DID CORN CONFIRM BOTTOM?

Overview

Grains close mixed, as corn gets some follow through strength, while soybeans give back half of yesterday’s rally. It was the wheat futures that led the way today

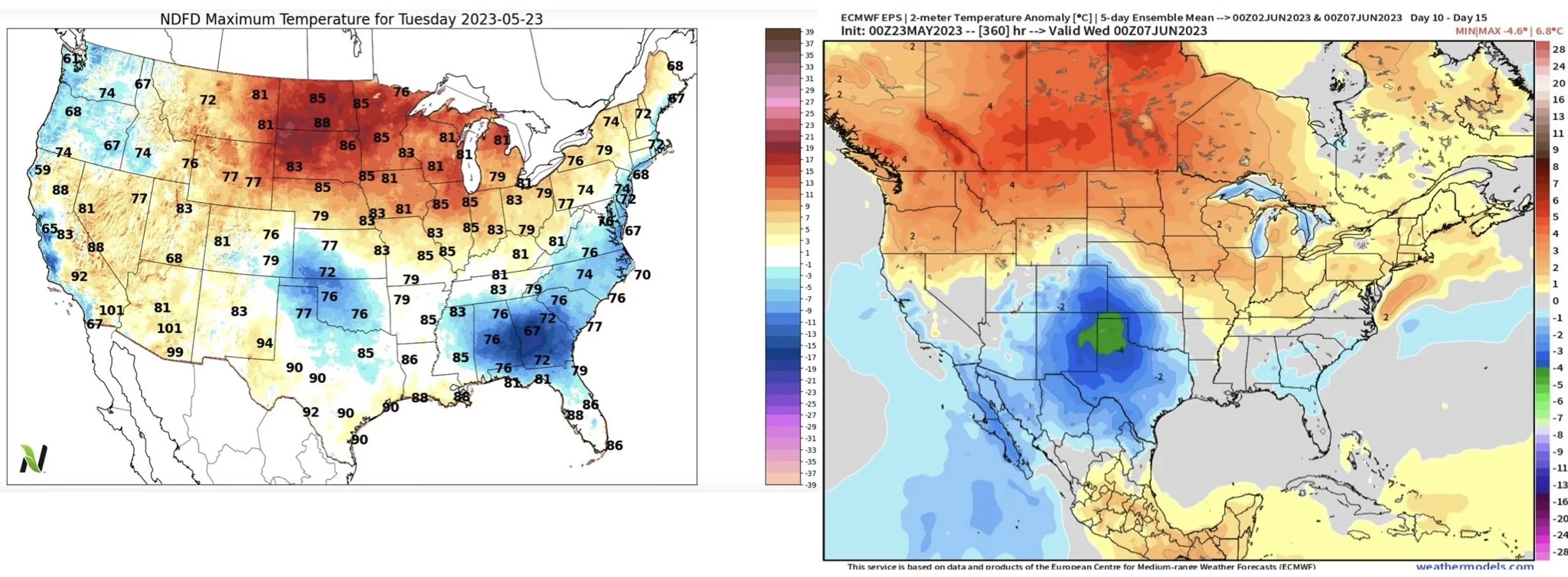

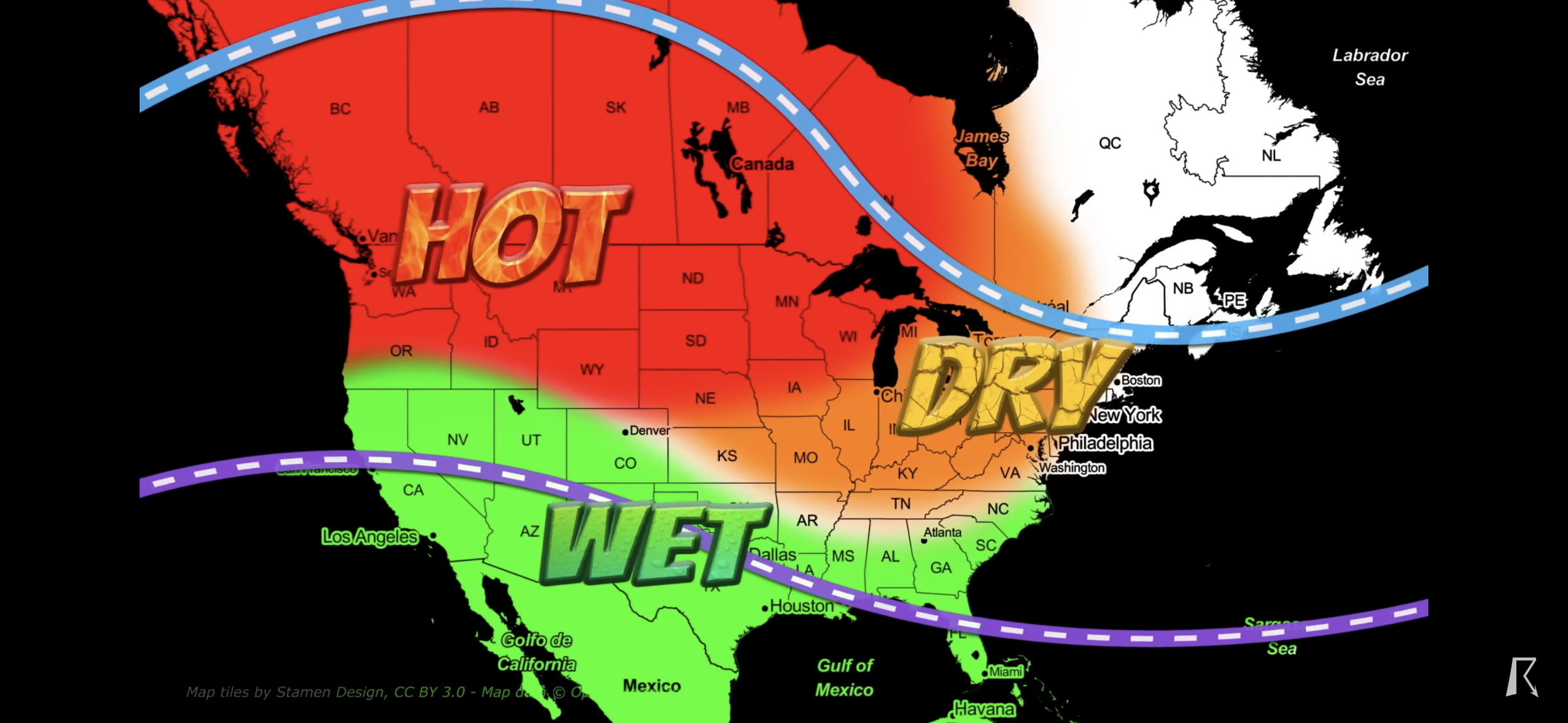

The main thing supporting our markets right now is drought concerns. We have drier weather in not just the US, but also in Canada, Brazil, Ukraine, and Australia. We touched on this yesterday, but many sources believe we are in for a Super El Niño type of event. Which would make our corn belt extremely dry, while making Canada very hot.

Going forward, weather is going to outweigh every other factor. It is going to be the number one factor that will push us higher, or perhaps lower.

The funds are still very short corn and wheat. Do they want to be that short going into a long weekend if we still have dry forecasts and concerns? You wouldn’t think so. I personally wouldn’t want to be short going into the long holiday weekend with drought and all the other uncertainties.

***

In case you missed it, Sunday's Weekly Grain Newsletter

Will We Replicate 2012 or 2013? Read Here

Today's Main Takeaways

Corn

Corn follows up yesterday's rally with some follow through strength, with July closing up 6 1/2 cents

The drought concerns globally have provided support to corn to start the week. The corn belt and I-states aren’t necessarily extremely hot, but they are very dry. Forecasts show they will continue to get drier with some models showing almost no rain for at least the next two weeks.

Even Brazil is now concerned about drought and their second corn crop. This is also something we had anticipating for the past few weeks, and another reason why those Chinese cancellations might actually have been a double edged sword.

The South America expert Dr. Cordonnier said yesterday that:

"Dryer weather has encomppaded most if not all the safrinha corn area of central and south-central Brazil. There is little rainfall in the forecast for central Brazil with a slight chance of rain for south-central Brazil. Some of the safrinha corn areas have been dry for about 4 weeks with little rainfall in the forecasts. The Brazilian National Weather Service is warning humidity may drop as low as 20%."

