GRAINS BOUNCE. WEATHER REMAINS BULLISH

Overview

Grains rally across the board today, as beans are now 70 cents off their lows from just a week and a half ago, the wheat market finally makes a higher high for the first time in 9 trading days as Chiago was up 4% on the day, while corn is now nearly 20 cents off of its lows from 2 days ago.

Why the bounce?

Weather & war. We saw news that Ukraine attacked Moscow with drones. For quiet some time now the markets have mostly ignored the war and headline animosity and given back all of the war premium we receive. We will have to see if the market can hold on to those gains and that premium, or sell the rally as has been the case recently.

The main catalyst is the weather. It's very hot, to go along with almost no rain. Weather was the reason we sold off to close out July, and it's the reason for this bounce.

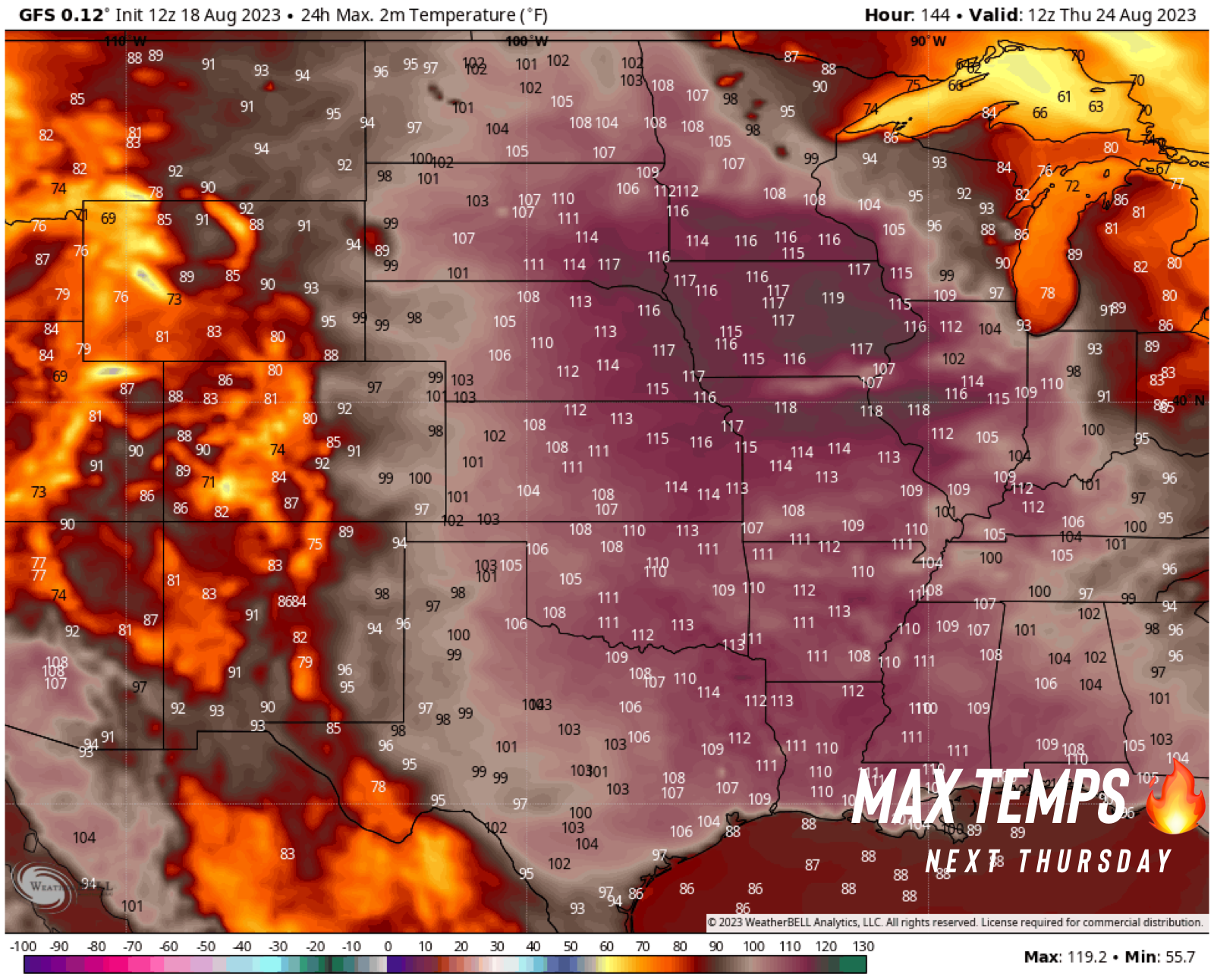

Here is the forecasts. The first one is the GFS model that shows the max temperatures for next Thursday. Now one thing to keep in mind is that often times this model can be off by 5 to 10 degrees. None the less, it’s extremely hot.

