GRAINS BOUNCE BACK AFTER BEARISH REPORT

Overview

The bearish tone surrounding yesterday’s report didn’t last for long. In Tuesday's audio we said that if the report is negative, the effects likely wouldn’t last for long.

As grains rally following yesterday's USDA report where we saw a sell off across the grains. Today corn and beans essentially erased all of yesterday's losses with the bearish report.

There were a few things supporting our markets here today. Firstly, we had the US dollar drop to fresh 14 months lows, breaking some key support. Most of this was due to the inflation numbers yesterday coming in not as hot.

Secondly, we had the newest drought monitor updates. They showed some slight improvements, but not as much as the trade was likely expecting. The midwest actually saw hardly any improvement. More on this later in today's update.

If you missed yesterday's report recap you can listen to it here.

Today's Main Takeaways

Corn

Corn follows the bean market higher, as we erased all of yesterday's losses. Bouncing back and closing above $5 after trading at it's lowest levels since 2021.

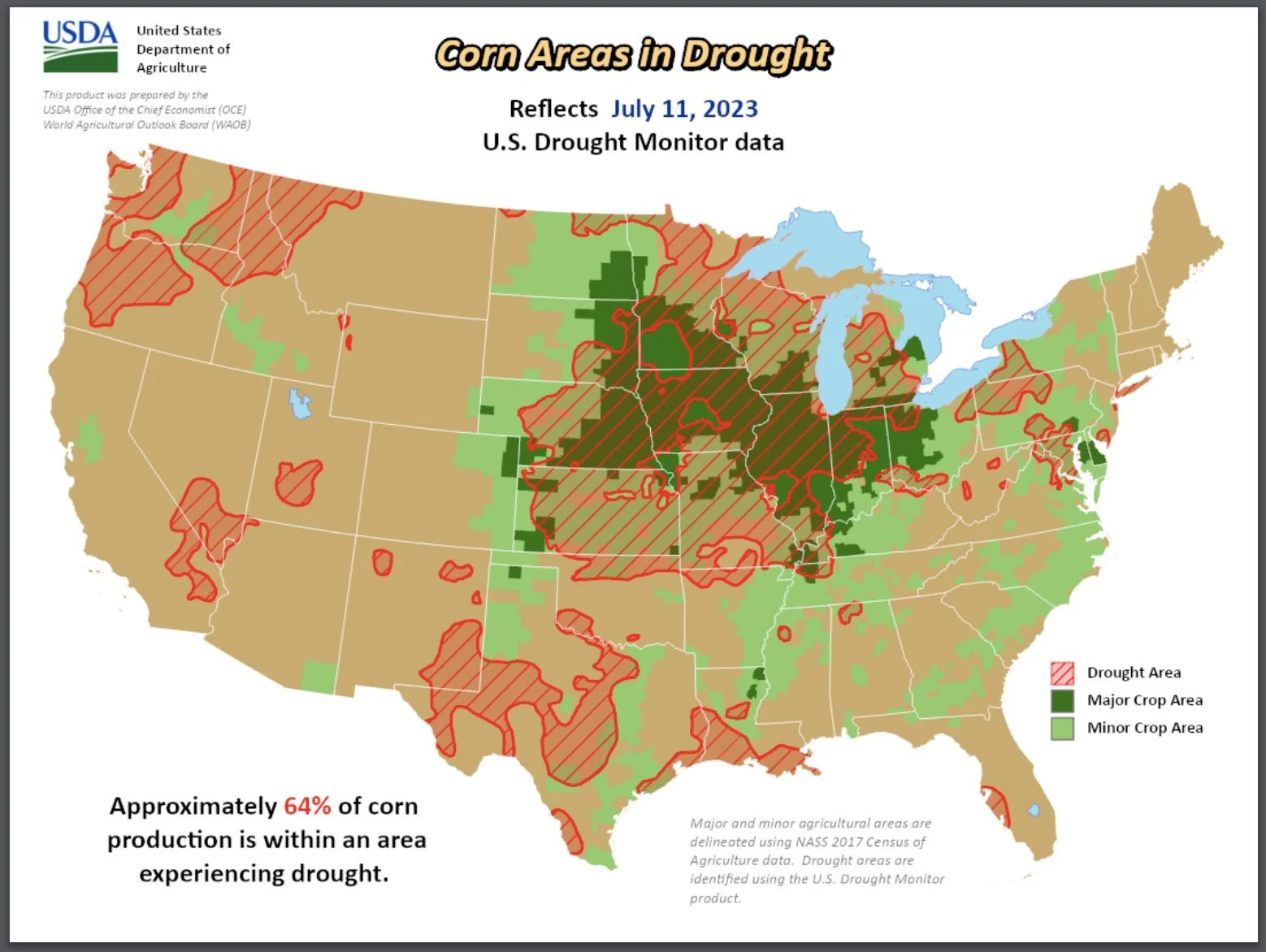

As mentioned, the newest drought monitors came out. We had some slight improvement nationally for corn areas experiencing drought. As the areas improved by 3% to a still pretty large 64%.

