ECON 101 APPLIED TO GRAIN SALES

Here are some not so fearless comments for www.dailymarketminute.com

Another violate week that included plenty of disappointing price action yet doing so in a way that left plenty of hope that we have a bottom in for corn and wheat.

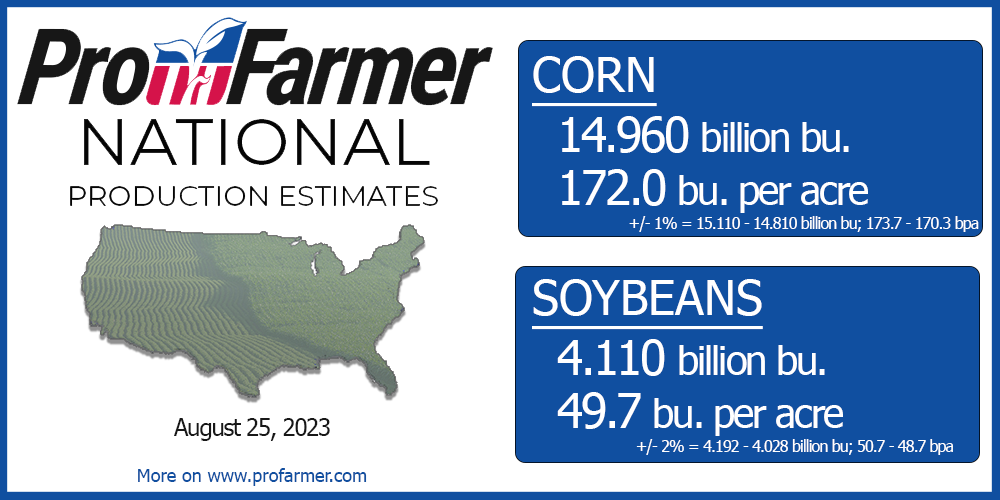

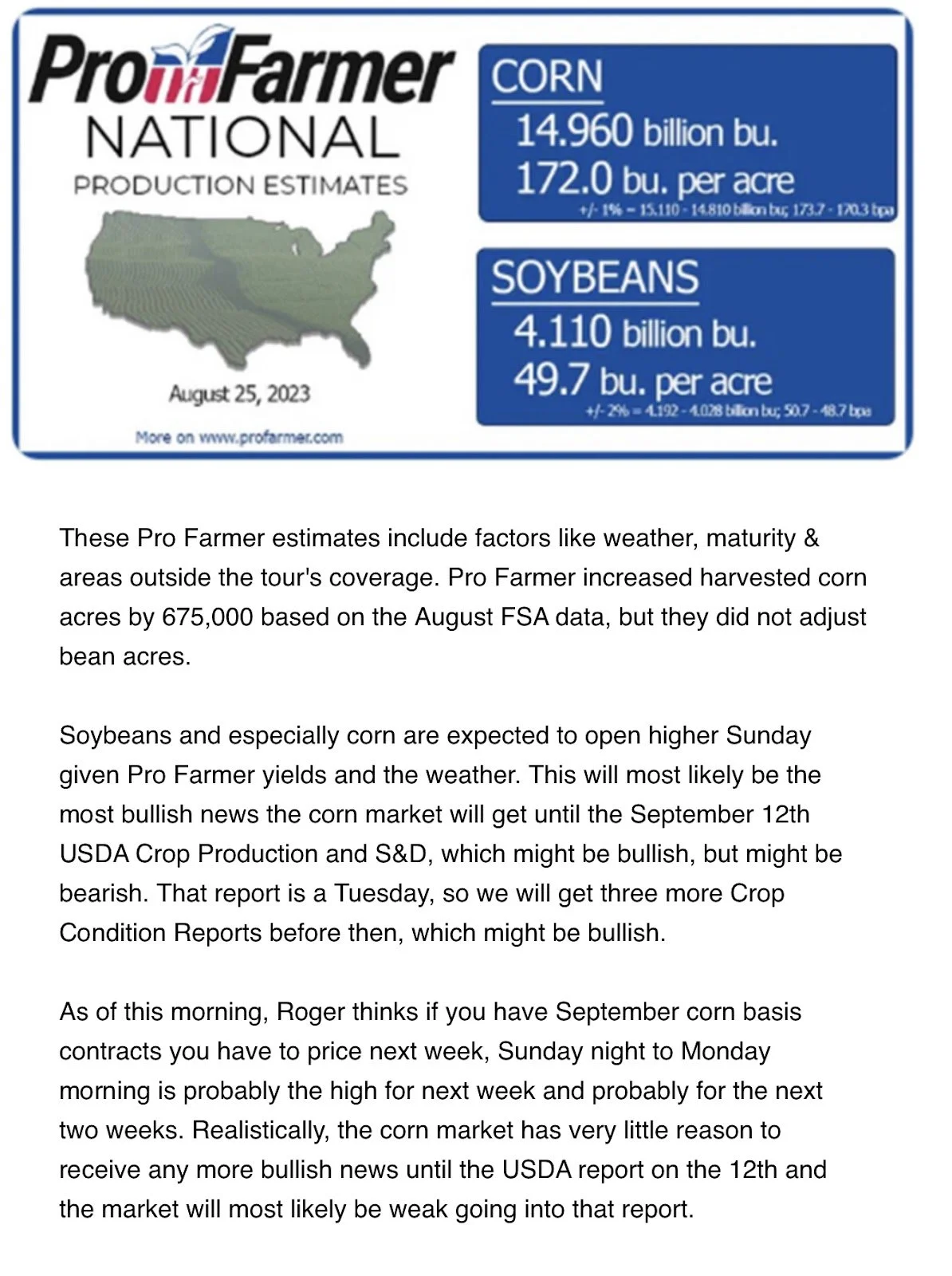

The big headline last week was the Pro Farmer Crop Tour. Which estimated that our production was less than what the August USDA printed. A little over 100 million under what the USDA had for corn. While Pro Farmer estimated the soybean production at 85 million less.

ECON 101 GRAIN MARKETING STYLE

Presently our markets are still in the supply discovery mode. Meaning we are trying to determine acres and yield. In ECON 101 we learn that more supply creates more demand, while higher prices create more supply. High prices cure high prices and low prices cure low prices. Etc

A few months ago we had corn yield ranges over 180 on the top side and under 165 on the low side. For corn that is a supply range of nearly 1.5 billion bushels. It goes without saying that if we have a billion bushels more corn prices will likely go down, if we have a billion bushels less corn production prices will likely go up.

For grains our production is determined by our acres and yield. While our supply includes old crop carryover. Acre ranges pre planting were at one point as wide as 7 million acre range. Every million acres is about 175 million bushels.

For soybeans I would say pre planting estimates had yield ranges of 5 bushels on yields and 7 million on acres. So for yield you have a little over a 400 million bushel production range. Which is 1-2 times what our carryout is.