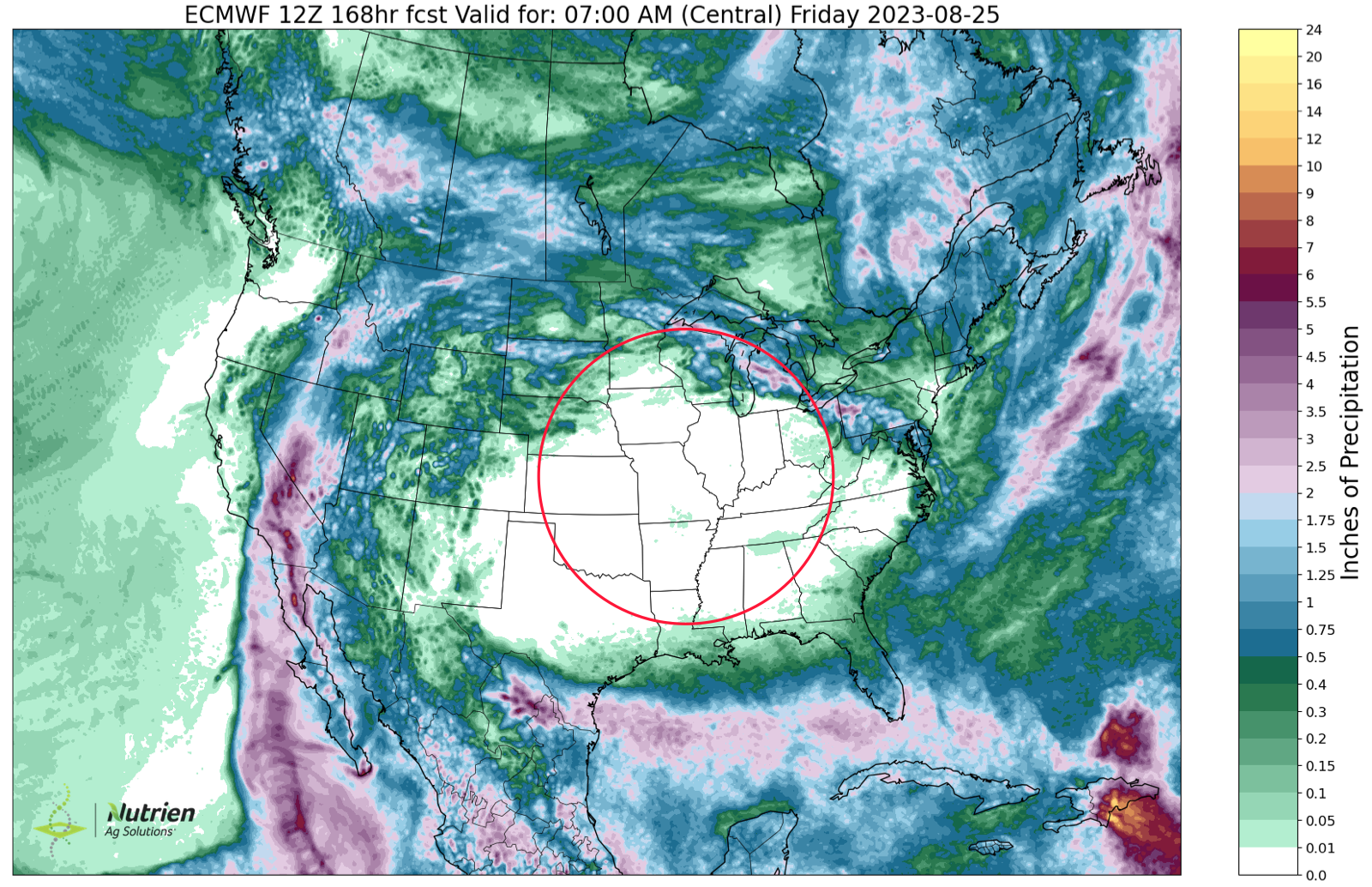

Notice the big pocket missing rain for the next 10 days.

