WHEAT RALLIES & CORN MAKES KEY REVERSAL

Overview

The grains continue to find support following our bearish report Wednesday that resulted in a sell off. As the grains close out the week strong for the second day in a row, as all of the grains reclaim the losses from the report.

As we stated Tuesday, if the report was bearish, the results and effects wouldn’t last long. Which is what has taken place. Corn has now made a key reversal, bulls would like to see some follow through strength for confirmation.

The recent support is coming from an absolute free fall in the dollar as mentioned yesterday. As the dollar trades at its lowest levels in well over a year. But more importantly, we are having rumors of some Chinese buying which has the markets excited.

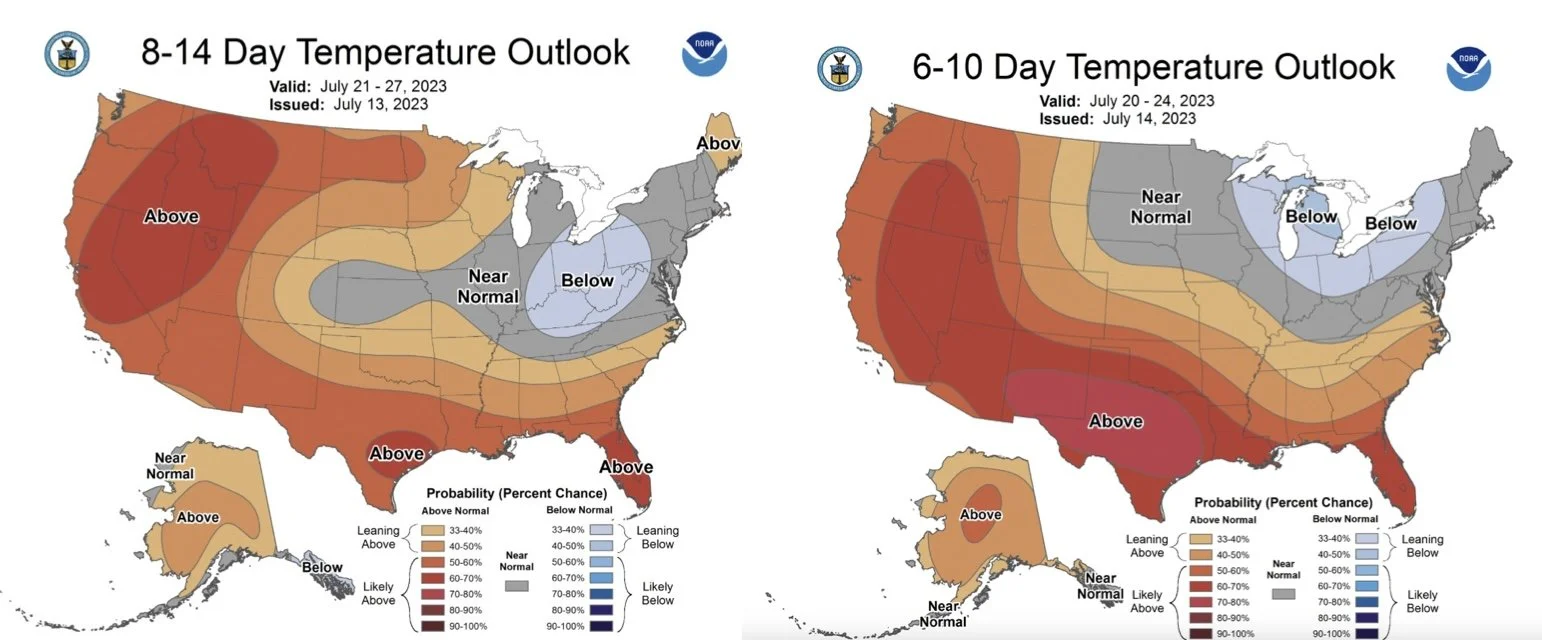

We additionally are starting to see some heat, which is a big reason for the strength in corn and wheat today. Now there is some forecasts over the weekend which are showing some decent rains in areas such as Illinois. So there is some risk there that we see some selling Sunday night if those do materialize.