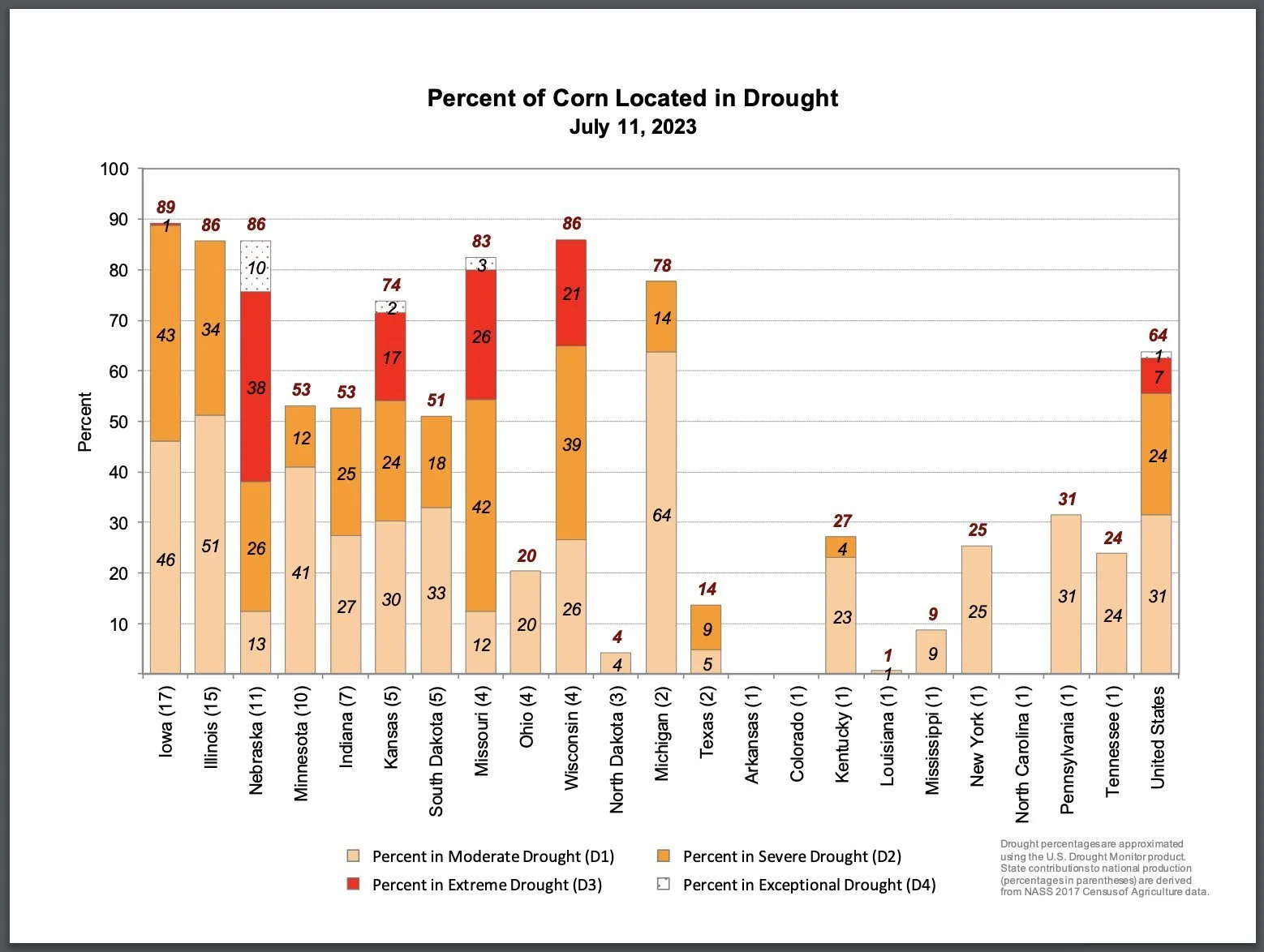

Here is a state by state breakdown. 8 of our top producing states still sit over 50%. The top 3 are all 86% or higher.