If Brazil does remain this dry, they could be in for some problems down the road. As could China, as they were initially expecting this massive crop they could snag for cheap.

We had been talking about this potential drought for months now. Especially when planting got off to a fast start, most looked at that as somewhat of a bearish factor. But instantly we knew that all the fast planting meant was that it was dry especially in the I-states.

North Dakota is a big question mark surrounding planting. As the argument is just how many acres will be lost to preventive plant. In the end of today’s update, I included a write up from Wright on the Market where he goes over that situation more.

I know we have compared this year to 2012 time and time again. Some people say there is no chance we experience a drought like that again. Perhaps they are right. But if you were to take a look at soil moisture and drought monitors comparing the two years, we are already in a worse situation than at this same time in 2012. If we do indeed get this El Niño event that all the weather gurus are predicting, we do have the possibility to see the corn market replicate something similar to that of 2012. So really all I am saying is that if it does remain dry, which nearly every model out there indicates it will, our markets have a great chance to see a significant rally.

If it stays dry for another 10-days (the current forecast suggest it will) top soil levels are expected to become the driest since 2004. Eclipsing that of 2012. We also have 50% of US corn drier than normal for the last 30 days. There is also a definite probability that April-May might be the driest across the 7-state corn belt since 1992. So is the market underestimating weather premium and drought? They very well could be.

Is the bottom in for corn? The action is corn has been pretty solid. We got the rally to start the week with some follow through strength again here today. Some would say that follow through strength is an indication of a bottom. If we haven't made it yet, I can imagine we are awfully close to doing so. If forecasts remain dry in the US and Brazil, I don't see why we wouldn’t continue higher from here. With the chance to go much much higher this summer if weather works out in the bulls favor. Personally I see a lot more upside than downside, and think drought will start to become more evident ultimately driving us higher in June.

*Scroll to the end of today’s update for maps showcasing lack of moisture and drought

Corn July-23

Soybeans

Soybeans were the outlier today, being the only of the grains to finish in the red. As they give back over half of their gains from yesterday's rally. Yesterday was soybeans biggest single day rally since last September's crop report.

Beans saw some pressure from the meal and oil getting hit fairly hard. Outside of that, there wasn't a ton of reason for today’s losses.

I mentioned yesterday that I could see a little bit of a turnaround for beans today. Perhaps it was just some technical selling and profit taking from the rally we saw yesterday. The funds likely just bought corn and wheat, while selling beans, meal, and oil against it.

However, the weather hasn't changed. We are still looking at hot and dry forecasts. Short term, sure the hot and dry weather will probably affect corn more so than it will beans, but nonetheless the weather is extremely supportive of both markets currently, and I believe it will continue to support both corn and beans, but more directly corn.

Brazil's massive crop is still the biggest thing bears continue to point at. But we did see yet another estimate cut to to Argentina, as Dr. Cordonnier again lowered his estimate, this time down to 22 million metric tons. So the USDA definitely has some work to do on their Argentina number.

Planting came in well ahead of pace, coming in at 66% vs our average of 58%. Similar to corn, North Dakota is really the only state that's falling behind, as they sit at just 20% planted.

Bulls are trying to find that next catalyst to drive us higher from here. Of course weather here in the US is the most likely, but there are a few other possible factors at play. Those would include seeing an increase in Chinese appetite, or possible a major logistical issue surrounding exports out of Brazil with their record crop. Argentina's awful crop could also cause some things down the road to add support.

I think weather is going to be the biggest factor, but there is a tad of uncertainty short term with beans as the nearby headlines could favor that of Brazilian exports. So bulls might need to find another demand story or see a problem in Brazil with their exports. I'm not totally sold that the bottom is in quiet yet for soybeans, but I ultimately think we do get a bigger bullish catalyst down the road to push us higher a little later this spring/summer.

Soybeans July-23

Wheat

Wheat futures finally find life again, following their 4 straight days of losses.

