DID WHEAT BREAK ITS DOWNTREND?

Overview

Wheat leading the grains today, while South American weather continues to be the focal point for both corn and soybeans

In case you missed it, read Sunday's Weekly Grain Newsletter:

What Does ADM Think About Chinese Demand - Read Here

Today's Main Takeaways

Corn

Corn ended the day down -4 cents at $6.79 3/4, but did see a high of $6.88 1/2 before coming down.

Corn continues to be pressured by some favorable South American weather and a continuation of disappointing export inspections that we saw yesterday.

Bulls are a little disappointed that we haven’t seen any business out of China yet. As most expected to see some as we began the week and China gets back into things after their holiday.

Demand is one of the bigger things keeping a lid on corn. As there just isn't much of a demand story right now. Bulls would like to see greater demand if we want higher prices.

One thing to keep in mind Brazil is running behind their planting for their second crop corn. Currently sitting around 5% planted vs 14% last year. it's a little early but there is the chance for this to raise some concerns in the future. Forecasts still call for pretty wet weather in Brazil. The window Brazil plants doesn’t go very far outside of February, as any later creates risk.

Majority also thinks we will see the USDA lower their Argentina production estimates. With the addition of uncertainty regarding Ukraine production and exports, as we could also see the USDA lower those as well.

Corn again tried to break out but ran into resistance, finding support at its previous resistance. A break above this trendline has bulls looking at $7.

