DROUGHT CONCERNS RALLY CORN & BEANS

Overview

Grains finally find strength following our recent sell off. As corn and beans lead the way higher. Beans end the day +34 cents higher, capturing back a good portion of that brutal sell off last week.

The strength today mostly came from the forecasts. As they are showing that the midwest is going to be dry for the next few weeks, with very few rains. The grains finally show some life, perhaps the trade is finally realizing the drought problem we could be facing.

At the end of today's write up we go deeper into the drought across the corn belt and discuss the Super El Niño and how this could further create drought in the most important growing areas across the US.

This morning we saw a sale of old crop meal to the Philippines. Wouldn’t be surprised to be see a lot more of these with Argentina, the biggest exporter of soybean meal, being out of the market.

Wheat did see some pressure on the news that Poland was exporting more wheat into the US.

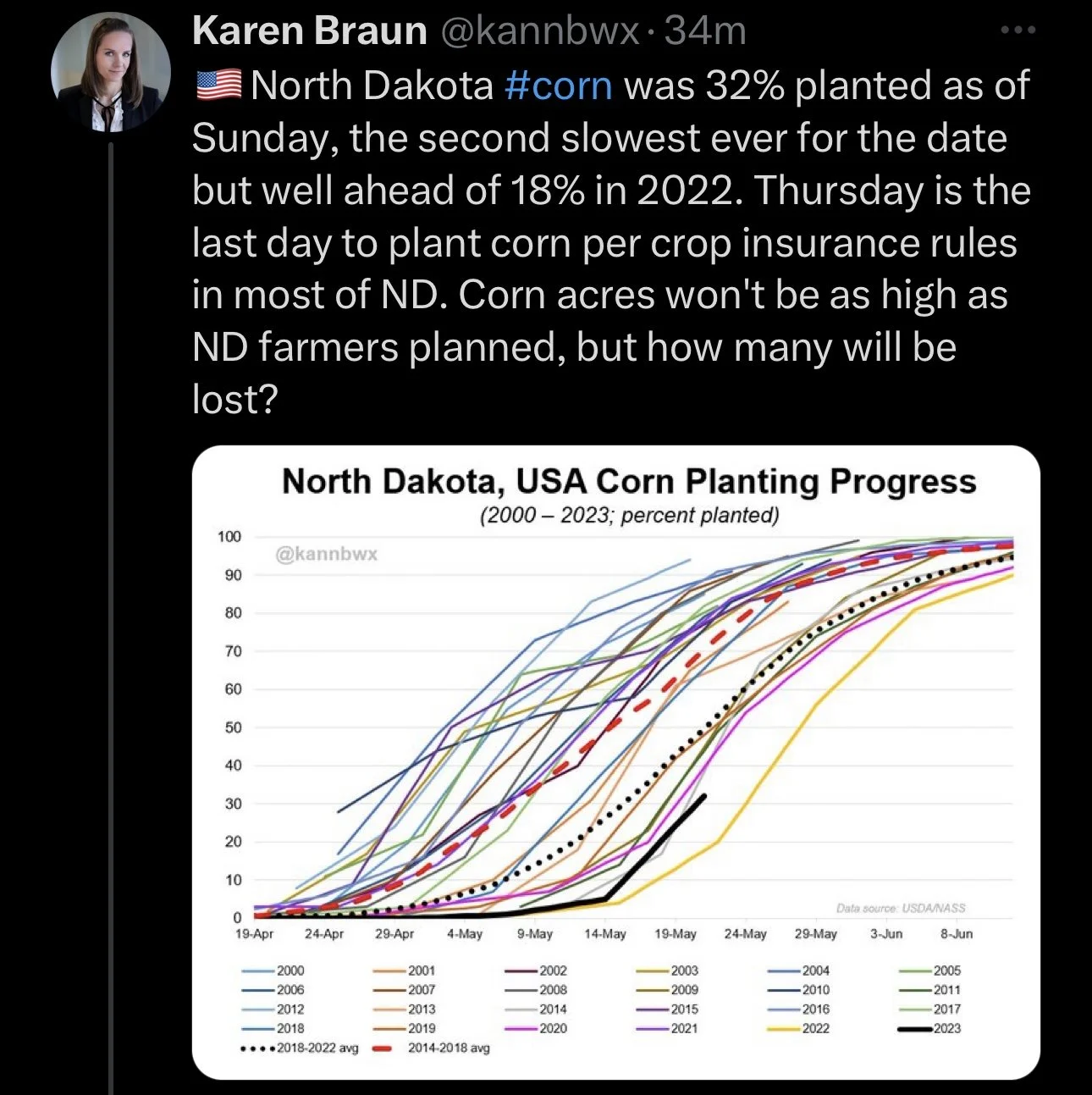

Planting progress and conditions were released after close today. Corn and beans are moving along fast, but were in line with the trade estimates. Spring wheat did advance more than expected. While winter wheat saw slight improvements to their conditions. But the top grower of Kansas still sits at just 10% rated for good to excellent. That is tied for the worst for any week since 1989.

With the fast planting, we could definitely possibly see some pressure tomorrow. Perhaps we see some profit taking from today's rally. If so, I expect the breaks to be bought back and the drought concerns to continue to provide support.

***

In case you missed it, Sunday's Weekly Grain Newsletter

Will We Replicate 2012 or 2013? Read Here

Crop Progress & Conditions

Corn 🌽

Planted 81%

Trade 82%

Last Week 65%

Last Year 69%

Average 75%

Beans 🌱

Planted 66%

Trade 66%

Last Week 49%

Last Year 47%

Average 52%

Spring Wheat 🌾

Planted 64%

Trade 60%

Last Week 40%

Last Year 48%

Average 73%

Winter Wheat 🌾

Good to Excellent 31%

Last Week 29%

Poor to Very Poor 40%

Last Week 41%

Today's Main Takeaways

Corn

Corn finds strength as it nearlt regains the losses from last week's sell off across the grains. Ending the day 16 1/2 cents higher.

