BEANS CONTINUE BULL RUN

Overview

Soybeans continue their bull run from their recent lows as wheat remains the weak link in the ag complex. As beans are now over $1 off their lows from August 8th.

The demand story for beans continues to grow. We got another sale to China this morning, this time 121k metric tons.

We have updates crop conditions Monday. There is a very good chance we see a significant drop in ratings. Here is what a few people in the industry think we will see Monday.

Mark Gold from TopThird:

2% to 5% drop

Heartland Farm Partners:

3% to 5% drop

Jason Britt, President of Central State Commodities:

7% drop in corn ratings

8% to 10% drop in bean ratings

So I’m expecting these to provide some support to both corn and beans. Keep in mind, a lot of damage that was done this week from the heat was not picked up in the tours.

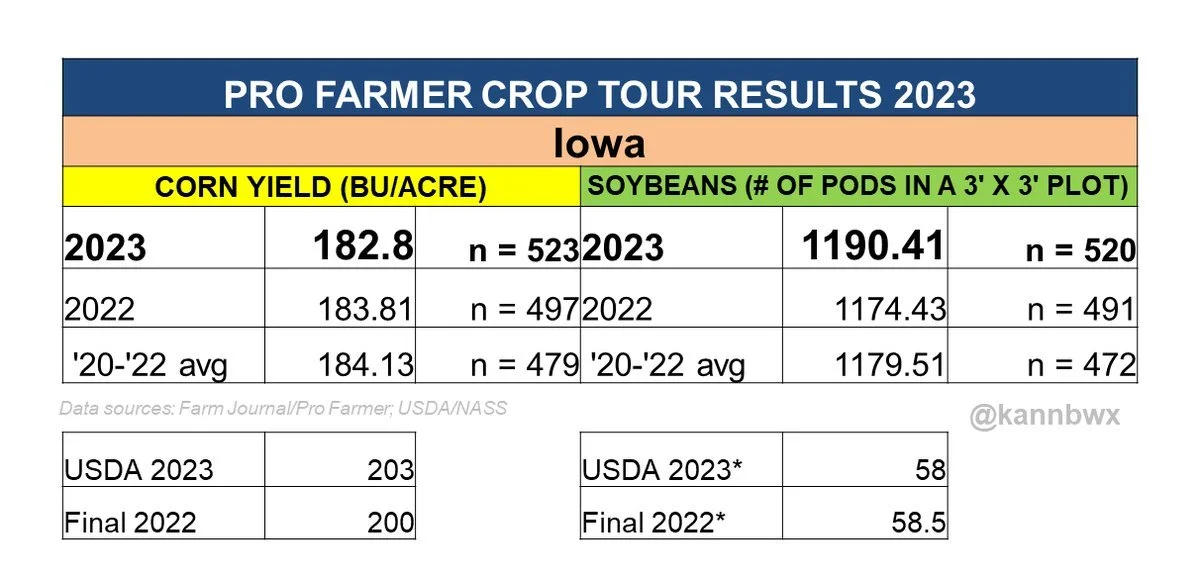

Overall day 4 of the crop tours were pretty friendly for the markets. Here were the results in case you missed them.

Iowa:

Corn at 182.8, below last year and the 3-year average.

Bean pods slightly higher than last year & the average.