Markets also had some fear about going into a weekend in the middle in July as forecasts are turning drier taking a look at the end of July.

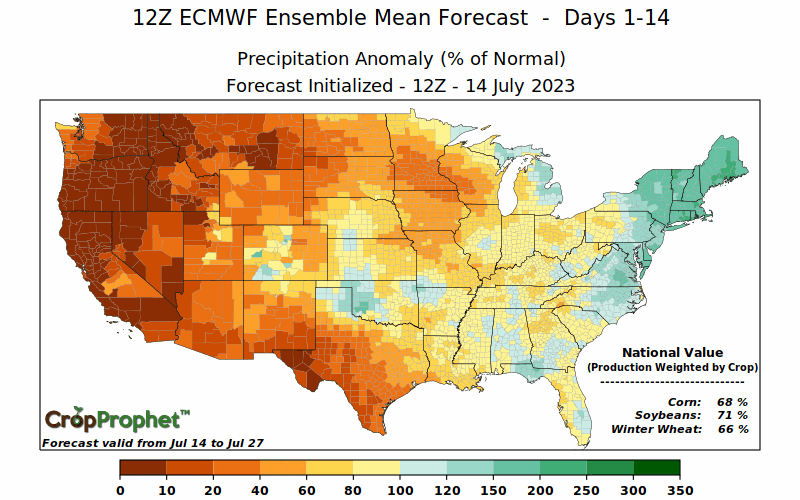

Here is the 14 day precip. It is indicating drier conditions.

Here is the 8-14 and the 6-10 day temperature outlook.

Today's Main Takeaways

Corn

Corn continues it's strength from yesterday, as we are now 33 cents off our lows from the sell off following the report on Wednesday.

One thing to note on the technical side of things is that we did put in a very strong technical weekly key reversal. As we took out last week's lows, then finished above last week's highs. Closing above that $5.09 1/2 level. So today's close was a pretty strong technical signal. A follow through would confirm the reversal.

The main strength in corn is simply due to the heat. As well as the trade realizing we might be in for some bigger cuts to yield, which we will touch on a little later.

