faster, as areas such as Parana have had some dryer weather which has allowed for solid progress. Brazil now sits at 91% planted vs 97% last year. The fast progress could look to add some pressure.

As for Argentina, we all know the problems they've faced and just how poor their crop is. We continue to see every analyst lower their estimates. Perhaps the Argentina crop has stabilized here at 35 million metric tons. But there is still talk that these numbers will continue to work their way lower, with some throwing out numbers close to 30 MMT. Here are where a few different places have their current estimates:

Dr. Cordonnier: 36 MMT

Buenos Aires Grain Exchange: 36 MMT

Rosario Grain Exchange: 35 MMT

USDA: 40 MMT

Taking a look at the next week and a half, we probably won’t have a ton of fresh headlines or weather news for either side to disect until we get the USDA report the last day of the month which is next Friday, In this report we will get a better grasp of overall demand and acre forecasts.

In the meantime, bulls would like to continue to see an increase in demand and Chinese appetite.

Taking a look at the chart, we again rejected off that $6.37 resistance level and our 20-day moving average. As the trade seems comfortable trading in the $6.06 to $6.40 range. I would like to see a break above the 20-day and that $6.40 level for higher prices, if we get a break we might look to the $6.60 range for the next stop.

Corn May-23

Soybeans

Beans pressured heavily today, closing down -19 cents at $14.67 and -30 cents off their highs of $14.97. The bean market has been pressured by bearish macro headlines. Funds probably weren’t too comfortable with their big long position which added to the selling today.

One thing bears are looking at is the cheap exports out of Brazil.

Bean harvest in Brazil is now sitting close to 60% complete, which is still behind last year's 69% but is some solid progress. So far the harvest numbers are fairly strong from Parana and Mato Grosso, with some parts of Parana and surrounding states showing record yields. While southern Rio Grande do Sul is continuing to trend lower. As they sit just 1% complete on harvest. So a lot of Brazil's final number could come down to the progress we see in Rio Grande do Sul, which has bulls hopeful that we see this weigh down Brazil's total production as they still could face weather problems down the road.

AgroConsult increased their bean forecast for Brazil up to 155 million metric tons, a 2 million increase vs the previous estimate. This increase came after 3 months of crop tours and despite the drought issues Rio Grande do Sul has been facing.

Argentina finally got some rain which probably added pressure here today, but overall it’s probably too little too late to make much of an impact at this point. There is still talks that we see a crop below 25 million metric tons. The USDA is currently at 33 million.

One thing to note is that the losses in Argentina bean production have now surpassed the surplus from the massive Brazilian crop. Which means tighter supplies into the U.S. growing season.

Some Questions Going Forward:

Where does Chinese demand sit for U.S. beans.

How bad is the Argentina situation.

How much crush margins will need to improve here in the U.S. to satisfy thenproblems in Argentina.

November beans closed below $13 for the first time since August 3rd of last year. There is a gap to the downside to $12.70 so we could see prices continue to correct to that level. Short term I could still see funds continue to liquidate some of their longs.

Taking a look at the chart, beans don’t look amazing from a technical standpoint. We broke our long term uptrend a while back and have chopped around since, creating a short term downtrend. Next level of support might be our 200-day moving average at $14.60, which is 7 cents lower than today's close. Bulls would like to get back above $15.

Soybeans May-23

Wheat

Wheat continues to disappoint bulls. Closing sharply lower in all classes today. The wheat market remains pressured by a few key factors.

The first is the continuation of cheap global wheat and Russian exports. The on and off debate surrounding the Black Sea agreement, and the banking crisis which has led to uncertainty in the U.S. economy.

Today pressure likely came from the meeting between Russia and China. As China looks like they are trying to broker a peace deal between Russia and Ukraine.

We some some updated winter wheat crop conditions here in the U.S. where we saw:

(Good to Excellent %)

Kansas actually improved up to 19% vs 17% last week.

Still the lowest since 2018.

50% rated poor to very poor.

Texas also saw a good improvement, up to 23% from last week's 17%.

Colorado was down to 36% vs 40% last week.

Oklahoma was down slightly to 29% vs 30% last week.

