USDA REPORT MONDAY

AUDIO & MARKET UPDATE

New lows in corn & beans

Yields expected to increase

182 yield priced in. Acres expected to decrease

Not much changes for carryout expected

Carryout is gonna be what surprises this market higher or lower

Market anticipating bearish numbers

If you have old crop corn unsold. What to do

Who should lock in basis?

Have an opinion on your basis

Good time to look at basis offers

Conservative & aggressive approach

Puts & cash sales strategy

How cheap is US grain? Scroll down*

$3.40 corn is a real risk. Scroll down*

USDA estimates below*

Full market update below*

Listen to today’s audio here

MARKET UPDATE

Prefer to Listen? Click Here

Another poor day for corn & beans as they both post new lows, while wheat continues to be the leader.

We continue to see pressure from old crop farmer selling, lack of demand, and of course the thought of massive record crops with Monday's USDA report expected to show increased yields. The funds are still record short grains with no reason to cover today.

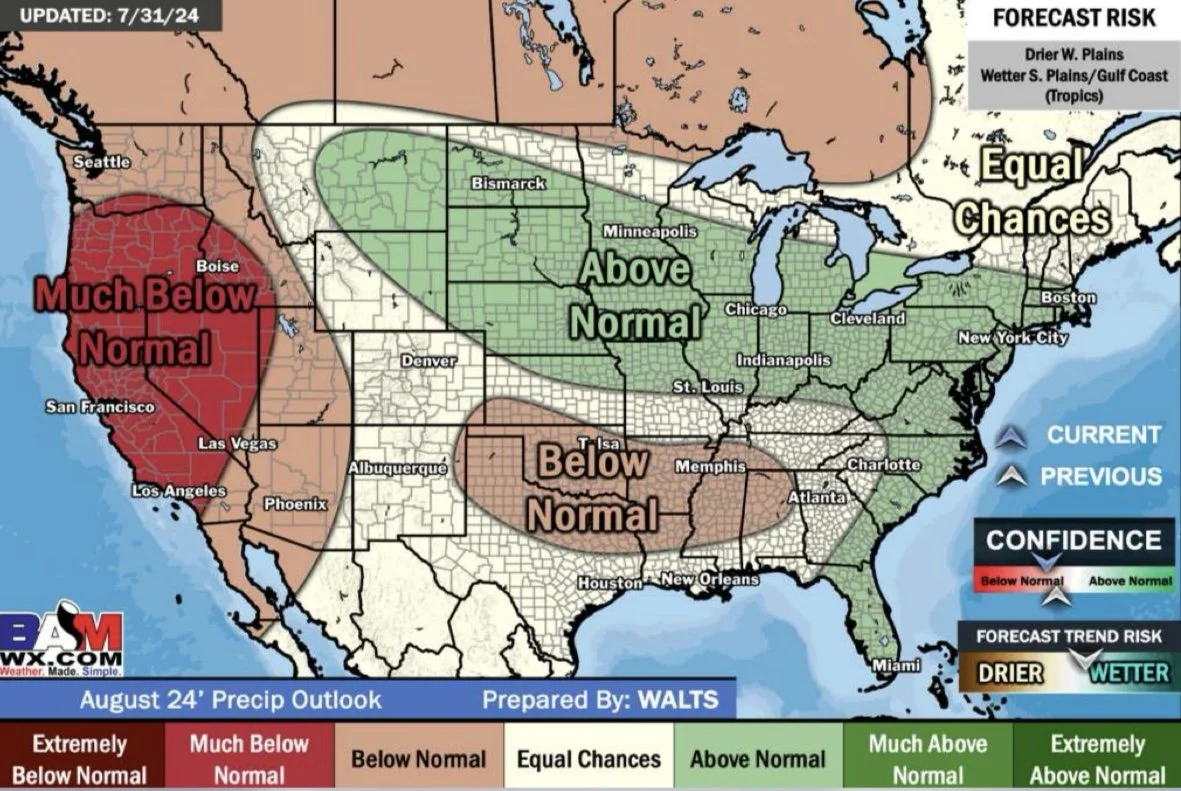

Weather is no longer a major market mover anymore, and it is very unlikely we see weather make much of an impact on prices here. However, it has been cool and the outlook remains cooler than normal. So pretty much perfect conditions for soybeans, not so ideal for prices. If this weather continues to be cool with some rain, that soybean crop could get a little bigger.

