WHAT TO DO IF YOU PANIC SOLD LAST WEEK

WEEKLY GRAIN NEWSLETTER

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

This week’s newsletter for me is a little different than most, as I lost my Father Tom Frost on Thursday. I wasn’t even sure if I was going to come up with something to say for this weekend's edition.

"In memory of my late father, a lifelong farmer who always had a deep respect for the land and a keen understanding of the markets. His passion for farming and commitment to producing high-quality crops that would benefit our community will always be remembered. As we navigate the ever-changing grain markets, I am reminded of his wisdom and guidance, and his enduring legacy inspires us to carry on his work with dedication and purpose. Rest in peace, Dad, we love and miss you.”

My father left me with two memories that stick out and are probably very similar to most everyone that is reading this. My Father was a hardworking farmer, so the first memory is of him sweating his #### off working on some machinery when I was younger. The other memory or fact was I knew he loved me.

God made many USA Farmers to feed the world and be the rock for what we know as America. Both of my Grandparents were farmers, my mother and nearly all of my family are in the Ag Industry and I am proud to be part of Agriculture because of everyone reading this. So keep up the great work, and thank you.

Have you ever heard the saying make America great again? Farmers make America great.

I am not just writing this as a thank you to the farmers of the world. I do have another purpose and that is to help provide information that will help your success continue to grow. I have talked many times about helping farmers become price makers instead of price takers. I believe that some of the corporations that run different facets of Ag, don’t always have the best interest of the American Farmer in mind. Some are greedy, some are really good at promoting fear in the farmer, always telling them that they need to sell. But I believe the farmers have so much more influence on the grain markets than they realize. I just think some of you need to be told. And need to understand the areas that you do have leverage in.

We all know that the percentage farmers get for grain versus what the product is sold for is pennies on the dollar. The buyers and processors are making plenty of money. ADM recently had record earnings and plenty of you remember how the Cargill Pro Pricing contracts worked out in the last year for those farmers that signed up for it, but very few have seen any monetary pain that Cargill ate for their recommendations that effectively sold grain to them below the market.

Me writing stuff like this and calling out various elevators/grain buyers doesn’t make me many friends at times.

I believe that farmers shouldn’t call an elevator and ask for a price, I believe they should tell the elevators and buyers what price they are willing to take, and it should be above the posted bid sheet. How much push is their in bids at times versus a posted bid? As many of you know I buy sunflowers and other grains, I remember a few short years ago where I was getting farmers 4-10.00 per cwt more than what the local elevator was willing to pay.

I remember buying millions of bushels of spring wheat when I worked at CHS when the spot floor was hot and we got rail cars. I remember paying several farmers more than 2.00 a bushel more than our posted price.

But I also know that buyers want to buy as cheap as possible and make as much money as possible because that is their job, it’s how they get bonuses.

Buyers have motivation even if they don’t realize it to try to get farmers to fear sell and sell cheap. There are some merchandisers out there that have roots that come from the farm and some of them only do what is right for the farmer. But most of the news you read from certain grain market advisors, Ag Corporations, or buyers in general give you the farmer biased information that helps promote fear selling.

Look at nearly every broker, or advisor out there and see where they get their paycheck from. Who sponsors some of the engagements they speak at.

Take ADM as an example, personally I think ADM is a great company, with great people. But have you ever listened to some of the BQCI commentary that they do for the elevators associated with them? It usually has a bearish bias because they naturally tend to focus and give information to their elevators to help them be able to buy grain. It’s good information but the bias is there to help their elevators have tools to get farmers to sell.

Even when I was at CHS, which is a COOP, the information we got on our daily calls with CHS Hedging tended to be geared towards helping us buy grain from the farmers. It was always the reason why farmers should sell and not stick their nose up in the air with the good prices.

I subscribe to many other advisors and for months and months, most have been screaming to farmers to sell now before the sky falls. One of them this weekend said “Bottom line: rallies should be sold”

I believe that one of the biggest mistakes that can happen in marketing is to sell too early. I think more money has been lost on selling too early than any other mistake in grain marketing. Who benefits when farmers sell too soon?