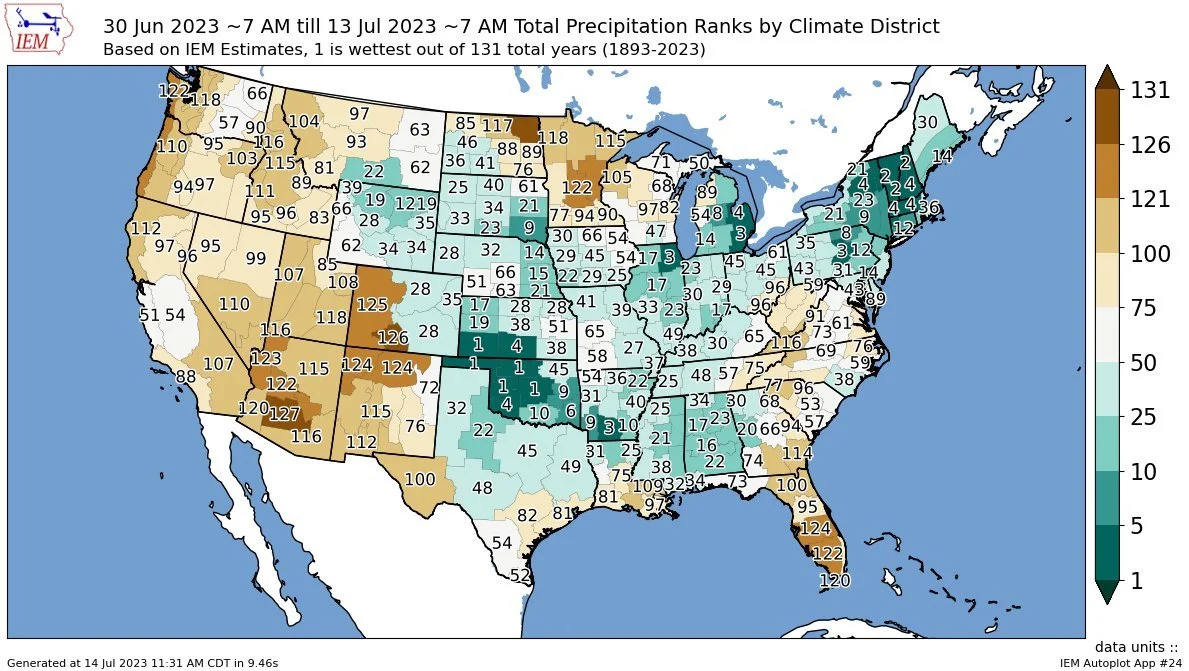

As for the weather. Below is a map that show cases where these past 2 first weeks in July rank up with history. You can see we have seen some great rains which explains the improvements in the crop.

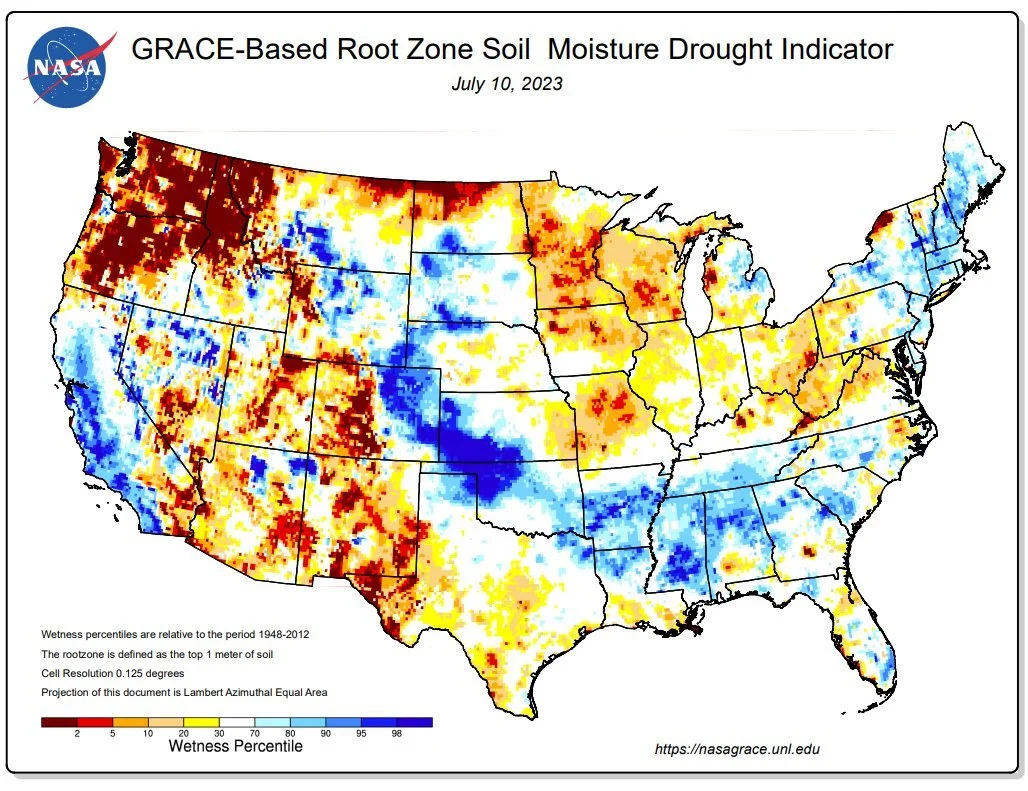

We have clearly seen some improvements. But that doesn’t mean this entire weather and drought situation has been necessarily fixed. There is still issues and concern.

