WHY WE COULD SEE NEW ALL-TIME HIGHS

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

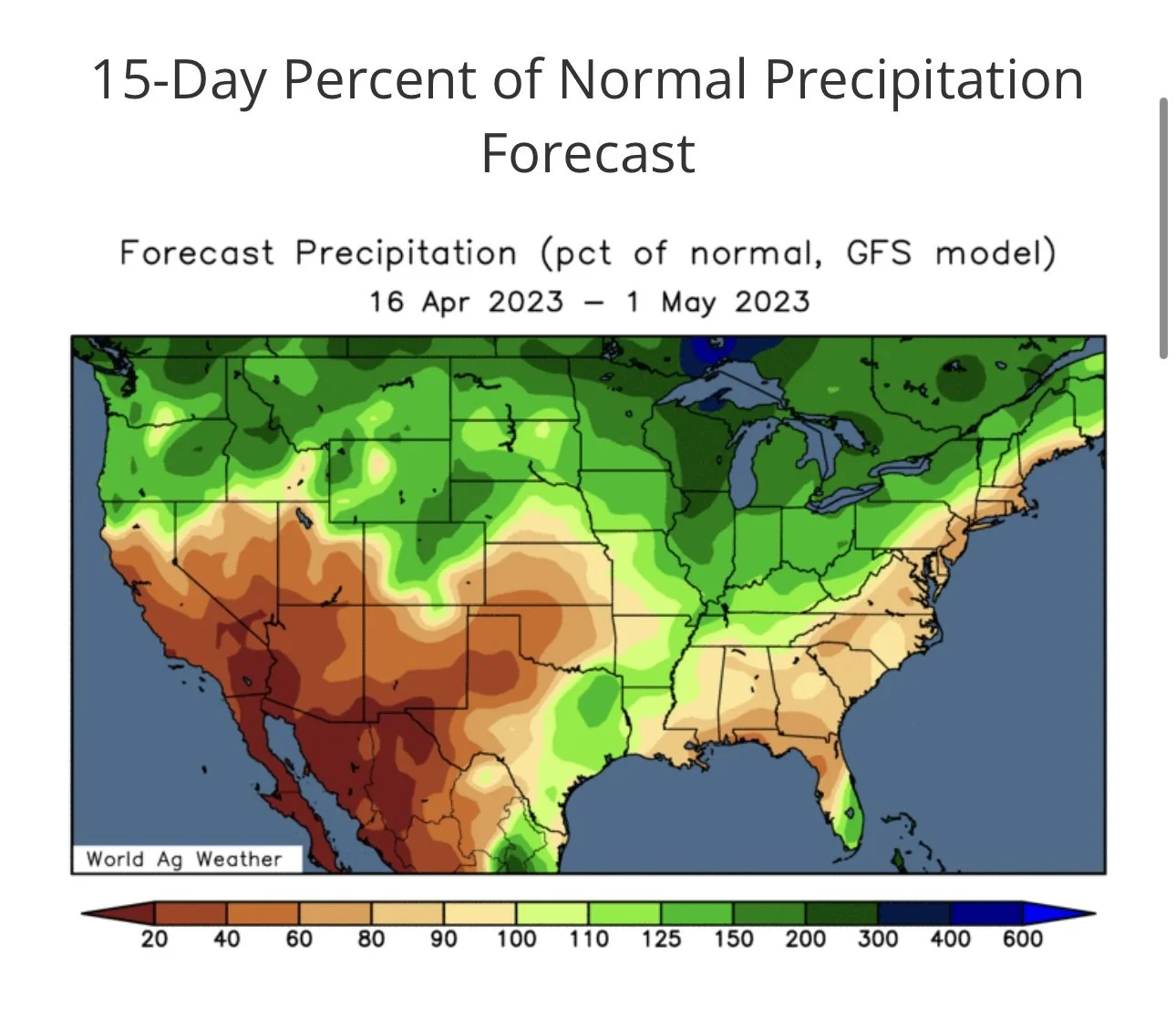

Tis this season as they say, not the holiday season but the weather market season has started for our grain markets. Just look at KC wheat price action to close out the week, with losses of nearly 20 cents on Thursday followed by gains of over 30 cents on Friday. With the main headline both days weather forecasts.

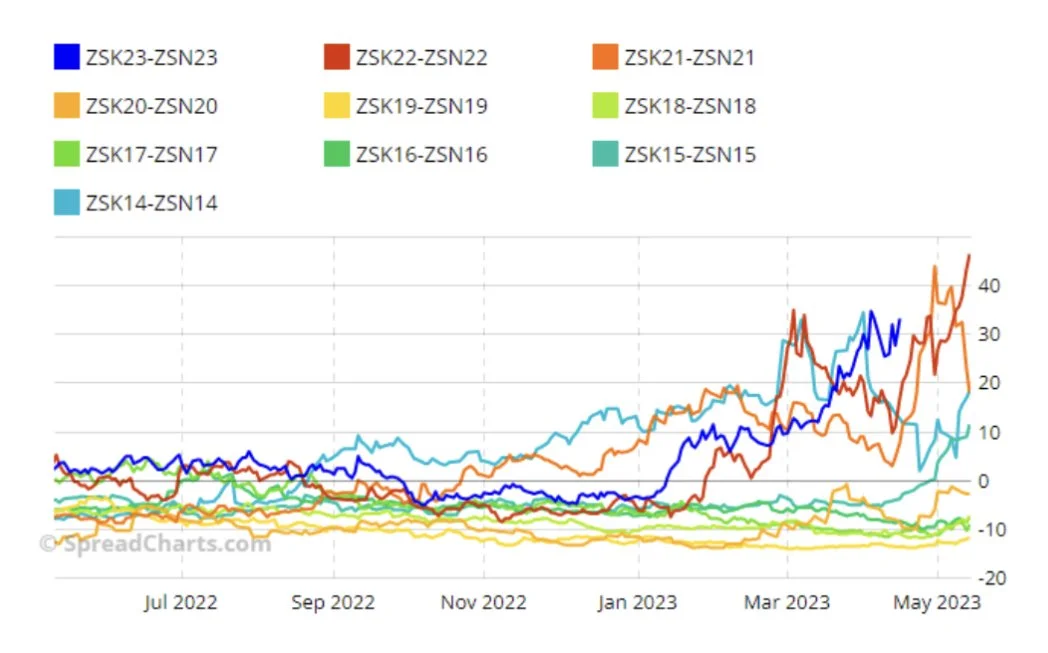

It is also the season of old crop new crop spreads. Showing extreme volatility, which in this advisor’s opinion is something that we need to help us achieve higher prices longer term. On Friday old crop May corn gained 8 cents on new crop December corn, while old crop May beans lost 10 ½ cents to the new crop November soybean contract.