Corn March-23

Soybeans

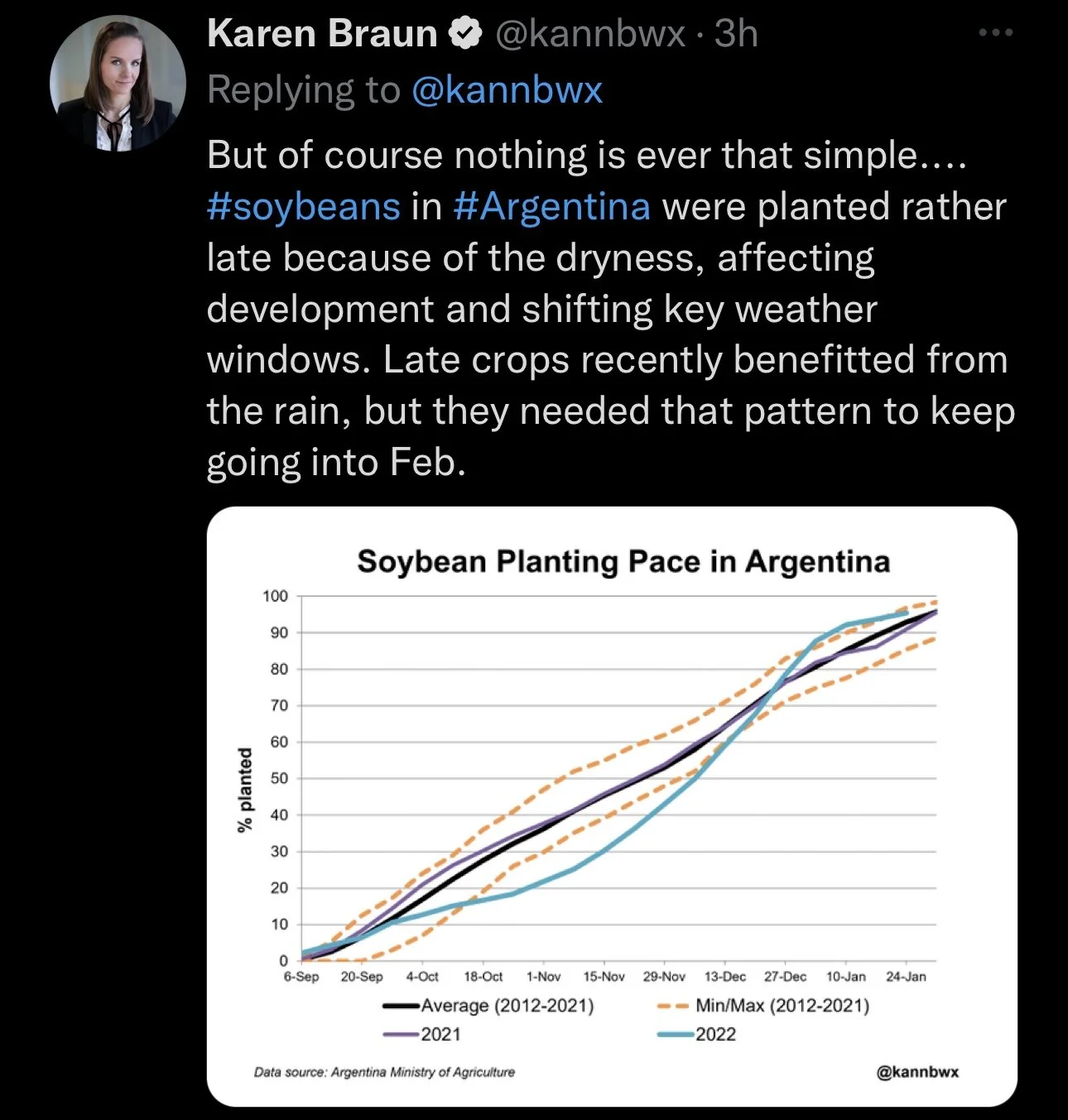

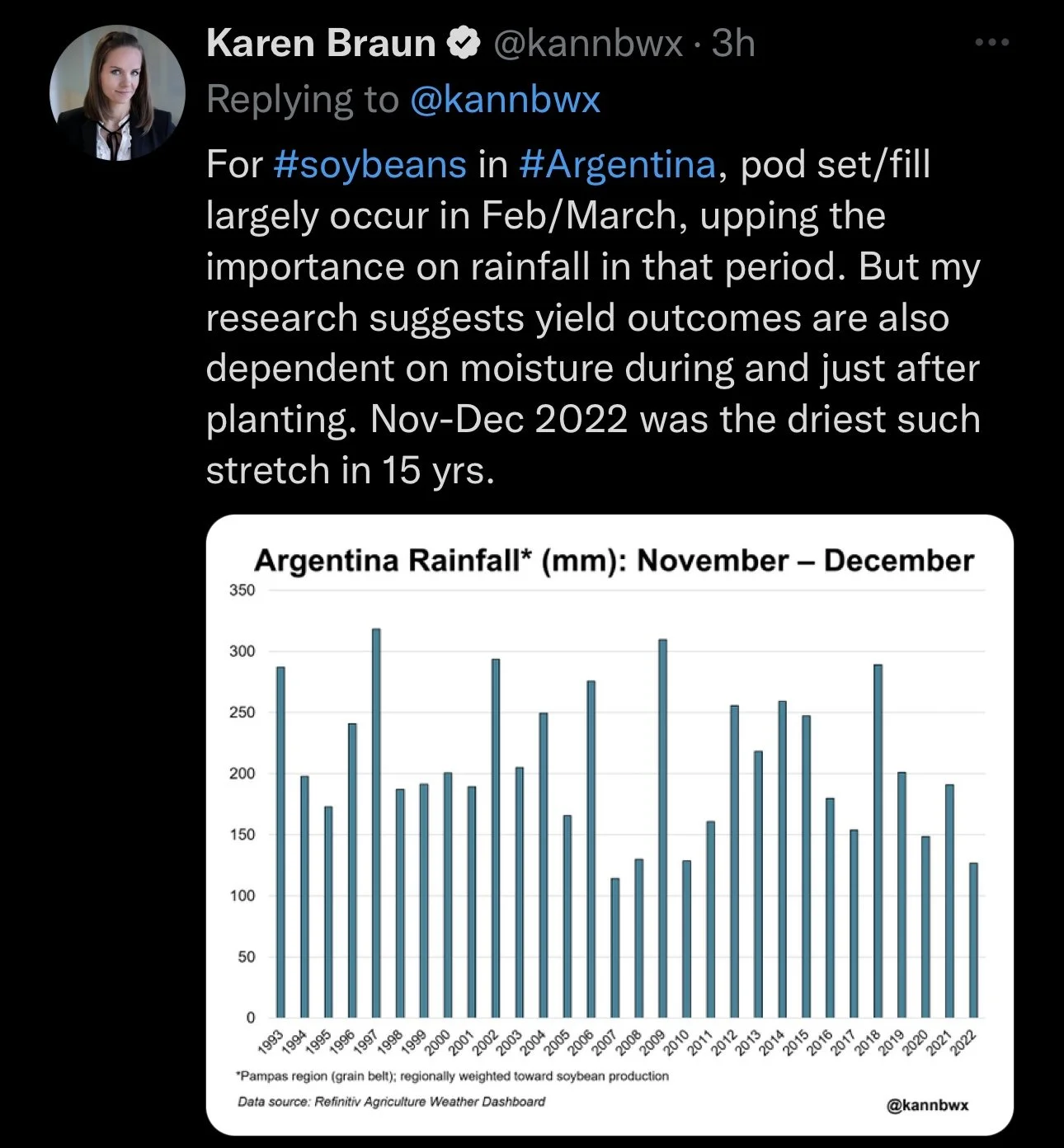

Soybeans led the grains higher yesterday despite some recent rains in Argentina. Soybeans able to end the day slightly green here again today. Closing up +3 cents, but well off their lows of $15.24 1/2 (+13 1/2 cents off our lows). Beans now up nearly +50 cents the last 5 trading days.

Brazil's bean harvest is also running behind. Sitting at 5% complete compared to 10% on average. Brazil is looking pretty wet, so if they continue to get more and more rain this could lead into bigger problems down the road. Every day they can't get their beans out gives the US an opportunity to sell to the Chinese, but so far Chinese appetite hasn't quiet been there.

Argentina weather is looking a little bit drier this week which has added support. But the temperatures are modest comparatively, coming in much cooler. Some think the recent rains have helped their crop quiet a bit, while others say the damage is done. Guess we will have to wait and see.

Some think we ultimately see the USDA make another sizeable cut to Argentina estimates, as weather is looking dry again.

If Argentina continues to be dry and struggle with production and Brazil continues to see harvest delays, some think we see an increase in exports.

Of course beans could push higher here, but with the recent rains and uncertainties in South America, I'm still nervous when beans climb into the mid $15 range. But ultimately South American weather and Chinese demand will be the deciding factors.

Soybeans continue to trade in their uptrend from October. From a technical standpoint, if beans were to break their recent highs, there is an extremely large gap there and plenty of room too run. I'm just not totally sold on the fact that Argentina weather and a large Brazilian crop will allow us to do so, but Argentina forecasts are looking drier and there is continued concerns with Brazil's harvest, so there is always a chance.

Soybeans March-23

Soymeal

Soymeal has been one of the main contributors in the recent rally. Yesterday I mentioned I wasn’t sure if meal would be able to sustain its bull run after hitting new contract highs. Meal is trading lower today adding some pressure to beans, and I'm still slightly nervous if meal can continue to push higher here, but then again I wouldn’t be too surprised to see it push past yesterday's highs either.

Argentina is the world’s leading exporter of soymeal, so it really comes down to Argentina weather.