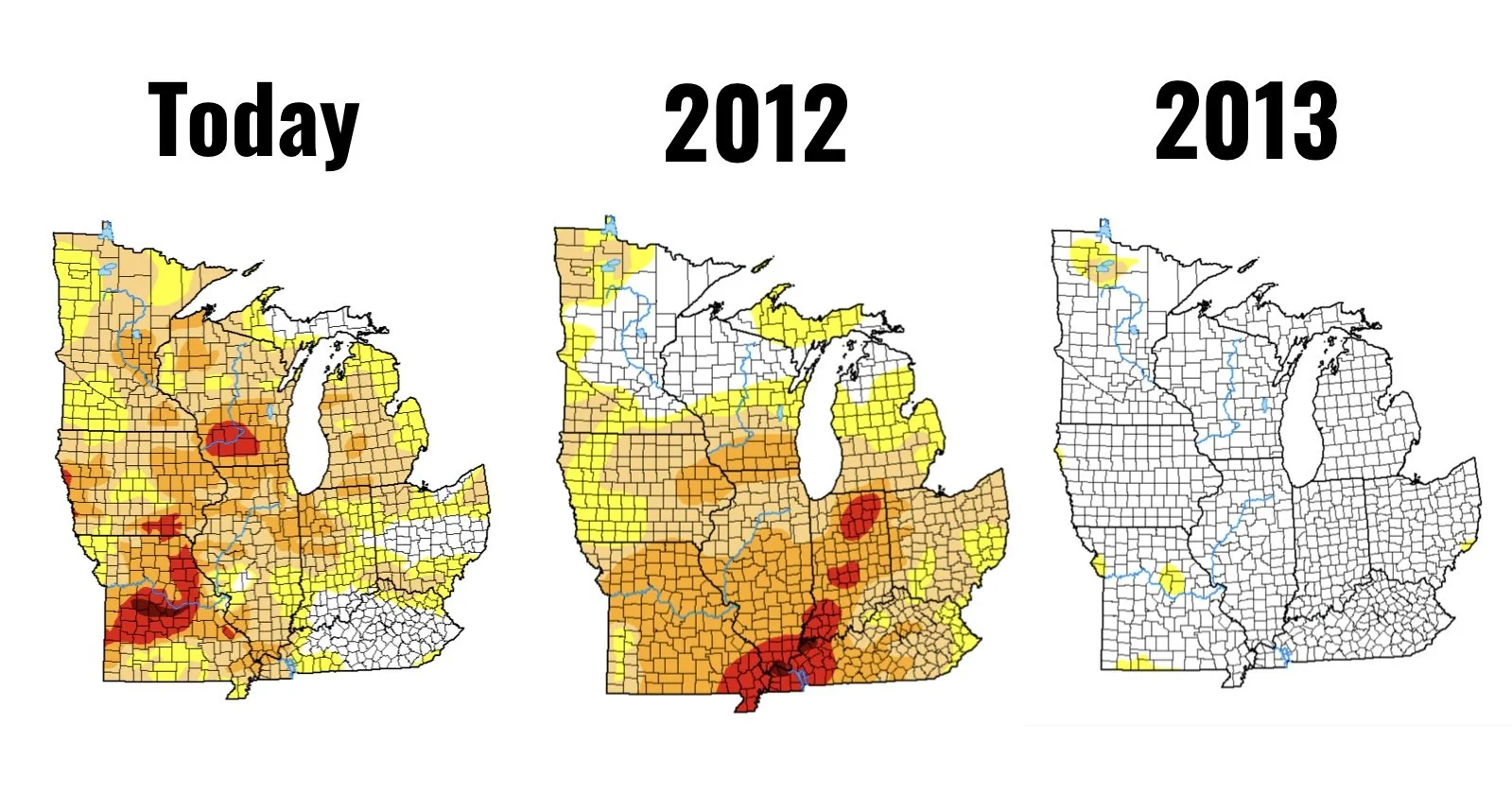

We have made many 2012 comparisons in the past. Yes, this year isn’t anything like 2012. But it’s not like 2013 either. It is a year of it's own.

We simply don’t have the heat we had in 2012. But in 2013, there was zero drought.

Actually, the Midwest is only 4% behind 2012 in terms of drought. Take a look at the 3 years.

Yesterday the USDA came out and they did decrease yield, but not as much as nearly everyone thinks they should have. We shouldn’t expect anything else from the USDA..

They estimated yield at 177.5 which is still 4 bushels an acre higher than last year..

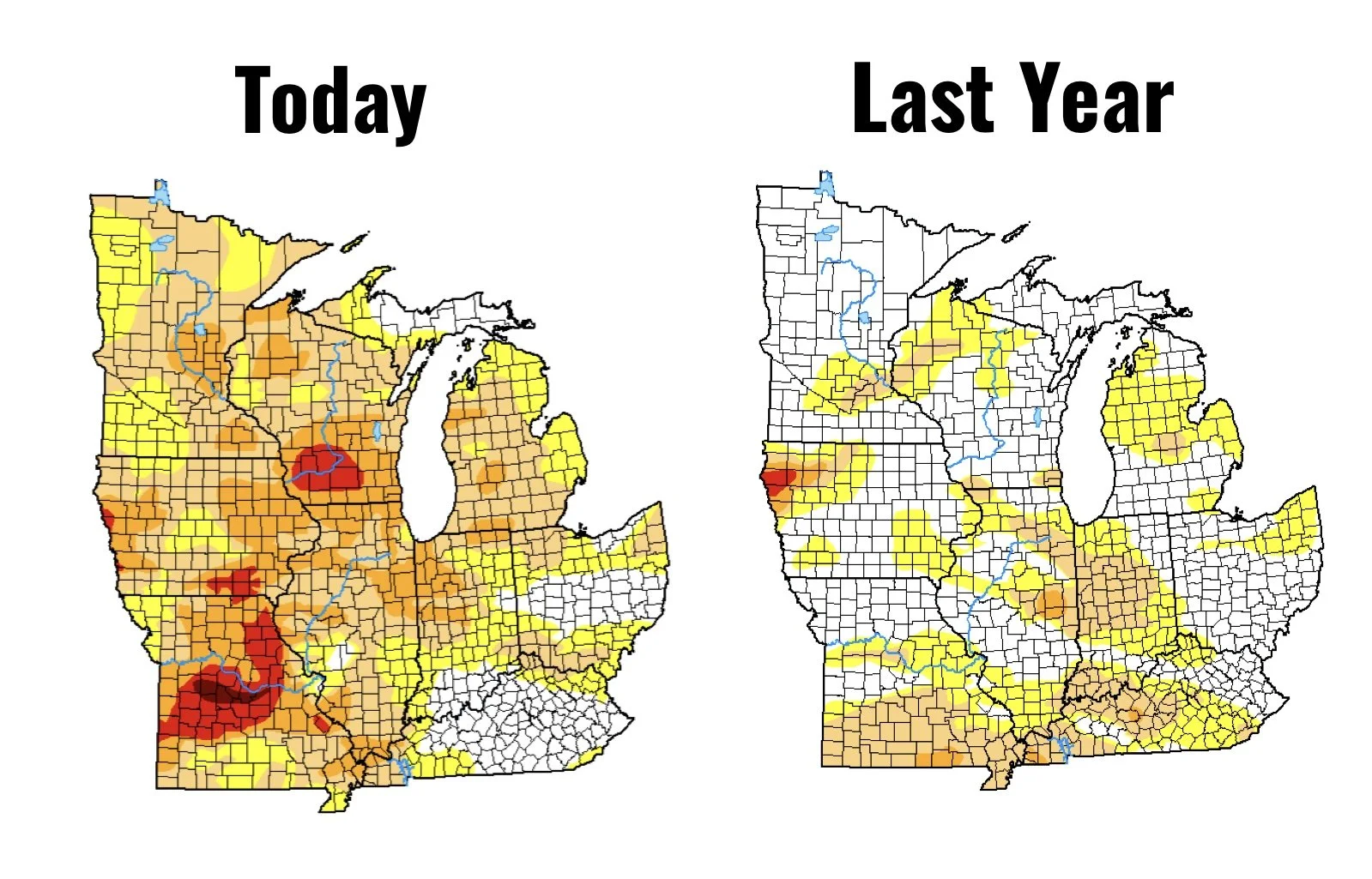

Which doesn’t make much sense given just how much worse are conditions are than last year. Here is a drought comparison to last year.