When the week was done we had May corn a 1.06 premium to December corn, while old crop May soybeans had a 1.99 premium to new crop November soybeans.

So what does it mean that it is the season? While longer term as we see volatility coming from unknowns such as production and weather it means we have the possibility of adding some weather premium to our prices. It also means that some are selling the rallies, some are buying the dips, some bears are always selling and some bulls are always buying. Eventually all those that are entering into new fresh positions will have to close out and take the opposite side, so adding a little more players to the game because of the volatility and unknowns typically benefits farmers and helps lead to seasonal trends that typically show row crops bouncing in May.

If you think about it, the more farmers become price makers instead of price takers and the bigger farmers get the higher the likelihood of higher prices should be.

What I mean by that is farmers do not have to pre sell a single bushel if they choose not to. Some even have the option to simply build more bins and in theory never supply the product to the market. Buyers on the other hand either need to buy, close shop, or find a replacement product. So naturally we should see prices rise when farmers are busy growing a crop and not focusing on risk management.

Not to say that is always a good thing, because historically farmers have been well served to make sales, put in price floors, or engage in some sort of grain marketing price risk management when they don’t know what they will grow, when they are very busy with other operational things that take priority and focus. Typically if a farmer becomes nervous about his production a buyer that will eventually need to buy a product also becomes nervous about supply availability. This is the reason why seasonals have worked for decades in many commodities and why they will continue to be something to monitor in the future.

The bottom line is we are in the seasonal time of the year when we simply do not know if corn yields will be well above expectations or well below expectations. The expectations will change with nearly every weather forecast for the next few months.

The thing that we do know is that things are tight. The future spreads between old crop and new crop tell us that, as does our carryout versus historical carryouts. The more volatile the spreads become the more potential we have as we have to not run out of old crop supplies while also producing rather big crops or we will need to ration demand via much higher prices.

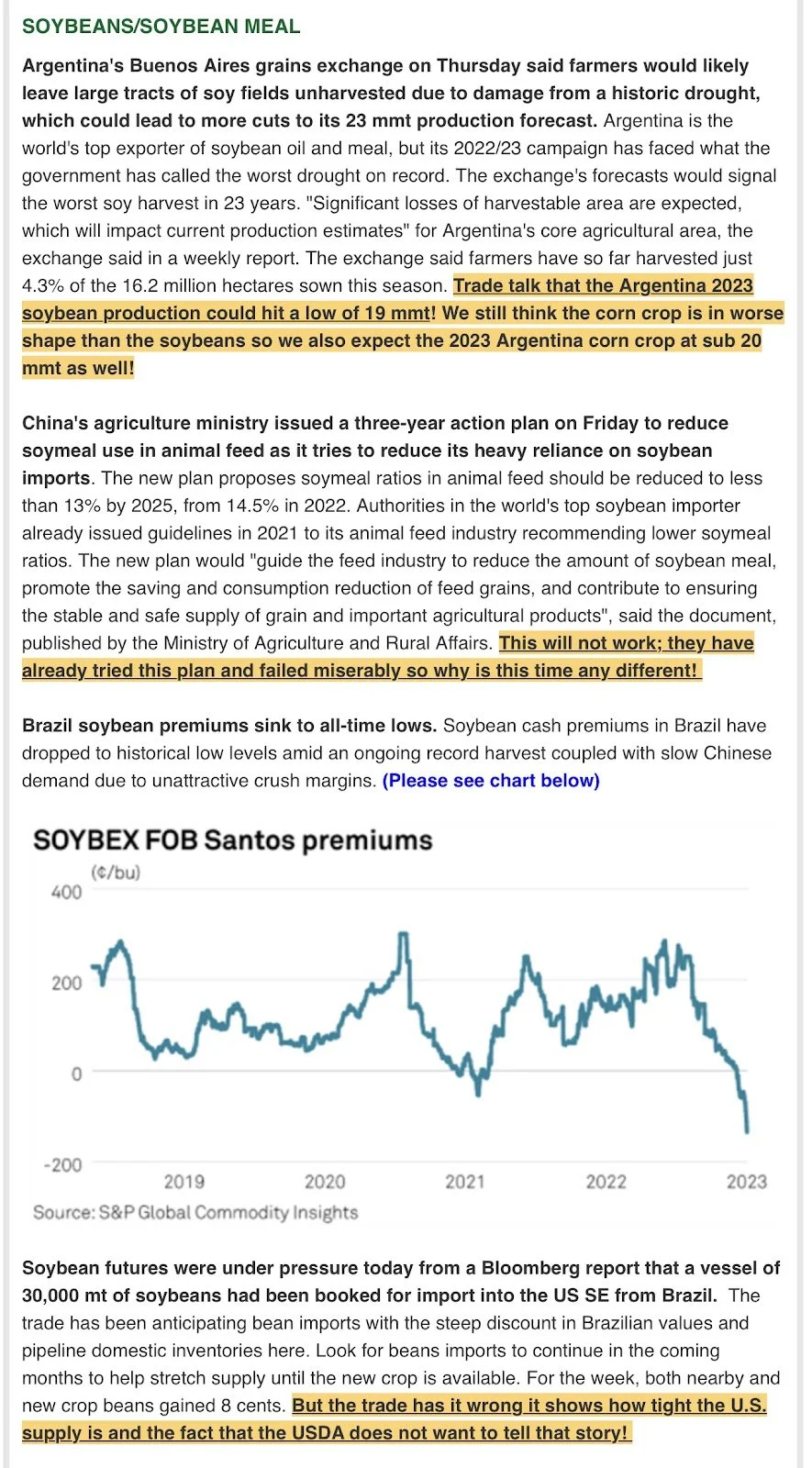

I thought the USDA report this week showed us that we have some major production risks with what has happened to the Argentina crops versus where we started. I can only imagine how stupid scary high we could see corn, beans, and wheat prices get should the USA and in particular the corn belt draw the same card Argy did.