Here is the 6 to 10 day outlook as of Friday afternoon. Showing a little less heat than the models showed the past two days, but still pretty hot with lack of mositure.

So overall, the forecasts look like it is going to be this way until possibly early September. Unless September brings some timely rains, it could very well be a less than favorable finish to the growing season in plenty of areas.

Most key growing regions are expecting temps in the high 90's into the 100's, and nobody is expected to get much if any rain.

Darrin Fessler, a highly respected futures trader said:

Don’t underestimate the impact of high overnight temps (silent killer of yields). Day time temps are one thing, overnight is another. A majority of this crop will not be getting a break starting this Sunday through Monday August 28th.

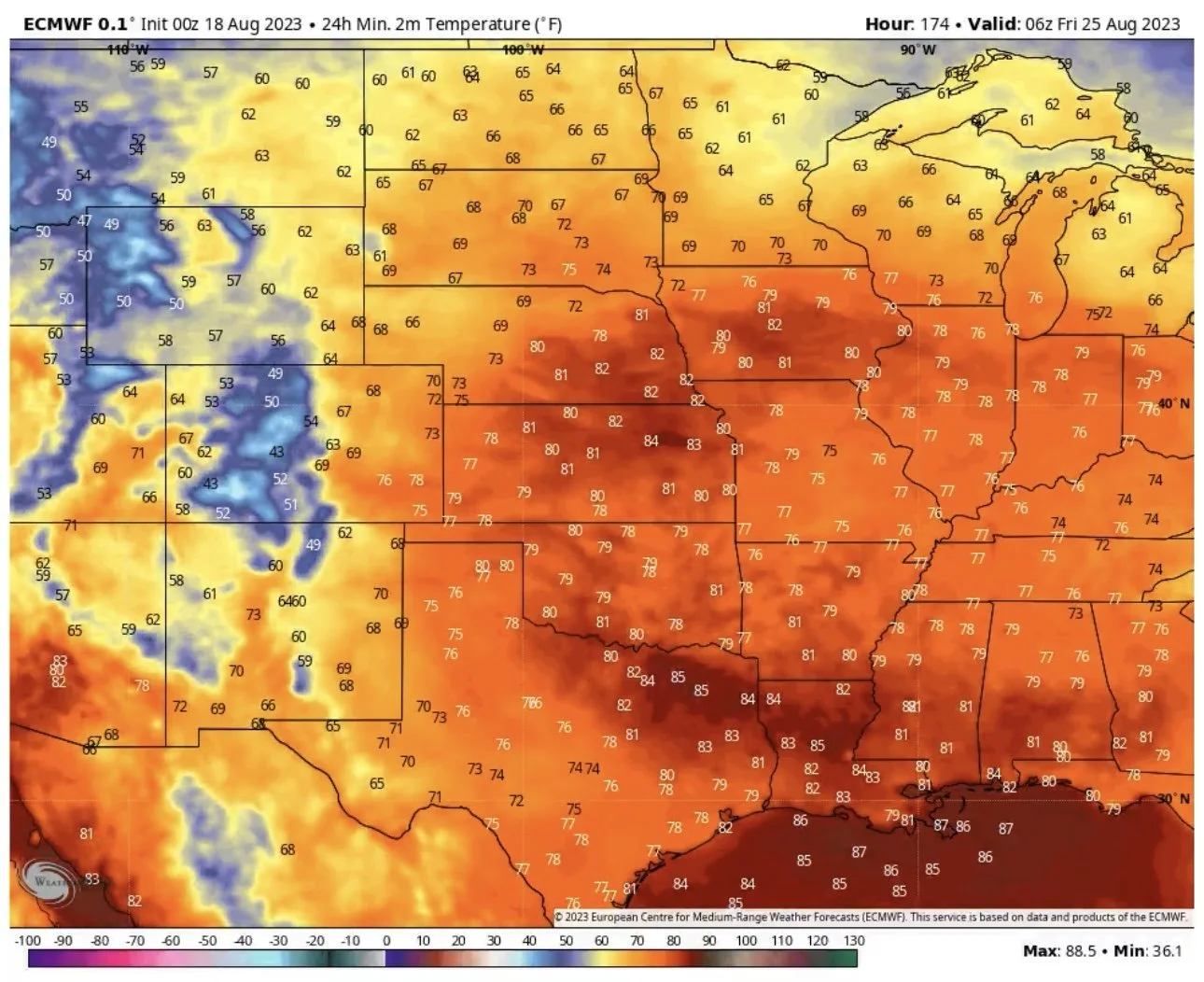

Here is the minimum temperature for next Friday.