As time goes by we narrow in the possible ranges for production, as we see how many acres get planted, followed by yield estimates and finally harvest results. Even though corn production isn’t going to be as big as what the USDA first put out in May it is going to be big enough that the job of the market MIGHT be to add demand.

For soybeans we have the exact opposite type of ECON 101 type of supply change versus USDA first estimates. So the job of the soybean market becomes curbing demand.

With the weather this past week the unknown for soybean supply (yield/production) has increased instead of being more dialed in. As estimates for soybean yields have seen the possible range widen out.

Presently USDA has bean yields at 50.9 bushels per acre on 82.7 million acres with an ending carryout of 245 million bushels. So if we end up 3 bushels less we end up with a negative carryout if our demand was the same as what the USDA has printed. Obviously that won’t be the case. As we can’t use what is not there.

The bottom line is that one should ask themselves what ECON 101 stage is the market at. Are we determining supply, determining demand ,needing to find demand, needing to curb demand. It isn't as simple as that but it helps when looking at the big picture.

The bottom line is that if we are needing to curb demand because our supply is lighter then estimated the easiest way to do so is to have prices go up. This is why the soybean market will have plenty of potential over the next several months.

The soybean oil situation and world veg oil situation is one that has demand outpacing supply. This should help prices long term.

HARVEST BASIS - STORAGE - PRICE LATER - DELAYED PRICE

When it comes to should I store, should I sell, or should I pick up the carry? My big picture point is that if you are supplying grain during harvest you are adding to the supply at the spot when we have the most supply of the year. But here again it isn’t as simple for most operations.