If you knew today that we would have the worst drought in 60 years in the corn belt in 2023 how much corn would you have sold, can you imagine how high the price would go? How many elevators would go broke from hedges in the wrong spot or from margin calls? How many farmers would be oversold and not able to fill contracts. How high would our price go? How quickly would it come back down and who would be left standing after it was all said and done?

It is more scary because I have never seen anything like it. Yes I experienced the 2012 drought and price change. But we went from 160 to low 120’s in yield. Argy experienced much worse of a % loss.

I don't think most in the industry are prepared at all for anything more than a 10% below trend line yield. I think 10% below takes us to new all time highs. I think 20-40% takes us so stupid high that we break so many elevators and farmers and others in the industry that it is worse than a nightmare. Far worse.

I know most reading this don't think that is a possibility, but I remember my first year buying grain for CHS Cooperatives and I remember millet going 5x its price in just a few short months.

Below are a couple of spread charts. The first is May corn to July corn. This just simply shows that presently we have the spread wider then ever for this time of year. Despite our exports dismal versus the past couple years the spread is wider then it was.

When I first started trading grain, one of the first things taught was the spreads indicate how bullish fundamentals are. When the market is willing to pay more for grain today versus later.

This next is the same spread but for soybeans. It shows the sales thing that for this time it is wider than ever. These spreads have had higher inverses each of the past couple years but not for the middle of April.

These next couple of screenshots are from ZEROHEDGE.com. The first is from an article that was on Friday. Just note the talk of Mother Nature being more disruptive, which was also mentioned on Market to Market this week, the volatility increasing.

Here is an older Zerohedge one. Just notice the date, last August. Then ask yourself what happened in Argy after that. Worst drought in 60 years, production 45-50% less then what was originally forecasted.

Does that mean we will get hit with a drought this summer in the USA? No, but it should serve as a reminder that things seem to be more volatile each year.

************

As many of you know we subscribe to as many other advisors, to help give us different views than just our own. It also helps us see if we are missing something at times, and it helps generally understand what and sometimes who is driving a market.

I regularly listen to Brian Henry with BQCI and Mark Gold with Top Third Marketing daily audio updates they do and I have for at least 10 plus years, maybe even closer to 20 years. I read several other advisors on a regular basis.

The one thing that I have taught myself to do is to ask what the motivation is for their pitch on the markets. Are they trying to sell a product? Or they are trying to help buy a product, etc. Or are they trying to get repeat business via their customer’s success.

This morning I read part of Wright on the Market that really hit home. He is what it said.

“From Mark in Minnesota, who has been an email client since November 2022:

"I like your numbers but they are so bullish I have a hard time to believe you. I have held on to this spring wheat for 6 months listening to your recommendations and starting to wonder if you are a perma bull and never sell?

What should I do here? I have another crop to plant if the snow ever melts."

Mark,

When one is seeking to price futures in the top 25% of a given year's price range, it means 75% of the annual range the recommendation must be "don't sell."

To go a step further, what percent of the time does a futures contract price stay in the top 25% of a given year's price range? Way less than 25% of the time.

In the case of spring wheat for the previous marketing year (1 June 2021 to 31 May 2022), the numbers:

The low was $7.43¾ on 1 June, 2021

The high was $14.12¾ on 17 May 2022

The price range was $6.89

75% of the range $5.16¾

Adding $5.16¾ to the low of $7.43¾ = $12.06½. Anything above $12.06½ would be in the top 25% of the annual price range.

During the 2021-2022 marketing year, spring wheat traded above $12.06½ between 10 May 2022 and 31 May 2022. That is 21 calendar days, which is 5.75% of the marketing year.

For the current marketing year, a price above $11.50 is in the top 25% of the annual price range. Spring wheat traded above $11.50 1 June to 21 June 2022; ironically also 21 days or 5.75% of a calendar year.

Thus, if a marketing goal is to sell in the top 25% of the year's price range, one had to say "Don't sell spring wheat" 94.25% of the days the past two years.

In the 2021-2022 corn marketing year, the price was in the top 25% of the annual price range 25.2% of the days. That is 74.8% of the days were a "Don't sell."

In the 2022-2023 corn marketing year, the price was in the top 25% of the annual price range 9.3% of the days. That is 90.7% of the days were a "Don't sell."

In the 2021-2022 soybean marketing year, the price was in the top 25% of the annual price range 6.8% of the days. That is 93.28% of the days were a "Don't sell."

In the 2022-2023 soybean marketing year, the price was in the top 25% of the annual price range 14.8% of the days. That is 85.2% of the days were a "Don't sell."

If that makes me a perma bull, then I am a perma bull.

If you think I am not correct in expecting higher wheat prices, which is entirely possible, I recommend you sell your old crop and/or new crop wheat. That will eliminate down side risk.

If wheat prices do go lower, you will be a genius. If wheat prices go sharply higher, buy put options and make the money on the way down you did not make on the way up and you will be a genius.

