CORN & BEANS RALLY OFF LOWS

Overview

Grains end the roller coaster week mixed, as corn and beans make an impressive bounce from their mid week lows.

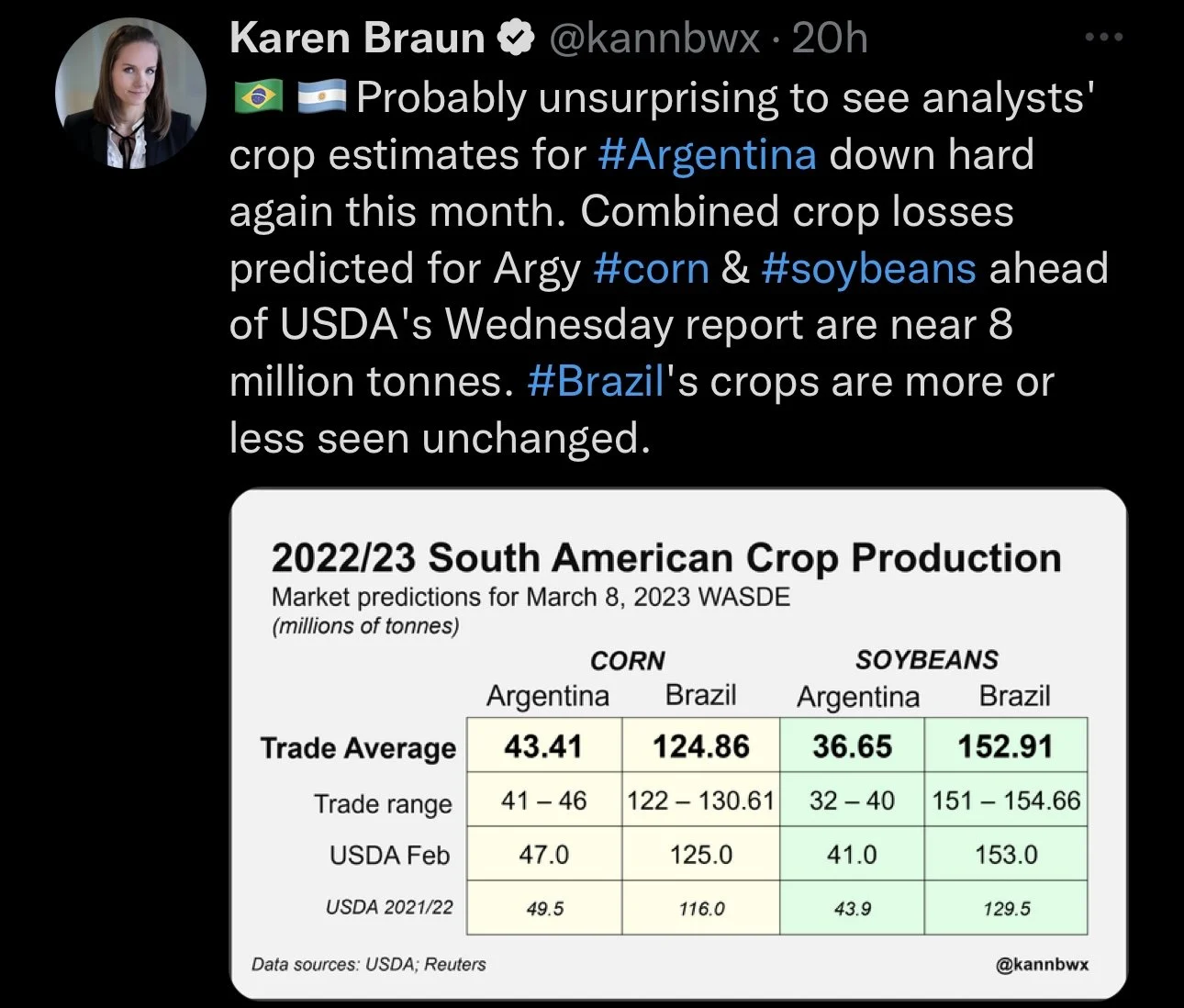

All eyes are on the USDA Supply & Demand report next Wednesday. How big of a cut will the USDA make to Argentina estimates?

Yesterday's Audio

Are The Lows In? - Listen Here

Today's Main Takeaways

Corn

Corn ending the week up +6 cents, and nearly 18 cents off their lows of $6.22 made Wednesday. Closing a quarter cent under $6.40.

This time of the year, we typically see corn sales ramp up, but bears look at another poor week of exports with the volume of sales declining for 4 weeks in a row. As sales came in last week at 23.5 million bushels, which was again on the low end. The sales pace is still trailing the USDA forecast.