Export sales came in fairly decent for corn this morning. Coming in at 1.323 million metric tons, near the higher end of the trade range.

The number one thing supporting corn and the rest of the markets is simply the forecasts looking very dry for nearly all of the corn belt.

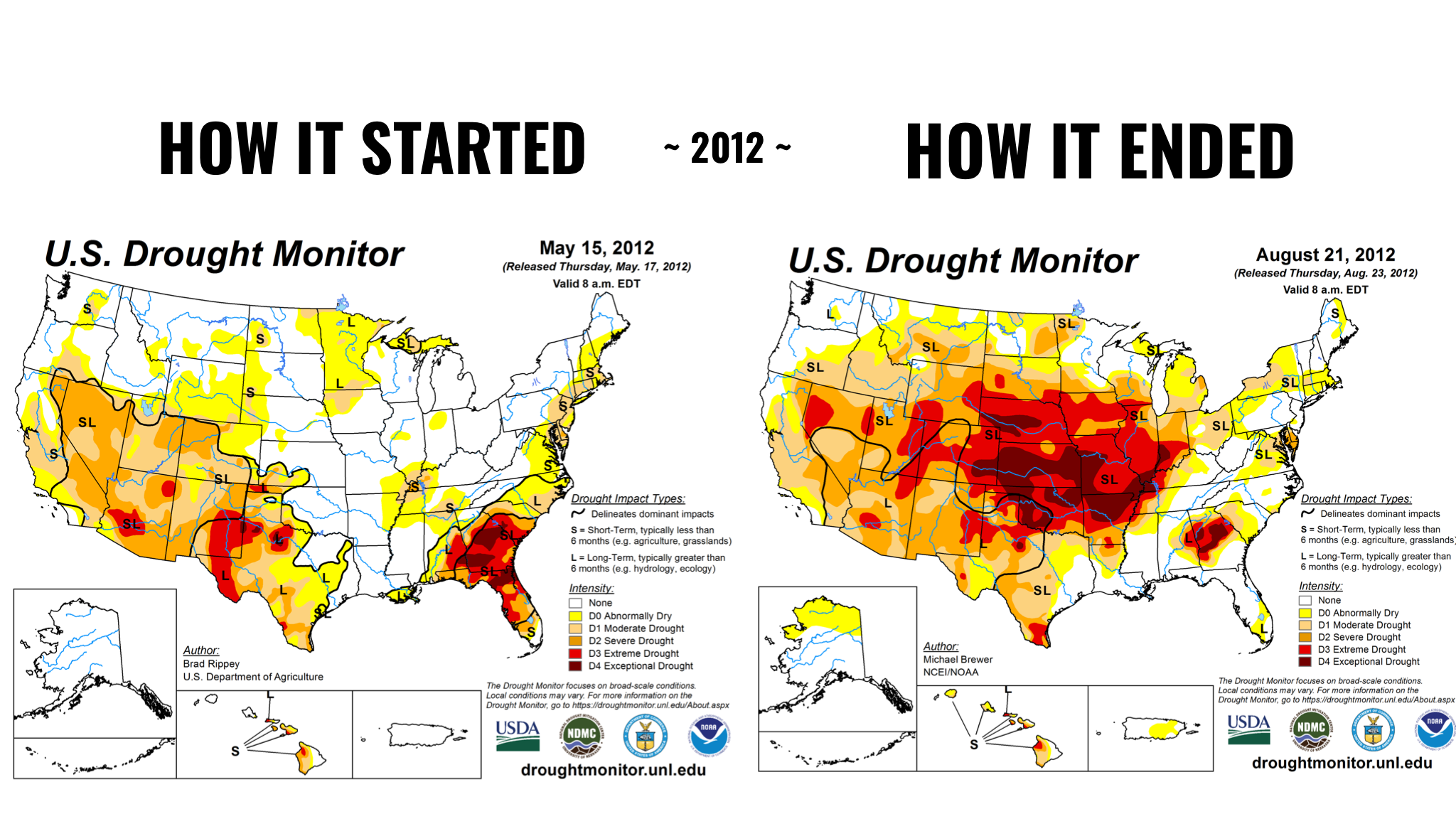

We had been anticipating a weather scare, mainly drought related, for weeks now. As we had constantly been comparing this year to that of 2012. It is already much drier than most people realize, and it looks like it is only going to be getting drier. Perhaps the trade is finally beginning to realize just how dry it is going be.