Roger”

Now something about this really hit home, because I have been called a perma bull recently. But those of you that know me or have done business with me for the past 20 plus years know that I have been bullish the past few years, but also remember times when I was extremely bearish and put out recommendations that made a lot of sales before big collapses in other bull market times. What struck home was the numbers.

These numbers remind me even though it seems like sometimes one is on a broken record hitting repeat that the past few years there have been far and few days between when one actually wanted to sell to be in the top 25%. I didn’t do these numbers like Roger did, but imagine if the goal was to be in the top 5-15%.

This should serve as a great reminder that we shouldn’t always be selling grain. The more times we sell during a year the better average we get, but the more times we sell the less likely we will be doing a great job of getting in the top 25% or better. Granted we know that tools can and will be used to try to make sales better then the price one sells at. But it serves as a reminder as to why one doesn’t panic sell.

The other thing that I have watched consistently is market to market. This week's speaker who happens to be mentioned above is a very colorful salesperson. He reminds me of the quote “always be closing”, because he promotes buying puts for protection or putting in floors. While buying calls if one has grain sold.

We can all debate when the right time is to do either, but the one thing that I totally agree with was his statement about if buying an option gives one the ability to do some sort of marketing when the time is right then it is totally worth it. I believe that comfort in marketing is something that can not have a price tag on.

So the bottom line is I believe there are much higher prices in the future, but I know I can be wrong, you know I can be wrong. If you're not comfortable, do what the Top Third guy recommended and buy that comfort level via a call or put option. It is simple and in my opinion one of the most important goals in a grain marketing risk management marketing program is to be comfortable with the unknown possibilities. If you're not there please give me a call and I can help provide you information as to how I would consider getting there based on the information you tell me about your operation, its goals and your risk/reward profile.

If you don’t have a hedge account open and would like to open one to help you, both myself and Wade have recently joined Texas Hedge Risk Management.

____

Below is a recent announcement that went out to some of those that I have worked with for years.

“Texas Hedge Risk Management along with Banghart Properties is excited to announce that Jeremy Frost and Wade Hardes are joining our team as associated persons for Texas Hedge Risk Management to better assist you with your grain price risk management solutions as we will now be able to tie in futures and options to cash grain trading that will still be offered via Banghart Properties.

Texas Hedge Risk Management is a new Independent Introducing Broker clearing through Dorman Trading, established in 2022. While the IB is new to the business, each broker has over 10 years of experience in not only the brokerage business, but production agriculture as well. While other IBs are on path to get acquired by larger corporate entities, Texas Hedge Risk Management takes pride in their ability to remain a small, regionally held office, that can maintain control over their operation while continuing to offer a competitive and comprehensive suite of risk management services and strategies.

The reason Jeremy and Wade are such a great fit for the team is because of their strong ties to production agriculture and their commitment to their customers.

Founding partner Lauren Urbanczyk, lives in Hereford, Tx. She brings over 10 years of experience in risk management strategies and solutions for farmers, ranchers, and commercial operations. Her husband farms corn, wheat, and sorghum silage for their own farms as well as a custom farms for several local dairies. He owns and operates a large custom hay and silage chopping business. Together they also run their own 2000 head grow yard, primarily feeding holstein angus cross cattle. Lauren brings her hedge experience to their cattle operation, managing the hedging and marketing of their cattle.

Founding partner Jake Kuker, lives in Onawa, IA, where he trades and farms himself. He brings over 20 years of experience in farming and marketing grain to the brokerage business. Besides ag markets, Jake tends to focus on equity futures. His business is trading and farming, which equips him to provide sound risk management strategies for his customers.

Managing member Ross Birkenfeld has worked with Lauren for the past 4 years. He brings his own proprietary trading models to the team, which are used for hedging execution and strategies. Options strategies are Ross’s strength, along with capital and cash flow management. When Ross isn’t trading, he is running his dairy, calf ranch, and grain farming operation.

Along with futures and options trading, Texas Hedge Risk Management also offers OTC services through HEDGE point Global. Margin financing and managed hedging services are now available to be offered in 2023.

We look forward to working with you and growing a lasting relationship for years to come.

To open a hedge account or to start the process of transferring your present hedge account simply click this link. https://www.dormanaccounts.com/eApp/user/register?brokerid=332

For those of you that don't know much about Dorman Trading you will be pleased to learn that they are owned by Miami International Holdings, Inc. (MIH) who also owns Minneapolis Grain Exchange.

This will further help producers in the Northern Plains gain a competitive advantage via having this partnership.

I look forward to helping you in your grain risk management and marketing needs in the near future. Thank you for your business over the years and thank you for your time.”

_____

Here are a few more screenshots in closing, the first one I just want you to notice the statement that despite Brazil having a record crop, it wasn't expected that they will have record exports. Because of the increased ethanol mandate.