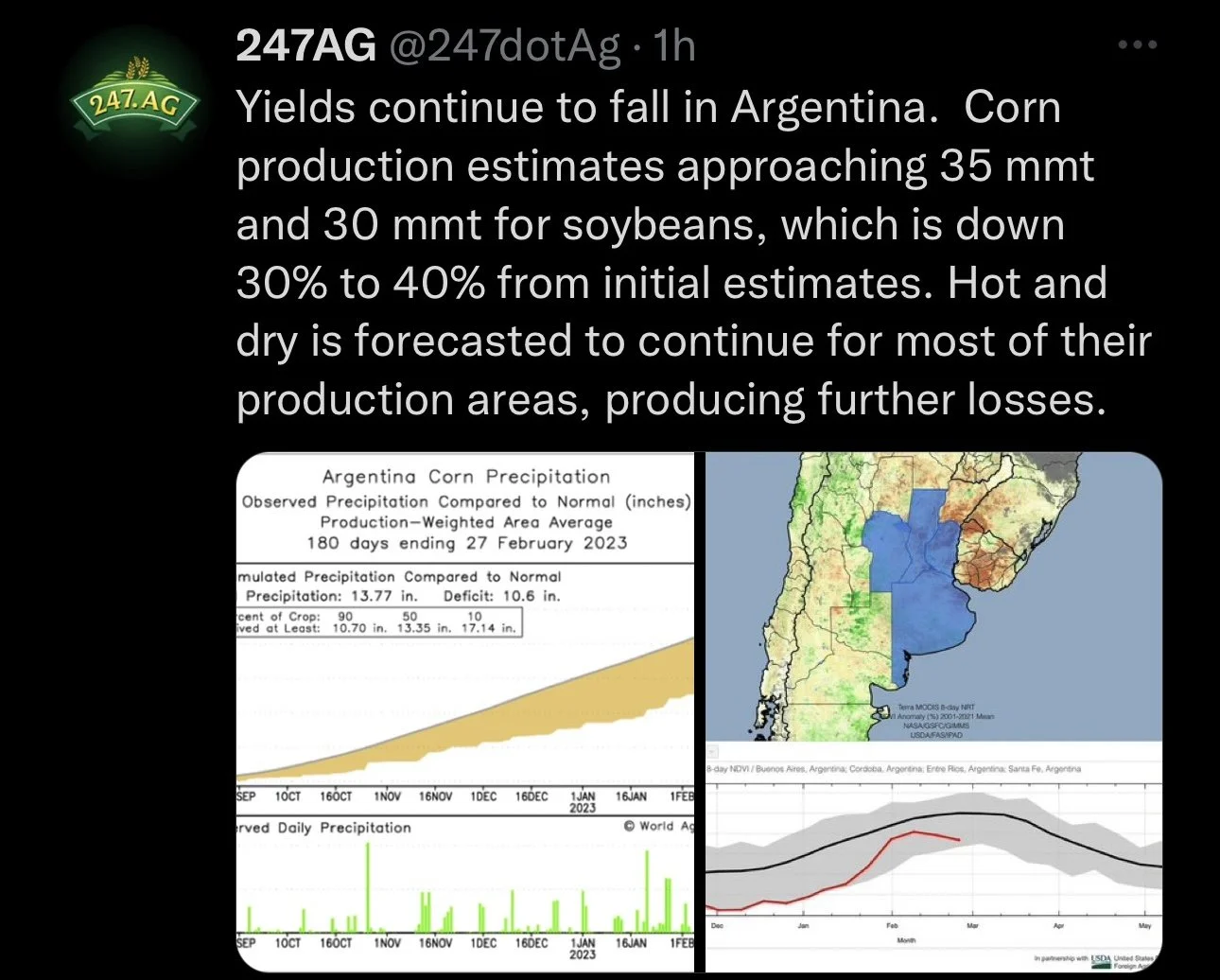

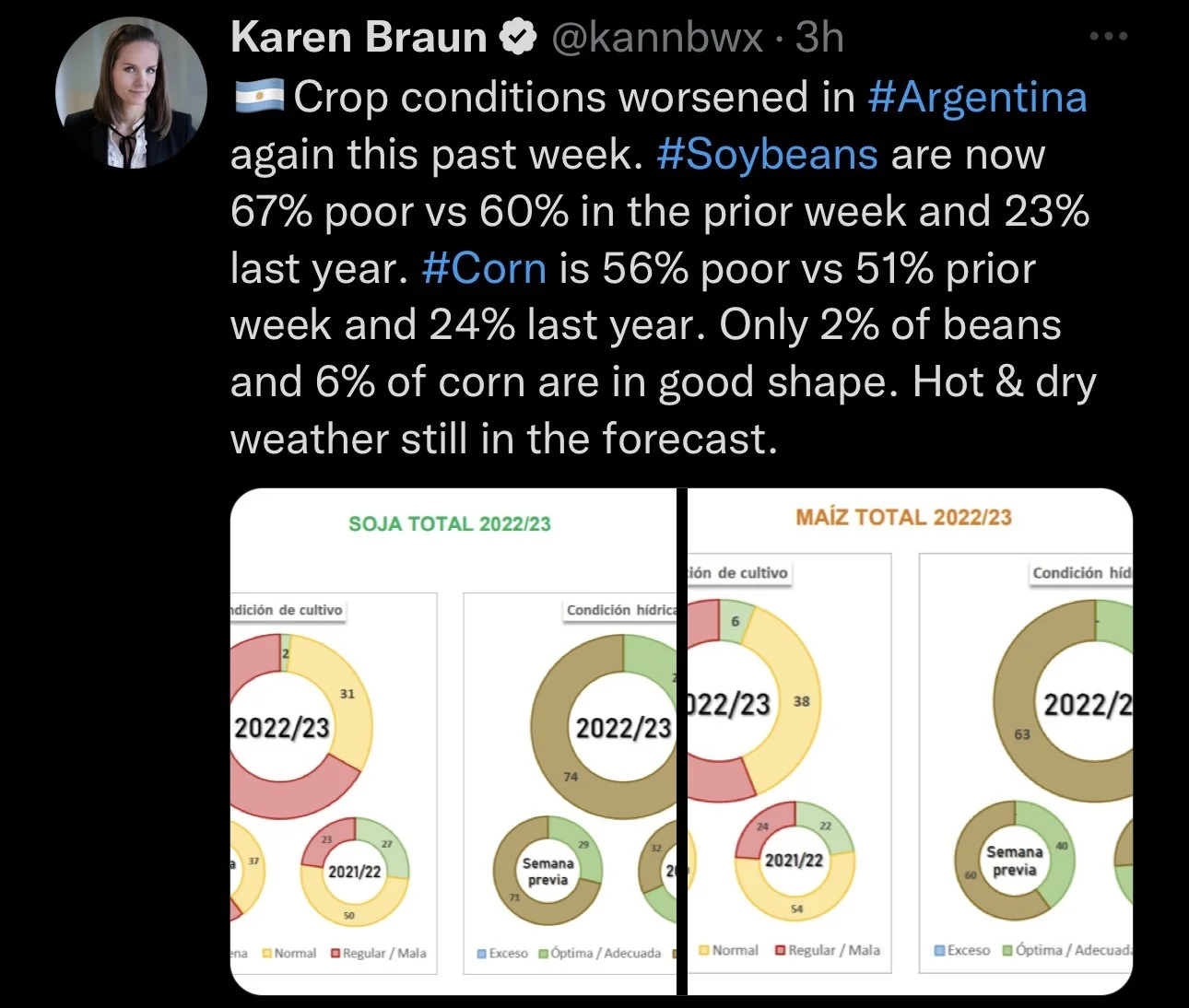

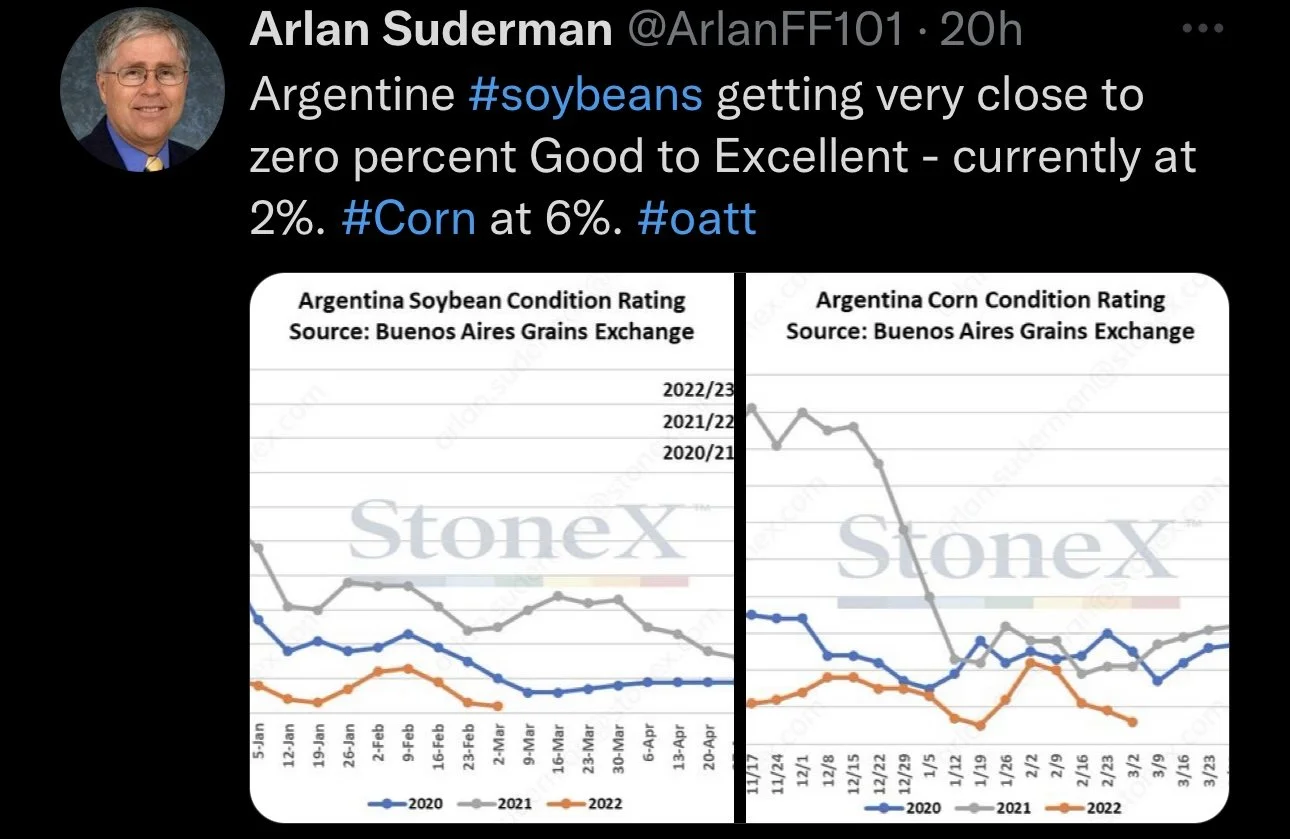

Argentina continues to support the corn and bean market, as crop conditions continue to decline. Buenos Aires left their production numbers unchanged this week at 41 million metric tons, but this is still well below the USDA's current number of 47 million. So its pretty clear we will see the USDA lower this Wednesday, but the question is how big of a cut will we see, and how much of that number is already priced in.

Crop condition ratings in Argentina came in at 6% rated good to excellent, which is a pretty large 3% decrease from last week's 9%. For comparison, last years ratings were 22% good to excellent.