Even with this amount of rain, the drought monitor yesterday still didn’t improve in the midwest as much as everyone expected it would. Another reason for the recent strength.

Below is a root zone soil moisture drought index. Often times at this point in the year, we need to pay more attention to this rather than the drought monitors.

Going forward, this weekend there is some rain in Illinois as we mentioned, which offers some potential risk. But we have normal rain int he 6-10 days, with below rain in the 8-14 day. Which comes right in the time frame when corn is in pollination. Which is another reason for the strength today.

So yes, we have seen some great improvement. The weather pattern has somewhat changed, but I wouldn’t say the weather problem is completely fixed.

The trade is feeling like we need to further lower corn yield. The trade was somewhat disappointed that we didn’t see this massive cut Wednesday. But remember, the USDA almost never cuts yield in July. The last time they did so was in 2012, and they don’t change it before August unless one of two things happen. WE have drought, or delayed planting.

In 2013 after what happened in 2012, they changed their methodology in how they come up with yield in July. Typically, they can’t lower yield in July unless that June is in the bottom 10% of driest Junes on record. Now, this June actually missed that threshold by 1-2% given that 1988 makes it awfully difficult to do so. But the USDA opted to change it anyways. Which indicates that yes there is a clear issue.

So even though they didn't lower it as much as expected, they still lowered it in a time where they historically never do so. Which opens the door for even further cuts to yield, and has the trade thinking we could be in for some more cuts.

We always talk about the Ukraine and Russia situation being a possible bullish wild card for the wheat market. But it could be big market mover for corn as well, because China has been buying a vast majority of their corn from Ukraine. Ultimately I think the deal gets renewed, but the possibility is there that it doesn’t.

As mentioned earlier, corn put in a very key reversal with a close above $5.09 1/2 which was last week's high. Most call this an outside week up. Nonetheless, usually a bullish indication of more upside. My next upside target is the $5.25 range and our 20-day moving average. Following that we still think we can get a bigger bounce to the $5.50 range and our 100-day moving average. The last upside target if we can get there is the $5.75 range and our 200-day.

Corn Dec-23

Soybeans

Soybeans end a very volatile filled day up just a penny. Ending 14 cents off our highs and 16 cents off our lows. As we continue to find very stiff resistance in the $13.80 area. We actually saw some great follow through strength overnight following yesterday's 40 cent rally, but we ultimately ran into that resistance and saw some profit taking.

It was also just a risk off day for beans. We had weakness in crude oil, which pressured bean oil and ultimately beans.

Another big thing was China. We had rumors of some Chinese buying. So that initial news had the markets excited and hopeful that we would see a flash sale, but we didn’t. So that was reason we couldn’t hold that early strength.

Where we go from here, the biggest factor will remain weather. We all know the bean crop is made in August. The USDA left yield unchanged at 52 bushels an acre. As they should given that it is still early. But the trade is realizing that there is definitely concern that weather isn’t going to be perfect in August. Which it would need to be pretty perfect to hit that 52 bushels an acre, which we would need to see not to have a ridiculously tight balance sheet.

Our balance sheet is tight. Demand doesn’t go down just because the USDA says it does. We will need to curve demand. How will we curve demand? We have said time and time again the past few weeks, the only way to curve demand is with higher prices.

Then again, overall weak demand is the number one thing bears will continue to point at. Old crop sales were the worst we have seen in the past two months. The main concern is will the South American production the possible concerns between the US and China relationship. But ultimately I think it mainly comes down to how weather plays out here to end July and August. If weather is cooperative, we could take it on the chin. If not, soybeans could be in for a ride.

So overall I still think the fundamental situation is very bullish, demand is still a slight concern. I still think we will surpass $14, but that doesn’t mean you shouldn’t manage some risk if that is what makes you comfortable here. I did notice another advisor had a sell signal and made some small sales of Nov beans, which another advisor saying they were preparing to make a few as well if we get another leg higher. As always, don’t hesitate to give us a call at 605-295-3100 if you want specific advise.