There are a couple other advisors out there that have gained more respect from me recently as they also tell farmers not to panic sell and they point out the price possibilities and reasoning behind it. Farms.com Risk Management and Wright on the Market are two that have been calling for much higher prices just like www.dailymarketminute.com is calling for.

One of the big news articles out this week has been the talk of the high demand for commodity fund traders because of all the money that the funds made last year. As more and more of these fund money traders start to realize the influence that the American Farmer can have on prices, the more volatility that we should see and the higher longer term price objectives we have.

Reasons I think we are going much much higher in our grain markets are.

Mother Nature.

She continues to be very moody to say the least. Almost daily we hear of some place in the world that has a major disaster or weather event that takes away yield in a hurry.

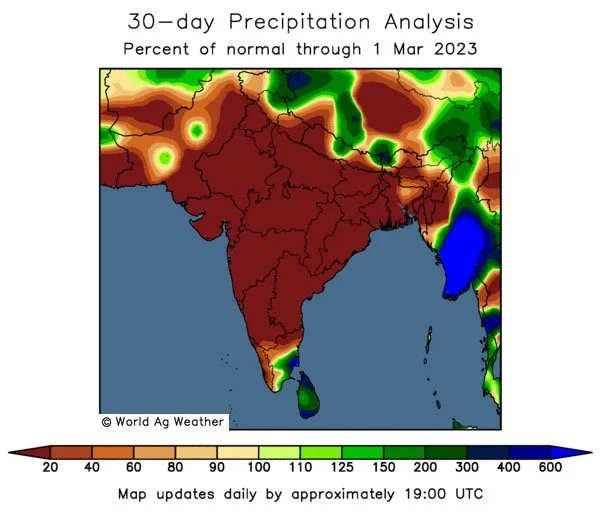

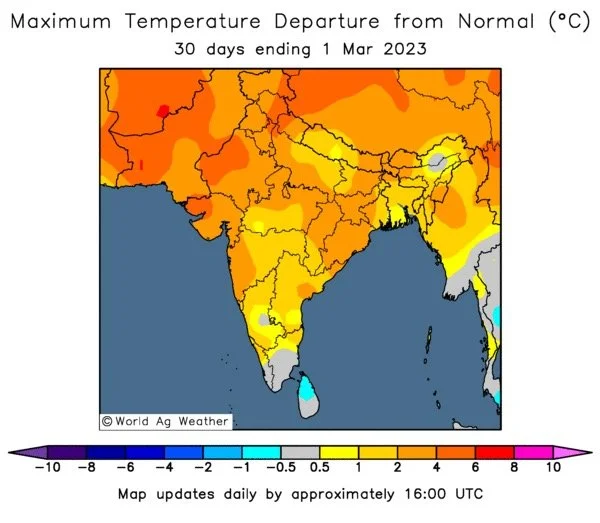

A couple examples the past couple of weeks are, the record heat in India.

The freeze in Argentina, which comes on the heels on the worst drought they have had in decades

The extremes that the US is seeing

Mother Nature is going to throw a curveball one of these years, (I think this year) to the corn belt. We will see yields drop well below the trend line. With the demand we have built up we can not ration it fast enough. When or if a 2012 like drought hits the corn belt we will see prices go so stupid as emotions get out of control as the world and the funds wonder who will all go hungry

Demand.

Margins are very strong for most of the major grain buyers. Look at soybean crush margins and tell me they will not try to buy all the beans that they can find.

The below is from Farms.com risk management

Money

There is so much more money to be made if grains go skyrocketing higher, that why would a fund manager want to try to short grains. We will never have grains go to zero, or stay at zero for an extended period of time. But we have and always will continue to see grains go 1.5-5x previous highs.

Any of you remember in 2001 when millet went from 4.00 per cwt to 20.00 per cwt in a matter of a few weeks.

Any of you remember 25.00 MPLS wheat in 2008

Technical trading.