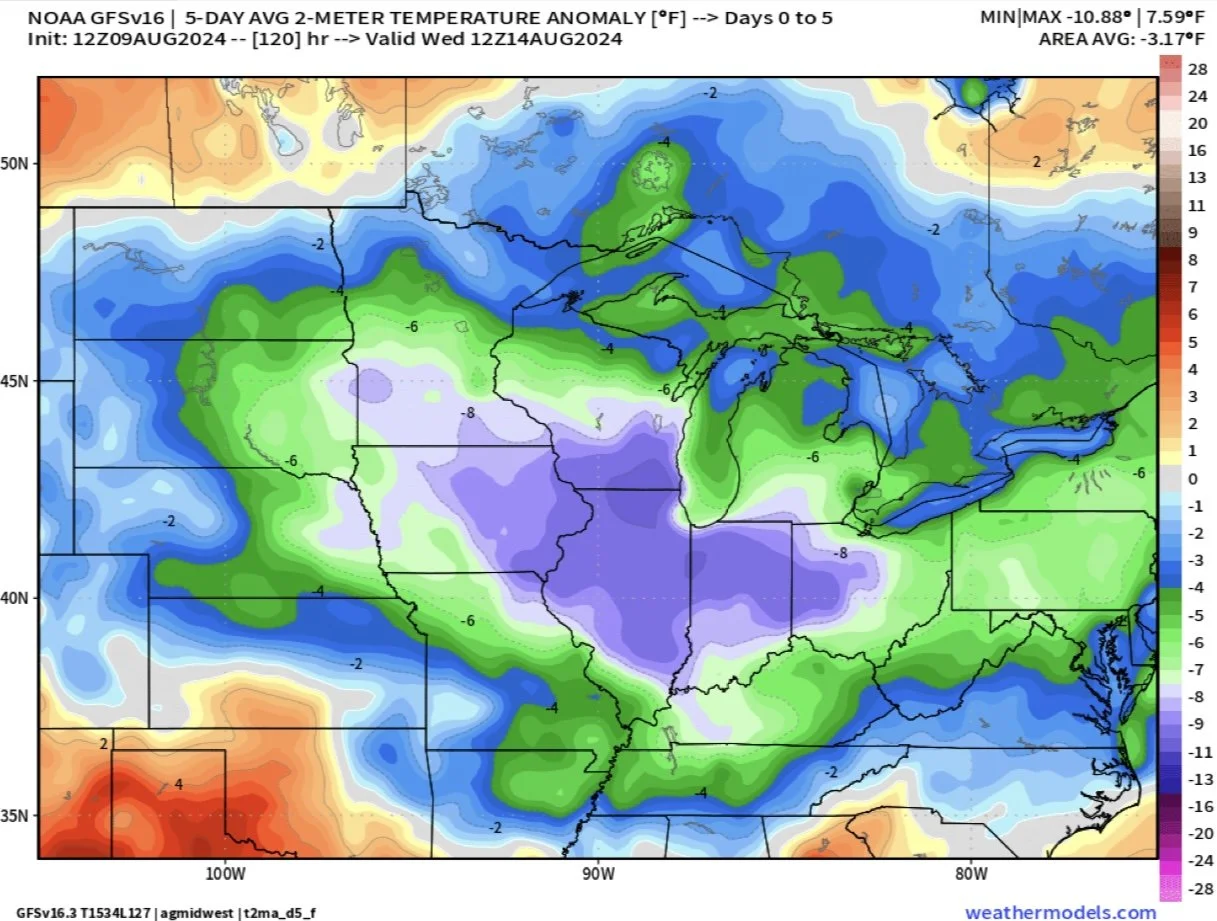

0-5 Day Temp

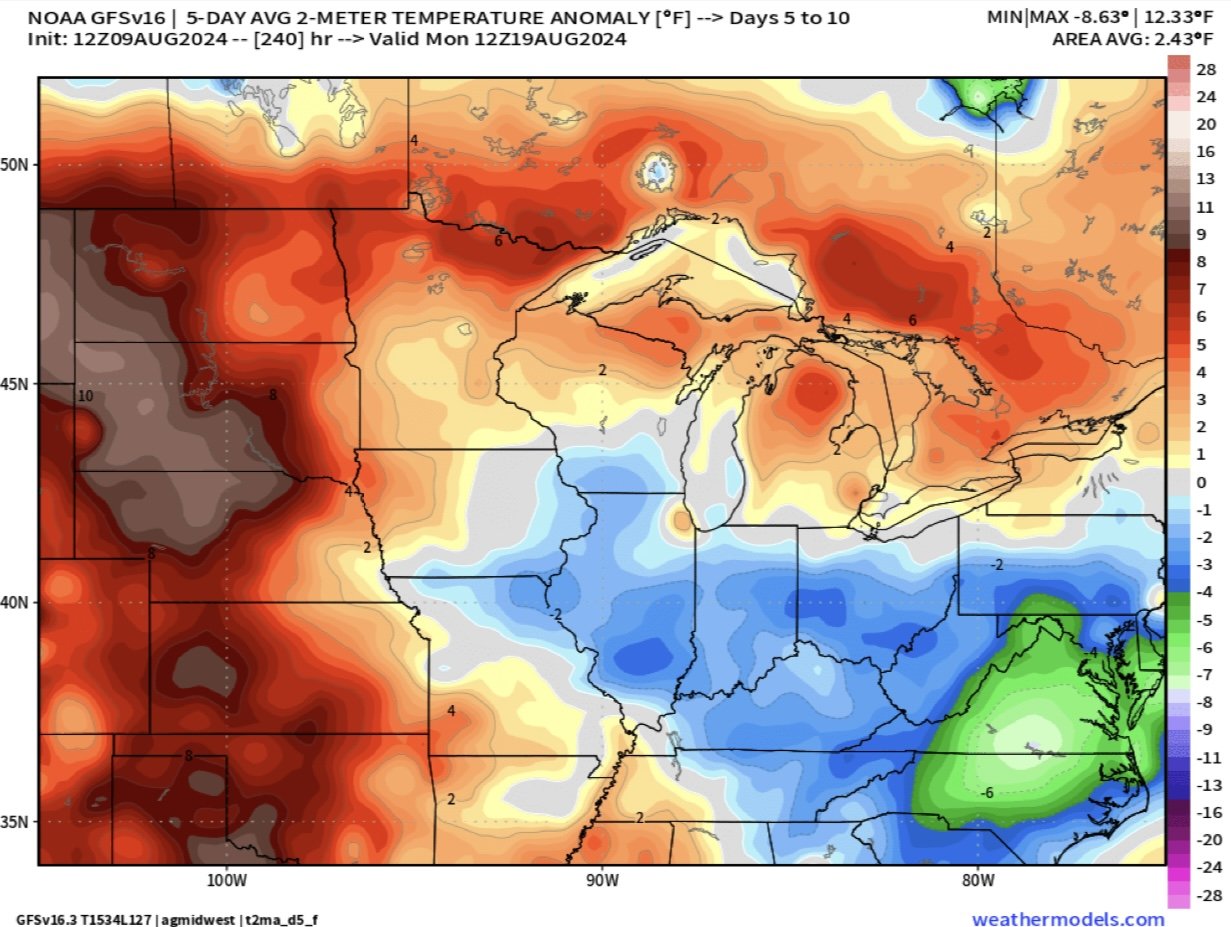

5-10 Day Temp

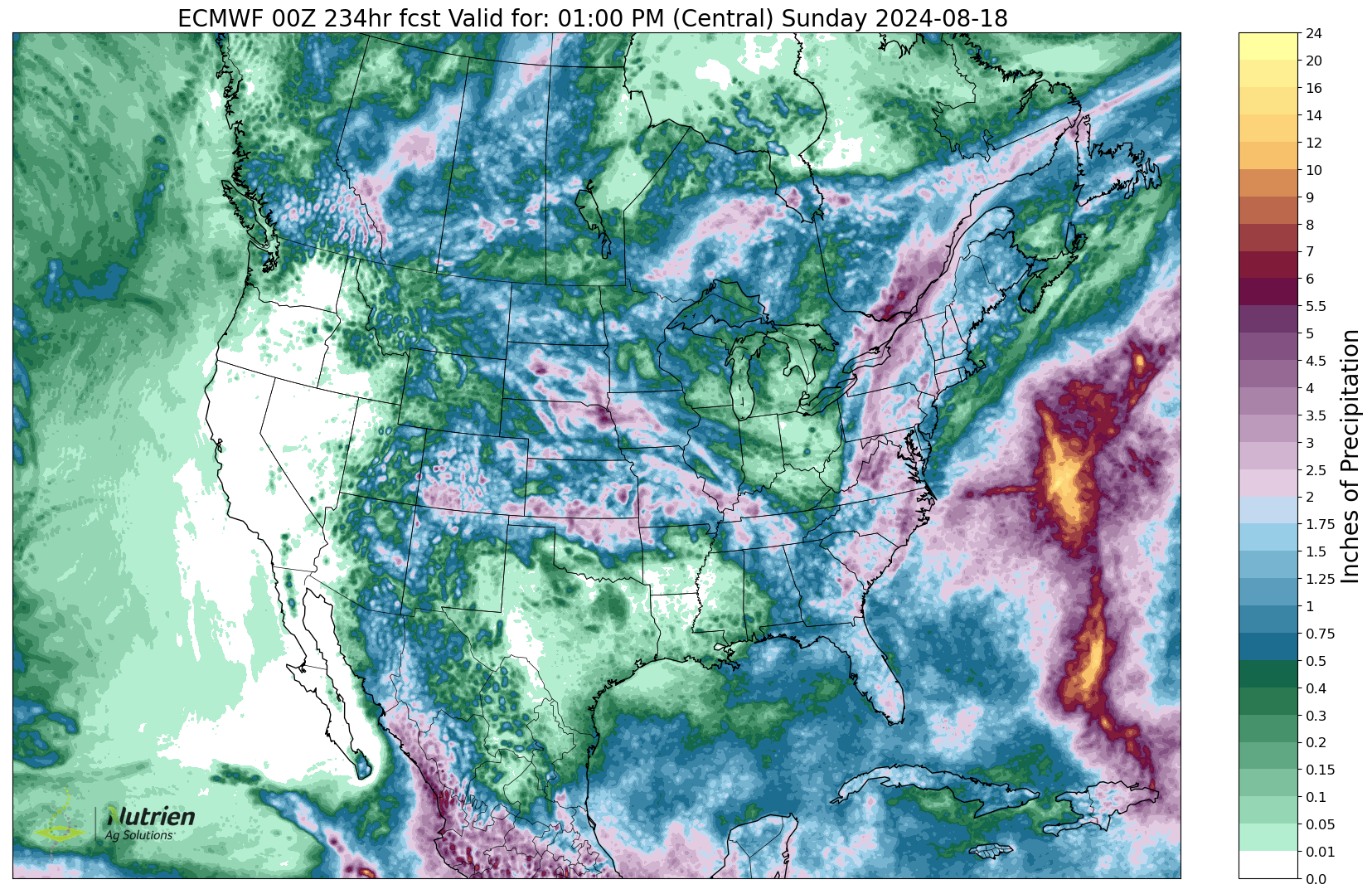

10-Day Euro

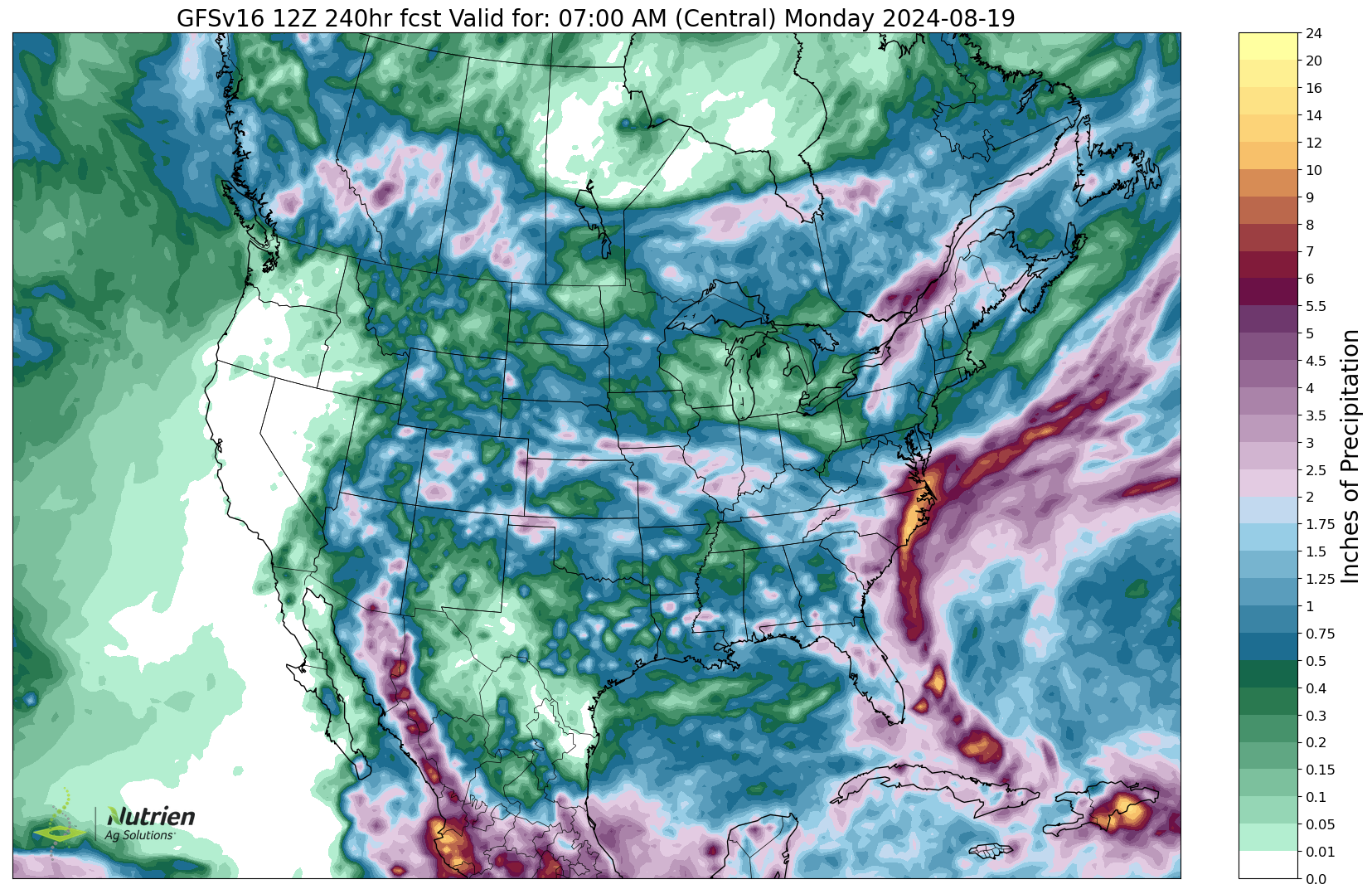

10-Day GFS

August Outlook from BAM Weather

USDA Estimates

The biggest thing is Monday's USDA report.

They are expecting yield increases from last month for both corn & beans. Some think we may even see numbers higher than these. As many analysts such as StoneX have a 183 or so yield.

Corn: 182.1 vs last months 181

Beans: 52.5 vs last months 52

However, actual production is not expected to see a big increase. As acres are expected to come down.

Acres are the true wild card. Most numbers people have a rough idea of. Acres can surprise high or low and it's a complete guess going into the report.

A report from Reuters expects corn acres to fall -470k.

We definitely had some issues with flooding etc. so we will have to see if those come into play. Typically the USDA does not incorporate acre numbers until the September or October report, but are doing so this month.

Carryout is expected to be unchanged for corn, but slightly higher for soybeans.