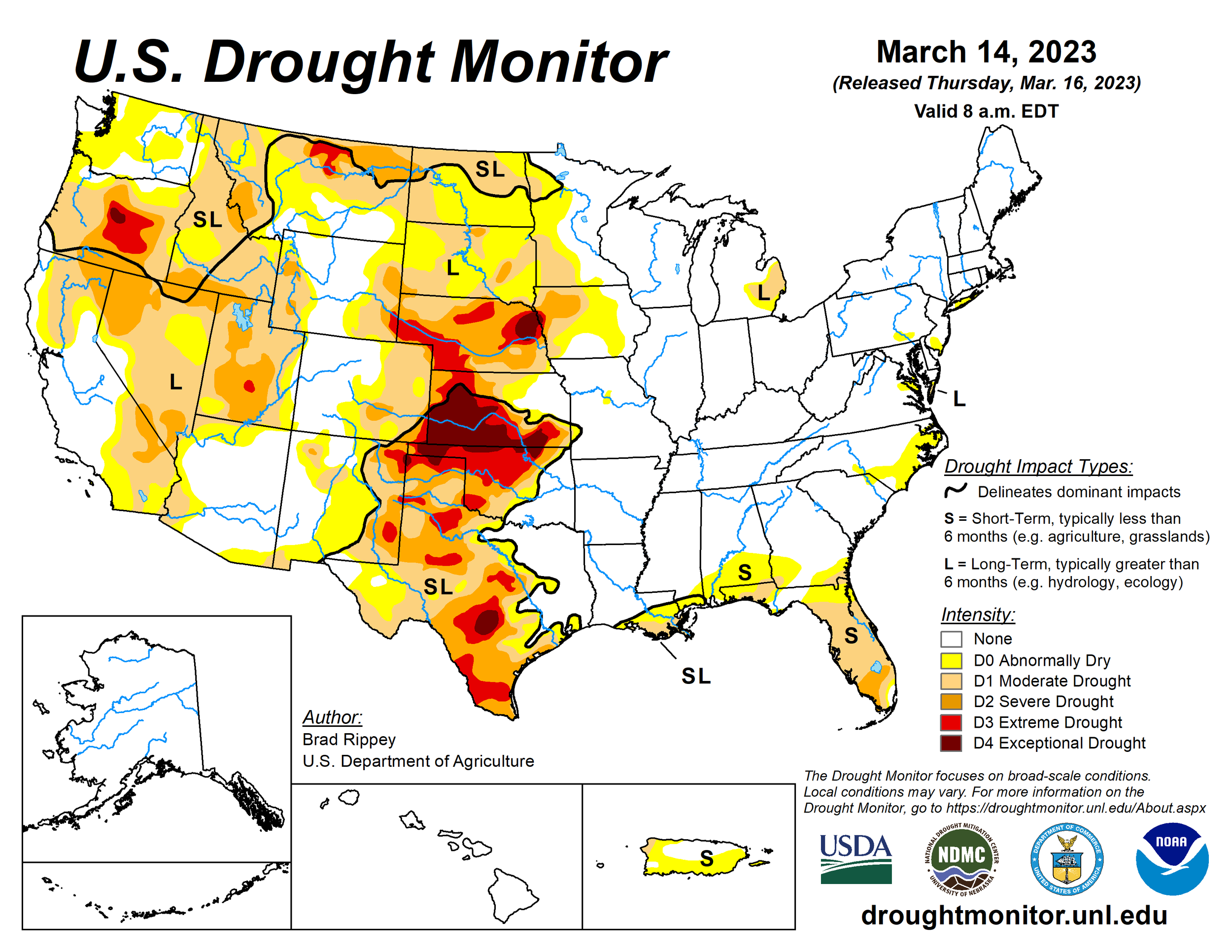

55% of the U.S. winter wheat is in drought condition vs 55% last week.

Overall the conditions remain poor. We somehow saw improvements in Kansas. I've heard a lot from Kansas guys questioning where there was even improvements. As plenty of guys are saying there was quiet a bit of winter kill in some areas, while some are saying we will lose that 2% increase this week and perhaps even see it lower than that with the warm weather and wind this week. Nonetheless, here in the U.S. we still have a pretty poor overall crop which should be a beneficial factor going forward.

Outside of the U.S. we also got news that winter crops in India have suffered some pretty serious damage the past couple of days due to excessive rains and storms. There hasn’t been any estimates for the losses just yet, but some are saying their wheat output might be lower than previously expected for the second straight year.

Russia Update:

The Black Sea agreement remains mixed. We saw the deal extended 60-days over the weekend. Russia said they want to be let back in to the global SWIFT financial system to allow money transfers. It's not looking like the U.S. is going to go for that. They also want grain to go to Africa out of Ukraine. Another statement they made was they might pull the grain agreement after 60-days. I doubt they do pull the agreement, as it's in their best interest to keep things together, but who knows what Putin will do. Traders are curious as to why Putin was only willing to do the 60-day, and if he has something else up his sleeve going forward.

The turnaround time for ships in the grain corridor is roughly 45 days. So this 60-day extension essentially means finishing up on the ships that are currently in route and that is about it. So no one really knows if Putin has something planned for when the deal expires.

Going forward, despite the poor beginning to start the week where we've given up half of our gains from last week, I still remain optimistic and hold a bullish tilt looking towards late spring and early summer. Short term we could of course see additional pressure to the downside. But looking longer term, I just think the potential bullish factors far outweigh the bearish ones. Still waiting for that catalyst to see the funds continue to liquidate their massive short. Nonetheless, wheat will remain influenced by weather, war, and the funds.