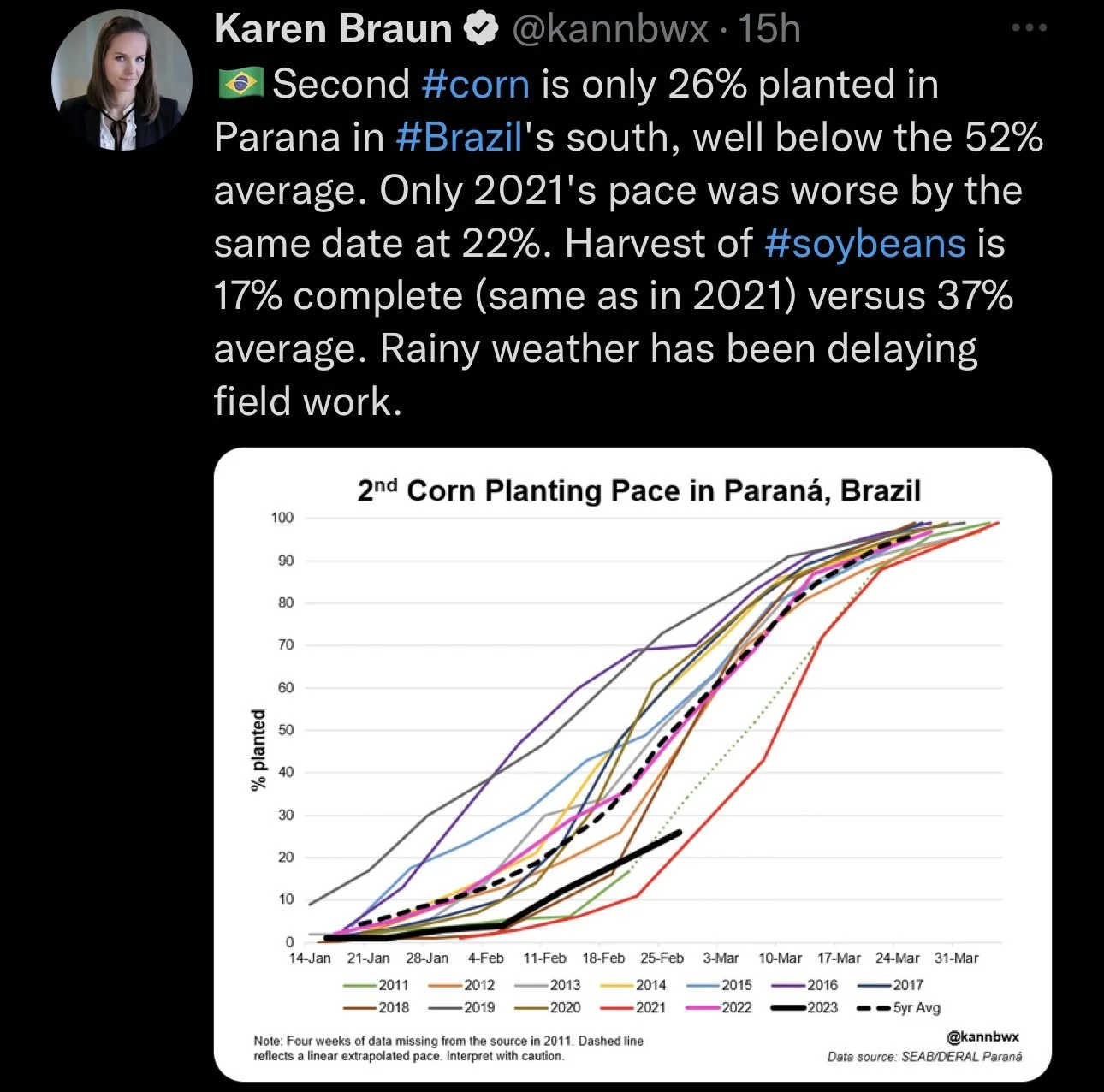

On the other hand, there is some rumors floating around that Brazil's corn crop actually might be a little larger than we previously thought, as some throw out numbers 3 to 5 million higher than the USDA's current estimate. Brazil's second corn crop continues to be heavily debated however with the planting delays due to rain.

Bears also look at acres, and think that if this early spring weather cooperates we could see acre numbers increase as well. We won’t know much more about this until the USDA's Prospective Planting report at the end of the month.

One thing bulls are hoping to see is an increase in Chinese appetite. As there have been some rumors of Chinese demand swirling around. Perhaps this small correction here will bring in some more overall demand for corn.

Looking short term, I could see us chopping around until we get a clear direction or big catalysts, as I don’t see the funds stepping in as huge buyers here short term. I actually wouldn’t be too entirely surprised to see the report Wednesday push us a little lower unless we get some bullish surprise. But looking long term we will still have the potential for prices to keep climbing into spring, and I'm leaning towards the belief that we are near our lows if we are not yet already there.

Weekly Change:

May-23 Corn: -9 1/2 cents

Corn May-23

Soybeans

Beans manage to rally well of their mid week lows, up over +40 cents and nearly finishing higher on the week as the trade continues to debate Argentina complications.

With Argentina facing its worst drought in over 40 years, their crop conditions continue to fall and were a key factor in beans mid week reversal. As conditions are nearly 0% rated good to excellent, coming in at a dismal 1%. A decline from 3% last week and far below last years 25%.

Similar to corn, Buenos Aires left their production numbers unchanged this week. As they had 33.5 million metric tons, which is again well below the USDA's 41 million. BAGE of Argentina also stated that if high temps and lack of rain continue this 33.5 will need to be revised lower, some are talking sub 30.

Traders are anxious to see what kind of numbers the USDA throws out next week, as there is a chance the USDA is still underestimating just how small this crop is going to be.

On the flip side, even with all the problems surrounding Argentina, bears are still trying to make the argument that Brazil's massive crop is going to far outweigh the losses in Argentina. We are also shifting into a period where the markets start to focus less on South American weather worries, but the problems can’t be ignored.

Brazil's large crop is the main concern and thing that has the ability to hold back some of these rallies. But that's not saying we can't still push higher because we certainly can. It's bullish that beans have continued to bounce back and push higher despite all the talk surrounding Brazil's crop.