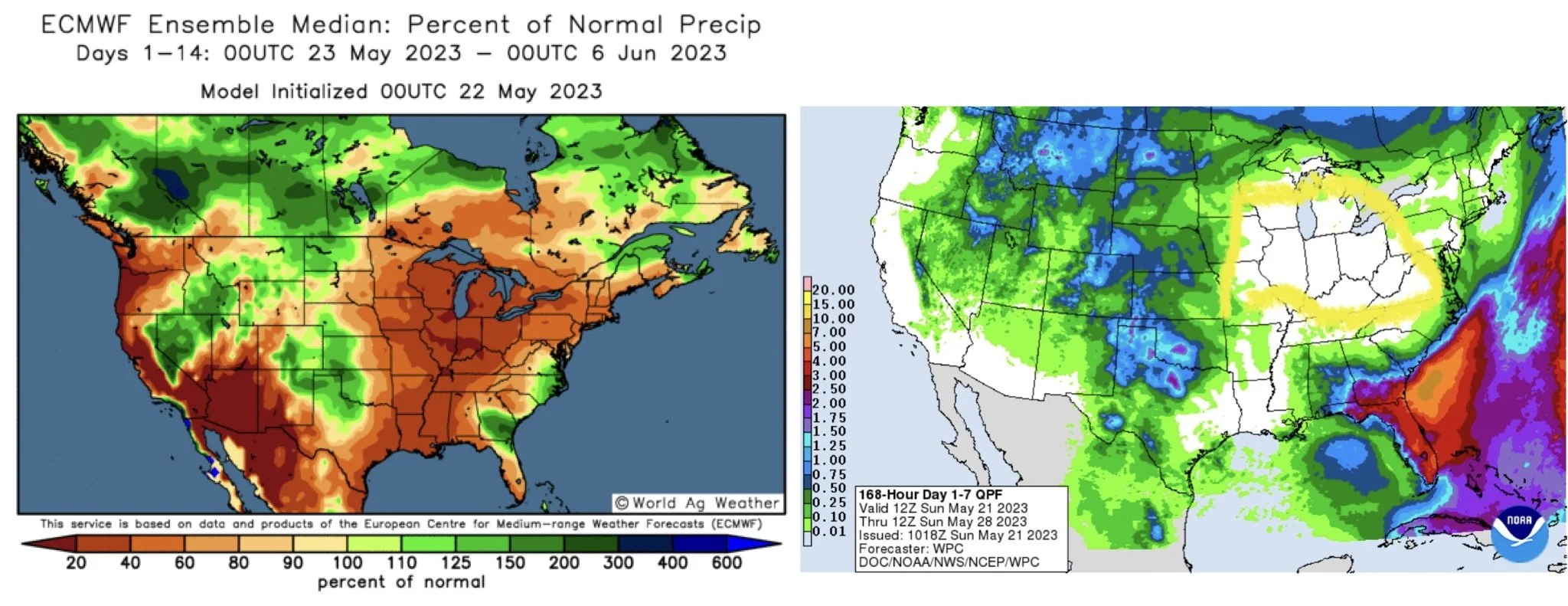

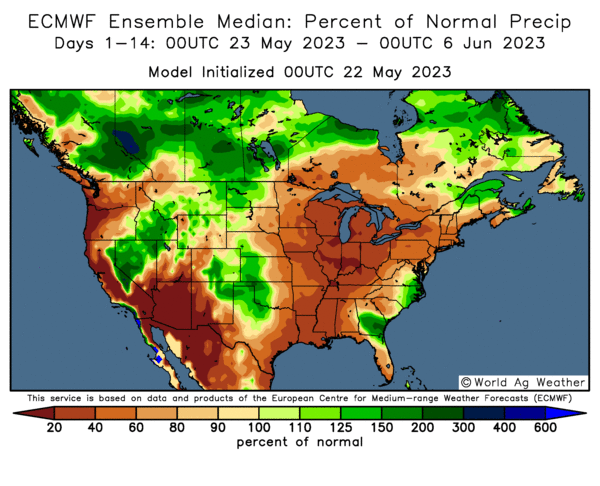

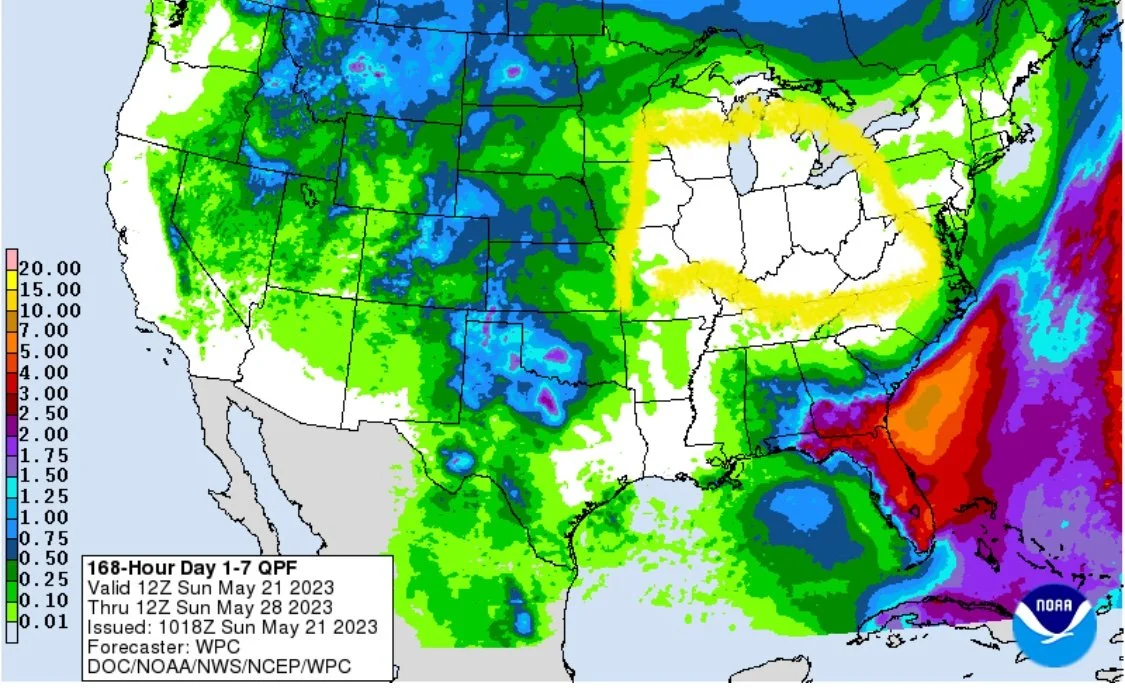