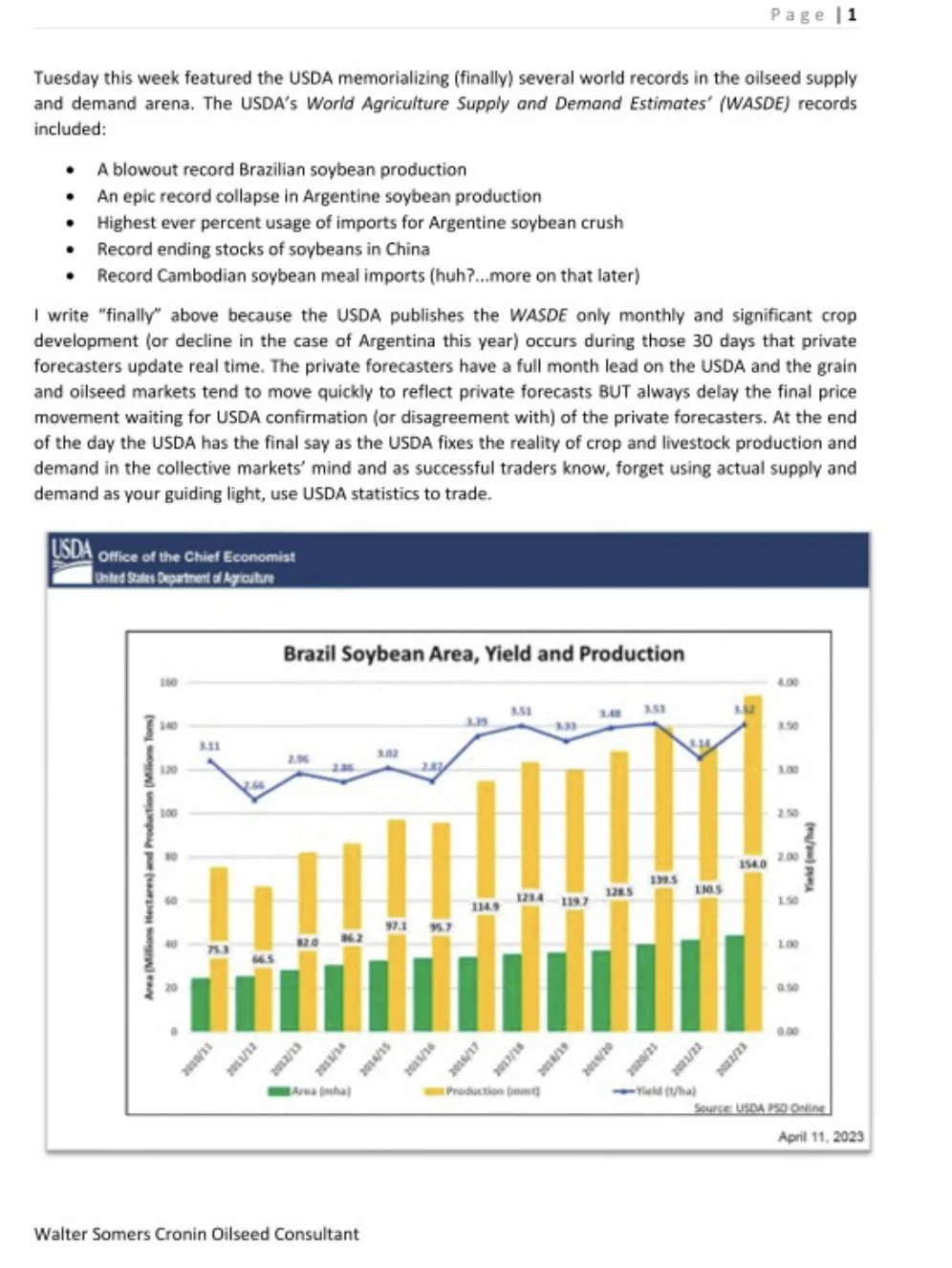

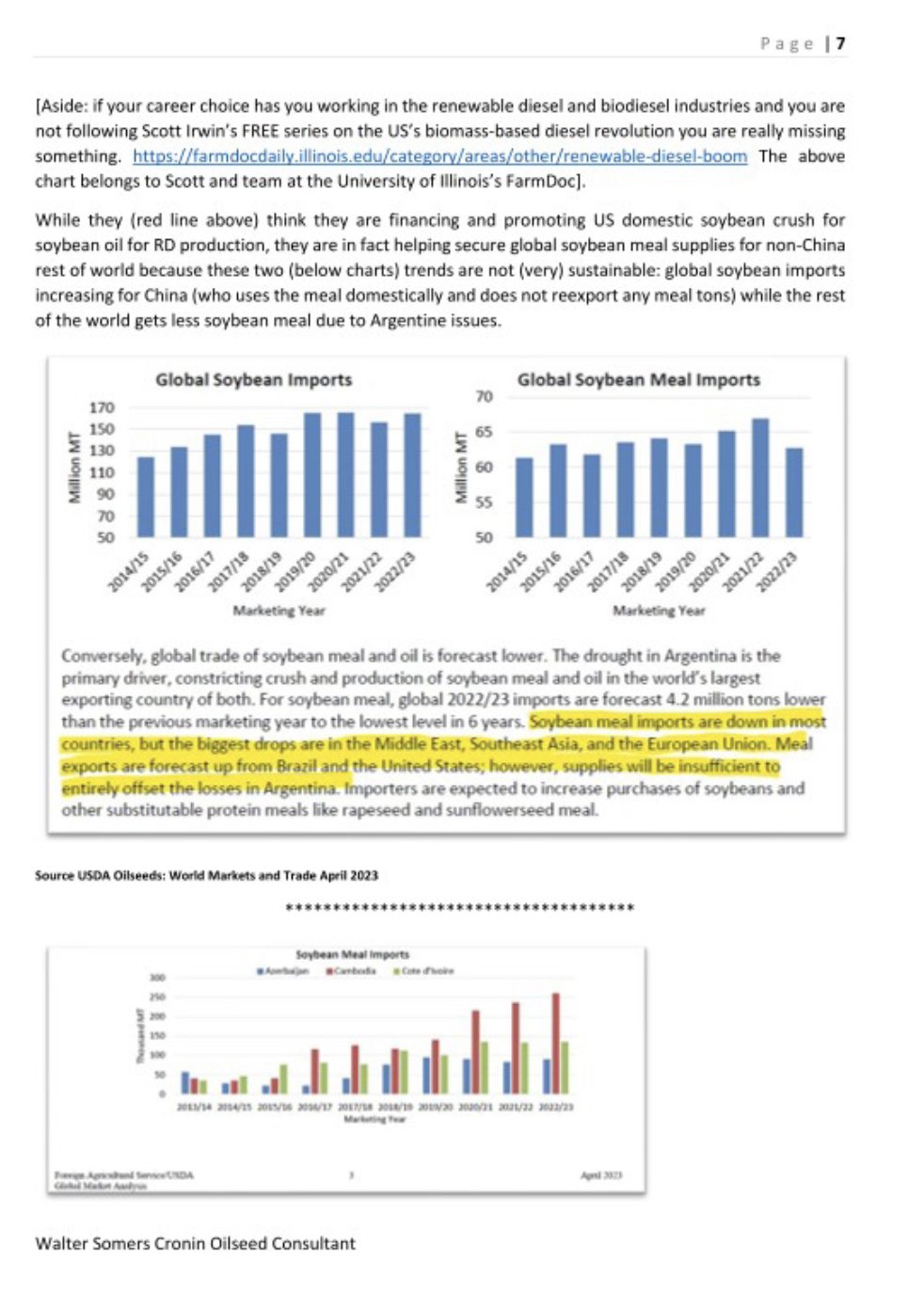