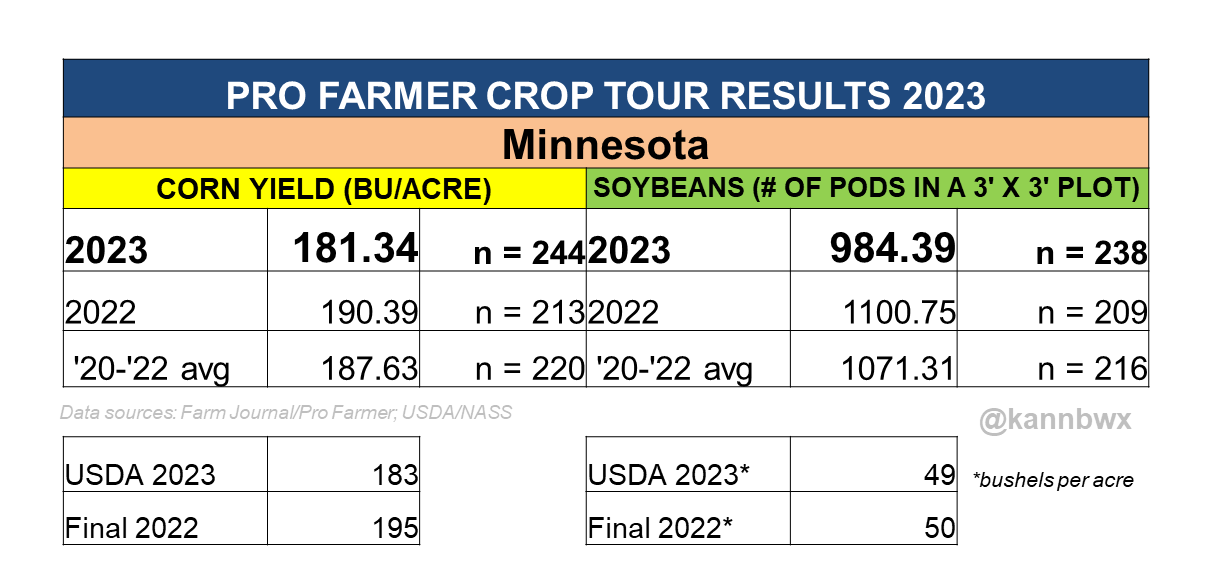

Minnesota:

Corn yield well below last year and the 3-year average.

Bean pods also well below both.

Following the crop tours, Pro Farmer released their yield estimates for the crops right after market close today.

Here were the results (bushels per acre):

Corn 🌽

Pro Farmer - 172.0

USDA - 175.1

Last Year - 173.3

Beans 🌱

Pro Farmer - 49.7

USDA - 50.9

Last Year - 49.5

Here are the production numbers:

Corn: 14.96 billion bushels vs USDA's 15.11 billion

Beans: 4.11 billion bushels vs USDA's 4.205 billion

These are pretty friendly numbers. What would happen if beans did drop below 49.5 bpa? Make sure you read the rest of today's update where we go over this into further detail and why soybeans might just have to go higher..

