BRAZIL HARVEST DELAYS & WHEAT OUTLOOK

Overview

Grains mixed here with soybeans getting hit the hardest with some unexpected rains in Argentina. One thing that has bulls a little disappointed is we haven’t seen any sales yet this week, as most were expecting to see some as China comes back from their holiday but that hasn't been the case.

Highlights Later in Today's Update

Wheat Outlook from Farms.com

Funds & Wheat from Wright on the Markets

Today's Main Takeaways

Corn

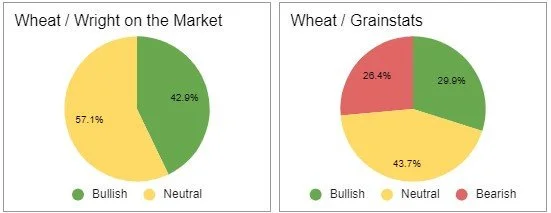

Corn closing just green today, but moved nicely off their early lows.

Traders are still waiting for some export business and remain optimistic but we just haven’t seen any thus far. But bulls still think we will see some Chinese demand coming off their holiday and covid lockdowns. Some demand would be very beneficial in helping corn futures push higher.

One thing bulls will be keeping their eyes on is the second Safrinha corn crop planting. This crop makes up roughly 75% of total South American production. The planting is currently sitting at 6% complete compared to last years 26.7% at this same time. The delays open up the crop to being vulnerable for more heat later in the season. So overall this will be a bullish factor to watch out if we continue to see delays.

With the harvest delays, there is some rumors that we will start to see some reductions in Brazil production estimates. To add on to the harvest delays in Brazil, we also have most suggesting that we see Argentina production estimates continue to be lowered.

We also have the war that continues to capture headlines. The grain corridor deal in Ukraine expires in less than two months. There is a chance this deal doesn’t get renewed when the time comes.

Despite some bullish possibilities, there are still a some question marks surrounding demand as exports and ethanol continue to be questionable.

The charts don't look amazing, as we rejected the trendline once again yesterday. But we found support on our previous trendline. Bulls still looking for a break to the upside which would likely bring us to $7.

Corn March-23

Soybeans

Soybeans sharply lower today after testing its recent highs yesterday. Beans under the most pressure of the grains due to some surprise rains in Argentina overnight.

Despite the rains overnight, the overall Argentina weather forecasts have shifted dry as of late. So this will of course be the number one thing traders will be keeping an eye on.

Traders will also be watching to see how Brazil harvest pans out. As it currently sits at 5.2% complete, which is a nice increase from last week but still not even half on pace of last years 11.6%. Their massive crop is currently projected at 152.7 mmt vs last years 125.5 mmt.

As mentioned earlier, bulls have been disappointed from lack of Chinese appetite for US product. But China did purchase a few cargoes of beans from Brazil. Getting them around 80 cents or so cheaper than the US, so it makes it tough to think we continue to see China buy beans from the US unless Brazil continues to have harvest problems.

Chinese demand and the reopening of their economy will continue to play a large factor in the soybean market. Bloomberg reported that they are projecting China's GDP to raise from 3% to 5.8% in 2023.

The funds continue to be buyers of beans despite better rains in Argentina and a lack of Chinese appetite.

Going forward South American weather will be the biggest factor of course. How much rain does Argentina get, will be continue to see Brazil's harvest be delayed.

It's still tough for me to have a super bullish outlook for soybeans here especially when we creep into the mid $15 range. With the uncertainties in Argentina rain, Brazil's massive crop, and uncertainties in Chinese demand all have me slightly nervous if soybeans can hold at these relatively high levels.

Beans tried to test their previous high yesterday, resulting in a sell off today. We still remain in a clear uptrend. Will have to see if it holds.

Soybeans March-23

Soymeal

Soymeal will continue to play a large role in the future of the bean complex, as Argentina weather remains a focal point and they are the worlds leading exporter of meal. With all the uncertainties I still remain slightly skeptical that we see meal continue to push higher and make more new highs.

Soymeal March-23

Wheat

Chicago wheat futures started off the day sharply lower down roughly -18 cents, but saw some strength as the day went on closing down just a penny and a half. KC wheat on the other hand saw some pretty good strength.