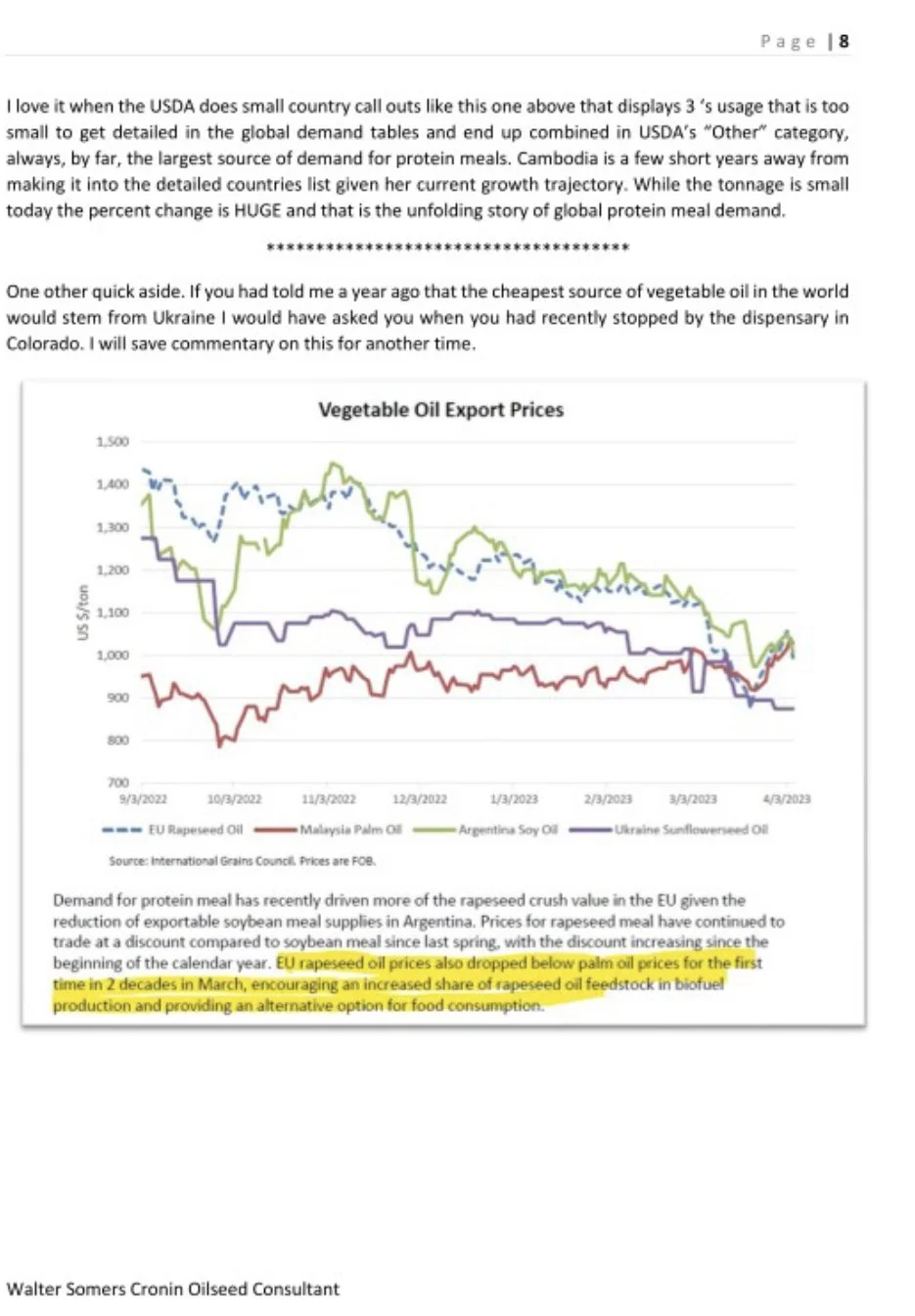

These next are from a great article that Walter Cronin had on LinkedIn.

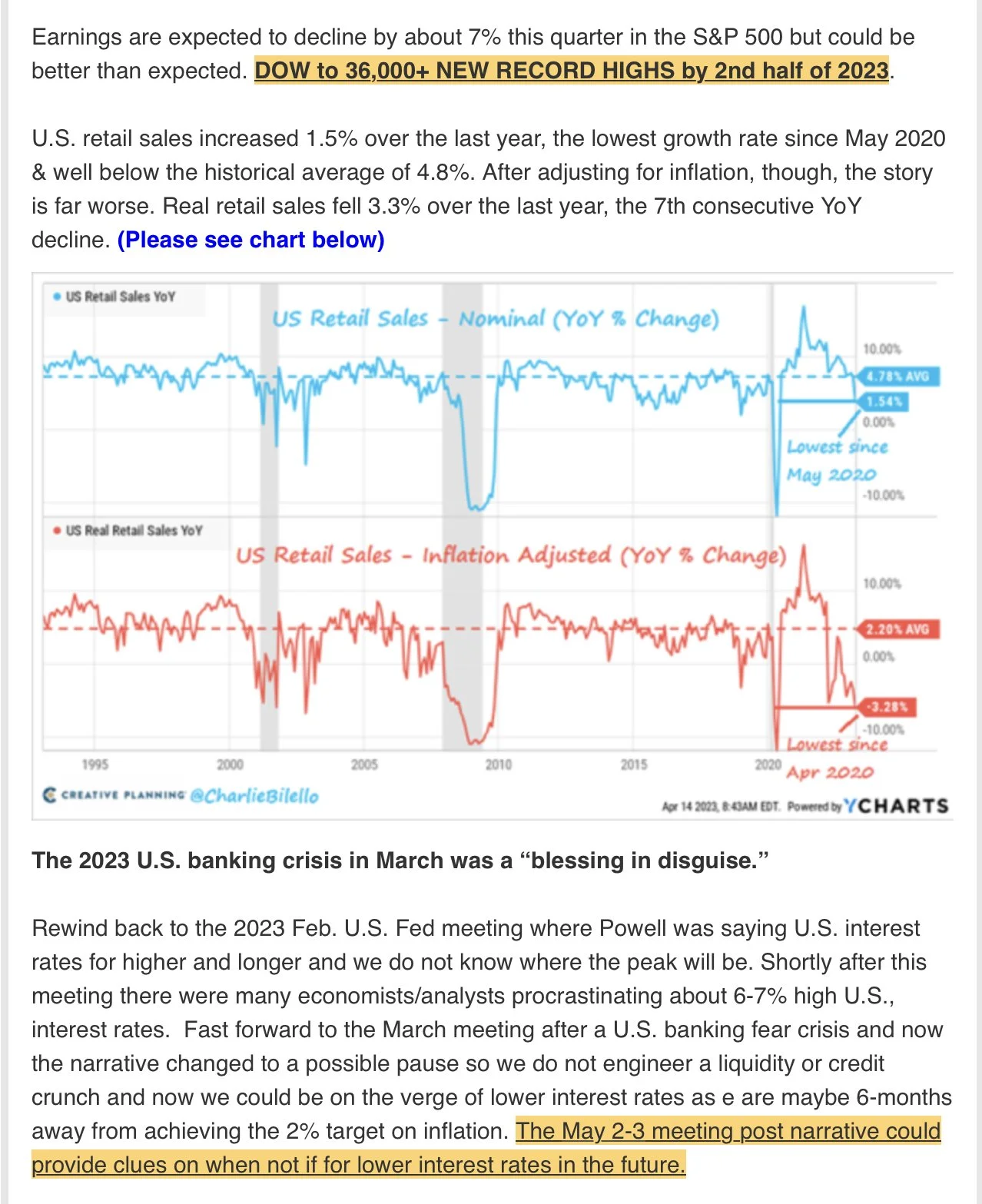

Lastly, a couple of screenshots from Farms.com risk management. No explaining should be need, but the highlight is the possibility of what Powell says in early May and the fact that Canada is leading the path towards lowering interest rates

Lastly this has been on Twitter and Facebook as what Budlight should be promoting. Those that gave their lives for us.

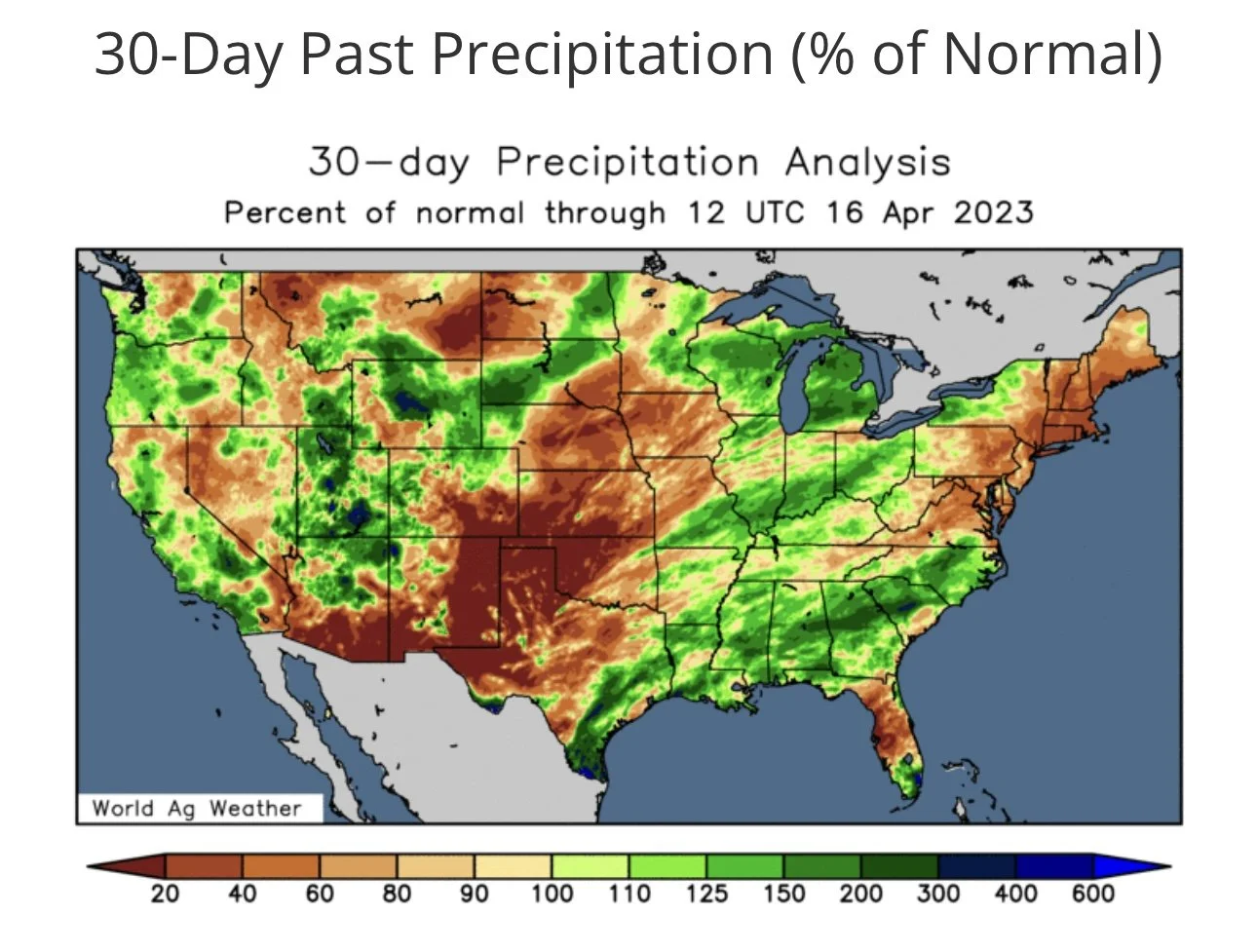

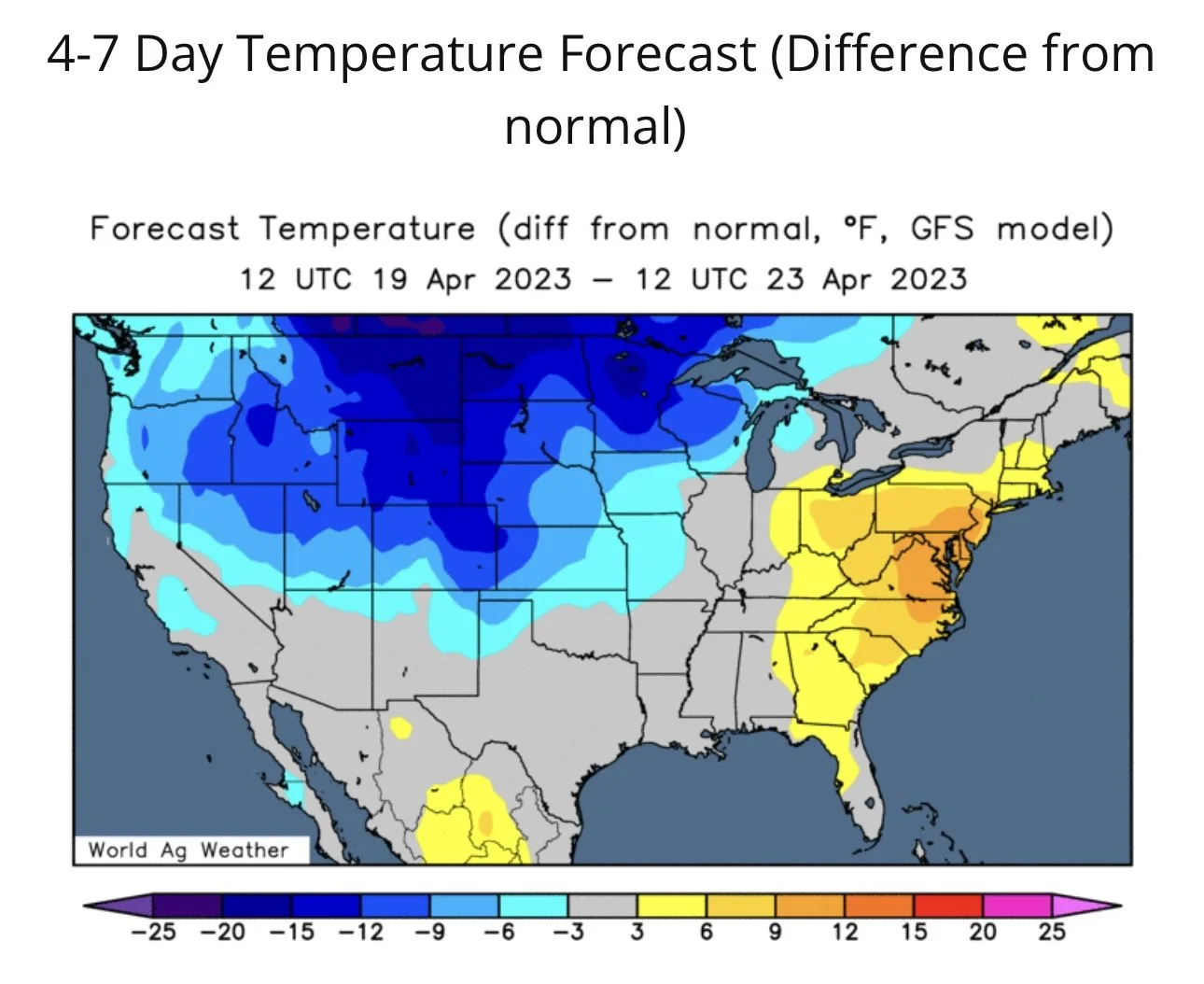

U.S. Weather

Charts

Fundamentally, we need to keep in mind that early in the week we could see some pressure if the planting progress tomorrow comes in hot. But the technicals are looking strong. We look for the seasonals to start kicking in and push us higher.

Corn 🌽

May corn is now 23 cents off its March lows, sitting just 20 cents or so lower than where we were before the massive sell off. We have created a very clear reversal, breaking that $6.60 target and moving averages we had talked about a week or two ago. Bulls would like to break that downtrend from September. A break above and we could be hearing talk about potentially seeing $7 corn once again.

Beans 🌱

May beans are nearly a full dollar off their lows made just over 3 weeks ago. We have found support at the $15, which is a level the bulls would like to hold. Bulls would also like to break out of this short term downtrend we have created. If beans were to keep pushing higher and we get a break above that 15.50 level (right where we made our recent highs in February) we have a wide gap to the upside.

Wheat 🌾

May Chicago continues to sit near its recent lows. Friday did provide some optimism. Perhaps it was the beginning of a reversal. We touched on this last week, but we created an inverse head and shoulders (a bullish indicator) and we bounced exactly where we needed to. A break above that bottom resistance line the next target is $7.13. If we break above above $7.13 the floor is wide open for higher prices.