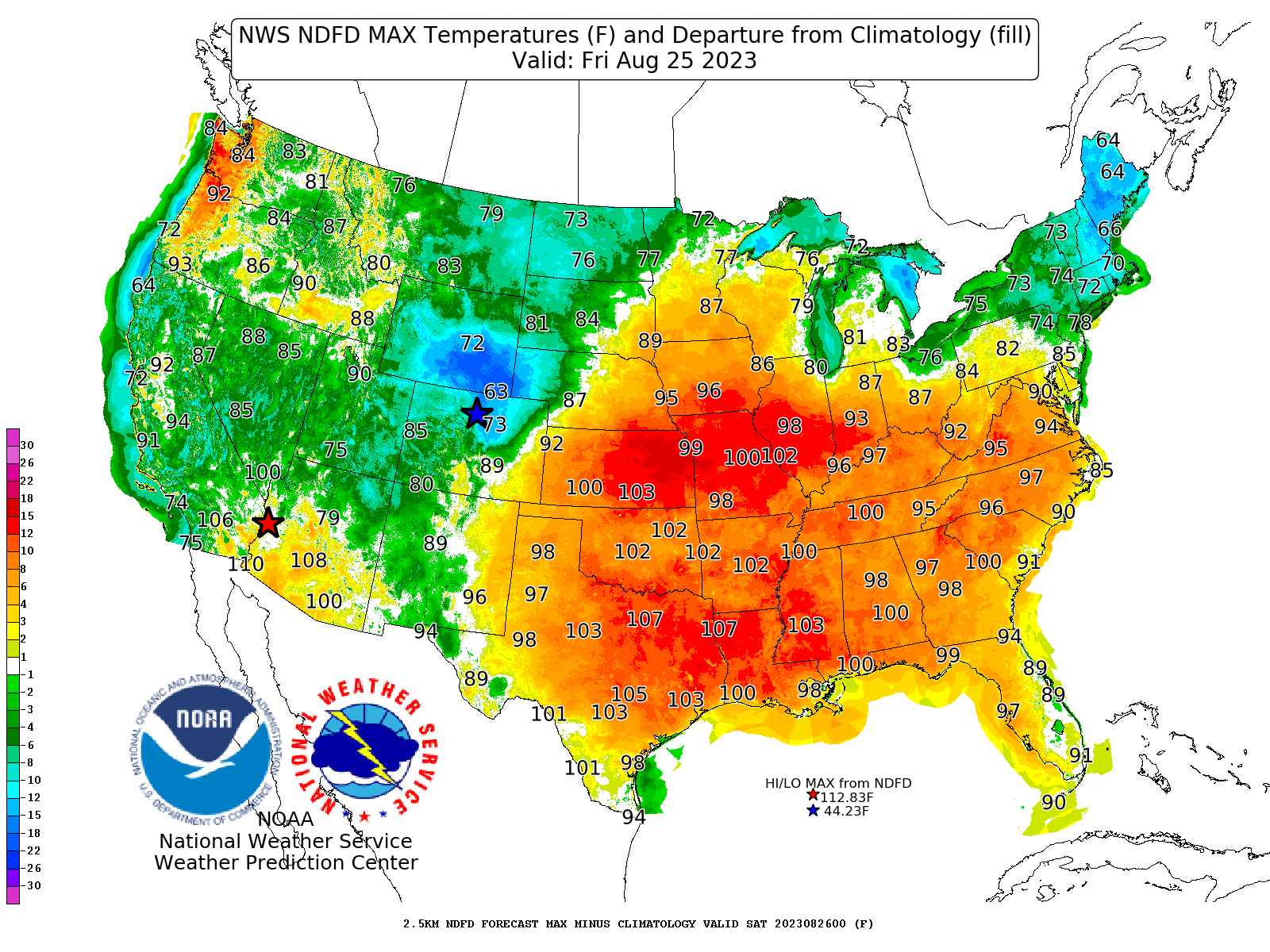

Here is the weather to close out the week. Still brutally hot today. Here was the max temperatures.