India says they are having their driest August in over 100 years.

We saw a flash sale of corn this morning to Mexico.

Mark Gold of Top Third said:

We haven't seen this before, in my 50 years in the business, finishing out an August this hot and dry. It is going to effect hurt the soybeans, corn will have some effect as well. I think with everything happening in the world I wouldn't want to be short here. I think we could see a sizeable rally, particularly in the soybean market. Of course, all of this could change very quickly if we get any change in the forecasts or a break in the heat. I think this heat will do a lot of damage out here.

The funds remains short corn and wheat, so we could be looking as some possible short covering. Although, I do think soybeans will continue to lead the grains as long as the forecasts stay like they are.

The Pro Farmer crop tours start next, so will be keeping a close eye on those.

Today's Main Takeaways

Corn

Corn follows the bean and wheat markets higher here today, closing 7 cents higher. On the week, corn managed to close nearly 6 cents higher and was 20 cents off it's lows made 2 days ago

It was a nice surprise and good indicator when yesterday we get the drought update and it shows that drought improved by a major 7% over the past week, yet corn was able to trade higher the past two sessions. Coming in at 42% experiencing drought vs 49% last week.

Bears continue to point at demand. However the weekly exports and war headlines have helped the demand story slightly. Demand is still the biggest thing holding back corn. We also have the competition out of South America that hasn’t helped, to go along with the recent surge in the dollar over their currency.

With the lack on the demand side of things, that leaves the supply side of the equation to do all of the heavy lifting, and right now at this moment in time, that isn't the most bullish story in world either. With expectations that this corn crop is a top 3 largest on record.

We do have this extreme heat and lack of rain the two weeks to close out August, which certainly won’t help the crop. But it won’t have quiet as big of an impact as it will on beans.

The USDA lowered yield to 175, a 6 bushel decrease from their original 181. There is a very solid chance we do eventually see this number closer to 170 or possible sub 170 when it's all said and done. But the bigger question rather than yield is the acre situation.

For corn to gain any huge upside momentum, we will have to see a spark in demand. As mentioned in our audio updates earlier this week, we did hear rumors that China could be sniffing around for US corn, so perhaps we do see an uptick in demand. If not, it will be tough for us to make a meaningful rally here. If we can find demand, we can find a reason to rally.

I do think the weather will continue to support us and I expect corn to follow higher behind beans for the next week or so. Will be keeping a close eye on the crop tours that start Monday.

Taking a look at the charts, on Tuesday we did break that $4.81 support and July lows. However, we bounced nicely from there. As we actually broke our downtrend from late July. Bulls would like to see a break and close above $5 which hasn't happened since August 2nd, perhaps the funds would then decide to push this thing a little higher from here and get that gap fill to $5.25.

Is the bottom in? Hard to say. When looking for a bottom, if we haven't already made the bottom, I would expect us to find a bottom in the $4.60 range if we were to continue lower.

Corn Dec-23

Soybeans

Beans rally 24 cents, now up roughly 50 cents the past 3 days and are over 70 cents off their lows of $12.82 from August 8th. Beans ended up nearly 44 cents on the week.

The most impressive takeaway from the past two days is that the market was able to see a clear improvement in drought conditions and trade 35 cents higher.

Yesterday we saw the drought conditions come in. They showed bean areas in drought sit at 38% versus 43% last week. A 5% change is a pretty big one. Usually, the trade would look at this as a very bearish factor. But they didn’t. The trades focus is completely on the upcoming weather and demand. Both of which remain bullish.

Bears will make the argument that the rain we saw to start off August completely made our bean crop. Which I suppose is a argument that could be made. But we can’t discount the damage this heat and lack of rain could do to the bean crop the next two weeks. As mentioned by Mark Gold, there is a lot of talk that we haven’t really seen an ending to August like this one. Where we get all of this rain and perfect growing conditions for the first half, then a massive heat wave and zero rain for the second half.

Who knows how much of an actual effect this will have on yield and the crop. But what we do know is the fact that the market likes to buy and sell based on what it sees happening in the future. What does it see right now? It sees extreme heat and zero rain, with the potential to cause damage. Although the extent of the damage is going to be unknown, the market will look at this as a bullish factor.

