BLACK SEA AGREEMENT PRESSURES WHEAT

Overview

Mostly a risk-off day once again, as recession fears set back in and create headwinds, impacting the commodity trade. With the Dow trading sharply lower, down over -400 points.

Corn continues weakness from yesterday's bearish USDA Ag Forum Outlook.

Beans lower despite decent numbers yesterday and additional cuts to Argentina production estimates.

Wheat sharply lower as it's looking like the Black Sea agreement is getting close to being renewed, while China is also helping push to get the deal done.

Yesterday's Audio & Ag Forum Recap - Listen Here

50% OFF SALE ENDS THIS WEEKEND

For those of you on a trial, we extended our President’s Day sale through the weekend.

Today's Main Takeaways

Corn

Corn sharply lower yesterday and continuing that weakness here again today, as the Ag Forum Outlook had higher acres, yield, and ending stocks.

The USDA set their projections for yield at a whopping 181.5 national average yield vs last year's 173.2 bushels. We've seen the USDA use this number in the past, as they used in it their basline forecast. But that number is still above our record yield which is 176.7. We had acres come in at 91 million vs last year's 88.6 million.

U.S. ethanol production came in a tad higher last week, staying above 1 million barrels a day for the sixth week straight. Ethanol stocks however reached record highs for the week and were the highest we've seen since last April, as production exceeded demand.