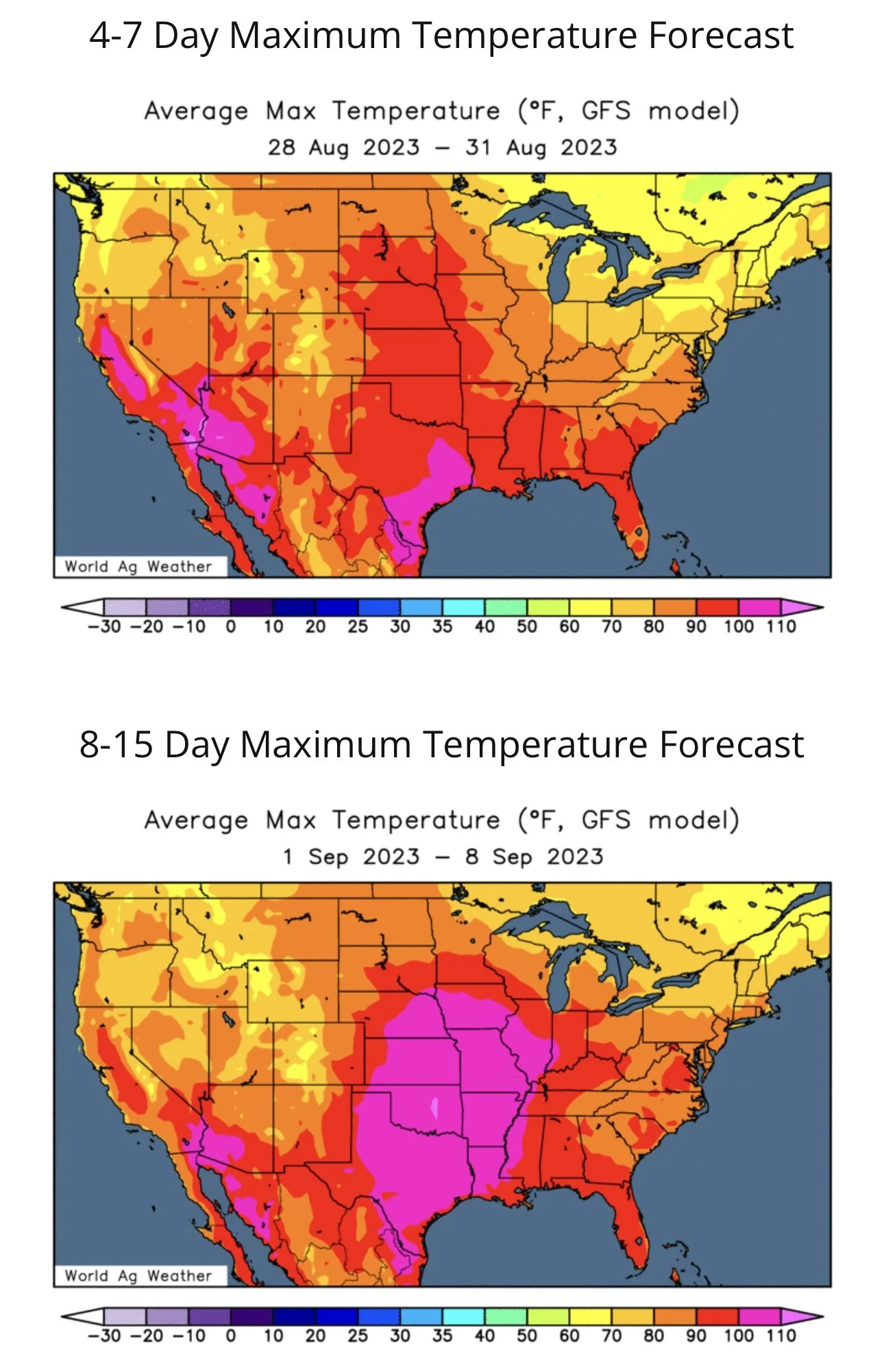

Here is how the heat looks for the next few weeks. As you can see, it cools off a little bit next week, but that heat is expected to make a return right as we head into September.