However, if we continue to see China's crush margins improve and see their economy ramp up we could start to see Chinese demand increase, which alone could help sustain these rallies. There is some debate surrounding the Chinese and U.S. relationship, but I don’t think this will have a huge effect on things. Nonetheless, the big factor will still be how Argentina and Brazil situations play out.

Going into next week, I could see funds selling this recent rally. But Wednesday will be a big day, as we get the USDA's take on where they think South America production stands. I doubt we see them make an overly huge adjustment, and see them slow play things.

Weekly Change:

May-23 Beans: -1/2 cent

Soybeans May-23

Soymeal

Soymeal May-23

Wheat

Wheat slightly lower here today, still floating around its recent lows with the uncertainty surrounding the Black Sea agreement.

There is now 2 weeks left in the Black Sea agreement. Russia has stated that they want sanctions removed in order for them to continue the deal. All eyes will be monitoring this. I still think they ultimately do renew the deal, but I also wouldn’t be surprised to see Putin and Russia to make some comments to push us higher until a decision is made.

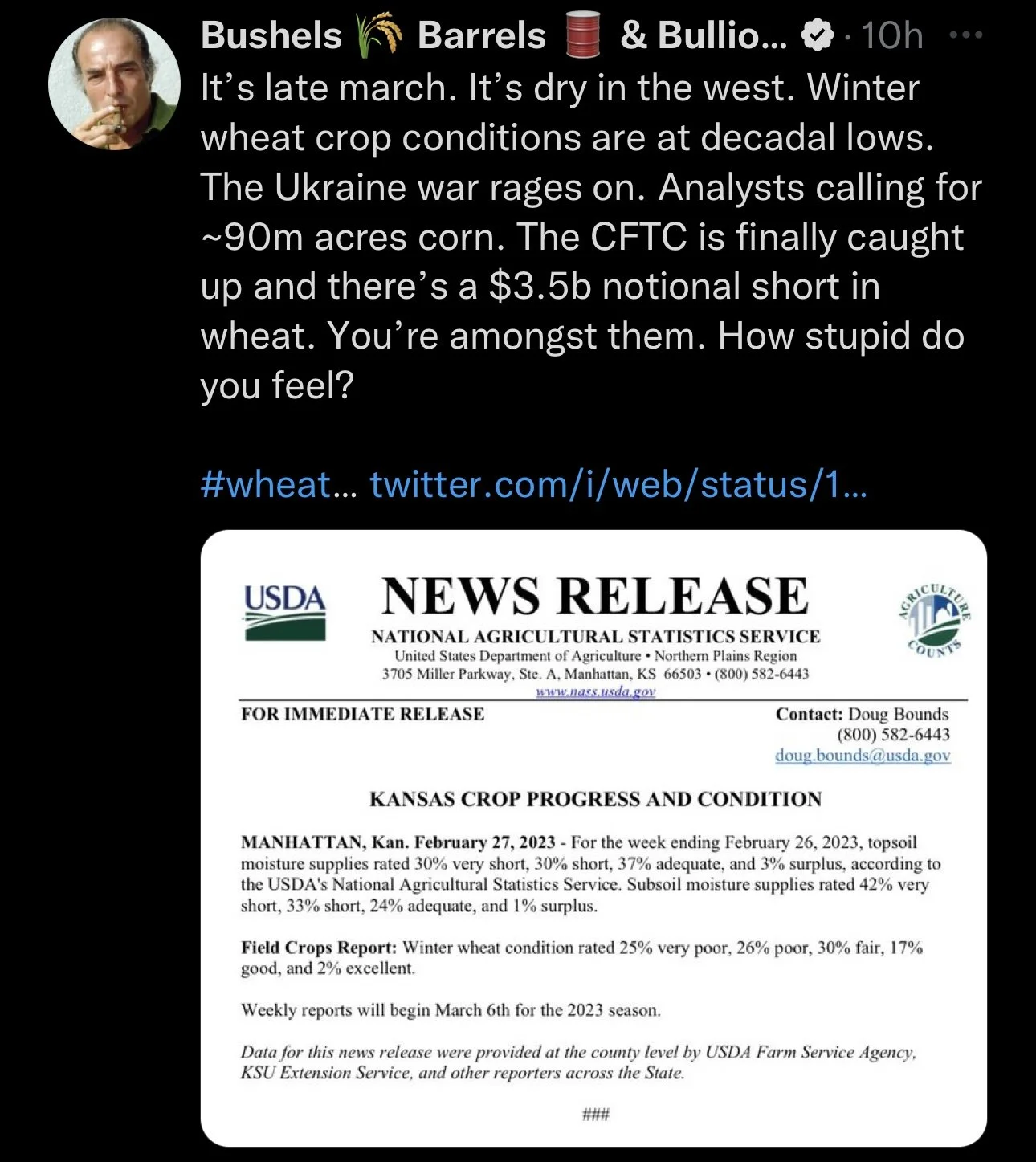

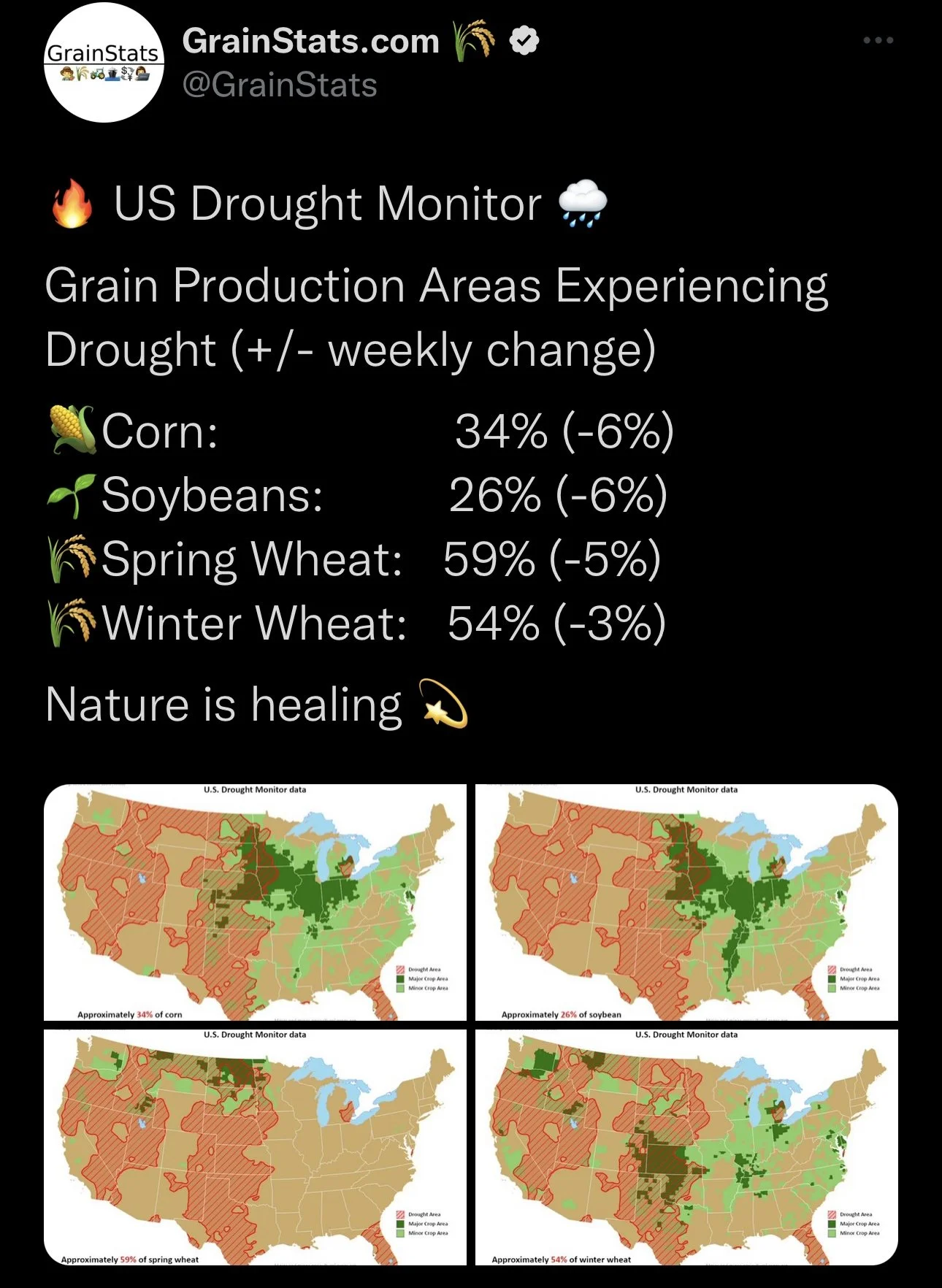

U.S. weather still start to gain more attention soon as the trade will start to put more focus into U.S. new crop production. The latest drought monitor update showed some slight improvements. As it showed 54% of winter wheat still in drought vs 57% last week. Despite the recent small improvements, we still have plenty of weather uncertainty ahead.

