FUNDS COVER WHEAT SHORTS

Overview

Corn and wheat rally to close out the week. With corn following wheat higher with more demand from China. The funds looking to cover their wheat shorts going into the weekend. Maybe they are further realizing the problems with the winter wheat crop in the US.

Soybeans on the other hand see some pressure as funds look to liquidate some of their longs. Part of this pressure is that we are importing beans from Brazil. Which means that Brazil is cheaper than the US. As we had a cargo of beans from Brazil headed for North Carolina.

Russia continues to add threats that they will not extend the Black Sea Agreement. They did say there is still time for the US to comply with their demands to extend the grain agreement. They said we have until May 18th. I doubt the US gives into the Russian demands. Ultimately there is some uncertainty, but I think we do probably see it exteneded again. Just how long of an extension we are looking at is the question. Perhaps we see another 30-day extension, but we have a month until that deadline so there is still chances for more headlines.

Overall, the technicals are starting to look better across most of the grains and we are still looking for seasonals to push us higher going into late spring and early summer. But a lot of this will weigh on weather amongst other factors.

*Note: We will be switching from May to July contracts on Monday. As July is now considered the lead month with most open interest.

-

Yesterday's Audio - Planting, Is It Wet or Dry?

Listen Here

Today's Main Takeaways

Corn

Corn strong here, up 14 cents today to finish the week. As May corn is now just about 60 cents off our lows of $6.07 made on March 23rd, just three weeks ago.

Looking to next week, we will have planting crop progress on Monday. With the weather being cooperative this week it wouldn’t be too surprising to see the corn planting numbers high. Which could lead to some pressure especially in old crop corn.

As for the weather, we have had several days of pretty good temps which likely helped planting. However, there is a possibility for frost and freezing in parts of growing areas on Sunday.

Taking a look at South America. Bulls saw the Rosario grain exchange lower their Argentina corn production by 3 million metric tons, down to 32 million. Which is still a lot lower than the USDA's 37 million. The USDA has already made a 30% reduction from its original estimate. On the other hand we saw CONAB slightly increase their Brazilian corn production estimate yesterday.

Bulls are also looking at yet another sale of US corn to China. As we got another flash sale of 382,000 metric tons this morning.

The situation in Ukraine and Russia is also one that is being closely monitored. Which will have a larger direct effect on the wheat market but is still definitely something that can be a market mover in corn as well.

Bears on the other hand are arguing that overall demand estimates might be a little high, as we had weaker ethonal and export numbers this week.

Going forward, the corn market is going to be influenced by US weather and planting, South America, Chinese appetite, and war headlines.

Short term, we could definitely run into some selling. Especially if we get high planting numbers on Monday. But our stance is still that we expect higher prices in the future as the seasonals start to kick in. Outside of some favorable planting weather, the fundamentals still remain bullish.

Taking a look at the chart, we are 60 cents off our lows from late March and only 20 cents or so from where we were before the massive sell off. Bulls would like to break that downtrend from September.

Corn May-23

Soybeans

Beans run into some selling today amist the rally in corn and wheat. With May beans down just half a cent, and July down 6 cents.

It wasn’t surprising to see beans under some pressure here today following the recent rally. With Brazil's supposedly monster crop in the rearview mirror looking to add pressure. As mentioned previously, the main reason for the lower prices action today was likely due to the news that the US is importing beans from Brazil. Which means that their crop is cheaper than ours.

So the biggest obstacle beans are facing is a large and cheap supply of beans from Brazil.