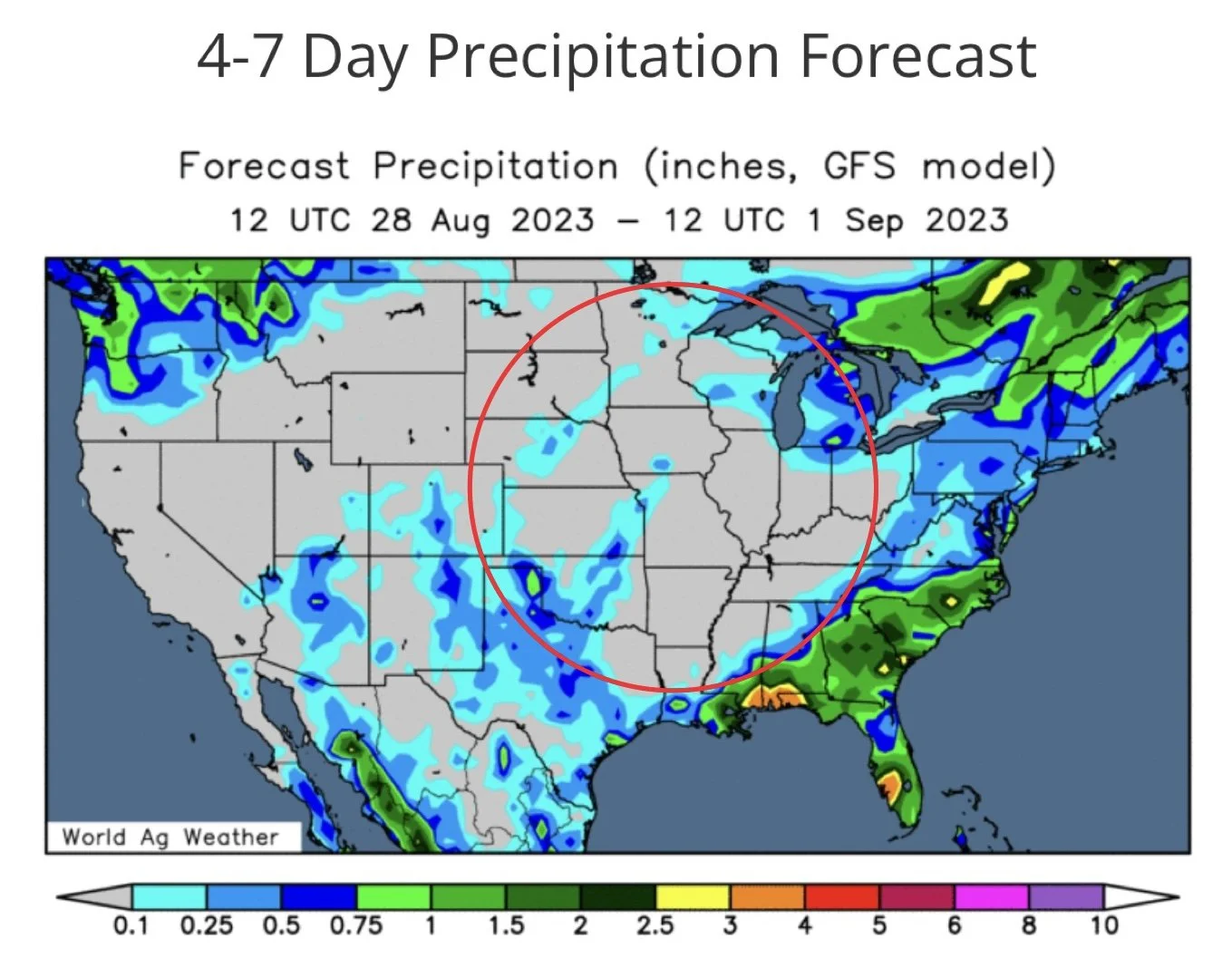

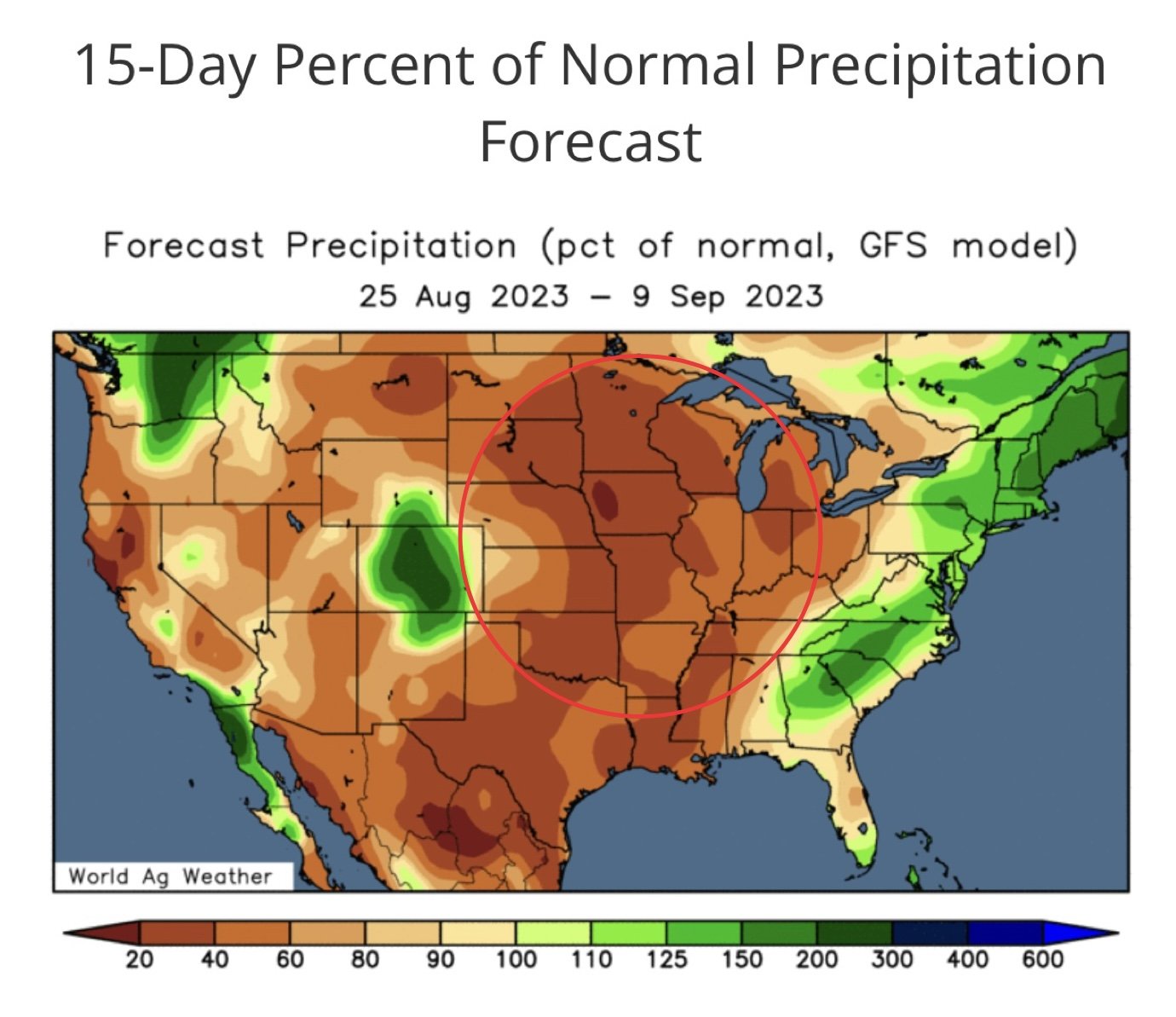

Now these next maps are just as important. As you can see, we aren’t expected to get much if any rain over the course of the next two weeks for a large portion of the corn belt. Notice the big pocket missing rain.