Taking a look at the chart, my current upside target is still a close over $7.13. A break above that level could open the door higher. Looking at the downside, I have levels of support at $6.75 and $6.61.

Chicago March-23

KC March-23

MPLS March-23

Crude Oil

Crude up another +2.5% today, now $5 off its lows. I'm still not completely sold that this rally was necessarily the bottom. Bulls would like to climb out of this long-term downtrend or get a break above $72. Support to the downside is $64.50 and $62.

April-23 Crude Oil WTI

China & Russia Meetings

Russia met with China the past two days. Russia & China made a joint statement saying that their relation has reached the highest level in their history. They also said there can be no winners in nuclear war.

China's President Xi said that China is prepared to defend world order alongside Russia in accordance with international laws.

It appears that China is trying to be a peacemaker, and attempting to arrange a Ukraine ceasfire.

This situation will be a closely monitored one. One question is, will China support weapons to Russia?

Putin also warned that Russia could drop out of the deal after the 60-days.

Lock-in basis now for later delivery?

From Wright on the Market

Many of you are loving the firmer basis being bid in various places for corn and beans. Just keep loving it and do not lock-it in.

Why?

A merchandiser’s job is to buy your grain and oilseeds on as weak a basis as possible. Put yourself in the seat of a merchandiser whose very job is to buy your bushels on as weak a basis as possible.

You, the merchandiser, have already set the basis for March delivery and first half April delivery. What facts would you consider to determine what basis you should set for last half April, May, June, July and August?

Of course you would look at the historical basis in your area, the local supply and demand over all and your facility’s anticipated needs for each of the delivery periods.

Let’s say you conclude your basis in May (or any other deferred month) will have to be 10 to 20 under the July futures, which will be about 15¢ firmer than normal.

This is March. May is two months away and June is three months away. How many bushels do you have to buy now for May, June, July or August delivery?

None!

Is there any possibility that a farmer would be willing to lock in the basis for June delivery at 25 under? How about 28 under? Or 32 under? Certainly, so why post a basis bid any firmer?

If you post a basis bid of 10 under and buy in March all the bushels you need for June, July, and August, what good does that do you? You will not have to beat the bushes to get bushels this summer, but how much profit will your employer make if you just locked-up three months’ supply of grain at a basis 20¢ firmer than the historical average? Maybe some profit, but maybe a loss.

Logically, your basis bid now will be on the weak side of your range of basis expectations for those delivery periods several months away. Your basis bid still might be historically firm, but on the weak side of your expected basis, none-the-less.

No matter how firm the basis bid is now for your stored bushels delivered in May through August, do not lock-in the basis now. It will get firmer for those months 19 out of 20 years. Your merchandiser’s job depends on low-balling the basis now for spring and summer delivery.

Why is Argentina's 50% soybean crop failure such a problem?

From Easy Newz

The Rosario and Buenos Aires Grains Exchanges have cut their soybean crops to 27 and 29 million tons each with industry sources fearing 23 to 26 is likely. 50% crop failures are extremely rare, and the effects will be felt globally. Argentina is the world's largest soybean meal and oil exporter, and now the question becomes, how will trade flows evolve to make up for these losses.

Argentina is uniquely positioned to be the world's low cost soybean processor and meal and oil exporter. The majority of the soybeans are grown tributary to the Parana River with deep water ports capable of receiving trucks from farmers that can then be processed on site and loaded directly onto a vessel. In Brazil and the United States, this requires multiple truck and barge elevations and discharge, often from hundreds or thousands of miles away.

Argentina's crush facilities are some of the largest in the world with three facilities capable of processing 20,000 tons per day. The largest facility in the United States is only 8,000 tons to put this in perspective.

In the previous two years, Argentina exported a combined 55 million tons of soybean meal and 10.5 million tons of soybean oil. Brazil and the United States exported 61 million tons of soybean meal and 5.2 million tons of soybean oil over this period. Brazil and the United States are the second and third largest product exporters after Argentina.

Argentina's government is heavily dependent on these exports for revenue, and the current account revenues are now hitting critical levels. Without these crops, Argentina could face default. Historically this has led to tax hikes, protests, and policies that lead to unproductive outcomes for the agriculture sector. Argentina's growing season may be coming to an end, but the problems globally may only just be beginning.

Highlights & News

China has shipped more than $12 in drones to Russia since it invaded Ukaine.

Before collapsing, Silicon Valley Bank gave insiders loans worth over $200 million dollars.

The 30-year fixed mortgage rate is expected to drop to an average of 6.35% this year according to Business Insider.

Winter planted crop sin Insia such as wheat have suffered damage due to unseasonal rains and hail storms. This has led to losses for thousands of farmers and increased the risk of food price inflation.

Looks like there is an 82% chance of a 25-point rate hike tomorrow.

Social Media

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

U.S. Weather

Source: National Weather Service