If we can get a close above that $13.80 resistance area where we have failed multiple times, that could open the door to easily seeing $14 plus. If we do get that weather scare in August, which is a very possible scenario, $15 beans isn’t out of the question.

I mentioned this in Monday's update. But a great indicator as to know when this rally is over is the moment we start importing beans from Brazil.

Soybeans Nov-23

Wheat

The wheat market leads the grains today, with over 20 cent gains across the board and Minneapolis wheat pushes to new recent highs.

Not a ton of huge news surrounding wheat as the trade awaits a decision from the Black Sea deal. But the potential that the deal could not get renewed was enough to add some strength today.

As was the story for corn today, the heat in the US added also support, as the spring wheat crop continues to see increased drought concerns. As in the latest update, spring wheat areas in drought jumped 6%.

Not is it only the US, but we also have Australia, Europe, Canada and many other areas that are seeing concerns as global weather continues to be a bullish wild card.

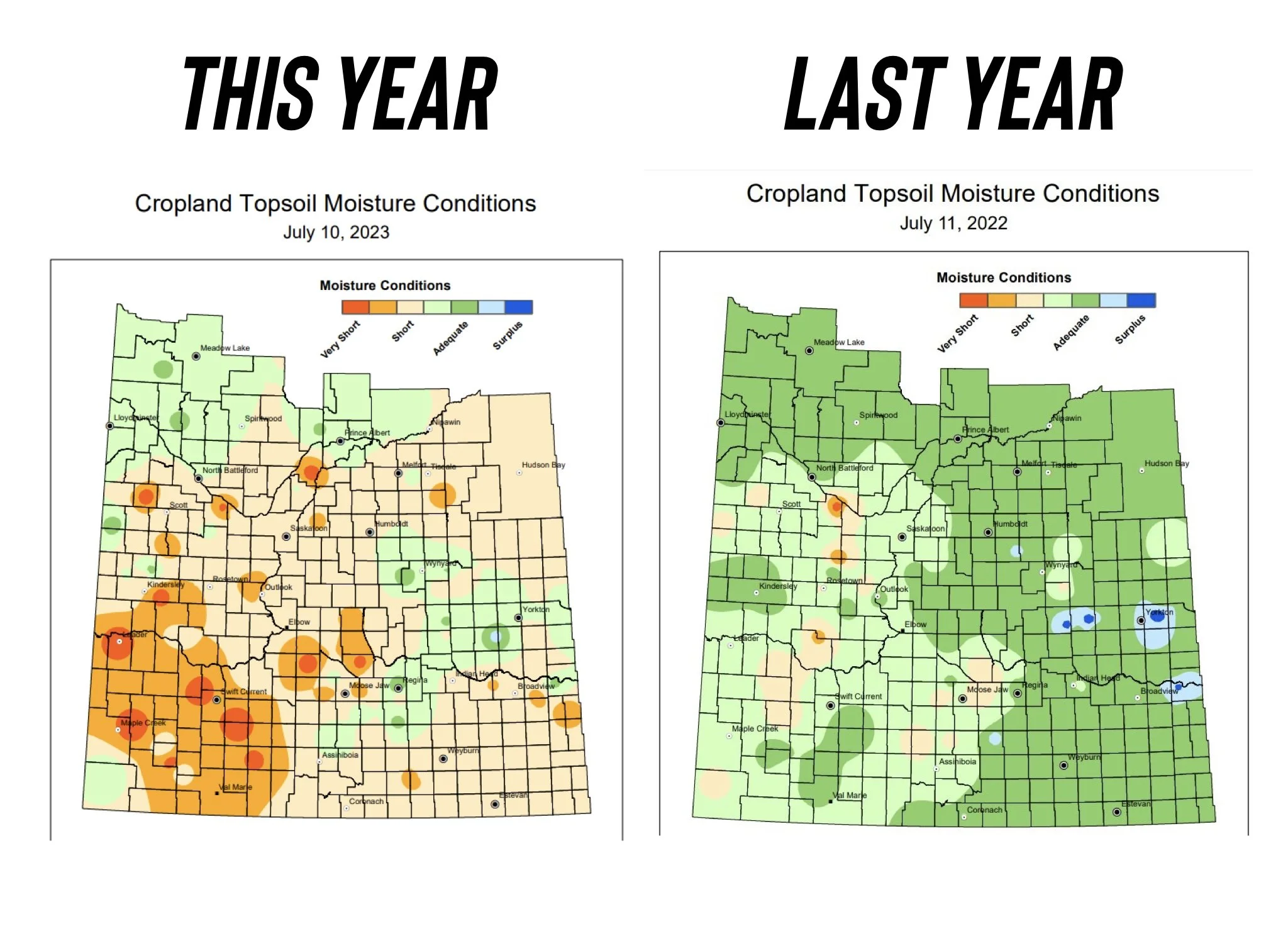

Below is a topsoil moisture condition comparison in an area of Canada for this year vs last year.

So the areas suffering from problems are the spring wheat growing areas. It seems like the trade is thinking the spring wheat crop could be getting smaller while the winter wheat crop could be improving.

I think there is still a lot of weather premium left to be built into the spring wheat market, so I think Minneapolis should be well supported, while KC on the other hand could potentially struggle to hold on to a rally, especially if we see some harvest pressure. But that doesn’t mean it’s not a bad idea to reward the recent spring wheat rally, as we are at some of the highest levels we have seen all year and well off our recent lows. I included a great analysis from Chris Robinson below for all of the classes of wheat. He points out that we are approaching some stiff resistance every time we climb up into the $9 range.

As for the Black Sea deal. Nobody really knows what is going on or what will ultimately unfold. The market is skeptical here. The deal is set to expire in 3 days. If a deal doesn't get done, we will go higher. If a deal goes through, we likely see some additional pressure. We have been in this exact situation before. The decision comes down the wire and they figure something out. I still think they figure it out, but it’s a essentially a coin toss here.

Wheat Technicals

Here are a few great technical analysis’ from Chris Robinson from the Robinson Review. Just a note that these are from this morning.