Chinese Demand: US Cheap?

Eventually, low prices cure low prices via demand. But demand is something we desperately need to save these markets if we don’t want to continue a lot lower.

There is also a very good chance the USDA is overestimating new crop demand for soybeans right now. As we have one of the worst new crop book of sales to China ever.

This morning the USDA report bean sales to China of 132k MT, Columbia of 88k, & 162k to unknown (likely China).

So we are starting to see some sales here and there, but not enough to really move the needle and excite the market.

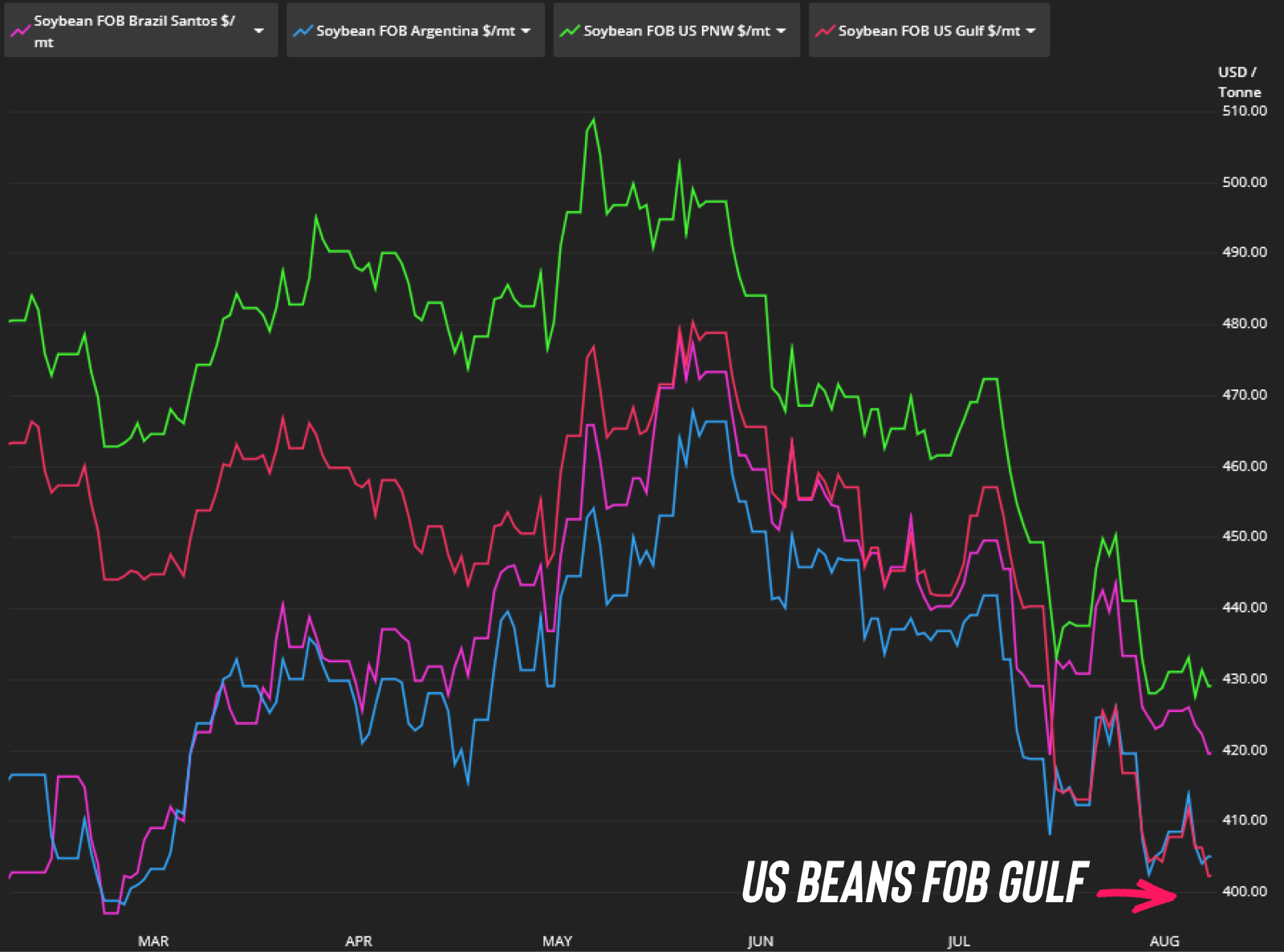

Take a look at this.

US Gulf soybeans are the cheapest in the ENTIRE WORLD.

US Gulf corn is also the cheapest in the world along with Argentina.

Not only are US Gulf beans the cheapest in the world. China is also very underbought.

We also have the Brazil farmer running out of beans to sell while the Brazilian Real (Their currency) rallying to it's highest levels in a month. Which helps us be more competitive against them.

Here is a quote from Grains Gorilla:

"The real is the firmest it's been in 3 weeks. Brazil farmer is running out of beans to sell. China shows up to buy US Gulf beans priced way under Brazil. Writing is on the wall. Market has priced US Gulf beans to sell and sub $10 beans fixed a lot of problems. Bad place to be short"

However, there is also another side to this argument brought up by GrainStats.

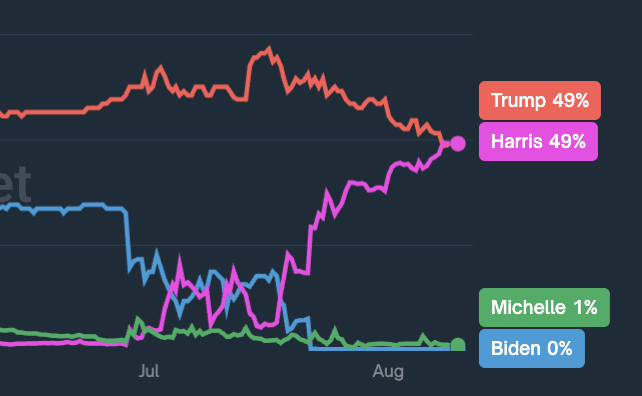

When Trumps odds of being elected soared, the thought process of many was that China was going to be pressured to rush in and buy as many beans as possible before he get's back in office in case of another trade war.

Now that did start happening, but when Kamala entered the race instead of Biden, the election became unclear. So that pressure to buy now basically vanished.

Betting websites have the election odds at 50/50. Kamala actually somehow took a slight lead today according to the betting polls.

So if we see Kamala start to lead as the favorite, we might not see as much pressure for China to buy soybeans. If Trump starts to lead, the could see China pressured into buying more beans.

Just some food for thought. It feels like China isn’t too interested in purchasing right now.

However, if/when China starts to come in and buy HEAVY it would be a very good indication that the bottom is in for soybeans. But we have yet to see that.

With US Gulf corn & beans being some of the cheapest in the world, you would think we get some demand. But have yet to get any.

Today's Main Takeaways

Corn

Corn back below $4.00 with a new low close today & yesterday.

Unless we reverse out of here like last time, $3.80 is the next downside target I've been mentioning for weeks.

Look at the continuous chart. I don’t think we get to $3.40, but that’s also a very real risk.

If you take a look at the continuous chart, we are in bear market territory.

Often times in other bear market years we didn’t find support until $3.40 to $3.50 range.

Also to note, this continuous chart is using Sep corn today. Once it uses Dec corn it’ll hopefully look a lot more friendly. Especially if Dec corn claws back over $4.05 which is where we often found resistance in the bear market.

Either way, for me to say the bottom is in Dec corn has to get back above $4.23 or so. Until then, the risk is lower. So if your risk is to the downside protect it.

We need demand to go higher. Long term I think we get there, as low prices create more demand.

But if we don’t see demand soon, a meaningful pricing opportunity will be hard until likely we get through harvest.

Matt Bennett had a good long term positive thought:

Fertilizer prices are so high. Higher than when corn prices were much higher. Which means a lot of guys will skimp on fertilizer next year. We could see high 80's for corn acres next year. Then if demand starts to pick up, and fertilizer prices don’t come down, the acres being lower could create a big opportunity especially with a weather scare next year.