Many of you know that we follow the tech guy from Wright on the market. Have many of you noticed some of the possible targets he has had out for months for corn and soybeans. These targets are not numbers he magically made up, they come from self fulfilling systems that many traders use which helps them work. These targets blow out the old all time highs. Keep this in mind that as our markets take out resistance more and more buyers will jump on board.

I am also a member of the commodity technical trading group on Facebook. Vince I, puts out some great info on there and I noticed today that he mentioned a 6.60 target for December corn, he has been in front of this recent price break calling it correctly and even he has a price target nearly a dollar above the present new crop price.

CHAT GPT, the upcoming new popular AI technology.

I asked this to the CHAT GPT AI;

“What factors determine if a commodity will go to new all time highs?”

AI’s answer;

“Several factors can contribute to a commodity reaching new all-time highs, including:

Supply and demand: When demand for a commodity exceeds supply, the price of that commodity tends to rise. Conversely, if supply exceeds demand, the price of the commodity tends to fall. Therefore, a significant increase in demand or a decrease in supply can contribute to a commodity reaching new all-time highs.

Economic growth: As economies grow and populations expand, demand for commodities tends to increase. Therefore, strong economic growth can contribute to a commodity reaching new all-time highs.

Geopolitical events: Political instability, war, and natural disasters can disrupt supply chains and lead to supply shortages, which can drive up prices and contribute to a commodity reaching new all-time highs.

Speculation: The behavior of investors and traders in futures markets can also contribute to a commodity reaching new all-time highs. If investors speculate that a commodity will continue to rise in price, they may buy futures contracts, which can drive up the price of the commodity.

Currency exchange rates: The exchange rate of a country's currency can affect the price of commodities. If the currency of a country that produces a commodity weakens, the price of that commodity can increase, as it becomes more expensive for other countries to purchase that commodity.

Climate and weather patterns: Climate and weather patterns can affect the supply and quality of commodities. Droughts, floods, and other extreme weather events can damage crops and disrupt supply, leading to price increases and contributing to a commodity reaching new all-time highs.

These factors, among others, can contribute to a commodity reaching new all-time highs, but it is important to note that predicting the price of commodities is always uncertain and subject to many variables.”

DID YOU MISS BUYING OPPORTUNITY OF A LIFETIME?

I believe that last week the USDA Outlook form gave buyers the opportunity of a lifetime to buy some cheap grain. We strongly encourage all livestock producers to cover 100% of their feed needs with calls.

For those of you farmers that sold grain, we like re-owning this price break in a manner that leaves you comfortable with the associated risk.

This week we will have a USDA report, and we could see a little sell off around it. Corn exports could be prematurely lowered because of our slow pace. Wheat could easily test the lows and breach them before it decides to run higher.

When we are marketing grain we don’t want to get caught up too much on the short term picture and the ups and downs of the market. We want to realize the triggers and signs that the market is giving us. Right now we want to remain patient in doing much if any grain marketing. We will be watching for signals, signs, triggers, whatever it is that you want to call it the will help you make a decision in pricing grain or marketing it in some shape or manner. So we want to be prepared, have hedge accounts open. I don’t want to leave standing target orders, but I want to have some goals in mind that hopefully we can go past.

Some marketing plans have simple exit dates and target prices, which help farmers become more proactive. We have a similar approach, but we want to read what the markets are telling us and wait for the markets to tell us what to do and when. We have a good idea that it will start happening as we get our seasonal price rally in April-May-June-early July.

What tools we use will be determined by your comfort level, but if you want to become a price maker instead of a price taker you need to be prepared to ride out the storm while learning which tools will make the most sense to utilize in the future.

One risk on the horizon presently is we could easily see a fast start to planting this spring. That could pressure new crop corn, similar to that it did in May June of 2012, before the funds woke up and realized the situation.

Please feel free to give me a call if you have any questions or need help making some marketing decisions for your operation . 605-295-3100

Here are a few screenshots/pictures of other information that should be helpful.