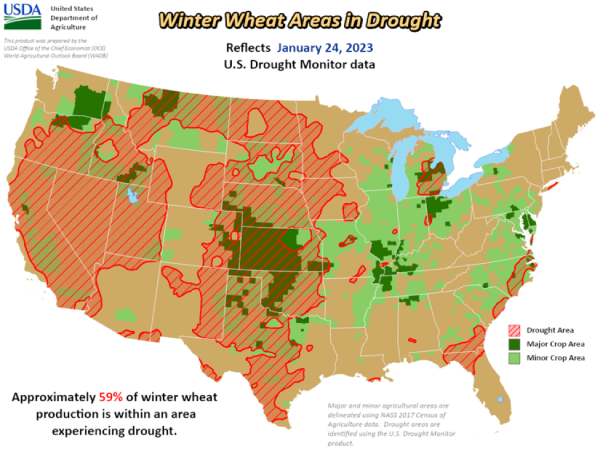

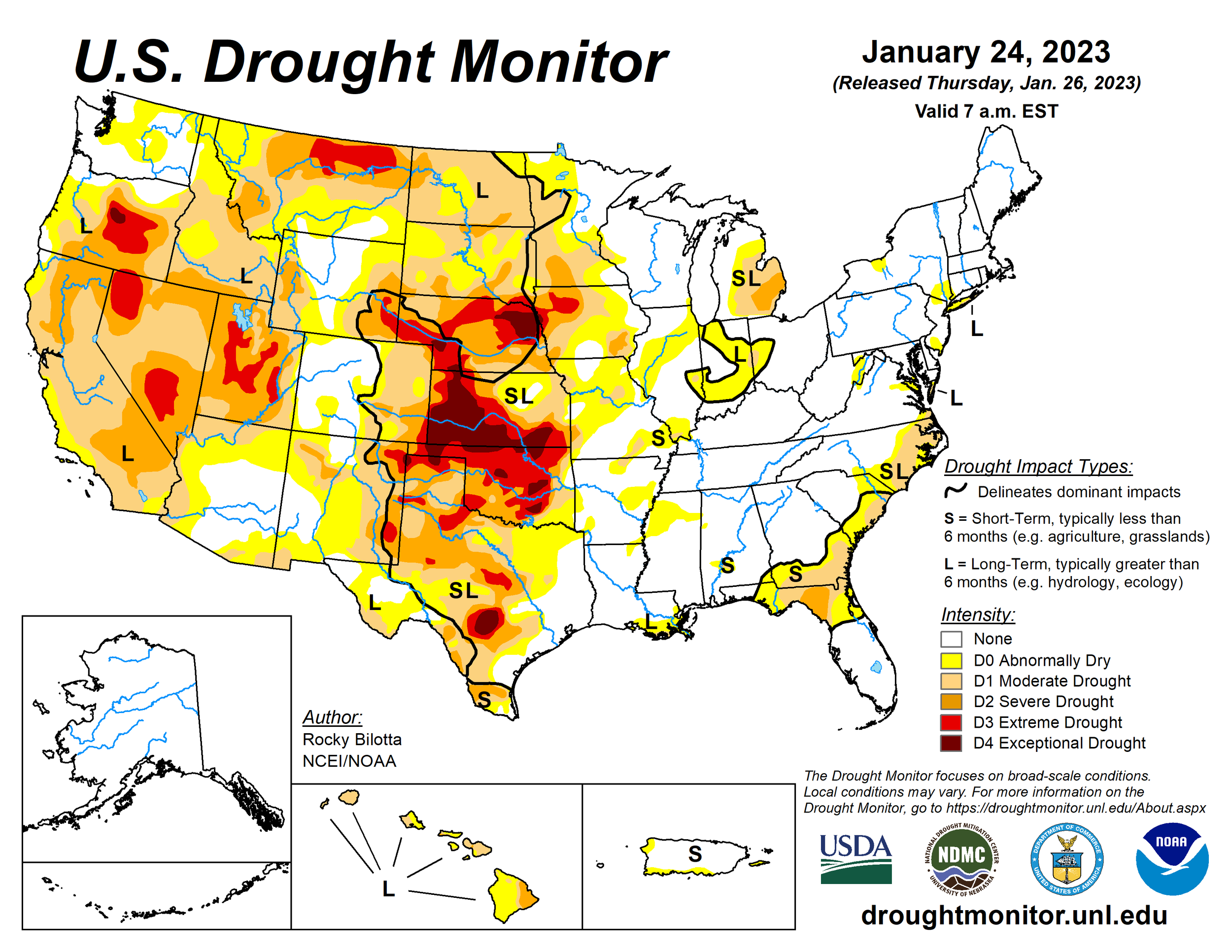

59% of US winter wheat is experiencing drought which is down from 73% in early December but still a large number. It’s looking like growing regions outside of Oklahoma and northern-central Texas will continue to not see much moisture for a while longer.

There have been some rumors of Russian winter wheat dryness that could ultimately effect their wheat crop.

The war and uncertainties will continue to support the wheat market. As we still have that chance that both Ukraine and Russia estimates are being a tad overly optimistic. I don't really see the war and headlines going away anytime soon.

Overall we haven’t seen a ton of changes. Funds are still short. The US remains overpriced. There is weather uncertainties both in the US and globally. I just think we have far more bullish cards in the deck rather than those of bearish ones.

Andrey Sizov tweeted this morning, "More wheat shorts are probably being printed today. This is starting to look like a bomb.. the clock is ticking, and I think not many know when and why it will explode. The Black Sea is likely to be key, so my advice - keep an eye on the war that could intensify shortly."

Yesterday I said I wouldnt be surprised to see prices take a breather. We started off sharply lower but found support right at our previous downward trendline. I think we continue to see wheat push higher and test $8.