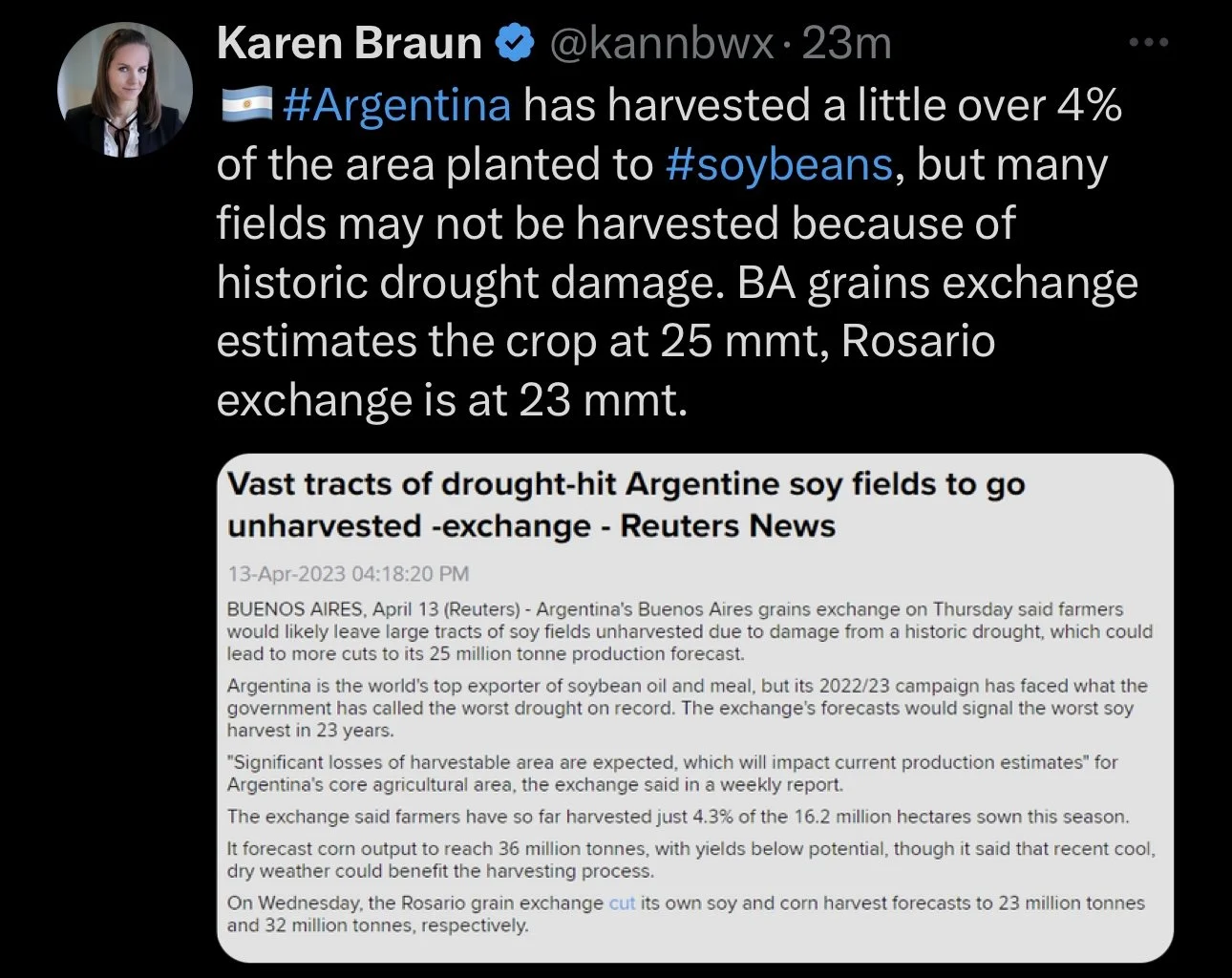

Despite Brazil's record crop. Bulls are quick to point out that Argentina is looking at it’s smallest crop in a quarter of a century, to go along with the worst drought in 60 years. As the USDA again reminded us just how small the crop was. The crop now sits at just half of what the original estimates for the year were. Keep in mind, Argentina is the worlds leading exporter of soybean oil and soymeal. Bears argument is that Brazil's crop will offset these losses in Argentina.

Similar to corn, we saw the Rosario grain exchange also lower their Argentina bean estimate by 3 million metric tons. Down to 23 million. Which is lower than the USDA's current 27 million estimate.

The main factors that will continue to influence beans are the exports out of Brazil, Argentina crush, US weather, and Chinese demand.

Short term we could see some additional pressure. Looking long term our fundamentals remain bullish. One has to wonder just how all the problems in Argentina will play out and effect things months down the road from now.

Soybeans May-23

Wheat

All classes of wheat trading much higher here today following the double digits losses yesterday. With Kansas City wheat leading the charge today. Trading over 30 cents higher. With Chicago up 15 to 16 cents, and Minneapolis up 24 to 26 cents.

Main thing bulls are pointing at right now is of course the problems the winter wheat crop has faced. To go along with delays in spring planting and abandoned winter wheat acres. We also have plenty of uncertainty and possible wild cards left from the Russia and war situation.

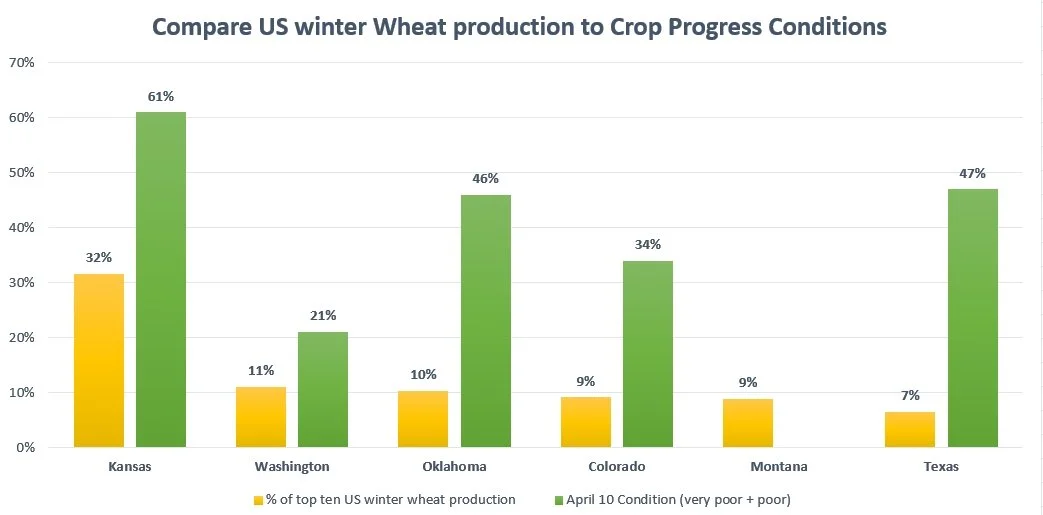

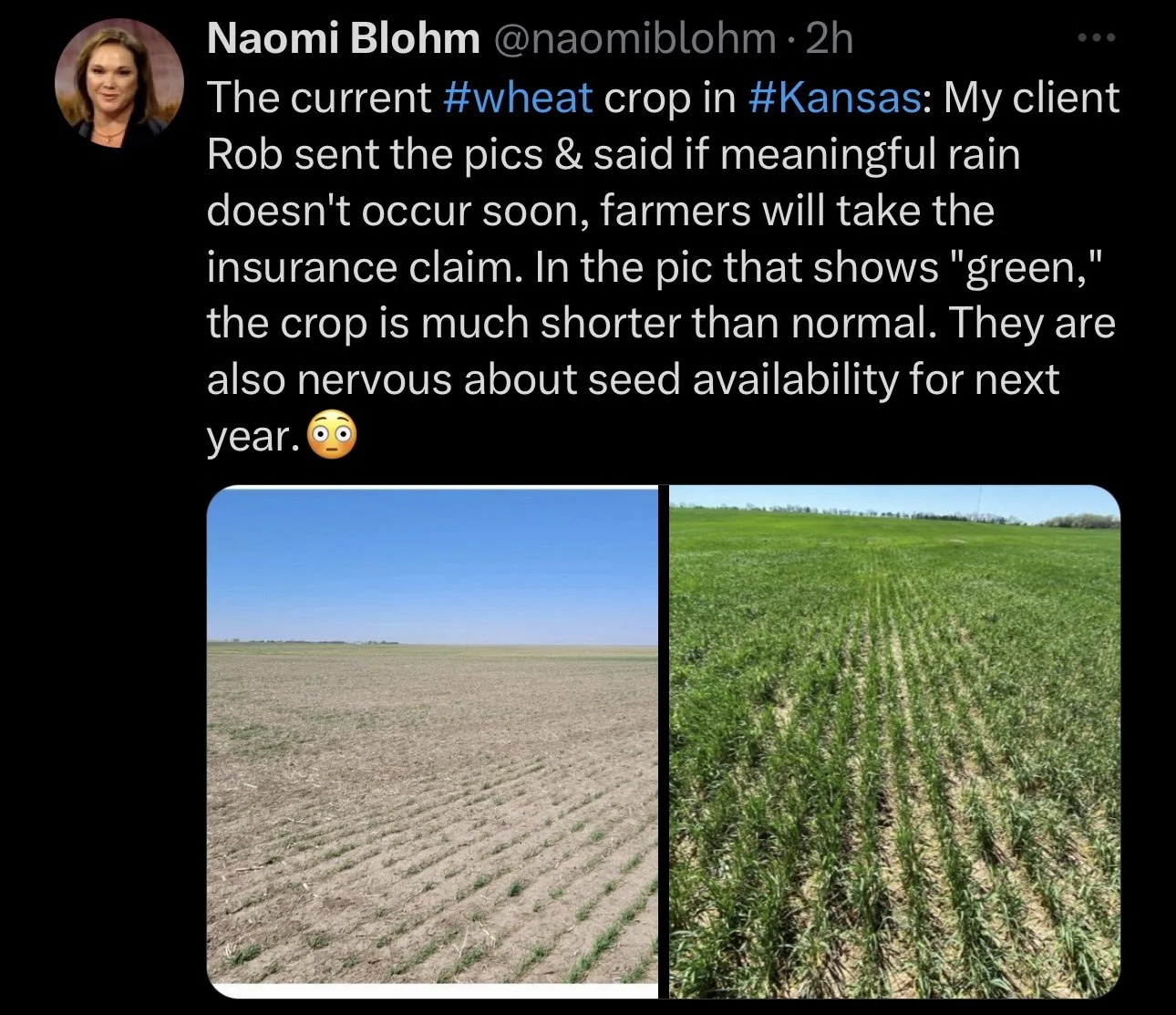

Again we have to take a look at just how historically poor this winter wheat crop here in the US really is. The recent crop progress report showed just 13% of winter wheat is good to excellent conditions.

Now Kansas.. the trade may be finally realizing just how big of an impact the poor crop in Kansas is going to have. To put things into perspective, the state of Kansas can produce over 10 million metric tons. Which equates to roughly 1/3 of Canada's total wheat production.

There is still raising concerns in the hard red wheat areas, with a warmer and drier forecast looking to further impact drought stricken areas. Which could lead to more abandoned wheat acres.

I mentioned this earlier, but we again saw Russia ruffle some feathers. Creating uncertainty around the Black Sea deal. Nobody knows how it will all play out, but I still think we could have a few more bullish wild cards left in the deck.

The funds remain very short wheat, so bulls would like to argue that we will soon see them shift into buyers further adding to today’s short-covering rally. The funds being so short opens the door for quick escalation to the upside given that we see a bullish catalyst to spark things.

From a technical standpoint, today’s rally was a good indicator of a possible reversal. I mentioned earlier this week that we had a potential inverse head and shoulders formation forming, and we bounced exactly where we need to. We will have to see if this reversal holds. We still remain just under that long term downtrend, so I would like a break above that and our 20-day moving average to see even higher prices.