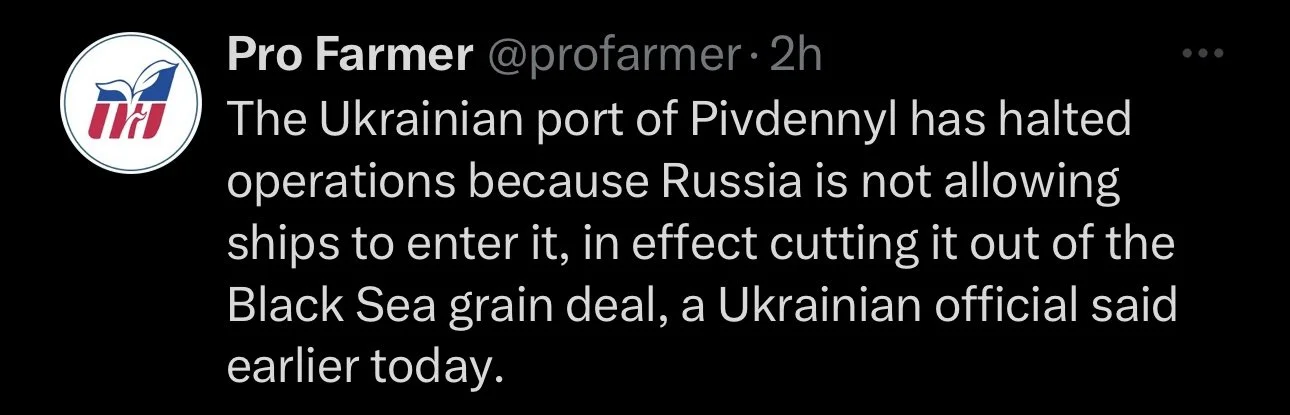

Wheat found some more support from the Black Sea. As news broke that the Russians are not allowing one of the ships to enter a Ukrainian port. Kind of acting like the grain agreement isn't a thing. One could imagine we see more headlines like this down the road. Since the agreement was renewed for 60-days, that gives us plenty of time for wild cards to pop up from Russia and war.

In yesterday's crop conditions and planting, we saw winter wheat conditions improve slightly, but that didn't stop wheat from rallying today. As yesterday winter wheat good to excellent rating actually jumped 2% from last week, to 31%. While our poor to very poor rating also decreased by 1% to 40%.

However, bulls still look at Kansas. As the top grower still sits with just 10% of their crop rated good to excellent. With 69% of their crop sitting poor to very poor. Oklahoma also continues to struggle, with 52% of their crop sitting poor.

We also saw news that Kansas farmers are going to abandon their most wheat acres since World War 1. As according to Reuters, they are planning to abandon around 33% of wheat acres.

Spring wheat planting also came in a lot faster than it has been. Coming in at 64% planted, this was higher than the trade estimate of 60% and a big jump from last week's 40%. Even with the good jump last week, spring wheat planting is still behind. Another thing to keep in mind is that a there is a lot of acres left up in North Dakota, which brings up the argument of how many acres ultimately get put in the ground.

Wheat is still facing a problem with global competition, and the US is still struggling to remain competitive in the world market.

Bears also point at the recent rally we have seen in the US dollar, as it hit a new multi-week high. This adds pressure and makes the global competition all that more difficult for the US.