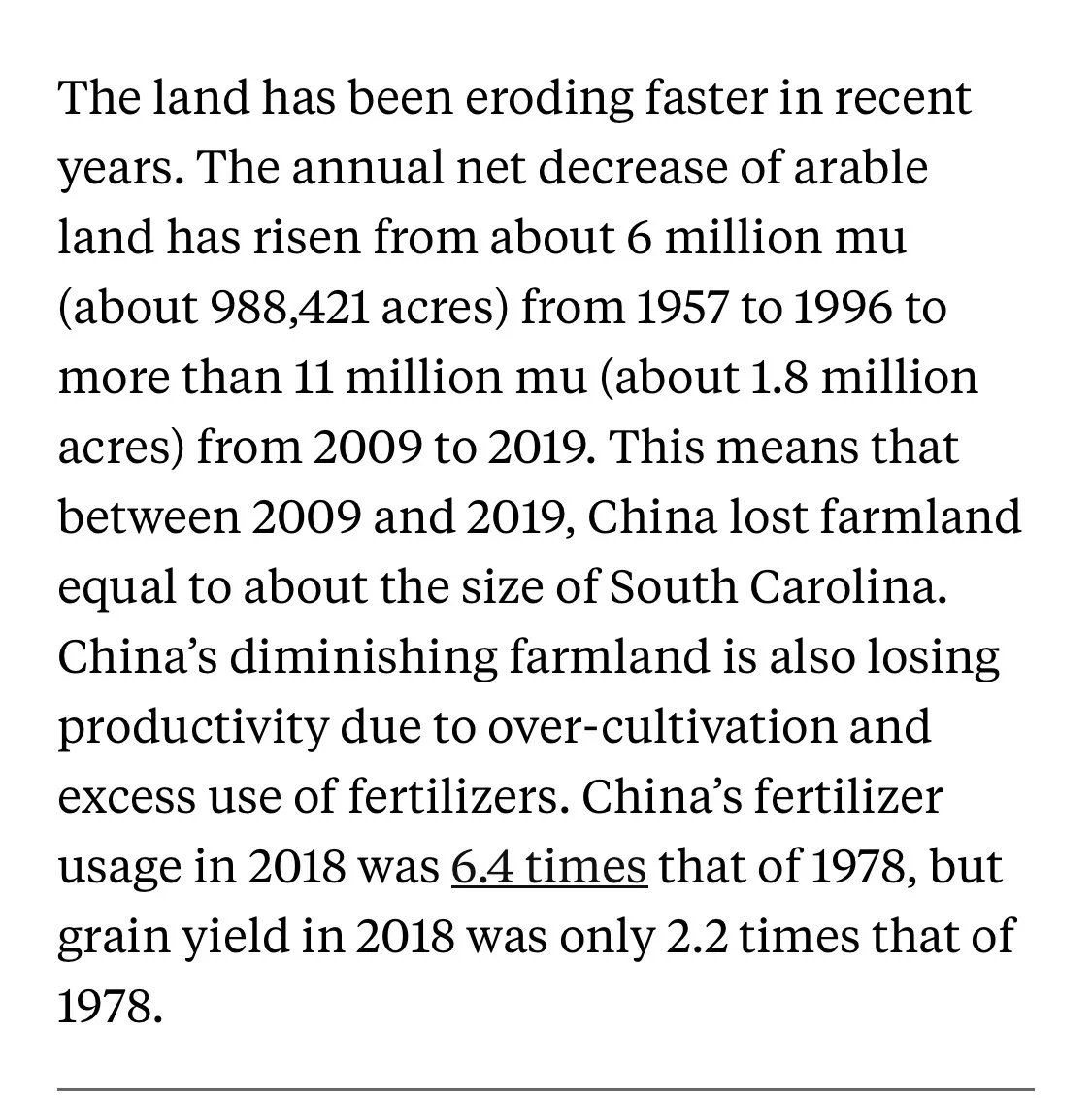

This is a clip from an article talking about the farmland issues in China.

Here is an old Tech guy chart, just to reference some of the target prices.

