IS CHINA TRYING TO STEAL GRAIN AGAIN?

WEEKLY GRAIN NEWSLETTER

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

Are we about to enter the Great Grain Robbery of 2023?

I don’t think it is likely, but I do want to ask everyone what their thoughts are on the 12 point proposal that the Chinese laid when they called for a cease-fire in Ukraine with point 9 being facilitating grain exports.

The grain market reaction that led to wheat selling off around 60 cents in just a couple of days reminds me of the “Great Grain Robbery”. It also reminds me and makes me scratch my head anytime either the Chinese or the Russians make some sort of headline. Historically when either one of them says something that makes major headlines you see their actions doing something much different.

So don’t be surprised at all if the Chinese just stated this headline to once again try to buy grain a little cheaper.

If that isn’t the purpose, then watch out. Because the other thing that they are saying is you two have to stop fighting because if you don’t where we will be able to get grain from. How will we fill our demand?

Either way, as much as one hates the price action we saw this week in corn and in particular wheat, realize that behind the headlines that caused action might be something just as positive in the weeks and months to come.

Keep in mind that one of the markets that relies heavily on the Chinese demand is the cotton market. On Friday it posted a nice reversal that could easily spillover some support to our other markets.

Why was cotton up so strong? Export sales came in at a marketing year high. Pork sales were also at a 2 month high. What do those two say about Chinese demand?

Beans Beans Beans

The bean market held relatively well last despite the ugly markets we had in corn and wheat. Why is my question?

Because of the fact that the wheat market is just a fund controlled market. When the funds can short more wheat then what wheat carryout is left out there, it becomes scary. It adds to the volatility and makes wheat like a beaten step child. It has been the whipping post for some time. The reality is the cheaper wheat gets here and now the higher it probably goes later on. If we continue to see our markets go lower we will simply add more demand that we don’t have enough supply for. This will cause us to go much higher later on. Low prices cure low prices.

But why did beans hang in there? We actually had been meal up 4 bucks a ton on Friday.

My answer is because the bean buyers know very well how tight things are, that if they do something to add more demand via allowing prices to slip, that they will have to double pay for it later on.

The situation in Argentina hasn’t improved nor even stabilized for most areas.

Look at Brazil, it has a record crop, yet prices are also floating with record highs, and actual at the highs for the year.

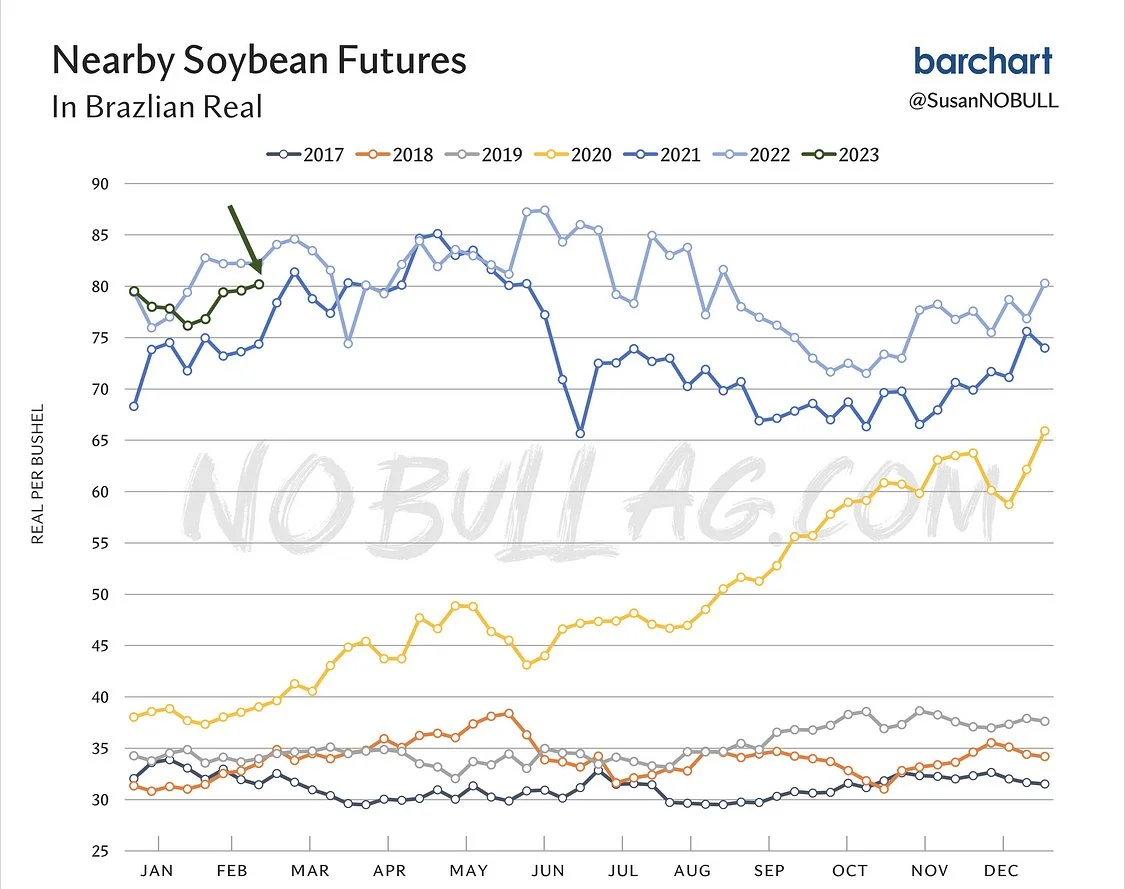

Here is a Brazil bean price graph that comes from www.nobullag.com. You will notice that we did make a new calendar year high just on Friday.

The other thing one might notice is that real bean prices per bushel are 2-2.5 times where they were at just a few years ago. These charts should serve as a reminder that we have the chance to double our prices. Could we double our prices at present levels? Only time will tell.

But the fact that the Chinese want the Russians and Urkrianes to work something out, I am guessing the reason they want them to work it out, isn't to save bloodshed and lives. It is for selfish Chinese reasons, like they need the grain.