But overall I don’t want to sell, nor deliver grain at harvest when everyone else is. I want to have enough on farm storage to hold multiple years of crop. I want to have staying power to have the flexibility to market my grian 1-2 years in advance to a year or two after it is harvested.

But for most operations it makes sense to not be pre-selling until you have some inputs locked in. So that one has a good idea of what break even is as well as what profit goals one has. While most operations need to have grain sold prior to the next harvest.

The vast majority of farmers therefore should have DATES by which they need to have grain sold by, or they end up in the situation where they end up moving grain in a manner that hurts prices because they SUPPLY the grain without having made the PRICE function of ECON 101 do the work it needed to get the supply to market.

In becoming a price maker you need to analyze your operation’s have to’s. And realize that your marketing pro-activeness either aligns with becoming a price maker or keeps one becoming a price taker. For example if you have to ship grain daily from Jan-March because of operation logistics you need to be more proactive than an operation that can hold grian for years.

Is your method of selling/delivering/supping your grain helping you become a price maker or a price taker via asking yourself in ECON 101 theory what it does for prices if higher prices come from less supply and lower prices come from more supply. For example if you bring grain in on a delayed price contract you are supplying the market without having to give you a negotiated price. If you do HTA’s instead of Futures contracts. You are supplying the buyer without having to compete on basis. If you are doing a basis contract and rolling it, you are allowing the buyer to use the value of your corn to help fund his business.

As it relates to harvest basis and whether or not one should lock in basis now or wait, well if you are supplying the market at the time when the supply is the highest, realize that you are simply not helping ECON 101 for prices. So you are playing a game against your buyers, who’s job is to buy grain at the cheapest basis possible.

So to the question of if one should lock in basis now or wait, it really is going to come back to what your local area has for production versus normal, what your flexibility is. If enough farmers in your area are supplying corn at harvest and storage is filling up basis will get weaker if the buyers get control in your area.

One doesn’t want to supply grain at harvest, you want to let your neighbors do that. But if you have put yourself in a situation where you have to deliver and your choices are basis contract, price later/delayed price, or cash it out.

The reality is that there is NO GOOD answer if you find yourself in that situation. All one can do is learn and try not to find yourself in the same situation year after year. Become more proactive or find a way so that you have the flexibility and are not forced to supply cheap grain. The good thing is that via you selling grain at harvest, taking that bad basis, etc. You help prices via helping supply low prices. If every farmer had storage for the whole crop we would end up hurting demand via not having enough supply when coverage is being sourced.

There are a couple of demand factors to watch out for on basis clues. The first is determining if corn supply is deficit or surplus in your area. The next is in surrounding areas.

Last year for example the drought from Texas all the way north helped firm basis in the western corn belt. That wont be supporting basis in our area this year.

But we could see China supporting our prices which in turn would help basis out in those areas such as the upper midwest that typically go out to the PNW to China.