Australia's Grain Corp expects their wheat crop to be around 25 million metric tons for 2023-24, which is down roughly 38 million from this year. The reason for this is the El Nino weather pattern that is expecting to hit in the later part of 2023 which has the potential to cause some yield damage.

Hot and dry weather is still in the cards for India for could continue to be a supportive factor for wheat.

If the Black Sea agreement gets renewed, itd be reasonable to think we see prices take another dip. But that doesn’t change a ton of outlook looking long term, as there are plenty of other factors that can push us higher. I think this recent sell off was a little over the top, and makes wheat undervalued here.

Bulls are still optimistic that we see war headlines cause funds to get out of their "sell wheat no matter what" mode. Personally I think its a matter of time before the funds look at this as a bargin of a buying opportunity. There is definitely more of a buying opportunity here rather than a selling opportunity. As there really isn't a selling opportunity at all. I still think we see prices continue to climb into spring and summer.

Yesterday, Andrey Sizov (a Black Sea grain production guru) said he is still cautiously bullish wheat. And said, "Looking at all the Black Sea news, I definitely advise not to short this market."

Weekly Changes:

May-23 Chicago: -13 cents

May-23 KC: -19 cents

May-23 Minneapolis: -9 3/4 cents

Chicago March-23

KC March-23

MPLS March-23

USDA Estimates

Next Wednesday, March 8th.

Wheat Outlook

From The Van Trump Report;

"From my perspective, to get prices to move steadily higher from here we need some type of more dire weather worry that impacts domestic or global production. It would also be nice to get a more bullish demand story brewing. If we want to add icing to the cake we need the funds to get behind a global growth story. In other words, we need a more broad-based supply side worry, a strengthening global demand story, and a more bullish fund buyer. The reason prices have been falling is because all three areas have been bearish. Russia and Australia recently harvested record crops, Canadian production greatly improved, and the US planted a lot more acres. At the same time, global demand has been disappointing and the funds are worried about a global recession, not global expansion."

Visit Van Trump Website

Soft, Hard, or No Economic Landing?

From Farms.com Risk Management;

Highlights:

Is inflation easing or not? If overall employment is growing strongly, but big tech giants are laying off hundreds of thousands of workers as they trim their fat or extra layers from being spoiled in the last 10+ years with cheap money? In 2022, the U.S. housing slumped, manufacturing faltered, but the labor market remained strong.

What inflation does will dictate what the U.S. Fed does and will determine whether we fall into a recession but with a very resilient consumer it could be a soft or no landing as we continue to grow at 1-3% despite sticky inflation.

The economy operates in a cyclical pattern, growing until it reaches its peak and then contracting before hitting a trough and rebounding again into an expansion phase. But this time around its more complicated and confusing thanks to COVID.

The trade consensus in early 2023 is that the U.S. economy would be in recession in 2023 with a 58% chance over 40 years including recessions but they have been wrong thus far.

U.S. Q4-2022 growth appeared strong on the surface, but underlying details remain soft. GDP expanded by 2.7% quarter-over-quarter annualized. Nearly 3/4 of the gains were concentrated in net exports and inventory investment, which continue to experience distortions as supply chains normalize.

What kind of economic landing we will get will depend on inflation in the next U.S. CPI report on March 14th. If at the end of Q2, inflation in the U.S. is still stubbornly high at 6.5%, then interest rates will stay higher for longer and we postpone the recovery. If inflations falls hard, its a no landing. But if inflation stays high for longer, its a soft landing and it delays the U.S. Feds pivot to lower interest rates until 2024.

The panic selling is over in the grain complex, and we are “ringing the bell” for a bottom in the grain markets as this is a relief rally not a dead cat bounce!

Read their full write up Here

Farms.com Risk Management Website

Highlights & News

Fertilizer prices are lower for the 9th week in a row.

Cotton is in a nasty bidding war for acres with corn and beans, so cotton market news is important to all of us. On yesterday’s weekly USDA export sales, cotton sales were a marketing year high, up 97% of the prior 4 week average. - From Wright on the Market.

Brazil's export bean sales are down 31% from last year to just 6 million metric tons. Mostly due to rain delaying harvest.

As of lately, the demand for electric vehicles has decreased, which is good for ethanol and bio diesel demand.

India's palm oil imports fall to 8-month lows.

Livestock

Live Cattle up +1.325 to 165.425

Feeder Cattle up +2.175 to 196.025

Feeder Cattle

Live Cattle

Social Media

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

U.S. Weather

Source: National Weather Service