As mentioned in this morning's audio, it would take some extremely timely and near perfect weather to top last year's yield. Could it happen? Of course it's possible, but not likely. I fully expect to see some more significant drops in the months ahead. Does this year's weather really ook like a record yield to you?

So we know yesterday's report was a disappointing outcome for yield. We also had a jump in production due to the higher acres from the June 30th report. Demand numbers for 23/24 were left unchanged. For old crop, feed use was up 150 million bushels, exports down 75 million, and ethanol production was cut 25 million. This lowered old crop carryout by 50 million bushels. Again you can listen to our report recap here.

Going forward, bulls would like to see a few things. First, another sizable cut to yield or a drop in harvested acres. Secondly, they would like to see an increase in demand. I think a drop in yield is the most likely scenario.

We also have some macro headlines and factors such as the weakness in the dollar, strength in crude, and possible war headlines. All of which could help support us.

Today was great price action following a bearish report yesterday. Often times people say that the price action the day after a report is more important than the day of.

Bulls would like to hold this $5 level again. Our upside target is the $5.50 range which is still a ways away. In this afternoon's audio we discussed the possibility of grabbing calls here. Again you can listen to that here if you missed it.

Corn Dec-23

Soybeans

Soybeans see a massive rally following the sell off yesterday, capturing back all of the losses. As November beans rallied 42 cents. Now again trading right around our recent highs.

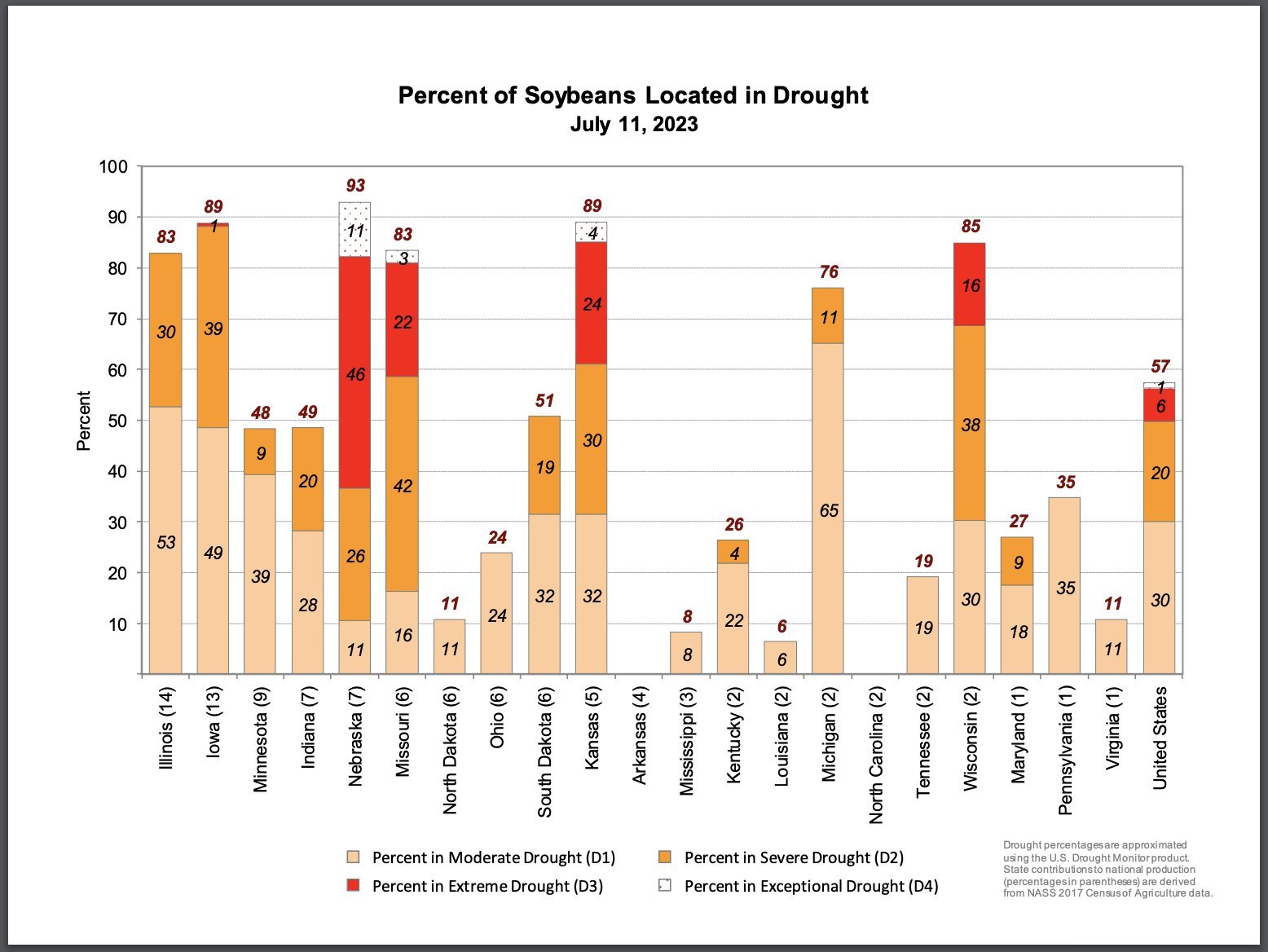

We touched on most of the drought situation in the corn section but here is the drought update for beans. Beans also saw a 3% improvement. Now sitting at 57% of beans experiencing drought.