I mentioned this Wednesday, but towards the end of their maturation cycle, moisture is crucial for beans. Without moisture, they can see huge reductions to yield.

So altough it is expected to somewhat cool down for a few days, we are still experiencing some not so great conditions to finish the growing season.

There might not be much to scare the funds and cause a massive rally in corn and wheat quite yet. But if beans start to take off, we would have to imagine corn follows suit and gets some short covering. Especially with crop conditions Monday, which I expect to see bullish numbers.

Overall, the bean situation remains very bullish. Seasonally we are nearing a time where we put in our lows for corn and wheat. We also have a crop that is getting smaller, not larger. All of which could push us higher in the future.

Today’s Main Takeaways

Corn

Not a great day for corn today. We only closed down 1/4 of a cent, but this was a nickel off our highs, as we failed to trade above yesterday's highs. On the week, corn only lost about 4 cents.

Demand is still the biggest thing holding corn back here. As bears look at the old crop cancellations as well as rumors that Brazil has the chance to overtake the US as worlds leading exporter of corn.

Pro Farmer had their yield estimates at 172 bushels an acre, below the USDA's 175 and last year's 173.

From the crop tours yesterday, they showed both Iowa and Minnesota are off worse than they were last year, and these numbers haven’t been fully impacted by the brutal heat and lack of moisture we just saw this week.

Bulls are looking for weather to continue to add some premium as we head into harvest. For the time being, weather remains fairly bullish. We also have the potential for Black Sea escalations to provide short covering, but that is still just a wild card.

South America weather is going to start playing a bigger key role as we head closer to the end of the year.

Taking a look to crop conditions Monday, as I mentioned, I fully expect these to support the market for both corn and beans.

Although, no there isn’t just that major catalyst sitting in front of us to push corn higher. But there is one for beans. If beans continue to be strong, we have to imagine corn will follow behind.

Seasonally, we chop around or trend slightly lower for another month or so before putting in a definite bottom. But I think the trade is severely underestimating the damage we have seen to the crop. Bulls would like a spark in demand to support a rally however.

So yes, I think we are in the process of putting in our lows. Are we there yet? It's possible. We have support at $4.85 to $4.81 range. If we were to trickle lower from here, there is still a chance that we do eventually go to look to test the $4.60 range before making a low for the year and eventually climb higher, but we have held this range pretty decently thus far.

If you made sales around $6, this area isn’t a bad spot to be looking at cheap calls over the course of the next 1 or 2 months. Remember, we don’t want to chase a rally. That is why it is called hedging. We like buying calls while they are still on sale.

If you are worried about the market dropping even further, perhaps look at cheap puts. Using puts to establish a floor is not the worst idea in the world.

Corn Dec-23

Soybeans

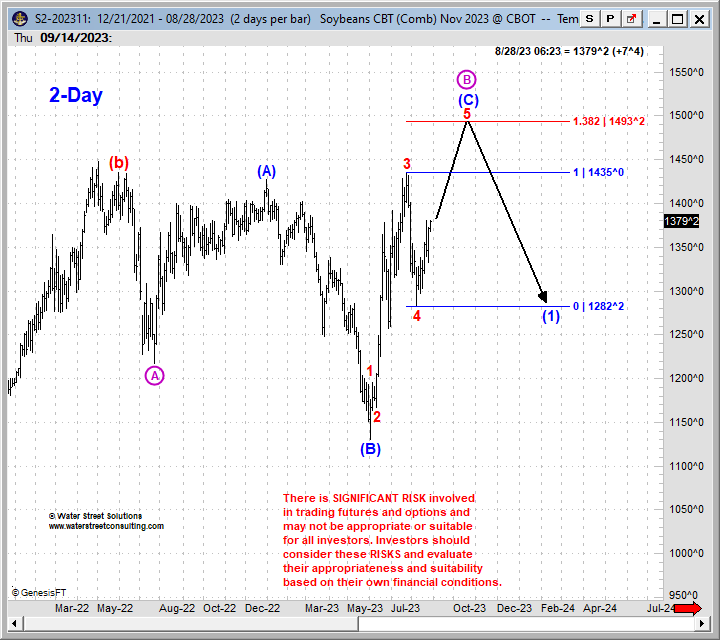

Beans continue their recent rally, as the demand and weather story continues to feed the bulls, as beans are now over $1 off their lows from the beginning of the month. As we took out our highs from Monday where we gapped higher. Beans look super strong here.