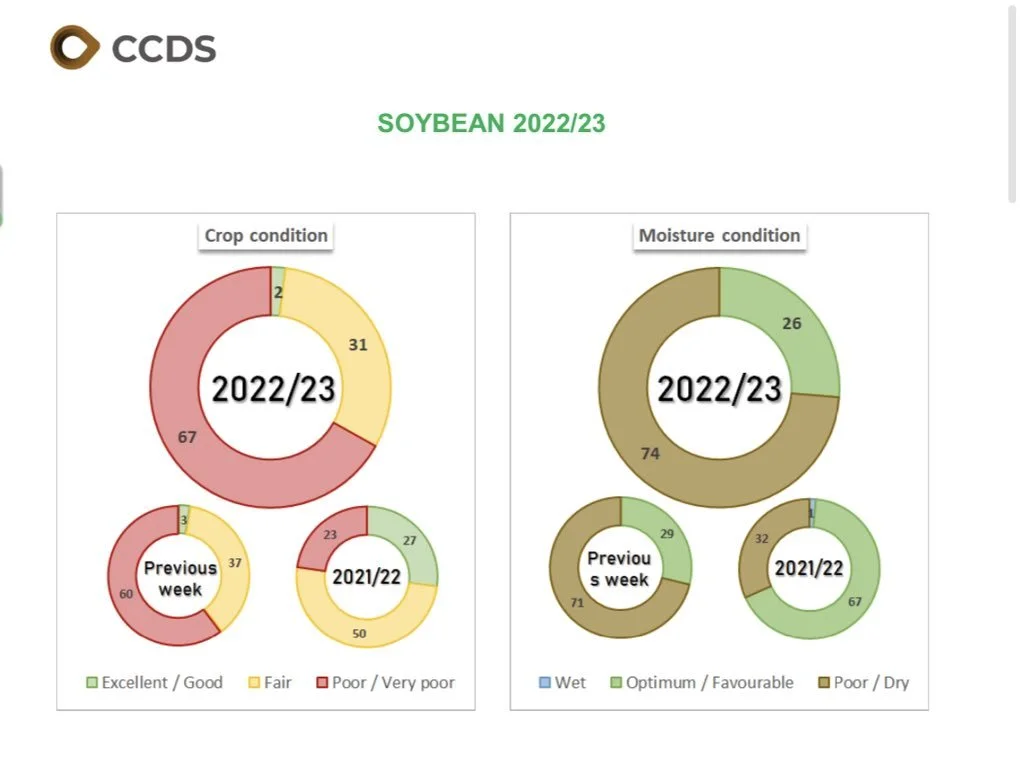

Crop conditions in Argentina.

India Weather

The Charts

Corn 🌽

Corn bounced nicely off its mid week lows (+18 cents). Bouncing off its long term upward trend line from July. Closing back above its support level around the $6.37 range. Next upward target is $6.50 level. Personally I think we are near our lows if we have not already made them. But the USDA report does have the potential to cause more downside short term.

Beans 🌱

Beans bounce right where you needed to at their long term July uptrend similar to corn. Rebounding over +40 cents from Wednesday’s lows. Still in a clear uptrend. Can we work our way back to our recent highs?

Meal 🐮 🌱

Meal continues its strength off the back of Argy worries (the world’s leading exporter of meal). Finding support at our uptrend from our initial rally in late November.

Wheat 🌾

Wheat futures continue to struggle. As on the recent sell off broke our February uptrend. Bulls trying to find some footing. We got a small bounce but nothing to the extent we saw in corn and beans. War escalation and where the Black Sea agreement goes will continue to be the main factors, as the deal is set to expire in 2 weeks. Sure we can have more downside here. But I don’t think anyone is selling here. I’m expecting higher prices come spring/summer.

Past Updates & Audio

3/3/23 - Market Update

Corn & Beans Rally Off Lows

3/2/23 - Audio Commentary

Are The Lows In?

3/1/23 - Audio Commentary

Is The Panic Selling Over?

2/28/23 - Audio Commentary

Now Is Not The Time To Panic Sell

2/26/23 - Weekly Grain Newsletter