See below couple of price charts from NOBULLAG.com

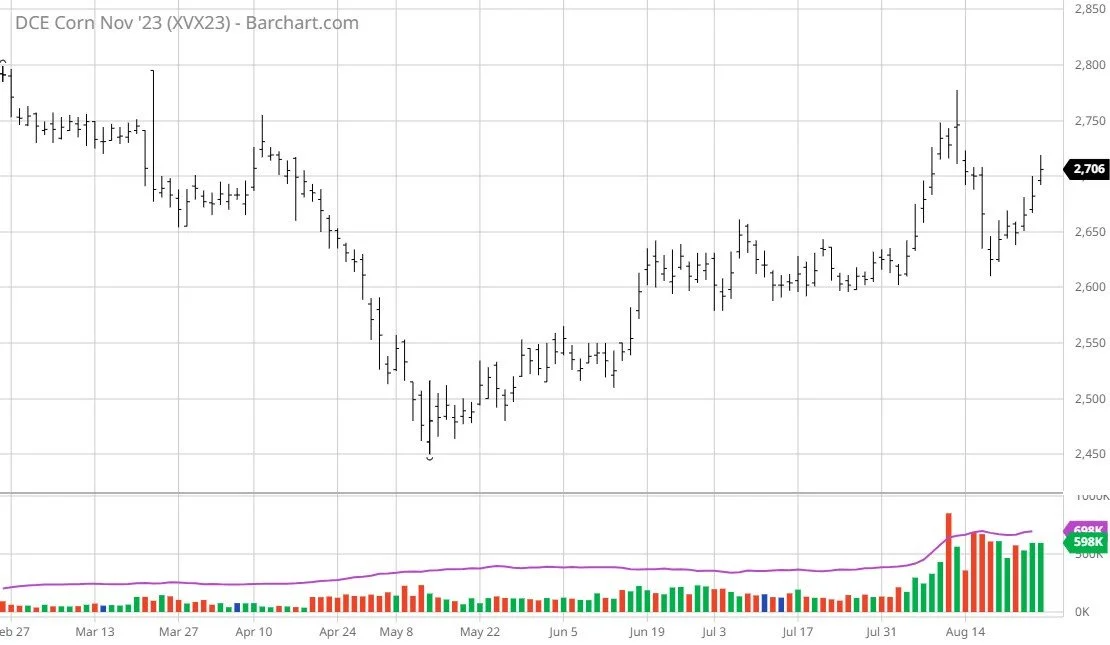

This chart is one of the reasons I don’t want to be super bearish at these price levels. It is Chinese corn and it shows it has had a nice little rally and wouldn’t take much to get to new yearly highs.

This chart shows that we now have a spread of over 5.00 a bushel, the first time since the fall of 2021. Don’t tell me that China won’t be buying our corn very soon.

The below is also from NOBULLAG.COM. It just shows that corn supply is becoming more known whereas soybeans still have the jury out. When supply is unknown we should have weather premiums added.

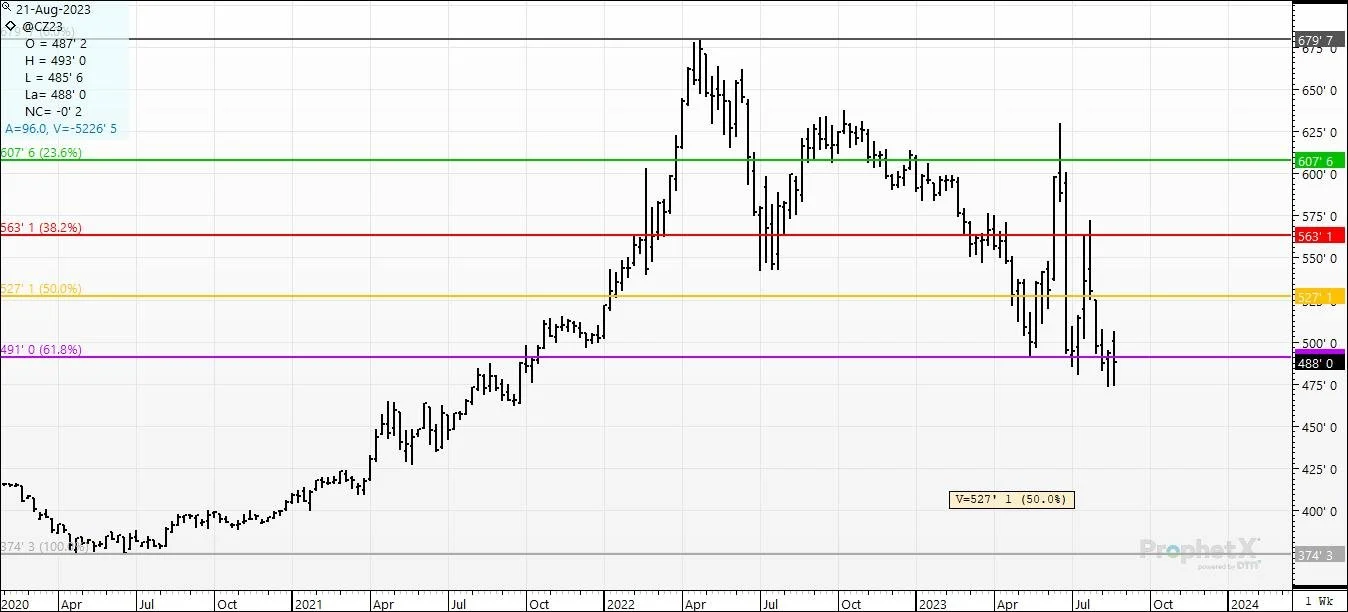

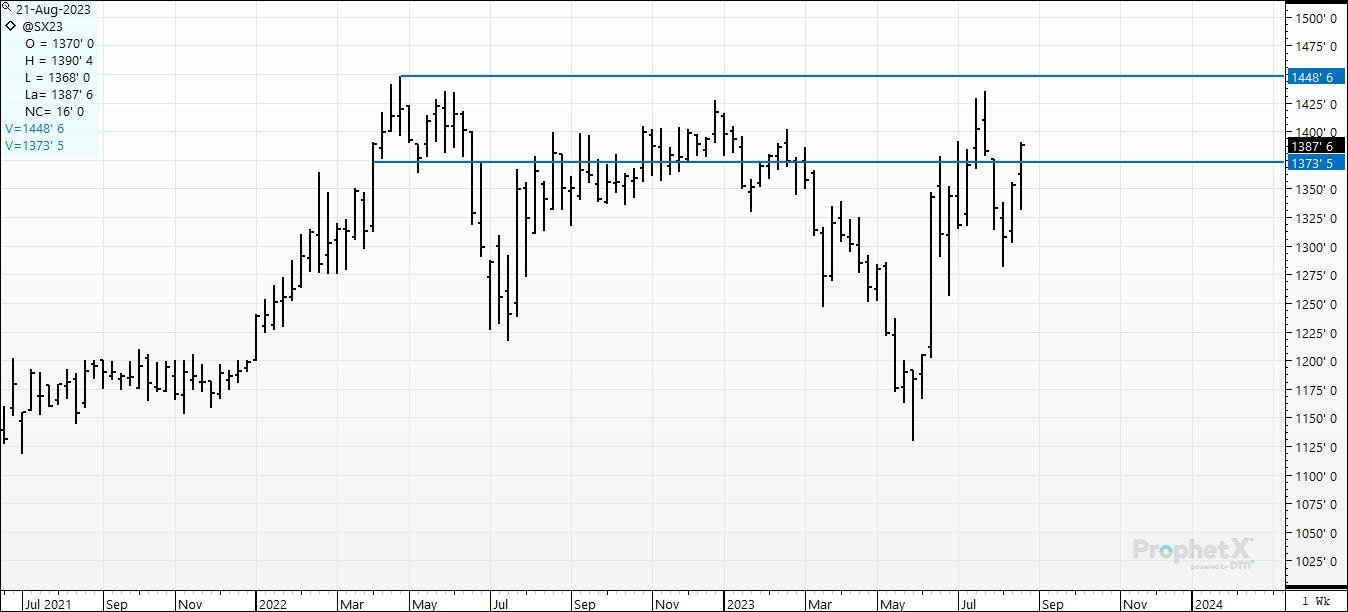

Last week I mentioned some targets for the various grains. The below charts indicate that we have still held levels of support that help keep the upside targets I mentioned still viable this week.

The other thing I wanted to mention is that as we figure out the supply side of the ECON 101 equation we also should take away some of the volatility. We very well could start to see our markets with more defined ranges. Especially in corn.

Here is Sep Corn

Dec Corn

Nov Soybeans

Oct Bean Meal

Oct Bean Oil

Dec CBOT Wheat

Dec KC

Dec MPLS

Oats. Do oats know is the question? Let's hope so.

Canola

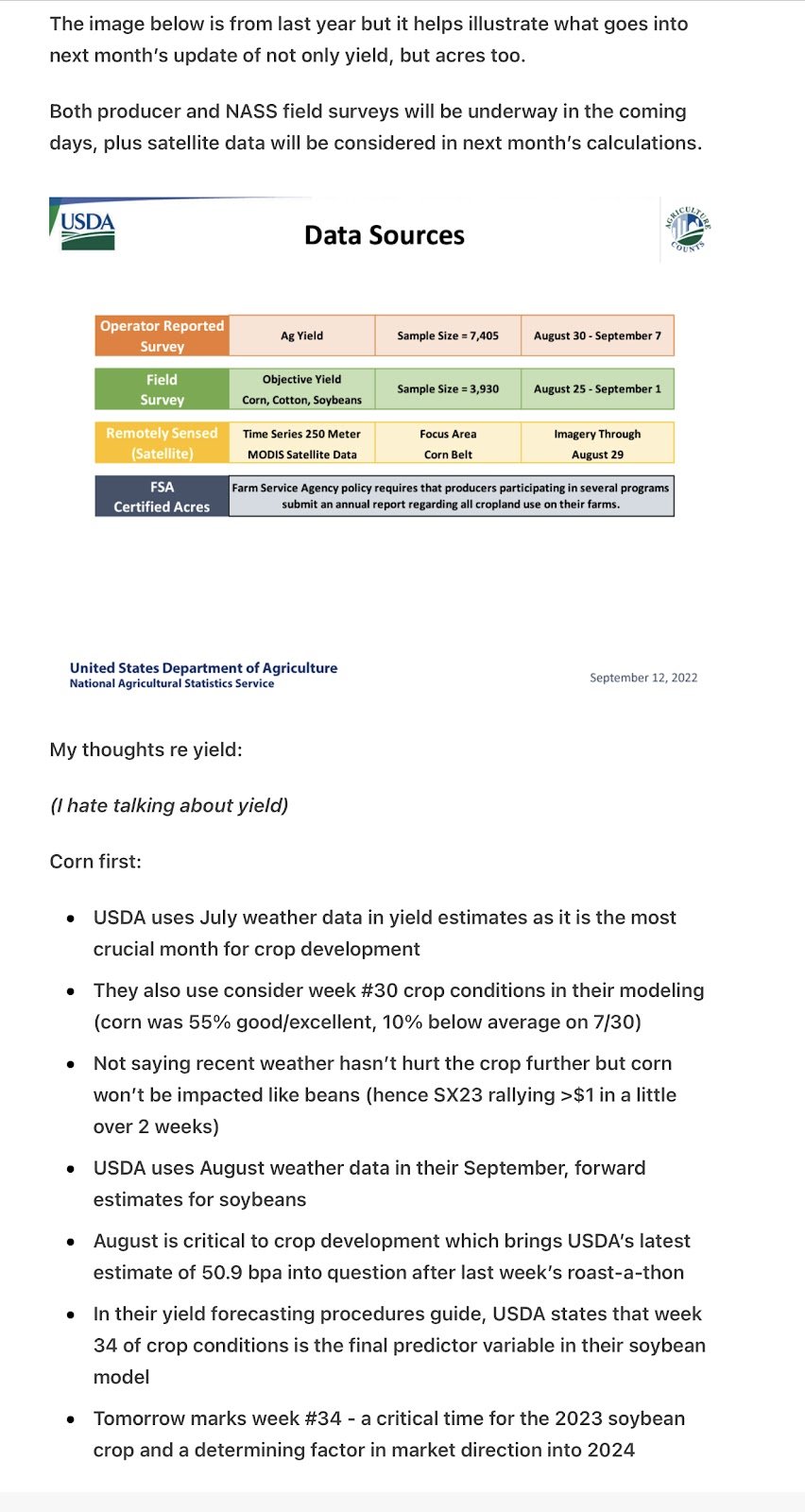

Below is from Wright on the Markets. He mentions how Pro Farmer comes up with production estimates. He mentions his price outlook and says that the market will most likely be weak going into the September corn production report. I don’t agree, I think that we will take some of the volatility out of the market, but if he thinks we are going to be weaker going into that report then one could assume that he thinks we are going to fail to hold some of the present chart support. We could easily continue to drift lower but we have plenty of Big Picture factors that are bullish. At the top of that could be Chinese demand for corn. They are in a situation similar to what Texas and Kansas had last year when they had supply issues. China corn supply issues are coming from flooding.

If you find yourself in a situation where you will be forced to give away some grain off of the combine. Make sure that you have the other tools you need to help become a price maker via having your hedge accounts open. Give me a call at 605-295-3100 for more info or click here to get started opening an account. https://www.dormanaccounts.com/eApp/user/register?brokerid=332

We recommend to any that have had to sell wheat to re-own it with calls. The Black Sea Wheat situation isn’t adding to confidence that buyers will be able to continue to get supply and it just doesn’t feel like it is sustainable. We also have issues in Canada, India, Argentina, and Australia. So wheat remains a sleeper that will eventually be a market where everyone says I told you so. But when or how long it takes for wheat to get excited remains to be seen.

The below is from the Robinson Review, Chris Robinson.

The main point that I see the comments to “end users”. I look for this to lead to demand that is need for us to hold these price levels.

He also mentions not owning expensive puts. So for those of you that have hedge accounts and get forced to sell your corn, perhaps one strategy for re-ownership that could be considered is selling puts. If you want more info on this please give me a call.

He said:

Ok, let's dial into this week-

1) Money Flow- As of Tuesday---

Corn- SHORT 101K. Added 33K new shorts

Soybeans: LONG 58K Added 8K new longs

Wheat: Chicago; SHORT 71k Added 6K new short

Wheat KC-- SHORT 6K-- Sold 6K --- They flipped short.

Wheat MN-- SHORT 6K - Sold 5K--

Bean oil: LONG 55K- Added 6K new longs

Soymeal: LONG 53K-- Sold 4K

Cotton: LONG 27K-- SOLD 7K

Protein Complex:

Live Cattle: LONG 90K Sold 7K

Feeder Cattle: LONG 12K Sold 1K

Lean Hogs: LONG 22K- Sold 1.5K

Take Away- The fund have the corn; bean spread on the "right" way . That means they are set up to make money if we continue to see that spread widen.

It's not because they "hate corn producers" and "love bean producers" They love on thing. Making Money. Who gets crushed or helped- for that matter- does not enter into whether they hit "buy" or "sell". It's just a business decision.

CZ3-

Weekly Range:

32 cents

Net Weekly Price Change: Down just 5 cents.

Fact- For the last 2 weeks; $4.73 has "held".

We are back to pivoting at $4.91- the key 62% retracement of the last big rally from $3.75 in June of 2020 to the Contract high at $6.79 in April of last year.

6 weeks out of the last 15 weeks-- $4.91 has been a pivot on the weekly trading ranges.

I'd watch it again this week. Bull or Bear.

Now is not the time to have expensive puts on the books.

End users? With price at 2-year lows-- you are being given a "blue-light-special" to protect your input needs.

Soybeans- SX23

A 58-cent trading range for the week

Net Price Change- UP 34.5 cents

Odditiy for the week- Where did SX hit and then pause? That July 4th weekend high at $13.91. I wrote about it before the opening on Friday. Hopefully, it helped you- bull or bear.

SX has clawed back into the price banc that for 16 months-- has been toppy--- does it mean we can not hit $15.00? No. All it means is-- this is a great area to reward with sales or to roll up protective put floors.

Why? Because we want the highest floor on paper-- BEFORE THE SELL OFF-- IF IT COMES. That's the whole justification for rolling puts up higher.

We want a higher floor BEFORE any correction that MAY be in the pipeline that we CAN NOT SEE TODAY.

Soymeal- December:

26.7 --- the weekly trading range.

UP 26 on the week.

The crush margin is driving the bus, and the soybeans's rally helped the cause.

key resistance above? 429 and the bear trend line above- The top of the wedge

key support below? 369 and the 3-year-old bull trendline below.

Bean Oil- Weekly range; 4.69

Weekly Change: DOWN-- .73 A bearish hook-- a new high and a lower settlment--- Are we topping out- finally?

18 months; That's how long Dec meal has repeatedly flirted with 65.0

72.30 is the "nightmare" for bears or anyone short bean oil at this point.

The managed money is long the entire bean complex. That's helping to push prices higher at this key level.

Hard to believe that 3 months ago - this contract was on a 2 year low.

The demand for bean oil for biodiesel is driving this bounce; The demand for crude oil=- jumping from 63 to 83-- played a big part in this gallop higher.

Updates You Might’ve Missed

8/25/23 - Market Update

BEANS CONTINUE BULL RUN

Read More

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio

DON’T PANIC. TODAY REINFORCED HIGHER PRICE OUTLOOK

8/21/23 - Audio & Market Update

MARKETS PLAYING LEAP FROG

8/20/23 - Weekly Grain Newsletter

WHY THIS IS MORE THAN A DEAD CAT BOUNCE..

Read More

8/18/23 - Market Update

GRAINS BOUNCE. WEATHER REMAINS BULLISH

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio