BEANS GIVE BACK GAINS, TRADE PREPARES FOR USDA

Overview

Grains mostly lower here following yesterday's strength from the poor crop conditions. On today's weakness soybeans give back all of their gains from yesterday and then some.

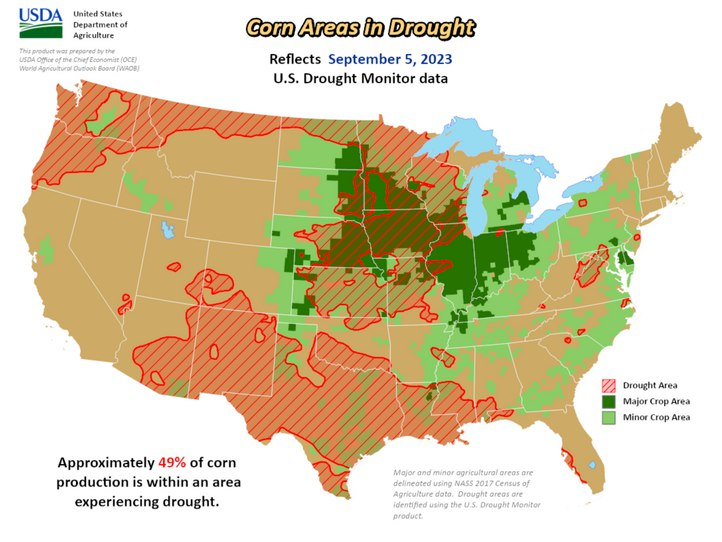

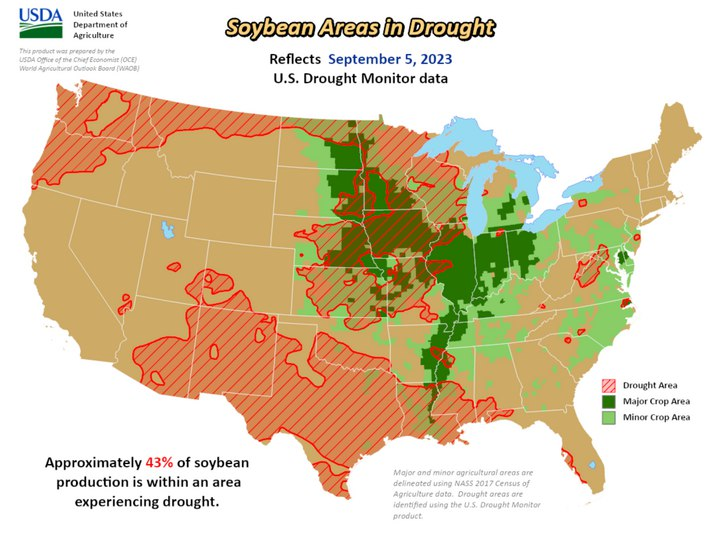

The newest drought monitor updates came out this morning. Here is what they showed.

Areas Experiencing Drought (% Weekly Change)

Corn: 49% (+4%)

Beans: 43% (+3%)

Spring Wheat: 56% (-1%)

Winter Wheat: 46% (0%)

Cotton: 44% (+7%)

Not a great reaction today in the trade from these numbers. We get confirmation of drought improvement and yet the market trades lower.