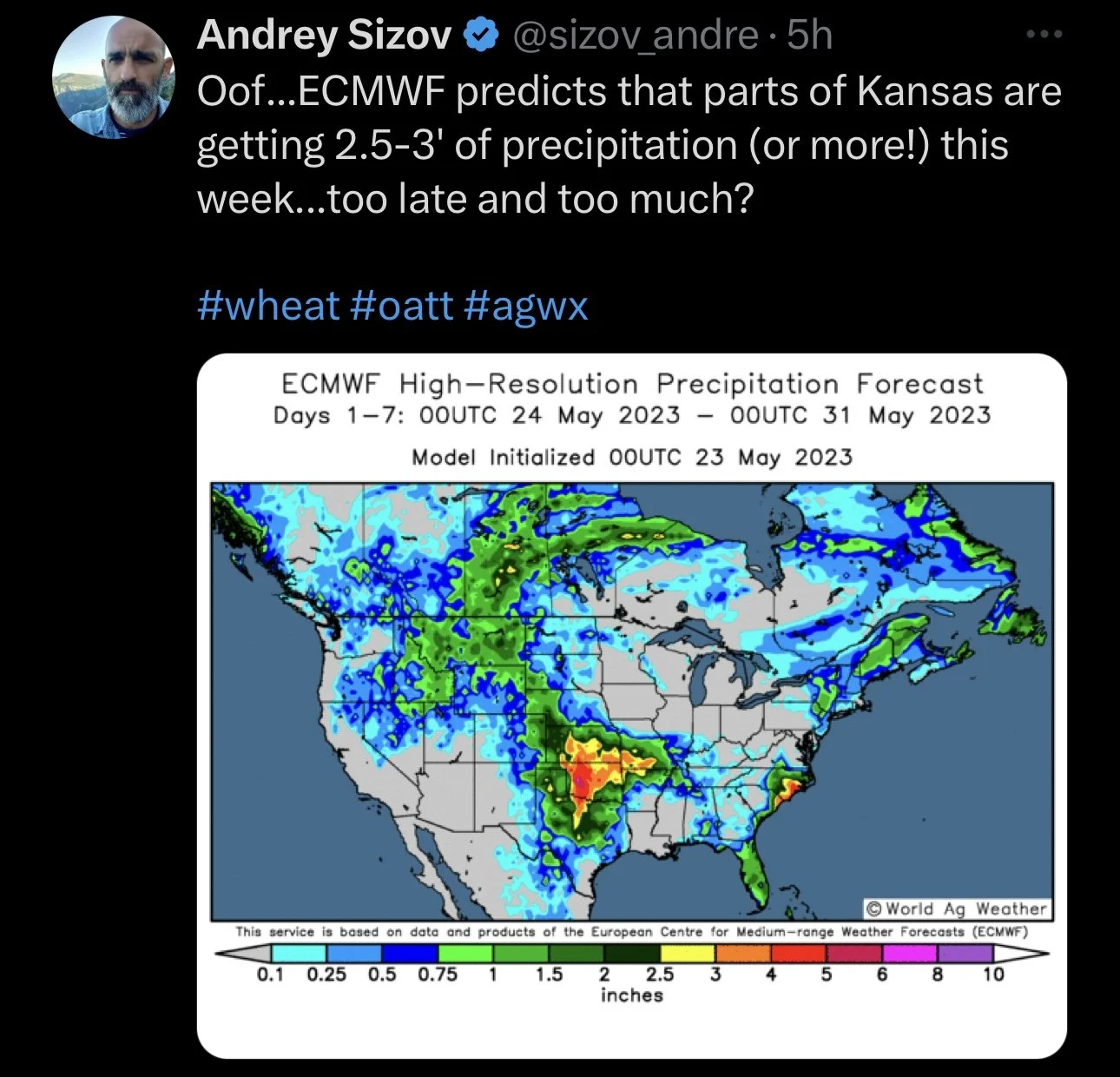

Weather remains fairly supportive. As of course we have the awful winter wheat crop. But some of those key areas are supposed to get some rains. Now will these rains make any difference? Well that’s up for debate, but I cant' imagine it makes much if any. Canada is also very dry which should look to add support.

Going forward, it is going to be more of the same in the wheat market. Weather and war. I still think both of these factors are bullish, but we need the funds to jump on board and cover their shorts if we want to go higher.

From a technical standpoint when looking at the Chicago chart, we are coming to end of an apex where that magic downward trendline meets support. So we might be due for a big move. I'm hoping it's one to the upside, but then again I've been caught trying to catch that falling knife in the wheat market in the past.

Chicago July-23

KC July-23

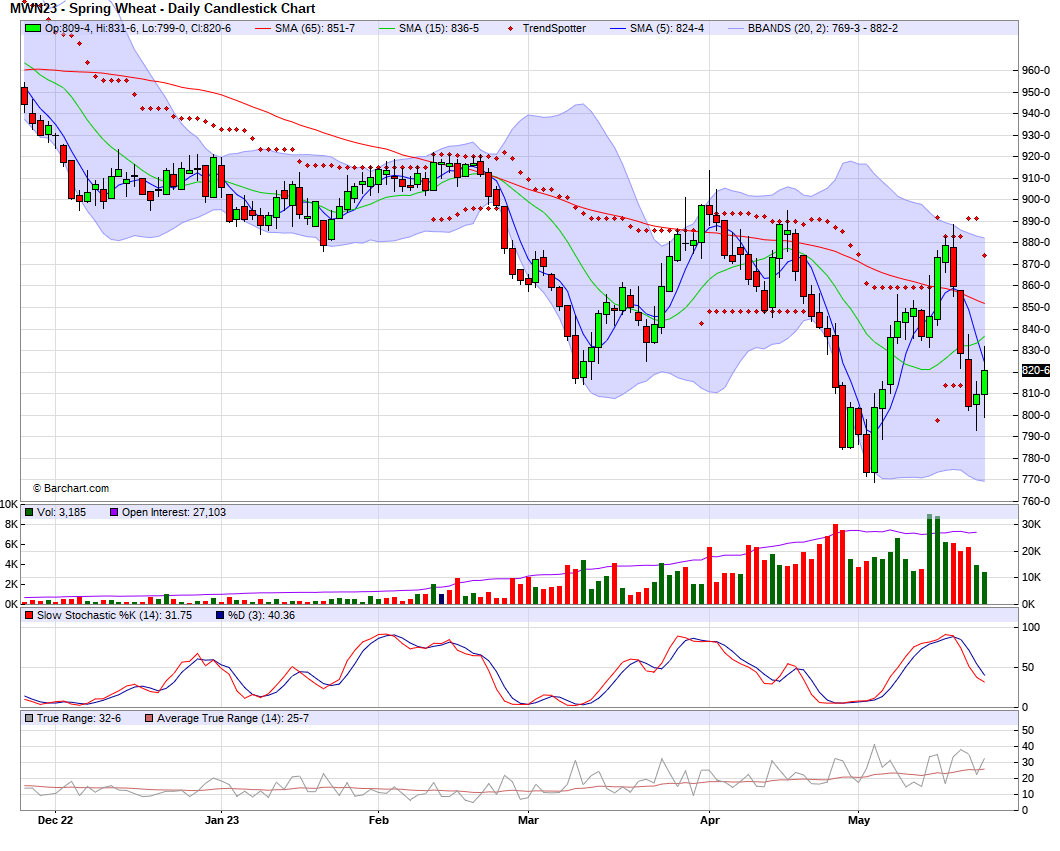

MPLS July-23

North Dakota Planting Problems

From Wright on the Market,

The USDA Weekly Crop progress report has North Dakota 32% planted in corn; the normal pace is 50%. Their soybean planting pace is 13% behind normal with just 20% in the ground. Sugar beets are 90% planted, 11% ahead of normal. Sunflowers are 5% planted, 8% behind normal. Oats, at 35% planted, are 27% behind. Barley at 38%, is way behind normal also.

Why is North Dakota so important? Farmers there planned to plant 3.75 million acres of corn, 27% more than last year, the single largest increase of corn acres for any state this year. Their corn prevent plant date is Thursday (May 25) for most of North and South Dakota and Northern Minnesota; May 31 for the majority of Minnesota.