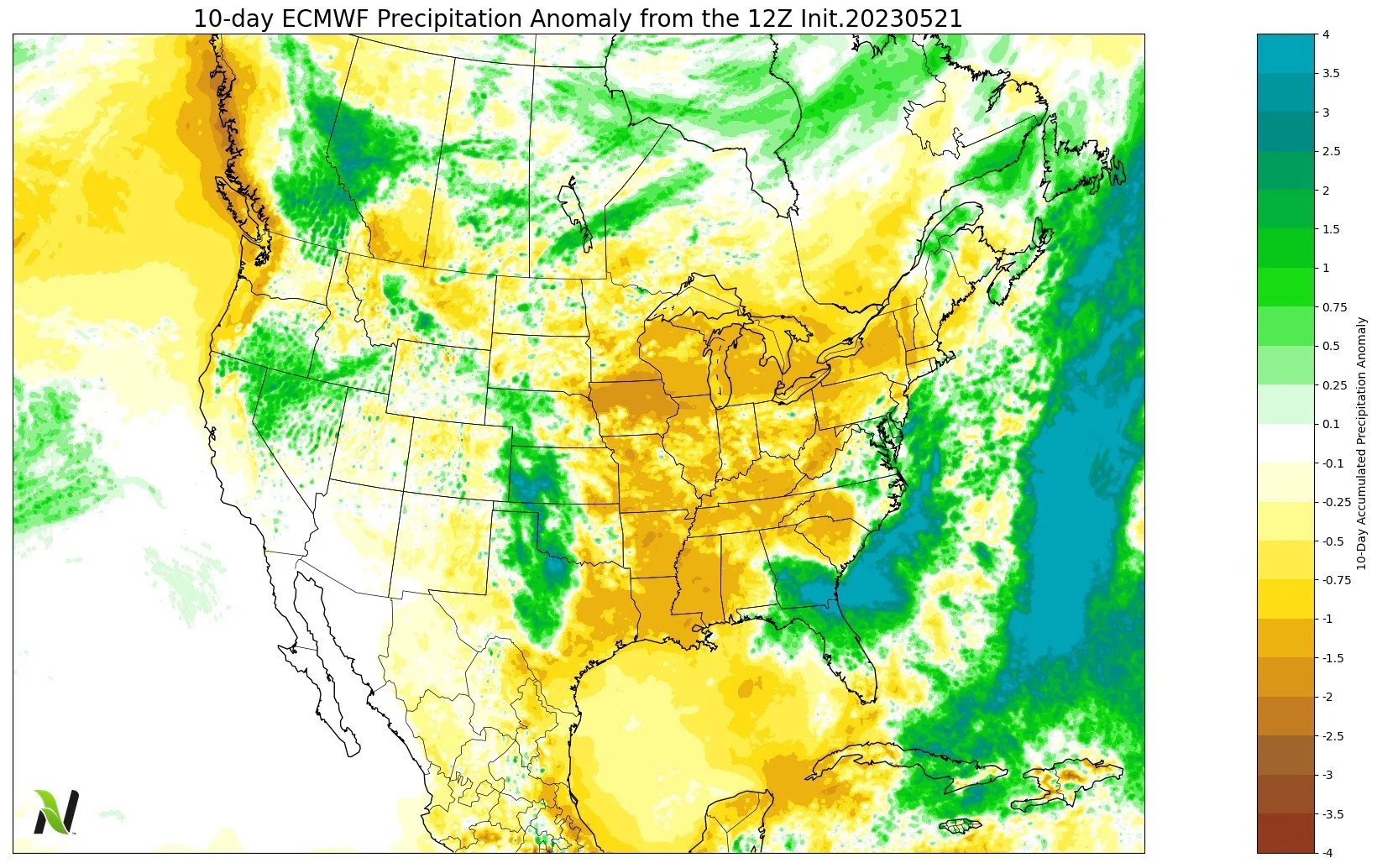

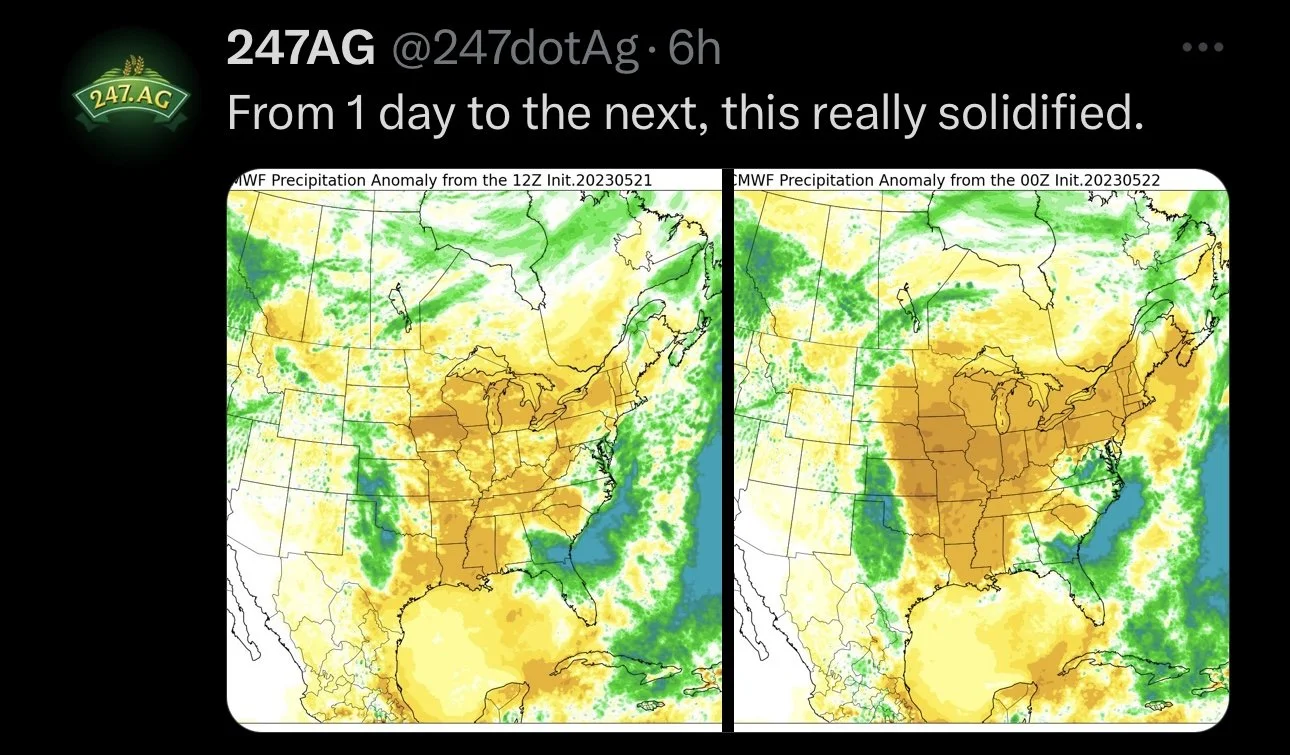

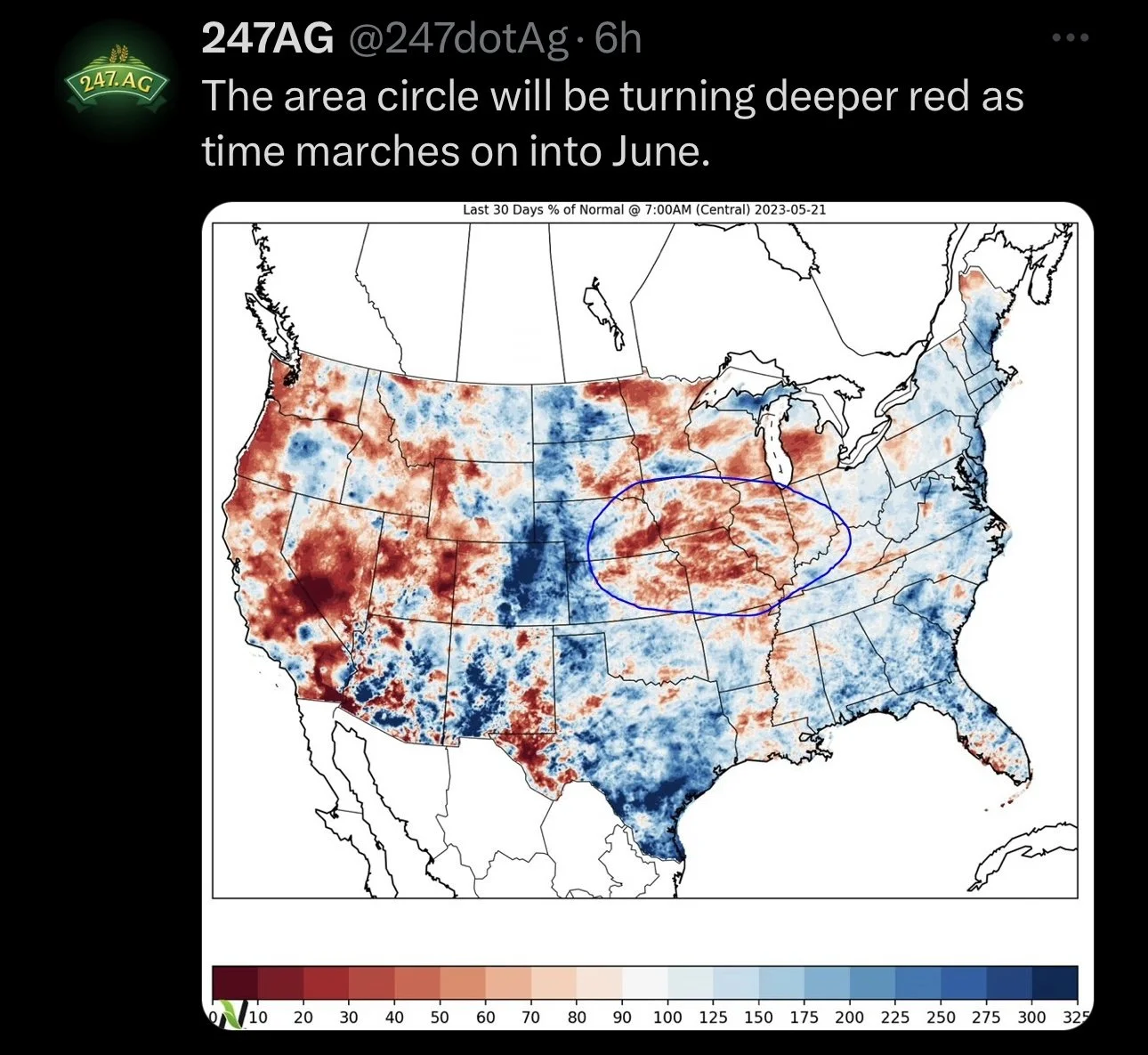

Here are the forecasts showcasing just how dry it is and the lack of rain in the forecasts for the corn belt.