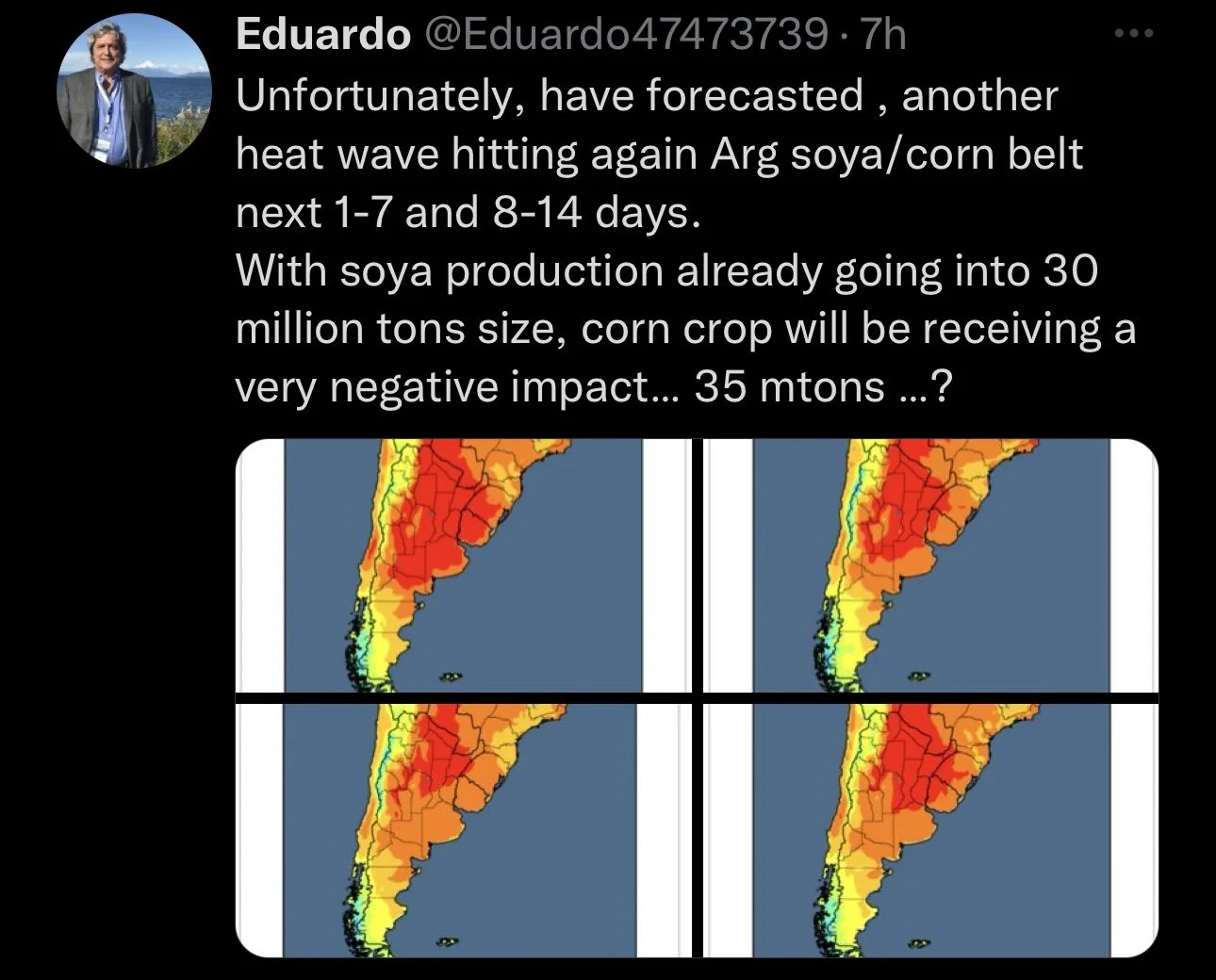

Buenos Aires Grain Exchange cut their Argentina estimates to 41, down from 44.5 million. The USDA currently has their number at 47 million.

Looking short term, there just isn’t a ton there to push us higher, aside from a possible relief bounce or additional weather worries in South America. The story that has the ability to push us higher is more of a story months from now.