Chicago March-23

KC March-23

MPLS March-23

US Winter Wheat Conditions

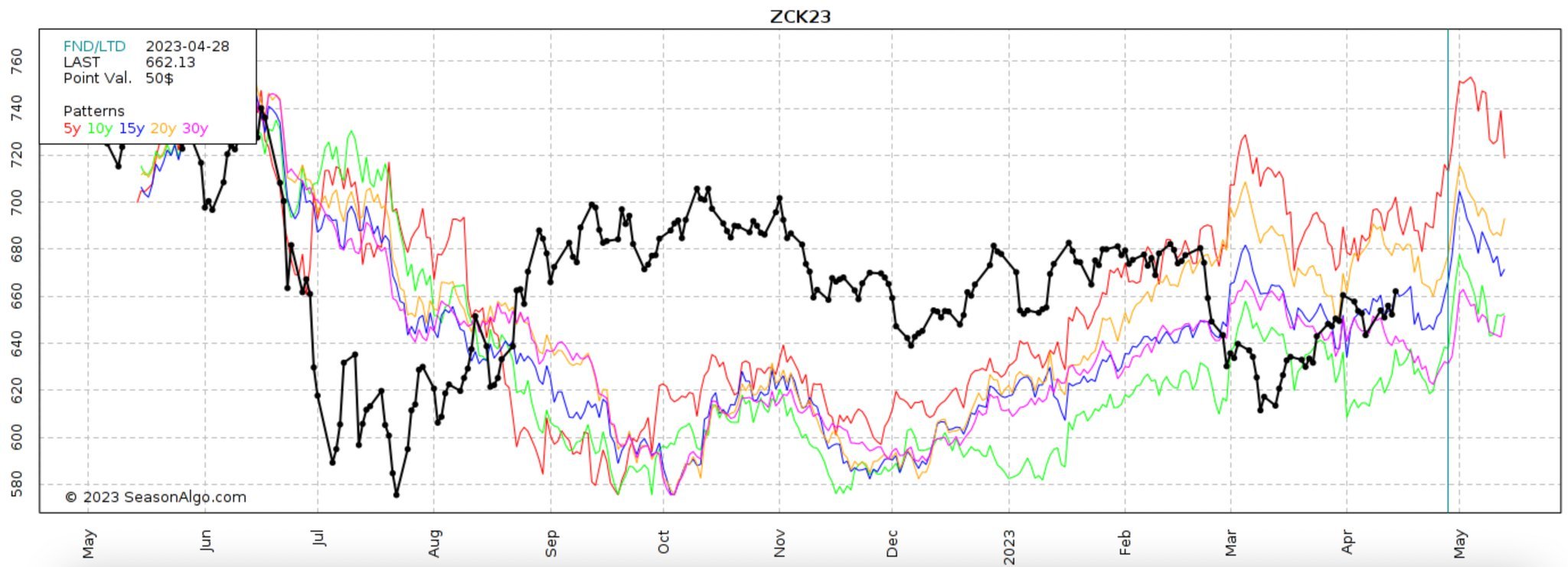

Comparing Corn History

Here are a few charts comparing corn futures to past years. As you can see from the various charts from previous years. They indicate that we might see a small correction here the next week or two before seeing a massive rally going into May. So the question is, will we again see a seasonal rally? Our personal thoughts are that we will be going higher into spring and early summer, but we can’t forget that we could see some further pressure from now until then if planting gets off to a hot start.

Chart Credit: Darin Fessler

The Bottom Line

From Farms.com Risk Management

The weekly U.S. sales report continued to decelerate, but China re-appeared for the first time in over one week with a modest 8 AM corn purchase announcement and there is still not a ton of action on new crop sales. If we can string 2 or 3 more new crop U.S. corn sales to China we will get a pop in new crop U.S. corn futures.

But what we need each week to meet USDA projections on U.S. soybeans is only 6.3 million bushels vs. this week at 13.4 and U.S. corn at only 14.2 million bushels vs. this week at 20.8. We are still on track to meet USDA 22/23 export projections however we still need more demand in the coming months to see old crop 22/23 grain futures trade higher. A 2.5 month low in the U.S. $ Index and a 10-month high in the Brazilian Real gives the U.S. export program the advantage near-term!

U.S. pork sales remain a bright spot vs. beef but U.S. beef sales remain strong despite record high prices!

Russia said today that there would be no extension of the UN-brokered Black Sea grain deal beyond May 18 unless the West removed a series of obstacles to the export of Russian grain and fertilizer. The removal of obstacles will not happen but markets do not believe it until the deal is cancelled. We smell a “short squeeze” soon when you add a potential “frost” on the more advanced HRW crop in the U.S!

Other Highlights & News

The National Oceanic and Atmospheric Administration said there is a 62% chance of an El Nino developing sometime between May and July. El nino is a warm phase when ocean temps are warmer and precipitation is greater.

China's total exports in March were eup 14.8% from a year ago. Snapping five straight months of declines. Economists predicted a 7% decline in that same span.

The US Producer Price Index came in yesterday a negative number. Meaning inflation at the wholesale level was actually deflation for the first time since March 2020.

BAGE in Argentina suggests that due tot he drought we will see producers abandon large tracts of soybean fields.

Check Out Past Updates

4/13/23 - Audio Commentary

Planting - Is It Dry or Wet?

4/12/23 - Market Update

Grains Strong Despite Bearish Report

4/11/23 - Audio & Report Recap

USDA Kicks Can Down the Road

4/10/23 - Market Update

Grains Mixed Ahead of Report

4/9/23

Weekly Grain Newsletter

Social Media

U.S. Weather

Source: National Weather Service