Why we might not be at a bottom yet from John Scheve:

The low for the year rarely happens in early August

Too many farmers have unpriced old crop corn still in storage

Every rally seems to be met by farmer selling

Dec Daily Corn

Continuous Monthly Corn

Soybeans

New lows in soybeans along with corn.

The chart does not look great here heading into the report.

Next stop is looking like at least the $10.00 psychological support level as we continue to reject off that May downtrend. Remaining in a heavy clear downtrend.

If $10.00 doesn’t hold, $9.60 could be next. As $9.60 is where we often found resistance during the trade war. (Look at the monthly continuous chart)

Old resistance turning to new support.

Soybeans really need to start seeing China come in here to buy.

We already know we are going to have a great crop in the US. But demand might be an even bigger probem.

However, demand is something that change very fast as exports to China make up for 20% of all soybean demand. China is about the only thing that can turn this market around.

When we see them making big purchases, that’ll be a good indicator the bottom is in.

You would think they step in here, but the risk is if they do not.

Until they do, the trend is lower & the risk is still lower. There is no saying we couldn’t go a lot lower if China doesn’t come in here to buy. Protect your risk.

Nov Daily Beans

Continuous Monthly Beans

Wheat

Wheats chart looks far more friendly than corn & beans.

There are plenty of factors that could lead to higher wheat down the road.

There are wheat problems in Russia & France.

India is looking to import wheat when they are usually an exporter.

We are at prices that aren’t going to incentive extra planting, so wheat acres should be moving lower.

For those of you that missed the Russia rally, I think you will get another chance to price wheat.

It will likely not even be close to the $7 we signaled in May. But realistically we could still get $6.25 wheat.

I think we see wheat higher over the next few months. But I still want to see us above $5.56, preferably $5.67 before calling a bottom.

We have been stuck in this 30 cent range for a month now. Once we break out of this range, the chart will look friendly.

After that, some targets would be $6.00 and then $6.25 which is our 50% retracement to the May highs.

If you have unpriced grain, keep puts for protection until you make a sale.

Sep Chicago

Sep KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

8/7/24

HUGE USDA REPORT MONDAY

8/6/24

WHEAT UNDERVALUED? CORN YIELD? WHAT TO DO WITH GRAIN OFF COMBINE

8/5/24

GRAINS STRONG WHILE WORLD PANICS

8/2/24

GRAINS RALLY, YIELD ESTIMATES, CHINA STARTS TO BUY

8/1/24

MARKET EXPECTS A PERFECT CROP?

7/31/24

CORN BREAKS $4.00, FAVORABLE WEATHER & CHARTS

7/30/24

GRAINS FAIL REVERSAL BACK NEAR LOWS

7/29/24

GRAINS SHOW SIGNS OF REVERSALS

7/26/24

BLOOD BATH IN GRAINS: EPA REVERSAL & WEATHER

7/25/24

CHINA, DROUGHT, FUNDS & RISK

7/24/24

BEANS LOWER DESPITE DROUGHT TALK

7/23/24

BACK TO BACK GREEN DAYS FOR CORN & BEANS: MARKETING DECISIONS

7/22/24

BEST DAY FOR GRAINS IN A LONG TIME

7/19/24

DULL MARKETS: STRATEGIES TO USE IN GRAIN MARKETING

7/18/24

DEMAND, CHINA, POLITICAL PRESSURE, & TECHNICALS

7/17/24

DIFFERENT GRAIN MARKETING SCENARIOS YOU MIGHT BE IN

7/16/24

RELIEF BOUNCE FOR GRAINS

7/15/24

GRAINS HAMMERED. TRADE WAR FEAR

7/12/24

USDA REPORT: LOW PRICES CREATING DEMAND

7/11/24

USDA TOMORROW

7/10/24

GRAINS CONTINUE TO GET HAMMERED

7/9/24

RAINS, RECORD FUND SELLING & 2014 COMPS

7/8/24

PUKE SELLING, RAIN MAKES GRAIN & FUNDS RECORD SHORT

7/3/24

THIN HOLIDAY TRADE FOR GRAINS

7/2/24

BEARISH WEATHER, RECORD SHORTS, & CHINA

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL-OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24