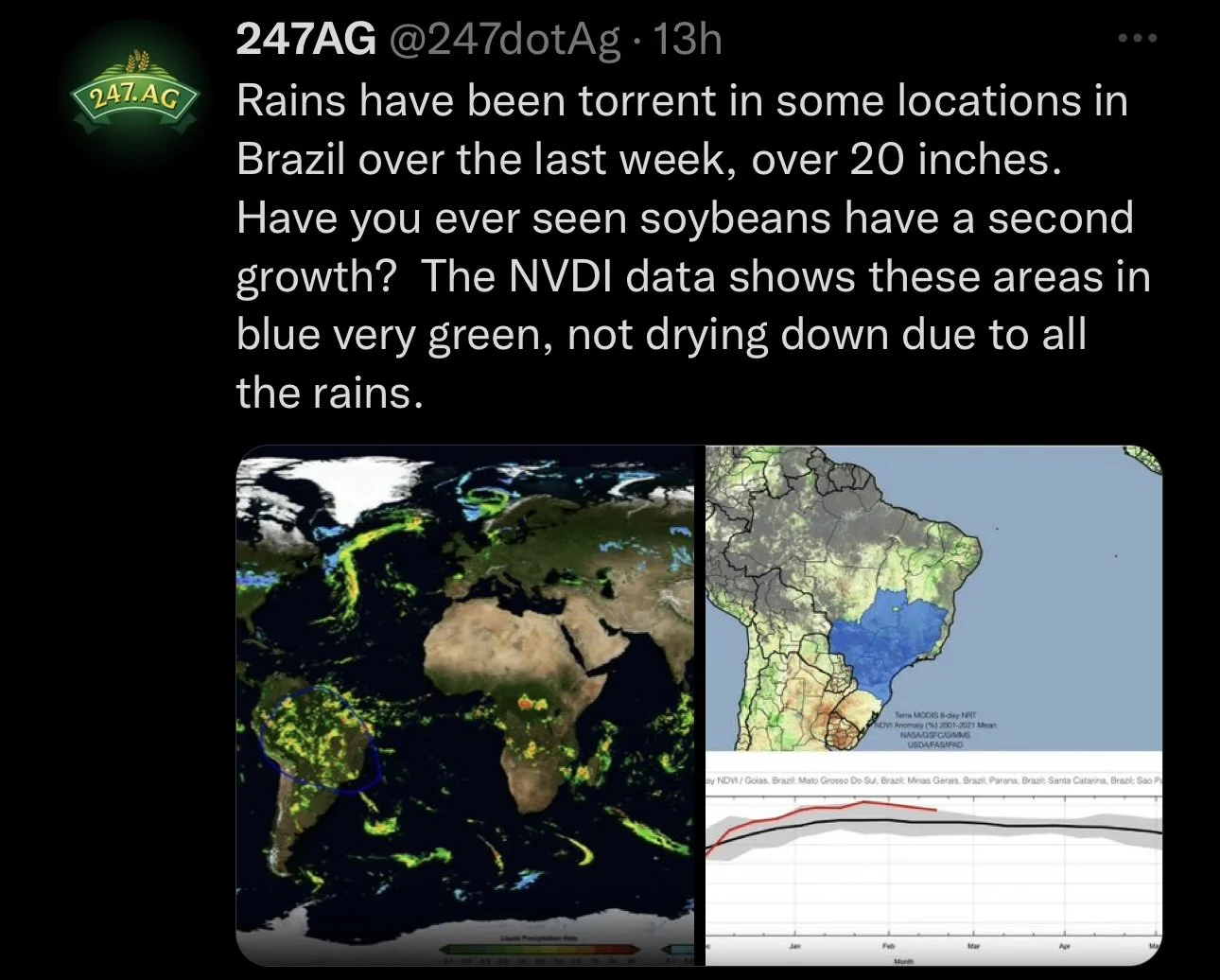

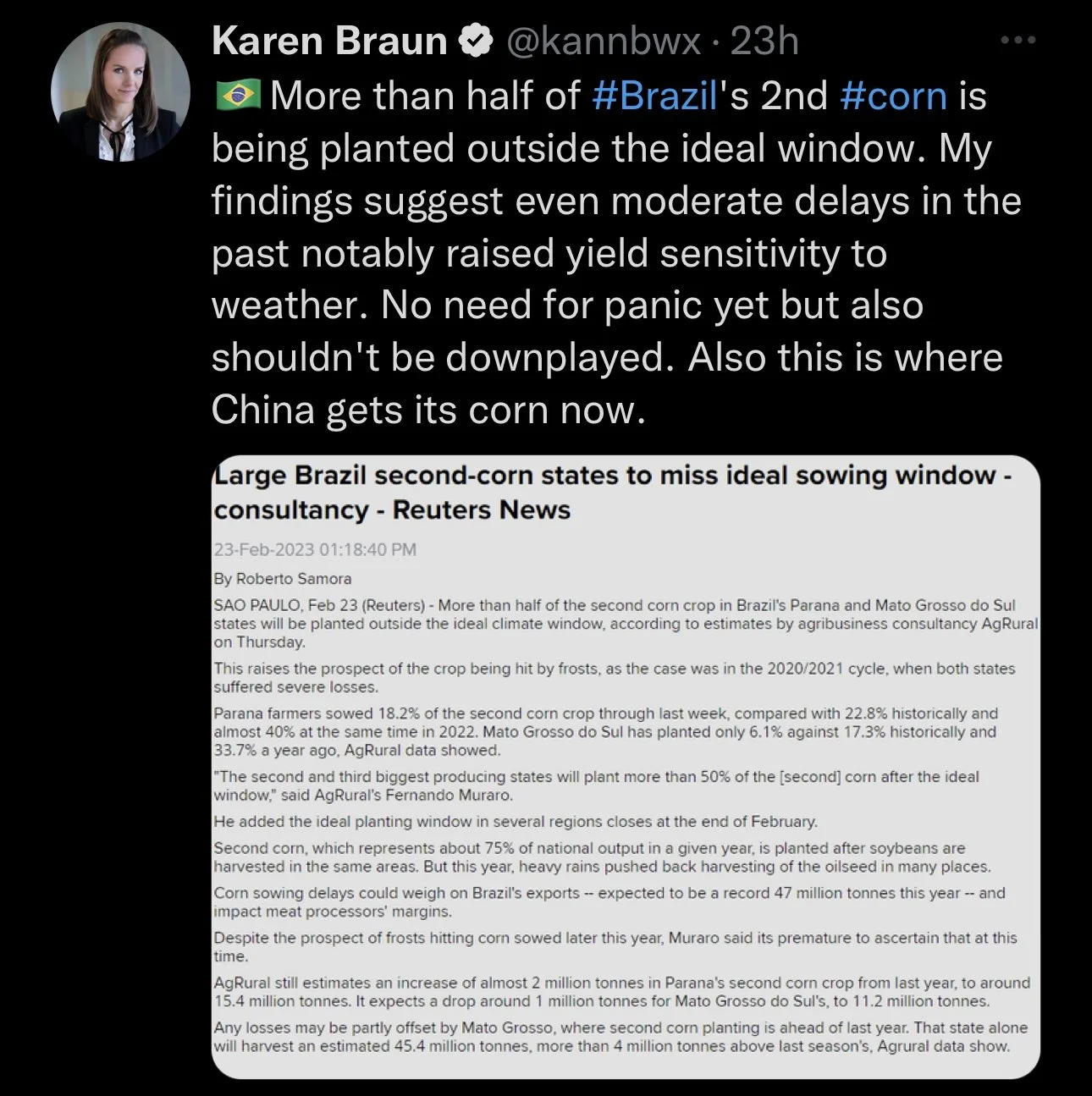

The main headlines to keep an eye on will continue to be Argentina and Brazil. As bulls wonder just how far can Brazil planting fall behind? Keep in mind that more than half of the second corn crop in Brazil's Parana and Mato Grosso will be planted outside their ideal growing windows.