Cheap prices cure cheap prices

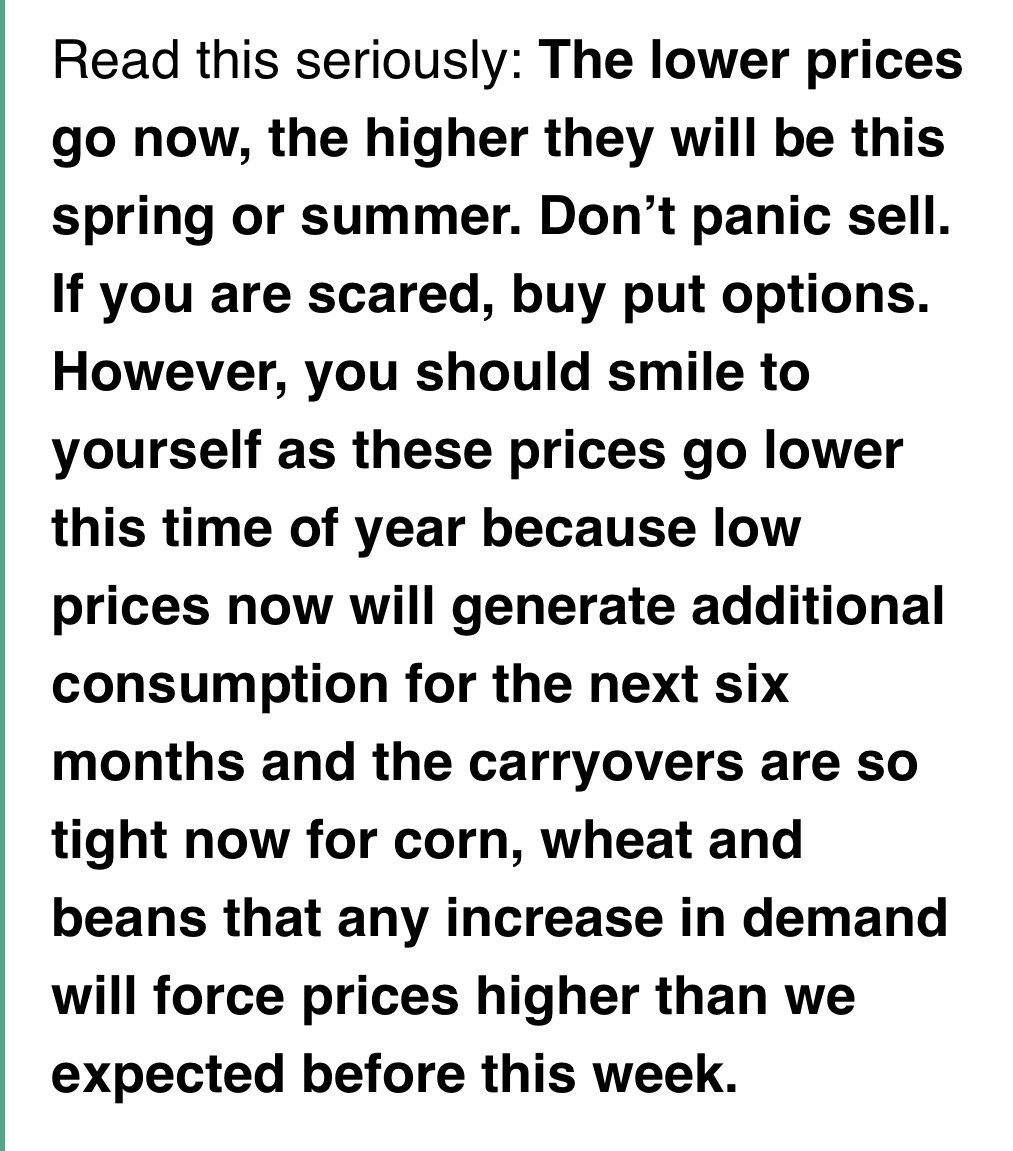

I am not the only one with the opinion that the cheaper we go now, the higher we go later. Check out from Wright on the Market what he wrote just the other day.

This is completely in line with my thinking, that I have zero interest in making sales. If I am nervous or not comfortable, open a hedge account and buy some puts for insurance.

Like I said last week, I want to buy fear. Selling now, during this time of the year is simply fear selling. Once in a great while it might turn out to be the right decision, but more likely and probable is that selling now is fear selling and leaving a lot on the table.

Why do the Chinese offer a 12 point plan to help end the War?

While at the same time US military intelligence reports that China is considering supplying Russia with drones, artillery, and other technology to help offset an expected counter attack from Ukraine?

I don’t know the answer for sure. But something smells like Chinese food to me.

Why is freight up?

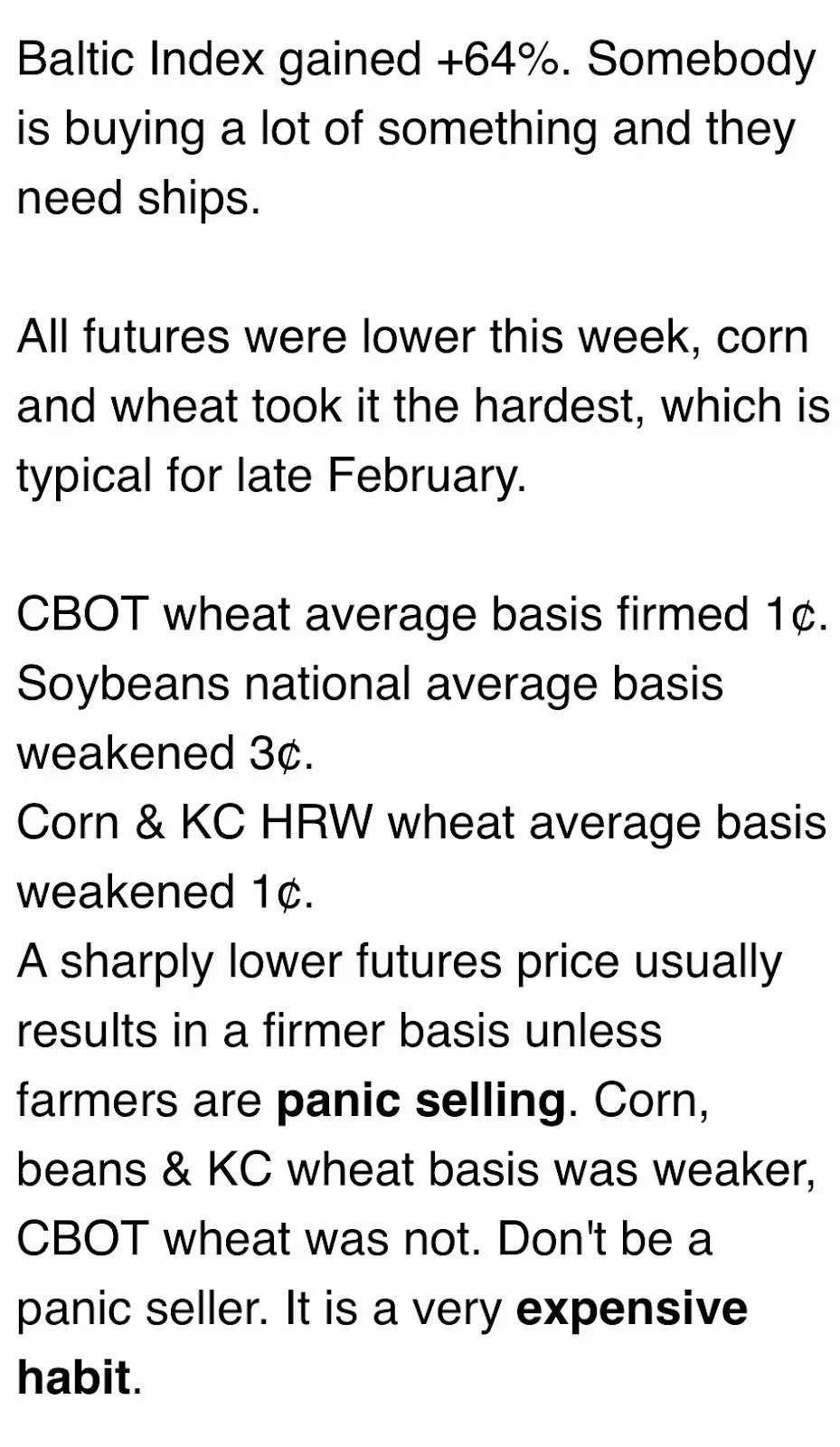

Below is another tidbit from Wright on the Market. He mentions that we had Baltic Index gain 64%, that is a good sign that demand is coming our direction.

Also note his comments about panic selling. I don’t believe in panic selling and one day in the near future I think we will see buying hit the panic buying button. When that day comes, when they are forced to buy no matter the price. I want to have something left to sell to them. That’s when I want to make sales.

I have traded millions and millions of bushels, and it can become easiy in some of the speciality markets to know when buyers enter panic buying mode. It is easy to pick them off, just remember the same thing happens when panic selling occurs. Farmers give away product because the buyers sense the selling.

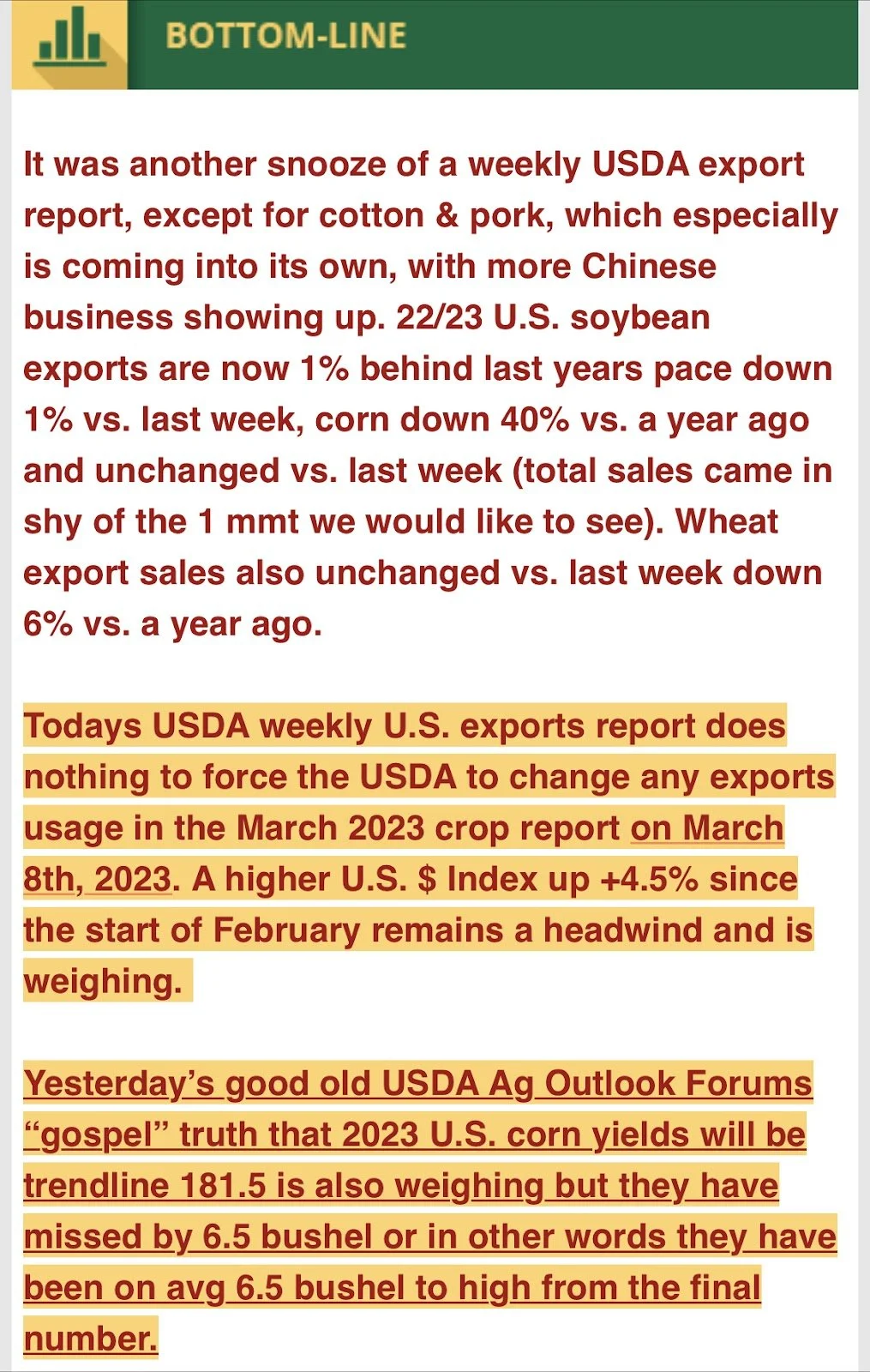

This is from farms.com risk management. I really like the comment about the calm before the storm. This is where I believe our markets are at.

Hi Oleic Sunflowers

Both myself and Wade are still looking for some Hi Oleic Sunflowers out of North Dakota. Please give us a call at 605-870-0091 or 605-295-3100.

As for pricing of the sunflower market I don’t look for it to firm up until we get into planting. We simply don’t have buyers having to compete much for the sunflowers today. They are able to buy them too easily.

Cheap prices cure cheap prices. Just not overnight.

Are prices cheap or expensive?

That’s a great question, that I really don’t have an answer for. I think that we are cheap relative to other inflationary type investments, such as the stock market. But the reality is we are expensive versus historical prices. Many buyers and end users are assuming we will go back down to 4.00 or less corn. They may be right, but I think we will see corn back about 7.00 and 8.00 before we see corn sub 4.00.

I really think that we simply don’t have enough products in the right areas. I think our world is growing and the need for humanity's living styles to grow remains.

The Charts

Corn 🌽

Up until Thursday, corn had been trading in a very choppy sideways pattern. But the forum numbers changed that. As corn broke -15 cents lower Thursday and closed down an additional -10 Friday. We will be looking for support at the $6.48 range right below where we closed today, with further support at $6.37. Given how sharp and violent this move to the downside was, we might be due for a bounce.

May-23 Corn

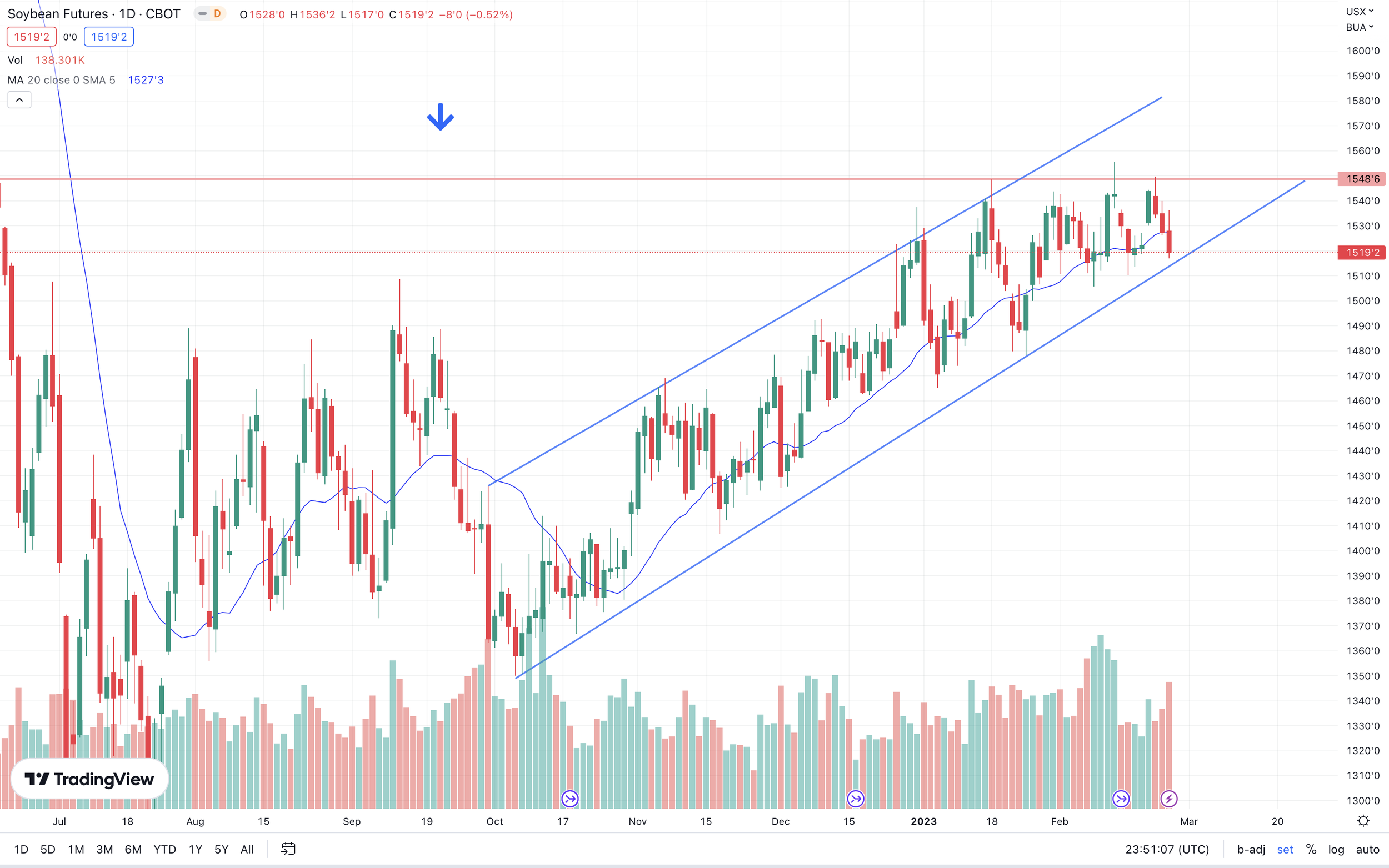

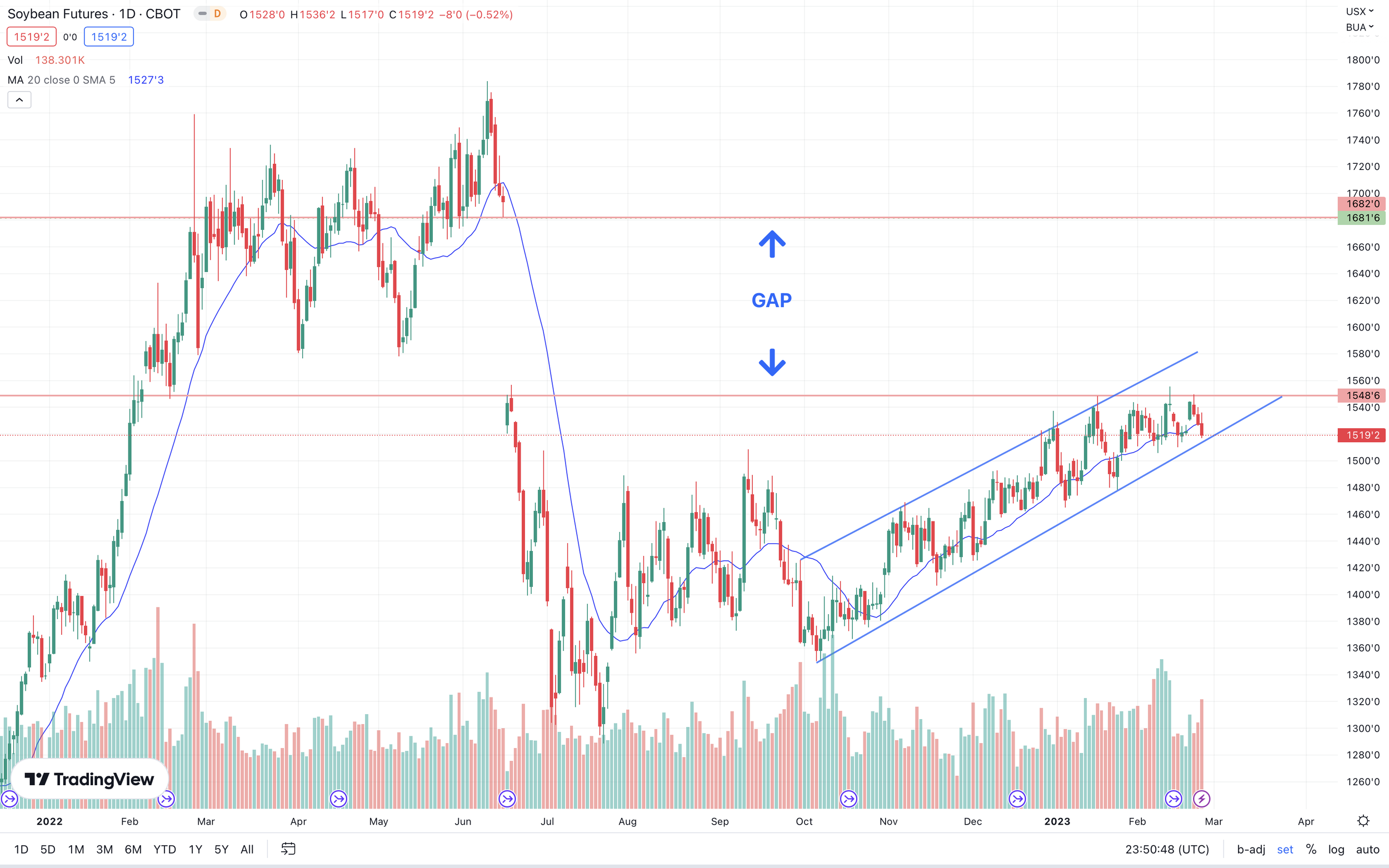

Soybeans 🌱

Taking a look at the charts, uptrend is still in tact as we near the trendline. Is the next move past our highs, or a break below the trend line. As mentioned in past updates, if we look to the upside, there is a huge gap.

May-23 Beans

Chicago Wheat 🌾

With nearly 8 straight days of losses, we are right back to where we were prior to our rally from our lows up to the $8 range. Making it the second time we fell sharply right after touching those highs directly under $8. We are approaching some important support. So bulls are hoping we get that bounce. I personally think wheat is undervalued here, and all it takes is one war headline cause some fireworks.

May-23 Wheat