Demand is the other main supportive factor aside of weather for beans. Demand, unlike corn, has been great for beans.

As mentioned in this morning's audio, it is typically a very difficult task to see the bean market lead the way up in harvest. But given everything going on in the markets, it looks like that could be the story.

Bottom line, the soybean situation looks great right now with the solid demand and bullish weather. However, for some of you, it might make sense to take some risk off the table here with beans sitting just 46 cents under $14 and a whopping 75 cents or so off our lows made just a week and a half ago. Not to mention that we were trading $2 lower at $11.50 in May and June. So do what makes you comfortable here. I think weather and demand will continue to support the bean market for now, but as we all know, weather can shift on a dime. If you want specific advice or help making a decision, don't hesitate to give us a call anytime at 605-295-3100.

Taking a look at our charts, beans smashed through my target of $13.37 that I had out below our audio updates on Monday and Wednesday. My next target is $13.63 then a gap fill to $13.78 which I think would be a reasonable 24-cent rally from here. I don’t see much reason as to why we wouldn’t look to fill that gap.

Beans are now above their 100 and 200 day moving averages. This might give the funds a green light to stay long beans and buy more.

-

From Chris Robinson of the Robinson Report:

We've rallied 70 cents from that 50% correction of the $3.05 rally. Very technical.

We used that break to roll down all of your deep-in-the-money puts to the $12.80 to $12.50 level.

We rolled them when those deep-in-the-money options were expensive.

We replaced them with cheaper puts-- on that break.

As we rally, puts lose value. But It's less painful- and a better hedge- to have cheap options go "worthless on rallies" vs. watching expensive options go worthless.

What's our goal? MAKING GOOD CASH SALES.

The options are the tools that keep us protected and in good position, so we can reward 70-cent rallies, vs. selling into $3.00 sell-offs.

Call me crazy, but I'd rather sell into rallies, than "dump" bushels on lows right into the hands of waiting commercials. This is a battle. Treat it as such.

Soybeans Nov-23

Wheat

Wheat finally gets a bounce, making a higher high for the day for the first time in 9 trading days.

Most of the support was of course war premium as mentioned, as Ukraine had drone attacks on Moscow, not to mention the wheat market was heavily oversold.

Wheat has remained the punching bag of the funds as they still remain short.

Things bulls are looking at outside of war, is the global weather problems we have in Argentina, Australia, among others such as India who is facing the driest August in a century.

Similar to corn, the demand just isn't there yet for the wheat market. Which again, leaves the supply side of the table to push prices higher. Now this isn't something I expect to happen soon, but down the road there is definitely the potential to see some major hiccups to the supply side of things globally.

Short term, wheat just doesn’t have a major reason this huge rally unless we get some crazy war headline.

As mentioned in this morning's audio, the wheat story will be one that will likely happen later on in the year. It may not have a reason aside from war to rally right now, but in the future it will.

One argument is that when the trade realizes Ukraine is done shipping. They have exported 2 years worth of grain in the past 9 months. What happens when they run out? When this story comes to realization and becomes a big problem, they will have to ship what they grew this year. Which isn’t a big number.

I fully expect another wild card to get drawn from the deck that catches the media and funds attention and sparks another war rally, but can we hold the war premium is the bigger question.

Taking a look at the charts, Monday I said Chicago would likely test our May 31st lows at $5.87 which is exactly where we bounced, and I said KC would test their lows as well. They both tested their lows and bounced, as Chicago and KC have both put in a potential double bottom.

Personally, for Chicago I would like a break above our 10 day moving average and the $6.22 resistance to bring more upside. Support remains at our lows in the $5.87 range. Chicago also did break that downtrend from July similar to corn, so perhaps that will cause the funds to load off some of their shorts and bounce this thing a little higher from these levels.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio

CAN DEMAND & WEATHER LEAD TO A BOUNCE?

8/15/23 - Audio

GRAINS LOWER WITH IMPROVEMENT TO CROPS

8/14/23 - Audio

BEANS RALLY BUT CONDITIONS IMPROVE & WHEAT DISAPPOINTS

8/13/23 - Weekly Grain Newsletter

WHAT’S NEXT FOLLOWING DISAPPOINTING USDA REPORT?

8/11/23 - Audio & Report Recap

USDA REPORT BREAKDOWN

Read More

8/10/23 - Audio