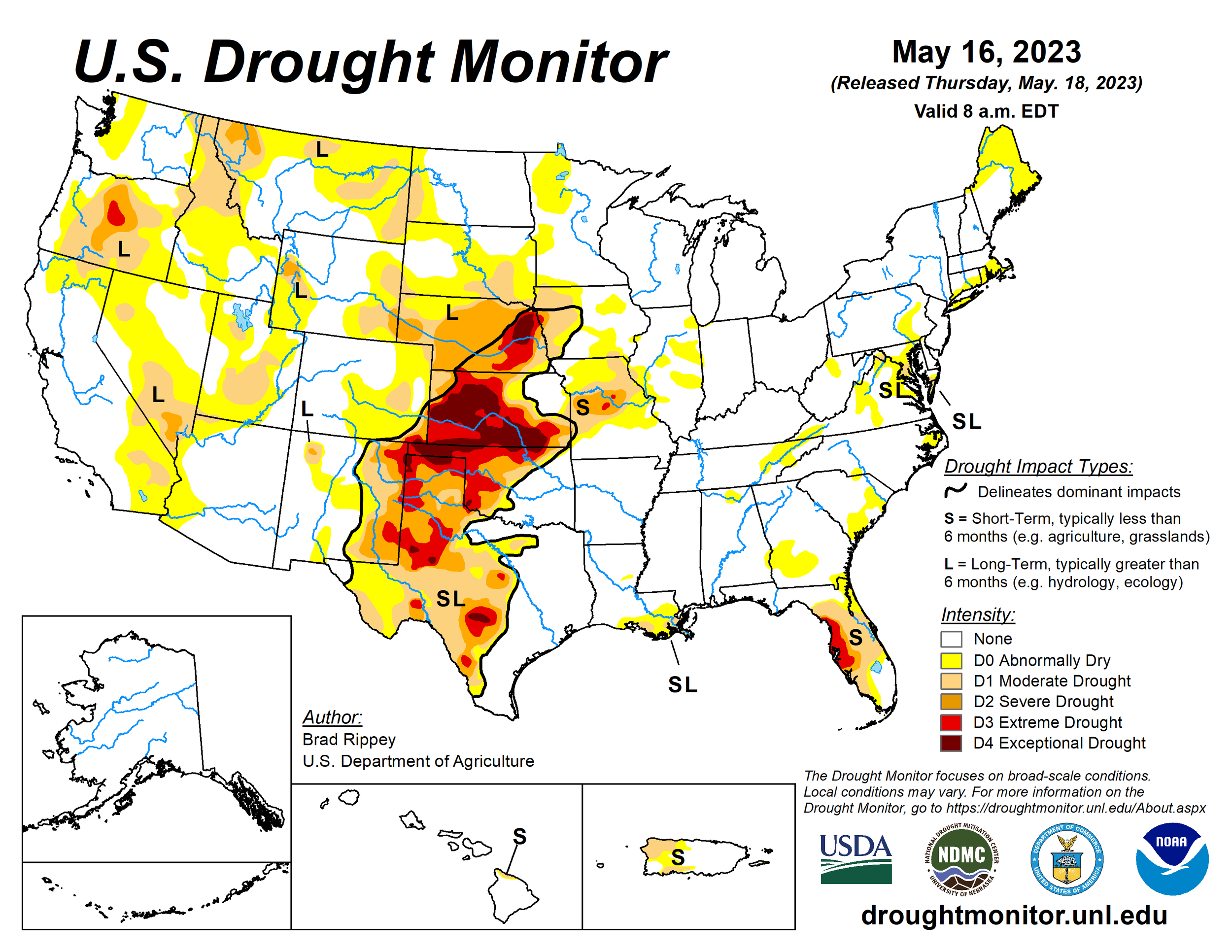

Below is the drought monitor from 6 days ago. If you take a look at our forecasts, I can only imagine this begins to move more and more into the corn belt.

Now here is the drought monitor from 2012. As you see, we are already in a much worse situation than we were at this same time in 2012.

At the end of today's write up, we touch more on this as well as the potential Super El Niño that make the drought all that much worse across the corn belt this year.

The funds are still short over a whopping 100k contracts. We can only imagine the results if this drought gets worse and they decide to cover this position. We could see a pretty big short covering rally.

Outside of the US weather, we have seen analysts continue to raise their estimate for Brazil’s second crop. In yesterday's newsletter we touched on this a bit, but the forecasts are also looking very dry for their crop. So ultimately there is a chance that the USDA might have jumped the gun when they came out raised their estimate for Brazil by as much as they did last report.

Bears also look at the recent Chinese cancellations and pressure from the Black Sea. Keep in mind, a big reason China cancelled was due to anticipation for a big Brazil crop at a discount. So if it stays dry in Brazil, we could see this act as a double edged sword when it is all said and done.

Additionally when looking at the cancellations from China. There is a rumor going around on Twitter that is was actually the United States, not China who cancelled the corn sales. The rumor is that the there wasn't enough corn at the US port facilities to fill the order. Now is this rumor true? Your guess is as good as mine. But nonetheless, an interesting conversation and a huge deal if it is indeed true.

Going forward, it is all going to come down to the weather. Does the drought get worse, or get better. I personally think this drought problem is going to be a much larger issue than many realize. I don't know if today was necessarily our lows here in the corn market. I could still see some choppy trade ahead. But I still expect us to make our lows at the beginning of June at the latest. With weather being the key factor to push us higher.

Dec. Corn Technical Audio

Here is an audio from Vince Irlbeck where he goes over Dec. corn breaking the downtrend, a potential $1 rally, his targets and more.

Vince's Dec. Corn Chart

Corn July-23

Soybeans

Last week soybeans took it on the chin. Getting hammered by roughly 90 cents, with new crop losing around 50 cents. Today however, bulls get a nice rally. As July beans capture back a good portion of last week's fall out. As most contracts posted their largest daily gain since September. As July rallied 34 cents on the day, despite the export sales this morning coming in at a 7-year low for the week. Coming in at just 155k metric tons.

As mentioned earlier, we saw a tad of support come from the Philippines, as they bought some old crop soybean meal. I do think there is a pretty good chance we could continue to see more of these, as the world's largest meal exporter, Argentina, is pretty much out of the game. Again, bringing me back to an argument I made last week that even though the trade has fully digested the awful Argentina crop. There could still be some effects from this down the road that ultimately add support.

The main reason for the sell off last week was due to this transition period. Where the trade goes from South America weather headlines to US weather headlines. While we were making this transition, we saw essentially zero weather premium. Planting was going extremely fast, so there was really nothing for the bulls to chew on. Often times a lack of headlines can lead us lower.