Here is a state by state breakdown. 4 of the top 6 states all sitting over 80%.

As for yesterday's report. The USDA opted to kick the can down the road as they typically do.

They decided to leave yield unchanged at 52 bpa which wasn’t necessarily a surprise, given the fact that we have only seen them lower bean yield 1 time in July since 2012. One could argue that yes, it very well could be too early. The bean yield is made in the next two months.

The big number yesterday was the 23/24 carryout. As it came in at 300 million bushels, which was 50 million less than June. But 100 million more than the estimates. They lowered the production 210 bushels and only lowered the carryout 50 million as they seem think there is going to be no demand. Can’t say I agree with that decision, as most seemed to think going into the report that we would be closer to 150 rather than 200, and then we come in up 50% from the estimates.

Going forward, I still think there is a greater demand story developing for beans.

The month of June was the driest ever for the Midwest since 1988, but the rains thus far in July have helped the crops. I have been hearing more and more talk about the end of July and early August cranking up the heat and becoming more dry. So that is definitely a huge thing the bulls are watching. But short term the weather does look fairly cooperative.

The bean crop is made is August. We know this and the USDA knows this, which is why they left yield unchanged. So there is plenty of time to see more weather scares. With today's rally we are within striking distance of $14.

If we can break yesterday’s highs and the $13.78 level (where we have found resistance 3 times prior) the next move up will be $14. A break past that and the upside opens right up.

Although I think we have the chance to see $15 IF Mother Nature works in our favor, and I think we will be going higher from here as well because the fundamentals surrounding beans are still very bullish. There is nothing wrong with rewarding a rally and taking some risk off the table. Keep in mind, we are still well over $2 off our recent lows not that long ago. If you want specific advice or want to know if you should be looking to put in a floor soon utilizing options or any other strategies, give Jeremey a call at 605-295-3100.

Soybeans Nov-23

Wheat

Wheat futures end the day higher along with corn and beans but don’t see quite the strength. As Minneapolis led the wheat market, closing 8 cents higher. Unlike corn and beans, today's strength did not wipe out the losses from yesterday.

The Russia and Ukraine headlines continue. Nobody knows how it will play out. One day Russia says they won’t extend it, the next Putin is tossing out possible solutions. Which is something that has added pressure here, as there is rumors that Putin is throwing out proposals to extend the deal. As I've mentioned several times, I think it ultimately does get extended.