Wheat

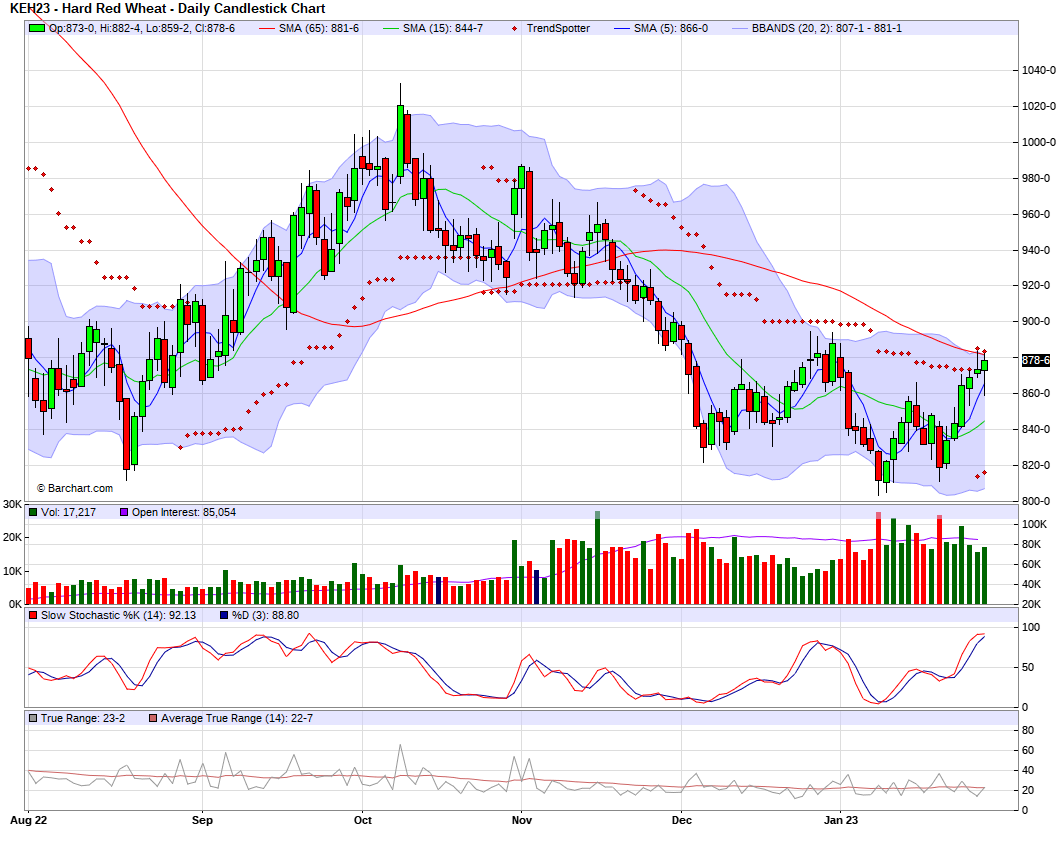

Wheat higher again here today, pushing past the resistance downward trendline. Is this the break out we've been waiting for?

We saw the state by state crop conditions which came in generally better. This had wheat under pressure overnight but we have since bounced back nearly +20 cents off our lows.

Notable State By State Conditions

Kansas winter wheat saw improvement of 19% to 21% rated good to excellent, but is still 30% lower than last year.

Texas, South Dakota, & Nebraska all saw small improvement.

North Dakota & Oklahoma saw declines.