Up until yesterday, corn had been trading in a very choppy sideways pattern. But the forum numbers changed that. As corn broke -15 cents lower yesterday and closed down an additional -10 today. We will be looking for support at the $6.48 range right below where we closed today, with further support at $6.37. Given how sharp and violent this move to the downside was, we might be due for a bounce.

Corn May-23

Soybeans

Beans lower here today despite having acres yesterday come in below expected in a slightly bullish report, to go along with more and more cuts to Argentina production estimates.

Acres yesterday came in roughly 1 million lower than expectations, but overall production estimates and ending stocks increased. As acres came in at 87.5 million vs 87.45 last year.

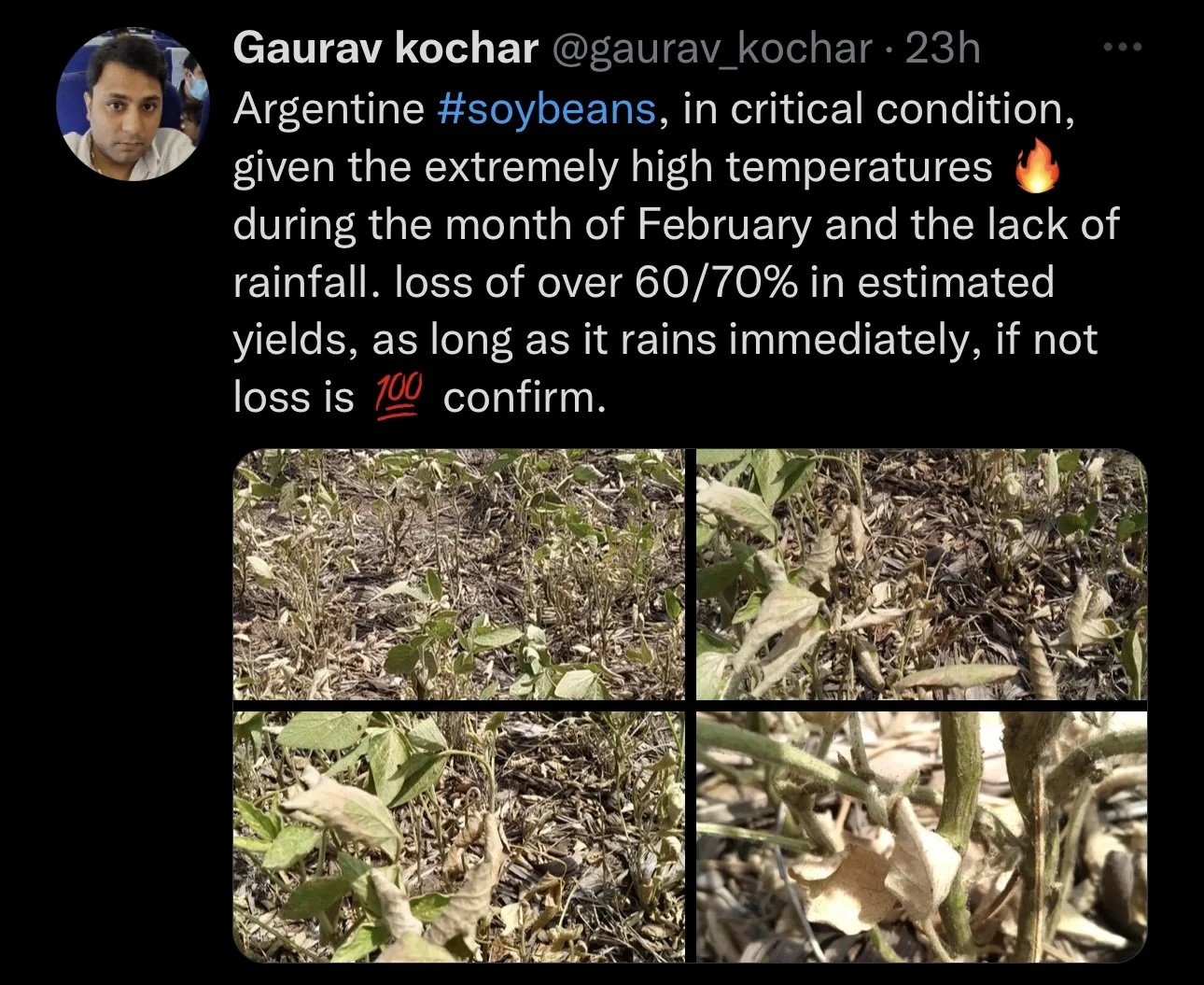

Soymeal was somewhat strong today but not enough to hold beans. As we again saw Argentina production estimates cut. This time Buenos Aires Grain Exchange cut their estimates from 38 to 33.5 million. The USDA is at 41 million. So we will undoubtedly see the USDA walk back their Argentina numbers. But we just have to wonder how much of these reductions are already priced in.

\

Despite the problems in Argentina, the main concern is still surrounding Brazil's massive crop. As many seem to think this will more than make up for the losses in Argentina.

Current forecasts for Argentina are still hot with little to no precipitation. So this will look to continue to support the soy complex.

Soybeans will continue to be influenced by two main factors. South American weather and Chinese demand/relations.

We still haven’t seen a ton on the damage from the freeze but I can’t imagine this doesn’t continue to support beans and meal. Argentina is the worlds leading exporter in meal, so if they continue to have problems one would think we continue to see meal support beans.

Chinese demand on the other hand is something bulls are slightly nervous about especially given how they recently are providing support to Russia. I don’t see this impacting demand as much as some think it might. Nonetheless it is something to be aware of.

Taking a look at the charts, uptrend is still in tact as we near the trendline.

Soybeans May-23

Soymeal

Soymeal May-23

Wheat

Wheat under heavy pressure as an extension with the Black Sea deal becomes more likely, as it looks like China has become a supporter in getting the deal done.

Today is the one year anniversary of the war. The war continues to be a driving force in the wheat market, whether that's higher or lower. Escalation leads to higher prices, while signs of peace or as in today’s case, optimism that the deal gets renewed result in lower prices.

News was that Russia, Ukraine, Turkey, and the United Nations would begin to discuss extending the deal. Ukraine wants a year long extension. China is also stepping in and trying to get this deal done, as this morning they proposed a peace deal that included extending the Black Sea deal.

As for the Ag Forum yesterday, it didn’t provide a ton for the wheat market. We did see estimates for production slightly increase but nothing too drastic. Ass acres came in up +3.8 million to 49.5 million from last year. We also had yield projections come in at 49.2 bushels an acre vs last year's 46.5.

Bears continue to look at the recession fears and recent strength in the dollar. To go along with large crops out of Russia and Australia.

Bulls taking it on the chin again today, as they are still hoping to get that bullish catalyst or headline to send prices higher. But we just haven’t got that yet.

We have the rumors of the deal reaching an extension which isn’t great for bulls, but there is still a ton of talk that Russia could very soon start launching some heavy attacks, as Putin has talked about increasing his nuclear weaponry. But nobody really knows at this point. If they continue to show signs of peace, prices might continue to trickle lower. But if we see Putin and Russia do something crazy, this thing could always turn around in a hurry.

Outside of war, we still have a very poor crop here in the U.S. and the funds are still very short, which opens the door for another short covering rally. But the funds have wanted to do anything expect purchase wheat as of lately.

With nearly 8 straight days of losses, we are right back to where we were prior to our rally from our lows up to the $8 range. Making it the second time we fell sharply right after touching those highs directly under $8. We are approaching some important support, hopefully we get a bounce at these levels.

I was bullish before this sell off and was wrong. But I'm still bullish, especially at these lower levels. I look at this massive correction as a buying opportunity. Sure there is definitely a chance we see prices continue lower here short term unless we get major war headlines. But I think we have a great opportunity to see prices climb higher as we approach spring. I also see wheat as pretty undervalued here.