For all the Crop Progress and Conditions state by state, go to: GrainStats

Drought Maps

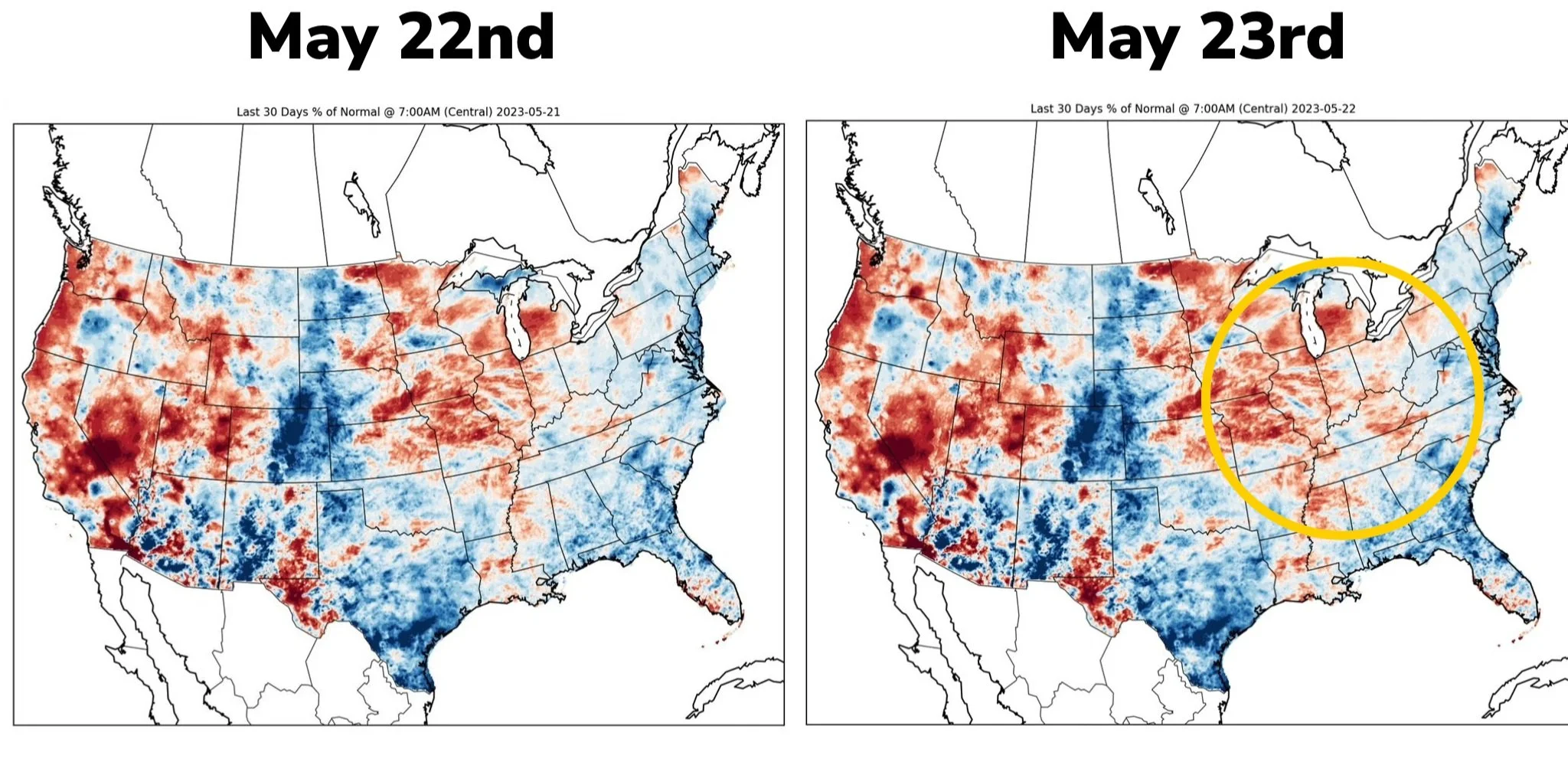

Just a 1 day difference of percentage of normal precipitation fell moving eat across the midwest.

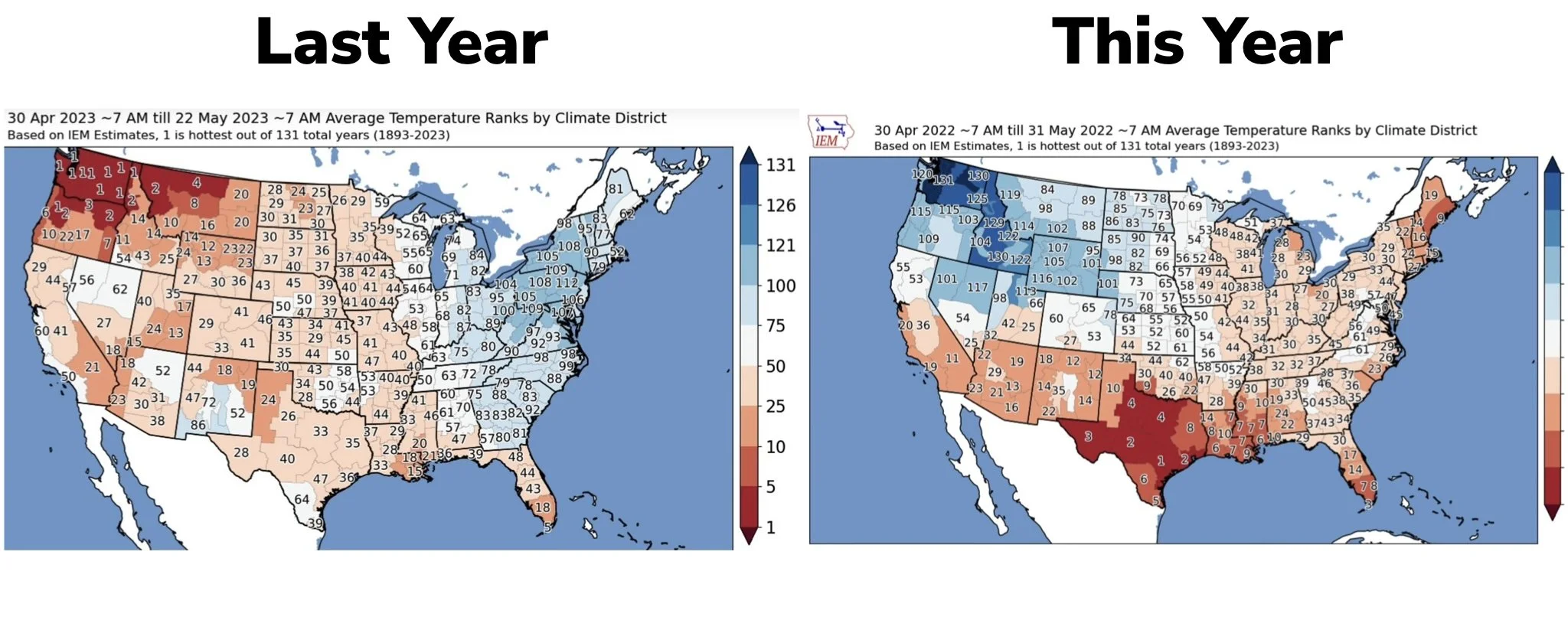

It has been a pretty big flip since last year.

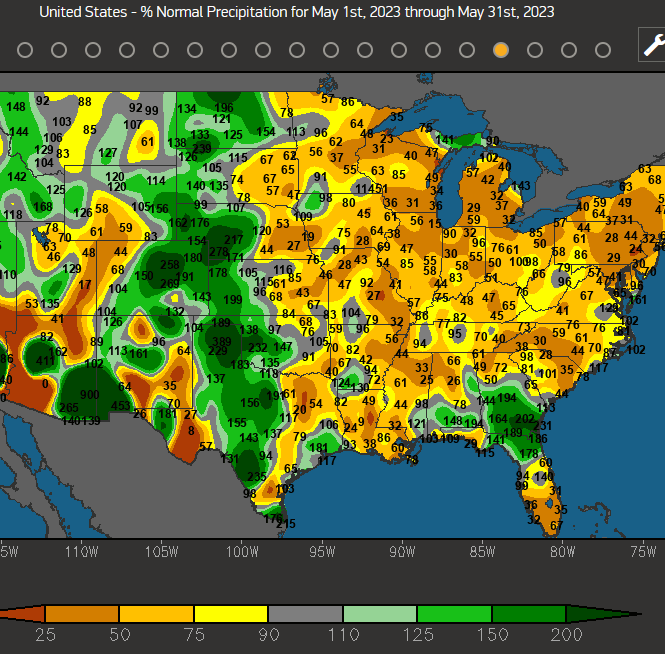

May was very dry. This was good for planting, but when do we start seeing this become a big problem for production?

These next two maps look eerily similar to that map I included yesterday that shows the effects a Super El Niño will have.

Crop Progress & Conditions

Corn 🌽

Planted 81%

Trade 82%

Last Week 65%

Last Year 69%

Average 75%

Beans 🌱

Planted 66%

Trade 66%

Last Week 49%

Last Year 47%

Average 52%

Spring Wheat 🌾

Planted 64%

Trade 60%

Last Week 40%

Last Year 48%

Average 73%

Winter Wheat 🌾

Good to Excellent 31%

Last Week 29%

Poor to Very Poor 40%

Last Week 41%

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Some Past Updates

5/22/23 - Market Update

Drought Concerns Rally Corn & Beans

Read More

5/21/23 - Weekly Grain Newsletter

Will We Get Repeat of 2012 or 2013?

5/19/23 - Market Update

Grains Fail to Gain Momentum

5/18/23 - Market Update

KC Joins Sell Off

5/17/23 - Audio

Black Sea Pressure & Games From China

Read More

5/15/23 - Audio

If You're Short Wheat.. Be Ready to Sleep On Street

5/14/23 - Weekly Grain Newsletter