The funds went from very long beans to now probably somewhere around even. Which there is some uncertainty there, as they could possibly look to add beans to their short arsenal that already includes corn and wheat. But I don't think this is an extremely likely scenario.

Short term, I could definitely see some profit taking and see part of this rally sold. But when its all said and done I think we have plenty of bullish fundamentals when we take a step back and look from a longer term perspective. Similar to corn, it is hard to predict whether today’s rally was the bottom, or if there is indeed some more selling left before we hit that definite bottom.

Taking a look at the chart, we found support from our summer lows last July. Potentially creating a double bottom.

Soybeans July-23

Wheat

Wheat futures started the day off lower but managed to piggy back off the strength in the corn and beans, ultimately finishing just in the green.

30k metric tons of Polish wheat was imported into the US for June or July delivery. That is the 3rd shipment that we have seen so far. That added some pressure early on, but we managed to rally well off our lows. As KC closed 15 cents off its lows while Chicago ended about a dime off its lows from last night.

There is a potentially negative headline looming for wheat, that being the budget crisis here in the US.

We also did see some decent rains in Kansas, which could add some pressure. But I don't think any amount of rain is going to wind up making much if any difference.

The Van Trump Report said,

"Bears argue if the crop in Europe is going to be sizeable, which looks to be the case, then their exporters are going to be forced to compete with cheap wheat out of the Black Sea region, meaning it could be a race to see who can undercut who."

I would have to agree that global competition is wheat's biggest roadblock in going higher. But then again, we need to keep in mind, funds are heavily short, we have one of the worst winter wheat crops history, and still have a war going on even though the trade has mostly put war headlines aside for now.

Bears are looking at cheap global wheat to go along with decently favorable weather across much of the world.

Bulls point at the drought here in Kansas as well as Canada. For bulls to get another run higher they would like to see another war or weather headline to get the funds out of their heavy short position of well over 100k contracts. I do think they will ultimately get one.

Planting progress and conditions came in after close today. Spring wheat planting came in at 64% planted vs the trades estimate of 60% and last week's 40%. So some very fast progress made the last week. I wouldn’t be surprised for this to add some pressure in tomorrows trade.

Winter wheat conditions saw slight improvements. As good to excellent rating went from 29% to 31%. Which was also 1% higher than the trades estimate of 30%. We also saw the poor to very poor rating drop a point, from 41% to 40%. So overall, it looks like the crop is seeing slight improvements. But my biggest takeaway from the report was that Kansas is still sitting at a dismal 10% rated good to excellent. That is the worst for any week since 1989.

Chicago July-23

KC July-23

MPLS July-23

Super El Niño & Drought

We have been talking about the drought across the corn belt for quiet some time now. Perhaps the market is finally starting to realize the impact this drought is going to have and that is is already much drier than most think it is.

Ever since the corn planting got off to a fast start in the I-states, we immediately began pointing out the drought concerns.

Fast planting = Dry

Today, images of the dryness across the I-states were all over Twitter.

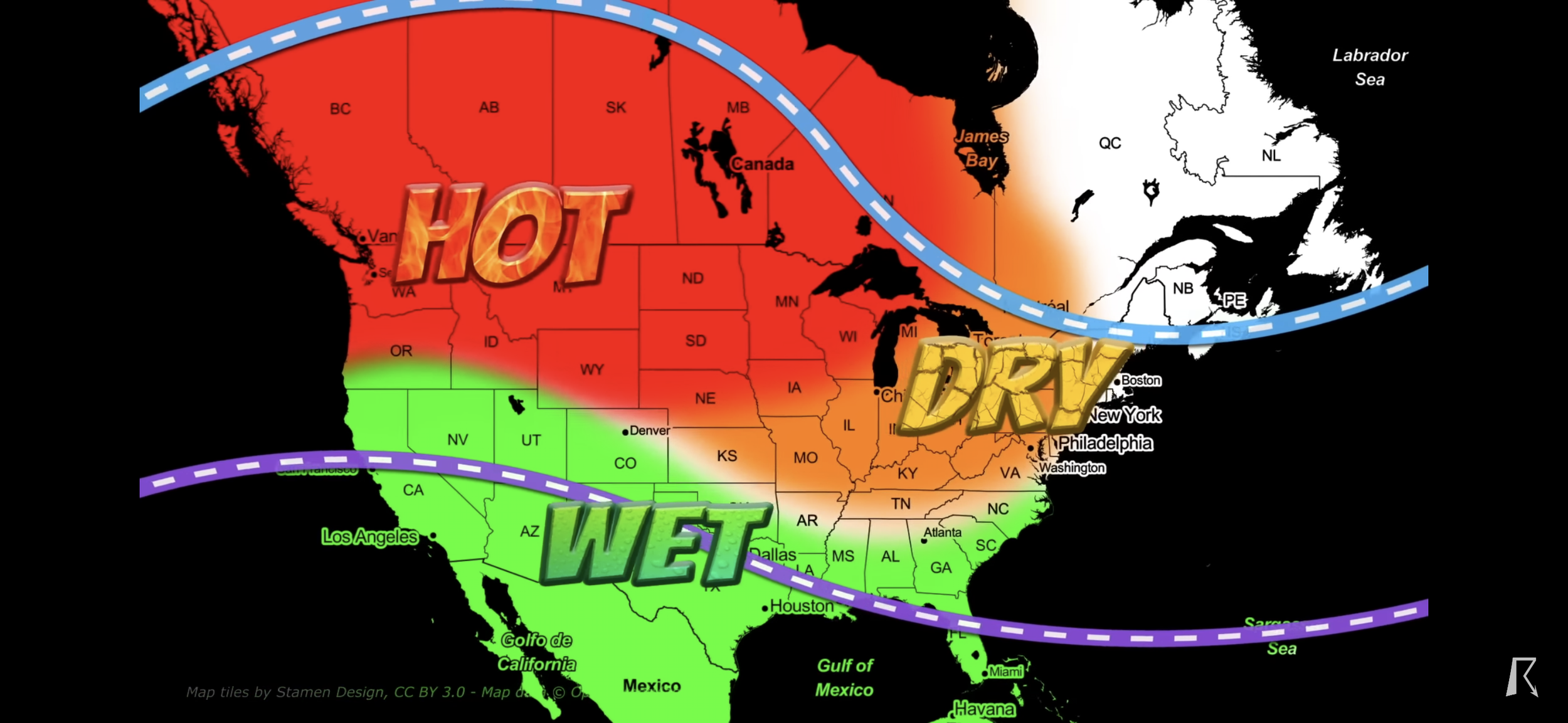

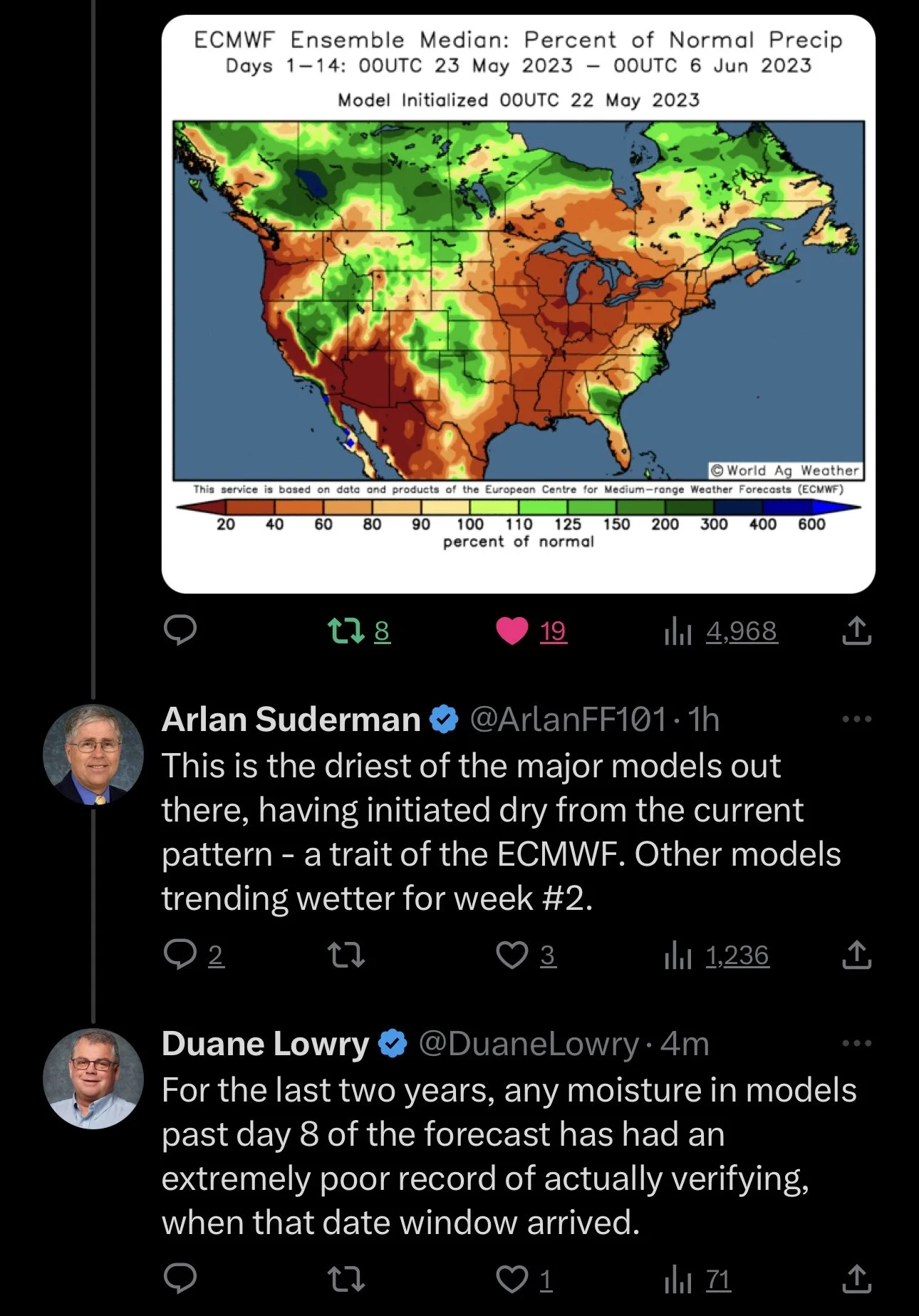

Will this drought get worse? Im not a weather man, but there are many many creditable sources that have been talking about a Super El Niño forming. This is also something we have touched on briefly a few weeks ago.

What is a Super El Niño and what does it mean for the corn belt?

I will include a link to a YouTube video that completely goes over what this El Niño is, how it's formed, impact on different areas etc.

But to summarize it’s impact, it is going to make the south west very wet, while making the north very hot and dry.

Here is a map of the areas it will impact. Notice how dry it is going to make the corn belt..

In conclusion, the closer we get to summer, the more and more similar this year begins to look like 2012. If this does indeed happen, we could see our markets take off.

Below is the YouTube video that goes over the Super El Niño if you were interested in seeing the details.

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

5/21/23 - Weekly Grain Newsletter

Will We Get Repeat of 2012 or 2013?

5/19/23 - Market Update

Grains Fail to Gain Momentum

5/18/23 - Market Update

KC Joins Sell Off

5/17/23 - Audio

Black Sea Pressure & Games From China

5/16/23 - Market Update

Beans Collapse

5/15/23 - Audio

If You're Short Wheat.. Be Ready to Sleep On Street

5/14/23 - Weekly Grain Newsletter