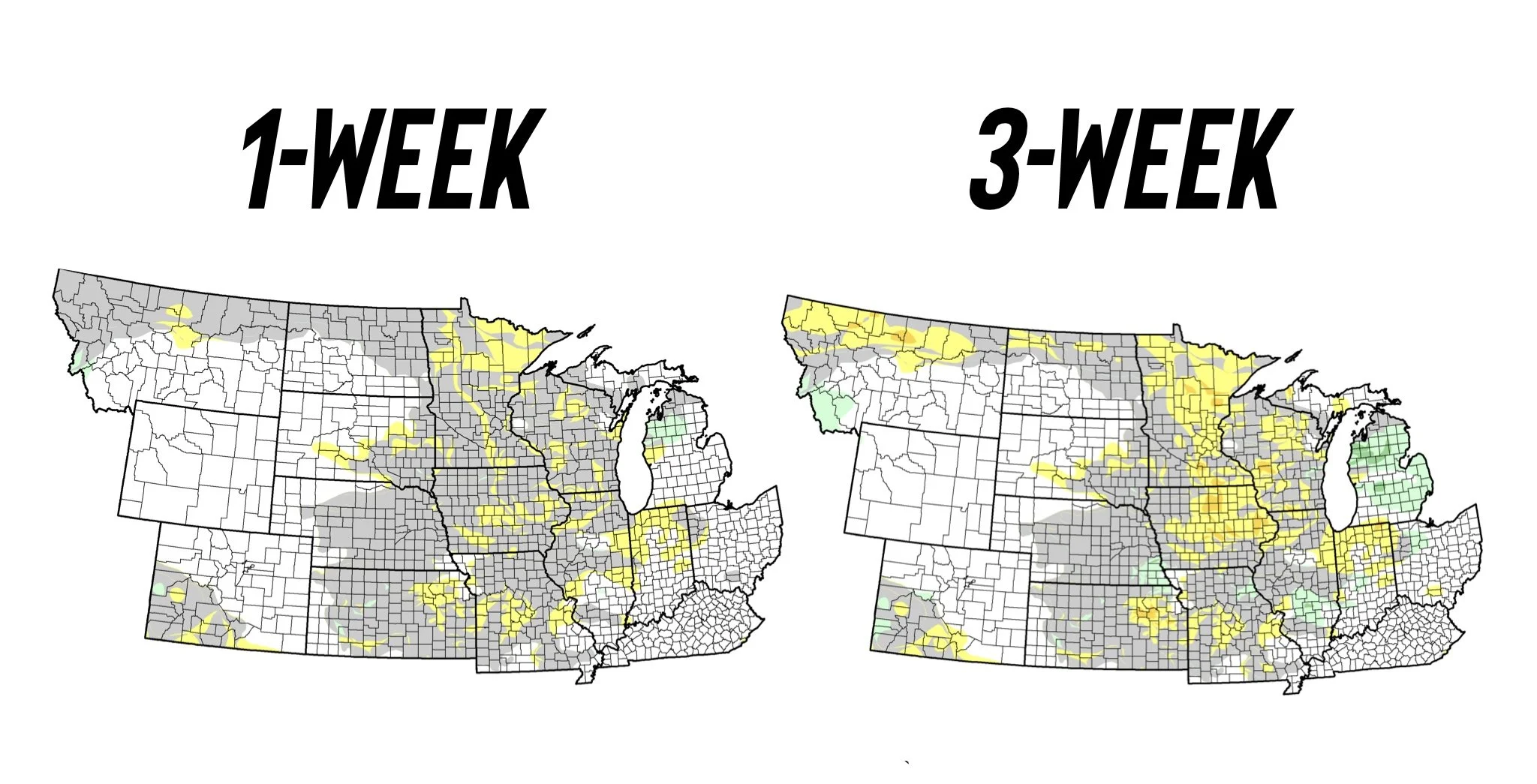

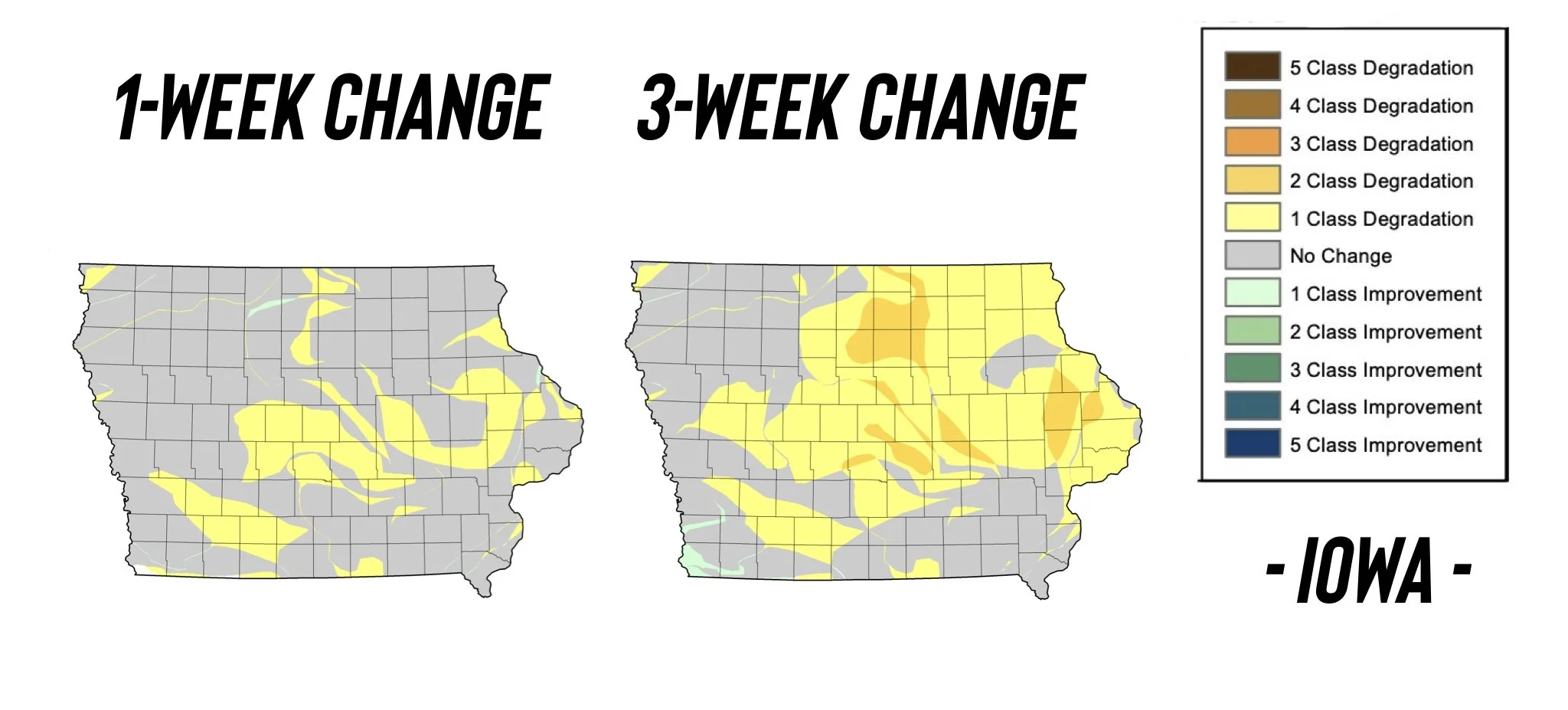

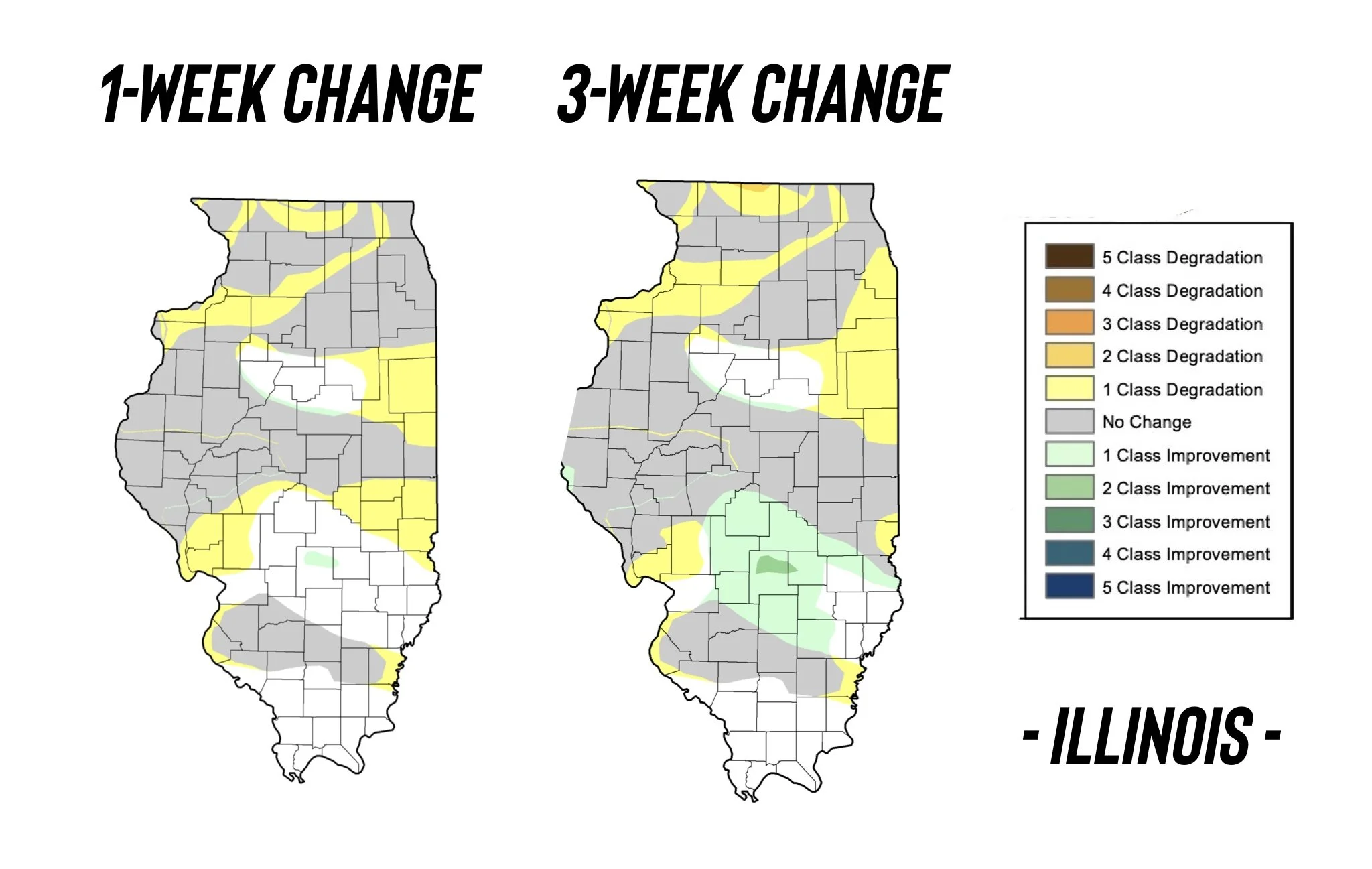

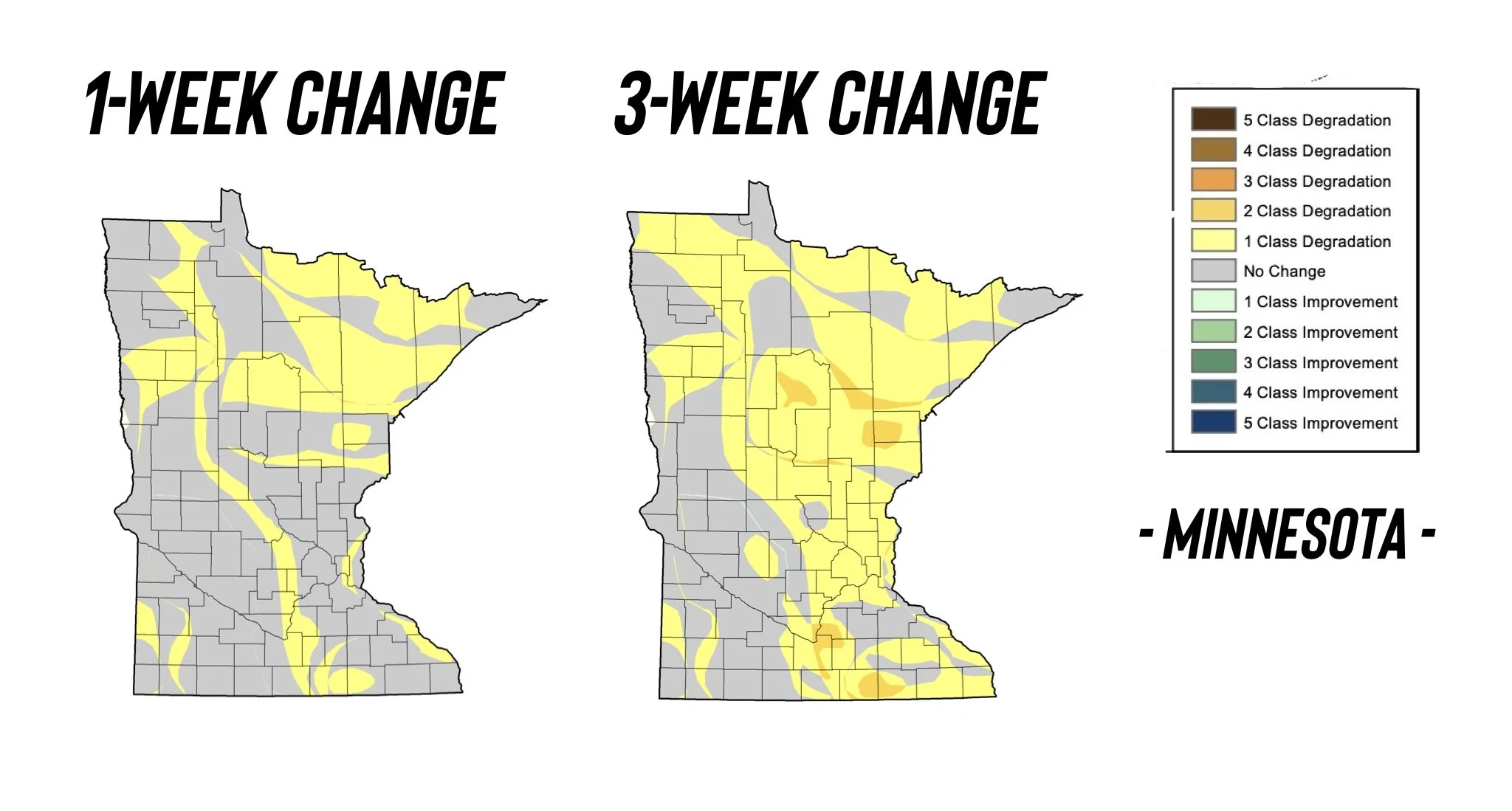

Here is how the drought has changed over the course of the past week and past 3 weeks for the midwest as well as 3 of our primary growing states of Iowa, Illinois, and Minnesota.

Iowa and Minnesota have seen some major increases to drought.

What percentage of production do these 3 states make?

41% of corn and 38% of beans.

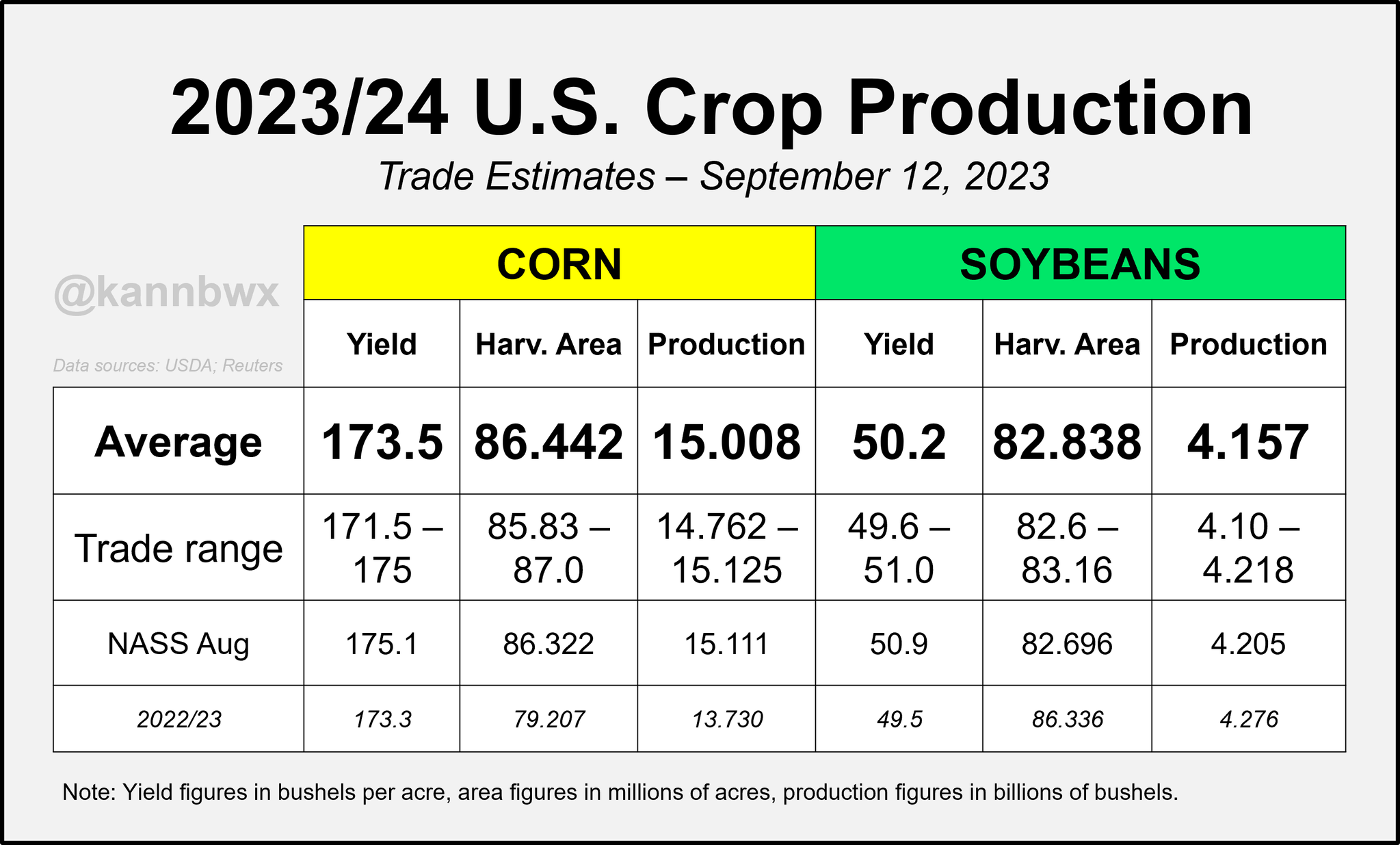

Here is the USDA estimates for next Tuesday. The analysts see corn and bean yields down from last month, however these losses are expected to somewhat be offset by higher acreage.

Chart Credit: Karen Braun

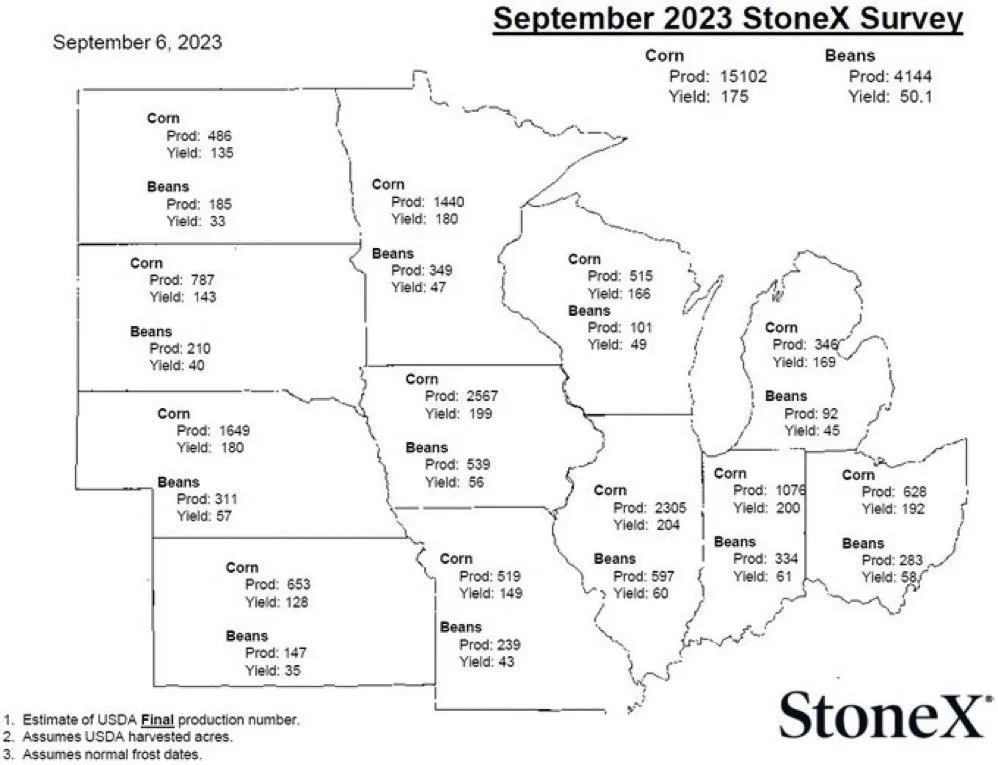

We also saw StoneX as well as Allendale release their estimates. Here is how they stack up against the USDA and Pro Farmer.

Corn Yield 🌽

StoneX: 175

Allendale: 171.51

Pro Farmer: 172

USDA in Aug: 175.1

Bean Yield 🌱

StoneX: 50.1

Allendale: 49.58

Pro Farmer: 49.7

USDA in Aug: 50.9

I think the Allendale estimates will ultimately be closer than the StoneX estimates, but we will have to wait and see. Here is StoneX's state by state breakdown.

Now often, estimates are indeed close when seed size is normal. However, when we get weather like we just had, seed sizes shrink and yields decline. So I do think we will come in on the lower side of the estimate range and think we should. But, we all know how the USDA works so we shouldn’t be too surprised if they do indeed come in right around their estimates of 173.5 for corn and 50.2 for beans. Nonetheless, Im still leaning in the direction for a bullish surprise, but that surprise also might not happen for a while as the extent of the recent damage remains to be seen.

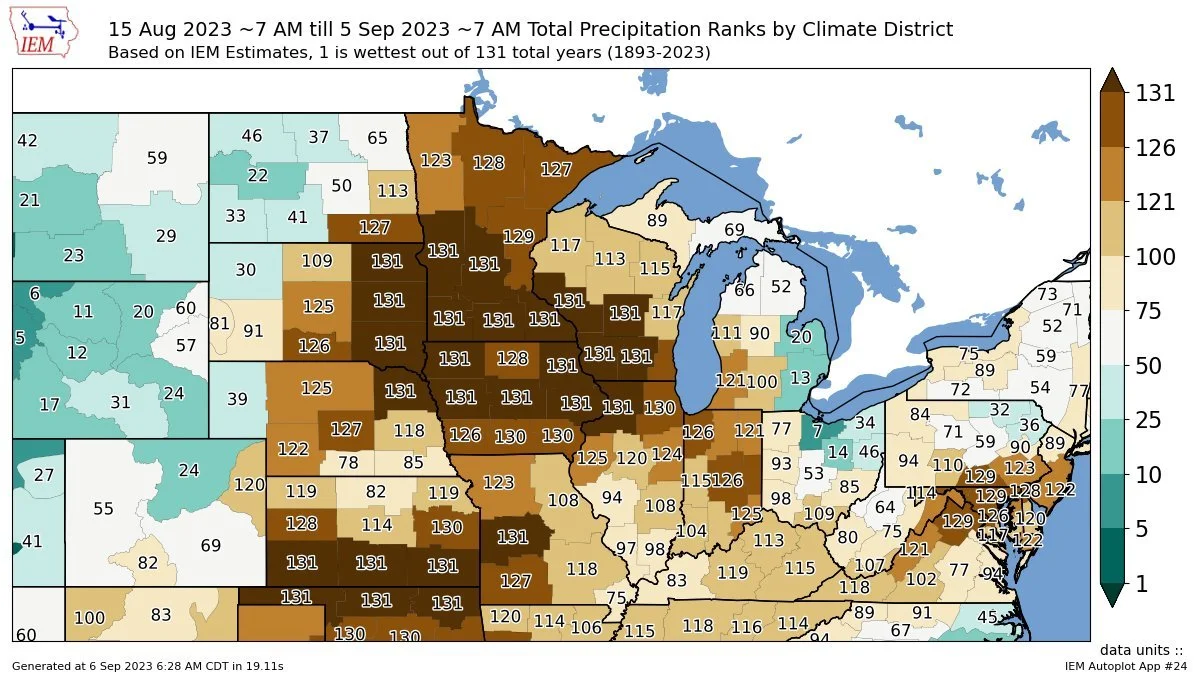

I included this below yesterday's audio update. But I again wanted to show just how dry the last 3 weeks have been. We haven’t quiet seen a finish to a crop this hot and dry before.

Out of the past 131 years since they started tracking this data, these past 3 weeks rank dead last for a good majority of the corn belt. Nearly the entire state of Iowa had it's driest second half of August ever.

How a crop finishes matters, and I still think that this damage is being underestimated. Now it may take time for the USDA to come to the game and realize the extent of the damage. But it's there and I think final yields still have some ways to go down before it's all said and done.

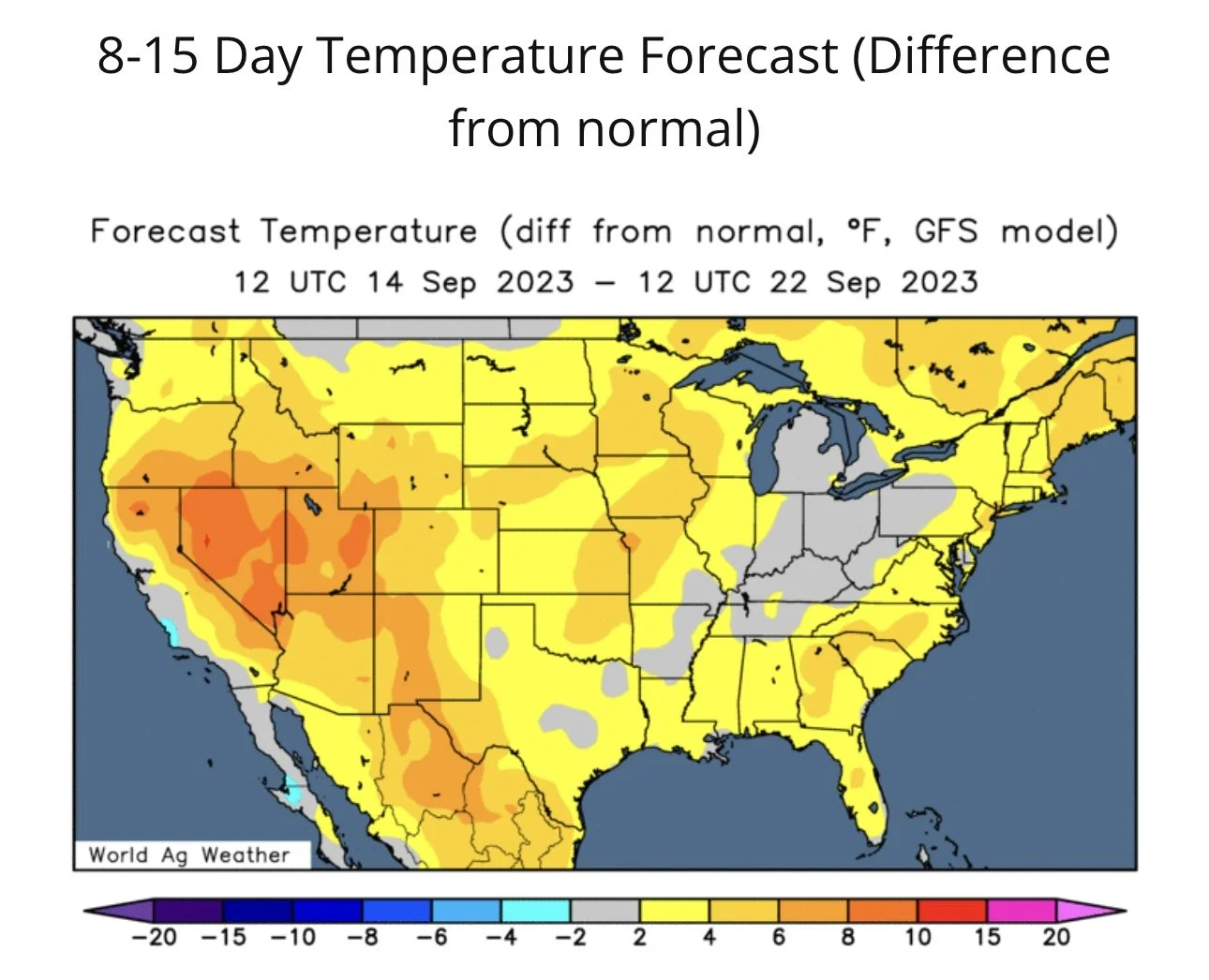

Now here is the forecasts. They have shifted more favorable and took out a good portion of our weather premium, part of the reason why soybeans have struggled to hold a rally despite the crop showing deterioration.

Yes we are getting more rain than we just had, but compared to normal, there is still less moisture than we are used to having for the northern and eastern side of the corn belt.

It is also quickly becoming too late in the season for soybeans to see full benefits from rain that falls past this weekend.

Temps are nowhere near as hot as they were, but still above average.

A big decline to yield is not priced in. The trade waits for the USDA to confirm it or for the combines to confirm it. So the extent of this recent damage will very likely take a few more weeks or even potentially a month to know.

Overall, the market is patiently waiting for the USDA. Tomorrow and Monday will likely be a lot of pre-positioning ahead of the report.

The funds remain heavily short corn and wheat, while long beans. I could see them covering up some of their short corn position before the report. I don’t think we see a ton of short covering in wheat ahead of the report unless we get war news. One could argue maybe they decide to liquidate some of their longs in beans, but I don’t see much of a reason for them not to continue to pile on the longs, especially with the risk the report brings if yields end up disappointing bears.

Seasonally, this is a time we start to put in our lows for wheat, while corn also looks for that harvest low.

All eyes on report Tuesday.

Today's Main Takeaways

Corn

Corn manages to close green on the day. Some of the pressure today came from Biden delaying his decision on whether to make it easier for sustainable aviation fuel made from corn based ethanol to qualify for subsidies.

We did see drought expand for corn producing areas as I pointed out earlier. Jumping 4% from last week to now 49% experiencing drought.

The state of Mato Grosso grows more than 30% of Brazil's corn and beans. The Institute of Mato Grosso Economic Association predicted that the 2024 second crop corn acres will be nearly 3% less than they were a year ago and stated that yield we be reduced "significantly" from 2023.

Bulls are happy that most of the pre report estimates are showing yields in the 171.5 to 173.5 range and not closer to the USDA's 175 yield.

I would have to agree, I think yields are much lower than what the USDA printed in August. We have seen some major concern in 3 of our top 4 growing states. Those being Iowa, Illinois, and Minnesota. Those 3 states make up for 41% of our total production here in the US.

When it is all said and done, a yield of 167 or even lower isn’t out of the cards. The market is nowhere close to pricing a cut like that.

Another thing that we pointed out a week or so ago was that the market also isn't expecting Chinese demand. But you can’t tell me they won’t start coming to us for business with their corn sitting at the largest spread vs ours since the fall of 2021.

Overall, we want to be patient here. See what the USDA brings next week. We don’t want to be selling here into harvest when the market has the most supply it will all year long.

I'm not trying to pick a bottom, but we are in for higher prices. This is the time of year we start to make our harvest lows. Only 1 time did we not make our harvest lows in August or September in the past decade. That was back in 2014 where we made our lows in October.

If it's not in already, a bottom is coming. So be patient making sales. Looking at cheap calls or putting in a floor with puts might make sense for some of you. If you need help with that or anything else shoot us a call at 605-295-3100.

The road higher isn’t going to be a smooth one with macro headlines such as the dollar trading at it's highest level in 6 months. But higher prices are coming sooner or later.

We still haven’t close above $5 in over a month now as the market seems pretty content with chopping around in this $4.80 to $5 range. We still have resistance at $5, then a gap fill to $5.25. We also sit well below both the 100 and 200 day moving averages. Support remains at our previous lows of $4.73.

If you take a look at the chart below, we are nearing the end of this falling wedge. The yellow line is the day of the USDA report. A falling wedge is a bullish pattern. So we could be potentially looking at a breakout from this recent chop.

Corn Dec-23

Soybeans

Beans end the day down nearly 17 cents, giving back all of yesterday's gains for the poor crop conditions.

Beans being pressured by profit taking as well as the weather shifting more favorable than it has been as of late.

Most estimates for the report next week are showing beans in the 49.5 to 50 bpa range. Personally I think we come in below 50 bpa Tuesday.

Then there are some such as Darren Frye of Water Street Solutions who thinks we have a legitimate chance of seeing bean yield at 46 bpa when it's all said and done.

Now a yield cut of that magnitude is nowhere close to being priced into these markets. We already have a tight situation in beans.

As we have mentioned multiple times in the past. We simply cannot afford to lose bean bushels and demand isn’t going anywhere yet. How do we curb demand? Higher prices.

Just because soybeans have the potential to go another $1.40+ higher, doesn’t mean you shouldn’t be managing risk here if that is what makes best sense for your operation. Because whether we want to admit it or not, at the end of the day there is just as much if not more downside than upside in the bean market. We traded $11.30 not long ago. $2 lower than where we are today. So do what makes you comfortable and give us a call if you want specific advice.

Overall, going into the report I could certainly see the funds look to liquidate some of their longs and rather move those longs into corn. But I could also see them continuing to pile on here, as there isn’t much reason not to be long aside from the improvements in weather. Demand is solid. We have a crop that just took some serious damage. More damage than I think is being realized. That story will likely be one that unfolds in the next few weeks to month.

If yield takes a major hit, we can’t afford that loss. So $15 beans are still not out of the deck. But we do need to keep in mind, it may be tough to sustain a rally throughout harvest. If we decided to make a move like that to $15, it likely won’t be until after harvest.

Soybeans Nov-23

Wheat

Wheat futures continue to bounce around near the bottom of their recent range. As wheat futures give up a good portion of yesterday's gains.

All in all, the wheat situation is still a sleeper.

We have all of these bullish wild cards just waiting to be dealt onto the table.

We have the war headlines. Russia is talking about slow planting and slow harvesting with tight oil supplies.

We have a crop over in Australia that is over 1/3 smaller than it was last year as they have dealt with some serious drought issues. To go along with the problems in Argentina. We have India going from a net-exporter to now net-importer as they fight inflation and food problems.

We have the weather scares over in Canada to go along with some planting and dry concerns of our own over here in the US.

We have yet another year of the world balance sheet for wheat shrinking. Rice is now in short supply and there is talk that wheat is going to have to be the replacement.

On the flip side, right now a lot of these problems just don’t seem to matter. We have the dollar trading at it's highest levels in half a year and wheat remains the punching bag of the funds. We also have the cheap supply coming out of Russia which has been a concern for some time now.

Now all of these problems may not be a huge concern right now, and are obviously not being taken into consideration when we look at prices. But later in the future they will. Wheat may not have a reason to rally today, or tomorrow, but eventually it will. Remaining patient knowing we could see a war or weather scare any moment while we put in our seasonal lows.

Chicago Dec-23

KC Dec-23

MPLS Dec-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

9/6/23 - Audio Commentary

BE PATIENT MAKING SALES AT HARVEST TIME

9/5/23 - Market Update

WEATHER IMPROVING, BUT DAMAGE WAS DONE

9/1/23 - Audio Commentary

HOW MUCH DAMAGE WAS DONE & WHAT IS MARKET EXPECTING

Read More

8/31/23 - Audio Commentary

THIS CROP HAS MORE DAMAGE THAN MOST REALIZE. DON’T PANIC SELL

8/30/23 - Audio Commentary

THIS VOLATILITY ISN’T GOING ANYWHERE

8/28/23 - Market Update

WEATHER REMAINS BULLISH BUT CROP CONDITIONS DISAPPOINT

Read More

8/27/23 - Weekly Grain Newsletter

ECON 101 APPLIED TO GRAIN SALES

Read More

8/25/23 - Market Update

BEANS CONTINUE BULL RUN

Read More

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio