BEANS & WHEAT SELL OFF CONTINUES

Today’s update will be a little different than usual. Will be more tidbits rather than an in depth review of all the grains. We apologize for lack of audio this week but we will have some out tomorrow after close.

Overview

Beans and wheat both continue to take it on the chin, adding on to the recent weakness we've seen all week.

Corn held up great despite the weakness everywhere else, as corn manages to close up +3 1/2 cents as Chinese appetite continues to support corn. Corn also closed a dime off our lows.

May beans down -18 1/2 cents as they closed today at their lowest level since December 7th of last year. Continuing their sell off from last week, now down over 60 cents since last Monday.

Beans are being pressured by Brazil's monster crop and a continuation of fund selling on their long position.

Wheat goes back to test our recent lows, giving back all of last week's rally. At one point May Chicago was down -30 cents which was lower than last week's lows, but we managed to close a dime off those lows. Closing just above our lows last week.

There isn’t really a particular reason for the recent sell off. The Black Sea deal was expected. Perhaps some weakness came from the improvement we saw in Kansas WW conditions. However, many sources are saying we will see that number pushed right back down as many are questioning where they saw improvement.

Tidbits & Takeaways

🇨🇳 China Continues to Buy Corn 🌽

We saw another Chinese purchase of corn. As China bought another 178k (7 million bushels) this morning. Making this purchase the 6th one since last week. Bringing the total since last week to 2.425 million metric tons.

Feds Increase Rates by 25 Basis Points

As expected, we saw the Feds opt to raise rates by 25 BPS. The big thing here was that the decision was unanimous. Not a single Fed voting member wanted to pause or cut rates. They made it fairly clear that we probably see more increases in the future.

Was enough to give an appearance that they are working on inflation without caving into the whole banking crisis.

Powell said:

Inflation remains too high and labor economy is too tight.

Process of getting inflation back down has a long way to go.

March 31st Planting Report

This is the big thing everyone will be watching next Friday.

Estimates:

Corn: 90.9 million acres, up 2.3 million from 2022

Beans 88.2 million acres, up 1.4 million from 2022.

Just how much larger we come in compared to last year will be the key in how the trade reacts. Nonetheless, the trade is expecting increases across the board.

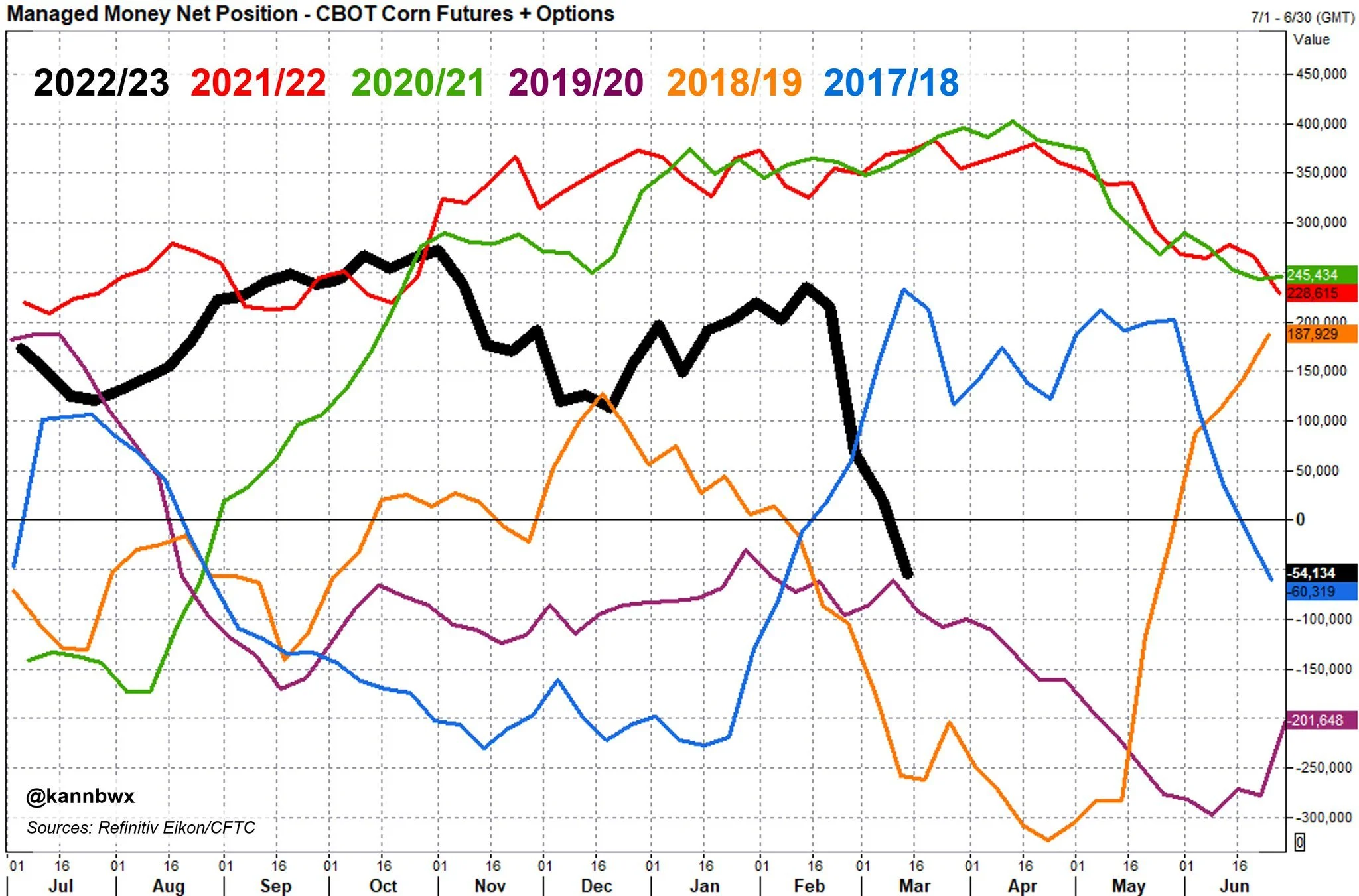

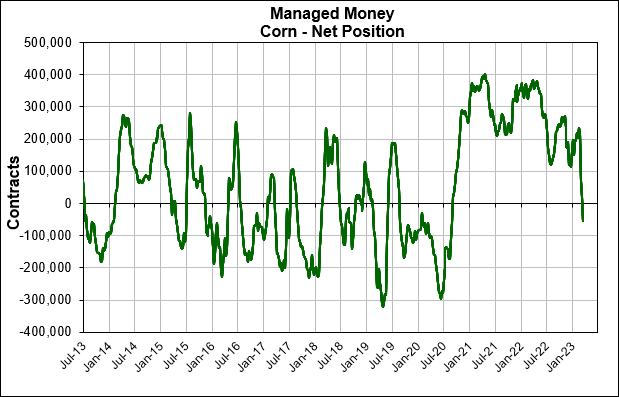

Funds Short Corn for First Time Since Aug. 2020

For the first time since August 2020, the funds hold a short net position in corn. (As of March 14th). As they net sold roughly 290k contracts (1.45 billion bushels). That selling over a 4 week span is a record.

However, one can imagine the funds are no longer too short corn. As they probably became buyers on this rally we've seen since our lows.

On the surface, yes it's bearish that the funds have shifted into sellers. But on the flip side, one could argue that it’s actually bullish we are still trading over $6.30 and only 50 cents off our recent highs prior to the selling.

Funds Positions

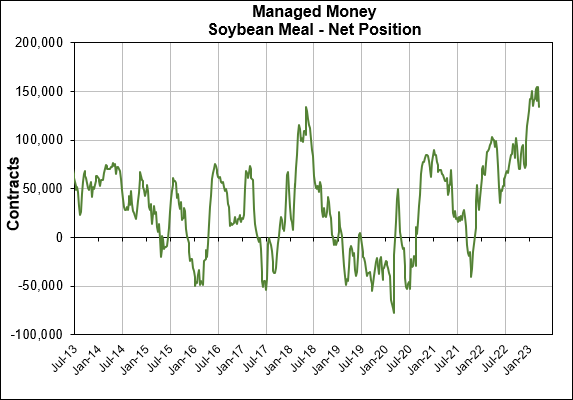

We finally got the CTFC data through March 24th. Of course the biggest change being the massive selling in corn we just touched on.

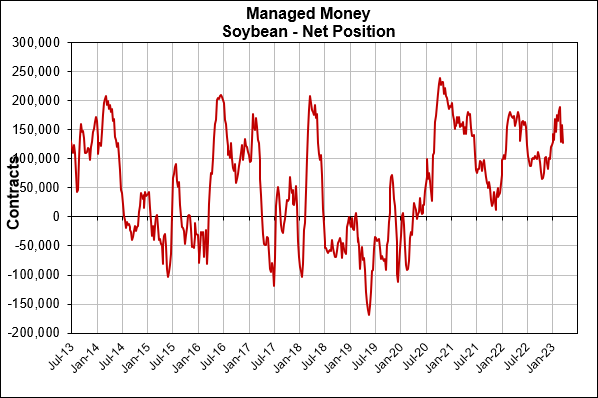

As of March 14th, the funds still hold a near record position in meal and a massive long position in beans as well. Their bean position is likely sizably smaller with the recent sell off.

Funds slightly added to their short KC and MPLS positions, while taking a bit off their Chicago. Still holding massive short positions across the wheat complex.

What Happens When Funds Decide to Buy Wheat

I touched on this last week, but the funds are still short over -100k contracts of Chicago wheat.

On last week's rally, we saw the funds liquidate only 15k of their position. In the meantime we rallied +40 cents.

It might not happen anytime relatively soon, but we still have to imagine what will happen to wheat futures when the funds decide to jump ship and start liquidating this massive short position. Because eventually they will, the question is just a matter of when.

12 Straight Red Days for Nov. Beans

November-23 beans have traded lower for the past 12 consecutive trading sessions with today's losses. As they have lost over $1 on this sell off.

Comparing 2008 Beans to 2023

New crop beans are down more than -5% this month. Comparing this to 2008, we saw Nov. beans plunge -24%. We then proceeded to make our lows in early April, followed by an even higher rally into the beginning of July.

So will we see the same price pattern this year? More downside until April, followed by a spring/summer rally.

Are Beans Oversold?

The RSI (Relative Strength Index) for November beans has dropped below 20, which indicates heavily oversold conditions. Beans have now been trading below the RSI 30 (standard oversold conditions) for a week now.

Karen Braun went back and looked at the other past times that beans' RSI has fallen below 20. A few of those instances happened in mid-June of 2018 during the trade war and mid-May 2019, just before the U.S. planting delay rally.

Dollar Downfall

Following the FOMC report, the dollar continues to trade lower, leaving the chart looking vulnerable. If the dollar doesn’t hold here we could be in for another leg lower.

Crude Moves Off Lows

Crude has made a nice little rally off it's lows. As mentioned in past updates, I'm not totally sold on the bottom being in just yet. Would like to us move out of the long term downtrend.

Bottom Line

The funds are selling right into demand, I could see the snap back resulting in higher corn and wheat. Short term still a little nervous we continue to see funds close out their longs in beans, but this downside correction was a little over done and beans might be oversold here. Looking long term I still think we see higher prices come late spring and early summer.

Here is what we had to say in Sunday's newsletter;

I strongly believe that the lower prices we have had recently have helped increase the odds that we see higher prices later this spring/summer. The market's job is to scare farmers into selling, that has happened, plus we have seen demand pick up, to go along with production issues that are huge such as Argentina.

We don't have enough supply, at least in the right areas, to meet the demand. With farmers heavily sold, we have lost our natural sellers and both buyers and the funds could go into panic mode once they wake up and realize the situation could develop if Mother Nature determines she wants to play that card, and even if she plays nice we still might not have the supply to meet the demand. No sellers, buyers panic buying, and the funds trying to run prices up to print more money could be our future.

Bottom line remains to be patient making grain sales. But the number one rule for grain marketing is to be comfortable. So with some of the unknowns (acres, yield, demand, weather, etc.) out there like how the banking crisis will shake out as well as its impact, like always I have no issue for those that need to have some floors in for grains that they are growing. There is nothing wrong with making sales that make sense. But with the upside potential that we have along with the fact that we have more upside potential then downside risk. We strongly encourage putting in floors versus making grain sales. We don’t want to give supply away to buyers that are trying to make plenty of money. We want to sell when they are in panic mode so that supply won’t be there.

So those needing to put floors in, make sure you have a hedge account open and buy puts when that’s what gets you comfortable. Wait to make the sales when the market starts telling us to.

Grain Trading Crash Course

This is a great substack post from GrainStats. They dive deep into all things grain markets. It goes over futures, grades, delivery and more. Great read.

Technicals & Charts

Corn 🌽

Corn has moved up nicely off it’s lows. Short term perhaps we trade sideways, but long term outlook is higher. Bulls would like a break past the $6.40 level.

Beans 🌱

The chart doesn’t look great. Next stop to the downside might be within the $14.40 to $14.20 range. However, the fundamentals still remain bullish long term and the seasonal trend is higher until mid-summer.

Wheat 🌾

I thought we made our lows on last week's rally, but wheat continues to leave bulls scratching their head. Will have to see if we hold at today and last week's lows and trickle lower once again. Fundamentals remain bullish.

Past Updates & Audio

3/21/23 - Market Update

BEANS & WHEAT CONTINUE TO DISAPPOINT

3/20/23 - Market Update

GRAINS CLOSE WELL OFF LOWS

3/19/23 - Weekly Grain Newsletter

MOTHER NATURE & BLACK SWANS

3/17/23 - Audio Commentary

DO WE HAVE ENOUGH GRAIN / CHINESE DEMAND

3/16/23 - Market Update

CHINESE APPETITE CONTINUES TO SUPPORT CORN

3/14/23 - Audio Commentary

WILL SVB LEAD TO FUND BUYING IN GRAINS

3/12/23 - Weekly Grain Newsletter