Chicago March-23

KC March-23

MPLS March-23

Why Yesterday's Numbers Weren’t As Important As The Market Thinks They Were

From Wright on the Market

-

The USDA 2023 Ag Outlook Forum took center stage yesterday, but it was not nearly as important as the market thinks it was.

All these numbers, including acreages, will change a lot in the coming months. These numbers are simply the benchmarks from which market analysts will comment on for the next 12 months.

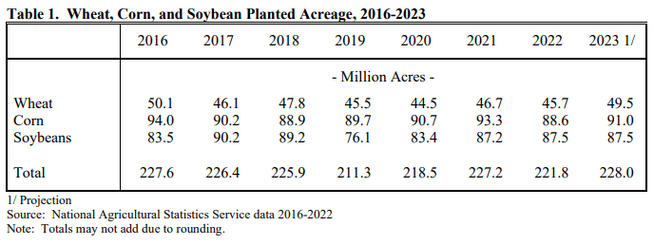

One of the two things you need to know is the number of acres expected to be planted. Corn and wheat acres were higher than expected, but the market should have expected every bit of those acres. The USDA sees total corn, wheat and bean acres higher than we have seen in a long time. We really doubt that will happen unless USDA counts double crop plantings as separate acres.

Corn acres were 100,000 more than expected

Soybean acres were 1.1 million less than expected

Wheat acres were 800,000 acres more than expected

The acreage history from 2016 to 2023 projections is here:

As always, USDA expects great yields and mediocre demand. Trend yield for corn is 181.5; wheat, 49.2; soybeans, 52.

The corn yield projection is 5.9 bushels more per acre than we ever produced before. It is possible with a good spring followed by an El Niño summer, but highly unlikely.

Even if we grow 1.355 billion bushels more corn than last year, USDA sees the corn carryover up just 620 million bushels, a 47 day supply. The 2022 carryover is projected to be a 33 day supply and that gave us $7.66 December 2022 corn futures last May.

They see bean production up 234 million bushels from 2022 with a yield 2.5 bushels better to add 75 million bushels to the old crop carryout; the 290 million bushel carryout would be a 24 day supply; the 2022 crop carryout is projected to be 19 day supply.

USDA sees 2023 wheat production up 237 million bushels and the carryover 40 million bushels higher. That would take the 2022 wheat carryout from 109 days to 133 days for 2023 wheat.

They see the soybean meal carryover up 28.6% and average price down $40 per ton from 2022 crop of $450.

USDA says soy oil carryover will be down 6.7% and average price will be down 8¢ per pound.

Ag Outlook Forum Takeaways

This is a great write up from Farms.com Risk Management going over the entire report yesterday and their takes on everything from acres to war.

Here are a few highlights;

U.S. 23/24 corn balance-sheet shows ethanol use flat, but feed & residual 325 million bushels higher which means they are underestimating the 22/23 usage and exports higher with a 181.5 bpa trendline yield which is too high!

U.S. soybeans 23/24 projections sees acres flat on the year (bullish), but record crop expected on strong yields (???? Not if it turns dry). Record crush, buoyant exports. 6.5% stocks/use not enough of a cushion!