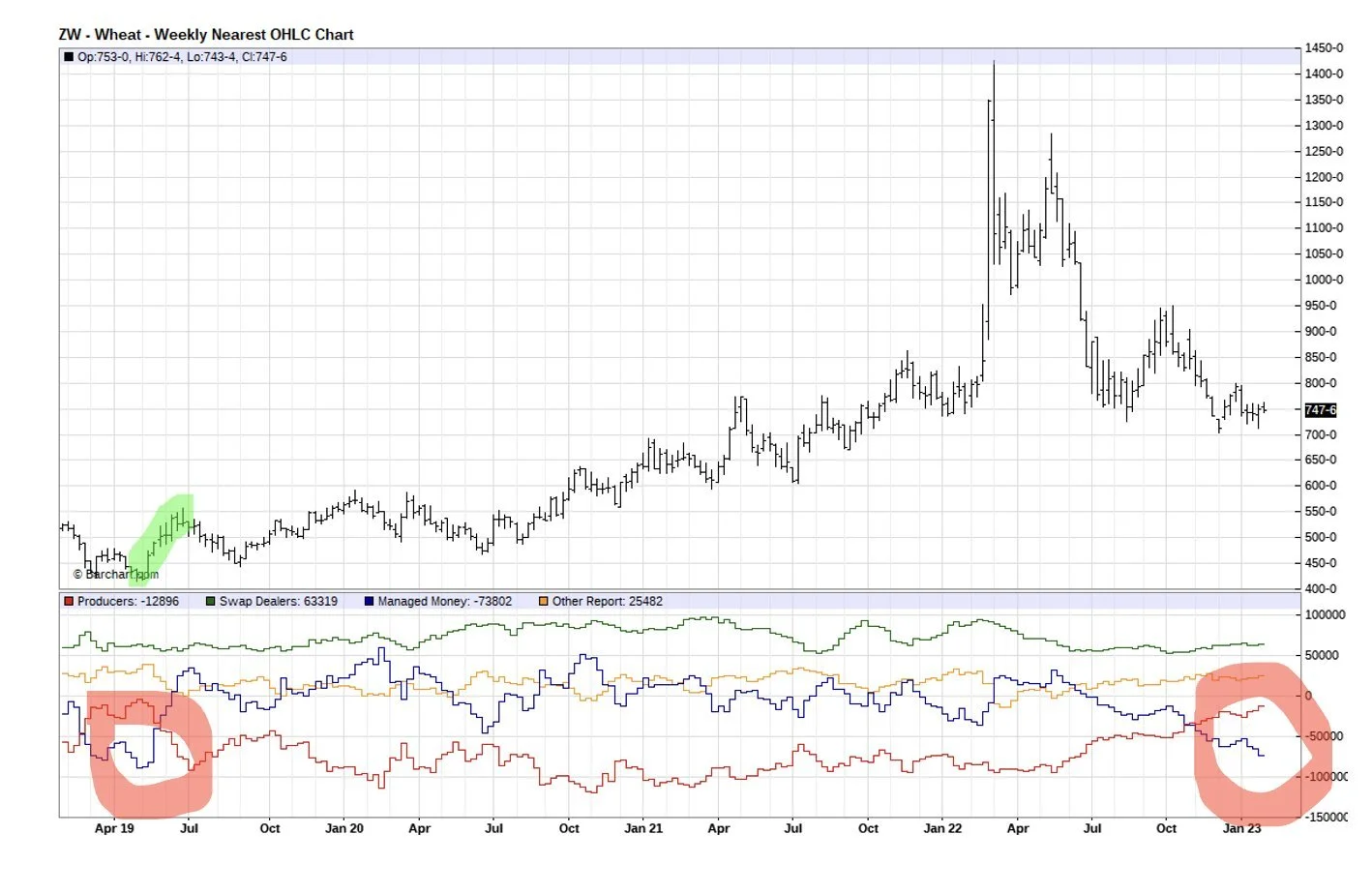

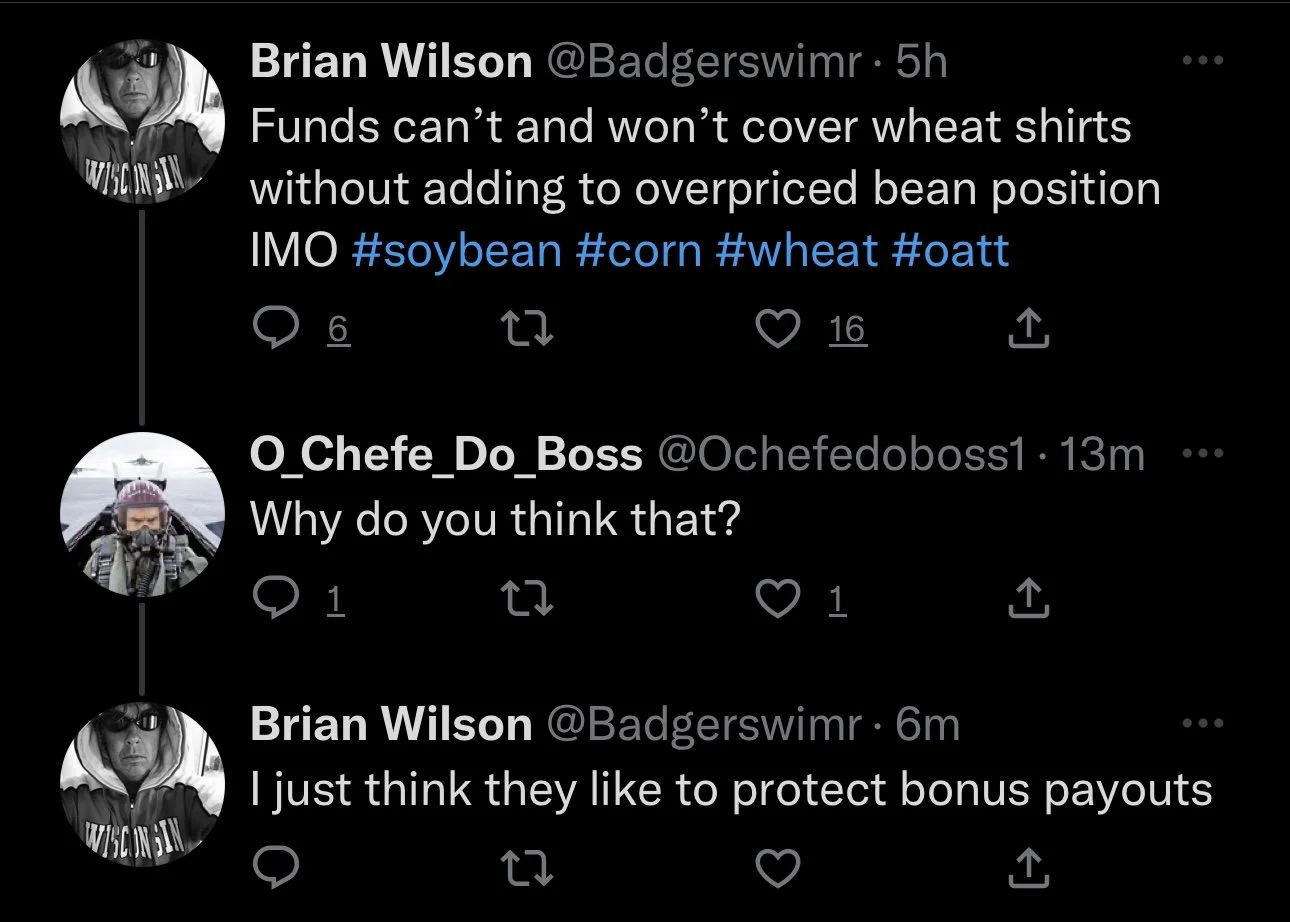

I mentioned this a few days ago, but I think we continue to see the long corn and short wheat spreads shift and start to see the funds increase their interest in a long wheat position given that they are still incredibly short. Check out the end of the article to see what happened the last time funds were this short wheat.

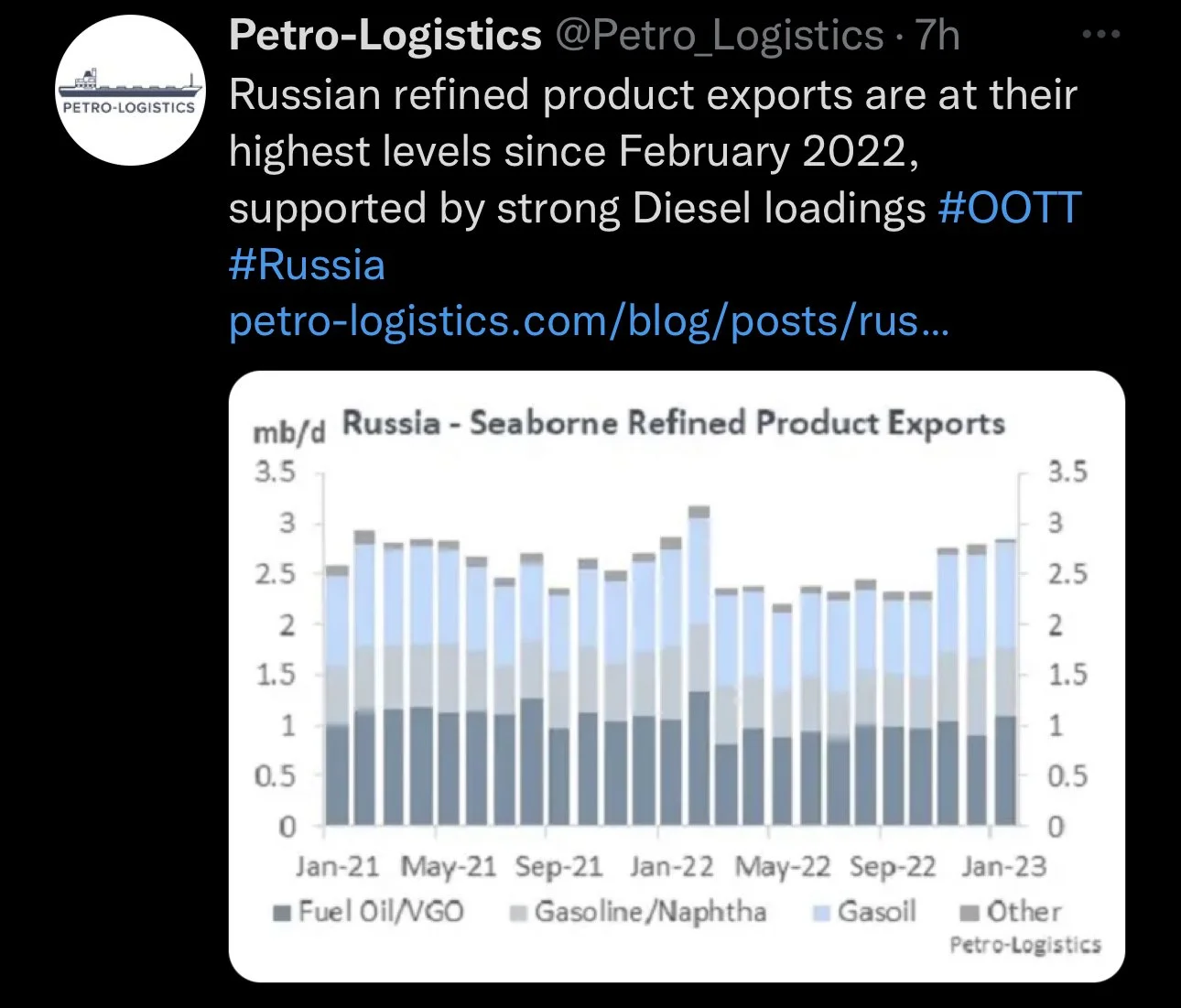

One of the biggest thing pressuring wheat still remains global competition as the US is still over priced, which will likely to continue to be the main point of concern in wheat as Russia continues to sell wheat at cheap prices. The Russians also said their wheat stocks are going to be 22.1 MMT, which is 42% higher than the 4 year average.

We also have some large crops around the world in areas such as Russia. But there is some rumors that their crop might not quiet be as big as everyone thinks it is. Ukraine production numbers might also be slightly overly optimistic as well.

There is some slight concerns here in the US regarding winterkill. Traders continue to wait and see if it’s significant or not. Nonetheless its still a concerning factor that could add strength to the market.

I noticed some advisors have sell signals in for all classes of wheat on this rally. I just don’t think this is a place to be making sales given we are still near recent lows and I personally see plenty of upside.

Overall I think we continue to strength in the wheat market. Funds are extremely short, so I don't see them getting any shorter. The war is still raging with the never ending possibility of headlines to push this thing higher. And we still have crop and weather concerns here in the US. There are plenty of wild cards that could ultimately push us higher.

From a technical standpoint we got a clean break past our downtrend from October. Will have to see if it holds. If so, our next stop might be $8. But I wouldn’t be too surprised either to see prices take a breather soon, however my long term outlook is still bullish.

Chicago March-23

KC March-23

MPLS March-23

Funds & Wheat

As we all know, the funds are building an incredibly long short position in wheat. As they added onto their short position by -74k contracts last week.

However, the funds being short actually isn't all that bad. Actually, the funds being this short might actually be bullish. Eventually they are going to have to cover these and become buyers.

When was the last time the funds were this short? May 2019.

What happened last time funds were this short? Wheat rallied 20% when they became buyers.

I think we see a similar situation here, and the funds scatter to cover their short positions leading to wheat pushing higher.

Chart Credit Andrey Sizov

Tidbits from Wright on the Market

Mato Grosso (MT) grows 30+% of Brazil corn and beans. It is 2.5 times the size of Texas. Its soybean harvest is 13.6% complete vs 31.8% last year. Last year was a little faster than normal harvest pace for beans and planting safrinha corn. If the rains continue to substantially delay soybean harvest for two more weeks, the safrinha crop production will be substantially reduced and very bullish corn.

Soybean export inspections yesterday were 68 million bushels; what is needed each to meet USDA projection for the year is 19.9 million bushels per week. Sure, US exports will slow, as they always do when Brazil gets some beans cut, but, even then, the price of beans will have to rise a bunch to keep the USA from running out of beans in August.

JP Morgan expects diesel fuel prices to remain about steady into late March, but steadily decline in the second quarter of 2023.

Yesterday morning, the USDA announced the sale of 112,000 mts of old crop corn to Japan.

OPEC+ (OPEC & Russia) will meet later this week to discuss oil production levels.

China's 2022 corn crop was revised 1.7% (4.6 million mt, 181 million bushels) larger to 277.2 million mts. However, feed mills have been increasing corn percentages in rations every month since July due to higher wheat and sorghum prices, according to Foreign Agricultural Service (FAS) of the USDA.

Poland, Bulgaria, the Czech Republic, Hungary, Romania and Slovakia have filed a notice with the Council of Europe that the suspension of import tariffs of agriculture products from Ukraine, have increased imports, in some cases, thousands of times, which has overcrowded warehouses and lowered prices enough that farmers will plant less feed grains and wheat.

Mexico slapped a 50% export tax on white corn, a staple food crop, until June 30, saying it is necessary to guarantee supply and price stability. We need to pay attention to how many countries have become very concerned about domestic food supply and price stability the past 18 months. It is beginning to feel like there may be a man-made food shortage caused by countries hoarding, which China has done for decades.

CHS, the largest agriculture coop in North America, will begin construction this spring on a 1.1-million-bushel grain shuttle facility in southeast South Dakota that will tie into an existing rail loop used for the company’s agronomy operations. The new facility will be built near the intersection of Interstate 29 and State Highway 44 near Worthing, South Dakota. Firmer corn basis coming to SE SD.

Last week was the first time since March 2020 that more than 50% of the office space of the ten largest metro areas in the USA was occupied. The week ending January 25 saw 50.4% of the offices had real people present, up 0.9% from the previous week according to the security firm Kastle Systems. Three years to get halfway back to normal… wow!

The CME will increase exchange fees for real time quotes on Wednesday.

The China province, Sichuan, will allow couples to have an "unlimited" number of children and made it legal for single women to have children. Given 2022 was the first year China’s population declined since 1961, the government finally realizes a rapidly aging population spells disaster for an economy in the decades to come unless some major changes are made. Society does not want major changes (like raising retirement age). A declining population is something no one alive has ever considered happening until a few years ago.

I highly recommend checking out Wright on the Market. They provide valuable info daily. Visit their website Here

Highlights & News

Brazil harvest continues to be delayed, currently at 5%.

Ukraine 2023 corn could fall by more than 33%.

Ukraine grain exports down -31%.

Other Markets

Crude oil up +1.19 to 79.09

Dow Jones up +350

Dollar Index down -0.211 to 101.880

Cotton down up +1.12 to 86.22

January Price Recap

The first week of new year started off as a rough one across the grains. The month of January was a roller coaster. Here is the winners, losers, and trade ranges.

Corn

Up +1.25 cents

40 cent trade range

Soybeans

Up +14 cents

83.5 cent trade range

Chicago Wheat

Down -29.75 cents

82 cent trade range

In Case You Missed It..

Here are a few of our past updates in case you missed them

Meal Made Contract Highs, Will Other Grains Follow

Listen Here

Yesterday's Market Update

Read Here

What Does ADM Think About Chinese Demand

Read Here

What to Expect Going into This Week

Listen Here

Jan. 26 - Will History Repeat Itself?

Listen/Read Here

Jan. 25 - When to Make Sales

Listen Here

Jan. 25 - Market Update

Read Here

Livestock

Live Cattle down -0.325 to 163.025

Feeder Cattle up +2.225 to 186.150

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service