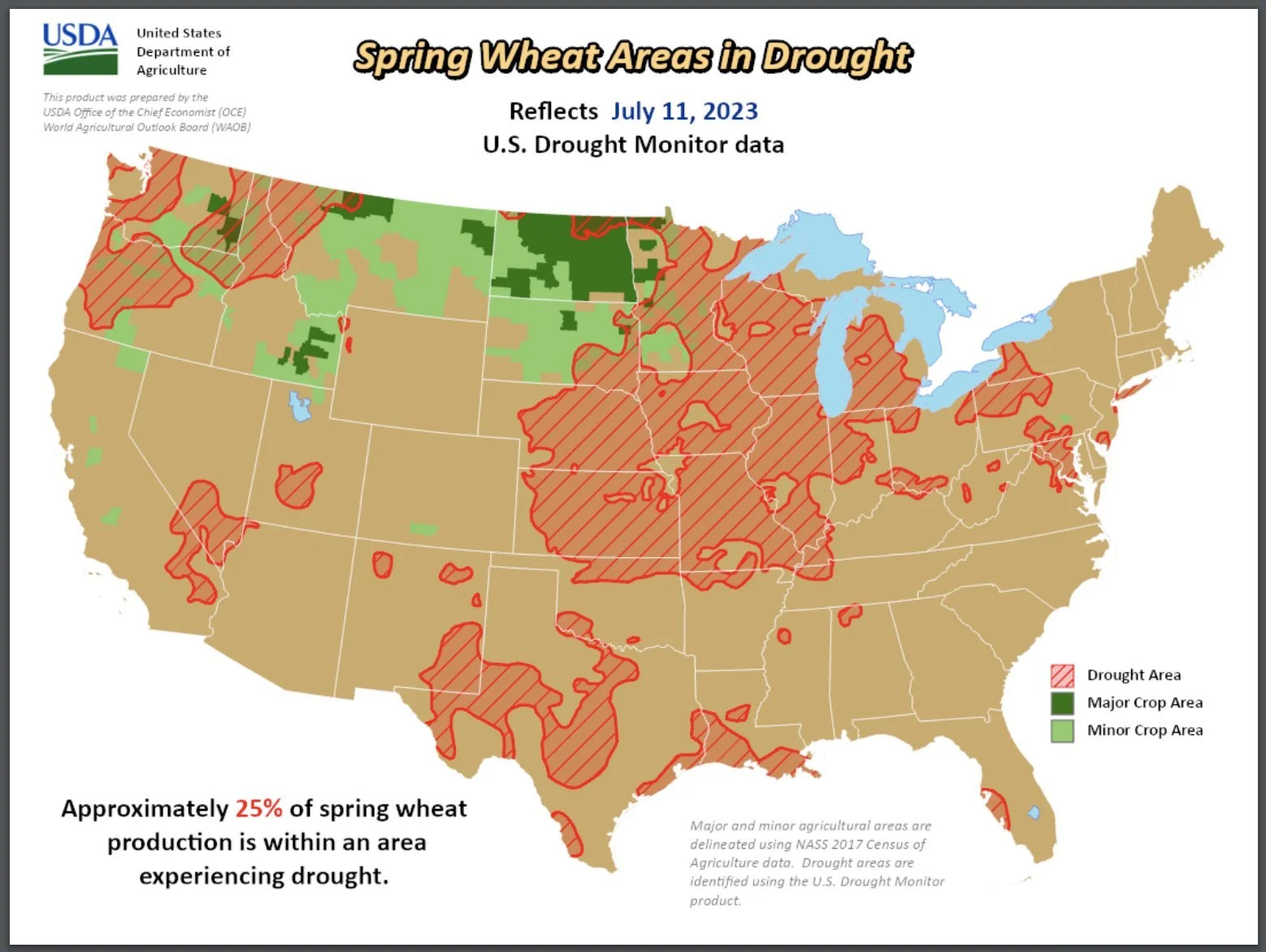

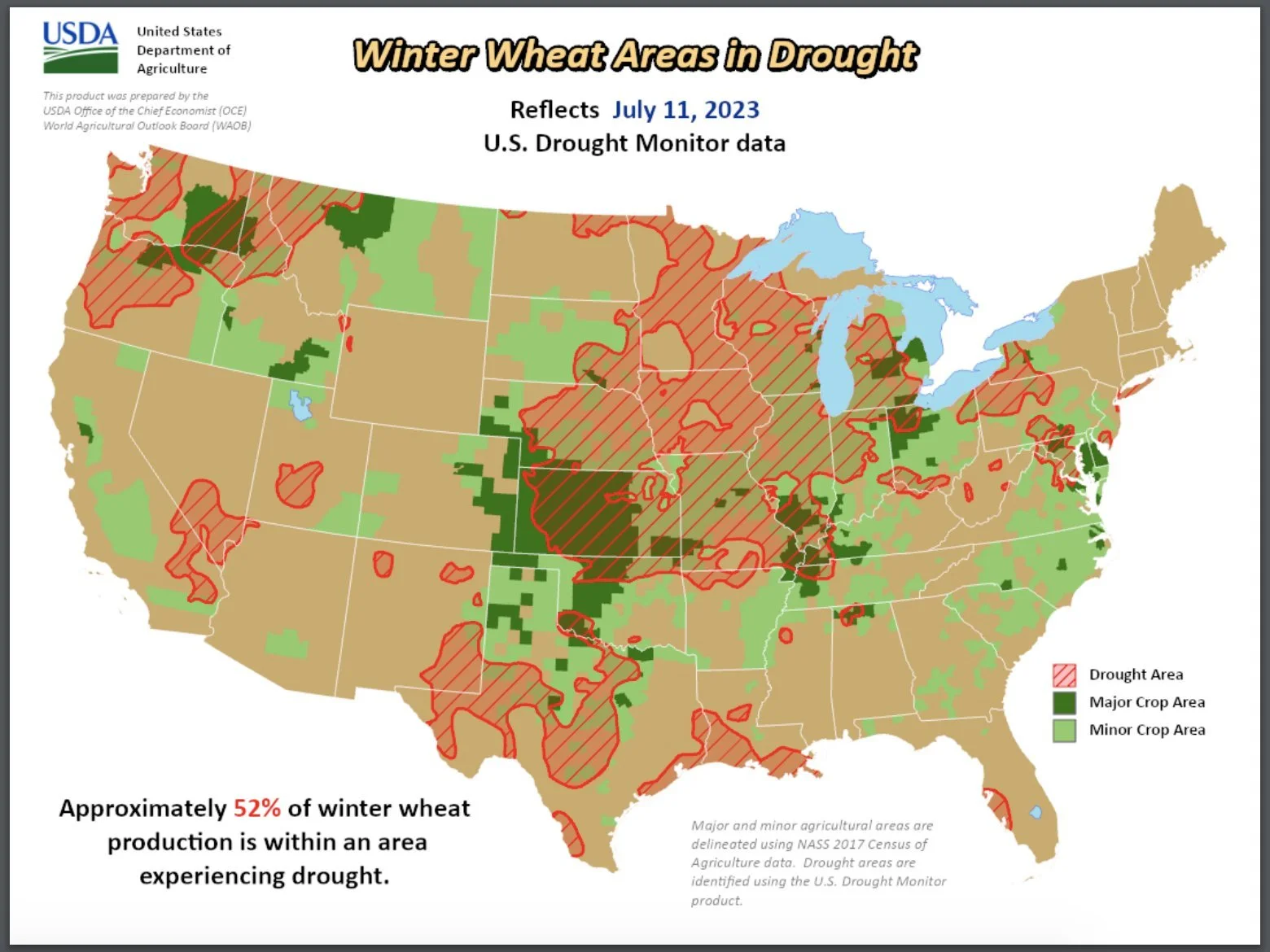

The newest drought monitors showed improvements in the corn and the beans as well as winter wheat. As winter wheat improved by 2%, now sitting at 52% in drought. But the big news was the increase in spring wheat drought.

As areas of spring wheat in drought jumped by 6% from last week. Now sitting at 25%.

Not only do we have the drought concerns here in the US. But globally there are a ton of different reasons for concern.