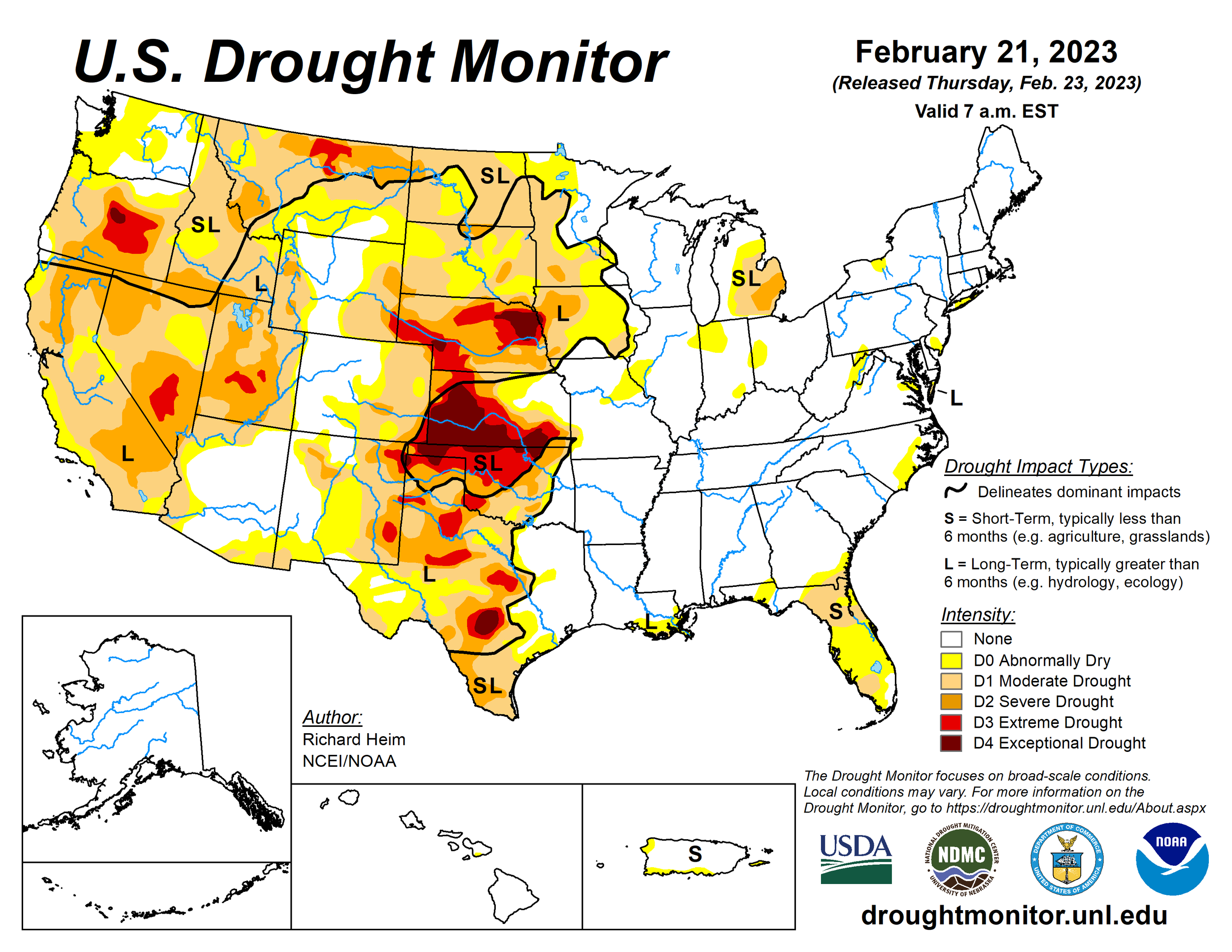

U.S. wheat 23/24 outlook sees acres rise significantly (too high harvested/abandoned acres will rise from HRW in Western Corn Belt its too dry), yield returns to 3 year highs and production rebounds. Exports to 3-year highs. Stocks/use is below average.

Ag Outlook Forum was neutral/bearish wheat and corn and bullish soybeans. This early guesstimate was largely ignored by the market, but it sets a good background for the 2023 growing season. Too many variables will have to fall in line for USDA’s optimistic numbers to become a reality. Mother Nature still rules supreme as “drought” remains the main concern particularly in the U.S. Western Corn Belt.

If we lower acres to 89.4 and yield to 177 which is still record high, ending stocks drop and there is no room for errors. If ethanol is increased by 100 mil bu, ending stocks fall below 22/23. A yield similar to 22/23 takes ending stocks below 1 billion bushels.

Read their full write up Here

Highlights & News

USDA forecasts smaller cattle herd but stronger live cattle prices for 2023.

U.S. egg prices are forecasted to fall roughly -30% following them reaching all time highs.

The war cost Ukraine billion of dollars in damage and caused its GDP to plummet by 30% in 2022.

Japan's inflation rose to 4.3%, the highest in over 40 years.

The U.S. unemployment rate is at 3.4%, the lowest since 1969.

Livestock

Live Cattle up +0.050 to 165.375

Feeder Cattle down -0.150 to 189.075

Feeder Cattle

Live Cattle

Check Out Past Updates & Audio

Here are a few of our past updates in case you missed them

2/23/23 - Audio

Is Next Years Corn Crop Already Record Yield

2/22/23 - Market Update

Grains Lower Ahead of Acre Estimates

2/21/23 - Market Update

Argy Frost Pulls Beans Higher

2/20/23 - Weekly Grain Newsletter

Was Bean Freeze Bullish Wild Card We've Been Waiting For

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service