Chicago March-23

KC March-23

MPLS March-23

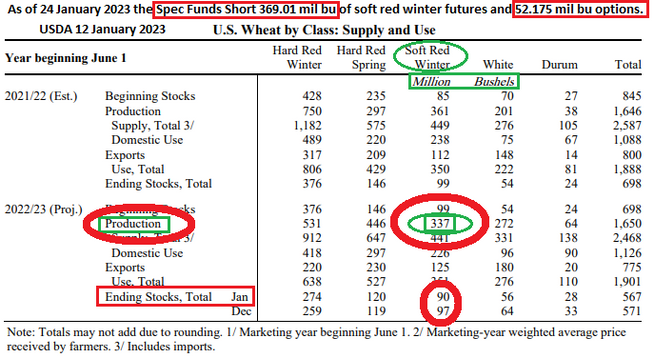

Funds & Wheat

In yesterday's update I included what happened the last time funds were this short wheat. Which was in May 2019, and after the funds being that short, we saw a rally of 20%.

Here is what Wright on the Markets had to say this morning about the funds being short soft red winter wheat;

Spec funds are net short 73,802 contracts of CBOT wheat, which is soft red winter wheat. Those funds have an obligation to buy 369 million bushels of SRW wheat or wheat futures, which is more than the U.S. produced in 2022 and nine times more than the carryover projected for May 31st, 2023. Do not be short soft red winter wheat. It is very difficult not to be super bullish CBOT wheat with such stupidity in play.

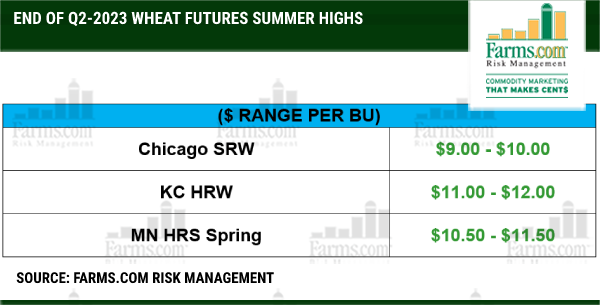

Wheat Outlook - $10 Wheat?

This is a great write up from Farms.com, where they highlight problems across the wheat market and why they have a bullish outlook;

Drought continues to be a major issue for U.S. winter wheat production with 59% of production areas estimated to be in regions experiencing drought. Winter wheat condition in top grower Kansas is 21% G-E, identical to late November but up +2% from the start of January. Texas G-E totals 14%, up from 11% a week earlier, but down from 21% from two months ago.

USDA winter wheat seedings showed an 11% jump in the number of acres seeded in winter wheat for the 2023 crop year mostly in SRW acres but some of the HRW wheat acres could be abandoned and offset higher acres as they do not survive winterkill, dust storms and lack of moisture. Farmers will need to maintain higher acres and yields to grow ending stocks otherwise stocks to use ratios will tighten again.

Globally trade is bullish wheat because stocks of the big 8 exporters have been getting tighter for 6-7 years in a row. U.S. wheat exports has some catching up to do down 6% for the year.

Global wheat prices have declined in all markets, reflecting abundant Black Sea grain exports and Southern Hemisphere harvests nearing completion but the 2023 crop in Ukraine will get smaller.

Higher Australian wheat output comes at a time of stiff competition from the Black Sea region, where all-time high output in Russia (questionable based on total acres and weather are they hiding stolen Ukraine wheat supplies) is keeping the global market well supplied.

The big increase in China’s imports of Australian wheat have come in conjunction with a large jump in overall wheat imports by China over the past 3 years.

Spec fund interest in wheat has been in freefall with a record short position in Chicago wheat, creating oversold, buying opportunities. Wheat futures trying to shake off the lethargy & rise up as they form a bottom.

Russian has more wheat under its control this year as it hides the Ukraine wheat supplies that it has stolen but has too much too export, and Russian/Ukraine production & exports will trend lower.

We are bullish wheat as a U.S. and global production hiccup somewhere in 2023 will take futures higher to ration demand with KC end of Q2 future target of $11 -$12.00, Chicago, $9.00 - 10.00 and MW at $10.50 - $11.50.

Bottom Line

Russian has more wheat under its control this year as it hides the Ukraine wheat supplies that it has stolen but will have too much too export, and Russian/Ukraine production & exports will trend lower in 2023.

HRW wheat acres will offset higher SRW wheat acres in the U.S. ECB as many will not survive the winter kill, dust storms and lack of moisture by harvest. As long as the war in Ukraine rages on which it will and there are no signs of ending it anytime soon, it will support grain prices and at some point, we will need to add back a war risk premium as the Black Sea grain gets smaller (Ukraine wheat down 50% and someone will need to fill the gap. There is no room for a production hiccup with global and U.S. ending stocks at 15 years lows! Funds remain too short Chicago wheat so look for a short squeeze into April as the bottom is in and we break out to the upside with KC end of Q2 future target of $11 -$12.00, Chicago wheat futures at $9.00 - 10.00 and MW at $10.50 - $11.50. 22/23 all US wheat ending stocks are 131 mil bu lower Y/Y and will continue to provide a floor under futures. (Please See Chart Below)

Highlights & News

Dr. Cordonnier left his Argentina corn and soybean estimates unchanged. 44 mmt for corn and 39 mmt for soybeans.

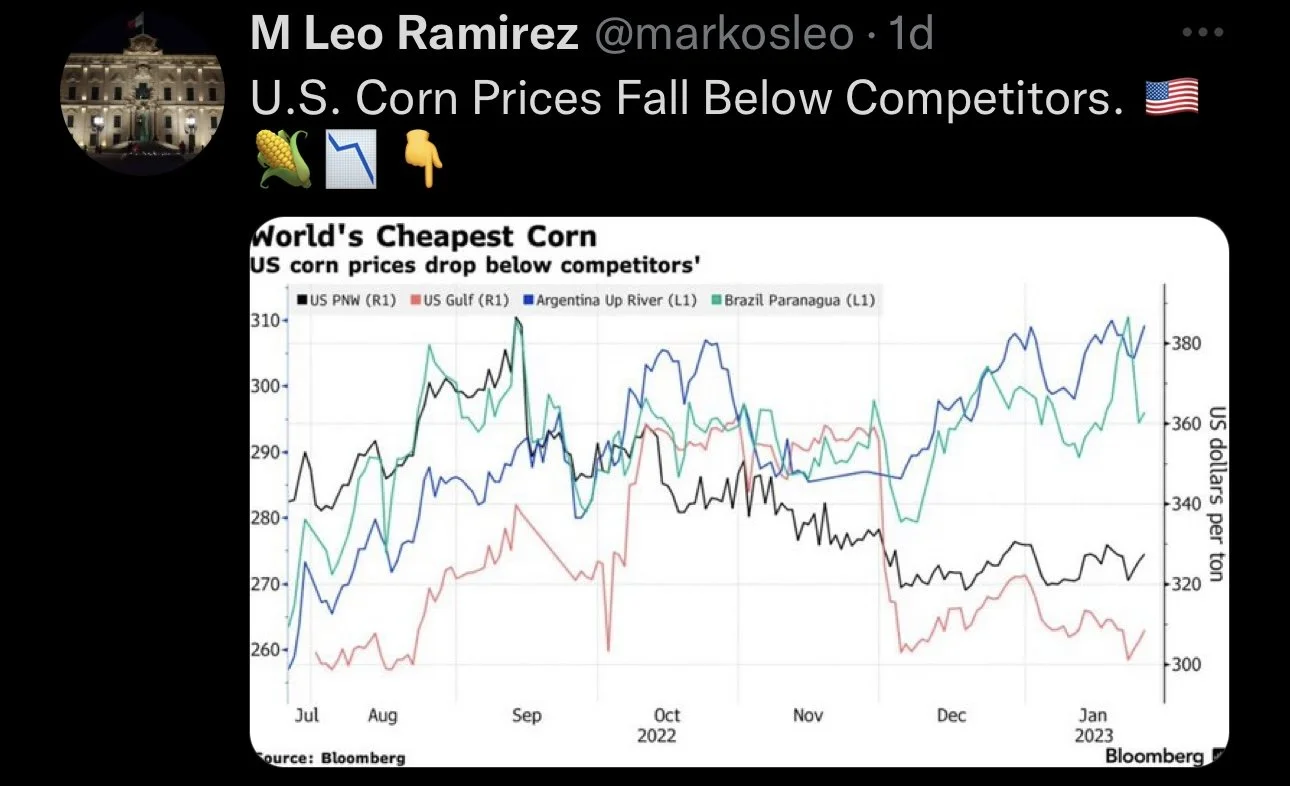

Average UAN28 fertilizer price dropped -9% during January.