Minneapolis Wheat

KC Wheat

Chicago Wheat

Chicago Sep-23

KC Sep-23

MPLS Sep-23

The Bottom Line

From Farms.com Risk Management,

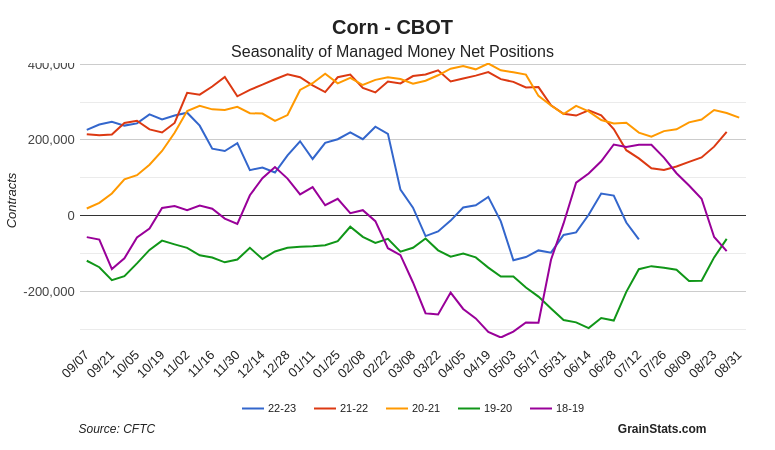

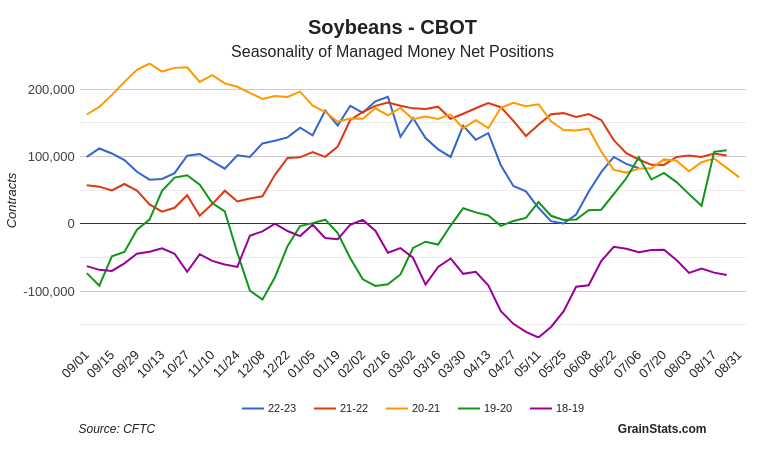

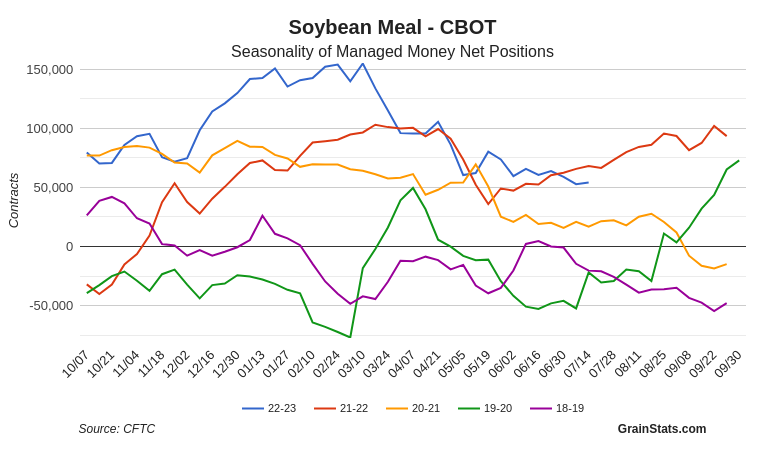

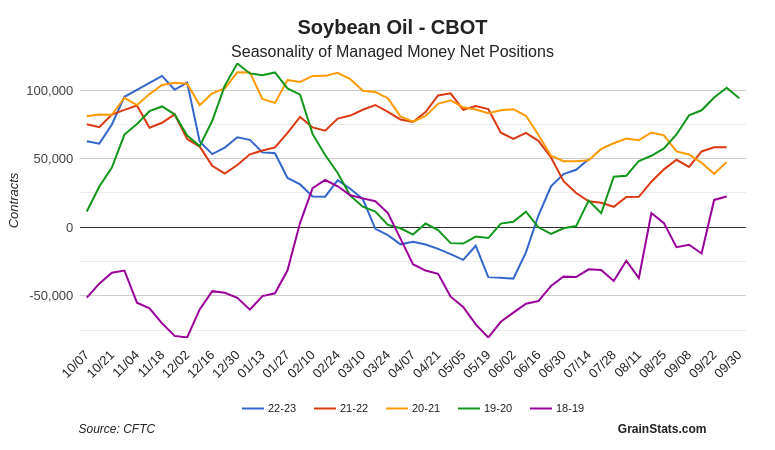

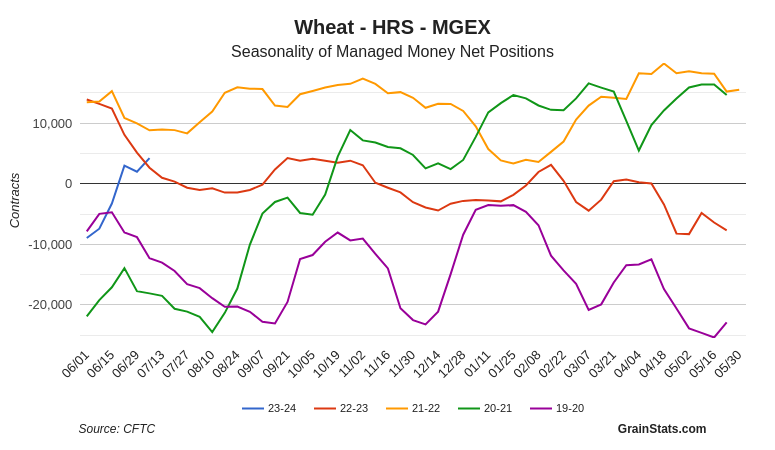

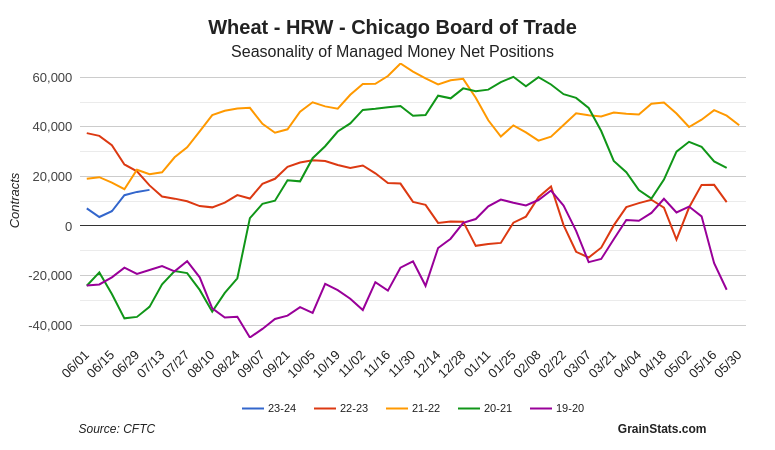

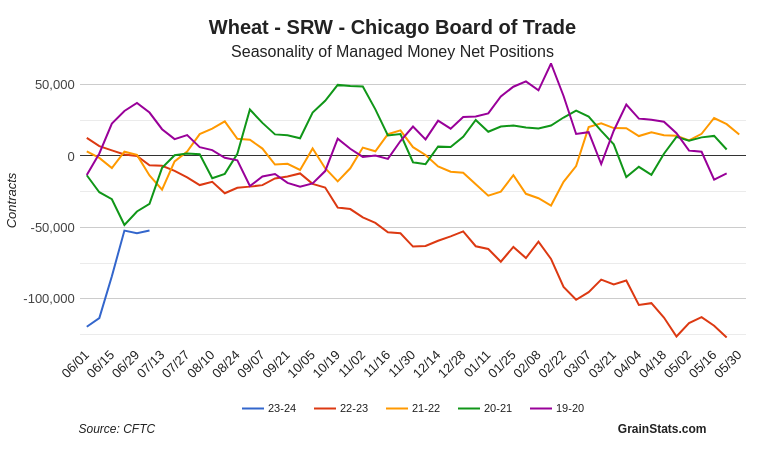

Funds Update

Shout out to Grain Stats for the updated numbers and charts.

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

7/13/23 - Market Update

GRAINS BOUNCE BACK AFTER BEARISH REPORT

Read More

7/13/23 - Audio

DROUGHT & DOLLAR ERASE YESTERDAY’S LOSSES

7/12/23 - Audio & Report Recap

FULL USDA REPORT BREAKDOWN

7/11/23 - Audio

WHAT TO EXPECT IN TOMORROW’S REPORT

7/10/23 - Market Update

CORN & BEANS STRONG AHEAD OF REPORT

7/9/23 - Weekly Grain Newsletter

ARE YOU COMFORTABLE WITH WHAT’S ABOUT TO HAPPEN?

7/7/23 - Market Update

GRAINS SLIDE WITH FAVORABLE FORECASTS

7/6/23 - Audio