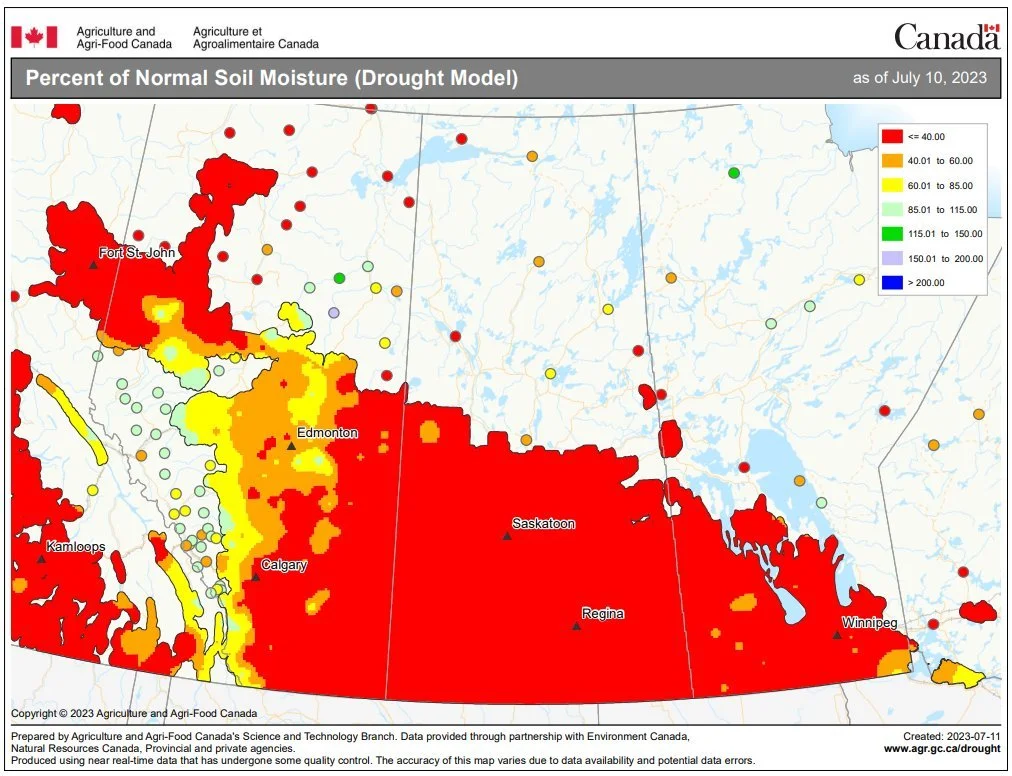

Below is the Canadian border, where it shows percent of normal soil moisture. As you can see, there is some obvious problems.

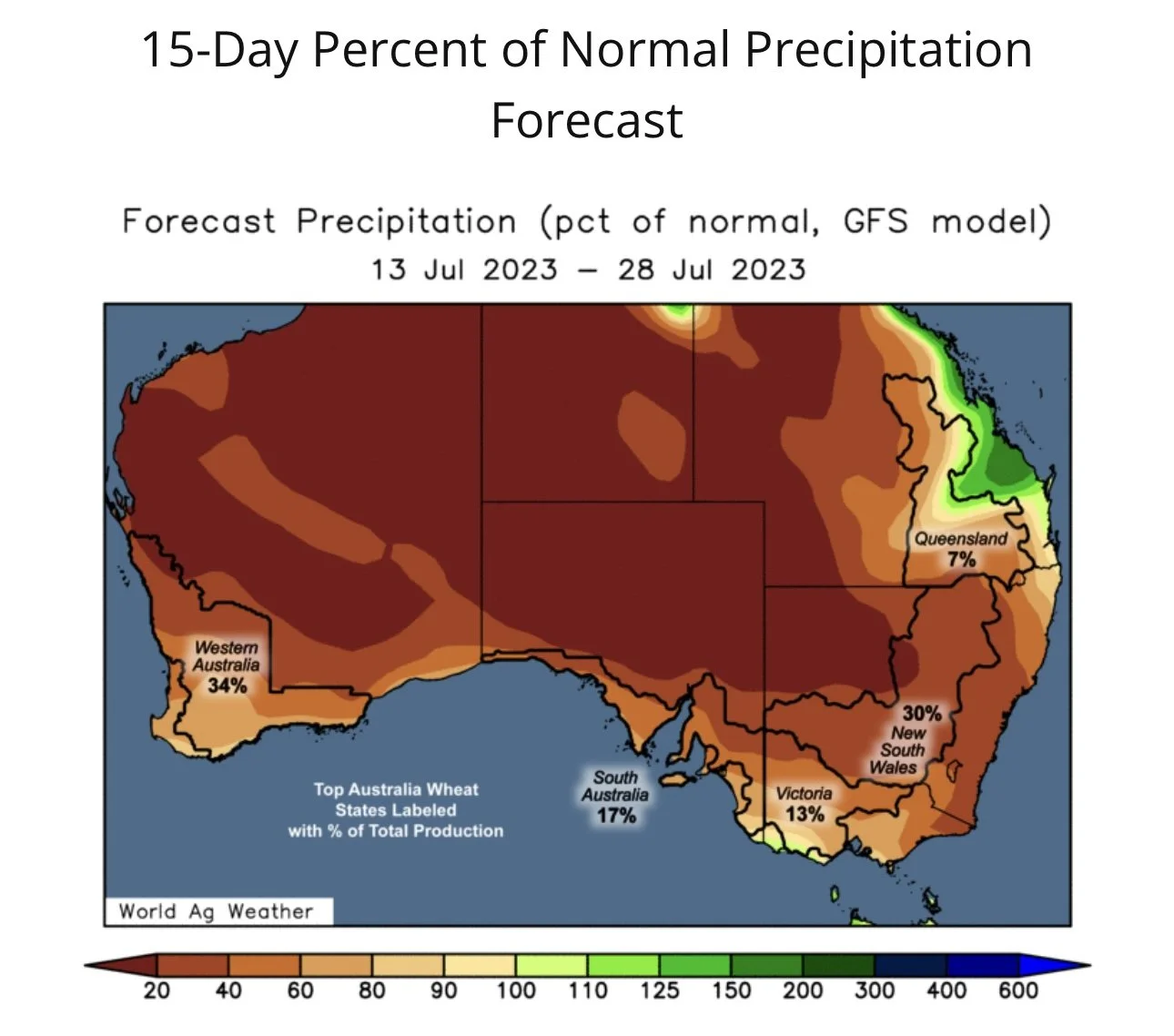

Australia's crop also looks to be getting smaller not larger. Here is their 15 day percent of normal precipitation forecast. Looks very dry.

As for yesterday's report, it was bearish just like the rest of the grains. Where all wheat production came in higher than estimates across the board.

As they raised all wheat production by 74 million bushels on the increased harvested acres, while raising yield from 44.9 to 46.1 bushels an acre.

Going forward, I imagine the grain deal gets extended, which will likely add some pressure. But if it doesn’t that could push us quiet a bit higher. We also have the weakness in the dollar which is looking to add support. Lastly we have the global weather issues. All of which could look to support the wheat market and keep this bottom in place. Still think there is quiet a bit of potential upside, but we could be in for some choppy trade.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

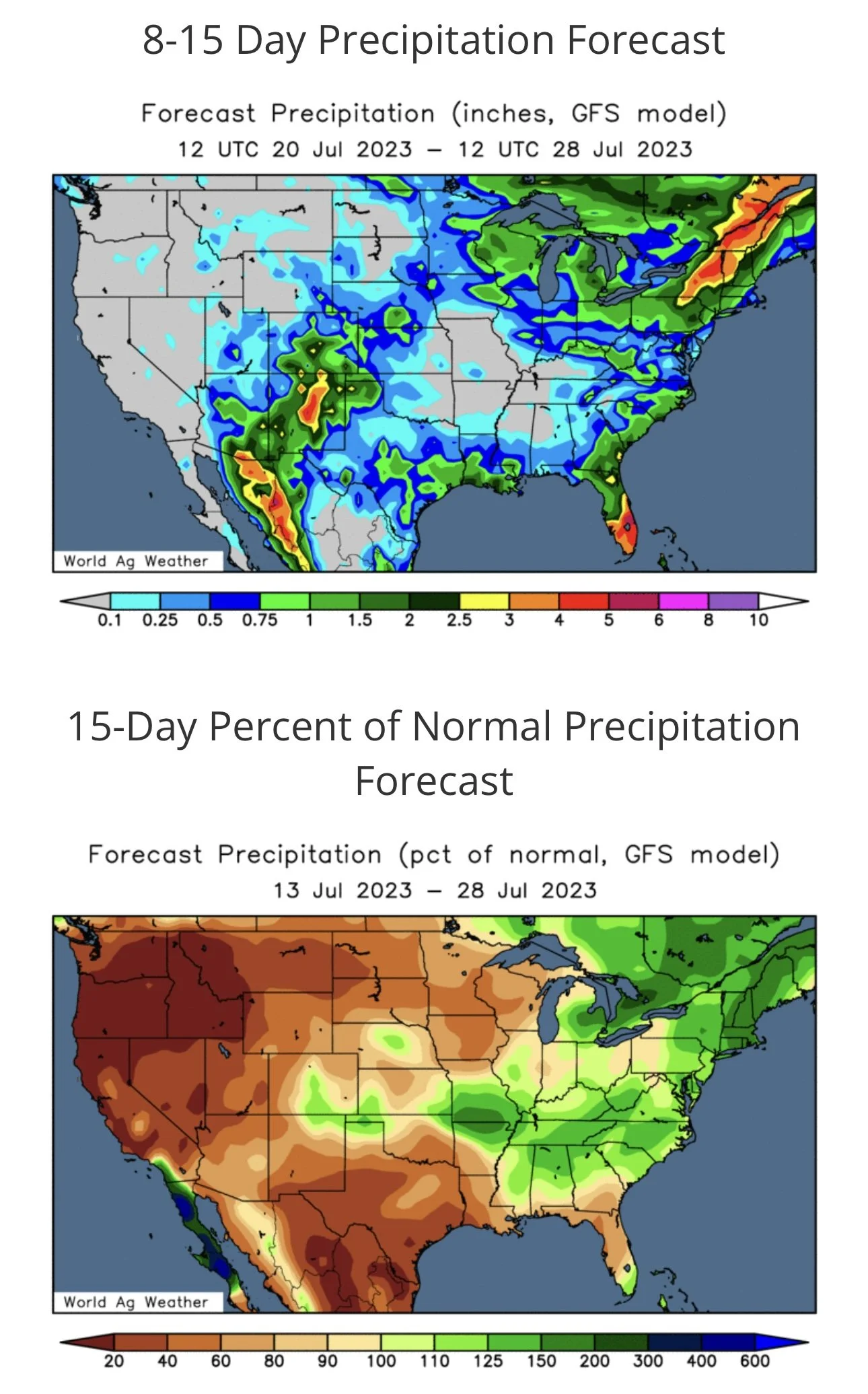

Weather

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

7/13/23 - Audio

DROUGHT & DOLLAR ERASE YESTERDAY’S LOSSES

Read More

7/12/23 - Audio & Report Recap

FULL USDA REPORT BREAKDOWN

7/11/23 - Audio

WHAT TO EXPECT IN TOMORROW’S REPORT

7/10/23 - Market Update

CORN & BEANS STRONG AHEAD OF REPORT

7/9/23 - Weekly Grain Newsletter

ARE YOU COMFORTABLE WITH WHAT’S ABOUT TO HAPPEN?

7/7/23 - Market Update

GRAINS SLIDE WITH FAVORABLE FORECASTS

7/6/23 - Audio