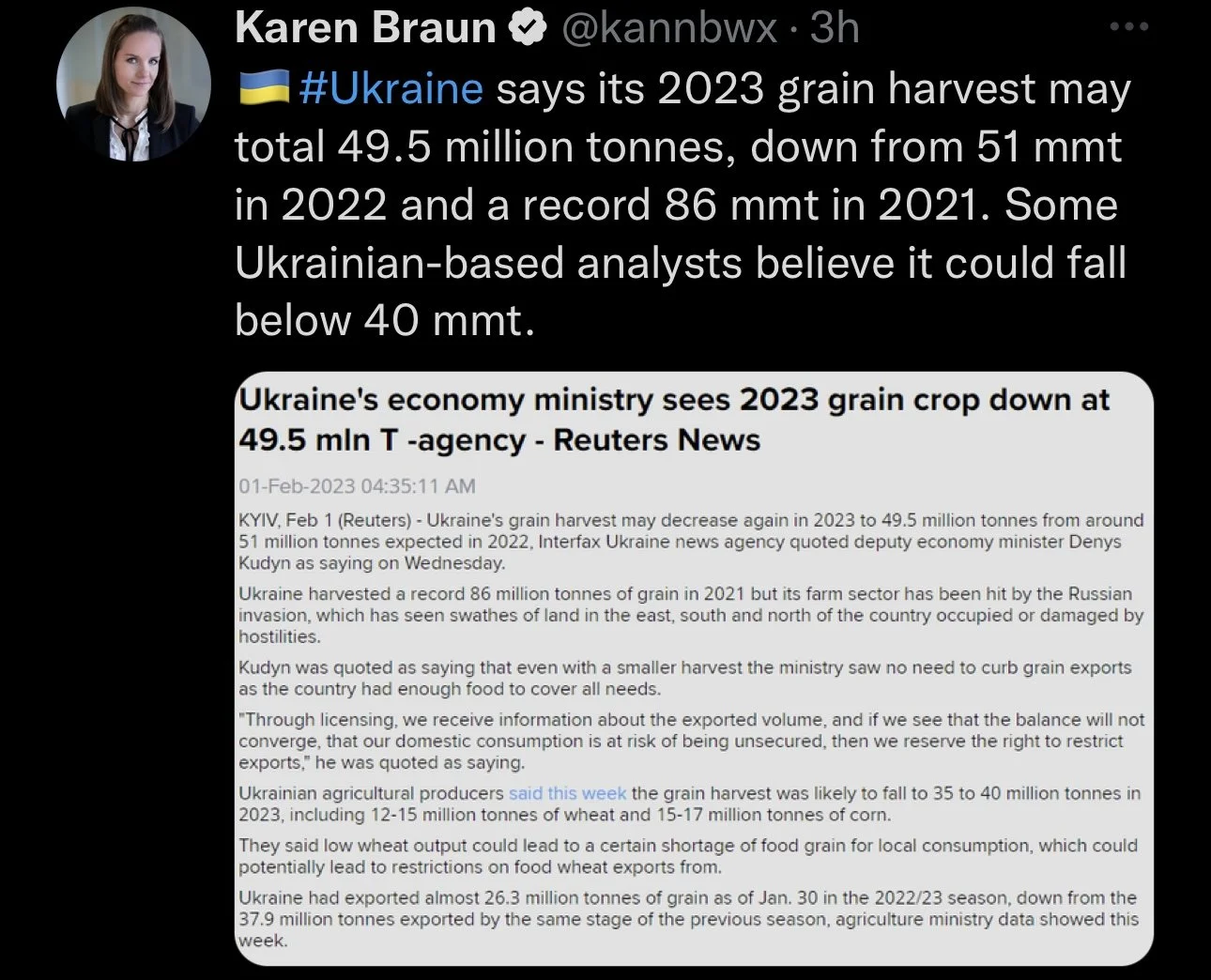

Ukraine says its 23 grain harvest may total 49.5 million tons. Down from 51 million last year and a record 86 million in 2021. Some Ukrainian analysts think we could see this number fall below 40 million.

Feds raise rates by 25 basis points. They signalled a likely increase in March.

Other Markets

Crude oil down -2.00 to 76.82

Dow Jones unchanged

Dollar Index down -0.965 to 100.950

Cotton down -0.61 to 85.61

Bullish vs Bearish

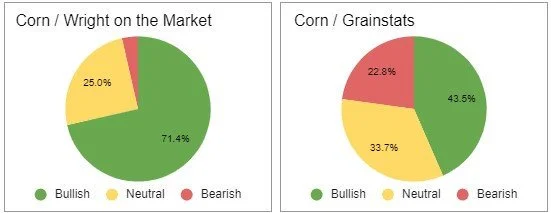

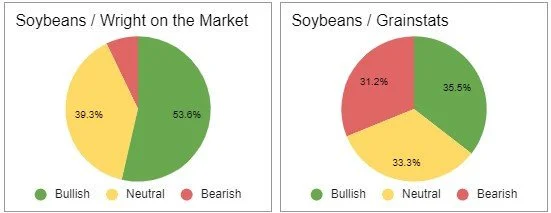

From Wright on the Market & Grain Stats. The following charts are voted on by their audiences.

In Case You Missed It..

Here are a few of our past updates in case you missed them

Yesterday's Update - Did Wheat Break It's Downtrend

Read Here

Meal Made Contract Highs, Will Other Grains Follow

Listen Here

Jan. 30 - Market Update

Read Here

What Does ADM Think About Chinese Demand

Read Here

What to Expect Going into This Week

Listen Here

Jan. 26 - Will History Repeat Itself?

Listen/Read Here

Jan. 25 - When to Make Sales

Listen Here

Jan. 25 - Market Update

Read Here

Livestock

Live Cattle down -0.800 to 162.225

Feeder Cattle down -2.900 to 183.250

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service