The two main factors right now are weather and demand. Both of which remain bullish.

The weather story isn't quiet as bullish next week, but the forecasts look pretty bullish throughout mid-September

From Jerry Welch of commodityinsite.com,

"The Pro Farmer yield estimate for soybeans looks damn bullish to me. So does the weather forecasts for the grain belt into mid-September. A zillion years ago, soybeans rallied $2 a bushel in September."

So we just got a heat wave that lasted 6 days, longer than the projected 4 days. With no rain in the foreseeable future.

My biggest takeaway from the crop tours is the bean yield and production. Their production estimate came in at 4.110 billion bushels. Below the USDA's 4.205 billion. That is over a 90 million bushel decrease.

The USDA's current carryout out is 245 million bushels. What happens if we lose another 90 to 100 million? We continue to get tighter, and we have to curve demand.

How do you curve demand? Higher prices.

It feels like demand has been increasing for beans. What happens if the yield is also decreasing? We will have to go higher to ration demand.

From the results of the tour, it appears that the June dryness had a bigger effect than most originally thought. Not to mention the effects this past week of heat had. But we haven’t even seen the real damage from the recent heat yet. Can only imagine if these crop tours were a week or two later.

Next few weeks of weather will be pretty important. But one thing we know for sure, the balance sheet will likely be tightening regardless.

What happens if bean yield comes in below 49.5 bpa? Take a look at a chart from Darren Frye and what he thinks will happen. One thing to keep in mind, this is the same guy who is typically known for being considerably bearish a good portion of the time. Where does he have beans making their highs? Just about $15, which we said was a possible scenario a few months ago. It still is.

Although, yes I do think we eventually go to look to test our highs we made in July, and yes there is still a chance for beans to go and test $15 later this year, you have to make yourself comfortable. It all comes down to your specific situation. If you need to catch up on sales, then by all means do so. Keep in mind, we are near our highs for the entire year. We were $1 lower a few weeks ago, and $2.50 lower just a few months ago. This is why we like to have our hedge accounts open. If you sell and we go higher, that is a perfect opportunity to buy puts and make money on the way down that you didn’t on the way up.

If you need help or want specific advice shoot us a text or call at 605-295-3100 free of charge.

Taking a look at the charges, beans look great here. We remain in a solid uptrend from our recent lows. Today we closed above Monday's overnight highs where we gapped open. Next target is $14.03, which is a 79% retracement.

Soybeans Nov-23

Wheat

Wheat remains the disappointing one of the grains, with another day of losses as they struggle to find their footing. One day we get war headlines that provide a spark, the next that war premium is completely gone. Today Chicago wheat lost a dime, while KC and Minneapolis wheat actually managed to close green by a few cents.

Bears continue to point out our weak export demand, as well as rumors of a bigger crop over Russia.

The funds also haven’t released their foot off of wheat neck, as they continue to be the funds punching bag with negative macro headlines such as the recent surge in the dollar.

On the other hand, we do have a ton of problems globally that can and will eventually push us higher. The key word is eventually.

We have the problems in Canada, Australia, among others.

As we have mentioned a few times this week, the wheat story isn't one that has to unfold anytime soon. The race in wheat is a marathon, and we are being patient for that story to tell itself.

Seasonally, this is a time where we start to put in our lows in the wheat market. So I do think we are in the process of making our lows if we have not already. Could we see another leg lower? Of course that is possible.

Taking a look at the charts, we found support exactly where we have the past 3 times in Chicago, which was $5.87 1/2. KC and Minneapolis have found some footing. So short term I wouldn’t be surprised to see some choppy trade as we look for some footing in attempts to find a bottom.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio

DON’T PANIC. TODAY REINFORCED HIGHER PRICE OUTLOOK

8/21/23 - Audio & Market Update

MARKETS PLAYING LEAP FROG

8/20/23 - Weekly Grain Newsletter

WHY THIS IS MORE THAN A DEAD CAT BOUNCE..

Read More

8/18/23 - Market Update

GRAINS BOUNCE. WEATHER REMAINS BULLISH

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio