BEANS OVER $1 OFF THEIR LOWS

Overview

The USDA report on Friday was fairly bullish, led by soybeans. As they continue to rally here again today to start the new week. Soybeans are now over $1 off their lows from just over a week ago on March 24th.

Corn and wheat showed some signs of strength early in the session but ultimately ran into some pressure and both closed well of their highs.

Over the weekend the OPEC+ nations announced combined cuts to their crude oil production that totaled over 1 million barrels a day. Russia previously announced they were cutting production by 500k barrels a day. The news has crude oil trading much higher today, back above $80 a barrel.

The upper midwest and northern plains are expected to see some pretty heavy winter conditions and a blizzard the next few days.

After close we got the U.S. winter wheat crop conditions. They came in at 28% rated good to excellent, below the trade expectations of 31% and the end of November's 34%. This is nearly the worst early April conditions on record.

Read to Yesterday's Weekly Grain Newsletter

How the USDA Report Was a Game Changer

Help Us Improve Survey

We know you are extremely busy people, but we would highly appreciate it if you took a few minutes to answer some questions on our survey. This survey lets us know what you think we can improve on in our service, what you would like to see and more.

Today's Main Takeaways

Corn

Corn showed strength early in the session but ultimately closed -11 cents off its highs, closing down just -3 cents on the day.

Friday's CFTC report showed that the funds had exited 40k of their short contracts in corn during the past two weeks. Which leaves the funds short a little over -13k contracts as of March 28th. Now if we continue to see the funds exit these shorts and start to rebuild that long position they had not too long ago, we could strength in corn continue.

Friday's USDA report was mixed. We had acres come in higher than he trade expected. Which shouldn’t actually be much of a surprise, given the numbers are from a survey a month ago when producers were getting better corn insurance guarantees. What this number showed could be completely different than what is actually planted, especially considering we could be getting even more snow in some areas such as Minnesota and the Dakotas. Here are a few states and increases in planted acres they had;

Minnesota 350k more acres

South Dakota 150k more

North Dakota 800k more

Michigan 50k more

So the USDA is estimating an additional 1.35 million acres of corn. But bulls are making the argument that we see these acre numbers smaller in the coming weeks, especiallypecially if the weather in some key growing regions remains on the extreme side of things, which could prevent some planting.

The stock numbers on the other hand were pretty bullish, coming in the smallest in nearly a decade and below the pre report estimates. As they came in at 7.401 billion bushels, which was lower than last years 7.758 billion.

With the stocks coming in tight, demand will continue to play a big role in the direction of corn the next month. As China bought over 3 million metric tons of corn in a two week span. We haven’t seen any new Chinese purchases since Thursday, but we saw a flash sale to Mexico this morning.

Corn is now 60 cents or so off our recent lows made not too long ago, bulls would like to see an increase in demand going forward to spark some fund buying. Other things to watch will be South America weather headlines, the war, and the U.S. weather and growing season ahead. There are plenty of bullish wild cards still out there that could push us higher down the road.

From Wright on the Markets:

Despite corn exports running 303 million bushels less than the USDA projection and corn for ethanol about 22 million less than projections year-to-date, yesterday's corn inventory showed the USA has 358 million fewer bushels on March 1st than a year ago and 70 million bushels less than the market expected. How is that possible?

Only one reason: feed use has been running nearly the same as a year ago. USDA will have to increase the corn for feed use by at least 300 million bushels and that will take the US carryout down to a carryover that will meet the needs of the USA for just 27 days. Don't forget, none of yesterday’s numbers took into account the 120 million bushels of corn sold to China the past three weeks.

On August 10th, 2012, the USDA cut the corn carryover by 13 days to a 21-day supply and December corn traded to $8.49 that day, the all-time high.

Taking a look at the chart, we met my $6.60 target I had been talking about the past two weeks. Seeing resistance at our 100 & 200-day moving averages. Going forward, bulls would like to see us test that downward trendline and get a break above those moving averages.

Corn May-23

Soybeans

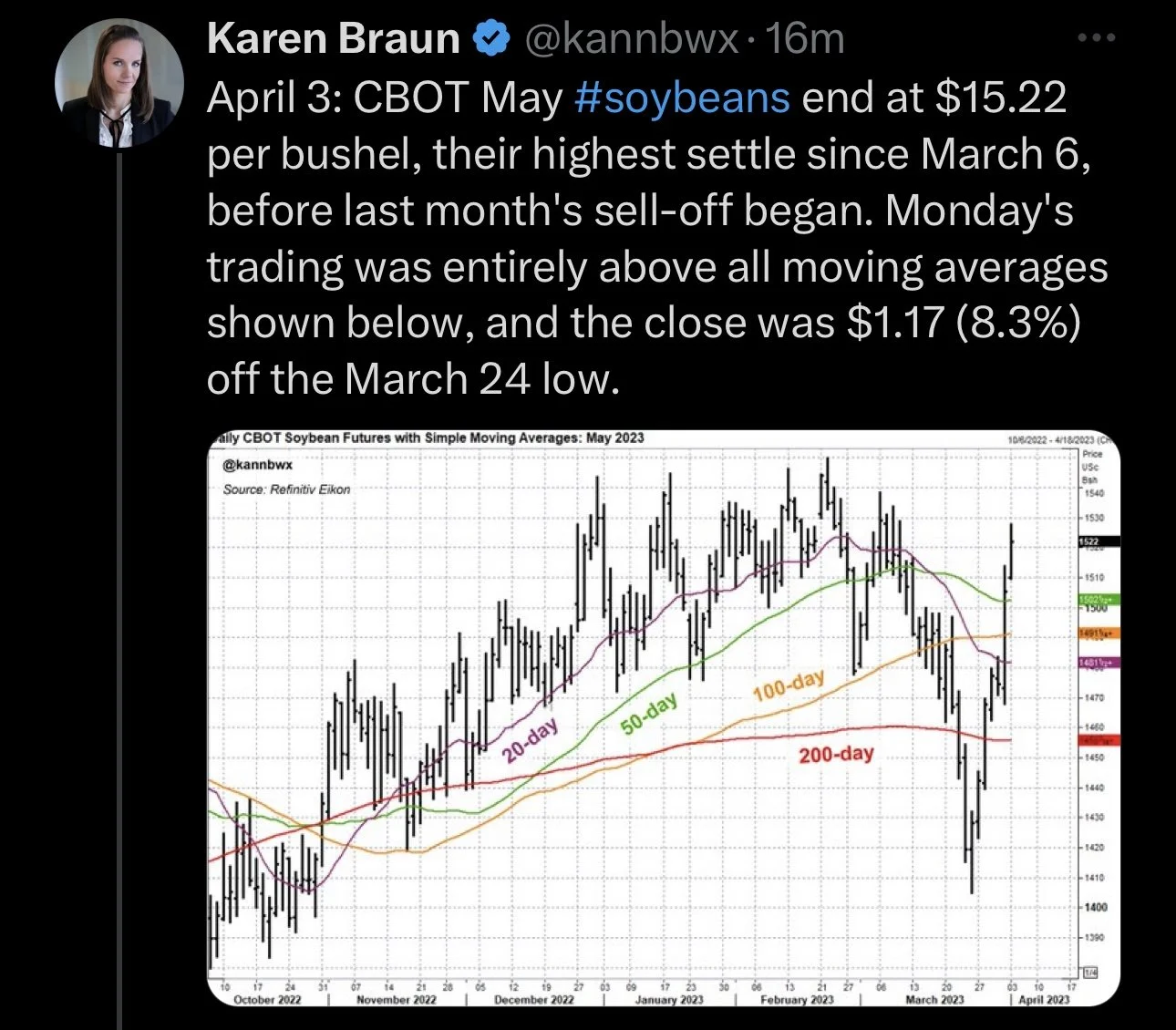

Beans continue their rally, as they are now well over $1 off our lows made a little over a week ago. As the USDA report added even more fuel to this rally. Taking a quick look at the report, beans had by far the most bullish report. With acres and stocks coming in below estimates. Which led to our +30 cent rally Friday. Beans are now inching closer to our highs made in February.

Our lows on March 24th were $14.05. Today we closed at $15.22. Our highest close in February was $15.43. So beans are only 20 cents away from those recent highs. Which is extremely impressive given we sold off $1.20 in a little over a 2 week span.

USDA Recap

Acres came in at 87.51 million acres, which was below the 88.3 million pre report estimates. Which brings us to basically last years number of 87.50.

Stocks came in at 1.685 billion bushels. Which was below the 1.742 estimate and far lower than last years 1.932 billion.

The trade will continue to watch the cheap exports coming from Brazil. As there is some talk that the ports of Brazil are very overloaded and the logistics are beginning to become more and more complicated.

Argentina weather will begin to start having less of an impact as their harvest begins. Argentina harvest is estimated to be roughly 10% complete.

With Argentina weather getting less attention, the trade will start to look more at U.S. weather as we make that transition from South America weather to U.S. weather.

From Wright on the Market:

The old crop inventory of beans is 57 million bushels less than expected and intended acres of soybeans for 2023 came in 737,000 less than expected and just 55,000 more than a year ago. The USDA’s March S&D had the bean carryout at 210 million bushels, just 18 days’ worth of use. Take 57 million bushels off that carryover and the carryover becomes a 13-day supply… Katie, Bar the Door because it will take much higher bean prices to get enough Brazilian beans imported to not run out of beans this summer here in the USA.

Taking a look at the chart, we ran past every resistance level. Actually breaking out of our short term downtrend and getting back above our old upward trendline. Can we go and re-test our February highs?

Soybeans May-23

Wheat

Wheat futures close mixed. With Chicago slightly higher and both KC and Minneapolis lower. Chicago closed -17 cents off its early highs.

As for the report Friday, wheats report was somewhat bearish. With stocks slightly higher and planting intentions coming in above estimates as well. Initially after the report we saw Chicago trading a dime lower but we quickly rebounded.

One thing bulls are making the argument for is that the estimates for acres we saw aren’t the most accurate. With a ton of producers up against some extreme weather and strong insurance guarantees, we could easily see less wheat acres being planted.

Yes we saw stocks come in 12 million bushels higher than expected. But it was still the lowest number in a decade.

India will see very hot temps the next two week's which could impact their wheat crop.

Wheat is still all about the 3 W's. Weather, war (and Russia headlines), and wealth (the funds).

War is still a major factor, as it seems like the trade has just almost forgot the war is still going on. Russia headlines will continue to play a crucial role. Will we see Russia limit exports? Will the deal be extended after the 60-days?

The funds are still very short, so bulls are sitting and waiting for that one major catalyst to come along and spark some buying.

Global and U.S. weather also continue to play a large role in the direction of wheat. If you scroll down to the end of today’s write up, there is a great article and interview from Andrey Sizov of SovEcon where he goes over what things could push wheat higher, Russia headlines, and more.

From Wright on the Markets:

With a war in the world’s bread basket (#1 & #5 wheat exporters), very little rain for four years in the US hard red winter area and two to three feet of snow for another 10 to 14 days on most of the North American spring wheat fields (#2 & #3 wheat exporters), the worst drought in 60 years in the Argentina (#7 wheat exporter), and (#6 wheat exporter) Australia’s new crop wheat production will be down 10 to 15 million mt less than the crop they just harvested due to the end of La Niña, wheat is way too cheap.

Oh, yea, one more thing: US spring wheat acres are projected to be 380,000 less than expected and 265,000 less than a year ago…

Taking a look at the chart, we are still in a clear downtrend. Bulls would like to break out of this range and bottom trendline. I still have the $7.13 level as my first upside target for higher prices.

Chicago March-23

KC March-23

MPLS March-23

Crude Oil

Crude oil is up nearly $5 a barrel (+6.5%) today off the news that OPEC was cutting production.

Crude completely broke out of our near year long downward trend. With a massive gap to the upside. Did we put in our bottom, and is this the start of a reversal to the upside?

Are We One Catalyst Away From An Explosion in Wheat?

These are some snippets from an interview with Andrey Sizov, a well-respected Black Sea wheat guru.

Sizov sees limited downside to global wheat prices, with an upside of perhaps 10% from current levels.

He believes there is a 20 to 30% probability we see a bull market develop.

He went on to say;

Something bad could happen in the Black Sea. The markets seem to have forgotten there is still a war going on.

Or there could be another trigger, such as worsening drought in the U.S. hard red winter wheat growing region, or an expansion of the financial crisis.

Those bullish scenarios could cause a 20% or greater explosion in wheat prices as speculative fund money urgently buys back its big short position in the soft red winter wheat market.

In the meantime, more trouble appears to be brewing in Russia. World Grain is reporting that Viterra plans to exit the grain organization and export business in that country.

Read the full article here

Planting Intentions Survey vs Final Report Trends

From Jon Scheve at Wright on the Markets

The USDA released their stocks report Friday and confirmed what was already suspected, there is less corn in storage now compared to last year. This should mean downside in old crop corn prices is limited and US corn exports will be watched closely over the next three months.

Planting Intentions Surveys vs Final Report Trends:

The USDA also released the producers planting intentions survey. It is important to keep in mind that this survey was conducted four weeks ago when prices were much higher for both corn and beans. Plus, the unpredictability of weather during planting can have a big impact in the number of acres actually planted.

Over the last 10 years, corn and bean acres were reduced in six years and increased in four years between the March planting intentions survey and the final planting report. In the years acres were reduced, two million fewer corn and bean acres each were planted on average. In the years acres increased, it averaged one million acres total for each crop.

Interestingly, there was only one year, 2014, when total corn acres dropped, and bean acres increased. In 2021 beans saw a reduction in acres while corn was higher. During the other eight years, if corn acres changed up OR down, beans had a gain or loss in the same year as well. This is contrary to what I would have expected if corn acres ran into planting issues.

Moving forward, the market will focus on planting conditions and export pace for price direction.

Jon Scheve

Superior Feed Ingredients, LLC

Other Highlights & News

Japan buys Russia oil at prices above the cap.

Argentina is set to reintroduce the soy dollar policy today. The policy will be similar to that of which we saw last September and December.

Despite the battle with interest rates and the bank failures, the stock market closed the first quarter strong and in the green. With the S&P up 150 points in March.

Check Out Past Updates

4/2/23 - Weekly Grain Newsletter

How the USDA Report Was a Game Changer

3/30/23 - Audio & Market Update

Are You Comfortable Heading Into USDA Report?

3/29/23 - Market Update

Beans Extend 4-Day Rally

3/28/23 - Audio Commentary

Is Momentum Changing in the Markets?

3/27/23 - Market Update

Grains Continue Their Rebound

3/26/23 - Weekly Grain Newsletter

What Have Funds Already Factored In?

Social Media

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

U.S. Weather

Source: National Weather Service